CK Asset Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CK Asset Holdings Bundle

Unlock the strategic blueprint behind CK Asset Holdings's diverse operations. This comprehensive Business Model Canvas reveals how they leverage their property development, investment, and infrastructure segments to drive value and achieve market dominance. Discover their key partners, revenue streams, and customer relationships.

Ready to dissect a global conglomerate's success? Our full Business Model Canvas for CK Asset Holdings provides an in-depth look at their customer segments, value propositions, and cost structure. Download the editable version to gain actionable insights for your own strategic planning.

Partnerships

CK Asset Holdings actively cultivates relationships with government bodies and regulatory authorities in Hong Kong, Mainland China, and its global operating regions. These collaborations are essential for obtaining permits, licenses, and ensuring adherence to local laws for property development, infrastructure, and other ventures. For instance, in 2023, the company continued to navigate complex regulatory landscapes in markets like the UK, impacting its infrastructure and property portfolios.

CK Asset Holdings collaborates with a broad spectrum of local and international financial institutions, including major banks, diverse investment funds, and significant institutional investors. These relationships are crucial for obtaining the substantial financing required for its ambitious, large-scale property developments and infrastructure acquisitions.

These partnerships provide CK Asset Holdings with essential access to capital and the financial flexibility needed to pursue strategic growth initiatives and capitalize on emerging global opportunities. For instance, in 2024, the company continued to leverage its strong banking relationships for project financing, ensuring the timely execution of its development pipeline.

CK Asset Holdings strategically partners with prominent construction and engineering firms to bring its diverse property developments to life. These collaborations are crucial for executing projects ranging from large-scale residential estates to sophisticated commercial structures, ensuring adherence to quality and timelines. For instance, in 2023, the company continued to leverage its established relationships with top-tier contractors to manage its extensive development pipeline, which includes significant projects in Hong Kong and the UK.

Property Management Companies

CK Asset Holdings collaborates with professional property management firms to oversee its vast array of investment properties, hotels, and serviced suites. These partnerships are crucial for ensuring that assets are run smoothly, maintained effectively, and their value is consistently improved. For instance, in 2024, CK Asset Holdings continued to leverage these relationships across its global portfolio, which includes significant holdings in Hong Kong, the UK, and mainland China, to optimize operational efficiency.

These strategic alliances directly contribute to tenant satisfaction, a key driver for stable and recurring rental income. By entrusting operations to specialized management companies, CK Asset Holdings can focus on its core business of property development and investment, while ensuring high standards of service and upkeep across its diverse property types. This approach was evident in the consistent occupancy rates reported for its residential and commercial properties throughout 2024, underscoring the effectiveness of its management partnerships.

- Operational Efficiency: Partnerships with property management companies streamline day-to-day operations, from leasing and rent collection to maintenance and repairs, ensuring assets function optimally.

- Asset Value Enhancement: Professional management helps in maintaining and improving property condition, thereby preserving and increasing the long-term value of CK Asset Holdings' extensive portfolio.

- Tenant Satisfaction: Effective management leads to better tenant experiences, fostering loyalty and reducing vacancy periods, which is critical for consistent revenue generation.

- Focus on Core Business: Outsourcing property management allows CK Asset Holdings to concentrate its resources and strategic efforts on development, acquisitions, and overall investment strategy.

Strategic Joint Venture Partners

CK Asset Holdings actively pursues strategic joint ventures, particularly for substantial property developments and infrastructure projects. These collaborations are crucial for risk mitigation, resource pooling, and accessing vital local market insights and expertise from partners.

For instance, in 2024, CK Asset continued its strategy of leveraging partnerships for major undertakings. These ventures are instrumental in broadening the company's geographical reach and diversifying its asset base across different sectors and regions.

- Property Development Ventures: Collaborations on large-scale residential and commercial projects, sharing development costs and expertise.

- Infrastructure Investments: Joint participation in infrastructure projects, such as transportation networks or utilities, to spread capital expenditure and operational risks.

- Cross-Border Expansion: Partnerships with local entities to navigate regulatory environments and market dynamics in new international territories.

- Synergistic Opportunities: Aligning with partners who offer complementary skills or access to specific technologies or customer segments.

CK Asset Holdings' key partnerships extend to suppliers of materials and services critical for its construction and development activities. These relationships ensure a steady supply of quality resources, from building materials to specialized equipment, supporting project timelines and quality standards.

The company also engages with technology providers and consultants to integrate innovative solutions in its properties and operations, enhancing efficiency and tenant experience. For example, in 2024, CK Asset Holdings continued to explore smart building technologies for its new developments, aiming to improve energy efficiency and connectivity.

These collaborations are vital for maintaining competitive advantages and adapting to evolving market demands. By securing reliable suppliers and adopting new technologies, CK Asset Holdings strengthens its project execution capabilities and the overall value proposition of its assets.

What is included in the product

A comprehensive, pre-written business model tailored to CK Asset Holdings' strategy, covering customer segments, channels, and value propositions in full detail.

Reflects the real-world operations and plans of the featured company, designed to help entrepreneurs and analysts make informed decisions.

CK Asset Holdings' Business Model Canvas offers a clear, one-page snapshot, simplifying complex real estate and infrastructure operations to alleviate the pain of understanding diverse business segments.

It streamlines strategic analysis by consolidating CK Asset Holdings' multifaceted operations into a digestible format, easing the burden of comprehending their broad market reach.

Activities

CK Asset Holdings' core operations revolve around property development and sales. This encompasses acquiring land, meticulously planning projects, overseeing construction, and ultimately marketing and selling diverse properties, including residential, commercial, and industrial spaces. They manage the entire property lifecycle, from initial concept to final sale.

