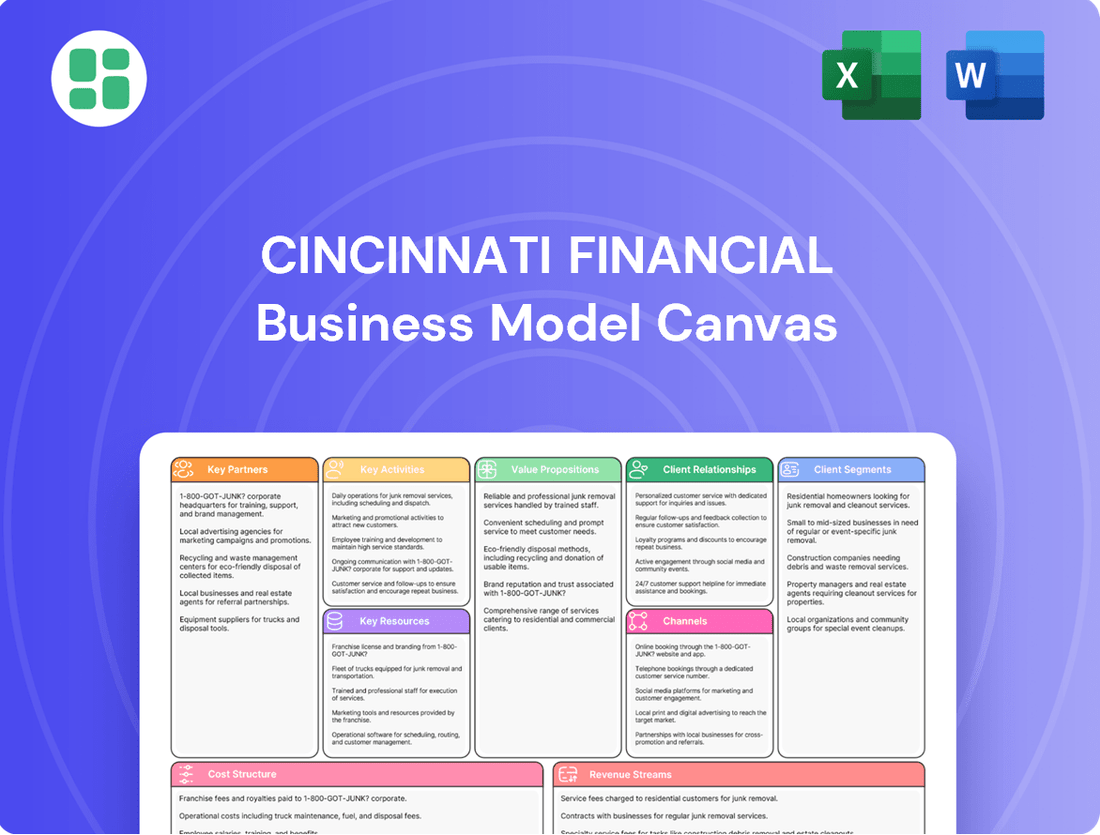

Cincinnati Financial Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cincinnati Financial Bundle

Unlock the strategic blueprint of Cincinnati Financial's success with our comprehensive Business Model Canvas. This detailed analysis reveals how they build strong customer relationships, leverage key resources, and create sustainable revenue streams in the insurance sector. Dive into the core elements that drive their market position and discover actionable insights for your own ventures.

Partnerships

Cincinnati Financial's business model hinges on its extensive network of independent insurance agencies. These partners are the primary channel for distributing property and casualty, life, and annuity products, reaching a broad spectrum of customers. In 2024, the company continued to foster these relationships, recognizing their vital role in localized service and market penetration.

The company's strategy includes actively supporting and expanding its agency relationships. This commitment is demonstrated through initiatives like increasing agency appointments, a key driver for premium growth. This partnership model allows Cincinnati Financial to effectively serve diverse customer needs across various geographic areas.

Cincinnati Financial relies on reinsurance companies to manage significant risk exposure, particularly from large-scale events such as natural catastrophes. By ceding portions of their underwriting risk, they safeguard their capital and maintain financial stability.

The company utilizes both internal reinsurance operations, Cincinnati Re and Cincinnati Global Underwriters Ltd., to handle this risk. These internal entities are supplemented by external reinsurers, providing an additional layer of protection and capacity.

Cincinnati Financial heavily relies on technology and software providers to streamline operations and elevate customer interactions. These partnerships are crucial for implementing advanced policy administration and claims processing systems, ensuring efficiency and accuracy.

Collaborations with data analytics firms are key to leveraging insights for better risk assessment and personalized customer offerings. For instance, in 2024, the company continued to invest in digital transformation initiatives aimed at enhancing its data capabilities and agent support tools.

By partnering with leading software vendors, Cincinnati Financial can offer its agents cutting-edge technological solutions, empowering them to serve clients more effectively. This focus on technological advancement is vital for maintaining a competitive edge in the dynamic insurance market.

Financial Institutions and Asset Managers

Cincinnati Financial, while managing a significant portion of its assets internally, may engage with external financial institutions and specialized asset managers. This can be to gain access to niche investment strategies or to broaden the array of financial products and services offered to its diverse client base. Such collaborations are designed to enhance investment performance and expand market reach.

These partnerships are crucial for optimizing Cincinnati Financial's investment portfolio, which comprises substantial holdings in fixed-maturity securities and equities. For instance, in 2024, the company's investment portfolio generated significant income, with a portion potentially benefiting from external expertise in managing specific asset classes or market segments. This strategic outsourcing allows for greater diversification and potentially higher risk-adjusted returns.

- Diversified Investment Strategies: Partnering with specialized asset managers provides access to unique investment opportunities and expertise not always available internally.

- Product and Service Expansion: Collaborations allow Cincinnati Financial to offer a wider spectrum of financial solutions, catering to a broader range of client needs.

