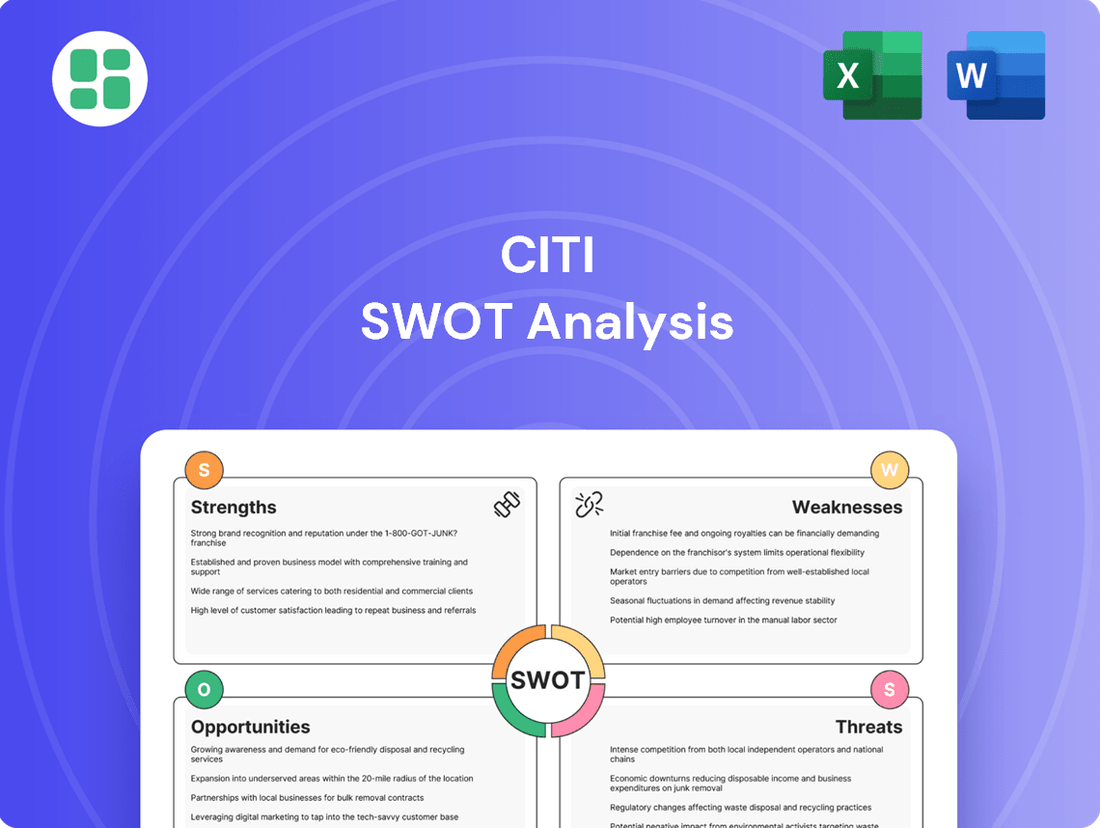

Citi SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Citi Bundle

Citi's robust global presence and diversified financial services are undeniable strengths, but understanding the nuances of its competitive landscape and potential regulatory headwinds is crucial. Our comprehensive SWOT analysis delves into these critical areas, offering a clear roadmap for strategic decision-making.

Want the full story behind Citi's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Citi's global footprint is a significant strength, with operations spanning over 160 countries and jurisdictions. This vast network allows the company to offer a comprehensive suite of financial products and services to a diverse clientele, encompassing individuals, corporations, governments, and institutions.

The bank's diversified operations are structured into two core segments: Global Consumer Banking and Institutional Clients Group. This structure enables Citi to provide a wide spectrum of services, from everyday consumer banking needs to sophisticated investment banking and wealth management solutions, catering to a broad market.

As of the first quarter of 2024, Citi reported a global workforce of approximately 232,000 employees, underscoring its extensive operational capacity. This broad reach and diversified business model position Citi to capitalize on global economic trends and mitigate risks associated with any single market or product.