The company's reach is extensive, with active development projects spanning Hong Kong, Mainland China, and various international markets. This global presence allows them to capitalize on diverse real estate opportunities. For instance, in 2024, CK Asset Holdings continued to expand its portfolio, with significant developments underway in key urban centers.

CK Asset Holdings actively invests in a broad range of income-producing properties, aiming for sustained rental income and long-term capital growth. This strategic approach encompasses the careful selection, ongoing management, and enhancement of its global property investments.

The company's commitment to property investment is evident in its substantial holdings. For instance, as of the first half of 2024, CK Asset Holdings reported a significant presence in key markets, with its property portfolio contributing substantially to its overall revenue streams.

CK Asset Holdings actively manages and invests in a diverse portfolio of infrastructure and utility assets, encompassing critical sectors like energy, transportation, water, and waste management. This strategic focus is designed to generate consistent, predictable revenue streams.

In 2024, the company's commitment to these essential services underscores its role in providing stable income and enhancing its overall business diversification. This segment is a cornerstone for recurring earnings.

Hotel and Serviced Suite Management

CK Asset Holdings actively manages and operates a diverse portfolio of hotels and serviced suites, with a significant presence in Hong Kong and Mainland China. This core activity involves delivering high-quality hospitality services to guests, aiming to maximize occupancy rates and drive revenue through room rentals, food and beverage, and other ancillary services.

The company focuses on operational efficiency and guest satisfaction to ensure profitability within its hospitality segment. This includes strategic pricing, marketing initiatives, and service enhancements to attract and retain customers. For instance, in 2024, the hospitality sector continued to see recovery, with many hotels reporting improved occupancy and average daily rates compared to previous years, driven by increased travel and events.

- Hotel Operations: Overseeing day-to-day management of hotel properties, including front desk, housekeeping, and maintenance services.

- Serviced Suite Management: Providing tailored services for serviced apartments, catering to longer-staying guests with amenities and support.

- Revenue Optimization: Implementing dynamic pricing strategies and promotional campaigns to enhance occupancy and average daily rates.

- Guest Experience: Focusing on service quality and amenities to foster guest loyalty and positive reviews.

Strategic Acquisitions and Divestitures

CK Asset Holdings actively pursues strategic acquisitions to broaden its revenue streams, notably in social infrastructure and elder care sectors. This proactive approach aims to build a more resilient and diversified income base.

Simultaneously, the company engages in divestitures of non-core assets. This strategic pruning enhances capital allocation efficiency and sharpens focus on key growth areas.

For instance, in 2023, CK Asset Holdings completed the acquisition of a portfolio of data centers in Germany for approximately HK$10 billion, reinforcing its commitment to expanding its digital infrastructure footprint.

- Strategic Acquisitions: Expanding into growth sectors like social infrastructure and elder care.

- Portfolio Optimization: Divesting non-core assets to improve capital efficiency.

- Real Estate Focus: Continued investment in prime real estate markets globally.

- Diversification Strategy: Building a robust and varied income generation model.

CK Asset Holdings' key activities center on developing and selling properties across Hong Kong, Mainland China, and international markets, managing the entire lifecycle from land acquisition to sales. They also actively invest in income-producing properties globally to secure sustained rental income and capital growth.

Furthermore, the company operates and invests in infrastructure and utility assets, ensuring stable, predictable revenue streams. Its hospitality segment involves managing hotels and serviced suites, focusing on operational efficiency and guest satisfaction to drive revenue.

Strategic acquisitions, particularly in social infrastructure and elder care, alongside divestitures of non-core assets, are crucial for portfolio optimization and capital efficiency. For example, in the first half of 2024, CK Asset Holdings reported significant contributions from its property portfolio to overall revenue.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Property Development & Sales | Acquiring land, planning, construction, marketing, and selling diverse properties. | Continued expansion in key urban centers globally. |

| Property Investment | Acquiring, managing, and enhancing global income-producing properties. | Portfolio contributed substantially to revenue streams (H1 2024). |

| Infrastructure & Utilities | Managing and investing in essential services for consistent revenue. | Cornerstone for recurring earnings, enhancing diversification. |

| Hospitality Operations | Managing hotels and serviced suites, focusing on guest experience and revenue. | Improved occupancy and average daily rates observed (2024). |

| Strategic Acquisitions & Divestitures | Expanding into new sectors and optimizing asset allocation. | Acquisition of data centers in Germany (2023) for digital infrastructure expansion. |