- Portfolio Optimization: External management or advisory services can be leveraged for specific segments of their fixed-maturity and equity investments to enhance overall portfolio performance.

- Access to Market Insights: Partnerships can facilitate the exchange of market intelligence and analytical capabilities, informing strategic investment decisions.

Service Providers and Vendors

Cincinnati Financial relies on a network of external service providers and vendors to maintain efficient operations. This includes specialized IT firms for system maintenance and development, independent claims adjusters to supplement their internal resources, legal counsel for expert advice, and various administrative support functions. These collaborations are crucial for managing operational costs and upholding high service standards.

These partnerships directly impact Cincinnati Financial's ability to focus on its core insurance competencies. For instance, by outsourcing certain IT functions, the company can leverage specialized expertise without the overhead of maintaining a large internal department. This strategic outsourcing allows for greater agility and responsiveness to technological advancements in the insurance sector.

The company's vendor management strategy is designed to ensure cost-effectiveness and service quality. In 2024, effective management of these relationships is particularly important as the insurance industry navigates evolving regulatory landscapes and increasing customer expectations. Strong vendor partnerships contribute to operational resilience and a competitive edge.

- IT Services: Partnerships with technology providers for cloud computing, cybersecurity, and software solutions.

- Claims Adjusters: Collaboration with independent adjusters for specialized claims handling, especially during high-volume periods.

- Legal and Compliance: Engagement with law firms and compliance consultants to navigate complex legal and regulatory environments.

- Administrative Support: Outsourcing of functions like customer service, data entry, and human resources support.

Cincinnati Financial's key partnerships are built around its distribution network of independent agencies, which are crucial for reaching customers and driving premium growth. The company also relies on reinsurance partners, both internal and external, to manage risk effectively. Furthermore, collaborations with technology and data analytics firms are vital for operational efficiency and enhanced customer service.

| Partnership Type | Key Role | 2024 Focus/Impact |

|---|---|---|

| Independent Insurance Agencies | Primary distribution channel for P&C, Life, Annuity products | Continued expansion of agency appointments for premium growth |

| Reinsurance Companies (Internal & External) | Risk management, capital protection against large losses | Maintaining financial stability through risk transfer |

| Technology & Software Providers | Streamlining operations, enhancing customer interaction, policy administration | Investing in digital transformation and agent support tools |

| Data Analytics Firms | Improving risk assessment, personalized customer offerings | Leveraging insights for better underwriting and marketing |

| External Financial Institutions/Asset Managers | Access to niche investment strategies, portfolio diversification | Potentially enhancing investment performance and market reach |

| External Service Providers (IT, Adjusters, Legal) | Operational efficiency, cost management, specialized expertise | Ensuring cost-effectiveness and high service standards |

What is included in the product

A detailed breakdown of Cincinnati Financial's strategy, outlining its customer segments, value propositions, and channels to deliver insurance and financial services.

This model reflects Cincinnati Financial's focus on long-term profitability and customer relationships, highlighting key partnerships and cost structures.

Cincinnati Financial's Business Model Canvas streamlines complex insurance operations, offering a clear, actionable framework to identify and address market inefficiencies.

Activities

Cincinnati Financial's core activity is the meticulous underwriting of insurance policies across commercial, personal, and excess & surplus lines. This process involves a deep dive into applications to accurately assess and price risk, setting premiums and policy terms to ensure profitability and manage potential exposures.

Their underwriting judgment is a critical driver of financial success. For instance, in 2023, Cincinnati Financial reported a combined ratio of 89.7%, a testament to their effective risk selection and pricing, which significantly outperformed the industry average.

Cincinnati Financial's claims management and processing is central to its customer-centric approach. This involves efficiently receiving, thoroughly investigating, and fairly settling claims, aiming for prompt resolution to foster policyholder satisfaction and maintain a strong reputation.

The company views rapid and fair claims service not just as a operational necessity but as a significant competitive advantage in the insurance market. This focus on service excellence directly impacts customer loyalty and retention.

In 2024, Cincinnati Financial continued to emphasize its commitment to claims excellence, a strategy that has historically contributed to its robust financial performance and market standing.

Cincinnati Financial actively manages a large portfolio of fixed-maturity and equity investments. This is a core activity that generates significant income, acting as a crucial supplement to profits earned from underwriting insurance policies.

The company engages in strategic asset allocation, regularly rebalances its holdings, and closely monitors market trends. These actions are designed to maximize investment returns while simultaneously ensuring the company's overall financial stability and strength.

In 2023, investment income for Cincinnati Financial reached an impressive $1.9 billion, highlighting its substantial contribution to the company's bottom line and its importance in overall profitability.

Policy Administration and Customer Service

Cincinnati Financial's policy administration and customer service are central to its operations, managing everything from policy renewals and endorsements to billing and customer inquiries. This crucial function is primarily executed through their extensive network of independent agents, fostering strong, long-term relationships with policyholders and driving retention.

The company emphasizes responsive and efficient service to maintain client satisfaction. For instance, in 2023, Cincinnati Financial reported a combined ratio of 95.1%, indicating effective management of claims and expenses, which directly impacts the quality of service and policyholder experience.

- Policy Management: Activities include handling renewals, endorsements, and billing for active insurance policies.

- Customer Support: Responsive service is provided, largely through independent agents, to ensure policyholder satisfaction and retention.

- Pricing and Underwriting: Continuous refinement of pricing accuracy and individual policy underwriting underpins these service efforts.

- 2023 Performance Indicator: A combined ratio of 95.1% in 2023 reflects operational efficiency that supports customer service.

Agency Support and Development

Cincinnati Financial's core strategy revolves around nurturing its independent agency force. A primary activity involves providing comprehensive support and development programs. This includes offering extensive training, robust marketing materials, and cutting-edge technology solutions.