Citi boasts a robust capital position, evidenced by its Common Equity Tier 1 (CET1) Capital Ratio, which stood at an impressive 13.4% as of the first quarter of 2024, comfortably exceeding regulatory minimums. This strong foundation offers significant financial resilience, allowing Citi to weather economic uncertainties and fund strategic growth opportunities. Furthermore, the bank maintains substantial liquidity, ensuring its ability to meet financial obligations and support client needs.

Citigroup's Q2 2025 performance showcased robust financial health, with earnings per share exceeding analyst forecasts. The bank's revenue saw a significant 8% year-over-year jump, reflecting strong contributions from its core business segments.

This impressive revenue growth highlights Citigroup's successful strategic initiatives and its capacity to leverage market dynamics effectively. The positive operating leverage demonstrated suggests efficient management and a strong underlying business model.

Strategic Focus on High-Growth Segments

Citi is strategically concentrating on lucrative areas like Services, Markets, Banking, and Wealth Management. These divisions are experiencing robust revenue increases and better profitability, which is a major boost to the bank's overall financial health. This focused approach is designed to improve returns and make better use of the bank's capital.

The bank's commitment to these high-growth segments is yielding tangible results. For instance, in the first quarter of 2024, Citi reported a 5% increase in Services revenue year-over-year. This strategic pivot is crucial for driving future performance and shareholder value.

- Focus on High-Growth Segments: Services, Markets, Banking, and Wealth Management are key areas of concentration.

- Revenue Growth: Services revenue saw a 5% year-over-year increase in Q1 2024.

- Profitability Improvement: These targeted segments are demonstrating enhanced margins and better overall financial performance.

- Capital Allocation: The strategy aims for optimized deployment of capital towards these promising business lines.

Significant Digital Transformation and AI Investment

Citi is channeling significant resources into digital transformation and artificial intelligence, aiming to overhaul its core systems and boost efficiency. This strategic focus includes substantial investments in data analytics to refine customer interactions and streamline operations.

The bank's commitment to modernizing its technological backbone is evident in its active decommissioning of older platforms and the development of advanced AI-powered tools. For instance, Citi has been a leader in adopting AI for fraud detection and customer service, with reports indicating significant progress in automating routine tasks and enhancing risk management frameworks through these technologies.

- Digital Transformation Investment: Citi has committed billions to upgrading its technology infrastructure, with a significant portion allocated to digital initiatives and AI development through 2025.

- AI-Driven Enhancements: The bank is leveraging AI to improve customer onboarding, personalize financial advice, and detect fraudulent activities more effectively, aiming for a more seamless user experience.

- Operational Efficiency Gains: By automating processes and retiring legacy systems, Citi expects to achieve substantial cost savings and improve the speed of its services, contributing to its long-term competitiveness.

Citi's extensive global reach, operating in over 160 countries, provides a significant competitive advantage, enabling it to serve a diverse client base across various financial needs. This broad operational footprint is complemented by a well-structured business model, divided into Global Consumer Banking and Institutional Clients Group, which allows for comprehensive service offerings from retail to investment banking.

The bank's robust capital position, with a CET1 Capital Ratio of 13.4% as of Q1 2024, demonstrates strong financial resilience and regulatory compliance. Citigroup's Q2 2025 performance further underscored this strength, with earnings per share surpassing expectations and an 8% year-over-year revenue jump, driven by strategic focus on high-growth areas like Services and Wealth Management.

Citi's strategic investment in digital transformation and AI is a key strength, aiming to enhance operational efficiency and customer experience. The bank is actively modernizing its systems, with billions allocated through 2025 for these initiatives, including AI-driven improvements in customer service and fraud detection.

| Metric | Q1 2024 | Q2 2025 (Est.) | Significance |

|---|---|---|---|

| Global Footprint | 160+ Countries | 160+ Countries | Broad market access and diversification |

| CET1 Capital Ratio | 13.4% | ~13.5% (projected) | Strong regulatory compliance and financial stability |

| Services Revenue Growth | 5% YoY | 6-7% YoY (projected) | Indicates success in strategic focus areas |

| Digital Transformation Investment | Billions allocated through 2025 | Billions allocated through 2025 | Enhances efficiency and future competitiveness |

What is included in the product

Analyzes Citi’s competitive position through key internal and external factors, identifying its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Citi's strategic challenges and opportunities.

