CK Asset Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CK Asset Holdings Bundle

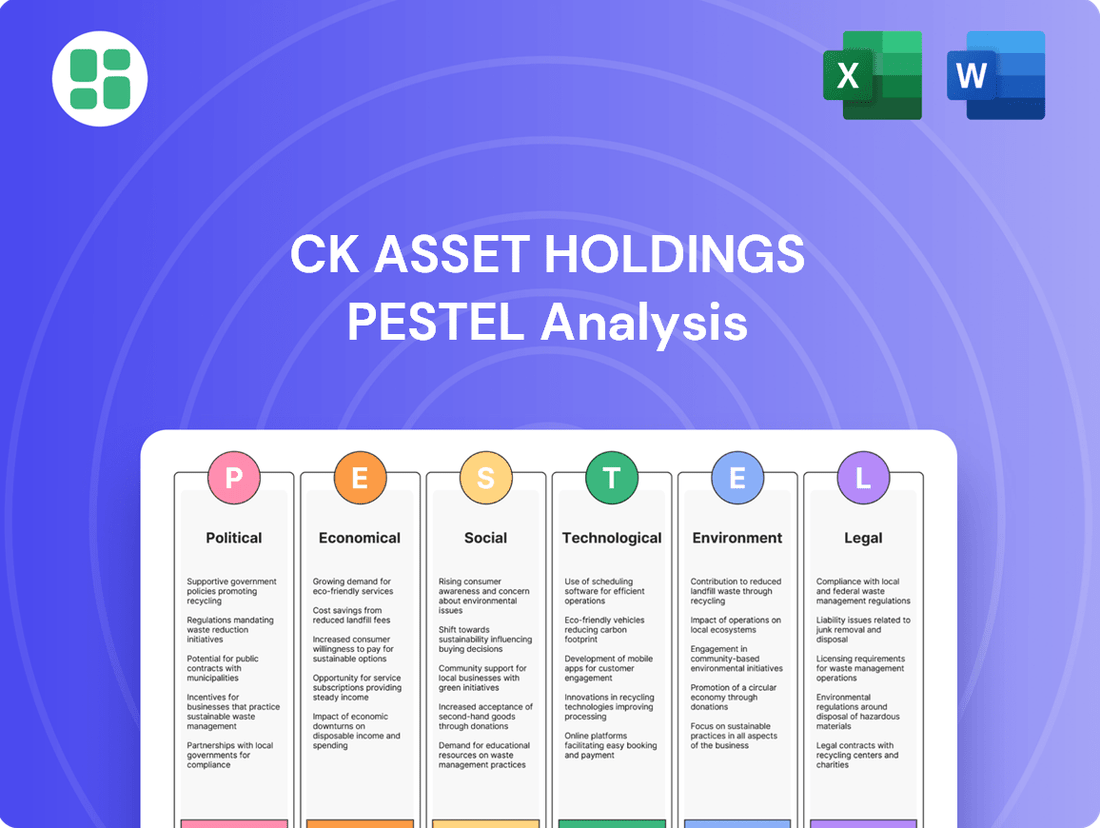

Gain a critical understanding of the external forces shaping CK Asset Holdings's trajectory. Our PESTLE analysis dives deep into political stability, economic fluctuations, social shifts, technological advancements, environmental regulations, and legal frameworks that directly impact their operations. Equip yourself with actionable intelligence to anticipate challenges and capitalize on opportunities.

Unlock the complete PESTLE analysis of CK Asset Holdings and gain a strategic advantage. This comprehensive report provides expert insights into the macro-environmental factors influencing their business, empowering you to make informed decisions. Download the full version now and stay ahead of the curve.

Political factors

The Hong Kong government's proactive stance in 2024-2025 has significantly reshaped the property landscape. Key policy shifts include the complete removal of demand-side stamp duties – the Special Stamp Duty, Buyer's Stamp Duty, and New Residential Stamp Duty – which had previously dampened transaction volumes.

Further bolstering the market, mortgage loan-to-value (LTV) ratios have been eased, making it easier for individuals to secure financing for property purchases. These measures are designed to inject vitality into the market, encouraging greater transaction activity and improving property affordability, which directly benefits developers like CK Asset Holdings.

