CK Asset Holdings Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CK Asset Holdings Bundle

CK Asset Holdings masterfully orchestrates its Product, Price, Place, and Promotion strategies to dominate the global real estate and infrastructure markets. Understand how their diverse portfolio, strategic pricing, global reach, and targeted promotions create a powerful competitive advantage.

Dive deeper into the specifics of CK Asset Holdings' marketing mix, exploring how their premium product offerings, value-driven pricing, extensive distribution networks, and impactful promotional campaigns drive consistent growth and brand loyalty. Unlock these insights and more.

Ready to elevate your own marketing strategy? Get instant access to a comprehensive, editable 4Ps Marketing Mix Analysis of CK Asset Holdings, packed with actionable insights and real-world examples. Save hours of research and gain a competitive edge.

Product

CK Asset Holdings (1113.HK) showcases its diverse property developments as a key element of its marketing mix, offering a comprehensive portfolio that spans residential, commercial, and industrial sectors. This broad approach caters to a wide array of market needs and investment profiles.

The company's strategic focus on residential projects is evident in recent successes. For instance, the pre-sales of Blue Coast and Blue Coast II in Wong Chuk Hang demonstrated strong market demand. Looking ahead to the first half of 2025, the anticipated launch of Victoria Blossom Phase 1 in Kai Tak is set to further bolster its residential offerings, reflecting a commitment to ongoing development and sales momentum.

Beyond residential, CK Asset Holdings actively engages in the development and management of investment properties. This includes prime retail spaces and modern office buildings, which contribute to a stable recurring income stream and enhance the company's overall market presence. These ventures underscore a balanced strategy that leverages both development and long-term asset management.

CK Asset Holdings' global infrastructure and utility assets represent a crucial diversification beyond its core property business, offering a steady stream of income. This segment includes vital services like energy, transportation, water, and waste management, providing essential services with predictable revenue. For instance, in 2023, the company continued to bolster this segment with strategic acquisitions, including social infrastructure and elderly care facilities in Germany, alongside utility assets in the United Kingdom.

CK Asset Holdings manages a robust portfolio of hotels and serviced suites, notably in Hong Kong, under established brands such as Harbour Grand Hotels and Harbour Plaza Hotels & Resorts. This strategic focus on hospitality assets is crucial for bolstering the group's recurring income streams.

The company actively refines its hospitality offerings to cater to a diverse clientele, encompassing both transient tourists and extended-stay guests. This dual approach ensures broad market appeal and consistent occupancy rates.

In 2024, CK Asset Holdings' hotel and serviced suite segment demonstrated significant growth, reporting an increase in both revenue and its overall contribution to the group's financial performance.

Property and Project Management Services

CK Asset Holdings offers extensive property and project management services, a key component of its Product strategy. These services cover a wide range of its real estate portfolio, including residential, commercial, and industrial assets. This integrated approach ensures operational excellence and high tenant satisfaction across its developments.

The revenue generated from these management services is primarily derived from management fees. These fees provide a consistent and reliable income stream, bolstering the group's overall financial performance. For instance, in 2023, CK Asset Holdings reported significant rental and property management income, underscoring the stability these services bring.

- Operational Efficiency: Manages residential, commercial, and industrial properties for optimal performance.

- Tenant Satisfaction: Focuses on ensuring a positive experience for all occupants.

- Revenue Stream: Generates income through management fees, contributing to steady earnings.

- Portfolio Synergy: Leverages expertise to enhance the value of its diverse property holdings.

Strategic Investments and New Ventures

CK Asset Holdings actively seeks strategic investments to broaden its recurring income streams, moving beyond traditional real estate. This proactive approach is evident in its diversification into sectors like agriculture and technology.

A prime example is the company's acquisition of agricultural land in Australia, specifically targeting opportunities in carbon sequestration. This move aligns with global sustainability trends and opens up a new revenue avenue.

Furthermore, CK Asset Holdings is investing in cutting-edge smart logistics technology, exemplified by its involvement with platforms like NEXX. This demonstrates a commitment to embracing innovation and capturing growth in evolving industries.

- Diversification Strategy: Expanding recurring income beyond core real estate and infrastructure.

- Sustainability Focus: Acquiring Australian agricultural land for carbon sequestration projects.

- Technology Adoption: Investing in smart logistics technology platforms like NEXX.

- Future Growth: Positioning the company for long-term success through forward-looking ventures.

