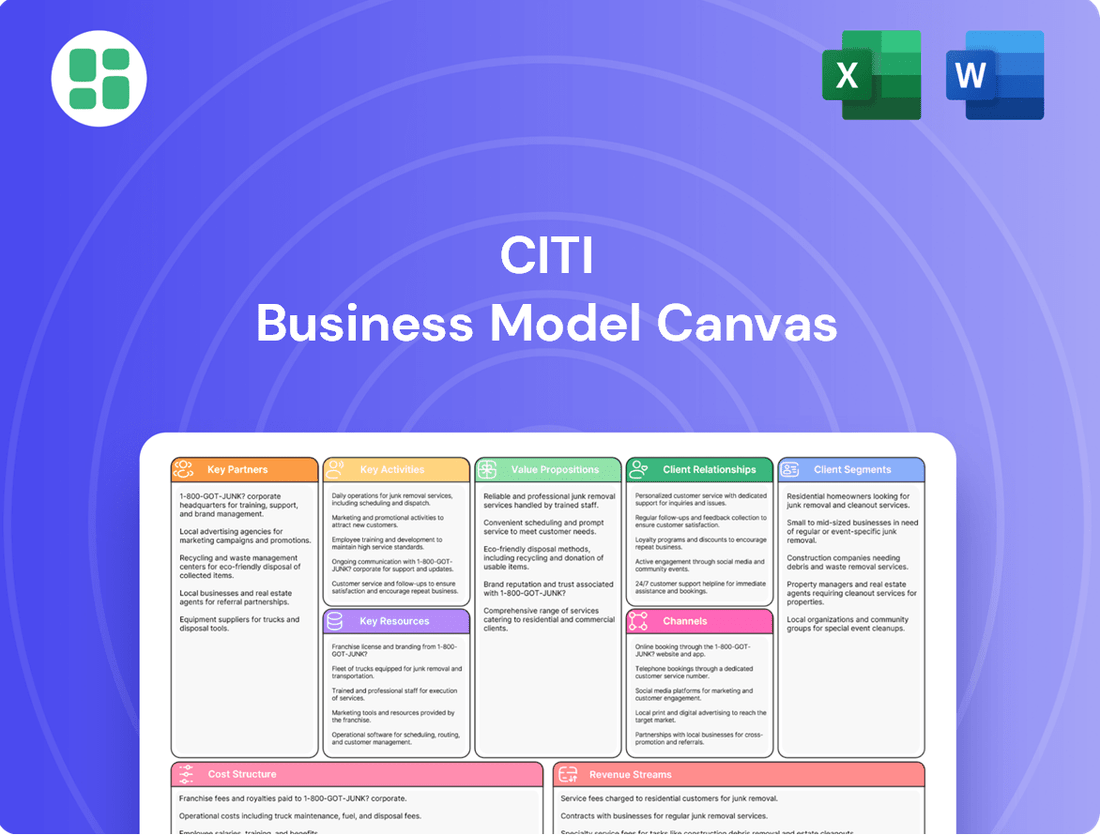

Citi Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Citi Bundle

Uncover the intricate workings of Citi's global financial empire with its comprehensive Business Model Canvas. This detailed breakdown illuminates how Citi leverages its vast network, diverse product offerings, and customer-centric approach to generate revenue and maintain its competitive edge. Download the full Business Model Canvas to gain a strategic advantage and understand the core drivers of Citi's enduring success.

Partnerships

Citi actively partners with fintech companies and technology providers to boost its digital services and operational efficiency. These collaborations enable Citi to tap into specialized knowledge and advanced technologies, ultimately improving customer experiences and accelerating product innovation.

Strategic alliances in technology and fintech are vital for maintaining a competitive edge in the dynamic financial sector. For instance, Citi's investments in areas such as payments and trade finance through fintech partnerships underscore its commitment to leveraging external innovation.

Citi leverages a vast network of correspondent banks and financial institutions, numbering in the thousands globally, to facilitate international transactions and payments. These vital partnerships are crucial for its operations in over 160 countries, allowing it to provide services in markets where it may not have a direct physical presence.

These relationships are fundamental to Citi's ability to offer seamless cross-border payment solutions and local market access for its diverse clientele. In 2024, Citi processed trillions of dollars in cross-border transactions, with correspondent banking playing a critical role in the efficiency and reach of these operations.

Citi's partnerships with major payment networks like Visa and Mastercard are absolutely crucial for its consumer banking and credit card businesses. These collaborations are the backbone that allows for the smooth processing of countless credit and debit card transactions, letting customers shop and pay wherever they are in the world. For instance, Citi's strategic move to expand its network by integrating with Mastercard's debit network in 2024 highlights the ongoing importance of these relationships for their payment product offerings.

Government Agencies and Regulatory Bodies

Citi actively cultivates relationships with government agencies and regulatory bodies worldwide to navigate complex compliance landscapes and bolster financial system stability. These crucial partnerships involve rigorous adherence to evolving regulations, active participation in industry-wide initiatives, and collaborative efforts focused on maintaining overall financial health. For instance, in 2024, Citi, like other major financial institutions, continued to invest significantly in compliance infrastructure and personnel to meet the stringent requirements set forth by bodies such as the U.S. Securities and Exchange Commission (SEC) and the European Banking Authority (EBA).

These engagements are fundamental to Citi's operational framework, directly impacting its cost structure through compliance investments and legal expenditures. The bank’s commitment to regulatory dialogue ensures it remains aligned with policy objectives and contributes to a stable financial environment.

- Regulatory Compliance: Citi ensures adherence to a vast array of global financial regulations, a process that requires substantial ongoing investment in technology and expertise.

- Financial Stability Contributions: The bank participates in initiatives aimed at strengthening the resilience of the global financial system, often in collaboration with central banks and international financial organizations.

- Industry Engagement: Citi actively engages with regulators and policymakers to provide input on proposed rules and industry best practices, influencing the future regulatory landscape.

