Citi Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Citi Bundle

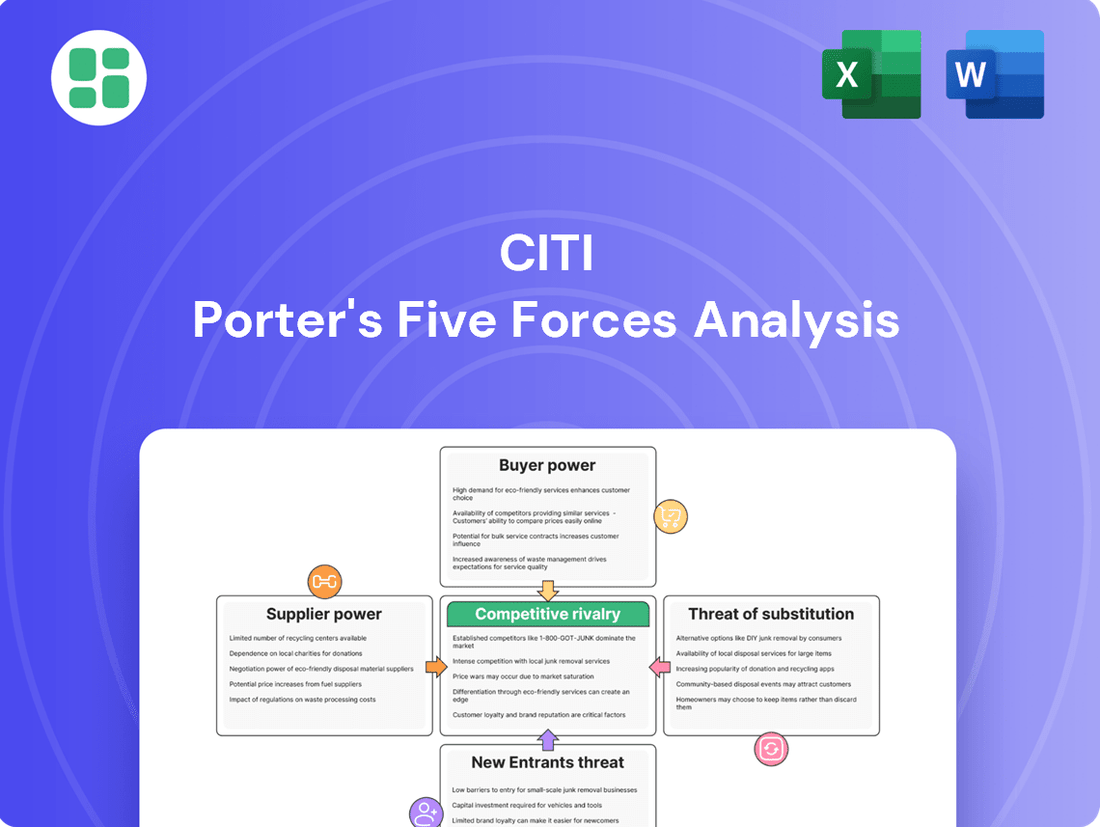

Understanding the competitive landscape for Citi requires a deep dive into Porter's Five Forces. This framework reveals the intense rivalry among existing competitors, the significant bargaining power of buyers, and the constant threat of new entrants disrupting the market.

The complete report reveals the real forces shaping Citi’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Technology and data providers are crucial for Citi's operations, powering everything from its digital banking platforms to its sophisticated analytical tools. While some niche providers might hold sway due to the unique nature of their offerings, the broader market for these services is quite competitive. This competition generally keeps their bargaining power at a low to moderate level.

Citi's significant size and market presence enable it to negotiate advantageous terms with these vendors. For instance, in 2024, major financial institutions like Citi often secure volume discounts and favorable service level agreements. Furthermore, Citi's strategic investments in developing some in-house technological capabilities can further temper the bargaining power of external suppliers, giving it more leverage in negotiations.

Highly skilled financial professionals, particularly in investment banking, technology, and risk management, are crucial suppliers to Citi. The intense competition for this specialized talent can elevate their bargaining power, influencing salary demands and benefits. For instance, in 2023, the average base salary for a quantitative analyst in New York City, a key role for financial institutions, ranged from $120,000 to $180,000, with bonuses often adding significantly to total compensation.