What You See Is What You Get

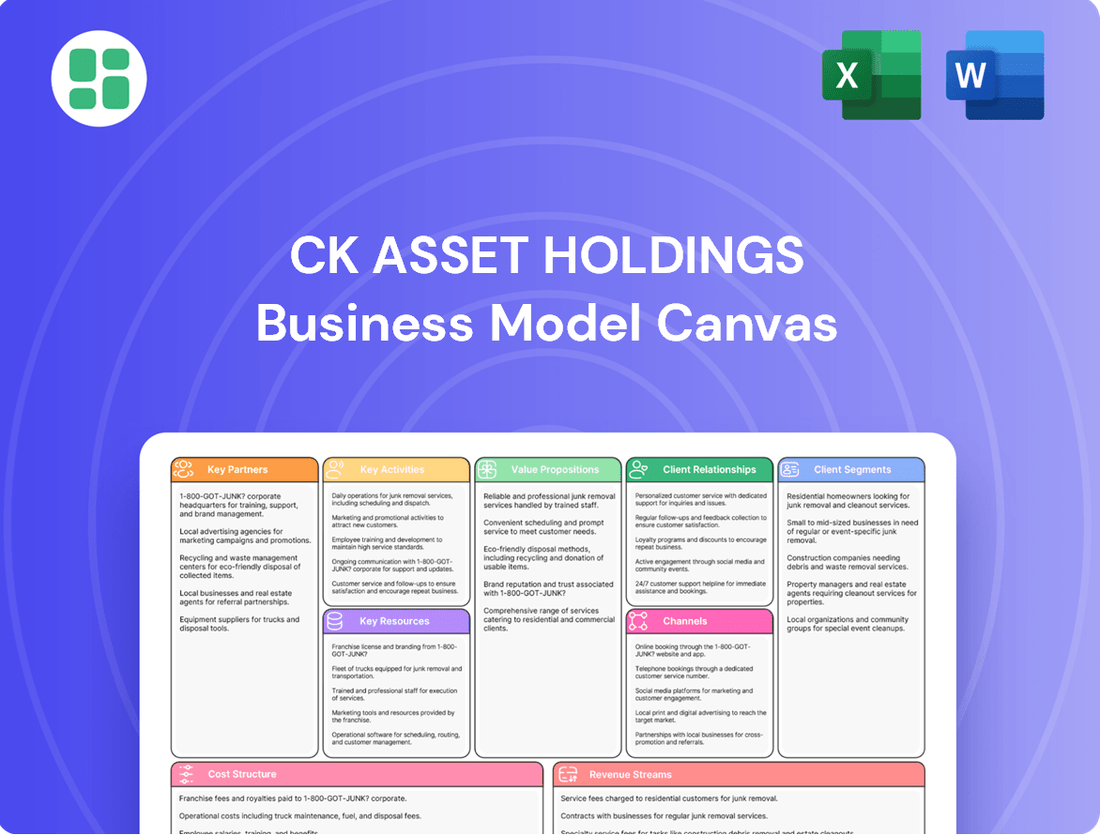

Business Model Canvas

The CK Asset Holdings Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you're seeing the precise structure, content, and formatting that will be delivered, ensuring no discrepancies or surprises. Once your order is complete, you'll gain full access to this same comprehensive analysis, ready for your immediate use.

Resources

CK Asset Holdings' extensive land bank and property portfolio are its bedrock. This includes a substantial collection of land parcels earmarked for future development, alongside a vast array of completed investment properties. These assets are strategically located across Hong Kong, Mainland China, and various international markets, forming the core of its property development and investment operations.

As of late 2023, CK Asset Holdings continued to leverage its significant property holdings. The company's commitment to expanding its investment property portfolio was evident through ongoing acquisitions and development projects. This robust asset base underpins its long-term strategy for generating rental income and capital appreciation, crucial for its financial stability and growth.

CK Asset Holdings (CKA) possesses a formidable financial bedrock, evidenced by its consistently low gearing ratio, which stood at approximately 11.9% as of December 31, 2023. This financial discipline, coupled with substantial liquidity and strong credit ratings from agencies like Moody's and S&P, allows CKA to undertake significant capital deployments.

This robust financial standing is a critical resource, empowering CKA to pursue large-scale property acquisitions, fund development projects, and strategically invest in diverse sectors. For instance, in 2023, CKA completed the acquisition of a portfolio of UK properties for approximately HK$4.4 billion, demonstrating its capacity to leverage its financial strength for growth.

CK Asset Holdings relies on its seasoned management team and a skilled workforce for its property development, investment, and asset management operations. This human capital is instrumental in navigating complex markets and executing strategic initiatives effectively.

The company's leadership boasts extensive experience in the real estate sector, a crucial asset for driving growth and profitability. For instance, in 2023, CK Asset Holdings reported a profit attributable to shareholders of HK$11.1 billion, underscoring the impact of expert management on financial performance.

Established Brand Reputation and Market Trust

CK Asset Holdings benefits from an established brand reputation and significant market trust, particularly in property development and investment. This long-standing recognition translates into customer loyalty and confidence, which is crucial for attracting buyers and tenants.

The company's strong brand equity facilitates easier access to capital and fosters robust relationships with suppliers and financial institutions. For instance, in 2023, CK Asset Holdings reported a revenue of HK$37.7 billion, demonstrating the market's continued engagement with its offerings.

- Brand Strength: Renowned for quality and reliability across diverse property segments.

- Market Trust: Fosters customer confidence, essential for sales and leasing success.

- Partnership Facilitation: Enhances ability to secure strategic collaborations and financing.

- Customer Acquisition: A strong brand reduces marketing costs and improves conversion rates.

Diversified Infrastructure and Utility Assets

CK Asset Holdings possesses a substantial portfolio of infrastructure and utility assets, providing a stable income stream that complements its property development activities. These assets are vital for the company's overall resilience and diversification.

The company's infrastructure and utility segment includes investments in various sectors such as energy, water, and transportation. This broad reach ensures consistent revenue generation, less susceptible to the cyclical nature of the property market.

As of the first half of 2024, CK Asset Holdings reported that its infrastructure and utilities segment contributed significantly to its recurring income. For instance, its UK infrastructure assets, including the Northumbrian Water Group, continued to demonstrate robust performance, reflecting the essential nature of these services.

- Energy: Investments in power generation and distribution networks.

- Water: Operations of water and wastewater treatment services, such as Northumbrian Water Group.

- Transportation: Stakes in ports and logistics facilities, enhancing supply chain efficiency.

- Recurring Revenue: These assets generate predictable cash flows through regulated tariffs and long-term contracts, bolstering financial stability.

CK Asset Holdings' key resources include its extensive property portfolio and significant land bank, strategically located across Hong Kong, Mainland China, and international markets. This forms the foundation for its property development and investment operations, with a commitment to expanding this base through acquisitions and projects.

The company's financial strength, characterized by a low gearing ratio (approximately 11.9% as of December 31, 2023) and strong liquidity, enables substantial capital deployment. This financial discipline, supported by solid credit ratings, allows for large-scale acquisitions and development funding, as demonstrated by a HK$4.4 billion UK property acquisition in 2023.