The Chinese government's ongoing efforts to stabilize its real estate market, which has seen considerable challenges since 2020, directly influence CK Asset Holdings. Initiatives such as the 'White List' lending program, designed to provide financial support to developers, and the push for urban village upgrades aim to curb price drops and reduce excess inventory across the country.

These policy interventions, including the easing of purchase restrictions in various cities, are crucial for CK Asset's substantial investments in Mainland China. For instance, by mid-2024, China's property investment had fallen by 9.8% year-on-year, highlighting the persistent need for government support to foster market recovery and manage developer liquidity.

Heightened geopolitical tensions globally, such as the ongoing conflicts in Eastern Europe and the Middle East, create an uncertain external environment for businesses like CK Asset Holdings. This uncertainty can significantly impact investor confidence and the flow of capital across borders. For instance, in early 2024, the MSCI World Index experienced volatility directly linked to these geopolitical flashpoints, reflecting broader market apprehension.

While CK Asset Holdings benefits from a robust financial position and a strategy focused on stable, recurring income from its diverse international portfolio, these geopolitical risks are not negligible. Cross-border acquisitions, a key growth driver for the company, can face increased scrutiny and potential delays due to sanctions or trade restrictions stemming from these tensions. CK Asset's significant real estate and infrastructure holdings in regions like the UK and Australia, while generally stable, are not entirely immune to the ripple effects of global instability.

Infrastructure and Urban Development Initiatives

Governments in both Hong Kong and Mainland China are heavily investing in major infrastructure and urban development. For instance, Hong Kong's Northern Metropolis plan aims to create new economic and residential hubs, a significant undertaking expected to drive substantial construction and related economic activity. This focus directly benefits CK Asset Holdings, given its substantial portfolio in infrastructure and utility sectors.

These government-driven projects offer a clear strategic alignment for CK Asset. The company's established presence in areas like ports, energy, and transportation infrastructure positions it well to capitalize on the increased demand generated by these large-scale developments. This synergy supports CK Asset's long-term growth objectives by leveraging ongoing public investment.

Key infrastructure and urban development initiatives relevant to CK Asset include:

- Hong Kong's Northern Metropolis: This ambitious project aims to develop a new city in the northern New Territories, projected to house a significant population and create numerous job opportunities, boosting demand for property and infrastructure services.

- Greater Bay Area (GBA) Integration: Continued investment in cross-border infrastructure, such as bridges and high-speed rail, facilitates economic integration and creates opportunities for CK Asset's logistics and utility businesses.

- Smart City Development: Government pushes for smart city technologies in urban renewal projects present avenues for CK Asset to integrate its property development with advanced technological solutions.

Talent Attraction and Immigration Policies

Hong Kong's proactive approach to attracting global talent, notably through initiatives like the revamped Capital Investment Entrant Scheme, directly bolsters its property market. This scheme, which permits investment in residential property, is a key driver for demand. In 2024, such policies are expected to continue supporting the residential sector, a core area for CK Asset Holdings.

The influx of skilled professionals and international students generated by these talent attraction policies significantly boosts the demand for rental properties. This creates a consistent revenue stream for CK Asset, which manages a broad portfolio of residential and commercial rental spaces, benefiting from increased occupancy rates and potentially higher rental yields.

- Talent Schemes Impact: Hong Kong's Capital Investment Entrant Scheme, allowing property investment, directly stimulates the residential market.

- Rental Demand Boost: Influx of professionals and students increases demand for rental properties, benefiting CK Asset's diverse portfolio.

- Economic Contribution: Attracted talent contributes to economic growth, indirectly supporting the property sector and CK Asset's long-term prospects.

Government policies in Hong Kong, such as the complete removal of stamp duties and eased mortgage LTV ratios in 2024, are designed to stimulate property transactions, directly benefiting developers like CK Asset Holdings.

China's efforts to stabilize its real estate market, including the 'White List' lending program and urban village upgrades, are crucial for CK Asset's significant investments there, especially as property investment fell by 9.8% year-on-year by mid-2024.

Global geopolitical tensions in 2024 create market uncertainty, impacting investor confidence and cross-border deals, a factor CK Asset must navigate despite its stable international portfolio.

Major infrastructure projects in Hong Kong, like the Northern Metropolis plan, and continued GBA integration efforts, align with CK Asset's strengths in infrastructure and utilities, promising sustained demand.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting CK Asset Holdings, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering immediate clarity on the external forces impacting CK Asset Holdings.