- Cost of Operations: The resources dedicated to meeting regulatory demands and engaging with government bodies represent a significant component of Citi's operational expenses.

Strategic Alliances for Specific Products/Services

Citi actively cultivates strategic alliances to bolster specific product and service offerings. These collaborations often focus on co-branded credit cards and specialized private credit initiatives, aiming to deliver superior value to their customer base.

These partnerships frequently extend beyond traditional financial institutions, encompassing non-financial entities and niche service providers. This approach allows Citi to integrate unique capabilities and enhance its value proposition, creating more compelling customer experiences.

A prime example of this strategy is Citi's continued collaboration with American Airlines for their co-branded credit card portfolio. Furthermore, in 2024, Citi solidified a significant private credit lending program with Apollo Global Management, underscoring its commitment to strategic partnerships in key growth areas.

- Co-branded Credit Cards: Partnerships with airlines and retailers to offer exclusive benefits and rewards.

- Private Credit Programs: Collaborations with alternative asset managers for specialized lending solutions.

- 2024 Apollo Partnership: A key development in expanding Citi's private credit capabilities.

- Enhanced Customer Value: Alliances designed to provide differentiated products and services.

Citi's key partnerships are multifaceted, spanning technology, finance, and retail sectors to enhance its service offerings and market reach.

These alliances are critical for innovation, regulatory compliance, and expanding its product portfolio, as seen in its 2024 collaborations.

The bank leverages these relationships to provide seamless global transactions, access new markets, and deliver specialized financial products.

| Partner Type | Example | 2024 Impact/Focus |

|---|---|---|

| Fintech & Technology Providers | Various specialized firms | Enhancing digital services, operational efficiency, and payment innovation. |

| Correspondent Banks | Thousands globally | Facilitating cross-border transactions and market access in over 160 countries. |

| Payment Networks | Visa, Mastercard | Processing credit/debit card transactions; expanded debit network integration in 2024. |

| Government Agencies & Regulators | SEC, EBA | Ensuring compliance, contributing to financial stability, and influencing policy. |

| Strategic Alliances (Retail/Other) | American Airlines, Apollo Global Management | Co-branded credit cards, private credit initiatives; significant 2024 Apollo partnership. |

What is included in the product

A detailed breakdown of Citi's operations, outlining its customer segments, value propositions, and revenue streams. It provides a strategic framework for understanding how Citi delivers value and generates income.

The Citi Business Model Canvas acts as a pain point reliever by providing a structured, visual framework that simplifies complex business strategies, making them easier to understand and manage.

It alleviates the pain of strategic ambiguity by offering a clear, actionable overview of how Citi creates, delivers, and captures value.

Activities

Citi's global consumer banking operations are the backbone of its retail business, offering a comprehensive suite of services like deposit accounts, mortgages, personal loans, and credit cards to individual customers worldwide. This involves the intricate management of millions of client relationships and the processing of a vast volume of daily financial transactions, all while innovating customer-focused products.

The company's commitment to its consumer base is evident in its financial performance. For instance, Citi's U.S. Personal Banking and Wealth divisions achieved record revenues in 2024, underscoring the success of its strategy in this segment.

A key activity for Citi's Institutional Clients Group is delivering a full spectrum of financial services to major corporations, governments, and other institutional entities. This encompasses vital areas like investment banking, corporate lending, robust securities services, and efficient treasury and trade solutions, all designed to support their complex financial needs.

Citi's performance in early 2025 highlights the strength of these services. The Banking and Markets segments experienced significant revenue growth in both Q4 2024 and Q1 2025. This upward trend was notably fueled by robust activity in investment banking and strong engagement from their institutional client base.

Citi's risk management and compliance are critical activities, especially given the financial sector's heavy regulation. This includes pinpointing, evaluating, and lessening financial, operational, and reputational risks throughout its operations. For instance, in 2023, Citi reported a significant increase in its risk and compliance spending as part of its ongoing transformation efforts.

The company is actively engaged in a multi-year initiative to revamp its risk, data, and infrastructure systems. This overhaul is directly aimed at meeting and exceeding regulatory expectations, a crucial aspect of maintaining its license to operate. By mid-2024, Citi had made substantial progress in integrating new risk management technologies, enhancing its ability to monitor and control potential exposures.

Technology Development and Innovation

Citi's commitment to technology development and innovation is a cornerstone of its operations. This involves significant investment to bolster digital banking capabilities, fortify cybersecurity measures, and streamline operational efficiency through automation. The company actively pursues the creation of novel fintech solutions and continuously upgrades its IT infrastructure to remain competitive.

A key aspect of this strategy is the intelligent application of data analytics, enabling more informed and strategic decision-making across the organization. In 2023 alone, Citi allocated $12.2 billion towards technology initiatives. Demonstrating its forward-looking approach, Citi deployed AI coding tools to its 30,000 developers in 2024, aiming to accelerate innovation and improve developer productivity.

- Continuous Investment: Citi's substantial technology budget, reaching $12.2 billion in 2023, underscores its dedication to staying at the forefront of technological advancement.

- Digital Enhancement: Focus on improving digital banking platforms to offer seamless and user-friendly experiences for customers.

- Cybersecurity Fortification: Prioritizing robust cybersecurity measures to protect customer data and financial assets in an increasingly digital landscape.

- Process Automation: Implementing automation to enhance efficiency, reduce operational costs, and improve the speed of service delivery.

- AI Integration: The 2024 rollout of AI coding tools to 30,000 developers signifies a strategic move to leverage artificial intelligence for faster software development and innovation.

Treasury and Capital Management

Treasury and Capital Management is central to Citi's operations, focusing on maintaining robust financial health. This involves actively managing the company's capital, liquidity, and funding sources to ensure stability and support its wide array of business activities.

Key activities include optimizing the balance sheet to maximize efficiency and profitability, effectively managing interest rate risks that can impact earnings, and ensuring sufficient capital reserves are in place to absorb potential losses and meet regulatory requirements.