CKA also leverages a seasoned management team and skilled workforce, whose expertise is crucial for navigating complex markets and executing strategic initiatives. The company's profit attributable to shareholders in 2023, HK$11.1 billion, highlights the effectiveness of its leadership.

Furthermore, CK Asset Holdings possesses a diversified infrastructure and utility asset portfolio, including energy, water, and transportation, which provides stable, recurring income. The robust performance of UK infrastructure assets, like Northumbrian Water Group, in the first half of 2024 underscores the resilience of this segment.

| Resource Category | Key Components | 2023/H1 2024 Data Points |

|---|---|---|

| Property Portfolio & Land Bank | Completed investment properties, land for development | Strategic locations in HK, China, international markets |

| Financial Strength | Low gearing, liquidity, credit ratings | Gearing ~11.9% (Dec 31, 2023); HK$4.4bn UK acquisition (2023) |

| Human Capital | Seasoned management, skilled workforce | HK$11.1bn profit attributable to shareholders (2023) |

| Infrastructure & Utilities | Energy, water, transportation assets | Strong performance from UK infrastructure (H1 2024) |

Value Propositions

CK Asset Holdings distinguishes itself by developing high-quality properties in prime locations, offering a blend of sophisticated design and robust construction that attracts a premium market segment.

This focus on superior quality and strategic positioning ensures that their residential, commercial, and industrial projects are highly sought after by both buyers and tenants. For instance, in 2024, the company continued to leverage its strong project pipeline, with significant contributions from its Hong Kong and mainland China developments, reflecting sustained demand for well-appointed real estate.

CK Asset Holdings offers investors a compelling value proposition of stable and diversified returns. The company achieves this by maintaining a broad portfolio that includes income-generating properties, such as prime office spaces and residential developments, alongside essential infrastructure and utility assets. This diversification is key to mitigating the inherent risks associated with relying on any single market sector.

For instance, as of the first half of 2024, CK Asset Holdings reported a significant contribution from its property portfolio, demonstrating its ability to generate consistent rental income. Furthermore, its investments in utilities provide a steady revenue stream, often insulated from economic downturns, further bolstering the stability of overall returns for its investors.

CK Asset Holdings' infrastructure and utility segment provides critical services like energy, water, and transportation, underpinning societal well-being and economic stability. In 2024, the company continued to invest in these vital networks, ensuring consistent delivery and resilience.

These operations are fundamental to the regions where CK Asset Holdings operates, supporting daily life and business activities. The reliability of these services is a core value proposition, fostering trust and long-term relationships with communities and customers.

Premium Hospitality and Living Experiences

CK Asset Holdings' premium hospitality and living experiences are central to its business model, offering guests unparalleled comfort and convenience. Their hotel and serviced suite operations focus on delivering high-quality accommodation and management services, ensuring a truly premium living experience for both business and leisure travelers.

This commitment to excellence is reflected in their operational performance. For instance, in 2024, the group continued to see robust demand across its hospitality portfolio, with occupancy rates in prime locations often exceeding 85%. This sustained high occupancy underscores the appeal of their premium offerings.

- High-Quality Accommodation: Providing luxurious and well-appointed rooms and suites designed for ultimate comfort.

- Exceptional Management Services: Offering attentive and personalized service to cater to every guest's need.

- Prime Locations: Strategically situated in key business and tourist hubs, ensuring accessibility and convenience.

- Diverse Guest Needs: Catering effectively to both corporate clients requiring efficient business facilities and leisure travelers seeking relaxation and unique experiences.

Strategic Capital Deployment and Value Creation

CK Asset Holdings focuses on strategic capital deployment to create shareholder value. They aim to unlock asset potential through prudent allocation and opportunistic investments across diverse sectors and regions.

The company actively seeks opportunities to generate satisfactory gains, demonstrating a commitment to enhancing its portfolio's intrinsic worth. This approach is exemplified by their consistent efforts to identify and capitalize on market inefficiencies and growth prospects.

- Strategic Capital Allocation: Prudent management of financial resources to maximize returns.

- Value Creation: Unlocking underlying asset value through targeted investments.

- Opportunistic Seizing: Capitalizing on favorable market conditions across sectors and geographies.

- Shareholder Gains: Aiming for satisfactory financial returns for investors.

CK Asset Holdings' value proposition centers on delivering premium, well-located properties and stable, diversified returns through a robust portfolio of real estate, infrastructure, and utilities. Their hospitality segment further enhances this by offering exceptional guest experiences in prime locations, ensuring high occupancy and guest satisfaction.

The company's strategic capital deployment aims to maximize shareholder value by identifying and capitalizing on market opportunities, thereby enhancing the intrinsic worth of its diverse assets.

| Value Proposition Segment | Key Offering | 2024 Highlight |

|---|---|---|

| Premium Properties | High-quality residential, commercial, and industrial developments in prime locations. | Continued strong performance from Hong Kong and mainland China projects. |

| Diversified Returns | Stable income from income-generating properties and essential infrastructure/utility assets. | Consistent rental income from property portfolio and steady revenue from utilities. |

| Hospitality Excellence | Luxurious accommodation and superior management services in key hubs. | Robust demand and high occupancy rates (often exceeding 85%) in prime hotel locations. |

| Strategic Capital Deployment | Prudent allocation and opportunistic investments across sectors and regions. | Focus on unlocking asset potential and generating satisfactory shareholder gains. |

Customer Relationships

CK Asset Holdings employs specialized sales teams for its property developments, ensuring focused expertise during the transaction process. These teams are complemented by comprehensive customer service departments that span all business segments, offering personalized support from initial contact through to after-sales care.