These resources are designed to empower agents, enabling them to expand their client base and deliver exceptional service. Financial incentives are also a key component, motivating agents to achieve growth targets. The company views increasing the number of agency appointments as a direct driver of premium expansion.

- Agency Training Programs: Focus on product knowledge, sales techniques, and customer service excellence.

- Marketing Support: Provision of co-branded materials, digital marketing tools, and lead generation assistance.

- Technology Integration: Offering agency management systems and digital quoting platforms to enhance efficiency.

- Performance Incentives: Bonuses and recognition for achieving premium growth and client satisfaction goals.

Cincinnati Financial actively manages its investment portfolio, focusing on fixed-maturity and equity investments to generate substantial income. This income stream is vital, supplementing the profits derived from its core insurance underwriting business.

The company employs strategic asset allocation and continuous market monitoring to optimize returns while ensuring financial stability. In 2023, this investment activity yielded an impressive $1.9 billion in investment income, underscoring its significance to the company's overall profitability.

| Key Activity | Description | 2023 Impact |

|---|---|---|

| Investment Management | Managing a large portfolio of fixed-maturity and equity investments. | Generated $1.9 billion in investment income. |

| Asset Allocation | Strategic selection and balancing of investment holdings. | Aims to maximize returns while ensuring financial stability. |

| Market Monitoring | Closely observing market trends to inform investment decisions. | Supports adaptive strategies for optimal performance. |

What You See Is What You Get

Business Model Canvas

The Cincinnati Financial Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you are seeing a direct representation of the final, comprehensive analysis, complete with all its strategic components. Once your order is processed, you will gain full access to this identical, ready-to-use business model canvas, ensuring no discrepancies between the preview and the delivered product.

Resources

Cincinnati Financial's financial capital and reserves are foundational to its operations, ensuring it can fulfill policyholder claims and adhere to strict regulatory standards. Their commitment to a strong balance sheet and risk-adjusted capitalization is recognized by AM Best, who rates their financial strength as 'strongest'.

This robust financial footing provides significant stability and builds trust with stakeholders. As of 2024, Cincinnati Financial's consolidated cash and total investments surpassed $29 billion, underscoring their substantial capacity to manage financial commitments.

Cincinnati Financial's core strength lies in its highly skilled human capital. This includes underwriters who leverage advanced pricing precision tools, claims adjusters committed to swift and equitable resolutions, and a robust network of independent agents. Their collective expertise directly shapes service quality and underwriting outcomes.

In 2024, the company continued to emphasize the value of these professionals, recognizing that their dedication is fundamental to delivering superior customer experiences and maintaining strong underwriting discipline. This focus on people supports their decentralized operating model, which empowers local decision-making and effective field services.

Cincinnati Financial's robust technology infrastructure is a cornerstone of its operations. This includes sophisticated systems for managing policies, processing claims efficiently, and conducting advanced data analytics. These platforms are crucial for maintaining operational agility and supporting the company's growth.

Digital platforms are also vital, providing seamless interaction for both agents and customers. The company's commitment to technological innovation in serving its agencies has been recognized with industry awards, highlighting its focus on user-friendly and effective digital solutions.

Access to comprehensive data and the strategic application of predictive modeling are key differentiators. This capability significantly enhances their ability to assess risk accurately and drive operational efficiencies across all business segments.

Brand Reputation and Trust

Cincinnati Financial's brand reputation is a cornerstone, built on a foundation of financial stability and dependable service. This trust is crucial for attracting and keeping both customers and its network of independent agents. In 2024, the company continued to highlight its financial strength, a key factor in ensuring it can meet its policyholder obligations.

The company's long-standing dedication to its agency partners further solidifies this trust. This commitment fosters loyalty within the distribution channel, which is vital for consistent business growth.

- Financial Strength: Cincinnati Financial consistently maintains strong financial ratings, underpinning its ability to pay claims.

- Reliable Service: A reputation for prompt and fair claims handling builds significant customer loyalty.

- Agent Relationships: The company's focus on supporting independent agents creates a stable and effective distribution network.

- Long-Term Commitment: Decades of consistent operation and adherence to its values reinforce its trustworthy image.

Diversified Product Portfolio

Cincinnati Financial's diversified product portfolio is a cornerstone of its business model, encompassing a wide array of insurance offerings. This includes robust commercial lines, catering to businesses of all sizes, and comprehensive personal lines, covering individual needs. The company also operates in excess and surplus lines, providing coverage for unique or hard-to-place risks.

Further strengthening its market position, Cincinnati Financial offers life insurance and fixed annuities, broadening its appeal to a wider customer base. This extensive range allows the company to serve diverse market segments and effectively manage risk by not being overly dependent on any single product category.

The strategic expansion into asset management services complements its insurance offerings. This integration provides clients with a more holistic financial solution, enhancing customer loyalty and creating additional revenue streams. For example, as of the first quarter of 2024, Cincinnati Financial reported total assets under management exceeding $110 billion, demonstrating the scale and importance of this segment.

- Extensive Insurance Offerings: Commercial, personal, and excess/surplus lines insurance.

- Life and Annuity Products: Providing financial security and long-term savings solutions.

- Asset Management Services: Managing over $110 billion in assets as of Q1 2024.

- Risk Mitigation: Diversification reduces reliance on any single market segment.