While the demand for such expertise is high, Citi's formidable global brand recognition and its robust offerings in career advancement and professional development serve as significant advantages. These factors enable Citi to attract and retain a substantial pool of talent, thereby moderating the individual bargaining power of its human capital suppliers. The bank's commitment to training and development, evidenced by millions invested annually in employee education programs, further strengthens its position.

Regulatory and compliance service providers hold moderate bargaining power over Citi. This is due to the sheer complexity of global financial regulations, requiring specialized legal and consulting expertise. For instance, the Bank Secrecy Act (BSA) and its associated Anti-Money Laundering (AML) regulations necessitate constant updates and skilled interpretation, making these service providers indispensable.

However, Citi's substantial internal compliance departments and its practice of engaging with numerous external firms mitigate the suppliers' leverage. By maintaining robust in-house capabilities and diversifying its external partnerships, Citi can negotiate more favorable terms and avoid over-reliance on any single provider. This strategic approach helps to keep the bargaining power of these specialized service providers in check.

Payment Network Operators

Major payment network operators, such as Visa and Mastercard, wield considerable bargaining power over financial institutions like Citi. This is primarily due to their near-ubiquitous acceptance by merchants globally and their robust, established processing infrastructure, which is critical for Citi's consumer banking and credit card operations.

Citi's reliance on these networks for transaction processing and card issuance means that the operators can influence fees and terms. For instance, interchange fees, which are paid by merchants to card issuers, indirectly impact Citi's revenue streams and operational costs. In 2023, Visa and Mastercard continued to be dominant players, facilitating trillions of dollars in transactions annually, underscoring their systemic importance.

- Dominant Market Share: Visa and Mastercard collectively processed over 80% of global card transactions in recent years, giving them significant leverage.

- Network Effects: The value of their networks increases with each additional user (both consumers and merchants), creating a strong barrier to entry for competitors.

- Infrastructure Investment: Continuous investment in technology and security by these operators means banks often rely on their advanced capabilities rather than building their own.

- Interchange Fees: These fees, set by the networks, represent a substantial revenue source for card issuers like Citi, but also a cost for merchants, influencing the overall economics of payment processing.

Real Estate and Infrastructure Providers

As a global financial institution, Citi's demand for extensive office space, data centers, and other physical infrastructure across numerous geographies positions it as a significant tenant. However, the sheer scale and diversification of its real estate needs, coupled with long-term lease agreements common in the sector, tend to temper the immediate bargaining power of individual property providers. Citi's ongoing emphasis on operational efficiency and strategic space utilization further shapes its engagement with real estate and infrastructure suppliers.

The bargaining power of real estate and infrastructure providers for a global entity like Citi is generally moderate. While Citi's substantial space requirements could theoretically grant leverage, the long-term nature of most commercial leases and the availability of multiple global markets for real estate acquisition and leasing dilute the power of any single supplier. For instance, in 2024, major financial institutions often engage in multi-year leases that lock in rental rates, reducing the supplier's ability to unilaterally increase prices. Citi's strategic approach to managing its physical footprint, including consolidating offices and investing in technology to enable remote work, also acts as a counterweight to supplier leverage.

- Global Presence: Citi operates in over 160 countries, meaning real estate needs are geographically dispersed, preventing any single supplier from holding significant sway.

- Long-Term Leases: Typical commercial real estate leases extend for 5-15 years, providing Citi with price stability and limiting suppliers' short-term price adjustment power.

- Efficiency Focus: Citi's commitment to optimizing its physical footprint, including smart building technologies and flexible workspace solutions, reduces its reliance on traditional, fixed infrastructure.

Suppliers of specialized technology and data, while critical, generally have low to moderate bargaining power due to market competition and Citi's own technological investments. However, highly skilled financial professionals, particularly in niche areas, can exert significant influence due to high demand and competitive salary expectations, as evidenced by the robust compensation packages for roles like quantitative analysts in 2023.

