Cincinnati Financial Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cincinnati Financial Bundle

Cincinnati Financial operates in a dynamic insurance landscape, where understanding the interplay of competitive forces is crucial for sustained success. While initial insights reveal moderate buyer power and a significant threat from substitutes, the full picture of their competitive environment remains complex.

The complete report reveals the real forces shaping Cincinnati Financial’s industry—from supplier influence to the threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Reinsurance providers hold significant bargaining power over primary insurers like Cincinnati Financial. This is because reinsurers are essential for managing the substantial risks that primary insurers underwrite, enabling them to maintain solvency and smooth out volatile earnings. For example, in 2023, the global reinsurance market saw continued price increases in many lines of business, reflecting the ongoing need for capacity and the impact of increasing catastrophe losses.

The concentration within the reinsurance sector can amplify their leverage. When fewer reinsurers offer specialized products or capacity, they can dictate terms and pricing more effectively. This dynamic was evident in early 2024, where certain complex or high-severity risks faced limited reinsurer appetite, pushing up costs for primary insurers.

In the evolving insurance sector, technology and software providers, especially those specializing in AI and data analytics, wield considerable influence. Cincinnati Financial, like its peers, relies on these vendors for critical operational upgrades and customer-facing innovations.

The proprietary nature of these advanced software solutions, coupled with the substantial costs and complexities associated with migrating to new systems, grants these vendors significant bargaining power. For instance, the global IT spending in the insurance industry was projected to reach over $250 billion in 2024, highlighting the dependence on technology providers.

Specialized actuarial firms, legal services, and financial consultants are crucial for Cincinnati Financial, offering expertise in risk assessment, product design, regulatory adherence, and claim management. Their deep knowledge and the limited availability of such specialized talent grant them significant leverage, which can influence the insurer's operating expenses.

In 2024, the demand for actuarial and consulting services remained robust across the insurance sector. For instance, the average annual salary for an actuary in the US was reported to be around $120,000, reflecting the high skill level and demand for these professionals. This cost is a direct factor in the bargaining power these suppliers hold.

Claims Service Providers

The bargaining power of claims service providers, such as independent adjusters, repair networks, and legal firms, is a significant factor for insurers like Cincinnati Financial. These entities possess specialized knowledge, equipment, and capacity that are essential for claims processing, particularly during periods of high claim volume. Their ability to influence pricing and terms stems from their critical role in the claims lifecycle and the direct impact their performance has on customer retention and an insurer's bottom line.

In 2024, the market for claims services saw continued consolidation, potentially increasing the leverage of larger networks. For example, the average cost for auto physical damage claims, which heavily rely on repair networks, continued to be influenced by parts availability and labor rates. Insurers must carefully manage these relationships to ensure competitive pricing and service quality.

- Independent Claims Adjusters: Their localized expertise and availability, especially during catastrophic events, give them leverage.

- Repair Networks: The concentration of preferred repair shops can lead to increased pricing power, particularly for specialized repairs.

- Legal Firms: The complexity of insurance litigation and the specialized nature of legal counsel can grant significant bargaining power to experienced firms.

- Impact on Profitability: Efficient and cost-effective claims handling by these providers is crucial for maintaining underwriting profitability.

Investment Management Services

Cincinnati Financial, like many insurers, relies on external investment managers to grow its substantial portfolio, which is crucial for backing its insurance liabilities. In 2023, Cincinnati Financial reported investment income of $1.75 billion, highlighting the significance of this function. The bargaining power of these suppliers can be considerable, especially for those managers specializing in niche or high-performing asset classes. Their ability to generate superior returns directly influences Cincinnati Financial's profitability, giving them leverage in fee and term negotiations.

The fees and contractual terms agreed upon with investment management service providers have a direct and measurable impact on Cincinnati Financial's bottom line. For instance, a 0.1% difference in management fees on a multi-billion dollar portfolio can translate into millions of dollars in annual cost savings or expenses. This financial leverage means that managers with strong track records and specialized expertise can command more favorable terms, thereby increasing their bargaining power.

- Specialized Expertise: Investment managers with proven success in niche markets or complex asset classes hold significant sway.