Cincinnati Financial's key resources are anchored by its substantial financial strength, evidenced by over $29 billion in consolidated cash and investments as of 2024, and its highly skilled workforce, including expert underwriters and claims adjusters. Its robust technology infrastructure supports efficient operations and agent/customer interactions, while a strong brand reputation built on reliability and agent relationships fosters trust and loyalty.

| Key Resource | Description | 2024 Data/Relevance |

|---|---|---|

| Financial Capital | Funds to cover claims and meet regulatory needs. | Consolidated cash and investments exceeded $29 billion. |

| Human Capital | Skilled underwriters, claims adjusters, and agents. | Essential for service quality and underwriting accuracy. |

| Technology Infrastructure | Systems for policy management, claims processing, and data analytics. | Enables operational agility and supports growth. |

| Brand Reputation | Trust built on financial stability and dependable service. | Attracts and retains customers and agents. |

Value Propositions

Cincinnati Financial provides a robust suite of insurance products, encompassing property, casualty, life, and annuities. This extensive portfolio allows clients to address a wide range of financial protection needs through a single, reliable source, simplifying their insurance management.

The company's strategy includes positioning itself as the preferred life insurance provider for the clients of its agent network. In 2024, Cincinnati Financial's life insurance segment continued to be a significant contributor to its overall business, demonstrating the success of this approach.

Cincinnati Financial's superior financial strength is a key value proposition, offering policyholders immense confidence and security. This is underscored by consistently high ratings from major agencies, including A.M. Best's A+ Superior, Fitch's A+ Strong, and Moody's A1.

This robust financial position isn't just a rating; it's a tangible promise. It ensures that Cincinnati Financial is well-equipped to fulfill its obligations and pay claims, providing a bedrock of stability for its customers.

Cincinnati Financial’s commitment to personalized service, delivered through its network of independent agents, is a cornerstone of its business model. These agents act as local advisors, fostering strong client relationships and offering tailored insurance solutions that direct insurers often can't match.

This agent-centered approach is highly valued. In 2024, Cincinnati Financial reported that its independent agents consistently praise the company for its responsiveness and financial stability, key factors that allow agents to effectively serve their clients.

Expert Underwriting and Claims Service

Cincinnati Financial's value proposition centers on expert underwriting and claims service, ensuring clients receive precise pricing and effective risk management. This dedication translates into a positive experience, especially during challenging times, as the company prioritizes fast, fair, and empathetic claims handling.

The company's commitment to quality is reflected in its financial performance. For instance, Cincinnati Financial reported a significant increase in its underwriting profit in 2024, underscoring the effectiveness of its underwriting practices in managing risk and generating profitable business.

- Expert Underwriting: Aims for precise pricing and accurate risk segmentation, leading to tailored insurance solutions.

- Claims Service: Focuses on speed, fairness, and empathy, providing crucial support to policyholders when they need it most.

- Risk Management: The combined expertise in underwriting and claims offers clients robust solutions for managing their risks effectively.

- Financial Performance: Cincinnati Financial's underwriting profit saw a substantial rise in 2024, highlighting the success of its operational strategies.

Integrated Financial Solutions

Cincinnati Financial goes beyond just insurance, offering a suite of integrated financial solutions. This includes asset management services and fixed annuities, allowing them to cater to a wider range of client needs, from safeguarding assets to growing wealth.

This integrated approach provides clients with a single point of contact for diverse financial requirements, enhancing convenience and leveraging Cincinnati Financial's expertise across multiple domains. For instance, in 2023, their total investment income reached $2.3 billion, highlighting the significance of their asset management capabilities.

Furthermore, the company supports its agents and their clients through leasing and financing services. This demonstrates a commitment to providing comprehensive support that extends beyond core insurance products, fostering stronger relationships and enabling business growth for their partners.

- Integrated Offerings: Insurance, asset management, and fixed annuities address protection and wealth accumulation needs.

- Client Convenience: A single provider for multiple financial services simplifies client management.

- Financial Strength: $2.3 billion in investment income in 2023 underscores the scale of their asset management operations.

- Agent Support: Leasing and financing services assist agents and their clients, fostering partnership.

Cincinnati Financial offers a comprehensive insurance portfolio, including property, casualty, and life insurance, acting as a one-stop shop for client financial protection needs. Their strategy to be the preferred life insurer for their agent network's clients proved successful in 2024, contributing significantly to their business. This integrated approach, combined with superior financial strength, as evidenced by top-tier ratings like A.M. Best's A+ Superior, provides policyholders with unparalleled confidence and security.

The company's value proposition is built on personalized service delivered through independent agents who provide tailored solutions and local expertise. This agent-centric model is highly regarded, with agents in 2024 consistently commending Cincinnati Financial for its responsiveness and financial stability. Furthermore, expert underwriting and claims service ensure precise pricing, effective risk management, and fast, fair claims handling, a commitment reinforced by a notable increase in underwriting profit in 2024.

Cincinnati Financial also provides integrated financial solutions, including asset management and fixed annuities, enhancing client convenience by offering a single point of contact for diverse financial requirements. Their significant investment income, reaching $2.3 billion in 2023, highlights the strength of their asset management capabilities. Additionally, support services like leasing and financing for agents and their clients foster strong partnerships and facilitate business growth.

| Value Proposition | Description | 2024/2023 Data Point |

|---|---|---|

| Comprehensive Insurance Portfolio | Property, casualty, life, and annuities for diverse client needs. | Life insurance segment a significant contributor in 2024. |

| Agent-Centric Service Model | Personalized, tailored solutions through independent local agents. | Agents praised company responsiveness and stability in 2024. |

| Superior Financial Strength | High ratings from agencies like A.M. Best (A+ Superior). | Underwriting profit saw a substantial rise in 2024. |

| Integrated Financial Solutions | Insurance, asset management, and annuities for holistic financial planning. | Total investment income reached $2.3 billion in 2023. |

Customer Relationships

Cincinnati Financial's customer relationships are primarily cultivated through a network of dedicated independent agents. These agents act as the crucial link between the company and its policyholders, offering personalized service and expert advice.

This model emphasizes long-term partnerships, with agents serving as the primary touchpoint for policyholders, ensuring tailored support and fostering strong customer loyalty. Cincinnati Financial actively invests in the success of these agents, recognizing their vital role in delivering exceptional customer experiences.

