Citi Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Citi Bundle

Curious about how this company's products perform in the market? Our BCG Matrix preview highlights their potential, but the full report unlocks the complete picture. Discover which products are Stars, Cash Cows, Dogs, or Question Marks, and gain the strategic clarity needed to make informed investment decisions.

Don't miss out on the actionable insights that lie within the full BCG Matrix. This comprehensive analysis provides a detailed breakdown of each product's position, empowering you to optimize your portfolio and drive growth. Purchase the complete report today for a strategic roadmap to success.

Stars

Citi's Treasury and Trade Solutions (TTS) has been a standout performer, achieving record revenues in 2024 and continuing this momentum into Q1 2025. This business unit is vital, offering essential cash management and trade finance services to global corporations. Its robust growth and expanding market share solidify its position as a star within Citi's Institutional Clients Group.

Citi Wealth's performance in the wealth management sector has been exceptionally strong. In 2024, the firm saw its net new investment assets climb by an impressive 40%, reaching $42 billion. This substantial inflow of client capital underscores a robust market position.

Further bolstering this positive trend, Citi reported a significant 24% revenue increase in the first quarter of 2025. This surge in revenue is directly linked to the growing investment assets under management and the associated rise in investment fees, reflecting successful client acquisition and retention strategies.

The combination of a 40% increase in net new investment assets to $42 billion in 2024 and a 24% revenue jump in Q1 2025 highlights Citi Wealth's strategic success. These figures demonstrate a strong market share within a dynamic and expanding wealth management landscape, signaling continued growth potential.

Citi's Investment Banking division is showing impressive growth, particularly in its M&A advisory services. In the first quarter of 2025, M&A advisory revenue saw a nearly twofold increase, signaling strong client activity and deal-making momentum. This surge contributes to a broader trend of rising investment banking fees observed in late 2024.

The bank is actively expanding its footprint in lucrative sectors, demonstrating strategic foresight. Citi is capturing market share in areas like healthcare technology, a rapidly evolving field, and leverage finance, a critical component of corporate transactions. Their focus on sponsors also highlights a commitment to key financial players driving market activity.

This robust performance underscores Citi's competitive positioning within a financial market that is not only recovering but also showing signs of significant expansion. The bank's strategic focus on high-growth segments is clearly paying dividends, as evidenced by these strong revenue figures and market share gains.

Fixed Income and Equities Trading (Markets Segment)

Citi's Markets segment demonstrated exceptional strength, with revenues climbing 12% in the first quarter of 2025. This growth was fueled by heightened client engagement in both Fixed Income and Equities trading.

The Equities division achieved its strongest annual revenue in ten years during 2024, underscoring a significant market position. Similarly, fixed income markets experienced substantial revenue increases, reflecting a dynamic and expanding trading landscape.

- Q1 2025 Revenue Growth: 12% increase in Markets segment revenue.

- Equities Performance: Highest annual revenue in a decade in 2024.

- Fixed Income Performance: Significant revenue gains observed in fixed income markets.

- Market Position: Indicates a strong market share in a high-growth trading environment.

U.S. Branded Cards

Citi's U.S. Branded Cards business is a cornerstone of its U.S. Personal Banking segment, consistently contributing to revenue expansion. This segment showcases a robust performance, reflecting its significant market presence in the consumer finance landscape.

In the fourth quarter of 2024, the branded credit card sector experienced notable growth. Spending volumes within Citi's branded cards rose by 5%, indicating increased consumer activity. Concurrently, average loans saw a healthy increase of 6% compared to the previous year.

- Strong Revenue Driver: Citi's U.S. Branded Cards business is a key revenue generator for the U.S. Personal Banking segment.

- Spending Volume Growth: In Q4 2024, branded credit card spending volumes increased by 5% year-over-year.

- Loan Portfolio Expansion: Average loans in the branded cards business grew by 6% year-over-year in Q4 2024.

- Market Leadership: The business maintains a leading market share in the mature yet consistently growing U.S. consumer finance sector.

Citi's Treasury and Trade Solutions (TTS) is a prime example of a star performer, achieving record revenues in 2024 and extending this success into early 2025. Its critical role in providing essential financial services to global corporations, coupled with expanding market share, firmly places it as a star within Citi's Institutional Clients Group.