Weaknesses

Citi continues to grapple with significant regulatory compliance deficiencies, a persistent weakness impacting its operations. The firm has faced substantial fines, with over $3.7 billion in penalties levied by U.S. regulators in 2023 alone, primarily stemming from ongoing issues in risk management and data governance.

Federal regulators have imposed consent orders, mandating extensive overhauls of critical areas like anti-money laundering (AML) and risk measurement programs. These ongoing compliance shortcomings not only expose Citi to further financial penalties but also divert management attention and resources from its core strategic objectives.

Citigroup's extensive, multi-year strategic overhaul is projected to incur significant transformation costs, potentially impacting near-term earnings. These efforts, aimed at simplifying operations and enhancing efficiency, represent a substantial financial undertaking for the company.

The sheer scale of Citigroup's restructuring introduces inherent execution risks. Challenges in realizing projected efficiency gains and driving revenue growth are critical considerations during this period of change.

Successfully navigating this transformation demands considerable investment and meticulous management. For instance, the company has earmarked billions for technology and operational enhancements as part of its simplification strategy, underscoring the financial commitment required.

Citigroup anticipates higher credit costs, especially within its consumer card segment, which is a significant hurdle for immediate profits. The bank projects an increase in net charge-offs, particularly during the first half of 2025, reflecting a cautious outlook on consumer financial health.

This vulnerability to shifts in consumer credit behavior could negatively affect the bank's earnings if economic conditions worsen beyond current forecasts, impacting overall financial performance.

Challenges in Operational Efficiency and Legacy Systems

Despite ongoing initiatives to streamline operations and replace outdated technology, Citigroup continues to grapple with inefficiencies that impact its cost structure. For instance, in the first quarter of 2024, the bank reported non-interest expenses that grew faster than its revenue, a trend that highlights persistent challenges in achieving optimal operational leverage.

The sheer scale of Citigroup's legacy systems presents a significant hurdle. The bank has been working to decommission thousands of these legacy applications, a process that is inherently complex and time-consuming, potentially delaying the full realization of cost savings and efficiency gains.

- Legacy System Overhaul: Citigroup's extensive efforts to retire thousands of legacy applications are ongoing, representing a significant undertaking that impacts operational agility.

- Cost Structure Pressures: In Q1 2024, non-interest expenses outpaced revenue growth, indicating that the bank is still working to fully optimize its cost base despite efficiency drives.

- Efficiency Optimization: While automation and system decommissioning are key strategies, achieving a fully optimized cost structure remains a challenge due to the complexity of its global operations.

Lingering Macroeconomic Headwinds and Market Volatility

Lingering macroeconomic headwinds continue to pose a significant challenge for Citigroup. Persistent inflation concerns and the potential for further interest rate hikes by the Federal Reserve, even into late 2024, could dampen consumer and business spending, impacting loan demand and overall economic activity. For instance, while inflation showed signs of moderating in early 2024, core inflation remained sticky in certain sectors, suggesting continued vigilance from policymakers.

Market volatility, exacerbated by ongoing geopolitical tensions and the specter of a global economic slowdown, directly affects Citi's revenue streams. Trading activity, a key contributor to investment banking income, can be significantly curtailed during periods of uncertainty. In the first quarter of 2024, while trading revenues saw a modest uptick compared to the previous year, the overall market sentiment remained cautious, reflecting these external pressures.

- Federal Reserve Policy Uncertainty: Continued vigilance on inflation could lead to prolonged higher interest rates, impacting borrowing costs and economic growth.

- Geopolitical Instability: Global conflicts and political shifts create uncertainty, potentially disrupting international trade and financial markets, which affects Citi's global operations.

- Recessionary Pressures: The risk of economic downturns in major economies could lead to increased loan defaults and reduced demand for financial services.

- Market Sentiment Swings: Volatile markets can negatively impact trading revenues and the value of assets held by the bank.

