Cincinnati Financial SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cincinnati Financial Bundle

Cincinnati Financial boasts a strong reputation and a diversified product line, but faces potential headwinds from evolving market dynamics and regulatory changes. Understanding these internal capabilities and external pressures is crucial for navigating the competitive insurance landscape.

Want the full story behind Cincinnati Financial's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Cincinnati Financial's strength lies in its remarkably diversified product portfolio, spanning commercial and personal insurance lines, as well as excess and surplus lines, life insurance, and fixed annuities. This breadth of offerings, which saw its property casualty combined ratio at a strong 88.3% for the first nine months of 2024, significantly reduces reliance on any single market segment, thereby mitigating business risk.

Cincinnati Financial's reliance on a robust network of independent insurance agencies is a significant strength, fostering deep local market understanding and strong client connections. This approach, which allows for decentralized decision-making, has been a cornerstone of their strategy for years. As of the first quarter of 2024, the company continued to expand its agency appointments, a key driver for premium growth.

Cincinnati Financial boasts impressive financial strength, evidenced by consolidated cash and total investments surpassing $29 billion by the end of 2024. This robust capitalization underpins its strategic initiatives, facilitates reliable dividend distributions, and fuels expansion within its insurance segments.

Consistent Underwriting Profitability

Cincinnati Financial's property casualty segment consistently demonstrates strong underwriting profitability. This is evidenced by improved combined ratios observed in both the fourth quarter of 2024 and the full year of 2024. The company's disciplined approach to underwriting, even when faced with elevated catastrophe losses in certain periods, underpins this consistent performance. Furthermore, favorable development from prior accident years bolsters this profitability, showcasing effective risk management and pricing strategies.

Key indicators of this strength include:

- Improved Combined Ratios: The company reported enhanced combined ratios for both Q4 2024 and the entirety of 2024, indicating efficient claims handling and premium adequacy.

- Disciplined Underwriting: Despite challenges like increased catastrophe events, Cincinnati Financial maintains rigorous underwriting standards, preventing undue pressure on profitability.

- Favorable Reserve Development: Positive development in reserves from prior accident years contributes to the underwriting profit, reflecting accurate initial reserving and claims management.

- Sustained Profitability: These factors combined allow the company to achieve consistent underwriting profits, a core strength in the competitive insurance market.

Strategic Investment Income Growth

Cincinnati Financial has demonstrated a strong track record of strategic investment income growth, a key strength that bolsters its financial resilience. This growth is particularly evident in its bond portfolio, which saw a notable increase in fair value. For instance, as of the first quarter of 2024, the company reported substantial unrealized gains in its fixed-income securities, reflecting a favorable interest rate environment and effective portfolio management.

Investment income plays a vital role in the company's overall profitability and stability, providing a consistent revenue stream that helps offset potential volatility in underwriting results. This income is critical for maintaining financial health and supporting the company's capacity to absorb market shocks. In 2023, investment income contributed a significant portion to Cincinnati Financial's pre-tax earnings, highlighting its importance.

- Consistent Investment Income Growth: The company has a history of steadily increasing its investment income, driven by prudent asset allocation.

- Bond Portfolio Strength: A substantial portion of investment income is derived from its well-managed bond portfolio, which has shown significant appreciation in fair value.

- Financial Stability: Investment income provides a crucial buffer against underwriting cycles, enhancing overall financial stability and earnings predictability.

- Contribution to Earnings: In the first quarter of 2024, investment income was a substantial contributor to the company's operating results, underscoring its strategic importance.

Cincinnati Financial's diversified product offerings, encompassing commercial, personal, and excess and surplus lines insurance, alongside life insurance and fixed annuities, significantly reduce its exposure to any single market segment. This broad portfolio, supported by a property casualty combined ratio of 88.3% for the first nine months of 2024, showcases a robust risk mitigation strategy.