Citi Wealth's performance in the wealth management sector has been exceptionally strong, with net new investment assets climbing 40% to $42 billion in 2024. This growth was further amplified by a 24% revenue increase in Q1 2025, driven by rising assets under management and investment fees, demonstrating a robust market position.

Citi's Investment Banking division, particularly its M&A advisory services, has shown impressive momentum. Q1 2025 saw M&A advisory revenue nearly double, indicating strong client activity and deal-making, contributing to a broader trend of rising investment banking fees observed in late 2024. Strategic expansion into lucrative sectors like healthcare technology and leverage finance further solidifies its star status.

The Markets segment at Citi also shines, with revenues up 12% in Q1 2025, fueled by strong client engagement in both Fixed Income and Equities. Notably, the Equities division achieved its strongest annual revenue in a decade in 2024, while fixed income markets also saw significant revenue gains, highlighting a dominant market position.

Citi's U.S. Branded Cards business remains a star performer within U.S. Personal Banking. In Q4 2024, spending volumes rose 5% and average loans increased 6% year-over-year, demonstrating consistent revenue expansion and a leading market share in the consumer finance sector.

| Business Unit | Key Performance Indicator | 2024 Data | Q1 2025 Data | Status |

|---|---|---|---|---|

| Treasury and Trade Solutions (TTS) | Revenue | Record Revenues | Continued Momentum | Star |

| Citi Wealth | Net New Investment Assets | +$42 billion (40% increase) | N/A | Star |

| Investment Banking | M&A Advisory Revenue | Rising Fees | Nearly Doubled | Star |

| Markets | Revenue Growth | N/A | 12% increase | Star |

| U.S. Branded Cards | Spending Volume Growth | 5% increase (Q4 2024) | N/A | Star |