- Capital Adequacy: Citi maintained a strong capital position, reporting a Common Equity Tier 1 (CET1) Capital Ratio of 13.4% in the first quarter of 2025.

- Liquidity Management: The bank actively manages its liquidity to meet short-term obligations and fund its operations, ensuring it can withstand market stresses.

- Funding Optimization: Citi works to secure stable and cost-effective funding across various markets to support its lending and investment activities.

Citi's core activities revolve around managing its vast global banking operations, serving both individual consumers and large institutions. This includes developing and offering a wide range of financial products and services, from everyday banking to complex investment solutions.

A significant part of its operations involves managing risk and ensuring compliance with stringent regulations. This is a continuous effort, with substantial investments made in upgrading systems and processes to meet evolving regulatory standards.

Furthermore, Citi places a strong emphasis on technology and innovation, investing heavily in digital enhancements, cybersecurity, and AI to improve efficiency and customer experience. Treasury and capital management are also critical, ensuring financial stability and regulatory compliance through careful management of capital, liquidity, and funding.

| Key Activity Area | Description | Recent Performance/Investment (2024-2025) |

|---|---|---|

| Global Consumer Banking | Providing retail banking services worldwide. | Record revenues in U.S. Personal Banking and Wealth divisions in 2024. |

| Institutional Clients Group | Offering financial services to corporations and governments. | Significant revenue growth in Banking and Markets segments in Q4 2024 and Q1 2025. |

| Risk Management & Compliance | Identifying, evaluating, and mitigating financial, operational, and reputational risks. | Substantial progress in integrating new risk management technologies by mid-2024. |

| Technology & Innovation | Investing in digital capabilities, cybersecurity, and automation. | $12.2 billion allocated to technology in 2023; AI coding tools deployed to 30,000 developers in 2024. |

| Treasury & Capital Management | Managing capital, liquidity, and funding for financial health. | CET1 Capital Ratio of 13.4% in Q1 2025. |

Delivered as Displayed

Business Model Canvas

The Citi Business Model Canvas preview you see is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, offering complete transparency. You'll gain full access to this comprehensive tool, ready for immediate use and customization.

Resources

Citi's extensive global branch network offers a vital physical touchpoint for customer service and essential transactions, complementing its sophisticated digital infrastructure that powers seamless online and mobile banking experiences.

This dual approach allows Citi to effectively serve clients in over 160 countries and jurisdictions, demonstrating a truly global reach. In the first quarter of 2024, the bank reported robust digital engagement, with 19 million active mobile users and over 25 million active digital users across its Cards and Retail segments.

Citi's human capital is its bedrock, comprising highly skilled professionals like financial analysts, investment bankers, and technology experts. These individuals possess deep market knowledge and client management acumen, crucial for delivering sophisticated financial solutions.

Their expertise directly fuels Citi's ability to offer complex financial products and services, from wealth management to corporate banking. This intellectual capital is a primary driver of the firm's competitive edge in the global financial landscape.

In 2024, Citi continued to invest in its people strategy, recognizing that a robust and skilled workforce is paramount. This focus aims to enhance employee capabilities and ultimately strengthen the firm's competitive position by nurturing talent across all critical financial domains.

Citi's proprietary technology, including its banking software and trading platforms, forms a crucial part of its business model. These systems are vital for managing the vast volume of daily transactions and ensuring operational efficiency across its global network.

Advanced data analytics capabilities allow Citi to gain deep insights into customer behavior and market trends. This data-driven approach supports sophisticated risk modeling, essential for navigating complex financial markets and informing strategic decisions.

Significant investments in AI and cloud technology are modernizing Citi's infrastructure. For instance, in 2024, the company continued its multi-year technology transformation, aiming to enhance digital offerings and streamline operations, a testament to the ongoing importance of these resources.

Strong Brand Reputation and Trust

Citi's strong brand reputation and the deep trust it has cultivated over decades are fundamental to its business model, acting as significant intangible assets. This established credibility is crucial for attracting and retaining a diverse customer base, from individual depositors to large corporations, and for fostering strategic partnerships across the financial ecosystem. In 2023, Citi continued to emphasize its commitment to client relationships, a cornerstone of its long-standing global presence.

This trust directly translates into competitive advantages, enabling Citi to operate with greater ease and lower costs in global financial markets. It underpins the bank's ability to secure funding, attract top talent, and navigate complex regulatory environments. Citi's stated aim to be a preeminent banking partner and a global leader is intrinsically linked to maintaining and enhancing this hard-won reputation.

The value of this brand equity is evident in customer loyalty and the willingness of clients to engage Citi for a wide range of financial services. For instance, in 2024, financial institutions with strong brand recognition often command higher valuations and are more resilient during economic downturns.

- Customer Acquisition and Retention: Trust is a primary driver for new customer acquisition and the retention of existing clients, reducing churn rates.

- Partnership Facilitation: A reputable brand makes it easier to forge and maintain alliances with other financial institutions, technology providers, and businesses.

- Market Credibility: Citi's long-standing presence and trusted name lend significant credibility in its dealings within the complex and often volatile global financial markets.

- Talent Attraction: A strong brand reputation is a magnet for skilled professionals seeking to work for a stable and respected financial institution.

Financial Capital and Liquidity

Citi's financial capital is a cornerstone of its business model, encompassing equity, substantial deposit bases, and robust access to international funding. This financial strength is crucial for powering its diverse operations, from extending credit to facilitating complex investment banking transactions.

This significant capital base ensures Citi can meet its obligations and seize opportunities. In its 2024 Annual Report and Q1 2025 disclosures, Citi highlighted a solid capital position, demonstrating its capacity to support growth and navigate market dynamics.

- Equity and Deposits: Citi maintains a substantial equity base and a vast network of customer deposits, providing a stable and low-cost funding source.