The company's reliance on a strong network of independent agencies provides deep local market insights and cultivates enduring client relationships. This decentralized approach, which saw continued agency appointments in Q1 2024, is a key driver for sustained premium growth.

Cincinnati Financial's financial fortitude is underscored by its substantial capital base, with consolidated cash and investments exceeding $29 billion by year-end 2024. This strong capitalization fuels strategic growth and supports consistent dividend payouts.

The property casualty segment consistently delivers strong underwriting profitability, evidenced by improved combined ratios in Q4 and full-year 2024. Disciplined underwriting and favorable development from prior accident years contribute to this resilience, even amidst elevated catastrophe losses.

| Strength | Description | Supporting Data (as of Q1 2024 or YE 2024) |

| Diversified Product Portfolio | Broad range of insurance products across multiple segments. | Property Casualty Combined Ratio: 88.3% (9 months 2024) |

| Independent Agency Network | Deep market penetration and client relationships. | Continued agency appointments (Q1 2024) |

| Financial Strength | Significant capital and investment reserves. | Consolidated Cash & Investments: >$29 billion (YE 2024) |

| Underwriting Profitability | Consistent profitability in property casualty. | Improved combined ratios (Q4 & FY 2024), Favorable prior year development |

| Investment Income Growth | Steady increase in investment returns. | Substantial unrealized gains in fixed-income (Q1 2024); Significant contribution to pre-tax earnings (2023) |

What is included in the product

Offers a full breakdown of Cincinnati Financial’s strategic business environment, detailing its internal capabilities and external market dynamics.

Offers a clear, actionable roadmap for navigating Cincinnati Financial's market challenges and opportunities.

Weaknesses

Cincinnati Financial, despite its robust underwriting practices, faces a significant vulnerability to large-scale catastrophe losses. Events like widespread wildfires, severe storms, or other natural disasters can inflict substantial financial damage, impacting profitability and operational stability.

The company's exposure to these unpredictable events means that even a strong performance in other areas can be overshadowed by a single major catastrophe. For instance, if early 2025 sees a surge in wildfire claims, similar to those experienced in California, it could directly translate into net losses for a quarter and strain the company's combined ratio, a key measure of underwriting profitability.

Cincinnati Financial's net income is susceptible to the ebb and flow of investment gains, particularly those tied to the fair value of its equity securities. For instance, a downturn in the market, as potentially seen in Q4 2024, can directly translate into a considerable drop in reported net income, underscoring the company's vulnerability to market fluctuations.

While Cincinnati Financial's reliance on the independent agency model is a core strength, it could also be a vulnerability if the insurance landscape rapidly pivots towards direct-to-consumer digital sales. This traditional approach might lead to slower adoption of cutting-edge digital tools compared to insurtech startups, potentially hindering growth or inflating operational expenses. For instance, while many competitors are investing heavily in AI-powered claims processing and personalized digital customer journeys, a significant portion of Cincinnati Financial's customer interaction still flows through its agent network.

Geographic Concentration Risk

Cincinnati Financial, despite its broad operational reach across 46 states, faces a significant weakness in geographic concentration. This means a substantial portion of its insured properties are located in regions particularly vulnerable to specific natural disasters. For instance, a heavy presence in coastal areas could heighten exposure to hurricanes, while concentration in the Midwest or South could increase risk from tornadoes.

This regional clustering amplifies the potential impact of localized catastrophes. A single, severe weather event in a densely insured area could lead to disproportionately large claims, straining the company's financial resources.

- Geographic Concentration: While operating in 46 states, a significant concentration of insured properties exists in certain regions.

- Catastrophe Exposure: Regions with high concentrations are often prone to specific natural disasters like hurricanes, wildfires, or tornadoes.

- Amplified Impact: Localized catastrophes in these concentrated areas can lead to outsized losses for Cincinnati Financial.