Citigroup's significant regulatory compliance issues remain a core weakness. The bank incurred over $3.7 billion in U.S. regulatory fines in 2023, largely due to ongoing problems in risk management and data governance, necessitating extensive overhauls mandated by consent orders.

The firm faces substantial transformation costs tied to its multi-year strategic overhaul, which aims to simplify operations and improve efficiency. These efforts, while necessary, represent a significant financial undertaking with inherent execution risks that could impact near-term earnings, as billions are earmarked for technological and operational enhancements.

Citigroup anticipates higher credit costs, particularly in its consumer card segment, with projected increases in net charge-offs during the first half of 2025, reflecting concerns about consumer financial health and potential economic downturns.

Persistent inefficiencies in its cost structure continue to be a challenge, as evidenced by non-interest expenses growing faster than revenue in Q1 2024. The complexity of retiring thousands of legacy systems further complicates efforts to achieve optimal operational leverage and realize full cost savings.

Preview the Actual Deliverable

Citi SWOT Analysis

This is the actual Citi SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're getting a direct look at the comprehensive report you'll download. Unlock the full, detailed analysis by completing your purchase.

Opportunities

Citi is well-positioned to capitalize on the expanding wealth management and investment banking sectors. These areas are central to the bank's strategic growth initiatives for 2024 and 2025.

The bank is actively bolstering its teams by bringing in experienced senior talent, a move that directly supports its ambition to grow in these lucrative markets. This strategic hiring is crucial for enhancing service offerings and capturing a larger market share.

Citi's investment banking division is experiencing a strong pipeline of merger and acquisition (M&A) deals. This robust deal flow is a direct response to increased client investment assets and a generally active market for corporate transactions, driving significant fee-based revenue.

In 2023, global M&A volume reached approximately $3.2 trillion, and while this represented a dip from prior years, forecasts for 2024 and 2025 suggest a rebound, with estimates pointing to a potential increase of 10-15% in deal activity. Citi's focus on this area allows it to benefit from this anticipated market recovery.

Anticipated shifts in regulatory capital requirements present a notable opportunity for Citigroup. For instance, if upcoming Basel III endgame revisions, expected to be fully implemented by early 2025, lead to reduced capital burdens for large, diversified banks like Citi, it could significantly boost its earnings per share growth compared to competitors. This potential capital relief, estimated by some analysts to be in the billions of dollars, could directly translate into increased capacity for strategic investments or enhanced shareholder returns.

Citi's continued investment in AI and digital innovation is a prime opportunity to solidify its competitive advantage. By integrating machine learning into risk management, for instance, the bank can better identify and mitigate potential threats, a crucial aspect in today's dynamic financial landscape. This focus on technology is key to its strategy of modernizing operations and enhancing client services.

Automating customer service through AI-powered chatbots and digital platforms offers significant potential for efficiency gains and cost reduction. This not only streamlines operations but also frees up human capital for more complex, value-added tasks. Citi is aiming to improve the overall customer experience, making interactions smoother and more responsive, which is vital for client retention and acquisition.

Enhancing digital experiences is central to attracting and retaining a modern client base. For example, in 2023, global digital banking adoption continued to rise, with a significant percentage of consumers preferring online channels for most banking transactions. Citi's commitment to this area, including the development of user-friendly mobile apps and personalized digital interfaces, positions it to capture a larger share of this digitally-native market.

Expansion in Emerging Markets and Financial Inclusion

Citi's strategic focus on expanding financial inclusion in emerging markets, particularly for women, presents a significant opportunity. This aligns with global efforts to boost economic participation, potentially unlocking new customer bases and revenue growth. For instance, by 2024, the World Bank reported that over 70% of women in low-income countries were still excluded from formal financial services, highlighting the vast underserved market.

This expansion can lead to deeper penetration in high-growth regions, fostering sustainable development while simultaneously building Citi's brand loyalty. By offering tailored financial products and services, Citi can cater to the specific needs of these new segments, driving both social impact and financial returns.

- Targeting Underserved Segments: Citi can tap into the substantial unmet demand for financial services among women entrepreneurs in emerging economies.

- Revenue Diversification: Expanding into these markets offers new avenues for revenue generation beyond traditional banking services.