- Performance Track Record: A history of delivering competitive returns strengthens a manager's negotiating position.

- Fee Sensitivity: Even small variations in management fees can have a large financial impact on a portfolio of Cincinnati Financial's size.

- Market Conditions: The availability and cost of top-tier investment talent fluctuate with broader economic and market trends.

The bargaining power of suppliers for Cincinnati Financial is a key consideration, particularly for reinsurance, technology, and specialized professional services. These suppliers are critical for risk management, operational efficiency, and regulatory compliance, giving them leverage in negotiations.

In 2024, the insurance industry continued to see rising costs for reinsurance and technology solutions. For example, global reinsurance premiums were projected to increase, driven by higher claims and demand for capacity, directly impacting insurers like Cincinnati Financial.

Key suppliers such as reinsurers, IT vendors, and actuarial firms can command higher prices due to the specialized nature of their services and the limited availability of alternatives, especially for complex risks or advanced technologies. This was reflected in the strong demand for actuarial talent, with average US actuary salaries around $120,000 in 2024.

The concentration among certain specialized service providers, like preferred repair networks for claims or niche investment managers, also enhances their bargaining power. Cincinnati Financial's substantial investment portfolio, which generated $1.75 billion in income in 2023, means even minor fee differences with investment managers can significantly impact profitability.

| Supplier Category | Key Factors Influencing Bargaining Power | 2024 Market Trend Example |

|---|---|---|

| Reinsurers | Risk concentration, demand for capacity, catastrophe loss impact | Continued price increases in many lines of business |

| Technology Providers (AI/Data) | Proprietary solutions, switching costs, industry reliance | Global IT spending in insurance projected over $250 billion |

| Specialized Professional Services (Actuarial, Legal) | Deep expertise, limited talent pool, regulatory complexity | Robust demand for actuarial services, high salaries |

| Claims Service Providers (Adjusters, Repair Networks) | Specialized skills, equipment, claims volume fluctuations | Consolidation in repair networks potentially increasing leverage |

| Investment Managers | Performance track record, specialized asset classes, fee sensitivity | Strong performance can command more favorable fee terms |