What is included in the product

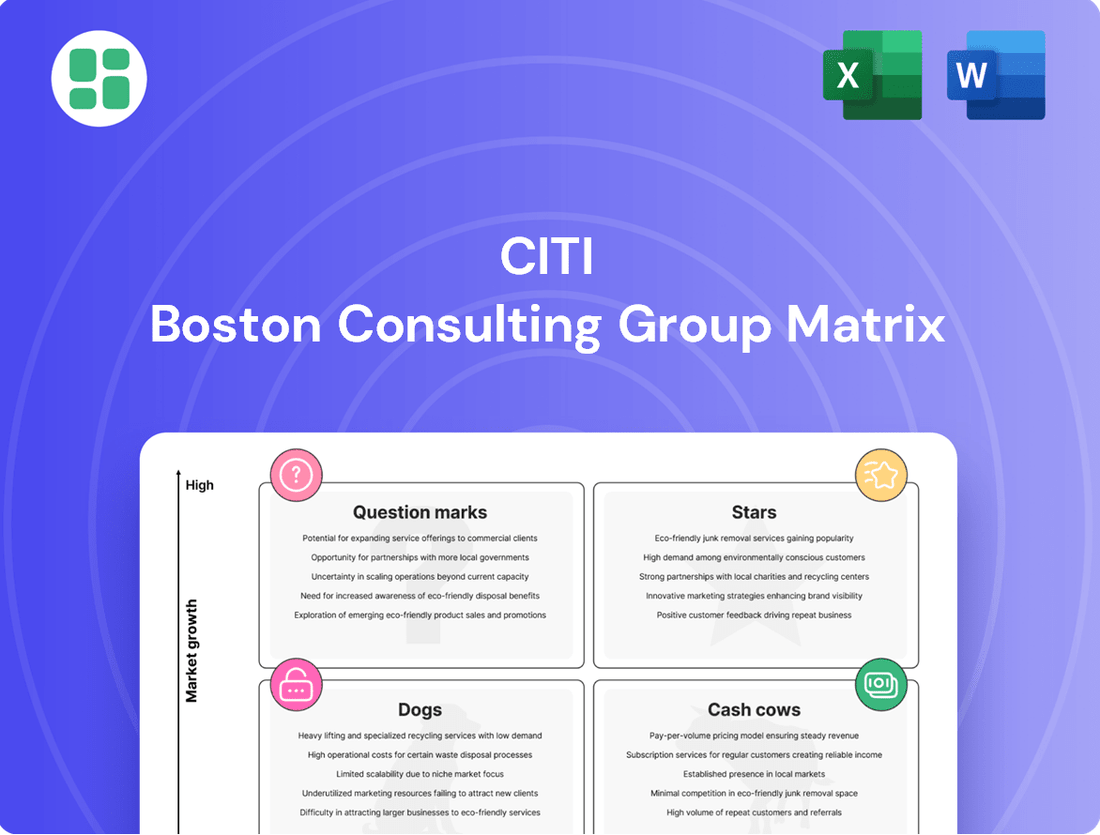

The Citi BCG Matrix analyzes business units based on market growth and share, guiding investment decisions.

Eliminate the headache of complex portfolio analysis by visualizing your business units on a clear Citi BCG Matrix.

Cash Cows

Citi's core U.S. retail deposit accounts function as a classic cash cow within the BCG matrix. These accounts, boasting high market penetration, offer a remarkably stable and cost-efficient funding stream for the bank. For instance, as of the first quarter of 2024, Citi reported that its U.S. retail deposits remained a significant component of its funding structure, underscoring their consistent contribution to liquidity.

Despite ongoing strategic realignments within Citi's broader U.S. Personal Banking division, these foundational deposit products continue to generate predictable, low-cost liquidity. This dependable cash flow is vital for supporting the bank's diverse operations and investments, solidifying their position as a mature and reliable asset.

Established corporate lending relationships within Citi's Institutional Clients Group are true cash cows. These long-standing ties with major corporations generate a substantial and consistent stream of revenue for the bank.

These mature relationships offer predictable interest income and fee generation, acting as a stable foundation for Citi's institutional operations. For instance, as of the first quarter of 2024, Citi reported total loans to commercial clients reaching approximately $270 billion, with a significant portion stemming from these established relationships.

Citi's Securities Services, specifically custody and fund administration, is a cornerstone of its Services segment, characterized by high volume and predictable fee-based revenue. This business line offers critical post-trade support to a global institutional client base, capitalizing on Citi's vast operational network and deep industry knowledge.

As a mature and well-established offering, custody and fund administration consistently bolsters the Services segment's financial performance. For instance, in the first quarter of 2024, Citi reported that its Securities Services business generated $1.3 billion in revenue, highlighting its significant and ongoing contribution to the bank's overall profitability.

Global Correspondent Banking Network

Citi's extensive global correspondent banking network, operating in over 160 countries, acts as a vital backbone for international financial transactions. This expansive reach allows Citi to facilitate payments, trade finance, and other critical services for banks across the globe, generating consistent fee-based income.

This mature business line is a consistent revenue generator, leveraging Citi's established infrastructure and deep market penetration. In 2024, the correspondent banking sector continued to be a stable contributor, with global cross-border payments projected to grow, benefiting from increased trade volumes and the ongoing digitization of financial services.

Key aspects of Citi's correspondent banking network include:

- Global Reach: Operations in over 160 countries, providing unparalleled access to international markets.

- Revenue Generation: Consistent income derived from transaction fees, clearing services, and interbank lending.

- Market Maturity: A well-established and essential service deeply integrated into the global financial system.

- Reliability: High-volume, dependable revenue stream supported by robust infrastructure.

Traditional Trade Finance Products

Within Citi's Treasury and Trade Solutions (TTS), traditional trade finance products like letters of credit and guarantees are established cash cows. These high-volume offerings support fundamental needs for large corporations on well-trodden trade routes.

These products consistently deliver predictable fee income, reflecting their mature position within the financial services landscape. For instance, in 2024, global trade finance volumes remained robust, with many large banks reporting steady revenue streams from these core services.

- High Volume, Predictable Income: These products generate consistent fee-based revenue due to their widespread use in established international trade.

- Mature Market Dominance: They serve the fundamental, ongoing needs of large corporate clients, ensuring a stable demand.

- Significant Contribution to TTS: Traditional trade finance is a cornerstone of Citi's TTS business, contributing substantially to overall profitability.

- Low Growth, High Share: While market growth might be modest, their established position gives them a high market share and strong cash generation.

