Citi PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Citi Bundle

Navigate the complex global landscape impacting Citi with our expert PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces shaping its future. Gain a competitive edge by leveraging these critical insights for your own strategic planning. Download the full version now for actionable intelligence.

Political factors

Geopolitical tensions and shifts in global trade policies profoundly shape Citi's international operations. Evolving trade dynamics between major economic blocs, like the ongoing U.S.-China trade relationship, directly influence investment flows and the demand for cross-border financial services, impacting Citi's revenue streams.

Citi's 2025 wealth outlook anticipates that political developments, such as potential changes in U.S. administration, could introduce new tariffs or protectionist stances. These policy shifts can disrupt global supply chains and alter investment strategies, creating both risks and opportunities for financial institutions like Citi.

The impact of these geopolitical and trade factors on Citi is substantial, affecting everything from currency valuations to the profitability of its international banking and investment services. For instance, increased trade barriers can reduce the volume of international transactions, a key component of Citi's global business model.

Government stability and policy shifts significantly influence Citi's global operations. For example, a change in U.S. administration could lead to altered regulatory approaches, impacting financial services. In 2024, the ongoing geopolitical landscape, including elections in numerous major economies, presents a dynamic environment requiring continuous monitoring and adaptation by Citi to navigate potential policy realignments.

Citi's vast global footprint is intrinsically linked to the health of international relations and the resulting market access it enjoys. The bank's ability to navigate and grow within diverse economies hinges on the quality of bilateral and multilateral agreements, influencing everything from regulatory frameworks to cross-border capital flows.

Strategic initiatives, like Citi's investment in expanding its wholly-owned investment banking operations in China, are directly shaped by the political landscape and market access policies of host nations. For instance, China's evolving regulatory environment for foreign financial institutions plays a crucial role in Citi's operational capacity and growth potential there.

Geopolitical risks, such as ongoing international conflicts and escalating global tensions, introduce significant uncertainty for financial institutions like Citi. These events can disrupt client confidence, impact investment activity, and create volatile market conditions, affecting the bank's performance across various regions.

Regulatory Cooperation and Oversight

The political landscape, particularly regulatory cooperation and oversight, significantly shapes Citi's operational environment. The priorities of U.S. regulators like the OCC and the Federal Reserve directly impact Citi's compliance requirements and strategic direction. For instance, ongoing scrutiny over risk management and data governance, evidenced by substantial fines, highlights the critical need for sustained improvement.

Recent regulatory actions underscore the intensity of this oversight. In 2023, Citi faced significant penalties, including a $35 million fine from the Office of the Comptroller of the Currency for deficiencies in its Bank Secrecy Act and Anti-Money Laundering compliance programs. This followed a substantial $400 million penalty in 2020 from the Federal Reserve for failing to address long-standing risk management and data issues. These events demonstrate a clear political will to enforce stringent standards.

- Regulatory Scrutiny: Continued focus on risk management and data governance by U.S. regulators.

- Compliance Burden: Significant investment required to meet evolving regulatory expectations.

- Enforcement Actions: Risk of further penalties for persistent deficiencies.

Fiscal and Monetary Policy Frameworks

Government fiscal policies, including spending and taxation, directly influence economic activity and, consequently, Citi's operational landscape. For instance, changes in corporate tax rates can impact net income, while government spending on infrastructure projects might stimulate lending opportunities. Citi's 2025 outlook suggests a cautious approach to fiscal policy, with governments aiming to balance debt reduction with economic growth initiatives.

Central bank monetary policies, such as interest rate decisions and inflation targets, are crucial for Citi. As of mid-2025, many central banks are signaling a potential easing of monetary policy, with interest rate cuts anticipated. This shift could lead to lower borrowing costs for consumers and businesses, potentially boosting loan demand and impacting Citi's net interest margins. For example, a 0.25% rate cut by the Federal Reserve could translate to billions in altered interest income for large financial institutions.

- Fiscal Policy Impact: Government spending on stimulus packages or infrastructure can boost economic activity, leading to increased demand for Citi's lending and investment banking services.

- Monetary Policy Impact: Anticipated interest rate cuts in 2025 by major central banks could lower borrowing costs, potentially increasing loan volumes and impacting Citi's profitability through net interest income.

- Inflation Targeting: Central banks' success in managing inflation influences the overall economic stability, affecting investment returns and the cost of capital for Citi and its clients.