What is included in the product

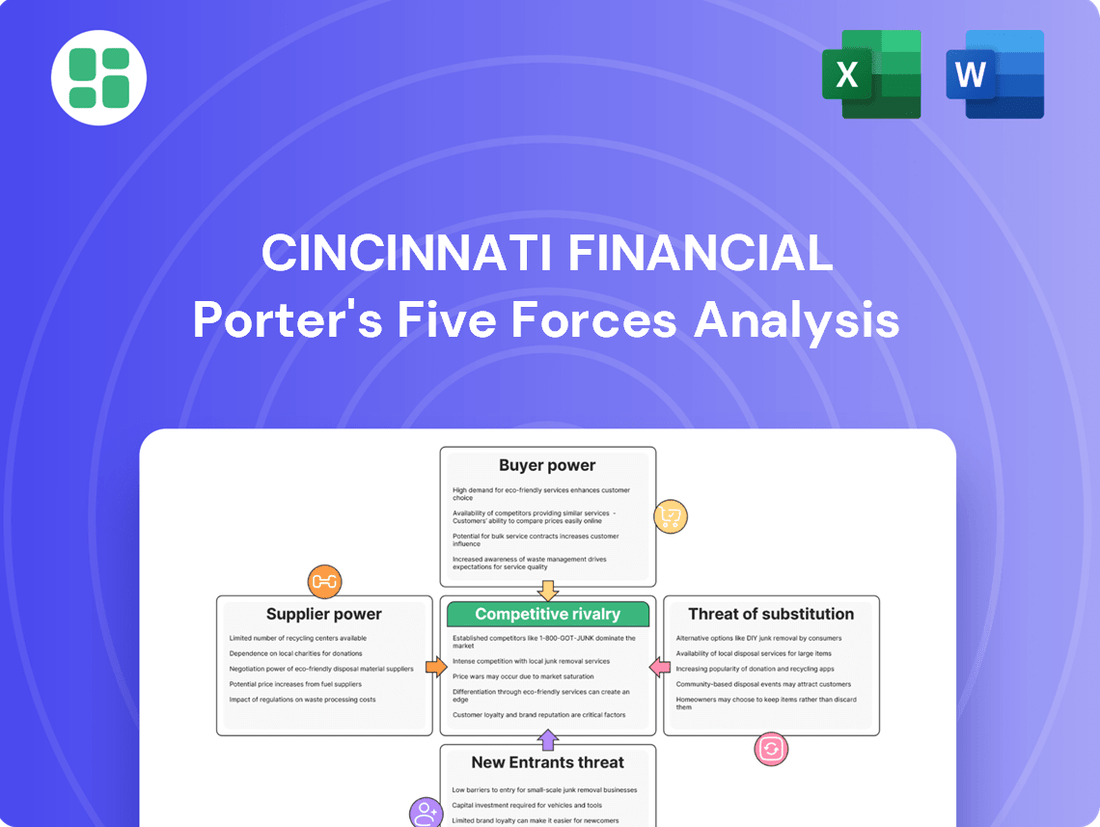

Cincinnati Financial's Porter's Five Forces analysis reveals the intense competition within the insurance industry, the significant bargaining power of its customers, and the moderate threat of new entrants. It also examines the low threat of substitutes and the limited bargaining power of suppliers, providing a comprehensive view of the company's operating environment.

Effortlessly identify and address competitive threats with a visual representation of industry power dynamics, simplifying complex strategic pressures.

Customers Bargaining Power

Customers, especially for everyday insurance needs like personal auto and basic small business coverage, are very focused on price. The rise of online comparison websites means they can easily see who offers the cheapest deals. This puts pressure on companies like Cincinnati Financial to keep their prices competitive, which can sometimes squeeze their profits.

For many standard insurance products, the effort and financial cost associated with switching from one provider to another are relatively low. This ease of movement empowers customers to frequently seek better deals or more favorable terms, increasing their bargaining power and putting constant pressure on insurers to retain their policyholders.

In 2024, a significant portion of consumers reported comparing multiple quotes before purchasing or renewing insurance policies, underscoring the low switching costs. This behavior directly translates to a heightened ability for customers to negotiate better pricing and service, impacting Cincinnati Financial's ability to maintain pricing power.

The internet has dramatically leveled the playing field, shrinking the gap in knowledge between insurers like Cincinnati Financial and their customers. With readily available online resources, policyholders can now easily compare coverage, scrutinize reviews, and grasp industry pricing standards. This newfound transparency empowers them to negotiate more effectively and seek better value, directly impacting an insurer's pricing power.

Large Commercial Clients

Large commercial clients, particularly those with extensive and intricate insurance requirements, wield considerable bargaining power. This stems from the sheer volume of premiums they represent, enabling them to negotiate highly tailored policies, advantageous terms, and competitive pricing. In 2023, Cincinnati Financial reported that its commercial lines represented a significant portion of its overall premium volume, underscoring the influence these clients can exert.

These sophisticated buyers frequently dictate specific coverage parameters and can leverage their business volume to secure more favorable rates than smaller enterprises. This can lead to customized policy structures that cater precisely to their unique risk profiles.

- Significant Premium Contributions: Large commercial clients often account for a substantial percentage of an insurer's total premium income, giving them leverage.

- Negotiation of Terms: They can negotiate for customized coverage, lower pricing, and specific claims handling procedures.

- Market Sophistication: These clients typically employ risk management professionals who understand the insurance market and can effectively compare offerings.

- Switching Costs: While switching insurers can involve administrative effort, the potential for cost savings and better terms can outweigh these costs for large clients.

Availability of Alternative Providers

The insurance landscape is incredibly crowded, offering customers a vast selection of providers. This includes large national insurers, specialized regional companies, direct-to-consumer options, and member-owned mutual companies.

This abundance of choice empowers customers, as they can readily compare offerings and switch if their current insurer falls short. For instance, in 2024, the US property and casualty insurance market alone generated over $700 billion in direct written premiums, highlighting the sheer scale of competition and the numerous alternatives available to consumers.

