Cincinnati Financial Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cincinnati Financial Bundle

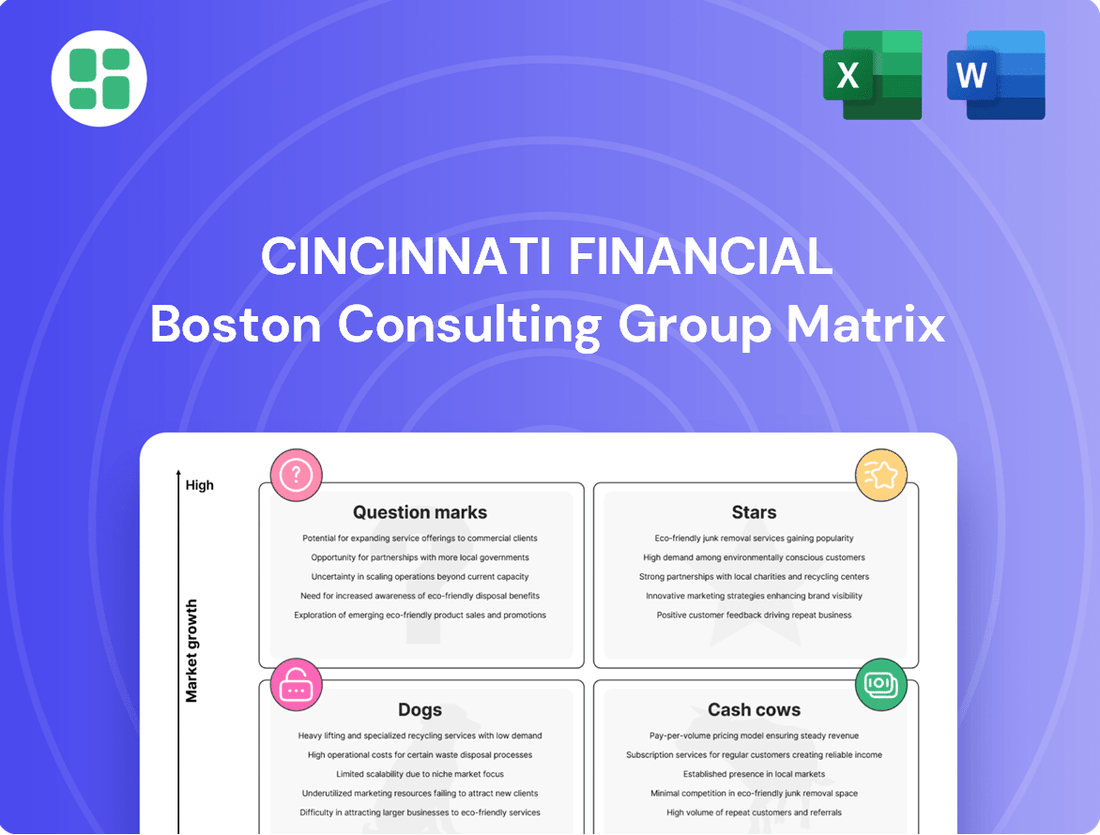

Curious about Cincinnati Financial's strategic positioning? This preview offers a glimpse into its market share and growth potential, but to truly understand where its business units shine and where they might be struggling, you need the full picture.

Unlock a comprehensive analysis of Cincinnati Financial's portfolio, revealing its Stars, Cash Cows, Dogs, and Question Marks. Our full BCG Matrix report provides the detailed insights and actionable strategies you need to make informed investment decisions and optimize resource allocation.

Don't miss out on the opportunity to gain a competitive edge. Purchase the complete BCG Matrix today and equip yourself with the knowledge to navigate the market with confidence and drive future growth.

Stars

Cincinnati Financial's commercial lines new business is a strong performer, experiencing robust growth. In the first quarter of 2025, net written premiums in this segment rose by 8%, followed by a 9% increase in the second quarter of 2025. This upward trend is largely driven by increased agency renewal and new business, highlighting the segment's appeal and expanding market presence.

The profitability of this segment is also noteworthy, as evidenced by an improving combined ratio. This suggests that the growth is not only in volume but also in financial health, reinforcing its position as a leader within the property and casualty insurance market.

The Excess and Surplus (E&S) lines segment, including Cincinnati Global, is a significant growth driver for the company. Net written premiums in this area saw a robust 15% increase in the first quarter of 2025, followed by a strong 12% rise in the second quarter of 2025.

Cincinnati Global, a key part of this segment, delivered exceptional performance with a 45% premium growth in Q2 2025. This surge is largely attributed to the successful expansion of its specialized product offerings, catering to unique and evolving market needs.