- Liquidity Management: Monetary policy decisions directly affect market liquidity, which is essential for Citi's trading and capital markets operations.

Political stability and government policies are paramount for Citi's global operations. In 2024, ongoing elections in major economies create a dynamic environment, necessitating continuous adaptation by Citi to navigate potential policy shifts. For instance, changes in U.S. administration could alter regulatory approaches, impacting financial services and compliance requirements.

Geopolitical tensions and trade policy shifts significantly influence Citi's international revenue streams. Evolving trade dynamics, such as those between the U.S. and China, impact cross-border financial services demand. Citi's 2025 outlook anticipates that political developments, like potential new tariffs, could disrupt global supply chains and investment strategies.

Regulatory scrutiny remains a key political factor for Citi. Significant penalties, such as the $35 million fine from the OCC in 2023 for BSA/AML deficiencies, underscore the intensity of oversight and the need for sustained improvement in risk management and data governance.

What is included in the product

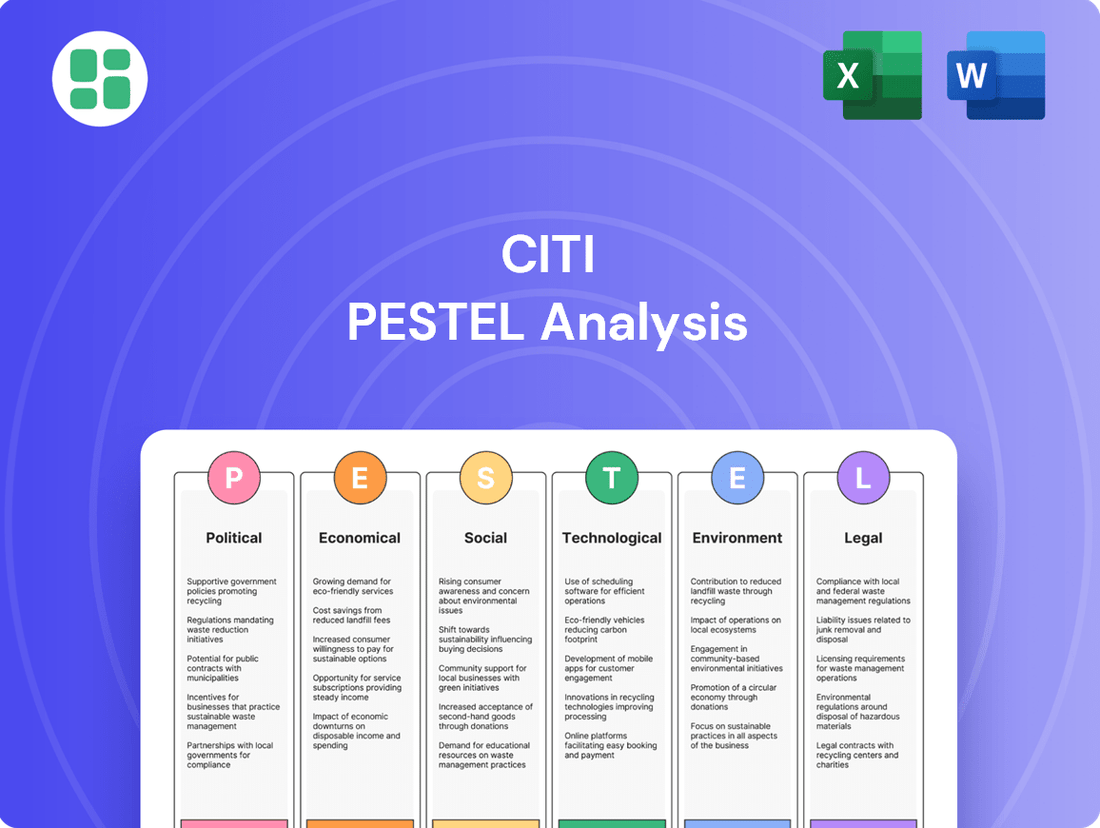

This Citi PESTLE analysis examines how external macro-environmental factors impact the organization across six key dimensions: Political, Economic, Social, Technological, Environmental, and Legal.

It provides actionable insights for strategic decision-making by identifying potential threats and opportunities stemming from these global trends.