CK Asset Holdings' product strategy is characterized by a diversified and high-quality property portfolio, complemented by strategic investments in infrastructure and hospitality. This multifaceted approach aims to capture value across various market segments and generate stable, recurring income streams. The company's commitment to innovation is also evident in its ventures into new sectors like agriculture and technology, positioning it for sustained growth.

| Segment | Key Offerings | 2023 Financial Contribution (Illustrative) | Strategic Focus |

|---|---|---|---|

| Property Development | Residential (e.g., Blue Coast, Victoria Blossom), Commercial, Industrial | Significant revenue from sales and leasing | Meeting diverse market needs, ongoing launches |

| Infrastructure & Utilities | Energy, Transportation, Water, Waste Management | Stable recurring income | Strategic acquisitions, global diversification |

| Hospitality | Hotels & Serviced Suites (e.g., Harbour Grand) | Increased revenue and contribution in 2024 | Catering to tourists and extended-stay guests |

| Diversified Investments | Agriculture (Australia), Technology (NEXX) | New revenue avenues, future growth potential | Sustainability, innovation adoption |

What is included in the product

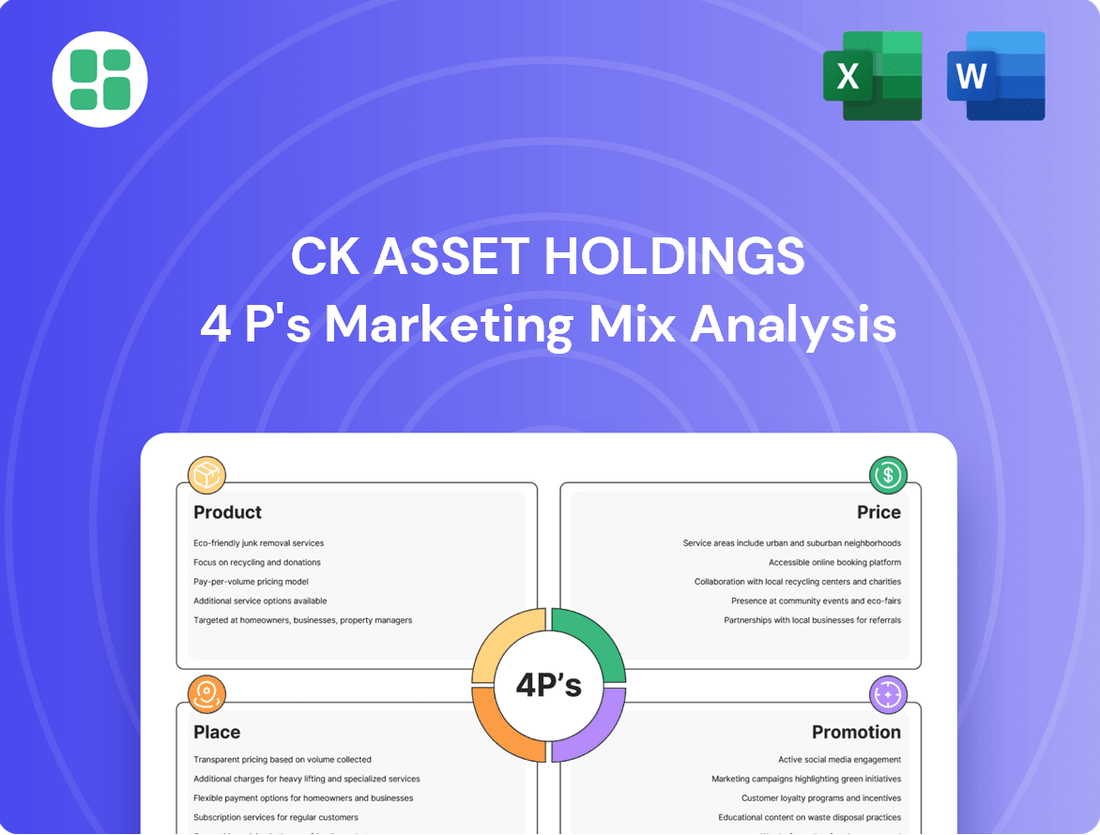

This analysis provides a comprehensive 4P's marketing mix overview for CK Asset Holdings, detailing their product portfolio, pricing strategies, distribution channels, and promotional activities within the competitive real estate and infrastructure sectors.

Provides a clear, actionable breakdown of CK Asset Holdings' 4Ps, simplifying complex marketing strategies to address the pain point of understanding their competitive positioning.

Offers a concise, visual representation of CK Asset Holdings' 4Ps, alleviating the difficulty of synthesizing broad market data into focused strategic insights.