Major payment networks like Visa and Mastercard hold considerable power due to their widespread acceptance and essential processing infrastructure, impacting Citi's revenue and costs through fees. Real estate and infrastructure providers have moderate leverage, influenced by the long-term nature of leases and Citi's global diversification, which limits the power of any single property supplier.

| Supplier Type | Bargaining Power Level | Key Factors Influencing Power | Example Data/Trend (2023-2024) |

|---|---|---|---|

| Technology & Data Providers | Low to Moderate | Market competition, Citi's in-house capabilities | Broad market competition keeps prices in check; focus on specialized AI/ML tools may increase power for niche providers. |

| Skilled Financial Professionals | Moderate to High | Demand for specialized skills (e.g., quant analysts), competitive compensation | Average base salary for quant analysts in NYC: $120k-$180k+ (2023); high demand for cybersecurity and AI expertise. |

| Payment Network Operators (Visa, Mastercard) | High | Dominant market share, network effects, critical infrastructure | Processed trillions in transactions annually; interchange fees remain a key negotiation point. |

| Real Estate & Infrastructure Providers | Moderate | Long-term leases, global diversification, Citi's space optimization | Multi-year leases common; focus on flexible workspaces and data center efficiency influences supplier terms. |

What is included in the product

This analysis dissects the competitive landscape for Citi by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Visualize competitive pressures instantly with the Porter's Five Forces analysis, allowing for rapid identification of threats and opportunities.

Customers Bargaining Power

Large institutional clients, such as major corporations and governments, wield considerable bargaining power with Citi's Institutional Clients Group. This power stems from the sheer volume of transactions and the potential for significant revenue these clients represent. For instance, in 2024, large corporate clients often negotiate for lower fees on treasury services and preferential rates on capital markets transactions due to their substantial business volumes.

These sophisticated clients can also demand highly customized solutions, leveraging their market knowledge and the availability of alternative providers. Citi's strategy to counter this involves showcasing its extensive global network and a broad suite of integrated financial products, aiming to become an indispensable partner rather than just a transactional service provider.

Retail and consumer banking customers wield moderate to high bargaining power. This is largely due to the relatively low switching costs associated with basic financial products like checking accounts and personal loans. For instance, in 2024, the average time for a consumer to switch banks remained quite low, often under a week for straightforward account transfers.

The broad availability of numerous banking alternatives, encompassing both traditional large institutions and agile digital-only banks, further amplifies customer leverage. This competitive landscape means consumers can readily compare offerings and move their business to find better rates or services. In 2023, fintech adoption continued its upward trend, with a significant percentage of consumers actively using or considering digital banking solutions.

Consequently, Citi must maintain a sharp focus on customer satisfaction, ongoing innovation in its product and service offerings, and competitive pricing strategies. These efforts are crucial for retaining its existing client base and attracting new customers in this dynamic market. Customer retention rates are a key metric, and in 2024, the industry saw continued pressure on margins as institutions competed for customer loyalty.

Wealth management clients, particularly those with high-net-worth and ultra-high-net-worth, wield significant bargaining power. Their demands for bespoke advice, a wide array of investment options, and competitive fees are paramount. For instance, in 2024, the global wealth management market continued to see clients actively seeking value, driving fee compression in certain segments.

Citi's approach to this powerful client base centers on its established position as a global leader in wealth management. The firm focuses on cultivating enduring client relationships, understanding that personalized service and a comprehensive global offering are key to retaining and attracting these discerning individuals.

Price Sensitivity and Commoditization

Many standard financial products, like basic checking and savings accounts, and certain loans, are increasingly seen as commodities. This means customers are highly sensitive to price, pushing institutions like Citi to aggressively compete on interest rates and fees. For example, in early 2024, the average interest rate on a savings account hovered around 0.46% APY, a figure customers actively compare across providers.

The digital age has amplified this. Online platforms and comparison tools make it incredibly easy for consumers to shop around for the best deals on financial services. This transparency directly empowers customers, forcing banks to be more competitive to retain and attract business. By mid-2024, the number of financial comparison websites in the US alone had surpassed several hundred, offering side-by-side views of rates and fees for everything from mortgages to credit cards.

- Increased Price Sensitivity: Customers readily switch providers for minor rate differences on savings accounts or checking fees.

- Commoditization of Products: Basic banking services are perceived as interchangeable, reducing brand loyalty.

- Online Transparency: Websites and apps allow for easy comparison of rates and fees, intensifying competition.

- Pressure on Fees and Rates: Banks must offer attractive terms to remain competitive in a transparent market.

Regulatory Empowerment of Consumers

Regulatory empowerment of consumers significantly shifts the bargaining power. Regulations mandating greater transparency, such as those requiring clear disclosure of fees and interest rates, allow customers to more easily compare offerings and negotiate better terms. For instance, in 2024, consumer protection laws continued to evolve, pushing financial institutions to simplify product terms and conditions.