The Citi PESTLE Analysis provides a clear, summarized version of the full analysis for easy referencing during meetings or presentations, alleviating the pain of sifting through extensive data.

Economic factors

Citigroup's internal analyses and wealth outlook reports project a continued global economic expansion into 2025 and 2026. The U.S. economy is expected to remain a primary driver of this growth, with forecasts suggesting a GDP growth rate of around 2.2% for 2025.

This positive macroeconomic backdrop generally supports increased client activity across Citi's diverse businesses, including consumer banking, investment banking, and wealth management. A robust global GDP growth forecast, potentially exceeding 2.5% in 2025 according to IMF projections, provides a favorable environment for the bank's diversified business strategy.

The interest rate environment remains a critical economic factor for Citi, heavily influenced by global central bank policies. Analysts are forecasting potential, though gradual, policy rate cuts in the first half of 2025. For instance, the Federal Reserve's benchmark rate, currently at 5.25%-5.50% as of early 2024, is expected to see a reduction, though the pace and magnitude are subject to inflation data and economic growth.

These anticipated shifts in interest rates directly affect Citi's financial performance. Changes in rates impact net interest income, which is the difference between interest earned on assets and interest paid on liabilities. Lower rates can compress these margins, while higher rates can expand them, but also increase borrowing costs for the bank and its customers.

Furthermore, the attractiveness of various financial products, from savings accounts to complex investment instruments, is directly correlated with the prevailing interest rate. Citi's lending margins and the performance of its investment portfolio are therefore sensitive to these monetary policy adjustments, requiring careful management of its balance sheet to navigate the evolving economic landscape.

While U.S. core inflation shows signs of moderating toward the Federal Reserve's 2% target, persistent price pressures continue to shape consumer behavior and impact financial institutions like Citi. For instance, the Consumer Price Index (CPI) for All Urban Consumers in April 2025 saw a 3.4% increase year-over-year, demonstrating ongoing, albeit slower, inflation.

These inflationary trends directly influence Citi's consumer banking. The bank's Q1 2025 earnings report highlighted an increase in the cost of credit, a direct consequence of higher net credit losses within its card portfolios. This rise in losses is further exacerbated by a less favorable macroeconomic outlook, making consumers more sensitive to price changes and potentially impacting their ability to manage debt.

Monitoring evolving consumer spending patterns is therefore critical for Citi. As consumers adjust their budgets in response to inflation, their demand for credit products and their repayment capabilities can shift significantly. This dynamic requires careful management of credit risk and proactive strategies to support consumer loan performance in a fluctuating economic environment.

Corporate Profitability and Market Performance

Citi anticipates robust global corporate profit growth, even as interest rates begin to decline. This expectation suggests favorable conditions for its Markets and Banking divisions, as healthy earnings often translate into higher trading volumes and increased demand for investment banking services.

Strong corporate earnings are a direct catalyst for enhanced activity across key Citi revenue streams. This includes greater securities brokerage, a rise in investment banking advisory and underwriting fees, and expanded opportunities within wealth management as clients benefit from improved corporate performance.

For instance, the S&P 500 companies are projected to see earnings per share growth of approximately 10% in 2024, a figure that bodes well for financial institutions like Citi. This positive corporate outlook underpins the bank's revenue growth strategy by fueling demand for its integrated financial products and services.

- Projected S&P 500 EPS Growth (2024): Approximately 10%.

- Impact on Citi: Increased demand for brokerage, investment banking, and wealth management services.

- Driver of Revenue: Positive corporate performance directly supports Citi's fee-based income.

Currency Fluctuations and Trade Imbalances

Currency fluctuations, especially involving the U.S. dollar, directly impact Citi's international earnings. For example, a stronger dollar in early 2024 meant that revenue earned in foreign currencies translated into fewer dollars, potentially affecting reported profits. This dynamic is crucial for Citi's global client services and its overall financial health.

Trade imbalances and tariffs also create headwinds. For instance, ongoing trade tensions between major economies can disrupt cross-border transactions and investment flows, areas where Citi is heavily involved. In 2023, global trade growth slowed, impacting the volume of international financial services provided by institutions like Citi.

- U.S. Dollar Strength: A stronger U.S. dollar can decrease the reported value of Citi's international revenues when converted back to U.S. dollars.

- Trade Imbalances: Significant trade deficits or surpluses between nations can lead to currency volatility and affect the volume of cross-border financial activities.