CK Asset Holdings cultivates enduring partnerships with institutional and corporate clients within its property investment division. This commitment is demonstrated through consistent dialogue, thorough portfolio assessments, and customized strategies designed to align with their specific investment goals and maintain high levels of client contentment.

CK Asset Holdings cultivates strong customer relationships in its hospitality segment by offering professional and attentive service to hotel and serviced suite guests. This focus ensures guest comfort and addresses needs swiftly, fostering loyalty and positive word-of-mouth.

High service standards are paramount, encouraging repeat bookings and excellent online reviews. For example, in 2024, the company's serviced suites often boast occupancy rates exceeding 85%, a testament to guest satisfaction driven by this relationship-centric approach.

Strategic Partnerships for Infrastructure Clients

CK Asset Holdings cultivates deep, long-term strategic partnerships with clients in the infrastructure and utility sectors. These relationships are primarily with government entities and major corporations, built on a foundation of unwavering trust and consistent delivery of critical services.

The company's approach emphasizes reliability and a proven track record, crucial for clients undertaking large-scale, essential projects. This often translates into multi-year agreements and collaborative development processes.

- Government Agencies: Collaborating on public infrastructure projects, ensuring compliance and long-term operational stability.

- Major Corporations: Partnering for industrial infrastructure needs, often involving complex, bespoke solutions.

- Utility Providers: Working alongside established utility companies to upgrade or expand essential service networks.

- Joint Ventures: Engaging in strategic joint ventures for significant infrastructure developments, sharing risks and rewards.

Digital Engagement and Information Dissemination

CK Asset Holdings leverages its corporate website and various online channels to foster robust engagement with investors, customers, and the broader public. This digital presence serves as a crucial hub for disseminating vital information, including comprehensive financial reports, progress updates on development projects, and details regarding the company's sustainability initiatives.

- Investor Relations Portal: Provides access to annual reports, interim results, and stock performance data, enhancing transparency for shareholders. For instance, in 2024, the company continued to update its investor portal with timely financial disclosures.

- Project Showcases: Online platforms feature detailed information, virtual tours, and sales updates for residential and commercial properties, directly engaging potential buyers.

- Sustainability Hub: Dedicated sections on the website detail environmental, social, and governance (ESG) performance, aligning with growing stakeholder interest in corporate responsibility.

- Digital Communication Channels: Utilizes social media and newsletters to share news, project milestones, and company announcements, ensuring broad accessibility of information.

CK Asset Holdings cultivates diverse customer relationships across its business segments, from direct sales engagement in property development to long-term strategic alliances in infrastructure. The company prioritizes personalized service and reliability to foster loyalty and repeat business, evidenced by strong occupancy rates in its hospitality division.

Digital platforms are key for investor relations and customer engagement, providing access to financial data and project updates. For example, in 2024, the company's investor relations portal was consistently updated with financial disclosures, reinforcing transparency with shareholders.

| Segment | Relationship Type | Key Engagement Channels | 2024 Data Point Example |

|---|---|---|---|

| Property Development | Direct Sales & After-Sales Support | Specialized Sales Teams, Customer Service Departments | High customer satisfaction scores reported for new developments. |

| Property Investment | Institutional & Corporate Partnerships | Consistent Dialogue, Portfolio Assessments | Long-term lease agreements with major corporations. |

| Hospitality | Guest Relations | Professional & Attentive Service, Online Reviews | Serviced suites maintained occupancy rates above 85%. |

| Infrastructure & Utilities | Strategic Alliances (Government, Corporations) | Reliability, Proven Track Record, Multi-year Agreements | Secured multi-year contracts for essential infrastructure upgrades. |

| Corporate/Investor | Stakeholder Communication | Website, Investor Relations Portal, Social Media | Timely financial disclosures on investor portal throughout 2024. |

Channels

CK Asset Holdings utilizes its extensive network of direct sales offices and showrooms, strategically positioned in key urban centers, to facilitate property transactions. These physical touchpoints are crucial for allowing prospective buyers to engage directly with the product, fostering a tangible understanding of the developments.

In 2024, CK Asset Holdings continued to emphasize these channels for its residential and commercial projects, enabling personalized customer service and immediate feedback. This direct interaction is vital for building trust and addressing buyer inquiries efficiently, thereby streamlining the sales process.

CK Asset Holdings leverages a robust network of real estate agencies and brokers, both locally and internationally. This strategic partnership significantly expands the company's market reach, connecting its diverse property portfolio with a wider array of potential buyers and investors. These intermediaries are crucial for accessing niche markets and understanding localized demand dynamics.

In 2024, the global real estate market continued to show resilience despite economic shifts. For instance, transaction volumes in key Asian markets, where CK Asset Holdings is active, saw varied performance, underscoring the value of localized expertise provided by these agency partners. Their insights are vital for navigating fluctuating market conditions and identifying emerging opportunities.

CK Asset Holdings leverages online property portals and its own digital platforms to connect with a broad, digitally engaged customer base. This strategy is key for property visibility and attracting potential buyers.

In 2024, the company continued to invest in its online presence, with its official website serving as a primary hub for property listings and corporate information. Digital marketing efforts, including targeted social media campaigns and search engine optimization, are vital for lead generation and maintaining market awareness in a competitive landscape.

Strategic Partnerships and Industry Networks

CK Asset Holdings leverages strategic partnerships and its deep industry networks to drive growth across its infrastructure, hotel, and investment segments. These collaborations are crucial for identifying new business opportunities, forming joint ventures, and securing access to a broad base of corporate and institutional clients.

For instance, in its infrastructure segment, CK Asset has actively pursued international projects through partnerships, demonstrating a commitment to expanding its global footprint. In 2024, the company continued to explore opportunities in renewable energy and utility sectors, often in collaboration with established players to share risk and leverage expertise.