Fair lending practices and robust consumer protection frameworks enable individuals to make more informed decisions and actively demand better value from financial service providers. This heightened awareness and legal recourse empower customers to challenge unfair practices and seek out institutions that prioritize ethical conduct and customer satisfaction.

- Increased Transparency: Regulations like the Consumer Financial Protection Bureau (CFPB) initiatives in the US in 2024 aimed to enhance clarity in financial product disclosures, making it easier for consumers to understand and compare options.

- Fair Lending Enforcement: Strong enforcement of fair lending laws prevents discriminatory practices, giving consumers more leverage to seek equitable treatment and pricing.

- Consumer Protection Agencies: The active role of agencies in addressing consumer complaints and enforcing regulations provides a safety net, emboldening customers to voice concerns and demand better service.

- Informed Decision-Making: Access to standardized information and complaint resolution mechanisms empowers consumers to make more strategic choices, driving competition among financial institutions to offer superior products and experiences.

Customers, especially those in retail and wealth management segments, possess significant bargaining power due to low switching costs and the availability of numerous alternatives. This is exacerbated by the commoditization of basic banking products, making customers highly sensitive to price differences. For example, in 2024, the average savings account interest rate remained under 1%, driving consumers to actively compare offerings across dozens of online platforms.

Regulatory mandates for transparency, such as enhanced fee disclosures, further empower consumers to negotiate better terms. This forces institutions like Citi to focus on customer satisfaction, competitive pricing, and innovative product development to retain market share. By mid-2024, the number of financial comparison websites in the US had grown significantly, offering consumers unprecedented ease in evaluating banking services.

| Customer Segment | Bargaining Power Level | Key Drivers (2024 Data) | Citi's Counter-Strategy |

|---|---|---|---|

| Large Institutional Clients | High | Volume of transactions, potential revenue, demand for customization, availability of alternatives. | Global network, integrated product suite, indispensable partnership approach. |

| Retail/Consumer Banking | Moderate to High | Low switching costs (e.g., <1 week for account transfers), broad availability of alternatives (digital banks), price sensitivity. | Customer satisfaction, product innovation, competitive pricing. |

| Wealth Management (HNW/UHNW) | Significant | Demand for bespoke advice, wide investment options, competitive fees, focus on value. | Global leadership, enduring client relationships, personalized service. |

Same Document Delivered

Citi Porter's Five Forces Analysis

This preview shows the exact Citi Porter's Five Forces Analysis you'll receive immediately after purchase, providing a comprehensive breakdown of the competitive landscape. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the banking industry. This professionally formatted document is ready for your immediate use, offering a complete and actionable strategic overview.

Rivalry Among Competitors

Citi navigates a fiercely competitive landscape within financial services, facing a multitude of global and regional rivals. This includes other large multinational banks, specialized investment banks, diverse asset management firms, and a growing number of non-bank financial institutions. For example, in 2024, the global banking sector continued to see intense competition, with major players like JPMorgan Chase, Bank of America, and HSBC actively vying for market share across various product lines and geographies.

These direct competitors, such as JPMorgan Chase and Bank of America, challenge Citi across numerous business segments, from retail banking and credit cards to investment banking and wealth management. The sheer volume of these players means that differentiation and strategic advantage are paramount for sustained success in this crowded market.

Citi faces fierce rivalry across its core operations. In banking and lending, competition is particularly sharp, driving down interest rates and fees, which directly impacts profitability. For instance, in 2024, the average interest rate on a new auto loan hovered around 7-8%, a testament to the competitive pressure on lending margins.

The asset management sector is similarly crowded, with numerous firms vying for investor capital. This intense competition forces players like Citi to constantly innovate and differentiate their offerings, whether through superior investment performance, enhanced customer service, or cutting-edge digital platforms. The pressure to maintain competitive fees while delivering value remains a constant challenge.

Citi's diversified business model, spanning consumer banking, corporate and investment banking, and wealth management, significantly reduces its vulnerability to intense competition within any single sector. This broad operational scope allows it to offset potential downturns in one area with strengths in others.

With a global footprint in nearly 160 countries, Citi's extensive reach provides a formidable barrier against more regionally focused rivals. This allows Citi to cater to complex cross-border financial needs and leverage its established network, a distinct advantage in a competitive global landscape.