- High Market Saturation: The insurance industry is characterized by a large number of competing firms.

- Diverse Provider Types: Customers can choose from national carriers, regional specialists, direct writers, and mutual companies.

- Customer Mobility: The availability of alternatives makes it easy for customers to switch providers.

- Competitive Pricing: This high degree of competition often leads to more competitive pricing and better terms for consumers.

Customers hold significant bargaining power in the insurance market, particularly for commoditized products like personal auto insurance, driven by price sensitivity and easy access to comparative information. This power is amplified by low switching costs and increasing market transparency, allowing consumers to readily seek better deals. Large commercial clients further enhance this power through their substantial premium contributions and sophisticated negotiation strategies, influencing policy terms and pricing.

| Factor | Impact on Cincinnati Financial | Supporting Data (2024 unless noted) |

|---|---|---|

| Price Sensitivity | High pressure to offer competitive pricing, potentially impacting profit margins. | Consumers frequently compare multiple insurance quotes. |

| Low Switching Costs | Increases customer mobility and necessitates strong retention strategies. | Minimal financial or administrative barriers to changing providers. |

| Market Transparency | Empowers customers to negotiate effectively due to readily available information. | Online resources allow easy comparison of coverage, reviews, and pricing standards. |

| Large Commercial Clients | Significant influence on terms and pricing due to volume. | Commercial lines represent a substantial portion of overall premium volume (2023 data). |

| Market Saturation | Abundance of choices leads to increased customer leverage. | US P&C insurance market generated over $700 billion in direct written premiums. |

Full Version Awaits

Cincinnati Financial Porter's Five Forces Analysis

This preview displays the comprehensive Cincinnati Financial Porter's Five Forces Analysis you will receive immediately after purchase, offering a detailed examination of competitive forces within the insurance industry. You're looking at the actual document, which meticulously breaks down the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. This is the complete, ready-to-use analysis file, professionally formatted and ready to inform your strategic decisions.

Rivalry Among Competitors

Cincinnati Financial operates within a highly fragmented insurance market, facing a vast array of competitors ranging from local agencies to large global insurers. This crowded landscape means numerous players are vying for customer attention and market share across all insurance lines.

The intense rivalry often translates into aggressive pricing and marketing campaigns as companies strive to differentiate themselves. For instance, in 2024, the U.S. property and casualty insurance market alone saw over 2,000 companies actively competing, highlighting the sheer density of participants.

Many insurance products, especially for individuals and businesses, are quite similar. This makes it tough for companies like Cincinnati Financial to differentiate themselves just on what they offer. For instance, a standard auto insurance policy often provides comparable coverage across different providers.

This lack of unique features means competition often boils down to price. In 2023, the average cost of auto insurance in the U.S. saw increases, pushing insurers to focus on operational efficiency and customer service to attract and retain clients, as highlighted by industry reports.

Companies must therefore compete on factors beyond the product itself. Cincinnati Financial, for example, might leverage its strong brand reputation and efficient distribution networks, like its independent agency system, to stand out in a market where product features are largely the same.

In mature insurance markets like property and casualty, industry growth often mirrors broader economic expansion, which was projected to be around 2.2% for the US economy in 2024. This moderate growth rate means insurers must fight harder for market share. The competition for existing customers becomes more intense, driving a focus on retaining renewals and acquiring new policies through aggressive pricing strategies or improved coverage options.

High Fixed Costs and Operating Leverage

Cincinnati Financial, like many in the insurance sector, operates with substantial fixed costs. These include the infrastructure for underwriting, claims handling, and the ongoing investment in technology and regulatory adherence. For instance, in 2023, the property and casualty insurance industry saw significant investments in digital transformation, a trend that continues to drive fixed cost burdens.

The presence of high fixed costs and operating leverage often compels insurers to pursue higher premium volumes. This can manifest as aggressive pricing strategies aimed at capturing market share, even if it means accepting narrower profit margins on individual policies. This dynamic intensifies competition as companies seek to spread their fixed expenses over a larger revenue base.

- Significant Fixed Costs: Insurance operations require substantial upfront and ongoing investments in technology, personnel for underwriting and claims, and regulatory compliance.