- Tariffs and Trade Wars: Imposed tariffs can reduce international trade volumes, thereby impacting the demand for trade finance and related services offered by Citi.

- Global Economic Outlook: Projections for 2024 indicated continued volatility in currency markets, influenced by differing interest rate policies and geopolitical events, posing ongoing challenges for multinational financial institutions.

Citigroup's performance is closely tied to global economic health, with projections indicating continued expansion through 2025. The U.S. economy is expected to lead this growth, with a GDP forecast of approximately 2.2% for 2025, supporting increased client activity across Citi's diverse banking and wealth management sectors.

Interest rate shifts, driven by central bank policies, significantly impact Citi's net interest income. Anticipated gradual rate cuts in early 2025, following the Federal Reserve's current 5.25%-5.50% range, will influence lending margins and the value of financial products.

While inflation is moderating, with U.S. CPI at 3.4% year-over-year in April 2025, it continues to affect consumer spending and credit portfolios, increasing credit costs for Citi.

Strong corporate profit growth, with S&P 500 companies projected to see around 10% EPS growth in 2024, is expected to boost trading volumes and demand for investment banking services, enhancing Citi's revenue streams.

| Economic Factor | 2024/2025 Projection/Data | Impact on Citi |

|---|---|---|

| Global GDP Growth | Projected >2.5% (IMF, 2025) | Favorable environment for diversified business strategy. |

| U.S. GDP Growth | ~2.2% (2025) | Primary driver of client activity. |

| Federal Funds Rate | 5.25%-5.50% (Early 2024), potential cuts in H1 2025 | Affects net interest income and lending margins. |

| U.S. Core Inflation (CPI) | 3.4% YoY (April 2025) | Influences consumer behavior and credit loss costs. |

| S&P 500 EPS Growth | ~10% (2024) | Drives demand for brokerage and investment banking services. |

| Currency Fluctuations | Continued volatility expected (2024) | Impacts reported international earnings. |

Preview Before You Purchase

Citi PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Citi PESTLE analysis breaks down the political, economic, social, technological, legal, and environmental factors impacting the company. You'll gain valuable insights into the strategic landscape affecting Citi's operations and future growth.

Sociological factors

Consumers increasingly prefer digital interactions and seek straightforward, personalized banking. Citi's strategic direction reflects this, with significant investments in digital advancements and the introduction of simplified banking platforms designed to enhance customer engagement and streamline service delivery. This adaptation is vital for maintaining competitiveness and fostering client loyalty.

Global demographic trends, such as the burgeoning middle class in emerging economies and a general increase in wealth accumulation, offer substantial avenues for Citi. For instance, by the end of 2024, it's projected that over 70% of global wealth will be concentrated in the hands of individuals, a trend that directly benefits financial institutions like Citi.

Citi's strategic pivot towards small and medium-sized businesses worldwide, coupled with robust growth in its Wealth Management division, directly capitalizes on these demographic shifts. In 2024, the global middle class is expected to reach 5.4 billion people, a significant portion of whom will require sophisticated financial services.

By closely monitoring these evolving demographics, Citi can effectively customize its product offerings and service strategies to meet the changing demands of its client base, ensuring continued relevance and market penetration.

Citi faces ongoing challenges in equipping its workforce with essential skills in risk management, compliance, and data governance. Internal reviews and regulatory scrutiny have consistently pointed to a need for more robust training in these critical areas. Despite significant spending on improvement initiatives, a noticeable skills gap remains, which could impede the bank's ability to meet its regulatory obligations effectively.

For instance, reports from 2023 indicated that while Citi invested billions in technology and talent, the effectiveness of this spend in closing specific skill gaps, particularly in advanced analytics for risk modeling, was still under evaluation. Addressing these workforce dynamics requires a strategic focus on targeted training programs and talent development to ensure operational resilience and sustained compliance in a rapidly evolving financial landscape.

Diversity, Equity, and Inclusion (DEI) Initiatives

Citi, as a global financial institution, places significant emphasis on Diversity, Equity, and Inclusion (DEI) initiatives to align with evolving societal expectations. This commitment is demonstrated through concrete actions and reporting, aiming to create a more representative and fair workplace.

The bank has made strides in closing pay gaps, reporting in 2023 that its global gender pay gap and U.S. racial pay gap were both less than 1% on an adjusted basis. This focus on equitable compensation is crucial for attracting and retaining a broad talent pool.