Regulatory Landscape and Transformation Efforts

The financial sector's inherent heavy regulation significantly shapes competitive rivalry. For instance, in 2024, global financial institutions collectively spent billions on regulatory compliance, creating a substantial barrier for new entrants. This environment means that established players like Citi, while burdened by these costs, also benefit from the elevated entry hurdles.

Citi's ongoing transformation efforts, including its strategic restructuring, directly impact its competitive standing. These initiatives, aimed at streamlining operations and boosting efficiency, are crucial for navigating the evolving market. However, the execution of such large-scale changes inherently carries risks that can affect its competitive posture.

- Regulatory Burden as a Barrier: In 2023, compliance costs for major banks often exceeded 10% of their operating expenses, deterring smaller or less capitalized competitors.

- Transformation for Competitiveness: Citi's stated goal for its transformation program is to improve its efficiency ratio, aiming for a target of below 50% by 2025, which would enhance its competitive edge.

- Execution Risk in Restructuring: The success of Citi's transformation hinges on effective implementation, with past large-scale restructuring efforts in the industry showing varied results in terms of immediate competitive gains.

Focus on Specific High-Growth Segments

Citi is strategically concentrating on high-growth segments like its Services business, which includes Treasury and Trade Solutions and Securities Services. This focus is a direct response to intense competitive rivalry, aiming to leverage areas where it has demonstrated strong performance and market share gains.

This deliberate emphasis on profitable and interconnected businesses is designed to accelerate growth and enhance returns. For instance, Citi's Treasury and Trade Solutions reported a robust performance, contributing significantly to the bank's overall results. This strategic pivot allows Citi to better compete by concentrating resources on its most promising and resilient offerings.

- Services Business Growth: Citi's Services segment, encompassing Treasury and Trade Solutions and Securities Services, has been a key driver of recent performance.

- Market Share Gains: The bank has actively pursued and achieved market share expansion within these chosen high-growth areas.

- Accelerated Returns: By focusing on profitable and interconnected businesses, Citi aims to boost its overall return on equity and shareholder value.

- Competitive Differentiation: This strategy allows Citi to differentiate itself in a highly competitive banking landscape by excelling in specific, high-demand financial services.

Competitive rivalry is a defining characteristic of Citi's operating environment, with numerous global and regional players vying for market share. This intense competition, particularly in areas like lending and asset management, pressures margins and necessitates continuous innovation. For example, in 2024, the global banking sector saw major institutions like JPMorgan Chase and Bank of America actively competing for customers, driving down interest rates and fees.

Citi's diversified business model and extensive global footprint offer some resilience against this rivalry. However, the sheer number of competitors, ranging from large multinational banks to specialized firms and fintechs, means differentiation and strategic focus are critical. The financial sector's heavy regulatory environment also plays a role, creating high barriers to entry that benefit established players like Citi, while also imposing significant compliance costs.

Citi's strategic restructuring and focus on high-growth segments like its Services business are direct responses to this competitive pressure. By concentrating resources on areas like Treasury and Trade Solutions, where it holds strong market positions, Citi aims to enhance its competitive edge and accelerate returns. This strategic pivot is essential for navigating a market where differentiation and efficiency are paramount for sustained success.

| Competitor Type | Example Competitors | Impact on Citi | 2024 Market Context |

|---|---|---|---|

| Global Multinational Banks | JPMorgan Chase, HSBC | Direct competition across all business lines, margin pressure | Intense competition for deposits and lending, digital service innovation |

| Specialized Investment Banks | Goldman Sachs, Morgan Stanley | Competition in M&A advisory, capital markets | Strong demand for advisory services, volatile capital markets |

| Asset Management Firms | BlackRock, Vanguard | Competition for investor capital, fee pressure | Growth in passive investing, demand for ESG-focused products |

| Non-Bank Financial Institutions/Fintechs | PayPal, Stripe | Disruption in payments, lending, and digital banking | Rapid adoption of digital payment solutions, increasing regulatory scrutiny |

SSubstitutes Threaten

The burgeoning fintech sector presents a potent threat of substitutes for traditional banking services like those offered by Citi. Companies specializing in online lending, digital payments, and automated investment advice are increasingly capturing market share. For instance, the global fintech market was valued at over $110 billion in 2023 and is projected to grow significantly, indicating a strong preference for these digital alternatives.

Direct lending and peer-to-peer (P2P) platforms present a significant threat of substitutes for traditional banking services. These platforms allow individuals and businesses to borrow or invest directly, bypassing intermediaries. For instance, the P2P lending market was projected to reach over $300 billion globally by 2025, indicating a substantial shift in funding sources.