In 2024, Cincinnati Financial continued to leverage this agent-centric approach, which has historically contributed to its high customer retention rates. The company's commitment to supporting its independent agents directly translates into more informed and satisfied policyholders.

Cincinnati Financial prioritizes a personalized customer experience through its network of independent agents. These agents offer tailored policy recommendations and provide direct support for customer inquiries and claims, fostering strong relationships built on individual attention and responsiveness.

This high-touch model, which emphasizes local decision-making and field services, differentiates Cincinnati Financial from purely digital or call-center based competitors. In 2024, the company continued to invest in agent training and support to ensure this personalized service remained a core strength.

Cincinnati Financial's claims service excellence is a cornerstone of their customer relationships. This commitment to fast, fair, and empathetic handling of claims significantly strengthens trust, particularly during difficult times for policyholders. In 2024, their dedication to efficient and supportive claims processes reinforces the perceived value of their insurance offerings.

Long-Term Partnership Approach

Cincinnati Financial cultivates enduring connections with its independent agents and policyholders, emphasizing a stable and dependable presence. This translates to providing agents with a consistent market for their clients' insurance needs and acting as a steadfast resource for policyholders throughout their lives.

Their long-term strategy is underscored by a history of operational resilience and commitment. For instance, in 2023, Cincinnati Financial reported a combined ratio of 91.4%, indicating strong underwriting profitability and a foundation for sustained partnerships.

- Focus on Agent Stability: Cincinnati Financial provides a consistent and reliable market for independent agents, fostering loyalty and mutual growth.

- Policyholder Longevity: They aim to be a trusted partner for policyholders, offering dependable service and support over many years.

- Historical Commitment: With 75 years of operation, the company demonstrates a proven track record of stability and long-term vision.

- Financial Strength: In 2023, their property casualty insurance companies maintained an A++ Superior rating from AM Best, reflecting their financial stability and ability to honor commitments.

Digital Support and Resources

While Cincinnati Financial's core strength lies in its agent relationships, it complements this with robust digital support and resources. These online platforms are designed to empower their agents with information, policy management tools, and communication channels, thereby streamlining operations and enhancing service delivery.

These digital offerings extend to policyholders for specific needs, ensuring accessibility and convenience. For instance, their online portals facilitate policy inquiries and management, reflecting a commitment to modernizing customer interactions. Cincinnati Financial has been recognized for its technological innovations aimed at supporting its agency force.

- Digital Platforms: Online portals offering policy information, management, and communication tools.

- Agent Empowerment: Resources designed to enhance agent efficiency and service capabilities.

- Policyholder Access: Digital channels for certain policyholder interactions and service requests.

- Award Recognition: Acknowledged for advancements in agency-focused technology.

Cincinnati Financial cultivates deep, lasting relationships primarily through its network of independent agents, who serve as the primary point of contact for policyholders. This approach fosters personalized service, expert advice, and strong customer loyalty, differentiating them from competitors. In 2024, the company continued to invest in agent training and support, reinforcing this high-touch, local decision-making model.

Their commitment to claims service excellence is a cornerstone, building trust through fast, fair, and empathetic handling, especially during challenging times. This focus on efficient and supportive claims processes significantly enhances the perceived value of their insurance products.

Cincinnati Financial also leverages digital platforms to empower agents with information and management tools, streamlining operations and enhancing service delivery. These online resources, alongside digital channels for policyholders, reflect a commitment to modernizing customer interactions and ensuring accessibility.

| Aspect | Description | 2023/2024 Data/Insight |

|---|---|---|

| Primary Channel | Independent agents | Core strategy for personalized service and advice. |

| Customer Loyalty | Long-term partnerships via agents | Historically high customer retention rates. |

| Claims Service | Fast, fair, empathetic handling | Key driver of trust and customer satisfaction in 2024. |

| Digital Support | Agent and policyholder platforms | Enhances efficiency and accessibility for policy management. |

Channels

Cincinnati Financial's most vital channel is its vast network of independent insurance agencies, operating in 46 states. These agencies are the backbone of sales and distribution for all their insurance products, offering a crucial local touch and direct client engagement.

The company consistently works to grow this network by appointing more agencies, aiming to broaden its market penetration and accessibility. In 2023, Cincinnati Financial reported a robust premium growth of 9% year-over-year, underscoring the effectiveness of this channel in reaching customers.

Cincinnati Financial's corporate website, cinfin.com, acts as a primary channel for disseminating general company information, detailing its diverse product offerings, and housing its dedicated investor relations portal. This digital hub is crucial for providing stakeholders with easy access to essential documents like financial reports and timely news releases.

The investor relations section of the website is specifically designed to cater to investors and potential partners, offering a transparent view into the company's performance and strategic direction. It ensures that vital shareholder information is readily available, fostering trust and informed decision-making among its audience.

This robust digital presence underscores Cincinnati Financial's commitment to transparency and effective communication, enabling a broad spectrum of users, from individual investors to financial professionals, to stay informed about the company's operations and financial health.

Direct field representatives are crucial for Cincinnati Financial, embodying specialized expertise and local decision-making through field claims service, underwriting, and support. These individuals foster strong relationships with independent agents and policyholders, delivering essential on-the-ground assistance and solidifying the company's localized operational approach.

Brokerage Services Subsidiaries

Cincinnati Financial leverages its brokerage services subsidiaries to tap into wider markets and provide specialized insurance solutions that go beyond its core offerings. This strategic channel is crucial for accessing excess and surplus lines business, catering to unique or complex client requirements that standard policies may not cover.

These subsidiaries enhance Cincinnati Financial's market penetration and offer greater flexibility in meeting diverse customer needs. For instance, in 2024, the specialty insurance market continued to show robust growth, driven by increasing demand for tailored coverage in areas like cyber risk and environmental liability, segments where brokerage operations often excel.