- Gender Pay Gap: Less than 1% globally (adjusted basis, 2023).

- U.S. Racial Pay Gap: Less than 1% (adjusted basis, 2023).

- Talent Attraction: DEI efforts enhance Citi's appeal to a diverse workforce.

- Client Service: A diverse workforce better understands and serves a diverse global client base.

Community Engagement and Social Impact

Citi actively pursues community engagement, channeling significant capital into affordable housing and neighborhood revitalization projects. For instance, in 2023, Citi committed $1 billion to support the development and preservation of affordable housing across the U.S., a continuation of its long-term strategy. This focus on sustainable finance and community development underscores a commitment to addressing pressing societal needs.

The Citi Foundation plays a crucial role in this social impact strategy, investing in programs that foster economic opportunity and empower underserved communities. Through its philanthropic efforts, the foundation aims to tackle systemic issues, contributing to a more equitable society. These initiatives are vital for building trust and demonstrating responsible corporate citizenship.

These social impact endeavors directly influence Citi's brand perception and stakeholder relationships. As societal expectations for corporate social responsibility continue to grow, Citi's proactive engagement in areas like affordable housing and community development reinforces its reputation as a socially conscious institution. This alignment with evolving stakeholder values is increasingly important in the financial sector.

Key aspects of Citi's community engagement include:

- Affordable Housing Investments: Significant capital allocation towards increasing the supply and accessibility of affordable housing.

- Community Development Initiatives: Support for local economic growth and neighborhood improvement projects.

- Citi Foundation Philanthropy: Targeted investments in programs addressing economic empowerment and social challenges.

- Sustainable Finance Goals: Integration of social impact objectives within broader financial strategies.

Sociological factors significantly shape consumer behavior and societal expectations, influencing financial institutions like Citi. The growing preference for digital channels means Citi must continue investing in user-friendly online platforms and mobile banking solutions to meet customer demand for convenience and personalization. This digital-first approach is crucial for retaining and attracting clients in the current market.

Technological factors

Citi is heavily invested in digital transformation, with a multi-year strategy involving billions in technology upgrades. This modernization aims to create a more robust risk and control framework, boost operational efficiency, and improve client-facing digital offerings.

By automating processes and modernizing its core infrastructure, Citi is positioning itself for enhanced competitiveness and long-term stability in the evolving financial landscape.

Citi is aggressively integrating Artificial Intelligence (AI) and Generative AI (GenAI) into its core operations, aiming to boost efficiency and customer experience. The bank is actively utilizing platforms such as Google Cloud's Vertex AI to build advanced generative AI tools for tasks like coding assistance, streamlining document analysis, and supporting customer service representatives.

This strategic adoption of AI is seen as critical for enhancing employee productivity, optimizing complex business workflows, and significantly bolstering fraud detection mechanisms. For instance, AI-powered tools can analyze vast datasets to identify suspicious patterns much faster than traditional methods, a key advantage in the financial sector.

Citi's commitment to cybersecurity and data governance is critical as digital transformation accelerates. The bank's significant investments in technology aim to bolster its risk management and internal controls, directly addressing past challenges with data quality that led to regulatory penalties. For instance, in 2023, Citi continued its multi-year investment in technology and infrastructure, with a substantial portion allocated to improving data management and cybersecurity protocols.

Protecting sensitive customer information and ensuring the reliability of its systems are core operational imperatives for Citi. These efforts are crucial not only for regulatory compliance but also for maintaining client trust in an increasingly interconnected financial landscape. The bank's ongoing efforts reflect a strategic focus on building a more resilient and secure operational framework to navigate evolving cyber threats.

Cloud Computing Adoption

Citi is significantly advancing its cloud computing adoption, a move critical for its technological modernization. Strategic partnerships with major cloud providers, such as Google Cloud, are central to this strategy. This collaboration facilitates the migration of numerous workloads and applications to robust, scalable cloud infrastructure.

The benefits of this cloud migration are multifaceted. It's designed to enhance Citi's capacity to deliver superior digital products to its customers. Furthermore, it aims to optimize employee workflows, making operations more efficient. Importantly, it supports the deployment of high-performance computing platforms essential for managing complex financial operations.