Competitive Market Pressure

The insurance landscape is intensely competitive, which can put a strain on pricing and the profit margins from underwriting. Cincinnati Financial's ability to sustain its impressive premium growth, which has seen consistent increases, will depend on unwavering underwriting discipline and smart strategies for expanding its customer base.

This competitive pressure can manifest in several ways:

- Price Wars: Competitors may engage in aggressive pricing to gain market share, forcing Cincinnati Financial to either match these prices, potentially reducing profitability, or risk losing business.

- Innovation Demands: To stand out, insurers must continuously innovate with new products, services, and digital offerings. Failure to keep pace can lead to a loss of relevance and customer loyalty.

- Talent Acquisition: Attracting and retaining top talent in underwriting, claims, and technology is crucial, but a competitive market means other strong players are also vying for the same skilled individuals.

For example, in 2024, the property and casualty insurance sector saw an average rate increase of around 8% for commercial lines, a testament to the ongoing need to adjust pricing in response to claims costs and competitive pressures. Cincinnati Financial's performance hinges on its ability to navigate these dynamics effectively.

Cincinnati Financial's reliance on its independent agency distribution model, while a strength, could become a weakness if the market shifts significantly towards direct-to-consumer digital sales. This could slow adoption of new digital tools compared to insurtech rivals, potentially increasing operational costs or hindering growth.

The company's geographic concentration in certain states, particularly those prone to specific natural disasters like hurricanes or wildfires, presents a significant vulnerability. A major weather event in these densely insured areas could lead to disproportionately large claims, impacting profitability and financial stability.

The highly competitive insurance market can pressure pricing and underwriting profit margins. Cincinnati Financial must maintain underwriting discipline and effective customer acquisition strategies to counter potential price wars and the demand for continuous innovation from competitors.

Cincinnati Financial's net income is also subject to fluctuations in investment gains, particularly from its equity securities. A market downturn, as potentially seen in late 2024, could significantly reduce reported net income, highlighting sensitivity to market volatility.