The E&S market offers specialized coverage solutions, and its dynamic nature presents a high-growth potential. This segment's strong profitability further solidifies its position as a crucial engine for Cincinnati Financial's overall expansion and success.

Cincinnati Financial's strategic expansion of its independent agency network is a key element of its growth. This approach fuels development across all its product offerings.

The company demonstrated this commitment by appointing 137 new agencies in the first quarter of 2025. This follows an even more substantial effort in 2024, with 304 new agency appointments throughout the entire year.

This aggressive growth strategy directly boosts market penetration and opens up new business avenues. It's particularly impactful for standard market property casualty production, effectively positioning these newly established networks as significant growth assets for the company.

Cincinnati Private Client Program

The Cincinnati Private Client Program is a key component of Cincinnati Financial's strategy, focusing on the high-net-worth segment within personal lines insurance. This initiative has demonstrated substantial momentum.

In the second quarter of 2025, net written premiums for the Cincinnati Private Client product surged by an impressive 25%. This robust growth underscores the program's success in capturing a significant share of a valuable market niche.

- High-Net-Worth Focus: The program specifically targets affluent individuals, a segment known for its demand for specialized and comprehensive insurance solutions.

- Strong Premium Growth: A 25% increase in net written premiums in Q2 2025 highlights the program's ability to attract and retain high-value clients.

- Market Share Expansion: This growth directly translates to an increasing market share for Cincinnati Financial in the lucrative private client insurance space.

- Strategic Importance: The program's success contributes significantly to the overall premium growth of Cincinnati Financial's personal lines business.

Catastrophe Reinsurance Capacity

Cincinnati Financial has bolstered its catastrophe reinsurance capacity, reaching $1.8 billion. This strategic move significantly strengthens its financial resilience against severe weather events, ensuring it can manage substantial claims without compromising liquidity. The expanded capacity is a key component of its business strategy, allowing for more robust underwriting in high-risk zones.

This increased capacity transforms potential vulnerabilities into avenues for growth. By confidently underwriting more business in catastrophe-prone regions, Cincinnati Financial can tap into higher-premium markets. This strategic positioning is crucial for maintaining a competitive edge and driving profitability in an evolving insurance landscape.

- Increased Reinsurance Capacity: Cincinnati Financial's catastrophe reinsurance capacity now stands at $1.8 billion.

- Risk Absorption: This enhancement improves the company's ability to absorb significant losses from major catastrophes.

- Growth Opportunity: The expanded capacity enables more confident underwriting in catastrophe-prone areas, unlocking access to higher-premium markets.

- Financial Resilience: It bolsters liquidity and financial stability during periods of heightened volatility.

The Cincinnati Private Client Program stands out as a star within Cincinnati Financial's portfolio, targeting the high-net-worth market. Its impressive 25% surge in net written premiums in Q2 2025 underscores its success in capturing a valuable niche. This focused approach on affluent individuals, who demand specialized coverage, directly contributes to expanding the company's market share in this lucrative segment.

| BCG Matrix Category | Cincinnati Financial Segment | Key Performance Indicators (Q2 2025) | Strategic Importance |

|---|---|---|---|

| Stars | Cincinnati Private Client Program | 25% Net Written Premium Growth | High-net-worth focus, market share expansion in lucrative niche |

What is included in the product

This BCG Matrix overview provides a tailored analysis of Cincinnati Financial's business units, highlighting which to invest in, hold, or divest.

A clear, visual Cincinnati Financial BCG Matrix provides a one-page overview, instantly clarifying each business unit's strategic position to alleviate decision-making paralysis.

Cash Cows

Cincinnati Financial's core commercial property and casualty underwriting is a true cash cow. This segment consistently delivers strong underwriting profits, proving its resilience even when the market gets a bit bumpy. For instance, in the first quarter of 2025, it achieved a solid combined ratio of 91.9%, followed by a 92.9% in the second quarter of 2025.

These impressive figures highlight the segment's ability to generate more cash than it needs to operate. This means it's a reliable engine for funding other areas of the business or returning value to shareholders, making it a foundational element of Cincinnati Financial's financial strength.

Cincinnati Financial's investment portfolio, a significant asset valued at nearly $30 billion as of March 31, 2025, acts as a powerful cash cow, generating substantial and stable income. This robust portfolio is a cornerstone of the company's financial strength.

The company experienced a notable 14% increase in pretax investment income during the first quarter of 2025. A primary driver of this growth was a remarkable 24% surge in income from its bond holdings, demonstrating effective management of its fixed-income assets.