Customers are increasingly turning to these alternatives for potentially more competitive rates and quicker approvals compared to conventional bank loans. In 2024, reports indicated that alternative lending sources, including P2P and direct lending, accounted for a growing percentage of small business financing, demonstrating their viability as substitutes.

For wealth management clients, a rapidly expanding universe of alternative investment vehicles, including private equity, hedge funds, and real estate crowdfunding platforms, presents a significant threat of substitution to traditional banking and brokerage services. These alternatives often provide distinct risk-reward profiles and access to specialized or illiquid markets, drawing capital away from conventional offerings.

The global private equity market, for instance, saw significant inflows, with fundraising reaching an estimated $1.2 trillion in 2023, demonstrating a strong appetite for these non-traditional asset classes. Similarly, the real estate crowdfunding sector has experienced robust growth, with projections indicating it could reach over $10 billion in the US alone by 2025, offering accessible real estate investment opportunities that bypass traditional channels.

In-House Corporate Treasury and Payment Solutions

Large corporations, especially those with extensive global operations, are increasingly building robust in-house treasury and payment processing systems. This trend allows them to manage their financial flows more directly, potentially reducing their dependence on external banking partners for fundamental trade finance and treasury functions.

For instance, in 2024, many multinational corporations reported significant investments in treasury management systems (TMS) designed to centralize liquidity, optimize cash flow, and automate payments. While these in-house solutions can offer cost savings and greater control, Citi's expansive global network, advanced fraud detection, and specialized advisory services continue to represent a significant value proposition that is difficult for many corporations to replicate entirely internally.

- In-house capabilities reduce reliance on banks for basic treasury services.

- Global corporations are investing in sophisticated treasury management systems (TMS).

- Citi's global network and specialized services offer a competitive advantage.

Cryptocurrencies and Decentralized Finance (DeFi)

The burgeoning world of cryptocurrencies and decentralized finance (DeFi) poses a significant threat of substitution to traditional financial institutions. These technologies facilitate direct peer-to-peer transactions, lending, and asset management, bypassing traditional intermediaries like banks. This disintermediation could erode revenue streams from fees and interest for established players.

While mainstream adoption is still developing, the growth trajectory is notable. For instance, the total value locked in DeFi protocols reached over $100 billion in early 2024, demonstrating a substantial shift in capital allocation. This indicates a growing user base and increasing reliance on these alternative financial mechanisms.

- Disintermediation: DeFi platforms eliminate the need for traditional financial intermediaries, potentially reducing transaction fees and operational costs for consumers.

- Accessibility: Cryptocurrencies and DeFi offer greater financial accessibility to individuals underserved by traditional banking systems.

- Innovation: The rapid pace of innovation in the crypto space, including stablecoins and yield farming, presents alternative investment and savings opportunities.

- Market Growth: The global cryptocurrency market capitalization, fluctuating around $2 trillion in early 2024, signifies a significant and growing alternative financial ecosystem.

The rise of digital payment solutions and challenger banks presents a significant threat of substitutes for Citi's core banking services. These fintech firms often offer streamlined user experiences and lower fees, attracting customers seeking modern alternatives. For example, by early 2024, several neobanks had amassed millions of users, demonstrating a clear shift in consumer preference towards digital-first banking models.

The increasing adoption of digital wallets and peer-to-peer payment apps means fewer transactions are routed through traditional bank accounts. This trend directly impacts fee income and customer engagement for established institutions. In 2024, global mobile payment transaction volume was projected to exceed $10 trillion, underscoring the dominance of these digital payment channels.

| Substitute Offering | Key Features | Market Penetration (Illustrative) | Impact on Traditional Banks |

| Fintech Payment Apps (e.g., PayPal, Venmo) | Fast, low-cost P2P transfers, online checkout integration | Millions of active users globally | Reduced transaction fees, competition for customer deposits |

| Challenger Banks (e.g., Revolut, N26) | Digital-only accounts, budgeting tools, international transfers | Rapid user growth, significant market share in specific regions | Loss of retail banking customers, pressure on account fees |

| Buy Now, Pay Later (BNPL) Services | Point-of-sale installment payments | Increasingly popular for e-commerce purchases | Competition for credit card business, potential impact on loan origination |

Entrants Threaten

The financial services sector, particularly for a global player like Citi, faces substantial hurdles for new entrants due to rigorous regulatory frameworks and significant capital demands. For instance, as of early 2024, major banking regulators globally, such as the Federal Reserve in the US and the European Central Bank, mandate substantial Tier 1 capital ratios, often exceeding 10-12% of risk-weighted assets, making it incredibly costly to establish a new, competitive institution.