- Expanded Market Access: Brokerage subsidiaries allow access to segments like excess and surplus lines, broadening the customer base beyond standard commercial and personal lines.

- Specialized Coverage: They facilitate the offering of niche or complex insurance products that complement the main insurance lines, addressing unique client risks.

- Flexibility and Agility: This channel provides greater adaptability in responding to evolving market demands and specific underwriting challenges.

Reinsurance Operations (Cincinnati Re, Cincinnati Global)

Cincinnati Re and Cincinnati Global Underwriters Ltd. are crucial channels for Cincinnati Financial's assumed reinsurance business. These operations enable the company to expand its premium base by engaging with the international reinsurance market, effectively diversifying its risk exposure beyond its core agency relationships.

These reinsurance arms provide access to a broader spectrum of risks, allowing Cincinnati Financial to participate in global insurance trends and opportunities. For instance, in 2023, Cincinnati Financial reported that its property casualty insurance segment, which includes reinsurance, saw a significant increase in net written premiums.

- Diversification of Risk: Accessing global reinsurance markets allows for spreading risk across a wider geographical and peril base.

- Premium Growth: Assumed reinsurance contributes to top-line growth by increasing the volume of premiums underwritten.

- Global Market Access: Cincinnati Re and Cincinnati Global provide a gateway to international insurance opportunities not available through domestic channels.

- Enhanced Underwriting Expertise: Engaging in reinsurance sharpens the company's underwriting capabilities by exposing it to diverse risk profiles.

Cincinnati Financial’s primary distribution channel remains its extensive network of independent insurance agencies, which are key to sales and client interaction across 46 states. The company actively works to expand this network, as evidenced by its 9% premium growth in 2023, demonstrating the channel's effectiveness in reaching a broad customer base.

The corporate website, cinfin.com, serves as a vital information hub for investors and the general public, detailing products and providing access to financial reports. This digital presence is crucial for transparency and communication with stakeholders, ensuring easy access to company performance data.

Direct field representatives play an essential role by offering localized underwriting, claims service, and support, fostering strong relationships with agents and policyholders. Their on-the-ground presence reinforces the company's localized operational strategy and commitment to customer service.

Brokerage subsidiaries are strategically utilized to access specialized markets, including excess and surplus lines business, thereby catering to complex client needs. This channel allows Cincinnati Financial to offer tailored insurance solutions and adapt to evolving market demands, as seen in the growing specialty insurance market in 2024.

Cincinnati Re and Cincinnati Global Underwriters Ltd. are critical for assumed reinsurance, expanding the company's premium base and diversifying risk exposure globally. These operations provide access to international insurance trends and opportunities, contributing to top-line growth and enhancing underwriting expertise.

| Channel | Description | Key Function | 2023/2024 Relevance |

| Independent Agencies | Vast network in 46 states | Sales, distribution, local client engagement | 9% premium growth in 2023 |

| Corporate Website (cinfin.com) | Digital information hub | Company info, product details, investor relations | Facilitates stakeholder access to financial reports and news |

| Field Representatives | On-the-ground specialists | Claims service, underwriting, agent support | Strengthens localized operations and relationships |

| Brokerage Subsidiaries | Access to specialized markets | Excess/surplus lines, niche products | Addresses complex client needs; growing specialty market |

| Reinsurance Arms (Cincinnati Re, Cincinnati Global) | Assumed reinsurance business | Premium growth, risk diversification | Access to global markets, enhanced underwriting |

Customer Segments

Cincinnati Financial serves individuals and families by providing essential personal insurance products. This includes coverage for homeowners and auto owners, addressing everyday risks. They also offer specialized policies like dwelling fire, inland marine, personal umbrella liability, and watercraft insurance, ensuring comprehensive protection for diverse assets.

Beyond property and casualty, Cincinnati Financial supports personal financial planning through life insurance and fixed annuities. These products are designed to help individuals secure their financial future and protect their loved ones. In 2023, the company reported substantial growth in its property casualty segment, highlighting the demand for these core offerings among individuals and families.

For high-net-worth individuals, Cincinnati Financial offers tailored solutions through its Cincinnati Private Client division. This specialized service recognizes the unique insurance and financial planning needs of affluent clients, providing customized coverage and wealth management strategies. This focus on specialized client needs contributed to their strong financial performance in recent years.

Small to medium-sized businesses represent a core customer segment for Cincinnati Financial, with a significant portion seeking essential property, casualty, auto, and workers' compensation insurance. The company focuses on delivering robust and adaptable coverage designed to meet the varied requirements of businesses operating across a wide array of sectors.

Cincinnati Financial is actively broadening its product offerings to better serve specialized small businesses. For instance, they are introducing tailored insurance solutions specifically for professions such as dentists, veterinarians, and optometrists, recognizing the unique risks and needs within these fields.

Large corporations and specialty risks represent a crucial customer segment for Cincinnati Financial, demanding intricate commercial insurance solutions. This includes specialized offerings like contract and commercial surety bonds, vital for large construction projects and business agreements, as well as fidelity bonds to protect against employee dishonesty and management liability coverage to safeguard against executive misconduct.

The excess and surplus (E&S) lines segment is particularly tailored for these clients, addressing unique or challenging risks that don't fit within conventional underwriting parameters. For instance, in 2024, the E&S market continued to show robust growth, with many larger businesses seeking specialized coverage for emerging risks such as cyber threats or environmental liabilities, areas where standard policies often fall short.

High-Net-Worth Clients

Cincinnati Financial caters to high-net-worth clients with its specialized Cincinnati Private ClientSM offerings, focusing on tailored personal lines insurance. This segment values sophisticated coverage designed for their complex assets and unique financial circumstances, demanding a high level of personalized service.