What You See Is What You Get

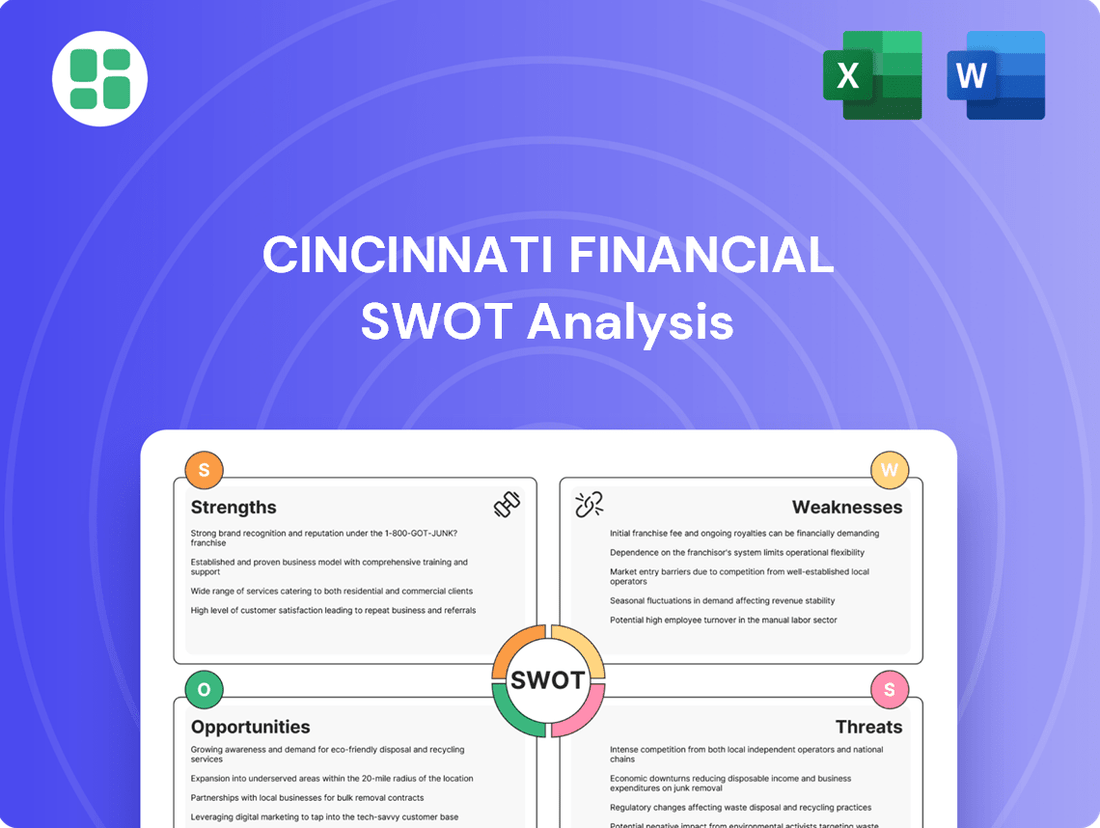

Cincinnati Financial SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Cincinnati Financial SWOT analysis, providing a clear overview of its strategic positioning.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to gain comprehensive insights into Cincinnati Financial's strengths, weaknesses, opportunities, and threats.

Opportunities

Cincinnati Financial has a significant opportunity to expand its excess and surplus (E&S) lines business. This is evident in the strategic launch of new products through its subsidiary, CSU Producer Resources Inc. This segment is attractive because it often provides higher profit margins compared to standard insurance lines.

The E&S market allows Cincinnati Financial to underwrite unique or complex risks that aren't typically covered by admitted carriers. This specialization opens up avenues for specialized growth and can lead to increased market share in niche areas. In 2024, the E&S market continued to show robust growth, with many carriers reporting double-digit increases in premium volume, presenting a favorable environment for Cincinnati Financial's expansion efforts.

Cincinnati Financial can significantly boost its operations by investing in advanced data analytics and cutting-edge technology. This strategic move is expected to refine underwriting accuracy, streamline claims handling, and create more personalized customer interactions.

By embracing these technological enhancements, the company can achieve superior risk selection and drive down operational costs. This will solidify its competitive position in the increasingly digital insurance market, especially as insurers increasingly rely on data for strategic advantage.

Cincinnati Financial's ongoing initiative to increase its agency appointments, especially for personal lines, offers a prime opportunity to broaden its market footprint and secure fresh business. This strategic push has already fueled substantial growth in new business written premiums, demonstrating its effectiveness and highlighting untapped potential for further expansion.

Growth in Life Insurance and Annuity Segments

Cincinnati Financial's life insurance subsidiary has demonstrated robust growth, with earned premiums consistently increasing, especially within the term life insurance sector. This upward trend highlights a strong market reception for their life insurance offerings.

Expanding the development and marketing of both life insurance products and fixed annuities presents a significant opportunity for Cincinnati Financial. Such a strategy can effectively diversify its revenue streams.

- Diversification: Offering a broader range of life insurance and annuity products can tap into new customer segments and reduce reliance on existing lines of business.

- Demographic Trends: An aging population and increased focus on retirement planning create a favorable environment for annuity products.

- Financial Planning Demand: Growing consumer interest in comprehensive financial planning solutions makes life insurance and annuities attractive components of a holistic strategy.

Favorable Underwriting Market Conditions

The property and casualty (P&C) insurance sector is experiencing a favorable shift, with projections indicating improved underwriting returns. This positive outlook is largely fueled by robust premium growth and a moderation in inflationary pressures, which have historically eroded profitability.

Cincinnati Financial is well-positioned to leverage these broader market tailwinds. By maintaining strategic pricing initiatives and upholding rigorous underwriting discipline, the company can effectively expand its profit margins and enhance its overall financial performance.