Place

CK Asset Holdings boasts a robust geographical footprint, anchoring its operations firmly in Hong Kong and Mainland China, where it actively manages significant property developments and investments. This dual focus in its core markets provides a stable foundation for its business.

The company's strategic vision extends globally, with a growing presence in key international markets. These include substantial investments and ongoing operations in the United Kingdom, various Continental European nations like Germany, Australia, and Singapore. This international diversification is crucial for mitigating risk and capitalizing on worldwide growth prospects.

CK Asset Holdings primarily employs direct sales channels for its property development, often initiating pre-sales to gauge and capitalize on market interest. This approach was evident in recent launches such as Blue Coast in Wong Chuk Hang and Victoria Blossom in Kai Tak, where direct interaction with prospective buyers was key to driving initial sales momentum.

While CK Asset Holdings is known for its physical properties, they are increasingly using online and hybrid platforms to connect with stakeholders. For example, their 2024 Annual General Meeting was a hybrid event, allowing shareholders to participate and vote either virtually or in person, showcasing a commitment to accessibility.

This digital approach extends to investor relations, where online platforms are crucial for disseminating corporate information and engaging with the investment community. This strategic blend of physical and digital presence ensures broader reach and participation.

Global Network for Infrastructure Assets

CK Asset Holdings leverages a robust global network for its infrastructure and utility assets, a critical component of its distribution strategy. This network comprises acquired and managed entities strategically positioned across key international markets, facilitating widespread operational reach and stable recurring income generation. The company's commitment to this global physical presence underpins the resilience and growth of its infrastructure business model.

The strategic placement of these assets is vital for consistent revenue streams. For instance, as of the first half of 2024, CK Asset Holdings' infrastructure portfolio continued to demonstrate stable performance, benefiting from diversified geographical exposure. This global footprint is not merely about scale but about ensuring operational efficiency and risk mitigation through varied market conditions.

- Global Footprint: Operations span the UK, Australia, New Zealand, Canada, and the United States.

- Income Stability: Diversified geographical presence supports predictable recurring income.

- Operational Synergy: Acquired and managed entities form an integrated global network.

- Strategic Location: Assets are positioned in markets offering stable economic and regulatory environments.

Hotel and Serviced Suite Locations

CK Asset Holdings' hotel and serviced suite portfolio strategically centers on prime urban locations, with a significant concentration in Hong Kong. This focus on key metropolitan areas ensures high accessibility for both business and leisure travelers, a crucial element in their marketing mix.

The company's flagship brands, including Harbour Grand Hotels and Harbour Plaza Hotels & Resorts, are situated in high-demand districts. For example, Harbour Grand Hong Kong is located in Wan Chai, a prime business and entertainment hub. This strategic placement directly supports their objective of maximizing occupancy and revenue by tapping into established market demand.

As of early 2024, CK Asset Holdings operates a substantial portfolio of hotels and serviced apartments. For instance, their Hong Kong properties, such as Harbour Grand Kowloon and Harbour Plaza Metropolis, consistently benefit from the city's status as a global financial and tourism center. This geographic advantage is a cornerstone of their Place strategy, ensuring visibility and convenience for their target clientele.

- Strategic Urban Concentration: Primarily located in major cities like Hong Kong, offering unparalleled convenience for travelers.

- Brand Presence in Key Hubs: Harbour Grand Hotels and Harbour Plaza Hotels & Resorts are positioned in prime business and leisure districts.

- Maximizing Demand: These locations are chosen to capitalize on high occupancy rates and robust revenue generation opportunities.

CK Asset Holdings' property developments are strategically situated in prime Hong Kong locations, such as Wong Chuk Hang and Kai Tak, facilitating direct engagement with potential buyers through pre-sales initiatives. Their infrastructure and utility assets are globally distributed, with a strong presence in the UK, Australia, and various European nations, ensuring stable recurring income and operational synergy across diverse markets.

The company's hotel and serviced suite portfolio is concentrated in high-demand urban centers, exemplified by its Hong Kong properties like Harbour Grand Hong Kong in Wan Chai. This strategic placement in key business and leisure districts aims to maximize occupancy and revenue by leveraging existing market demand and accessibility.

| Asset Type | Key Markets | Strategic Rationale |

|---|---|---|

| Property Development | Hong Kong (Wong Chuk Hang, Kai Tak) | Direct sales, pre-sales, capitalizing on local demand. |

| Infrastructure & Utilities | UK, Australia, Europe, North America | Stable recurring income, operational synergy, risk mitigation. |

| Hotels & Serviced Suites | Hong Kong (Wan Chai), other major cities | High accessibility, maximizing occupancy, capitalizing on tourism and business travel. |

What You Preview Is What You Download

CK Asset Holdings 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive CK Asset Holdings 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion in detail. You'll gain valuable insights into their strategic approach to the market.