Launching a new bank or financial services firm on a global scale requires not only vast financial reserves but also deep operational expertise and a robust compliance infrastructure. This complexity, coupled with the need for extensive licensing across multiple jurisdictions, acts as a powerful deterrent, effectively limiting the speed and ease with which new competitors can emerge and challenge established players like Citi.

Established financial institutions like Citi leverage substantial economies of scale, which translate into lower per-unit costs for operations, technology, and marketing. For instance, in 2024, major global banks continued to invest billions in digital transformation and cybersecurity, a cost burden that smaller, newer entrants find exceedingly difficult to absorb. This cost advantage makes it challenging for new players to compete on price.

Moreover, decades of building trust and a strong brand reputation create significant customer loyalty in the financial services sector. Consumers often prefer to bank with institutions they perceive as stable and reliable. Citi's brand recognition, a result of consistent service and marketing, acts as a powerful deterrent, as potential customers are less likely to switch to an unknown entity for their critical financial needs.

The sheer scale of existing infrastructure presents a significant barrier. For instance, in 2024, major global banks like JPMorgan Chase reported billions in annual technology spending, a testament to the ongoing investment needed to maintain and upgrade complex global networks and digital platforms.

Replicating the vast physical and digital distribution channels that legacy institutions have cultivated over decades is incredibly challenging and capital-intensive. New entrants would face immense upfront costs to establish a comparable reach and customer touchpoints.

The decades of investment in proprietary technology systems and established distribution networks by incumbent banks create a formidable moat. This entrenched advantage makes it prohibitively expensive and time-consuming for newcomers to achieve parity in operational efficiency and market access.

Technological Advancement and Fintech Innovation

Technological advancements and the rise of fintech companies present a nuanced threat of new entrants for established financial institutions like Citi. While nimble fintechs can disrupt niche markets, scaling to challenge a diversified global player requires overcoming significant hurdles.

New entrants, particularly fintechs, often focus on specific services, like payments or lending, where they can leverage technology for efficiency. However, replicating Citi's broad product suite, global reach, and established customer base is a substantial undertaking. For example, while neobanks have seen growth, they still represent a fraction of the total banking market share compared to incumbents.

- Regulatory Hurdles: Obtaining necessary licenses and complying with stringent financial regulations globally is a major barrier for new entrants aiming to offer a full spectrum of services.

- Customer Acquisition Costs: Attracting and retaining customers in the competitive financial services landscape demands significant investment in marketing and building trust, which is often easier for established brands.

- Integration Complexity: New entrants must build or acquire capabilities to integrate across various financial services, from wealth management to corporate banking, a complex and costly endeavor.

Talent Acquisition and Retention

New entrants face a substantial hurdle in attracting and retaining the highly skilled workforce essential for global financial services. This includes everything from investment banking specialists to crucial cybersecurity talent.

Established players, such as Citi, benefit from well-developed recruitment channels and competitive compensation packages, making it difficult for newcomers to match their talent acquisition capabilities.

The financial services industry, particularly in 2024, continues to see intense competition for top-tier professionals, with demand often outstripping supply in specialized areas.

- Talent Scarcity: Shortages in areas like AI and data analytics professionals are prevalent, driving up recruitment costs for all firms.

- Compensation Wars: Leading firms are offering increasingly attractive packages, including substantial bonuses and equity, to secure and keep key personnel.

- Brand Reputation: A firm's established brand and reputation play a significant role in attracting talent, giving incumbents an advantage.

The threat of new entrants in the financial services sector, particularly for a global giant like Citi, is significantly mitigated by immense capital requirements and stringent regulatory oversight. For instance, in early 2024, global banking regulations mandated substantial capital reserves, with Tier 1 capital ratios for major institutions often exceeding 10-12% of risk-weighted assets, creating a formidable financial barrier for any aspiring competitor.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including publicly available financial statements, industry-specific market research reports, and insights from reputable business news outlets. This multi-faceted approach ensures a comprehensive understanding of the competitive landscape.