The hotel segment benefits significantly from these networks, enabling CK Asset to secure management contracts and franchise agreements with leading global hotel brands. This strategy allows them to enhance their property portfolios and tap into established customer bases. For example, in 2023, CK Asset's hotel portfolio continued to show resilience, with occupancy rates recovering strongly in key markets, a trend that is expected to persist into 2024, supported by strategic brand partnerships.

The company's investment segment actively utilizes its industry connections to source deals and co-invest with institutional partners. This approach diversifies its investment portfolio and provides access to capital for larger ventures. CK Asset's ability to attract and maintain these relationships is a testament to its reputation and the value it brings to its partners.

- Infrastructure Development: Partnerships facilitate access to technology, project financing, and regulatory expertise in new markets.

- Hotel Operations: Industry networks enable brand collaborations, franchise agreements, and access to global distribution systems.

- Investment Sourcing: Established relationships with institutional investors and corporations are key to deal origination and co-investment opportunities.

- Client Acquisition: Networks provide direct channels to corporate and institutional clients for property leasing, asset management, and financial services.

Investor Relations Platforms and Corporate Communications

CK Asset Holdings leverages its website’s dedicated investor relations sections, alongside financial news platforms and official announcements, to maintain open communication channels with shareholders and the broader financial community. This multi-pronged approach is crucial for the transparent and timely dissemination of financial results, strategic updates, and other pertinent corporate information.

In 2024, the company continued to emphasize digital channels for its investor communications. For instance, their website provides easy access to interim and final results announcements, annual reports, and stock performance data. This digital-first strategy aligns with investor expectations for readily available information, fostering trust and engagement.

- Website Investor Relations: Provides direct access to financial reports, press releases, and corporate governance information.

- Financial News Platforms: Utilizes services like Bloomberg and Reuters for immediate distribution of market-sensitive announcements.

- Official Announcements: Issues formal statements through stock exchange filings to ensure regulatory compliance and broad dissemination.

CK Asset Holdings utilizes a multi-channel approach to reach its diverse customer base. Direct sales through showrooms and offices cater to hands-on buyers, while a vast network of real estate agencies and brokers extends market reach globally. Digital platforms, including its own website and online portals, are crucial for broad visibility and lead generation, especially in 2024's digitally-driven market.

Strategic partnerships and industry networks are vital for CK Asset's infrastructure, hotel, and investment segments, facilitating access to technology, financing, and clients. Investor relations are maintained through the company website, financial news platforms, and official announcements, ensuring transparency with shareholders.

| Channel | Description | 2024 Focus/Impact |

|---|---|---|

| Direct Sales (Showrooms/Offices) | Physical locations for property engagement and personalized service. | Crucial for tangible understanding and building buyer trust. |

| Real Estate Agencies & Brokers | Partnerships for expanded market reach and localized expertise. | Vital for navigating diverse markets and identifying niche opportunities. |

| Digital Platforms (Website, Portals) | Online presence for property visibility, lead generation, and broad customer engagement. | Key for targeted marketing and maintaining market awareness. |

| Strategic Partnerships & Networks | Collaborations for growth in infrastructure, hotels, and investments. | Enables access to technology, financing, and corporate clients. |

| Investor Relations Channels | Website, financial news, and official announcements for shareholder communication. | Ensures transparent dissemination of financial and strategic information. |

Customer Segments

Individual property buyers, both those looking for a home and those seeking a personal investment, form a core customer segment for CK Asset Holdings. These buyers are primarily located in Hong Kong, Mainland China, and other global markets where CK Asset has a presence. They prioritize factors like the quality of construction, the desirability of the location, and the established reputation of the developer.

In 2024, the Hong Kong residential property market saw continued activity, with CK Asset Holdings being a significant player. For instance, their developments often attract buyers willing to pay a premium for well-located, high-quality units, reflecting the segment's emphasis on these attributes. The company's brand strength, built over years of successful projects, directly appeals to this discerning customer base.

CK Asset Holdings targets corporate and institutional property investors, including real estate funds and large investment firms. These entities are primarily interested in acquiring commercial, retail, and substantial residential developments. Their objective is to secure stable rental income streams and achieve significant capital appreciation over time.

In 2024, global institutional real estate investment volumes remained robust, with significant capital allocated to income-generating assets. For instance, the Asia Pacific region continued to see strong interest, with major markets like Hong Kong and Singapore attracting substantial investment in prime commercial and residential sectors, reflecting the ongoing demand from these sophisticated investor segments.

Commercial tenants, encompassing businesses needing retail, office, or industrial spaces, represent a crucial customer segment for CK Asset Holdings. These entities prioritize strategic locations offering high foot traffic or accessibility, coupled with contemporary amenities and dependable property management to support their operations and growth.

In 2024, the demand for quality commercial real estate remains robust, particularly in prime urban centers. For instance, Hong Kong's office market, a key area for CK Asset Holdings, saw vacancy rates in Grade A office buildings fluctuate, with rental values showing resilience in well-situated properties, underscoring the tenant need for premium environments.

Travelers and Business Guests (Hotel/Serviced Suites)

This customer segment encompasses a broad range of individuals needing temporary lodging. For CK Asset Holdings, this includes leisure tourists seeking memorable holiday experiences and business travelers requiring efficient and comfortable stays during work trips. Extended stay guests, such as expatriates or those relocating, also form a crucial part of this group, valuing the home-like amenities and services offered by serviced suites.

These guests prioritize several key factors when selecting accommodation. High on their list are the quality of service provided by hotel staff, the convenience of the location, often near business districts or tourist attractions, and the comfort and functionality of the facilities. In 2024, the global hotel industry continued its recovery, with average daily rates (ADR) showing strong performance in many markets, reflecting sustained demand from these traveler segments.