Helps support discussions on external risk and market positioning during planning sessions, enabling proactive strategy development for CK Asset Holdings.

Economic factors

The Hong Kong residential property market demonstrated a soft performance throughout 2024. Despite the government's removal of cooling measures, including the abolition of all stamp duties on residential property transactions in February 2024, the market saw continued price declines, albeit at a moderating pace towards year-end.

For instance, the Centaline Property Price Index recorded a year-on-year decrease of approximately 5% in the first half of 2024. While market sentiment began to stabilize somewhat in the latter half of the year, driven by interest rate cut expectations and policy adjustments, overall caution persisted, with analysts predicting a further moderate price softening in 2025.

Mainland China's property market saw a significant slump in 2024, with sharp drops in both new and existing home prices. For instance, by late 2024, many major cities reported year-on-year declines exceeding 5% for new home prices.

Despite government efforts to prop up the market, a widespread recovery is unlikely in 2025. This ongoing weakness directly affects CK Asset Holdings' revenue streams from property sales in China, as demand remains subdued and developers face greater challenges.

Anticipated interest rate cuts by the US Federal Reserve in 2025 are poised to lower borrowing costs for mortgages in Hong Kong. This reduction in interest rates is expected to make housing more accessible and potentially stimulate increased activity in the property market.

The Hong Kong Monetary Authority (HKMA) has also eased Loan-to-Value (LTV) ratios, further enhancing mortgage accessibility for potential homebuyers. For instance, in February 2024, the HKMA relaxed LTV limits for higher-value properties, allowing for greater leverage.

Economic Growth and Consumer Confidence

Hong Kong's economy experienced moderate growth in 2024, with real GDP expanding by 2.5%, largely driven by its external sector. However, this growth was tempered by a slight decrease in private consumption expenditure.

Consumer confidence remained subdued throughout 2024, a trend that significantly impacted property markets in both Hong Kong and Mainland China. This economic uncertainty directly affects CK Asset Holdings by dampening demand for its real estate developments.

- 2024 Real GDP Growth: 2.5%

- Impact on Property: Weak consumer confidence weighs on demand.

- Key Driver: External sector supported economic expansion.

Diversified Income Streams and Global Expansion

CK Asset Holdings' strategic push into global infrastructure and utility assets, alongside its expansion in the elderly care sector in markets such as the UK and Germany, is a key driver of diversified income. This approach creates a stable base of recurring revenue, offering a significant hedge against volatility in traditional property markets.

This diversification is crucial for financial resilience, particularly as CK Asset navigates challenges in the Hong Kong and Mainland China property sectors. For instance, while the company reported profit declines in 2024, its international utility and infrastructure investments are designed to provide a more predictable earnings stream.

- Global Infrastructure Investments: CK Asset's portfolio includes significant stakes in utilities and infrastructure projects, such as the acquisition of UK renewable energy assets.

- Elderly Care Expansion: The company is actively growing its presence in the European elderly care market, acquiring facilities in Germany and the UK to tap into a growing demographic need.

- Revenue Diversification: These non-property related ventures aim to balance the cyclical nature of the real estate business, contributing to more stable financial performance.

- Mitigation of Market Risks: By reducing reliance on specific geographic property markets, CK Asset enhances its ability to absorb economic shocks and downturns in individual regions.

Economic factors present a mixed outlook for CK Asset Holdings. While Hong Kong's property market experienced a downturn in 2024, with prices softening despite policy easing, Mainland China's property sector faced a more significant slump, impacting sales. However, anticipated interest rate cuts in 2025 and relaxed LTV ratios are expected to improve mortgage accessibility in Hong Kong, potentially stimulating market activity.

CK Asset's strategic diversification into global infrastructure and utilities, alongside its European elderly care expansion, provides a crucial buffer against property market volatility. This focus on recurring revenue streams from international assets is designed to enhance financial resilience and offer a more stable earnings profile amidst regional property market challenges.

| Economic Factor | 2024 Data/Trend | 2025 Outlook | Impact on CK Asset |

| Hong Kong Property Market | Price declines (approx. 5% YoY H1 2024), moderating pace | Continued moderate softening predicted | Reduced sales revenue from HK property |

| Mainland China Property Market | Significant slump, prices down >5% YoY in major cities (late 2024) | Unlikely widespread recovery | Subdued demand and sales challenges |

| Interest Rates (US Fed) | Stable/Slightly elevated in 2024 | Expected cuts in 2025 | Lower borrowing costs, potential property market stimulus |

| Hong Kong Economy | 2.5% real GDP growth (driven by external sector) | Moderate growth expected | Overall economic stability, but subdued consumption |

| Consumer Confidence | Subdued in 2024 | Likely to remain cautious | Dampened demand for property developments |

Same Document Delivered

CK Asset Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of CK Asset Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will gain valuable insights into the external forces shaping CK Asset Holdings' business landscape, enabling informed strategic planning and risk assessment.