This initiative aligns with Citi's broader objective to modernize its technology stack. For instance, in 2024, Citi announced plans to invest billions in technology, with cloud infrastructure being a core component of that investment. This strategic shift is expected to yield significant improvements in agility and operational resilience.

- Enhanced Digital Product Delivery: Cloud infrastructure supports faster development and deployment of innovative digital banking solutions.

- Streamlined Operations: Migration to cloud platforms simplifies IT management and improves internal process efficiency.

- Scalability for Complex Tasks: High-performance computing on the cloud enables advanced analytics and risk management capabilities.

- Cost Optimization: While initial investment is high, cloud adoption offers long-term potential for reduced IT operational costs through pay-as-you-go models.

Fintech Competition and Innovation

The fintech sector is a major technological force, creating both challenges and avenues for growth for established institutions like Citi. The ability to adapt and innovate digitally is paramount to staying competitive and meeting evolving customer demands.

Citi is actively investing in digital transformation to counter the agility of fintech startups. This includes enhancing user interfaces and optimizing internal operations. For instance, the bank’s focus on digital payments, exemplified by initiatives like Citi Payments Express, aims to streamline transactions and improve customer experience.

- Digital Transformation Investment: Global banks are projected to spend over $200 billion on technology in 2024, with a significant portion allocated to digital initiatives.

- Fintech Funding: Despite a market cooldown, fintech startups globally secured over $40 billion in funding in 2023, indicating continued innovation and investment in the sector.

- Customer Expectations: A 2024 survey revealed that 75% of banking customers prefer digital channels for routine transactions, highlighting the need for robust online and mobile platforms.

Citi's technological strategy heavily emphasizes digital transformation and cloud computing, with billions allocated to infrastructure upgrades through 2025. This includes a significant push into AI and GenAI, seen as crucial for enhancing operational efficiency and customer engagement. The bank is actively migrating workloads to cloud platforms, partnering with providers like Google Cloud to improve service delivery and internal processes.

Cybersecurity and robust data governance are paramount, with substantial investments aimed at strengthening risk management and protecting sensitive information. This focus is critical for maintaining client trust and regulatory compliance in an increasingly digital financial ecosystem.

The bank's digital initiatives, such as Citi Payments Express, are designed to compete with agile fintech firms and meet evolving customer expectations for seamless digital transactions, as 75% of banking customers now prefer digital channels for routine banking.

| Area | 2024/2025 Focus | Impact |

|---|---|---|

| Digital Transformation | Billions invested in modernization | Enhanced competitiveness, improved client offerings |

| AI & GenAI Integration | Adoption for efficiency & customer experience | Boosted productivity, optimized workflows, better fraud detection |

| Cloud Computing | Migration of workloads via partnerships | Improved digital product delivery, operational efficiency, scalability |

| Cybersecurity | Significant investment in data governance & risk management | Client trust, regulatory compliance, system resilience |

Legal factors

Citigroup's legal landscape remains heavily influenced by ongoing regulatory oversight. In 2023, the bank faced continued scrutiny and significant fines from U.S. regulators like the OCC and Federal Reserve. These penalties stem from persistent deficiencies in critical areas such as risk management, data governance, and internal controls, issues that have been a focus for several years.

A major legal challenge for Citi involves addressing a 2020 consent order. The bank has incurred substantial financial penalties for not demonstrating adequate progress in rectifying the issues outlined in that order. Successfully resolving these long-standing control deficiencies and proving timely remediation efforts are paramount legal and operational priorities for Citigroup moving forward.

Citi operates under a complex web of global anti-money laundering (AML) and sanctions regulations. These rules are designed to combat illicit financial activities, and compliance is paramount for a financial institution with Citi's international reach.

Past regulatory actions, such as consent orders related to AML program deficiencies, underscore the ongoing challenge. For instance, in 2022, Citi agreed to a $400 million penalty with the Office of the Comptroller of the Currency (OCC) to address deficiencies in its risk management and internal controls, including AML programs. This emphasizes the constant need for sophisticated monitoring, rigorous due diligence, and adaptable compliance frameworks.

Non-compliance carries significant risks, including hefty fines and severe reputational damage. In 2023, financial institutions globally faced billions in AML-related fines, a trend that is expected to continue as regulators intensify scrutiny.

Citi's global operations necessitate strict adherence to a patchwork of data privacy laws, including the European Union's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA). These regulations impose significant obligations on how customer data is collected, processed, and stored.