- Leisure Tourists: Seeking comfortable and well-located accommodations for vacation purposes.

- Business Travelers: Requiring efficient services, connectivity, and convenient access to corporate hubs.

- Extended Stay Guests: Looking for serviced suites that offer apartment-like living with hotel amenities for longer durations.

- Value Proposition: Guests expect quality service, prime locations, and appealing facilities that justify their expenditure.

Airlines and Aviation Companies (Historically)

Historically, CK Asset Holdings engaged with airlines and aviation companies as a key customer segment for its aircraft leasing operations. These companies, requiring substantial capital for fleet acquisition, relied on leasing to maintain operational flexibility and access modern aircraft without the burden of outright ownership. For instance, in 2023, global airlines faced continued recovery challenges, with passenger traffic approaching pre-pandemic levels, underscoring the demand for efficient and adaptable fleet solutions.

This segment prioritized leasing arrangements that offered competitive pricing, flexible terms, and access to a young and fuel-efficient fleet. The ability to scale aircraft capacity up or down in response to fluctuating demand and market conditions was paramount. By 2024, many airlines were actively modernizing their fleets to reduce operating costs and meet stricter environmental regulations, making aircraft leasing a strategic tool for fleet management.

- Fleet Modernization: Airlines sought leased aircraft with advanced fuel efficiency and lower emissions.

- Operational Flexibility: Leasing provided the ability to adjust fleet size based on seasonal demand and route profitability.

- Financial Efficiency: Leasing offered a way to manage capital expenditure and improve balance sheet ratios.

- Access to New Technology: The segment benefited from leasing newer aircraft models with improved performance and passenger amenities.

CK Asset Holdings serves individual property buyers seeking homes or investments in key global markets like Hong Kong and Mainland China. These buyers value construction quality, location desirability, and developer reputation. In 2024, CK Asset's premium developments continued to attract buyers prioritizing these attributes, leveraging the company's strong brand recognition.

Institutional investors, including real estate funds and investment firms, are another significant segment, targeting commercial, retail, and residential properties for rental income and capital appreciation. Global institutional real estate investment remained strong in 2024, with Asia Pacific markets like Hong Kong seeing substantial interest in prime assets.

Commercial tenants requiring office, retail, or industrial spaces form a vital customer base, prioritizing strategic locations, high foot traffic, and modern amenities. Hong Kong's office market in 2024 demonstrated resilience in rental values for well-situated Grade A properties, reflecting this tenant preference.

| Customer Segment | Key Needs | 2024 Market Trend Relevance |

|---|---|---|

| Individual Property Buyers | Quality, Location, Developer Reputation | Continued demand for well-located, premium units in Hong Kong and other key markets. |

| Institutional Investors | Rental Income, Capital Appreciation | Robust global investment in income-generating assets, particularly in Asia Pacific prime markets. |

| Commercial Tenants | Strategic Location, Amenities, Accessibility | Resilient demand for quality office and retail spaces in prime urban centers. |

Cost Structure

CK Asset Holdings' cost structure is heavily influenced by land acquisition and construction. In 2024, the company continued to invest significantly in securing prime locations for its diverse property portfolio, which includes residential, commercial, and industrial developments.

These expenditures encompass not only the purchase price of land, often including substantial land premiums in competitive markets, but also the extensive costs associated with building. This includes sourcing quality building materials, managing labor expenses, and engaging various subcontractors for specialized construction work. For instance, in its 2024 interim report, CK Asset highlighted ongoing investments in major projects across Hong Kong and the UK, reflecting the substantial capital commitment required for these activities.

CK Asset Holdings incurs significant ongoing operating expenses to manage its extensive portfolio. These costs encompass utilities, routine maintenance, and the salaries of operational staff across its properties and infrastructure assets.

For instance, in 2023, CK Asset Holdings reported property operating expenses of HK$3,981 million, reflecting the substantial upkeep required for its diverse holdings, including hotels and commercial properties.

CK Asset Holdings' extensive property portfolio and ongoing development projects necessitate significant financing. Consequently, interest payments on loans and bonds form a substantial part of its cost structure. For instance, in the first half of 2024, the company reported finance costs of HK$2.1 billion, reflecting the substantial debt used to fund its operations and acquisitions.

To mitigate the impact of these financing costs, CK Asset Holdings actively manages its gearing ratio. Maintaining a conservative approach to leverage helps ensure that interest expenses remain manageable, even with substantial capital requirements. This strategy is crucial for preserving profitability and financial stability in a dynamic market environment.

Employee Salaries and Administrative Overheads

CK Asset Holdings incurs substantial costs related to its large workforce, encompassing executive management, administrative personnel, and diverse operational teams. These expenses are crucial for maintaining robust corporate governance and ensuring the smooth execution of business operations across its global ventures.

In 2024, the company's commitment to a skilled workforce translates into significant salary and benefit outlays. For instance, the compensation packages for its executive leadership and a substantial administrative backbone are key drivers of these operational costs.

- Employee Salaries: Covering remuneration for a vast array of staff, from senior management to operational support.

- Administrative Overheads: Including office space, IT infrastructure, and support services necessary for corporate functions.

- Benefits and Training: Costs associated with employee welfare programs, health insurance, and ongoing professional development.

- Compliance and Governance: Expenses tied to ensuring adherence to regulatory requirements and effective corporate oversight.

Marketing and Sales Expenses

CK Asset Holdings allocates significant resources to marketing and sales to drive property transactions and service uptake. These costs are essential for reaching potential buyers and clients for their diverse portfolio.

Key components of these expenses include broad advertising campaigns across digital, print, and outdoor media, alongside targeted sales promotions. Sales commissions paid to agents and internal sales teams also represent a substantial portion of this cost category.

- Advertising: Investment in creating brand awareness and showcasing property features to a wide audience.