The content and structure shown in the preview is the same document you’ll download after payment. This analysis provides a robust framework for understanding the opportunities and threats CK Asset Holdings faces in the global market.

Sociological factors

Ongoing urbanization in Mainland China and Hong Kong, alongside shifting demographics, directly impacts the demand for different kinds of properties. For instance, the State Council's five-year plan aims to boost the urban population in China, signaling continued urban migration. This trend means CK Asset Holdings needs to fine-tune its development strategies to meet the evolving needs of these growing urban centers.

Consumer preferences in Hong Kong's housing market are notably shifting towards smaller, more budget-friendly units. This trend is largely driven by economic uncertainties and fluctuating interest rates, making larger properties less accessible for many potential buyers. For instance, reports from early 2024 indicated a significant increase in the sale of smaller studio and one-bedroom apartments, reflecting this growing demand for affordability.

Developers like CK Asset Holdings must adapt their strategies to cater to this evolving demand for what are often termed 'small lump sum units'. This means adjusting project designs and marketing to appeal to a wider segment of the population seeking manageable entry points into the property market. The success of CK Asset in 2024 and into 2025 will likely hinge on its ability to deliver these more compact, yet desirable, living spaces.

Societal trends show a significant rise in the desire for smart living, with consumers increasingly seeking properties that integrate advanced technology for greater convenience and connectivity. This demand is particularly strong among younger demographics and urban dwellers. For instance, a 2024 survey indicated that over 60% of potential homebuyers are interested in smart home features, such as automated lighting and security systems.

CK Asset Holdings, as a leading property developer, must adapt by embedding these smart technologies and fostering community-focused designs within its new projects. This includes not just individual unit automation but also shared amenities and digital platforms that enhance resident interaction and overall quality of life. By aligning with this shift, CK Asset can better capture market share and meet the evolving expectations of its customer base.

Social Responsibility and Community Engagement

CK Asset Holdings, as a global entity, is navigating heightened expectations for corporate social responsibility. This includes a growing demand from consumers and investors for ethical business practices and positive societal impact. For instance, in 2023, a significant portion of global consumers indicated a willingness to pay more for products from companies committed to social and environmental causes, underscoring the financial implications of CSR.

The company's strategic investments in community development and placemaking initiatives, such as its support for social infrastructure portfolios, directly address these societal demands. This proactive approach not only bolsters CK Asset's public perception but also fosters stronger relationships within the communities where it operates. Such engagement can translate into tangible benefits, including enhanced brand loyalty and a more favorable operating environment.

CK Asset's commitment to social responsibility is further evidenced by its participation in various community programs. For example, its efforts in urban regeneration projects aim to improve local living standards and create sustainable environments. These initiatives often involve partnerships with local governments and non-profit organizations, demonstrating a collaborative approach to addressing social needs.

The company's financial reporting increasingly highlights its contributions to social well-being. These disclosures provide transparency and allow stakeholders to assess CK Asset's performance against its social responsibility commitments. This focus on measurable impact is becoming a critical factor in investment decisions for many institutional investors.

Workforce Dynamics and Talent Attraction

Hong Kong's proactive approach to attracting global talent, particularly from Mainland China, is reshaping its property market. This influx directly impacts demand for both residential sales and rental properties, influencing CK Asset's strategic focus on catering to this growing demographic, which includes students and professionals seeking accommodation.

The government's initiatives, such as the Top Talent Pass Scheme, have seen significant uptake. For instance, as of early 2024, over 200,000 applications had been received, with a substantial portion approved, indicating a growing population of potential renters and buyers. This trend supports CK Asset's ongoing development and sales strategies for properties in key urban areas, aiming to meet the housing needs of these new residents.