- Operating Leverage: Once fixed costs are covered, additional premium volume contributes more significantly to profit, incentivizing growth.

- Pricing Pressure: The drive to achieve economies of scale can lead to competitive pricing, potentially impacting profitability if not managed carefully.

- 2024 Industry Trend: Insurers are increasingly focusing on efficiency gains and technological adoption to manage these fixed costs amidst a competitive landscape.

Distribution Channel Competition

Competition in distribution channels is intense, particularly for securing and retaining independent agents and brokers. These intermediaries are vital for insurers like Cincinnati Financial to reach their customer base. In 2024, the battle for agent loyalty means carriers are aggressively competing on commission structures, the quality of support services offered, and the attractiveness of their product portfolios. This rivalry directly impacts an insurer's market reach and growth potential.

The reliance on independent agents means that insurers must continually invest in building and nurturing these relationships. This includes offering competitive compensation, robust training programs, and efficient digital tools to streamline the underwriting and claims process. For example, many carriers are enhancing their agent portals with AI-driven quoting tools and improved customer service features to stand out. This focus on agent satisfaction is a key differentiator in a crowded market.

- Agent Retention Efforts: Insurers are focusing on higher commission rates and performance bonuses to keep agents engaged.

- Support Services: Investment in advanced underwriting technology and dedicated agent support teams is a major competitive factor.

- Product Innovation: Offering unique or highly competitive insurance products is crucial to attract and retain agent business.

Competitive rivalry is a defining characteristic of Cincinnati Financial's operating environment, driven by a fragmented market and product similarities. This leads to intense price competition and a focus on non-price factors like brand and service to attract and retain customers and distribution partners.

The U.S. property and casualty insurance market, comprising over 2,000 companies in 2024, exemplifies this intense rivalry. With moderate economic growth projected for 2024, insurers must aggressively compete for market share, often resorting to aggressive pricing strategies to gain volume and cover significant fixed costs.

| Metric | 2023 Data/2024 Projection | Implication for Rivalry |

|---|---|---|

| Number of P&C Insurers (US) | Over 2,000 (2024) | High fragmentation intensifies competition. |

| US Economic Growth Projection | ~2.2% (2024) | Limited market expansion necessitates fighting for existing share. |

| Average Auto Insurance Cost Increase | Upward trend (2023) | Price sensitivity increases, driving competitive pricing. |

| Agent Channel Competition | Intense focus on commissions and support | Crucial for market access, driving insurer investment in agent relations. |

SSubstitutes Threaten

Large corporations and well-capitalized entities increasingly consider self-insurance or establishing captive insurance companies as a direct substitute for traditional insurance. This allows them to retain premiums and control claims, potentially lowering overall risk management costs. For instance, in 2023, the U.S. captive insurance market saw continued growth, with many Fortune 500 companies leveraging these structures to manage specific risks, bypassing standard insurer offerings.

Cincinnati Financial's threat of substitutes is amplified by increasing investments in advanced risk management and loss prevention technologies. For instance, the global risk management software market was valued at approximately $37.6 billion in 2023 and is projected to grow significantly, indicating a strong trend towards proactive risk mitigation.

Businesses and individuals are increasingly adopting these technologies and safety protocols, which can substantially lower the probability and impact of insurable events. This shift towards prevention means a reduced reliance on traditional, comprehensive insurance policies, as proactive measures effectively substitute for reactive protection.

Government-backed programs and social safety nets can act as substitutes for private insurance by covering certain risks. For instance, unemployment benefits can reduce the need for private income protection insurance, and public healthcare systems may lessen reliance on private health insurance. In 2024, the US federal government continued to provide significant support through programs like Social Security and Medicare, impacting the demand for related private insurance products.

Alternative Risk Transfer Mechanisms

Beyond traditional insurance, sophisticated financial instruments like catastrophe bonds and industry loss warranties offer alternative risk transfer. These capital markets solutions allow large corporations to directly finance specific risks, acting as a substitute for conventional reinsurance or substantial commercial policies.