Promotion

CK Asset Holdings employs a dynamic sales approach, timing property launches to align with favorable market conditions. This proactive strategy aims to capitalize on buyer interest, as seen with significant pre-sales for developments like Blue Coast and Victoria Blossom.

CK Asset Holdings prioritizes clear corporate communications, utilizing official announcements, detailed financial reports, and annual general meetings to keep shareholders and the broader market informed. This proactive approach ensures transparency regarding the company's financial health, strategic direction, and future growth potential.

These communications are crucial for building and maintaining investor confidence. For instance, CK Asset Holdings' 2024 interim report, released in August 2024, highlighted a robust financial performance, reinforcing its commitment to delivering value to its stakeholders through strategic asset management and development.

CK Asset Holdings actively engages in sustainability and community efforts, participating in events like Earth Hour 2024 to underscore its dedication to corporate social responsibility. This commitment extends to fostering positive community relations and environmental stewardship.

The company's recognition as a Caring Company by the Hong Kong Council of Social Service for 21 consecutive years highlights its consistent dedication to social welfare and corporate citizenship. This long-standing acknowledgment significantly bolsters its public image and brand reputation.

Brand Reputation and Legacy

CK Asset Holdings benefits significantly from the formidable brand reputation and enduring legacy established by its founder, Li Ka-shing, and the broader CK Group. This established presence in property and infrastructure development acts as a powerful, inherent promotional tool, fostering immediate credibility and trust with both consumers and the investment community.

The company's decades-long track record is a testament to its stability and reliability. For instance, as of the first half of 2024, CK Asset Holdings reported a robust financial performance, demonstrating its capacity to deliver value and maintain its market position, which further bolsters its promotional appeal.

- Established Trust: The CK Group's history, dating back decades, cultivates a deep-seated trust that translates into customer loyalty and investor confidence.

- Credibility in Development: A long-standing presence in property and infrastructure signifies expertise and a proven ability to execute complex projects successfully.

- Financial Strength Reinforces Brand: Consistent financial performance, such as the reported profit attributable to shareholders in H1 2024, validates the brand's strength and reliability.

Targeted Market-Specific s

CK Asset Holdings' marketing strategy likely tailors promotions to specific market nuances. For example, the discontinuation of Hong Kong's demand-side management measures in 2024 would necessitate adjustments in property marketing, potentially involving localized incentives or targeted advertising campaigns to resonate with Hong Kong buyers.

This market-specific approach acknowledges that consumer behavior and purchasing power vary significantly by region. By adapting promotional efforts, CK Asset Holdings can more effectively engage potential buyers in different economic environments, ensuring marketing spend is optimized for local conditions.

- Hong Kong Property Market Adjustments: The removal of demand-side management measures in 2024 signals a shift in government policy, potentially impacting buyer sentiment and affordability in Hong Kong.

- Targeted Promotions: CK Asset Holdings would likely implement promotions that directly address these new market dynamics, perhaps offering attractive financing options or value-added services.

- Demographic Focus: Marketing efforts would be further refined to appeal to specific demographic segments within Hong Kong, considering their unique needs and financial capacities.

CK Asset Holdings leverages its strong brand heritage and consistent financial performance as key promotional assets. The company's proactive communication strategy, exemplified by its interim report in August 2024, reinforces investor confidence. Furthermore, its commitment to sustainability and community engagement, recognized by its 21 consecutive years as a Caring Company, enhances its public image and brand appeal.

The company's promotional activities are also finely tuned to market conditions. For instance, the discontinuation of Hong Kong's demand-side management measures in 2024 likely prompted localized promotional adjustments, such as targeted incentives for Hong Kong buyers, to optimize marketing effectiveness.

| Promotional Aspect | Description | Supporting Data/Example |

|---|---|---|

| Brand Heritage & Trust | Leverages decades of established reputation from CK Group. | CK Group's long history fosters immediate credibility and customer loyalty. |

| Financial Transparency | Maintains clear communication of financial health and strategy. | 2024 interim report (released August 2024) highlighted robust financial performance. |

| Corporate Social Responsibility | Demonstrates commitment through sustainability and community initiatives. | Recognized as a Caring Company for 21 consecutive years by the Hong Kong Council of Social Service. |

| Market-Specific Promotions | Adapts marketing to regional economic shifts and policies. | Adjustments in promotions likely followed the removal of Hong Kong's demand-side management measures in 2024. |

Price

CK Asset Holdings prioritizes a market-focused pricing approach, launching new property developments strategically to align with demand and prevailing economic conditions. This often translates to setting what they term "market-clearing" prices, ensuring competitiveness and positive sales momentum even when the market is challenging. For instance, during 2024, their pricing in Hong Kong reflected a careful balance between capturing buyer interest and acknowledging market sensitivities.