- Talent Inflow: Hong Kong's Top Talent Pass Scheme received over 200,000 applications by early 2024, signaling a robust influx of skilled professionals.

- Property Demand: This demographic shift directly fuels demand for both residential property purchases and rental units, particularly in prime locations.

- CK Asset's Strategy: The company is positioned to benefit by developing and marketing properties that appeal to students and professionals relocating to the city.

Societal shifts toward sustainability and green living are increasingly influencing property choices, with consumers prioritizing energy efficiency and eco-friendly materials. This growing environmental consciousness, evident in a 2024 survey showing a 55% preference for green features among homebuyers, necessitates that developers like CK Asset Holdings integrate sustainable practices into their projects. Aligning with these values can enhance brand reputation and market appeal.

The increasing demand for flexible living arrangements, such as co-living spaces and serviced apartments, reflects changing lifestyle preferences, particularly among younger generations and expatriates. In 2024, the serviced apartment sector in major Asian cities experienced a notable recovery, with occupancy rates rising significantly. CK Asset Holdings can capitalize on this by diversifying its property portfolio to include more adaptable and community-oriented housing solutions.

CK Asset Holdings must also consider the evolving expectations around community engagement and social infrastructure. Consumers are increasingly looking for developments that offer more than just housing, seeking integrated amenities that foster social interaction and well-being. For instance, projects incorporating communal gardens or co-working spaces have seen higher demand in 2024. This trend underscores the need for developers to focus on placemaking and creating vibrant, connected communities.

Technological factors

CK Asset Holdings, like the broader real estate industry, is experiencing a significant shift towards PropTech and digitalization. This involves integrating technologies such as artificial intelligence, big data analytics, the Internet of Things (IoT), virtual reality (VR), and augmented reality (AR) into their operations. These advancements aim to refine property management, boost overall efficiency, elevate tenant satisfaction, and streamline core business processes.

The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) is becoming essential for smart building and infrastructure management. CK Asset Holdings can leverage these technologies to implement predictive maintenance for its critical assets, ensuring smoother operations and minimizing downtime. For example, by 2025, the global smart building market is projected to reach $114.2 billion, indicating significant growth potential for companies adopting these solutions.

Optimizing energy consumption through smart systems offers substantial cost savings and environmental benefits. CK Asset can utilize real-time data analytics from IoT sensors to identify inefficiencies and make informed decisions about energy usage across its properties. This approach can lead to reduced operational expenditures, a key factor in maintaining profitability in the competitive real estate sector.

Hong Kong's construction sector is increasingly adopting innovative methods such as Modular Integrated Construction (MiC). This approach allows for faster project completion, better quality control, and helps mitigate labor shortages, a persistent challenge. For instance, by 2023, the Hong Kong government had set targets to increase the use of MiC in public housing projects, aiming for a significant portion of new developments to incorporate this method.

CK Asset Holdings can leverage these technological advancements by integrating MiC and other smart construction technologies into its property development pipeline. This strategic adoption can lead to enhanced operational efficiency, reduced construction timelines, and a more sustainable building process, ultimately improving project profitability and market competitiveness.

Data Analytics for Market Insights

CK Asset Holdings can leverage sophisticated data analytics, including AI and machine learning, to unlock deeper market insights. These technologies can process extensive real estate datasets, identifying patterns and predicting future trends with remarkable accuracy. For instance, by analyzing transaction histories, demographic shifts, and economic indicators, CK Asset can refine property valuations and pinpoint lucrative investment opportunities. This data-driven approach is crucial for navigating the dynamic property market, especially in 2024 and looking into 2025.

The application of these advanced analytics empowers CK Asset with a significant competitive edge. It facilitates more informed decisions across various business functions, from initial site selection and development planning to marketing strategies and property management optimization. Understanding granular market dynamics allows for tailored product offerings and more efficient resource allocation, ultimately driving profitability and mitigating risks.

Key applications for CK Asset include:

- Predictive modeling for property price fluctuations, enabling proactive investment strategies based on anticipated market movements.

- Customer segmentation and behavior analysis to tailor marketing campaigns and product development to specific buyer profiles.

- Operational efficiency improvements in property management through predictive maintenance and optimized resource deployment.

- Risk assessment for development projects by analyzing factors like construction costs, regulatory changes, and local economic health.