The company's commitment to this affluent demographic is evident in its financial performance. For the first quarter of 2025, Cincinnati Private Client saw its net written premiums increase by a robust 10%.

- Target Audience: Affluent individuals and families with substantial assets.

- Service Offering: Specialized personal lines insurance, including high-value home, auto, and excess liability coverage.

- Key Differentiator: Personalized service and sophisticated coverage options to meet complex needs.

- Performance Indicator: 10% growth in net written premiums for Cincinnati Private Client in Q1 2025.

Reinsurance Ceding Companies

Cincinnati Financial's reinsurance segment, operating through Cincinnati Re and Cincinnati Global, caters to other insurance companies. These ceding companies transfer a portion of their underwriting risk to Cincinnati Financial in exchange for a premium. This business-to-business relationship is crucial for insurers seeking to stabilize their financial results and manage their capital more effectively.

In 2024, the global reinsurance market continued to be shaped by evolving risk landscapes, including climate-related events and cyber threats. Reinsurers like Cincinnati Financial play a vital role in absorbing these large-scale risks, thereby supporting the stability of the broader insurance industry. For instance, major natural catastrophes in 2023 led to significant insured losses, underscoring the ongoing need for robust reinsurance capacity.

- Risk Transfer: Provides other insurers with the ability to offload specific risks, such as those associated with large property damage or liability claims.

- Capital Management: Helps ceding companies optimize their capital by reducing their exposure to potentially volatile underwriting outcomes.

- Market Stability: Contributes to the overall resilience of the insurance sector by spreading risk across multiple entities.

- Specialized Expertise: Offers deep underwriting knowledge and analytical capabilities to assess and price complex risks.

Cincinnati Financial's customer base is diverse, encompassing individuals, families, and businesses of all sizes. They provide essential personal insurance like homeowners and auto coverage, alongside specialized policies for unique assets. For affluent clients, the Cincinnati Private Client division offers tailored solutions, reflecting a 10% increase in net written premiums in Q1 2025.

Small and medium-sized businesses are a cornerstone, seeking property, casualty, auto, and workers' compensation insurance. The company is expanding its reach with specialized offerings for professions like dentists and veterinarians. Large corporations and those with specialty risks require intricate commercial insurance, including surety and management liability coverage, often utilizing the excess and surplus lines market which saw continued growth in 2024.

The reinsurance segment, through Cincinnati Re and Cincinnati Global, serves other insurance companies by transferring risk. This business-to-business model is crucial for insurers managing capital and stabilizing financial results, especially in the face of increasing large-scale risks like climate events and cyber threats, which were highlighted by significant insured losses in 2023.

Cost Structure

Claims and loss adjustment expenses represent the most substantial portion of Cincinnati Financial's cost structure. These costs encompass the actual payouts for covered losses and the significant expenses incurred in investigating, evaluating, and settling those claims.

The volatility of these costs is directly influenced by the frequency and severity of insured events. For instance, during the first quarter of 2025, Cincinnati Financial experienced a notable increase in catastrophe losses, which can have a profound impact on the company's financial performance and profitability.

Cincinnati Financial's underwriting and operating expenses are the backbone of its insurance operations, encompassing everything from employee compensation to the technology that powers its business. These costs include salaries and benefits for a dedicated team of underwriters, claims adjusters, and administrative staff, as well as investments in essential technology infrastructure and general office overhead.

The company places a strong emphasis on managing these outflows efficiently. For instance, in 2023, Cincinnati Financial reported an underwriting expense ratio that remained consistent with previous years, demonstrating a commitment to cost control while maintaining operational effectiveness. This focus ensures that resources are allocated strategically to support profitable growth.

Cincinnati Financial, as an agent-centric insurer, dedicates a substantial portion of its costs to commissions paid to its network of independent insurance agents. These commissions are earned for both securing new policies and maintaining existing ones, reflecting the agents' crucial role in driving business volume.

Beyond standard commissions, the company also engages in profit-sharing agreements with its agents. These arrangements further incentivize agents by tying a portion of their compensation to the overall profitability of the business they help generate, aligning their interests with Cincinnati Financial's financial success.

For the fourth quarter of 2023, Cincinnati Financial reported that lower accruals for agency profit sharing commissions contributed to a reduction in its expense ratio, demonstrating the direct impact of these compensation structures on operational efficiency.

Reinsurance Premiums Paid

Cincinnati Financial incurs significant costs by paying reinsurance premiums to external entities. This practice is fundamental to their risk management, allowing them to offload exposure to exceptionally large or catastrophic events. While they manage some reinsurance internally, outsourcing a portion is a key strategy.

For instance, in 2023, Cincinnati Financial reported total ceded premiums written of $3.3 billion. This figure reflects the substantial investment made in reinsurance to protect their balance sheet from severe financial impacts.

- Reinsurance Premiums Paid: A significant operational expense for risk transfer.

- 2023 Ceded Premiums Written: $3.3 billion, illustrating the scale of their reinsurance arrangements.

- Risk Mitigation: Essential for managing exposure to catastrophic events and large claims.

Investment Management Expenses

Investment management expenses are a critical component of Cincinnati Financial's cost structure, reflecting the significant resources dedicated to overseeing its extensive investment portfolio. These costs encompass fees paid to external asset managers, if any, alongside internal operational expenses for the investment department. Trading costs, such as brokerage commissions and bid-ask spreads, also contribute to this category.

While investment income is a primary revenue driver, the effective management of these assets inherently incurs costs. For instance, in 2023, Cincinnati Financial reported total investment income of $2.2 billion. However, managing this substantial asset base involves ongoing expenditures that directly impact profitability.

- External Asset Management Fees: Costs incurred when outsourcing the management of specific investment segments to specialized firms.

- Internal Investment Department Costs: Salaries, research tools, and operational expenses for the in-house team managing the portfolio.