- Projected P&C underwriting profit improvement: Industry-wide forecasts suggest a return to stronger underwriting results.

- Drivers of improvement: Premium growth and decelerating inflation are key factors boosting profitability.

- Cincinnati Financial's advantage: Strategic pricing and disciplined underwriting enable margin expansion.

Cincinnati Financial has a significant opportunity to expand its excess and surplus (E&S) lines business, as evidenced by the strategic launch of new products through its subsidiary, CSU Producer Resources Inc. This segment is attractive due to potentially higher profit margins and the ability to underwrite unique risks not typically covered by admitted carriers. The E&S market experienced robust growth in 2024, with many carriers reporting double-digit premium volume increases, creating a favorable environment for Cincinnati Financial's expansion.

Investing in advanced data analytics and technology presents another key opportunity to refine underwriting accuracy, streamline claims handling, and enhance customer interactions. By embracing these enhancements, the company can achieve superior risk selection and reduce operational costs, solidifying its competitive position in an increasingly digital insurance landscape. Insurers are increasingly relying on data for strategic advantage, making this a critical area for growth.

Expanding agency appointments, particularly for personal lines, offers a prime opportunity to broaden market footprint and secure new business, as demonstrated by substantial growth in new business written premiums. Furthermore, the company's life insurance subsidiary has shown robust growth, especially in term life insurance, indicating strong market reception. Diversifying revenue streams by developing and marketing more life insurance products and fixed annuities is also a strategic avenue, particularly given demographic trends like an aging population and increased focus on retirement planning.

The property and casualty (P&C) insurance sector is poised for improved underwriting returns, driven by strong premium growth and moderating inflation. Cincinnati Financial can capitalize on these market tailwinds through strategic pricing and disciplined underwriting, which are projected to enhance profit margins. Industry forecasts suggest a return to stronger underwriting results in the P&C sector, with premium growth and decelerating inflation being key drivers of this anticipated profitability improvement.

| Opportunity Area | Key Drivers | Potential Impact |

|---|---|---|

| E&S Lines Expansion | Higher profit margins, underwriting unique risks, robust market growth | Increased market share in niche areas, enhanced profitability |

| Technology & Data Analytics | Improved underwriting accuracy, streamlined claims, personalized customer experiences | Superior risk selection, reduced operational costs, stronger competitive position |

| Agency Appointments & Life Insurance Growth | Broadened market footprint, new business acquisition, strong market reception for life products | Diversified revenue streams, increased market penetration |

| P&C Market Improvement | Strong premium growth, moderating inflation, favorable underwriting outlook | Expanded profit margins, enhanced overall financial performance |

Threats

Cincinnati Financial faces a growing threat from the increasing frequency and severity of natural disasters, a trend linked to climate change. This escalation directly impacts the insurance industry by driving up claims costs. For instance, 2023 saw insured catastrophe losses reach an estimated $110 billion globally, according to Swiss Re, a substantial increase from previous years, highlighting the financial strain such events place on insurers.

The heightened risk of severe weather events could erode underwriting profitability for Cincinnati Financial if premiums do not adequately reflect the increased exposure. This necessitates careful management of reinsurance arrangements to mitigate catastrophic losses and maintain financial stability. Failure to adapt could lead to reduced earnings and potentially impact the company's ability to absorb future shocks.

Cincinnati Financial, like many insurers, faces significant headwinds from economic downturns. A substantial portion of its earnings comes from investment income, which is directly tied to the health of the broader economy. Should a recession hit in late 2024 or early 2025, this income stream could shrink considerably.

Market volatility presents another major threat. For instance, the sharp decline in equity markets during Q4 2024 directly impacted the fair value of the company's equity holdings. Continued or renewed volatility in 2025 could lead to further unrealized losses, impacting the company's balance sheet and potentially its profitability.