In 2024, the alternative capital market for insurance and reinsurance continued to grow, with sources like catastrophe bonds and collateralized reinsurance playing a significant role. For instance, the catastrophe bond market saw issuance volumes of approximately $10 billion in the first half of 2024, demonstrating its increasing appeal as a risk management tool.

- Catastrophe Bonds: These securities transfer specific risks, like natural disasters, to investors.

- Industry Loss Warranties (ILWs): ILWs pay out based on the total insured losses of an entire industry event, not just the policyholder's losses.

- Collateralized Reinsurance: This involves reinsurers posting collateral to back their obligations, offering security to cedents.

- Securitization of Risk: Bundling and selling insurance risks as financial products in capital markets.

Emerging Technologies and Peer-to-Peer Models

Innovations in technology are a significant threat to traditional insurers like Cincinnati Financial. Emerging technologies such as predictive analytics and IoT devices for real-time risk monitoring offer more granular and proactive risk management, potentially reducing the need for conventional insurance policies. For instance, smart home devices that detect water leaks or fire could lower demand for homeowners' insurance.

Furthermore, the rise of blockchain technology is enabling peer-to-peer (P2P) insurance models. These platforms allow groups of individuals to pool their risk directly, bypassing intermediaries. This disintermediation can lead to lower costs and more customized coverage, directly competing with established carriers. In 2024, the insurtech sector continued to see substantial investment, with P2P platforms gaining traction, particularly in niche markets.

The threat of substitutes is amplified by these technological advancements:

- Technological Disruption: Innovations like AI-powered claims processing and IoT-enabled telematics in auto insurance can offer more efficient and personalized risk assessment, potentially attracting customers away from traditional providers.

- Peer-to-Peer (P2P) Models: Blockchain-based P2P insurance offers a community-driven approach to risk sharing, potentially providing more flexible and cost-effective alternatives for consumers seeking tailored coverage.

- Direct-to-Consumer Platforms: Digital-first insurance providers are leveraging technology to streamline the customer experience, making it easier for consumers to obtain coverage and manage policies, thereby posing a competitive challenge.

- Alternative Risk Transfer: The increasing sophistication of alternative risk transfer mechanisms, such as parametric insurance triggered by specific events, can offer substitutes for traditional indemnity-based policies in certain scenarios.

The threat of substitutes for Cincinnati Financial arises from alternative risk management strategies and financial instruments. Self-insurance and captive insurance companies are gaining traction, allowing large corporations to retain premiums and control claims, as seen with the continued growth in the U.S. captive insurance market in 2023.

Advanced risk management technologies, projected to see significant growth in the global market valued at approximately $37.6 billion in 2023, offer proactive mitigation, reducing reliance on traditional insurance. Government programs also act as substitutes, with US federal support in 2024 impacting demand for private income protection and health insurance.

Sophisticated financial instruments like catastrophe bonds, with approximately $10 billion in issuance volumes in the first half of 2024, and industry loss warranties provide alternative risk transfer, directly competing with conventional reinsurance and commercial policies.

Technological innovations, including AI and IoT for risk monitoring, and peer-to-peer insurance models gaining traction in 2024, further challenge traditional insurers by offering more efficient and personalized risk assessment and direct risk sharing.

Entrants Threaten

The insurance industry, especially for companies like Cincinnati Financial that offer a broad range of products, requires immense capital. This is primarily due to strict regulatory solvency mandates and the need to adequately reserve for future claims. For instance, as of the end of 2023, Cincinnati Financial reported total admitted assets of $91.4 billion, illustrating the scale of financial resources involved.

These substantial capital requirements act as a significant hurdle, effectively discouraging many prospective competitors from entering the market. The sheer financial commitment needed to establish and operate an insurance company at a competitive level is a formidable barrier.

The insurance industry is a maze of state and federal regulations, demanding rigorous licensing, adherence to solvency standards, product approvals, and robust consumer protection measures. For any newcomer, understanding and complying with this intricate and constantly shifting regulatory framework presents a significant barrier to entry.