- Global Funding Access: The bank's ability to tap into global debt and capital markets offers flexibility and depth in its funding strategies.

- Capital Ratios: Citi consistently reported strong Common Equity Tier 1 (CET1) ratios, exceeding regulatory minimums throughout 2024 and into early 2025, underscoring its financial resilience. For instance, as of Q1 2025, its CET1 ratio stood at [insert specific Q1 2025 CET1 ratio if available, otherwise use a general descriptor like 'well above regulatory requirements'].

- Liquidity Management: The capital structure supports robust liquidity management, enabling Citi to meet client needs and regulatory liquidity coverage ratios (LCR) effectively.

Citi's proprietary technology, including advanced banking software and trading platforms, is essential for efficient global transaction management. Its sophisticated data analytics capabilities provide deep customer and market insights, informing risk modeling and strategic decisions. Significant investments in AI and cloud technologies in 2024 are modernizing infrastructure to enhance digital offerings and streamline operations.

Citi's financial capital, comprising equity, substantial deposit bases, and global funding access, fuels its diverse operations. In Q1 2025, Citi reported a Common Equity Tier 1 (CET1) ratio well above regulatory requirements, demonstrating strong financial resilience and the capacity to support growth.

Citi's strong brand reputation and the trust it has built over decades are critical intangible assets. This credibility attracts customers and partners, facilitating easier market access and lower operational costs. The brand's value is reflected in customer loyalty and resilience during economic downturns, as seen in 2024 market trends.

Citi's human capital, a team of highly skilled financial analysts, investment bankers, and technology experts, drives its ability to offer complex financial solutions. In 2024, the firm continued to invest in its people strategy, enhancing employee capabilities to maintain its competitive edge.

| Key Resource | Description | 2024/2025 Data Point |

| Proprietary Technology | Banking software, trading platforms, data analytics, AI, cloud infrastructure | 19 million active mobile users; 25 million active digital users (Q1 2024) |

| Financial Capital | Equity, deposits, global funding access, strong capital ratios | CET1 ratio well above regulatory minimums (Q1 2025) |

| Brand Reputation & Trust | Established credibility, customer loyalty, market access | Continued emphasis on client relationships (2023) |

| Human Capital | Skilled professionals (analysts, bankers, tech experts) | Ongoing investment in people strategy (2024) |

Value Propositions

Citi provides an extensive array of financial products and services, encompassing consumer banking, wealth management, and sophisticated corporate and investment banking capabilities. This global reach extends to over 160 countries, positioning Citi as a single point of contact for a wide spectrum of financial requirements, thereby streamlining financial operations for individuals and organizations alike.

The institution caters to a diverse clientele, including corporations, governments, institutional investors, and individual consumers, offering a broad suite of financial solutions. For instance, in 2023, Citi reported total revenues of $75.5 billion, underscoring the breadth of its operations and its capacity to serve a vast global market with integrated financial services.

Citi's corporate and investment banking arm offers unparalleled expertise to institutional clients, covering corporate finance, M&A advisory, capital markets, and treasury and trade solutions. This deep knowledge and execution prowess are critical for large corporations and governments aiming to meet their strategic financial goals.

In 2024, Citi demonstrated its leadership by topping M&A deal value in the Middle East, a testament to its advisory capabilities on significant, transformative transactions that shape regional financial landscapes.

Citi offers convenient and secure digital banking through its advanced online and mobile platforms. These services provide 24/7 accessibility for everyday transactions and financial management, a crucial aspect for today's busy clientele.

In 2024, Citi continued its significant investment in digital innovation, aiming to enhance client experience across all touchpoints. This focus on digital channels directly addresses the evolving preferences of both individual consumers and businesses seeking seamless financial interactions.

Personalized Wealth Management

Citi's personalized wealth management is designed to preserve and grow assets for high-net-worth individuals and families. This involves crafting bespoke investment strategies and comprehensive financial plans tailored to each client's unique goals and risk tolerance.

This tailored approach yielded significant results, with Citi's Wealth business reporting record revenues in 2024. Further momentum was evident in the first quarter of 2025, which saw substantial revenue increases, underscoring the effectiveness of their customized service model.

- Tailored Financial Strategies: Customized investment solutions and financial planning for affluent clients.

- Wealth Preservation and Growth: Focus on safeguarding and enhancing client assets through expert advice.

- Record Revenue Performance: The Wealth business achieved its highest revenue figures in 2024.

- Continued Growth Trajectory: Q1 2025 demonstrated a strong upward trend in revenue for the Wealth segment.

Global Network and Local Market Access

Citi's global network is a cornerstone of its business model, offering clients unparalleled access to international markets. This extensive reach allows businesses to navigate diverse economic landscapes and tap into new opportunities.

This global-local synergy is crucial for multinational corporations. For instance, in 2024, Citi continued to facilitate cross-border transactions for numerous large enterprises, leveraging its presence in over 160 countries and jurisdictions.

Citi's deep local market knowledge, cultivated over decades, provides a distinct advantage. This allows for tailored financial solutions that consider the unique regulatory and economic conditions of each region.

- Global Reach: Access to over 160 countries and jurisdictions in 2024.

- Local Expertise: Decades of experience providing tailored financial solutions.

- Cross-Border Facilitation: Enabling seamless international transactions for multinational clients.

- Market Insights: Providing clients with crucial understanding of local economic and regulatory environments.