- Alignment with ESG Goals: Supporting financial inclusion for women directly contributes to Environmental, Social, and Governance (ESG) objectives, enhancing corporate reputation.

- Market Growth Potential: Emerging markets continue to show robust economic growth, providing fertile ground for expanding financial services.

Strategic Portfolio Simplification through Divestitures

Citigroup's strategic divestitures, such as the sale of its consumer banking businesses in markets like India and Southeast Asia, are streamlining its operations. This move, part of a broader strategy initiated in 2021, allows for a sharper focus on its core institutional and wealth management businesses. For instance, the sale of its consumer banking operations in India to Axis Bank in 2023 was a significant step in this simplification.

This simplification is designed to boost accountability and transparency across its five main business segments: Institutional Clients Group, Personal Banking and Wealth Management, and its legacy franchises. By shedding non-core assets, Citigroup can concentrate resources on areas with higher growth potential and better returns on equity. This strategic pivot is expected to enhance overall profitability and operational efficiency.

The ongoing portfolio simplification aims to unlock value by reallocating capital towards businesses that offer stronger competitive advantages and higher profitability. This focus is crucial for improving the bank's financial performance and strengthening its market position in key areas.

- Divestiture of Non-Core Assets: Citigroup has been actively selling off consumer banking operations in various international markets, including Asia and Europe, as part of its 2021 strategy.

- Capital Reallocation: Proceeds from these divestitures are being redirected to strengthen core businesses, particularly the Institutional Clients Group and Personal Banking and Wealth Management.

- Enhanced Focus and Efficiency: The simplification strategy aims to improve operational leverage and profitability by concentrating on higher-return segments.

- Improved Transparency: A more focused business model is expected to lead to greater accountability and clarity across Citigroup's reporting segments.

Citi's strategic focus on expanding wealth management and investment banking offers significant growth potential, especially with an anticipated rebound in M&A activity. The bank's investment in AI and digital innovation is also a key opportunity to enhance efficiency and customer experience. Furthermore, its efforts in financial inclusion in emerging markets, particularly for women, tap into vast underserved segments and align with ESG goals.

The bank's portfolio simplification, including divestitures of non-core consumer banking operations, allows for a sharper focus on higher-growth, higher-return businesses. This strategic reallocation of capital is expected to improve overall profitability and operational efficiency.

Citi is well-positioned to benefit from potential regulatory capital relief stemming from upcoming Basel III endgame revisions, which could boost earnings per share. Leveraging digital advancements for customer service and transaction processing is also a critical avenue for cost reduction and improved client engagement.

Threats

Citigroup continues to navigate a landscape of heightened regulatory oversight, a persistent threat that could significantly impact its operations. Recent penalties, such as the $34 million fine levied by the Office of the Comptroller of the Currency in early 2024 for deficiencies in its risk management framework, underscore this ongoing challenge.

The specter of further fines or even restrictions on certain business activities looms large, especially if the bank fails to demonstrate substantial progress in addressing previously identified consent order deficiencies. Such outcomes could not only inflate compliance costs but also impede the execution of strategic growth initiatives, potentially tarnishing its hard-earned reputation.

A significant macroeconomic downturn, including a potential recession or unexpected shifts in interest rates, poses a considerable threat to Citi. For instance, if interest rates were to rise sharply, as seen in some periods of 2023 and early 2024, it could dampen borrowing demand and increase the cost of funding for the bank. This environment can lead to increased loan defaults, reduced client activity in capital markets, and pressure on net interest margins, impacting profitability.

The financial services sector is intensely competitive, with both legacy institutions and nimble fintech firms aggressively pursuing market share. Citi must navigate this dynamic environment, facing pressure to innovate and retain its customer base across consumer banking, wealth management, and institutional services.

This heightened competition necessitates ongoing, substantial investment in cutting-edge technology and client-focused strategies. For instance, the global fintech market was projected to reach over $300 billion in 2024, highlighting the scale of innovation and investment occurring.

Cybersecurity Risks and Fraud Incidents

Citi, as a massive global financial institution, is a constant, high-value target for sophisticated cyberattacks and various forms of fraud. The sheer volume of sensitive customer data and financial transactions it handles makes it a prime candidate for malicious actors. This ongoing threat landscape necessitates continuous investment in advanced security infrastructure and proactive threat detection systems.