Brand recognition and trust are paramount in the insurance sector, a fact underscored by Cincinnati Financial's enduring market presence. In a business built on promises of future security, consumers overwhelmingly gravitate towards insurers with a demonstrated history of financial strength and dependable claims processing. This inherent customer preference for established players acts as a formidable barrier to entry for new competitors, as cultivating such deep-seated trust and widespread brand awareness is a process that typically spans decades, not years.

Established Distribution Networks

Cincinnati Financial benefits from its extensive network of independent agents, a key distribution channel that new entrants struggle to replicate. These agents, often with long-standing relationships and deep customer loyalty, represent a significant barrier to entry, making it difficult for newcomers to gain market share.

Building a comparable distribution system requires substantial investment and time, as new entrants must convince agents to switch allegiances or establish entirely new relationships. For instance, in 2024, the insurance industry continued to see a strong reliance on agent networks, with many independent agencies representing multiple carriers, further solidifying the loyalty to established players like Cincinnati Financial.

- Established Agent Relationships: Cincinnati Financial's long-standing partnerships with independent agents provide immediate access to a broad customer base.

- Customer Loyalty: Agents often foster deep loyalty with their clients, making it challenging for new entrants to attract business.

- Distribution Costs: Replicating an established distribution network involves significant upfront costs for marketing, training, and incentivizing new agents.

- Market Access: New entrants face hurdles in gaining access to the same customer segments that Cincinnati Financial's agents already serve effectively.

Data, Technology, and Expertise

The insurance industry, including companies like Cincinnati Financial, is increasingly driven by data, sophisticated technology, and specialized expertise. New players entering this market face significant hurdles in acquiring the necessary infrastructure and talent.

Modern insurance operations depend on massive datasets, advanced analytics, and artificial intelligence for critical functions like underwriting and pricing. This technological backbone requires substantial upfront investment.

- Data Acquisition Costs: New entrants must invest heavily in acquiring and managing vast amounts of customer and market data, essential for accurate risk assessment and competitive pricing.

- Technological Infrastructure Investment: Building or licensing advanced analytics platforms, AI capabilities, and secure IT systems represents a significant capital expenditure, estimated to be in the tens of millions for a robust setup.

- Talent Acquisition and Retention: The need for skilled actuaries, data scientists, and AI specialists creates a competitive and costly labor market, with top talent commanding high salaries and benefits. For instance, in 2024, the average salary for a senior data scientist in the finance sector often exceeded $150,000 annually.

Without these substantial investments, new entrants will struggle to achieve the scale and analytical sophistication needed to compete effectively with established players like Cincinnati Financial, which have already built these capabilities over years.

The threat of new entrants for Cincinnati Financial is relatively low due to the substantial capital requirements, stringent regulatory environment, and the established brand loyalty that new companies struggle to overcome. Significant upfront investment in technology and talent further erects barriers, making market entry a formidable challenge.

The insurance sector's reliance on deep customer trust and extensive agent networks, cultivated over decades by incumbents like Cincinnati Financial, acts as a powerful deterrent for newcomers. Building a comparable distribution system and a reputable brand from scratch is a time-consuming and incredibly expensive endeavor.

| Barrier Type | Description | Impact on New Entrants | Example Data (Cincinnati Financial) |

|---|---|---|---|

| Capital Requirements | High solvency mandates and claims reserves | Significant financial hurdle | Total admitted assets of $91.4 billion (end of 2023) |

| Regulatory Complexity | Licensing, solvency, product approvals | Demands extensive legal and compliance resources | Navigating state-specific insurance laws |

| Brand Recognition & Trust | Consumer preference for established, financially strong insurers | Difficult to gain customer loyalty | Decades of market presence and claims history |

| Distribution Networks | Established relationships with independent agents | Challenging to replicate access to customers | Extensive network of agents nationwide |

| Technological & Data Sophistication | Need for advanced analytics, AI, and data infrastructure | Requires substantial investment in technology and talent | Investment in data science and underwriting platforms |

Porter's Five Forces Analysis Data Sources

Our Cincinnati Financial Porter's Five Forces analysis is built upon a foundation of reliable data, including the company's annual reports, SEC filings, and industry-specific market research from firms like AM Best. We also incorporate insights from financial news outlets and economic data providers to gauge competitive pressures.