- Trading Costs: Expenses related to executing trades, including commissions, fees, and market impact.

- Custody and Administration Fees: Costs associated with holding and administering the investment assets.

Cincinnati Financial's cost structure is heavily influenced by claims and loss adjustment expenses, which represent the payouts for insured events and the costs of managing them. Underwriting and operating expenses, including employee compensation and technology, form another significant part of their operational backbone. Additionally, substantial costs are allocated to commissions and profit-sharing agreements with their network of independent insurance agents.

Reinsurance premiums paid to external entities are a crucial expense for managing catastrophic risk, as evidenced by $3.3 billion in ceded premiums written in 2023. Investment management expenses, encompassing fees for external managers, internal operations, and trading costs, are also critical as they directly impact the profitability derived from their $2.2 billion investment income in 2023.

| Cost Category | 2023 Data Point | Significance |

| Claims & Loss Adjustment | N/A (Volatile) | Largest expense, tied to insured events. |

| Underwriting & Operating Expenses | Consistent Expense Ratio | Covers staff, technology, and overhead. |

| Commissions & Profit Sharing | Lowered expense ratio in Q4 2023 | Incentivizes agent network. |

| Reinsurance Premiums | $3.3 billion (Ceded Premiums Written) | Risk mitigation for large/catastrophic events. |

| Investment Management | N/A (Offset by Investment Income) | Costs associated with managing a large portfolio. |

Revenue Streams

Cincinnati Financial's core revenue is built upon property and casualty insurance premiums. This income is derived from its diverse offerings across commercial, personal, and specialized excess and surplus lines of insurance.

The growth in these premiums is a vital sign of the company's expanding reach and success in capturing market share. For the entirety of 2024, Cincinnati Financial saw a robust 15% increase in its net written premiums for property and casualty insurance.

Cincinnati Financial also generates revenue from premiums collected on its life insurance policies. This includes a variety of products such as term life insurance, designed for temporary coverage, and universal life insurance, which offers more flexibility and a cash value component. These offerings are crucial for clients looking to secure their beneficiaries' financial futures and manage long-term financial planning.

The life insurance segment plays a significant role in diversifying the company's overall revenue streams, reducing reliance on any single business line. This diversification helps to stabilize earnings and provides a consistent income source. For instance, in 2024, earned premiums within Cincinnati Life saw a growth of 3%, underscoring the segment's steady contribution to the company's financial performance.

Cincinnati Financial generates substantial revenue from its investment portfolio, a key component of its business model. This income primarily arises from interest earned on its bond holdings and dividends received from its stock investments, providing a stable and significant financial contribution.

Investment income plays a vital role in bolstering Cincinnati Financial's overall profitability and reinforcing its financial stability. For the full year 2024, the company reported a notable 15% increase in pretax investment income, underscoring its importance as a revenue driver.

Fixed Annuity Premiums/Deposits

Cincinnati Financial generates revenue through fixed annuity premiums and deposits. These are long-term savings and income products designed to help clients meet their retirement and savings goals. This stream diversifies their income sources and strengthens client relationships.

In 2024, the insurance industry, which includes annuities, saw continued interest as individuals sought stable returns and predictable income. While specific figures for Cincinnati Financial's fixed annuity revenue for 2024 are not yet publicly available, the broader market trend indicates a consistent demand for such products.

- Fixed Annuity Premiums: Direct income from clients purchasing fixed annuities.

- Deposit Growth: Revenue from additional deposits made by existing annuity holders.

- Investment Income: Earnings generated from the invested premiums and deposits.

- Fee Income: Potential revenue from administrative or surrender charges, depending on contract terms.

Asset Management Fees

Cincinnati Financial earns revenue from its asset management arm by charging fees for the services provided to clients. This is a key revenue stream that complements its core insurance business.

These fees are typically calculated as a percentage of the total assets under management (AUM). This model allows the company to grow its income as its investment portfolio expands.

For instance, in 2024, the company's robust investment portfolio management likely contributed significantly to its overall financial performance, showcasing the diversification benefits of these asset management fees.

- Fee-based income from managing client assets.

- Percentage of Assets Under Management (AUM) model.

- Diversifies revenue beyond insurance premiums.

- Leverages investment expertise for additional income.

Cincinnati Financial's revenue streams are multifaceted, primarily driven by property and casualty insurance premiums, which saw a significant 15% increase in net written premiums for 2024. Life insurance premiums, including term and universal life policies, also contribute, with earned premiums in the life segment growing by 3% in 2024, diversifying the company's income base.

Investment income is a substantial revenue driver, with pretax investment income rising by 15% in 2024, stemming from interest on bonds and dividends from stocks. Additionally, the company generates revenue from fixed annuity premiums and deposits, reflecting continued client interest in stable retirement savings products.

The company also earns fees from its asset management services, typically calculated as a percentage of assets under management. This fee-based income diversifies revenue beyond insurance and leverages the company's investment expertise.

| Revenue Stream | Description | 2024 Performance Indicator |

| Property & Casualty Premiums | Income from commercial, personal, and specialized insurance policies. | 15% increase in net written premiums. |

| Life Insurance Premiums | Income from term and universal life insurance policies. | 3% growth in earned premiums for Cincinnati Life. |

| Investment Income | Earnings from bonds and stocks in the investment portfolio. | 15% increase in pretax investment income. |

| Annuity Premiums & Deposits | Revenue from fixed annuities and client deposits. | Steady market demand noted. |

| Asset Management Fees | Fees charged for managing client assets (percentage of AUM). | Leverages investment expertise; robust portfolio management likely contributed significantly. |

Business Model Canvas Data Sources

The Cincinnati Financial Business Model Canvas is built using extensive financial disclosures, actuarial data, and market research reports. These sources provide a robust foundation for understanding revenue streams, cost structures, and customer segments.