The bank's capacity to safeguard extensive customer data is paramount, particularly as regulators scrutinize data accuracy and security. For instance, as of early 2024, financial institutions are facing increased scrutiny over data breaches, with fines for non-compliance reaching millions of dollars.

Maintaining customer trust and avoiding costly legal penalties hinges on Citi's robust compliance with these evolving data protection mandates. Failure to do so can result in reputational damage and substantial financial liabilities.

Consumer Protection Laws

Citi, a significant player in consumer banking, navigates a complex landscape of consumer protection laws. These regulations are crucial for maintaining fair practices in areas like credit card terms and mortgage disclosures, ensuring transparency and responsible lending. For instance, in 2024, the Consumer Financial Protection Bureau (CFPB) continued to emphasize enforcement actions against financial institutions for deceptive practices, impacting how companies like Citi must structure their product offerings and customer communications.

Failure to adhere to these consumer protection mandates can result in substantial penalties. In 2024, regulatory fines levied against financial institutions for consumer protection violations reached billions of dollars globally, underscoring the financial risks of non-compliance. Beyond monetary penalties, such breaches can severely erode consumer trust, a critical asset for any financial services firm.

Key areas of focus for Citi and its peers in 2024-2025 include:

- Fair Lending: Adherence to regulations preventing discriminatory practices in credit allocation.

- Truth in Lending: Ensuring clear and accurate disclosure of credit terms and costs.

- Data Privacy and Security: Compliance with evolving laws protecting sensitive customer financial information, such as GDPR and CCPA-related mandates.

- Responsible Debt Collection: Following rules that govern how debts can be collected from consumers.

International Trade and Investment Regulations

Citi, as a global financial services giant operating in over 160 countries, is deeply affected by international trade and investment regulations. These rules govern everything from how much foreign ownership is allowed in its subsidiaries to how capital can move across borders and how transactions are processed internationally. For instance, evolving trade agreements or shifts in national investment policies can significantly alter Citi's strategies for entering new markets and impact the financial performance of its global operations.

The complexity of these regulations presents both challenges and opportunities. For example, in 2024, many nations continued to review and update their foreign direct investment (FDI) screening mechanisms, particularly in sensitive sectors like finance, potentially adding layers of compliance for Citi's cross-border activities. Similarly, ongoing discussions around digital trade and data localization policies in major economies could influence how Citi manages its international data flows and technology infrastructure.

- Foreign Ownership Limits: Citi must adhere to varying foreign ownership caps in different markets, impacting its ability to fully control subsidiaries. For example, some Asian markets have historically maintained stricter limits on foreign bank ownership.

- Capital Controls: Regulations restricting the movement of capital across borders can affect Citi's ability to repatriate profits or move funds efficiently between its global entities.

- Cross-Border Transaction Rules: Compliance with diverse regulations on international payments, currency exchange, and anti-money laundering (AML) is crucial for Citi's operational integrity.

- Trade Agreement Impacts: Changes in trade pacts, such as those affecting financial services liberalization, can directly influence Citi's market access and competitive landscape in specific regions.

Citigroup's legal and regulatory environment is characterized by stringent oversight, particularly concerning risk management and data governance. The bank has faced substantial fines, such as a $400 million penalty in 2022 from the OCC, for persistent deficiencies in these areas, highlighting ongoing remediation efforts as a critical priority.

Compliance with global anti-money laundering (AML) and sanctions regulations is paramount, given Citi's extensive international operations. Billions in AML-related fines were levied globally in 2023, indicating intensified regulatory scrutiny that impacts financial institutions of Citi's scale.

Data privacy laws like GDPR and CCPA impose significant obligations on customer data handling, with financial institutions facing millions in fines for breaches as of early 2024, underscoring the need for robust data security and compliance.

Consumer protection laws, including fair lending and truth in lending, are also critical, with the CFPB continuing enforcement actions for deceptive practices in 2024, leading to billions in penalties for non-compliance across the sector.

Environmental factors

Citi is deeply invested in addressing climate change, aiming for net zero greenhouse gas emissions by 2050. This ambitious goal is supported by interim targets for reducing emissions within its financed sectors, aligning with global efforts to transition to a low-carbon economy.

The financial sector, including Citi, plays a crucial role in this transition by financing green initiatives and managing climate-related financial risks. Citi's strategy involves actively measuring, managing, and reducing the climate risk and impact stemming from its extensive client portfolio, a key component of its environmental responsibility.