This consistent and growing investment income stream is crucial, providing reliable cash flow that underpins Cincinnati Financial's operational stability and its ability to sustain dividend payments to shareholders.

Cincinnati Financial's life insurance subsidiary acts as a reliable cash cow, consistently bolstering the company's overall earnings. This segment offers a stable income, less susceptible to the dramatic swings often seen in property casualty insurance, especially those tied to weather events.

In the fourth quarter of 2024, this subsidiary demonstrated its strength by reporting $28 million in net income. Furthermore, earned premiums for term life insurance saw a healthy 4% increase during the same period, underscoring its dependable cash-generating capabilities.

Favorable Prior Accident Year Reserve Development

Cincinnati Financial's consistent favorable prior accident year reserve development is a significant strength, acting as a recurring cash flow enhancer. This trend, evident over many years, positively impacts the company's combined ratio and frees up capital, directly boosting profitability.

This favorable development is a testament to their disciplined underwriting and robust reserving methodologies. For instance, in 2023, Cincinnati Financial reported favorable prior year reserve development of $357 million, a substantial contribution that bolstered their financial performance and underscored their operational excellence.

- Disciplined Underwriting: Favorable development indicates that premiums collected were sufficient to cover claims, with reserves often exceeding the ultimate cost of claims.

- Capital Release: As claims are settled for less than initially reserved, the excess reserve capital is released, available for investment or other corporate uses.

- Profitability Boost: This development directly reduces the current period's reported loss and loss adjustment expenses, thereby improving the combined ratio and overall net income.

- 2023 Impact: The $357 million in favorable prior year reserve development for 2023 significantly contributed to their strong financial results, highlighting its ongoing importance.

Fixed Annuity Product Offerings

Fixed annuity product offerings at Cincinnati Financial likely function as Cash Cows within a BCG Matrix framework. These products are a cornerstone for established insurers, attracting capital from individuals prioritizing guaranteed returns. This consistent inflow of assets under management provides a stable financial foundation.

The predictable cash flow generated by fixed annuities is a significant advantage, even if the market growth for this specific product segment has moderated. For instance, in 2024, the fixed annuity market continued to see strong demand from risk-averse investors. Data from industry reports indicated that sales of fixed indexed annuities, a popular sub-category, saw robust growth throughout the year.

- Stable Market Share: Fixed annuities typically hold a high market share for insurers with a strong reputation.

- Attracts Capital: These products appeal to investors seeking guaranteed returns, bolstering assets under management.

- Predictable Cash Flow: The consistent nature of fixed annuities ensures a reliable revenue stream.

- 2024 Market Performance: Fixed annuity sales, particularly fixed indexed annuities, demonstrated continued strength in 2024, reflecting ongoing investor demand for security.

Cincinnati Financial's commercial property and casualty underwriting, along with its investment portfolio, are strong cash cows. The underwriting segment achieved a combined ratio of 91.9% in Q1 2025 and 92.9% in Q2 2025, indicating profitability. The investment portfolio, valued at nearly $30 billion as of March 31, 2025, saw a 14% increase in pretax investment income in Q1 2025, driven by a 24% surge in bond income.

The life insurance subsidiary also contributes significantly as a cash cow, reporting $28 million in net income in Q4 2024, with earned premiums for term life insurance up 4% in the same period. Additionally, favorable prior accident year reserve development, totaling $357 million in 2023, consistently enhances cash flow and profitability.

| Segment | Metric | 2024/2025 Data | Significance |

|---|---|---|---|

| Commercial P&C Underwriting | Combined Ratio | 91.9% (Q1 2025), 92.9% (Q2 2025) | Consistent profitability, strong cash generation |

| Investment Portfolio | Pretax Investment Income Growth | 14% (Q1 2025) | Stable and growing income stream |

| Life Insurance Subsidiary | Net Income | $28 million (Q4 2024) | Reliable earnings, less volatile |

| Prior Accident Year Reserve Development | Favorable Development | $357 million (2023) | Capital release, profitability boost |

Delivered as Shown

Cincinnati Financial BCG Matrix

The Cincinnati Financial BCG Matrix preview you are viewing is the exact, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises – just a professionally crafted analysis ready for your strategic planning.

Rest assured, the BCG Matrix report you see now is precisely the same comprehensive file that will be delivered to you upon completing your purchase. It's a polished, analysis-ready document designed for immediate application in your business strategy discussions.

What you're previewing is the actual, final Cincinnati Financial BCG Matrix report you'll download after purchase. This ensures you receive a complete, professionally designed document that's ready for immediate editing, printing, or presentation to stakeholders.