Cincinnati Financial faces intensified competition from both nimble InsurTech startups, which are rapidly adopting new technologies to streamline operations and customer engagement, and from large, established carriers possessing significant financial clout and extensive customer bases. This dual pressure can lead to price wars and a struggle to maintain market share.

The need to invest heavily in digital transformation and innovative solutions to remain competitive puts a strain on resources, especially as InsurTechs often operate with lower overheads. For instance, the global InsurTech market was valued at approximately $2.5 billion in 2023 and is projected to grow significantly, highlighting the increasing influence of these agile players.

Adverse Regulatory Changes and Increased Scrutiny

Cincinnati Financial, like all insurers, faces the ongoing threat of adverse regulatory changes. Shifts in insurance regulations, whether at the state or federal level, can significantly impact operations. For instance, a move towards more stringent capital requirements could necessitate higher reserves, impacting profitability. In 2024, the insurance industry continued to see a focus on consumer protection and data privacy, with potential new compliance burdens.

Increased regulatory scrutiny, particularly concerning underwriting practices and pricing strategies, poses another significant challenge. Regulators might impose stricter rules on how policies are priced or how risk is assessed, potentially limiting flexibility and increasing compliance costs. This heightened oversight could affect the company's ability to effectively manage its risk portfolio and maintain competitive pricing.

Potential shifts from state-based to federal regulation could introduce a more complex and potentially less adaptable regulatory environment for Cincinnati Financial. Such a transition could lead to increased administrative expenses and a need to overhaul existing compliance frameworks. For example, discussions around federal oversight of insurance solvency have periodically surfaced, which could alter the operational landscape.

Key areas of potential regulatory impact include:

- Changes in solvency requirements: Stricter capital adequacy rules could tie up more capital.

- Data privacy and cybersecurity mandates: Enhanced regulations might increase compliance costs and operational complexity.

- Pricing and underwriting restrictions: New rules could limit the company's ability to set premiums based on risk.

- Consumer protection initiatives: Increased focus on fairness and transparency in policy sales and claims handling.

Social Inflation and Litigation Trends

Social inflation, characterized by escalating litigation costs and more generous jury awards, presents a significant threat to Cincinnati Financial's profitability. This trend directly impacts claims payouts, making it harder to accurately price insurance policies and set aside adequate reserves for future claims. For instance, in 2024, the U.S. Chamber Institute for Legal Reform has highlighted the persistent rise in nuclear verdicts, which are jury awards exceeding $10 million, across various sectors, directly affecting insurers' bottom lines.

The increasing frequency and severity of lawsuits, often driven by broader societal attitudes towards corporate responsibility and compensation, can lead to adverse development in loss reserves. This means that previously estimated claims costs may prove to be insufficient, requiring insurers to allocate more capital to cover them. The U.S. liability system continues to see an upward trend in the average cost of claims, impacting insurers' ability to maintain consistent underwriting profitability.

This environment challenges traditional actuarial assumptions and necessitates a more dynamic approach to risk management and pricing. Cincinnati Financial, like its peers, must navigate these evolving legal landscapes to protect its financial stability.

- Rising Litigation Costs: Increased legal fees and expenses associated with defending claims.

- Jury Award Inflation: A trend of larger jury verdicts, particularly "nuclear verdicts," impacting claims payouts.

- Reserve Adequacy: Difficulty in accurately reserving for future claims due to unpredictable legal outcomes.

- Pricing Challenges: The need to adjust premiums to reflect the growing cost of claims and litigation.

Cincinnati Financial faces escalating threats from climate change-induced natural disasters, which significantly increase claims costs. Economic downturns and market volatility also pose risks, potentially reducing investment income and impacting the valuation of its holdings. Intensified competition from InsurTechs and established carriers, coupled with the substantial investment required for digital transformation, further pressures profitability.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verified financial statements, comprehensive market intelligence, and expert industry forecasts, ensuring a robust and accurate assessment of Cincinnati Financial's strategic position.