Citi has committed to financing and facilitating $1 trillion in sustainable finance by 2030, a significant environmental goal. By 2024, the company had already surpassed the halfway mark, demonstrating substantial progress. This includes substantial investments in crucial areas like renewable energy projects and clean technology advancements worldwide.

Citi is dedicated to minimizing its direct environmental impact, focusing on its global facilities. The bank has made significant strides, achieving or exceeding several of its 2025 targets for reducing greenhouse gas emissions, energy use, water consumption, and waste generation.

ESG Reporting and Disclosure Requirements

Citi faces increasing pressure from investors, regulators, and other stakeholders to provide transparent Environmental, Social, and Governance (ESG) reporting. This demand means the bank must offer comprehensive disclosures on its operations and impact.

The bank actively addresses this by publishing annual ESG and Sustainability Reports. These reports detail Citi's progress on critical areas such as environmental impact, managing climate-related risks, and its various sustainability initiatives. For instance, Citi's 2023 ESG Report highlighted a 39% reduction in Scope 1 and 2 greenhouse gas emissions compared to a 2019 baseline.

Staying current with evolving ESG frameworks is vital for Citi. This adherence is key to maintaining investor confidence and clearly demonstrating its commitment to corporate responsibility. Citi is aligning with frameworks like the Task Force on Climate-related Financial Disclosures (TCFD) and the Global Reporting Initiative (GRI).

- Investor Demand: Growing investor preference for sustainable investments, with global sustainable fund assets projected to reach $50 trillion by 2025, drives the need for robust ESG data.

- Regulatory Scrutiny: Regulators worldwide, including those in the EU with the Corporate Sustainability Reporting Directive (CSRD), are mandating more stringent ESG disclosure requirements.

- Climate Risk Management: Citi reported $10.1 billion in financed emissions in 2023, underscoring the importance of transparently managing and disclosing climate-related financial risks.

- Sustainability Initiatives: The bank has committed $1 trillion in sustainable finance by 2030, requiring detailed reporting on progress and impact.

Physical and Transition Risks from Climate Change

Citi actively assesses and manages the financial risks stemming from climate change. These risks are categorized into physical impacts, such as damage from extreme weather events affecting its assets and clients, and transition risks, arising from policy shifts, technological advancements, and market realignments in the move towards decarbonization.

The bank rigorously tests the resilience of its lending portfolios against these climate-related risks. For instance, in 2023, Citi reported stress testing its portfolios against various climate scenarios, with a focus on sectors highly exposed to physical and transition risks.

- Physical Risk Example: Increased frequency of hurricanes in coastal regions could impact Citi's real estate loan portfolio.

- Transition Risk Example: Stricter emissions regulations could affect the value of investments in carbon-intensive industries.

- Portfolio Resilience: Citi integrates climate scenarios into its enterprise-wide risk management, aiming to identify and mitigate potential impacts on its capital and liquidity.

Citi's environmental strategy centers on achieving net-zero emissions by 2050, with interim goals for financed sectors. The bank is a key player in financing the transition to a low-carbon economy, actively managing climate-related financial risks within its client portfolio.

The commitment to financing $1 trillion in sustainable finance by 2030 shows significant progress, with substantial investments in renewable energy and clean technology. Citi also focuses on minimizing its direct operational footprint, having already met or exceeded several 2025 targets for emissions, energy, water, and waste reduction.

Transparency in ESG reporting is paramount, driven by investor demand and regulatory scrutiny. Citi's annual ESG reports, like the 2023 ESG Report detailing a 39% reduction in Scope 1 and 2 emissions against a 2019 baseline, demonstrate this commitment and alignment with frameworks like TCFD and GRI.

| Metric | 2023 Data | Target/Baseline | Progress |

|---|---|---|---|

| Financed Emissions | $10.1 billion | N/A | Focus on management and disclosure |

| Sustainable Finance | Exceeded halfway mark of $1 trillion | $1 trillion by 2030 | On track |

| Scope 1 & 2 GHG Emissions Reduction | 39% reduction | 2019 baseline | Significant progress |

PESTLE Analysis Data Sources

Our Citi PESTLE Analysis is meticulously constructed using a blend of official government publications, reputable financial news outlets, and comprehensive industry-specific reports. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting Citi's operations.