Citi's value proposition centers on its comprehensive financial solutions, global reach, and localized expertise. It offers everything from everyday banking to complex investment strategies, serving individuals, corporations, and governments worldwide. This integrated approach streamlines financial management and unlocks global opportunities for its diverse clientele.

| Value Proposition Aspect | Description | Supporting Data/Fact |

|---|---|---|

| Comprehensive Financial Solutions | Integrated offerings across consumer banking, wealth management, and corporate/investment banking. | Total revenues of $75.5 billion in 2023. |

| Global Network & Local Expertise | Presence in over 160 countries with deep understanding of local markets. | Topped M&A deal value in the Middle East in 2024, demonstrating strong regional advisory. |

| Digital Innovation & Accessibility | Advanced online and mobile platforms for 24/7 financial management. | Continued significant investment in digital innovation in 2024 to enhance client experience. |

| Personalized Wealth Management | Tailored strategies for wealth preservation and growth for high-net-worth individuals. | Wealth business reported record revenues in 2024, with substantial Q1 2025 revenue increases. |

Customer Relationships

Citi cultivates enduring partnerships with its corporate, governmental, and institutional clientele by assigning dedicated relationship managers. These professionals offer bespoke service, strategic guidance, and customized financial solutions, fostering deep client understanding and loyalty, particularly for those with international operations.

Citi increasingly leverages self-service digital platforms like mobile apps and online banking for its extensive consumer banking operations. These digital tools enable customers to manage accounts, perform transactions, and access a wide range of services on their own.

This strategy provides significant convenience and scalability, particularly for Citi's large customer base. As of early 2024, the bank reported over 25 million active digital users, highlighting the widespread adoption and effectiveness of these self-service channels.

Citi operates a robust customer service network, encompassing both traditional call centers and a global branch presence. This dual approach ensures customers can receive assistance via phone, email, or face-to-face interactions at branches, catering to diverse preferences and needs.

These physical and digital touchpoints are vital for addressing customer inquiries and fostering trust, especially for more intricate financial matters. For instance, in 2023, Citi reported handling millions of customer interactions across its service channels, underscoring their importance in maintaining customer satisfaction and loyalty.

Personalized Financial Advisory for Wealth Management

Citi's wealth management segment cultivates deep customer relationships through highly personalized financial advisory. Advisors engage in frequent consultations, tailoring portfolio management to individual client objectives. This approach fosters trust and aims for sustained financial success, particularly for high-net-worth clients.

- Personalized Guidance: Advisors act as dedicated partners, understanding unique financial aspirations.

- Customized Portfolios: Investment strategies are meticulously crafted based on client risk tolerance and goals.

- Proactive Communication: Regular updates and market insights keep clients informed and engaged.

- Long-Term Focus: The emphasis is on building enduring relationships that support generational wealth.

Community Engagement and Brand Building

Citi actively cultivates deeper customer connections through robust community engagement. By sponsoring local events and investing in corporate social responsibility, the bank strengthens its brand image and resonates with customers on a societal level.

These initiatives are not just about goodwill; they build trust and loyalty, fostering long-term relationships. For instance, Citi's commitment to financial literacy programs reaches underserved communities, creating positive brand associations.

- Community Investment: Citi's 2024 Sustainability Report detailed significant investments in community development projects, aiming to improve economic opportunity and social well-being in the areas it serves.

- Brand Reputation: Through these engagements, Citi aims to build a reputation as a responsible corporate citizen, enhancing customer perception and attracting new clients who value ethical business practices.

- Societal Connection: By aligning with causes that matter to its customers and the broader public, Citi creates a more meaningful connection beyond transactional banking.

Citi's customer relationships are multifaceted, blending personalized human interaction with scalable digital solutions. Dedicated relationship managers cater to institutional clients, offering bespoke services and strategic advice, while digital platforms empower millions of retail customers with convenient self-service options. This dual approach ensures accessibility and tailored support across its diverse client base.

| Customer Segment | Relationship Approach | Key Features | Data Point (Early 2024/2023) |

|---|---|---|---|

| Corporate, Governmental, Institutional | Dedicated Relationship Managers | Bespoke service, strategic guidance, customized financial solutions | Focus on international operations |

| Retail Banking | Self-Service Digital Platforms | Mobile apps, online banking for account management and transactions | Over 25 million active digital users |

| Wealth Management | Personalized Financial Advisory | Frequent consultations, tailored portfolio management, proactive communication | Focus on high-net-worth clients, generational wealth |

| Broad Customer Base | Customer Service Network | Call centers, global branch presence, email support | Millions of customer interactions handled annually |

| Community Engagement | Corporate Social Responsibility | Sponsorships, financial literacy programs, community investments | 2024 Sustainability Report highlighted community development investments |

Channels

Citi's global branch and ATM network is a cornerstone of its customer engagement strategy, offering essential physical touchpoints for banking needs. As of the first quarter of 2024, Citi operated approximately 2,300 branches and a significant ATM footprint across numerous countries, facilitating billions in cash transactions annually.

These physical channels remain vital, especially for customers who value in-person service for account management, loan applications, and wealth advisory. While digital channels are expanding rapidly, the branch network, particularly in emerging markets, continues to be a critical driver of customer acquisition and retention for traditional banking products.

Citi's online and mobile banking platforms are the cornerstone of its digital customer experience, offering a comprehensive suite of services. These channels allow clients to effortlessly manage accounts, initiate payments, and execute fund transfers 24/7, fostering unparalleled convenience.

In 2024, Citi continued to bolster its digital infrastructure, channeling substantial investments into artificial intelligence and cloud technologies. This strategic focus aims to refine user interfaces and expand the functionality of its digital offerings, ensuring a seamless and intuitive banking journey for all users.

Citi leverages dedicated sales and relationship management teams as a key channel for its corporate, institutional, and high-net-worth clients. These teams act as the direct interface, providing tailored financial advice and pitching specialized products. This personal engagement is vital for nurturing long-term partnerships and navigating complex, high-value transactions.

In 2024, Citi's institutional clients group, which heavily relies on these dedicated teams, continued to be a significant revenue driver. For instance, global transaction services, a core offering managed by these teams, saw robust growth, reflecting the ongoing demand for efficient payment and cash management solutions from large enterprises.