Dogs

Cincinnati Financial's personal lines business in catastrophe-exposed areas, notably California, has been a significant drag. The company reported a Q1 2025 combined ratio of 151.3% for personal lines, largely driven by substantial catastrophe-related losses. This performance compelled them to temper new business acquisition and implement what they termed 'California adjustments'.

This specific segment is currently a cash consumer rather than a generator, indicating a challenging market position. It operates within a sector characterized by high unprofitability and limited growth opportunities for the company, placing it firmly in the 'Dog' category of the BCG matrix.

Underperforming equity securities, within Cincinnati Financial's broader investment strategy, presented a challenge in the first quarter of 2025. These specific holdings saw a reduction in fair value by $56 million after taxes, directly contributing to the company's net loss during that period.

This decline highlights how these equities can act as a drag on overall portfolio performance, especially when the market experiences downturns. They represent an asset class that, in difficult economic times, ties up capital without reliably producing positive returns, impacting the company's financial health.

Cincinnati Financial's legacy product lines, while perhaps historically significant, are likely experiencing a decline in market share. These might include older, less innovative insurance offerings or highly specialized policies that no longer resonate with a broad customer base. For instance, if a particular type of property insurance, once a staple, now faces intense competition from newer, more adaptable solutions, its market share would naturally shrink.

These declining segments often require continued administrative oversight and support, yet contribute very little in terms of new premium generation or overall profitability. Think of them as cash traps; resources are tied up in maintaining these products rather than being invested in areas with higher growth potential. In 2023, while specific legacy product data isn't public, the company's overall strategy focuses on growth in its Select, Financial Institutions, and Excess & Surplus segments, implying a de-emphasis on older, less competitive lines.

Segments with Strategic Premium Reductions

Cincinnati Financial's reinsurance segment, particularly Cincinnati Re, experienced a strategic reduction in premiums. In the second quarter of 2025, net written premiums for Cincinnati Re declined by 21%. This reduction was a direct result of the company's commitment to pricing discipline in markets where conditions had softened, signaling a deliberate move away from less profitable or highly competitive reinsurance areas.

These specific market niches are not currently viewed as high-growth or high-share opportunities for Cincinnati Financial. The company's decision to reduce exposure in these segments, especially when profitability is challenged, indicates a strategic pivot to protect margins rather than chase volume.

- Strategic Premium Reduction: Cincinnati Re saw a 21% drop in net written premiums in Q2 2025.

- Pricing Discipline: The reduction was driven by a focus on pricing discipline in softened market conditions.

- Market Niche Assessment: These segments are not considered high-growth or high-share opportunities by the company.

- Minimizing Exposure: The company is actively reducing its involvement in less profitable reinsurance areas.

Inefficient or Outdated Operational Processes

Inefficient or outdated operational processes within Cincinnati Financial can be categorized as dogs in the BCG matrix. These internal functions, while not products, can drain valuable resources like time and capital without bolstering market share or offering a competitive edge. For instance, a 2024 report indicated that companies with legacy IT systems often experience a 20-30% increase in operational costs compared to those utilizing modern, integrated platforms.

In the insurance sector, which is increasingly driven by digital transformation, failing to adopt advanced analytics or automation across all departments is a significant risk. This can lead to inflated expense ratios, directly impacting profitability. In 2023, the average expense ratio for property and casualty insurers in the US was around 35%, but companies lagging in technological adoption could see this figure climb higher, eroding their competitive position.

- Resource Drain: Outdated processes consume excessive time and money, hindering growth.

- Competitive Disadvantage: Lack of digital leverage increases expense ratios and reduces agility.

- Lost Opportunities: Inefficient operations miss chances to improve customer experience and streamline workflows.

- Impact on Profitability: Higher operational costs directly reduce net income and shareholder value.

Cincinnati Financial's personal lines business in catastrophe-exposed areas, particularly California, is a prime example of a 'Dog' in the BCG matrix. The company reported a Q1 2025 combined ratio of 151.3% for personal lines, heavily impacted by substantial catastrophe losses, leading to tempered new business and 'California adjustments'.