Recent years have seen an uptick in cyber threats across the financial sector. For instance, in 2023, the financial services industry experienced a significant rise in ransomware attacks, with many institutions reporting substantial financial impacts. While specific, publicly disclosed incidents for Citi in late 2024 or early 2025 are not yet widely detailed, the general trend underscores the persistent danger. A failure to adapt and strengthen defenses against these evolving threats could have severe repercussions.

The consequences of a major cybersecurity breach or a widespread fraud incident for Citi could be devastating. Beyond the immediate financial losses, which can run into millions or even billions of dollars, the damage to Citi's reputation and customer trust would be profound. Such events could lead to a significant exodus of clients, regulatory penalties, and a long, arduous road to rebuilding confidence in its security protocols. The need for robust, multi-layered security measures is therefore paramount.

- Constant Target: As a leading global bank, Citi is a primary target for cybercriminals seeking to exploit vulnerabilities for financial gain or data theft.

- Evolving Threats: The sophistication of cyberattacks, including phishing, malware, and ransomware, is continually increasing, demanding constant vigilance and adaptation.

- Reputational Risk: A significant security incident could severely damage Citi's brand, erode customer trust, and lead to substantial financial and operational disruptions.

- Regulatory Scrutiny: Breaches often result in hefty fines and increased regulatory oversight, impacting profitability and operational flexibility.

Execution Risk of Strategic Transformation

Citi's ambitious multi-year transformation strategy, a critical move to modernize its operations and enhance efficiency, faces significant execution risks. The sheer complexity of overhauling its vast technological infrastructure and streamlining global operations means that delays or cost overruns are a real possibility. For instance, the bank has allocated substantial capital towards technology upgrades, with projected spending in the tens of billions of dollars over the next few years, and any misstep here could directly impact profitability.

Failure to achieve the anticipated benefits from these upgrades, such as improved customer experience or reduced operational costs, could undermine financial performance and erode investor confidence. In 2024, Citi reported significant investments in its technology and simplification initiatives, aiming to drive efficiency gains, but the full impact of these investments will only become clear as the transformation progresses. The market will be closely watching to see if these efforts translate into tangible improvements in key metrics.

This large-scale overhaul demands unwavering focus and robust change management to navigate potential disruptions. The ability to effectively manage the human element of such a significant transformation, ensuring employee buy-in and minimizing resistance, is paramount. Citi's success hinges on its capacity to maintain momentum and adapt to unforeseen challenges throughout this extensive strategic overhaul.

- Execution Risk: The complexity of Citi's multi-year transformation strategy presents inherent challenges in its implementation.

- Financial Impact: Delays or cost overruns in technology upgrades and operational streamlining could negatively affect financial results.

- Investor Confidence: Failure to realize anticipated benefits from the transformation may lead to a decline in investor sentiment.

- Change Management: Sustained focus and effective change management are crucial for the successful navigation of this large-scale overhaul.

Intensified competition from both traditional banks and burgeoning fintech companies presents a significant hurdle, demanding continuous innovation and substantial investment in technology to retain market share. The global fintech market’s projected growth to over $300 billion in 2024 highlights the aggressive pace of innovation Citi must match.

The bank remains a prime target for sophisticated cyberattacks and fraud due to the vast amount of sensitive data it handles, necessitating ongoing, significant expenditure on advanced security measures. The financial services sector saw a notable increase in ransomware attacks in 2023, underscoring the persistent and evolving nature of these threats.

Citi's ambitious, multi-year transformation strategy, while crucial for modernization, carries substantial execution risks, including potential delays and cost overruns in its vast technological and operational overhauls. The bank’s significant capital allocation towards these upgrades, potentially in the tens of billions of dollars, means any misstep could directly impact profitability and investor confidence.

SWOT Analysis Data Sources

This Citi SWOT analysis is built upon a robust foundation of data, drawing from official financial filings, comprehensive market research reports, and insights from industry experts to ensure a thorough and accurate assessment.