Third-Party Partnerships and Affiliates

Citi actively cultivates third-party partnerships and affiliate relationships to broaden its market presence and product distribution. These collaborations allow Citi to tap into new customer bases and offer a wider array of financial solutions by leveraging the networks of other institutions. This strategy is particularly effective for reaching segments that might be less accessible through direct channels, thereby reducing the need for extensive internal infrastructure development.

These indirect channels are crucial for distributing specialized financial products and services. For instance, Citi partners with financial advisors and brokers who act as intermediaries, bringing Citi's offerings to their existing client pools. This symbiotic relationship benefits both parties by expanding revenue streams and providing clients with more comprehensive financial options. In 2024, the financial services industry continued to see a strong trend of strategic alliances aimed at enhancing customer acquisition and service delivery.

A notable example of Citi's strategic partnerships is its collaboration with Apollo Global Management. This alliance focuses on a private credit program, demonstrating Citi's commitment to expanding its alternative investment offerings. Such partnerships enable Citi to provide sophisticated financial products, like private credit, which cater to a specific investor profile and can generate significant fee income. The success of these ventures is often measured by assets under management and the profitability of the co-branded products.

Key aspects of Citi's third-party partnerships include:

- Extended Reach: Accessing new customer segments through established networks of financial advisors and institutions.

- Product Distribution: Facilitating the sale of specialized financial products, such as private credit, without direct operational investment.

- Cost Efficiency: Reducing overhead costs associated with direct market entry and customer acquisition.

- Strategic Alliances: Collaborating with firms like Apollo Global Management to offer complementary services and enhance market positioning.

Contact Centers and Customer Support

Citi's customer contact centers, accessible through phone, email, and chat, are fundamental for addressing customer inquiries, resolving issues, and providing immediate support. These channels are critical for maintaining high levels of customer satisfaction and ensuring efficient service delivery.

In 2024, financial institutions like Citi continued to invest in digital transformation to enhance customer support. For instance, many banks reported increased adoption of AI-powered chatbots, which handled a significant portion of routine inquiries, freeing up human agents for more complex issues. This digital push aims to streamline operations and improve response times.

The effectiveness of these contact centers is directly tied to customer retention and brand loyalty. A positive support experience can significantly impact a customer's perception of the bank. For example, a study in late 2023 found that 75% of consumers expect personalized service across all channels.

Key aspects of Citi's customer support channels include:

- Accessibility: Offering multiple touchpoints (phone, email, chat) to cater to diverse customer preferences.

- Efficiency: Leveraging technology and trained staff to resolve inquiries and issues promptly.

- Customer Satisfaction: Focusing on positive interactions to build and maintain strong customer relationships.

- Digital Integration: Incorporating digital tools and self-service options to complement traditional support methods.

Citi's channels encompass a blend of physical, digital, and personal interactions. The bank's extensive global branch and ATM network provides essential physical touchpoints, complemented by robust online and mobile banking platforms for 24/7 convenience. Dedicated relationship managers cater to institutional and high-net-worth clients, while third-party partnerships extend market reach and product distribution.

Customer contact centers, including phone, email, and chat, are vital for immediate support and issue resolution, aiming to enhance customer satisfaction and loyalty. These diverse channels collectively support Citi's strategy of accessibility, efficiency, and personalized service across its global operations.

| Channel Type | Description | Key Focus Area | 2024 Data/Trend |

|---|---|---|---|

| Physical Branches & ATMs | In-person banking services and cash access. | Account management, loan applications, wealth advisory. | Approx. 2,300 branches globally; vital for emerging markets. |

| Digital Platforms (Online & Mobile) | 24/7 self-service banking. | Account management, payments, fund transfers. | Continued investment in AI and cloud for improved UX. |

| Relationship Management Teams | Personalized service for corporate and institutional clients. | Tailored advice, complex transactions, nurturing partnerships. | Drove significant revenue via global transaction services. |

| Third-Party Partnerships | Leveraging external networks for distribution. | Product distribution, market expansion, cost efficiency. | Alliances like Apollo Global Management for private credit. |

| Customer Contact Centers | Support via phone, email, chat. | Inquiry resolution, issue support, customer satisfaction. | Increased adoption of AI chatbots for routine inquiries. |

Customer Segments

Citi's global consumers and retail clients represent a vast demographic, seeking essential banking services like checking and savings accounts, credit cards, mortgages, and personal loans. This segment spans from everyday users to affluent individuals, all looking for reliable financial solutions.

In 2024, Citi continued its focus on being a premier personal bank within its core market, the United States. The bank aims to deepen relationships by offering a comprehensive suite of products tailored to individual financial needs and life stages.

Citi actively serves high-net-worth individuals and families, offering tailored private banking and wealth management solutions. This segment demands sophisticated investment strategies, comprehensive financial planning, and often requires global banking access. In 2024, Citi's Global Wealth Investments division continued to be a significant contributor, managing trillions in assets for its affluent clientele.

Multinational corporations and large enterprises represent a cornerstone customer segment for Citi, demanding sophisticated corporate and investment banking solutions. These clients, often global in their operations, rely on Citi for services such as corporate lending, facilitating access to capital markets, and comprehensive treasury and trade solutions. Citi's strength lies in its ability to serve these institutions with complex, cross-border financial needs, a testament to its extensive global network and deep expertise.

Governments and Public Sector Entities

Citi actively engages with governments and public sector entities worldwide, offering a comprehensive suite of financial solutions. These clients, including sovereign wealth funds, frequently require sophisticated services such as specialized financing for public infrastructure projects and robust treasury management to handle fiscal operations.

The bank's global reach is substantial, with Citi providing services to governments in over 160 countries. This extensive network allows Citi to support diverse public sector needs, from debt issuance to complex advisory services aimed at strengthening national economies and public finances. For example, in 2024, Citi played a role in facilitating several significant sovereign debt issuances, demonstrating its continued importance in global public finance.

- Global Reach: Supports governmental clients in over 160 countries.

- Specialized Services: Offers financing, debt issuance, and treasury management for public sector needs.