Cybersecurity and Data Protection

Cybersecurity and data protection are paramount as CK Asset Holdings integrates more digital platforms and smart technologies. The company must implement strong safeguards for sensitive information and its digital infrastructure, especially with the increasing prevalence of connected devices in real estate and retail operations. For instance, in 2024, global spending on cybersecurity solutions was projected to reach over $270 billion, highlighting the significant investment required in this area.

CK Asset's reliance on technology means it faces evolving cyber threats. Protecting customer data, proprietary information, and operational integrity is crucial for maintaining trust and avoiding costly breaches. The company's commitment to innovation in smart buildings and digital services necessitates continuous investment in advanced cybersecurity measures. In 2023, the average cost of a data breach globally was estimated at $4.45 million, underscoring the financial risks associated with inadequate protection.

- Growing threat landscape: The increasing sophistication of cyberattacks demands constant vigilance and adaptation of security protocols.

- Regulatory compliance: Adhering to data protection regulations like GDPR and similar frameworks globally is essential to avoid penalties and maintain reputation.

- Investment in technology: Significant capital expenditure is required for state-of-the-art cybersecurity software, hardware, and skilled personnel.

- Reputational risk: A major data breach could severely damage CK Asset's brand image and customer loyalty.

CK Asset Holdings is actively integrating advanced technologies like AI, IoT, and big data analytics to enhance property management and operational efficiency. The global smart building market is projected for substantial growth, reaching an estimated $114.2 billion by 2025, underscoring the strategic importance of these digital advancements.

The adoption of Modular Integrated Construction (MiC) is a key technological trend in Hong Kong's construction sector, aiming for faster project delivery and improved quality. By 2023, the Hong Kong government was targeting increased MiC usage in public housing, signaling a broader industry shift.

Leveraging data analytics and AI allows CK Asset to gain deeper market insights, refine property valuations, and identify new investment opportunities, crucial for navigating the dynamic market through 2024 and into 2025. Cybersecurity remains a critical focus, with global cybersecurity spending projected to exceed $270 billion in 2024, reflecting the need for robust data protection measures.

Legal factors

In 2024, Hong Kong's government enacted substantial legal and regulatory shifts impacting its property market. Notably, the abolition of stamp duties on property transactions and the relaxation of mortgage loan-to-value (LTV) ratios were implemented. These changes aim to invigorate property sales and lower entry barriers for buyers, directly influencing CK Asset Holdings' sales volumes and pricing approaches.

Government land sales programs significantly shape the property development landscape for companies like CK Asset Holdings. In Hong Kong, the government has been actively pursuing policies to boost land and housing supply, aiming to address affordability concerns. For instance, the Lands Department's land sale program for the fiscal year 2024-2025 includes a projected supply of approximately 13,000 residential units from government land sales.

Mainland China's approach, however, often focuses on curbing speculative demand. This regulatory stance impacts how developers like CK Asset can replenish their land banks, requiring careful navigation of national and local policies. In 2024, various cities continued to implement measures such as purchase restrictions and mortgage rate adjustments to stabilize the property market, influencing the cost and availability of land for acquisition.

Global environmental regulations are tightening, with a significant focus on carbon emissions and sustainable building practices. For instance, by 2024, many jurisdictions are implementing stricter energy efficiency standards for new constructions. CK Asset Holdings must navigate these evolving laws, ensuring its property developments and infrastructure projects meet or exceed these requirements.

The company's commitment to sustainability is crucial for compliance and market competitiveness. In 2023, the global green building market was valued at over $1.5 trillion and is projected to grow substantially. CK Asset's integration of green building guidelines, such as those mandated by LEED or BREEAM certifications, will be key to meeting these regulatory demands and appealing to environmentally conscious stakeholders.

International Investment and Regulatory Frameworks

CK Asset Holdings' global reach, particularly its significant investments in the UK and Germany, necessitates a deep understanding of varied legal landscapes. Navigating property laws, foreign investment rules, and evolving policies driven by geopolitical events across these jurisdictions is critical for sustained growth and compliance. For instance, the UK's property market is subject to regulations like the Land Registration Act, while Germany has its own stringent property and investment laws.

The company must remain agile to adapt to potential policy shifts. For example, changes in foreign direct investment screening in the UK or EU could impact future acquisitions. Staying abreast of these legal nuances ensures CK Asset can effectively manage its international portfolio and mitigate risks associated with cross-border operations.