Citi's U.S. retail deposit accounts are a prime example of a cash cow within the BCG matrix. These accounts, benefiting from high market penetration, provide a stable and cost-effective funding source for the bank. As of Q1 2024, these deposits continued to be a substantial part of Citi's funding, demonstrating their consistent contribution to liquidity.

These foundational deposit products consistently generate predictable, low-cost liquidity, even amidst strategic shifts in Citi's U.S. Personal Banking division. This reliable cash flow is crucial for supporting the bank's various operations and investments, reinforcing their status as a mature and dependable asset.

| Business Segment | Product/Service | BCG Category | Key Characteristics | Q1 2024 Data/Context |

|---|---|---|---|---|

| U.S. Retail Banking | Retail Deposit Accounts | Cash Cow | High market penetration, stable funding, low cost | Significant component of funding structure, consistent liquidity contribution |

| Institutional Clients Group | Established Corporate Lending | Cash Cow | Long-standing relationships, predictable revenue | Total commercial loans ~$270 billion, significant portion from established relationships |

| Services | Securities Services (Custody & Fund Admin) | Cash Cow | High volume, predictable fee revenue, global network | $1.3 billion revenue in Q1 2024 |

| Treasury and Trade Solutions | Traditional Trade Finance (LCs, Guarantees) | Cash Cow | High volume, predictable fee income, mature market | Steady revenue from core services, robust global trade finance volumes in 2024 |

What You See Is What You Get

Citi BCG Matrix

The Citi BCG Matrix preview you're examining is the identical, fully-prepared document you will receive upon purchase, ensuring complete transparency and immediate utility for your strategic planning. This comprehensive report is designed for professional application, offering clear insights into your business portfolio without any watermarks or demo content. Once you complete your purchase, this exact file will be delivered, ready for immediate editing, presentation, or integration into your business strategy. You are essentially previewing the final, analysis-ready BCG Matrix that will empower your decision-making processes right away.

Dogs

Citi's strategic exit from several consumer banking operations, including those in Russia, Korea, China onshore, and Poland, clearly places these businesses within the Dogs quadrant of the BCG Matrix. These divested units often struggled with low market share and limited growth potential in their specific regions.

The decision to sell these non-core assets reflects a deliberate move to streamline operations and reallocate capital. For instance, the sale of its consumer banking business in Poland was completed in 2022, and the exit from Russia was finalized in 2023, illustrating the ongoing nature of this strategic shift.

Citi's 'All Other' segment, often a repository for non-core or winding-down operations, has demonstrated a concerning trend of declining revenues and profits. In the first quarter of 2024, this segment reported a revenue of $1.2 billion, a 15% decrease year-over-year, and a net loss of $250 million.

This segment's performance highlights areas that are not aligned with Citi's strategic simplification efforts, acting as a drain on resources. For instance, certain legacy credit card portfolios within this segment continue to face higher charge-off rates, impacting overall profitability.

The persistent underperformance of the 'All Other' segment underscores the ongoing challenge of managing and divesting these non-strategic assets. As of the end of Q1 2024, the segment represented only 3% of Citi's total assets, yet contributed negatively to its return on equity.

Within Citi's extensive global consumer banking operations, certain niche or geographically isolated retail banking portfolios likely found themselves in the Dogs category of the BCG Matrix. These were typically operations that struggled to achieve critical scale or a distinct competitive advantage. For instance, in 2023, Citi continued its strategic exit from markets like Poland and Greece, which had relatively smaller consumer banking footprints and faced intense local competition, indicative of such underperforming segments.

These portfolios would have been characterized by a low market share within their respective geographies and limited prospects for significant growth. The high costs associated with maintaining these smaller operations, coupled with their inability to generate substantial returns, made them prime candidates for divestiture. Citi's broader strategy to simplify its global operations, which saw it exit consumer banking in thirteen markets across Asia and EMEA by early 2022, underscores the rationale behind moving such "dog" assets.

Inefficient Legacy IT Infrastructure

Inefficient legacy IT infrastructure within Citi can be viewed as a Dog in the BCG Matrix. These systems, characterized by their age and fragmentation, represent a significant drain on resources due to high maintenance costs and operational inefficiencies. Citi's substantial investments in modernizing its IT backbone and retiring outdated applications underscore the fact that these legacy systems offer little competitive advantage while consuming valuable capital.