This segment is currently a cash consumer, not a generator, operating in an unprofitable sector with limited growth prospects for the company. Similarly, underperforming equity securities, which saw a $56 million after-tax reduction in fair value in Q1 2025, tie up capital without reliable returns. Legacy product lines, facing declining market share and requiring administrative support without significant premium generation, also fall into this category. Finally, inefficient operational processes, such as those reliant on legacy IT systems, increase costs by an estimated 20-30% compared to modern platforms, directly impacting profitability and representing a drain on resources.

| BCG Category | Business Segment/Asset | Market Share | Market Growth | Cash Flow | Strategic Implication |

|---|---|---|---|---|---|

| Dogs | Personal Lines (Cat-Exposed Areas) | Low | Low | Negative | Divest or restructure; focus on profitability over volume. |

| Dogs | Underperforming Equity Securities | N/A | N/A | Negative | Review and reallocate capital to more productive assets. |

| Dogs | Legacy Product Lines | Declining | Low | Negative | Phase out or reposition to minimize resource drain. |

| Dogs | Inefficient Operational Processes | N/A | N/A | Negative | Invest in modernization and automation to improve efficiency. |

Question Marks

Cincinnati Financial's Wildfire Deductible Buyback product, launched in 2024, targets a rapidly expanding, high-risk market. This innovative offering addresses a critical need for homeowners in wildfire-prone areas, providing a crucial financial safety net. As of late 2024, early adoption rates are expected to be modest due to its novelty, but the product is positioned for significant future growth.

Cincinnati Financial is actively investing in advanced AI and data analytics to enhance its core operations, particularly in underwriting, pricing, and claims. This strategic push into high-growth technology areas signifies a commitment to future efficiency and competitive differentiation.

While the company has a history of data utilization, its newest AI implementations are still in their early stages of market penetration. These cutting-edge tools require substantial capital outlay but promise transformative improvements in operational effectiveness and market standing, positioning them as high-growth, low-current-share initiatives.

Cincinnati Financial's strategy of appointing new agencies, particularly those specializing in personal lines, across various states signals a deliberate push into markets where its presence is currently minimal or non-existent. This targeted geographic expansion aims to capture high-growth opportunities by bringing its proven insurance models to previously untapped territories.

In these new or under-penetrated markets, Cincinnati Financial likely holds a low initial market share, characteristic of a 'Question Mark' in the BCG matrix. The company's investment in establishing new agency relationships in these areas reflects a belief in their future growth potential, aiming to build a stronger foothold and replicate its success from more mature markets.

Variable Universal Life (VUL) Offerings

Variable Universal Life (VUL) products are positioned in a robust growth sector, with LIMRA projecting a 5% to 9% increase in the VUL market for 2025. If Cincinnati Financial's current VUL segment represents a smaller part of their overall life insurance business, it signifies a high-potential area where they have room to expand their market presence.

This presents an opportunity for Cincinnati Financial to invest strategically in its VUL offerings. Such investments could potentially elevate these products from a Question Mark to a future Star within the BCG matrix.

- Market Growth: LIMRA forecasts 5%-9% VUL market growth for 2025.

- Strategic Opportunity: Low market share in a high-growth VUL segment.

- Potential Transformation: Investment could shift VUL offerings to a Star.

Strategic Partnerships for Innovation

Strategic partnerships are crucial for Cincinnati Financial to bolster its technological capabilities and access specialized talent in the evolving insurance and asset management sectors. These collaborations, even if nascent, represent investments in innovative areas with the potential to fuel future growth, though their immediate market share impact may be limited.

For instance, in 2024, the insurance industry saw significant investment in InsurTech partnerships, with venture capital funding reaching billions globally. Cincinnati Financial could leverage such trends by forming alliances to develop advanced data analytics or AI-driven customer service platforms. These ventures, while not immediately contributing substantial revenue, are vital for long-term competitive positioning.

- Technological Advancement: Partnerships to develop AI for claims processing or personalized customer experiences.

- Talent Acquisition: Collaborations with tech firms to gain access to specialized data scientists and software engineers.

- Investment in Innovation: Funding early-stage InsurTech startups for potential future integration or acquisition.

- Market Entry: Strategic alliances to explore new digital distribution channels or niche markets.

Cincinnati Financial's expansion into new geographic markets and its investment in emerging technologies like AI and InsurTech partnerships can be viewed through the lens of the BCG matrix, specifically identifying "Question Marks." These initiatives represent areas with high growth potential but currently low market share, requiring significant investment to capture future market leadership.

The company's strategic focus on these areas, such as the 2024 launch of Wildfire Deductible Buyback and its exploration of VUL market growth, aligns with the characteristics of Question Marks. These ventures are positioned in expanding markets but require further development and investment to solidify their market position and transition into potential Stars.

The success of these Question Marks hinges on strategic resource allocation and effective execution. By nurturing these nascent opportunities, Cincinnati Financial aims to build a robust portfolio that balances established Cash Cows with future growth drivers, ensuring long-term competitive advantage.

Cincinnati Financial's strategic initiatives, particularly in new markets and technological advancements, align with the "Question Mark" quadrant of the BCG matrix. These are high-growth potential areas where the company currently holds a low market share, necessitating strategic investment to foster future growth and market penetration.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.