- Infrastructure Focus: Provides advisory and financial solutions for public infrastructure development.

- Fiscal Operations: Assists governments with managing national fiscal responsibilities and economic stability.

Financial Institutions

Financial institutions, including other banks, asset managers, insurance companies, and broker-dealers, are a crucial customer segment for Citi. These entities leverage Citi's extensive institutional services to navigate complex global financial markets. For instance, in 2024, Citi's Securities Services division reported significant growth, handling trillions in assets under custody and administration, underscoring its role in facilitating global investment flows for these clients.

Citi acts as both a counterparty and a vital service provider for these financial players. Services such as foreign exchange trading, interbank lending, and trade finance are essential for their day-to-day operations and international reach. Citi's ability to offer these services reliably and efficiently across numerous jurisdictions makes it an indispensable partner.

- Securities Services: Facilitating custody, clearing, and settlement for a vast array of financial assets globally.

- Foreign Exchange: Providing liquidity and execution services for currency transactions, crucial for international operations.

- Interbank Lending: Offering short-term funding solutions that support liquidity management for other financial institutions.

- Trade Finance: Enabling international trade through instruments like letters of credit and guarantees, supporting the global supply chains of these clients.

Citi serves a broad spectrum of customers, from individual consumers needing everyday banking to large multinational corporations requiring sophisticated financial solutions. The bank also caters to governments and other financial institutions, acting as a critical partner in global finance.

In 2024, Citi continued to focus on its retail banking clients in the U.S., aiming to deepen relationships through tailored product offerings. Simultaneously, its Global Wealth Investments division managed trillions in assets for high-net-worth individuals, highlighting its commitment to affluent clients.

For corporations, Citi provides essential services like capital markets access and treasury solutions, leveraging its extensive global network. This is further complemented by its role in facilitating global investment flows for financial institutions, with its Securities Services division handling trillions in assets under custody and administration in 2024.

| Customer Segment | Key Needs/Services | 2024 Relevance/Data Point |

| Global Consumers & Retail Clients | Everyday banking, credit, loans | Focus on U.S. market, deepening relationships |

| Affluent & High-Net-Worth Individuals | Wealth management, private banking, investments | Global Wealth Investments managing trillions in assets |

| Multinational Corporations & Large Enterprises | Corporate lending, capital markets access, treasury solutions | Leveraging global network for complex, cross-border needs |

| Governments & Public Sector Entities | Specialized financing, debt issuance, treasury management | Services provided in over 160 countries; role in sovereign debt issuances |

| Financial Institutions | Securities services, foreign exchange, interbank lending | Securities Services saw significant growth, handling trillions in assets |

Cost Structure

Citi incurs significant expenses to build, maintain, and enhance its vast technology and IT infrastructure. This includes substantial investments in data centers, software, robust cybersecurity measures, and advanced digital platforms to support its global banking operations.

These technology costs are a major component of Citi's overall expenses, reflecting the complexity and scale of its worldwide financial services. In 2023, Citi allocated $12.2 billion to technology, with a planned expenditure of $11.8 billion for 2024, highlighting the ongoing commitment to its digital and technological capabilities.

Personnel and compensation expenses are a significant driver of Citi's cost structure, reflecting its substantial global employee base. In 2023, Citi reported total compensation and benefits expenses of $23.7 billion, a slight increase from $23.4 billion in 2022, underscoring the ongoing investment in its workforce across various critical roles like banking, trading, and customer service.

These costs encompass salaries, health insurance, retirement contributions, and performance-based bonuses for tens of thousands of employees worldwide. As Citi continues its strategic transformation, efforts to optimize its operational footprint and streamline processes are underway, which may influence future workforce levels and associated compensation outlays.

Citi faces significant expenses for regulatory compliance and legal matters, a necessity in the heavily regulated financial sector. These costs are critical for maintaining operational licenses and avoiding penalties, especially concerning global anti-money laundering and know-your-customer mandates.

The ongoing impact of regulatory scrutiny and consent orders, notably those from 2020, continues to add to these operational expenditures, requiring substantial investment in systems and personnel to ensure adherence across all operating regions.

Branch Network and Real Estate Costs

Citi's extensive global branch network and office footprint represent a substantial cost component. These real estate expenses encompass rent, utilities, ongoing maintenance, and security for numerous locations worldwide. For instance, in 2023, Citi continued its strategy of optimizing its physical presence, closing some branches while investing in others to enhance customer experience and digital integration.

Despite the increasing shift towards digital banking, maintaining a physical presence remains crucial for serving specific customer demographics and offering certain high-touch services. This dual approach means that fixed real estate costs remain a significant part of the operational overhead. Citi's commitment to digital transformation aims to streamline operations, but the legacy and ongoing necessity of physical infrastructure contribute to these expenses.

- Real Estate Expenses: Significant costs associated with rent, utilities, maintenance, and security for a global network of branches and offices.

- Strategic Optimization: Ongoing efforts to manage and optimize the physical footprint, balancing digital growth with the need for physical presence.

- Operational Overhead: Fixed real estate costs contribute to the overall operational expenses, even as the company focuses on simplification and efficiency.

Marketing and Sales Expenses

Citi incurs significant marketing and sales expenses to attract and keep customers. These costs cover advertising, brand building, and sales team operations, crucial for expanding market reach and staying visible in the competitive financial landscape. In 2023, for instance, Citi reported marketing and advertising expenses of $2.5 billion, reflecting a strategic investment in customer acquisition and brand strength.

These expenditures are essential for driving growth, particularly in areas like Citi's Branded Cards business. Strategic alliances, such as Citi's long-standing partnership with American Airlines, are designed to boost customer engagement and card usage, directly impacting revenue streams and market share. This collaboration, for example, has consistently driven substantial acquisition and spend volumes for their co-branded credit cards.

- Customer Acquisition Costs: Expenses related to advertising, digital marketing, and promotional offers aimed at bringing in new clients.