The ongoing efforts to overhaul its technology stack highlight the strategic imperative to move away from these underperforming assets. For instance, reports from 2024 indicated that a significant portion of IT spending was allocated to maintaining these older systems, diverting funds from innovation and growth initiatives.

- High Maintenance Costs: Legacy systems often require specialized, expensive support and are prone to frequent breakdowns.

- Operational Inefficiency: Outdated technology hinders speed, scalability, and integration with newer platforms.

- Resource Drain: Funds and personnel dedicated to maintaining legacy IT could be better utilized for strategic investments.

- Limited Competitive Edge: These systems often lack the agility and capabilities needed to compete effectively in a rapidly evolving digital landscape.

Select Non-Strategic Small Business Lending Portfolios

Within the Citi BCG Matrix, non-strategic small business lending portfolios are characterized by both low market growth and a low market share. These segments, often in niche markets or serving specific client groups where Citi doesn't hold a dominant position, can tie up valuable capital inefficiently.

For instance, in 2024, data might show certain specialized small business loan types experiencing only 2-3% annual growth, while Citi's penetration in these areas remains below 5%. This combination signals a potential need for strategic review.

- Low Market Growth: Indicates limited expansion opportunities within the segment.

- Low Market Share: Suggests a weak competitive standing and difficulty in scaling.

- Inefficient Capital Deployment: Capital allocated here yields suboptimal returns compared to more strategic areas.

- Optimization Candidates: These portfolios may be candidates for divestiture, consolidation, or a reduced strategic focus.

Citi's strategic divestitures, such as exiting consumer banking in Russia and Poland, align with the Dogs quadrant, representing businesses with low market share and growth potential. The 'All Other' segment, reporting a $1.2 billion revenue in Q1 2024, down 15% year-over-year, exemplifies these underperforming assets that drain resources and negatively impact returns.

Legacy IT infrastructure, requiring significant maintenance costs and offering limited competitive advantage, also falls into the Dogs category. In 2024, a substantial portion of IT spending was reportedly dedicated to these older systems, diverting funds from innovation.

Non-strategic small business lending portfolios, characterized by low market growth and Citi's limited share, are further examples of Dogs. These segments, potentially seeing only 2-3% annual growth with less than 5% market penetration, represent inefficient capital allocation.

| Business Segment/Asset | BCG Quadrant | Key Characteristics | Relevant Data/Observation (as of 2024/latest available) |

| Exited Consumer Banking (e.g., Russia, Poland) | Dogs | Low Market Share, Low Growth Potential | Exits completed 2022-2023; Q1 2024 'All Other' segment revenue down 15% YoY |

| Legacy IT Infrastructure | Dogs | High Maintenance Costs, Operational Inefficiency | Significant IT spending in 2024 allocated to maintaining older systems |

| Non-Strategic Small Business Lending | Dogs | Low Market Growth, Low Market Share | Potential 2-3% annual growth, <5% market penetration in niche areas |

Question Marks

Citi is strategically focusing on expanding its footprint within the commercial banking sector, aiming to capture a larger share of this market. This move suggests that while the commercial banking landscape presents considerable growth prospects, Citi’s current penetration in specific niches within this segment is relatively modest.

The bank's aggressive pursuit of market share in commercial banking positions it as a 'Question Mark' in the BCG matrix. This classification stems from the substantial investments needed to build out capabilities and client relationships, balancing high market growth potential with a currently lower, though aspirational, market share.

Citi is making substantial investments in digital payment solutions like Citi Payments Express and WayFinder. These platforms are designed to streamline customer transactions and boost digital engagement across its services.

These new digital offerings are positioned within dynamic and fast-growing digital banking sectors. Citi is allocating considerable capital to these ventures, aiming to capture significant market share and establish a strong presence.

While these initiatives show high potential for future growth, they currently represent significant cash outlays. Their ultimate classification as Stars in the BCG matrix hinges on their ability to achieve market leadership and profitability in these competitive digital landscapes.