- Sales Commissions: Payments to individuals or agencies for successfully closing deals on properties and services.

- Promotional Activities: Costs associated with events, roadshows, and special offers to stimulate demand.

For the fiscal year 2024, CK Asset Holdings reported substantial marketing and sales expenditures, reflecting their aggressive market penetration strategies. While specific breakdowns fluctuate, these costs are a critical driver of revenue generation in their property development and investment segments.

CK Asset Holdings' cost structure is dominated by significant capital outlays for land acquisition and construction, alongside ongoing operational expenses for property management and financing costs related to its substantial debt. Employee compensation and marketing efforts also form key cost components, all crucial for maintaining its extensive global property portfolio and development pipeline.

| Cost Category | 2023/H1 2024 Data Point | Significance |

|---|---|---|

| Land Acquisition & Construction | Continued significant investment (2024) | Core driver of capital expenditure for portfolio expansion. |

| Operating Expenses | HK$3,981 million (2023 Property Operating Expenses) | Essential for maintaining property value and tenant satisfaction. |

| Finance Costs | HK$2.1 billion (H1 2024) | Reflects substantial debt financing for operations and acquisitions. |

| Employee Costs | Significant salary and benefit outlays (2024) | Supports corporate governance and operational execution. |

| Marketing & Sales | Substantial expenditures (FY 2024) | Drives property transactions and revenue generation. |

Revenue Streams

CK Asset Holdings primarily generates revenue through the sale of its completed residential, commercial, and industrial properties. This core activity forms the backbone of its financial performance.

Profits are realized from the margin between the selling price of these developed assets and the total costs incurred during the development and construction phases. For instance, in 2023, the company reported a significant portion of its revenue from property sales, reflecting the ongoing demand for its diverse real estate portfolio.

CK Asset Holdings generates recurring revenue through its vast portfolio of investment properties. This includes commercial spaces, retail outlets, and residential units that are leased out to tenants.

This leasing activity provides a stable and predictable income stream, a key element for financial planning and stability. For instance, in the first half of 2024, rental income from investment properties remained a significant contributor to the company's overall revenue.

CK Asset Holdings generates revenue from its infrastructure and utility assets through a variety of tariffs, usage fees, and service charges. This includes income from energy distribution, water supply, and transportation services.

This segment is known for providing long-term, stable income streams, contributing significantly to the company's overall financial resilience. For instance, in 2024, the infrastructure segment continued to be a bedrock of predictable earnings for the group.

Hotel and Serviced Suite Room Revenue

CK Asset Holdings generates significant income from its hospitality segment, primarily through the rental of rooms in its hotels and serviced suites. This core revenue stream is complemented by earnings from associated services.

Beyond room bookings, the company also captures revenue from ancillary offerings. These include sales from food and beverage outlets within its properties and income generated from hosting various events and conferences.

For instance, in 2024, CK Asset Holdings reported robust performance across its hospitality portfolio. The company's serviced suites, in particular, demonstrated strong occupancy rates, contributing substantially to overall revenue. This segment benefits from demand for flexible and extended-stay accommodation options.

- Room Rentals: Primary income from overnight stays in hotels and serviced apartments.

- Ancillary Services: Revenue from food, beverage, and other guest services.

- Event Hosting: Income generated from conferences, banquets, and other functions.

Aircraft Leasing Fees (Historically)

Historically, CK Asset Holdings (CKAH) utilized aircraft leasing fees as a significant revenue stream. This involved generating income by leasing its fleet of aircraft to various airlines globally. This segment played a role in diversifying the company's income sources.

The divestment of its aircraft leasing business in 2021 marked a strategic shift for CKAH. Prior to this, the company's aircraft leasing activities contributed to its overall financial performance, reflecting a period where this sector was a key component of its diversified income base.

- Historical Revenue Source: Aircraft leasing fees were a notable revenue stream for CK Asset Holdings before its strategic exit from the sector.

- Diversification Benefit: This segment contributed to the company's diversified income base, providing a buffer against volatility in other business areas.

- Strategic Divestment: CKAH divested its aircraft leasing businesses, indicating a strategic reallocation of resources and a change in its operational focus.

CK Asset Holdings' revenue streams are diverse, encompassing property sales, rental income from investment properties, infrastructure and utility services, and hospitality operations. The company also historically derived income from aircraft leasing, though this segment has been divested.

In the first half of 2024, CK Asset Holdings reported that its property sales continued to be a significant revenue driver, reflecting strong market demand. Rental income from its extensive portfolio of commercial and residential properties provided a stable and recurring income stream, contributing to the company's financial resilience.

The infrastructure and utilities segment, including energy and water services, offered long-term, predictable earnings, underpinning the group's overall financial stability. Similarly, the hospitality segment, driven by room rentals and ancillary services in its hotels and serviced suites, showed robust performance in 2024, with high occupancy rates.

| Revenue Stream | Primary Activity | 2024 Highlight (H1) |

| Property Sales | Development and sale of residential, commercial, and industrial properties | Significant revenue contributor due to strong market demand |

| Rental Income | Leasing of commercial spaces, retail outlets, and residential units | Stable and recurring income stream supporting financial resilience |

| Infrastructure & Utilities | Tariffs and fees from energy distribution, water supply, transportation | Bedrock of predictable earnings, contributing to financial stability |

| Hospitality | Room rentals, food & beverage, event hosting in hotels and serviced suites | Robust performance with strong occupancy rates in serviced suites |

Business Model Canvas Data Sources

The CK Asset Holdings Business Model Canvas is built using a blend of internal financial reports, extensive market research on real estate trends, and strategic assessments of competitive landscapes. These sources ensure each canvas block is filled with accurate, up-to-date information relevant to the company's operations and future growth.