CK Asset Holdings employs value-based pricing across its varied portfolio, aligning costs with customer perception. For residential properties, this means factoring in prime locations, amenities, and prevailing market demand, as seen in their Hong Kong developments where prices can reach tens of millions of Hong Kong dollars per unit.

Rental properties and infrastructure assets, however, are priced to capture the stability of long-term leases and consistent revenue. For instance, their infrastructure investments, like the UK’s Northumbrian Water, generate predictable, often inflation-linked, income streams, underpinning their valuation and pricing strategy.

CK Asset Holdings' pricing strategy is deeply influenced by the Hong Kong property market's dynamics, which experienced a noticeable slowdown in 2024. This softness in demand, coupled with persistent high land premiums and construction costs, presents a significant challenge.

Despite these headwinds, the company aims to maintain competitive pricing while ensuring its projects remain profitable. For instance, the average price per square foot for new residential properties in Hong Kong saw fluctuations throughout 2024, with some segments experiencing downward pressure, a factor CK Asset must consider.

The company's ability to manage development costs effectively, even with elevated land acquisition expenses, is crucial for its pricing decisions. Navigating these economic conditions requires a delicate balance to attract buyers and achieve positive financial contributions.

Stable Recurring Income and Dividend Policy

CK Asset Holdings benefits from a substantial portion of its earnings derived from stable, recurring income streams. These include revenue from property rentals and its diverse global infrastructure portfolio, which underpins a consistent dividend policy. This recurring income base provides a solid foundation for shareholder returns.

While the final dividend for 2024 was lower than in 2023, the company's ongoing commitment to dividend payouts signals financial resilience. This dedication to returning value directly influences investor confidence and their perception of CK Asset Holdings' intrinsic worth.

- Recurring Income Sources: Property rentals and global infrastructure operations form the backbone of stable earnings.

- Dividend Policy: The company maintains a commitment to returning value to shareholders through dividends, reflecting financial stability.

- Investor Perception: A consistent dividend policy, supported by recurring income, enhances the company's attractiveness to investors seeking stable returns.

Strategic Land Bank Replenishment and Cost Management

CK Asset Holdings actively manages its land bank, seeking out prime locations for future projects. This careful replenishment strategy is crucial for long-term growth and ensuring a steady pipeline of properties for completion, especially those slated for recognition in 2025.

The company emphasizes cost efficiency throughout the land acquisition and development process. By controlling land premiums and managing development expenses diligently, CK Asset Holdings aims to optimize the final pricing of its residential and commercial offerings, directly influencing profitability for projects coming online in 2025.

- Land Bank Strategy: CK Asset Holdings maintains a prudent approach to acquiring new land parcels, focusing on strategic locations that offer strong development potential.

- Cost Management: The company prioritizes cost control in land premiums and development expenditures to enhance project profitability.

- 2025 Project Impact: Efficient land acquisition and cost management directly influence the pricing and financial success of properties scheduled for completion in 2025.

CK Asset Holdings strategically prices its properties, aiming for market-clearing levels that balance competitiveness with profitability. In the challenging Hong Kong market of 2024, this meant adjusting to soften demand while managing high land and construction costs, ensuring projects remained attractive and financially viable.

The company's pricing reflects a value-based approach, particularly for residential developments where location, amenities, and market demand dictate prices, often reaching tens of millions of Hong Kong dollars per unit. Conversely, rental and infrastructure assets are priced for stable, long-term revenue generation.

CK Asset Holdings' pricing decisions are heavily influenced by the Hong Kong property market's 2024 performance, marked by slower sales and elevated costs. Their ability to control development expenses, even with significant land premiums, is key to setting competitive prices for upcoming 2025 projects.

4P's Marketing Mix Analysis Data Sources

Our CK Asset Holdings 4P's Marketing Mix Analysis is built upon a robust foundation of publicly available data. We meticulously review company filings, investor relations materials, and official press releases to understand their strategic decisions.