Citi is actively integrating generative AI, notably with tools like Agent Assist in U.S. Personal Banking and AI coding assistants for its developers. These initiatives represent substantial capital investments designed to streamline operations and elevate customer interactions.

The deployment of these AI tools, while in early stages and incurring costs, is strategically positioned to unlock significant competitive advantages. Success in these pilots could translate into tangible gains in market share and operational efficiency for Citi.

Targeted Wealth Management Expansion in High-Growth Regions (e.g., India)

Citi's wealth management strategy includes a focused expansion into high-growth markets like India, aiming to capture a larger share of the burgeoning wealth in these regions. While established in developed markets, Citi is making strategic investments to build its presence in areas with significant wealth accumulation potential, recognizing the opportunity to grow from a smaller current base.

India's wealth management market is projected for substantial growth, with the number of high-net-worth individuals (HNWIs) expected to rise significantly. For instance, reports from 2023 indicated a robust increase in Indian HNWIs, signaling a fertile ground for Citi's targeted expansion efforts. This growth is driven by factors such as a young demographic, increasing disposable incomes, and a dynamic entrepreneurial ecosystem.

- Projected growth in India's wealth management sector: Analysts forecast double-digit annual growth for India's wealth management industry in the coming years, driven by economic expansion and increasing financial literacy.

- Increasing HNWI population: India's HNWI population has been on an upward trajectory, with estimates suggesting continued strong growth through 2024 and beyond, presenting a significant client base for wealth services.

- Strategic investment for market share: Citi's approach involves dedicated resources and tailored offerings to attract and retain clients in these emerging wealth hubs, aiming to solidify its position beyond its current market share.

- Focus on digital integration: Leveraging digital platforms and personalized client experiences will be crucial for Citi to effectively compete and expand its footprint in the tech-savvy Indian market.

Strategic Private Credit Partnerships

Citi's strategic move into private credit, exemplified by its $25 billion partnership with Apollo, positions it to capture significant growth in this burgeoning asset class. This substantial capital allocation underscores a deliberate strategy to build market share and establish a strong foothold in a sector that has seen considerable expansion in recent years.

By entering into such a large-scale partnership, Citi is not merely participating but aiming for a leadership position. The private credit market, which has grown substantially, offers attractive yields and diversification benefits, making it a key area for financial institutions looking to enhance returns and expand their alternative investment offerings. As of late 2024, the global private credit market is estimated to be well over $1.5 trillion, with continued projections for robust growth.

- Market Entry and Expansion: Citi's $25 billion partnership with Apollo signifies a major commitment to the rapidly growing private credit market.

- Capital Commitment: This substantial capital allocation indicates a strategic intent to build significant market share in this asset class.

- Growth Potential: The private credit market, estimated to be over $1.5 trillion globally by late 2024, presents a high-growth opportunity for financial institutions.

- Strategic Focus: Establishing a dominant position requires dedicated capital, expertise, and a clear strategic focus on private credit strategies.

Question Marks in the BCG matrix represent business units or products with low market share in high-growth industries. These ventures require significant investment to grow and capture market share, but their future success is uncertain.

Citi's investments in digital payment solutions and generative AI, along with its expansion into India's wealth management and private credit markets, all fit the Question Mark profile. These areas offer substantial growth potential, but Citi is currently a smaller player needing to invest heavily to compete effectively.

The success of these initiatives will determine if they transition into Stars or potentially decline if they fail to gain traction. Citi's strategic allocation of capital to these high-potential, yet uncertain, areas highlights its forward-looking approach to market expansion and innovation.

| Business Area | Market Growth | Current Market Share | Investment Needs | BCG Classification |

| Digital Payments (e.g., Citi Payments Express) | High | Low to Moderate | High | Question Mark |

| Generative AI Integration (e.g., Agent Assist) | High | Low | High | Question Mark |

| India Wealth Management | High (projected double-digit growth) | Low | High | Question Mark |

| Private Credit (e.g., $25B Apollo partnership) | High (>$1.5T market size by late 2024) | Low | High | Question Mark |

BCG Matrix Data Sources

Our Citi BCG Matrix is constructed using a blend of internal financial statements, external market research reports, and economic growth forecasts to provide a comprehensive view of business unit performance.