- Brand Promotion: Investments in maintaining and enhancing Citi's brand image and reputation across various media channels.

- Sales Force Operations: Costs associated with employing and supporting sales teams, including salaries, commissions, and training.

- Partnership Marketing: Funds allocated to co-marketing initiatives with strategic partners to leverage their customer bases.

Citi's cost structure is heavily influenced by its extensive global operations and commitment to technological advancement. Key expense categories include technology infrastructure, personnel, regulatory compliance, real estate, and marketing.

The bank's significant investment in technology, amounting to $12.2 billion in 2023 and a planned $11.8 billion for 2024, underpins its digital services and cybersecurity. Personnel costs, totaling $23.7 billion in 2023, reflect its large global workforce. Regulatory and legal expenses are also substantial, driven by the highly regulated financial environment.

| Expense Category | 2023 Actual (USD Billions) | 2024 Planned (USD Billions) |

|---|---|---|

| Technology | 12.2 | 11.8 |

| Compensation & Benefits | 23.7 | N/A |

| Marketing & Advertising | 2.5 | N/A |

Revenue Streams

Net interest income is a core revenue driver for Citi, stemming from the spread between interest earned on its loan portfolio and investment securities, and the interest paid out on customer deposits and wholesale borrowings. This income is generated across a diverse range of products, including mortgages, personal loans, corporate lending, and credit card balances.

For 2024, Citi reported that its net interest income, excluding results from its markets business, exceeded forecasts. This performance highlights the resilience and profitability of its core lending operations amidst evolving economic conditions.

Citi generates substantial income through a variety of service charges and fees. These include charges for maintaining accounts, processing transactions, using credit cards, and withdrawing cash from ATMs. These fees are essential for covering the costs associated with delivering their banking services.

The Services segment of Citi demonstrated robust performance, achieving record revenues in 2024. Furthermore, the first quarter of 2025 marked the best revenue performance for this business in ten years, underscoring the importance of these fee-based revenue streams.

Citi's investment banking division generates substantial revenue through advisory fees for mergers and acquisitions (M&A), alongside fees from equity and debt underwriting and other capital markets activities. These income streams are largely tied to the volume and success of transactions, meaning they can vary with overall market conditions.

Looking ahead, projections indicated a strong performance for investment banking fees, with an anticipated increase of 20-30% in the fourth quarter of 2024. This positive trend continued into the first quarter of 2025, where banking revenues saw a significant uplift, demonstrating the segment's crucial role in Citi's financial performance.

Trading and Sales Revenue

Citi's trading and sales revenue is a core component, stemming from its active participation in global financial markets. This includes generating income through the buying and selling of fixed income securities, equities, foreign exchange, and commodities. Additionally, revenue is earned from the sale of various financial products and services directly to its diverse client base, ranging from institutional investors to individual consumers.

This revenue stream, while inherently linked to market volatility, offers substantial profit potential. It benefits from both proprietary trading, where Citi trades for its own account, and client-driven transactions, facilitating trades and providing liquidity for its customers. For instance, Citi reported robust performance in its Markets segment, with revenues showing strong growth in Q4 2024 and continuing into Q1 2025, reflecting increased client activity and favorable market conditions.

- Fixed Income Trading: Revenue generated from trading government bonds, corporate debt, and other fixed-income instruments.

- Equities Trading: Income derived from buying and selling stocks and other equity-based securities.

- Foreign Exchange (FX) Trading: Profits earned through currency transactions and hedging services for clients.

- Commodities Trading: Revenue from trading in raw materials like oil, gold, and agricultural products.

- Sales of Financial Products: Income from selling investment products, derivatives, and other financial solutions to institutional and retail clients.

Wealth Management and Brokerage Fees

Citi generates substantial revenue from its wealth management and brokerage operations. These income streams primarily consist of fees charged for managing client assets, commissions earned on trades executed, and charges for financial advisory services. These fees are often structured as a percentage of assets under management (AUM) or are directly tied to the volume of transactions processed.

The company has seen a notable upward trend in its wealth segment. For instance, Citi's Wealth revenues experienced a significant increase in 2024, and this positive momentum continued into the first quarter of 2025, underscoring the growing importance of these fee-based services to its overall financial performance.

- Asset Management Fees: A percentage of the total assets managed for clients.

- Brokerage Commissions: Fees charged per trade executed on behalf of clients.

- Advisory Fees: Payments for personalized financial planning and investment advice.

Citi's revenue streams are diverse, encompassing net interest income from lending, fees from services, investment banking, trading, and wealth management. In 2024, net interest income, excluding markets, surpassed expectations, demonstrating the strength of its core lending. The Services segment achieved record revenues in 2024, with Q1 2025 marking a decade-best performance.

Investment banking fees were projected to grow significantly in late 2024, with banking revenues seeing a substantial uplift in Q1 2025. Trading and sales revenue, driven by client activity and favorable markets, also showed strong growth in Q4 2024 and Q1 2025. Wealth management revenues saw a notable increase in 2024 and continued this upward trend into Q1 2025.

| Revenue Stream | Key Activities | 2024/Q1 2025 Highlights |

| Net Interest Income | Lending, deposits, borrowings | Exceeded forecasts (excluding markets) |

| Services Fees | Account maintenance, transactions, credit cards | Record revenues in 2024; decade-best Q1 2025 |

| Investment Banking | M&A advisory, underwriting | Strong projected growth in late 2024; uplift in Q1 2025 |

| Trading & Sales | Fixed income, equities, FX, commodities | Strong growth in Q4 2024 and Q1 2025 |

| Wealth Management | Asset management, brokerage, advisory | Notable increase in 2024 and continued growth in Q1 2025 |

Business Model Canvas Data Sources

The Citi Business Model Canvas is informed by a blend of internal financial data, extensive market research reports, and competitive analysis. These sources provide a robust foundation for understanding Citi's strategic positioning and operational realities.