- UK Property Law Compliance: Adherence to regulations such as the Landlord and Tenant Act 1954 and the Town and Country Planning Act 1990 is essential for CK Asset's UK property ventures.

- German Investment Regulations: Understanding the German Foreign Trade and Payments Act (Außenwirtschaftsgesetz) and its implications for capital flows and investment approvals is paramount.

- Geopolitical Impact on Policy: Monitoring potential changes in international trade agreements or sanctions, which could indirectly affect investment regulations in key markets like the UK and Germany, is a continuous requirement.

Consumer Protection and Data Privacy Laws

As CK Asset Holdings navigates an increasingly digital world, consumer protection and data privacy laws are paramount. Regulations like the Personal Data (Privacy) Ordinance in Hong Kong and similar frameworks globally dictate how the company must handle customer information across property sales, leasing, and management. Adherence is crucial for maintaining consumer trust and avoiding significant legal penalties.

For instance, the European Union's General Data Protection Regulation (GDPR), which came into full effect in 2018, sets a high bar for data handling. While CK Asset's primary operations are in Asia, the increasing interconnectedness of global markets means awareness of such stringent standards is beneficial. Non-compliance can lead to substantial fines, impacting financial performance and brand reputation. In 2024, data privacy enforcement actions globally continued to rise, with significant penalties levied against companies for breaches and misuse of personal data.

- Data Protection Compliance: CK Asset must ensure its digital platforms and operational processes comply with evolving data privacy laws, such as Hong Kong's PDPO and international standards.

- Fair Practices in Sales and Leasing: Regulations govern transparent and fair dealings in property transactions, preventing deceptive practices and protecting consumer rights.

- Consumer Trust: Robust data privacy measures and ethical business conduct are essential for building and maintaining consumer confidence in CK Asset's services.

- Legal and Financial Risks: Non-compliance with consumer protection and data privacy laws can result in substantial fines, litigation, and reputational damage.

Legal and regulatory frameworks significantly influence CK Asset Holdings' operations, particularly concerning property development and investment. Hong Kong's 2024 policy shifts, like the abolition of stamp duties and relaxed mortgage rules, directly impact sales and pricing strategies, aiming to boost market activity. In contrast, Mainland China's focus on curbing speculation, through measures like purchase restrictions, affects land acquisition costs and availability.

Globally, tightening environmental laws mandate adherence to stricter energy efficiency standards for new constructions, a trend evident by 2024. CK Asset must integrate green building practices, aligning with standards like LEED or BREEAM, to meet regulatory demands and appeal to environmentally conscious stakeholders, a market valued at over $1.5 trillion in 2023.

Navigating diverse legal landscapes in key international markets like the UK and Germany is crucial. Compliance with property laws, foreign investment regulations, and evolving policies, such as the UK's Land Registration Act and Germany's Foreign Trade and Payments Act, are paramount for sustained growth and risk mitigation. Staying informed about potential shifts in foreign direct investment screening is also vital.

Data privacy and consumer protection laws, such as Hong Kong's PDPO and the EU's GDPR, are critical for maintaining consumer trust and avoiding penalties. With global data privacy enforcement actions rising in 2024, CK Asset must ensure its digital operations and customer data handling practices meet stringent standards to prevent legal and reputational damage.

Environmental factors

Global and local commitments to achieve carbon neutrality before 2050 are reshaping the property and infrastructure sectors. CK Asset Holdings, recognizing this, is actively pursuing its transition to carbon neutrality, aiming to reduce its carbon emissions. This strategic focus aligns with increasing regulatory pressures and investor expectations for sustainable business practices.

The real estate sector, including CK Asset Holdings, faces increasing pressure to adopt sustainable building practices and enhance energy efficiency. Globally, green building certifications like LEED and BREEAM are becoming standard, with a growing number of new constructions aiming for net-zero energy status by 2030. CK Asset's commitment to ESG principles is evident in its adoption of sustainable building guidelines, aligning with this trend towards environmentally conscious development.

CK Asset's participation in initiatives like 'Earth Hour' demonstrates a broader commitment to environmental stewardship, reflecting a growing public and investor demand for corporate responsibility. In 2024, for instance, many major corporations reported significant reductions in carbon emissions through energy-saving measures in their buildings, a trend CK Asset is likely to follow to maintain its appeal.

CK Asset Holdings prioritizes efficient resource management, focusing on water and energy conservation across its operations. This includes implementing advanced building technologies to reduce consumption in both construction phases and ongoing property management. For instance, new developments in 2024 are incorporating smart metering systems and high-efficiency HVAC units, aiming for a 15% reduction in energy usage compared to previous benchmarks.

Waste reduction is another key environmental focus for CK Asset. The company is committed to minimizing construction waste through better material sourcing and recycling programs, with a target of diverting 70% of construction debris from landfills by the end of 2025. In property management, initiatives like enhanced recycling streams and composting programs are being rolled out in residential and commercial portfolios to further lessen their environmental impact.

Biodiversity Protection and Environmental Impact Assessment

CK Asset Holdings recognizes that property development and infrastructure projects can significantly affect local ecosystems and biodiversity. The company has established a Biodiversity Policy, demonstrating a commitment to evaluating and reducing the environmental footprint of its developments, especially in ecologically sensitive regions.

This policy guides their approach to minimizing negative impacts, such as habitat loss or disruption to wildlife. For instance, in 2023, CK Asset reported undertaking environmental impact assessments for new projects, aiming to integrate biodiversity considerations from the planning stages. Their commitment extends to exploring mitigation strategies like habitat restoration or creating green spaces within developments.

- Biodiversity Policy Adoption CK Asset has formally adopted a Biodiversity Policy.

- Environmental Impact Assessment Focus The policy mandates assessment and mitigation of environmental impacts.

- Sensitive Area Prioritization Special attention is given to projects in ecologically sensitive locations.

- Mitigation Strategies The company aims to implement measures to reduce negative effects on biodiversity.

Environmental, Social, and Governance (ESG) Integration

Environmental factors are becoming a significant consideration for investors and stakeholders alike. CK Asset Holdings acknowledges this growing trend and is actively integrating Environmental, Social, and Governance (ESG) principles into its core business strategy. This commitment is not just about corporate responsibility; it's about building long-term value and resilience.

The company's approach involves embedding sustainability into its investment selection process and daily operations. This proactive stance helps to mitigate risks associated with environmental regulations and resource scarcity, while also fostering a positive corporate image. For instance, CK Asset Holdings has been increasingly focused on developing properties with a lower environmental footprint, such as incorporating energy-efficient designs and sustainable materials. This aligns with global efforts to combat climate change and promotes a more responsible approach to real estate development.

- ESG Integration: CK Asset Holdings is actively incorporating ESG principles into its investment and operational frameworks, reflecting a growing investor demand for sustainable practices.

- Sustainability Focus: The company recognizes that sustainability is crucial for long-term corporate viability and reputation enhancement, driving its strategic decision-making.

- Risk Mitigation: By addressing environmental concerns, CK Asset Holdings aims to reduce potential regulatory risks and enhance its resilience against climate-related challenges.

- Reputation Enhancement: A strong commitment to ESG principles contributes to a positive brand image, attracting environmentally conscious investors and stakeholders.

CK Asset Holdings is actively responding to the global push for carbon neutrality, with a strategic focus on reducing its carbon emissions to align with 2050 targets. This commitment is driven by increasing regulatory demands and a growing investor preference for businesses demonstrating strong Environmental, Social, and Governance (ESG) principles.

The company is enhancing energy efficiency in its properties, adopting sustainable building practices and aiming for net-zero standards, a trend echoed by many global developers. Initiatives like participation in Earth Hour and the implementation of smart technologies in new builds, such as advanced HVAC systems, underscore this dedication to reducing environmental impact and operational costs.

CK Asset Holdings is also prioritizing efficient resource management, focusing on water and energy conservation across its operations. Furthermore, the company is committed to waste reduction, with targets for diverting construction debris from landfills and improving recycling programs in its managed properties, demonstrating a holistic approach to environmental stewardship.

The company's adoption of a Biodiversity Policy highlights its commitment to minimizing the ecological footprint of its developments. This policy guides the assessment and mitigation of impacts on local ecosystems, with a particular focus on sensitive areas and the implementation of strategies like habitat restoration.

PESTLE Analysis Data Sources

Our PESTLE Analysis for CK Asset Holdings is built on a robust foundation of data from official government publications, reputable financial news outlets, and leading industry research firms. This comprehensive approach ensures that all insights are grounded in current and verifiable information.