Cincinnati Financial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cincinnati Financial Bundle

Cincinnati Financial operates within a dynamic landscape shaped by evolving political regulations, economic fluctuations, and technological advancements. Understanding these external forces is crucial for predicting future performance and identifying strategic opportunities. Our comprehensive PESTLE analysis delves deep into these factors, offering actionable intelligence to guide your decisions. Download the full version now and gain the clarity needed to navigate the complexities of the insurance market.

Political factors

Government policy and regulation significantly shape Cincinnati Financial's operational landscape. Changes in insurance laws, tax structures, and trade policies directly influence profitability. For example, evolving state-specific insurance regulations, like those concerning data privacy or claims handling, necessitate ongoing compliance adjustments and can impact operational costs.

The political climate, particularly the current US administration's approach to financial services, plays a crucial role in the regulatory environment. Stricter oversight or deregulation efforts can alter competitive dynamics and compliance burdens for companies like Cincinnati Financial. For instance, shifts in capital requirements or solvency standards mandated by regulators can affect how the company manages its balance sheet and capital allocation.

Cincinnati Financial's operations are heavily influenced by political stability, especially within the United States, its primary market. In 2024, ongoing legislative debates and potential policy shifts regarding economic regulation and climate change initiatives could impact the insurance sector's operating environment and investment strategies.

Geopolitical risks, such as the continued global trade tensions and regional conflicts, pose significant threats. For instance, disruptions stemming from international disputes in 2024 could exacerbate supply chain issues, potentially driving up costs for goods and services, which in turn could lead to increased claims payouts and affect the investment returns on Cincinnati Financial's substantial portfolio, estimated to be in the tens of billions of dollars.

Government fiscal policy, including spending and taxation, alongside central bank monetary policy, significantly shapes the economic landscape for Cincinnati Financial. For instance, the Federal Reserve's monetary policy decisions, such as adjustments to the federal funds rate, directly impact the yields Cincinnati Financial can earn on its substantial fixed-income portfolio. As of early 2024, the Fed has maintained a hawkish stance, with interest rates at elevated levels, which generally benefits insurers' investment income.

Monetary policy also influences consumer behavior and demand for financial products. Higher interest rates can make certain life insurance and annuity products less attractive due to increased borrowing costs for consumers and potentially lower returns on competing savings vehicles. Conversely, persistent inflation, a concern in 2023 and early 2024, can increase claims costs for Cincinnati Financial's property and casualty insurance lines, impacting underwriting profitability.

Industry-Specific Lobbying and Advocacy

Cincinnati Financial, like many in the insurance sector, relies on robust industry-specific lobbying and advocacy to navigate the complex regulatory landscape. Organizations such as the American Property Casualty Insurance Association (APCIA) and the National Association of Mutual Insurance Companies (NAMIC) are instrumental in shaping policies. For instance, in 2024, these groups continued to advocate for reforms in areas like climate-related disaster funding and tort reform, which directly impact insurers' profitability and operational stability.

These advocacy efforts are critical for mitigating potential adverse impacts from legislation. Key areas of focus often include solvency requirements, product standardization, and the management of catastrophic risks. For example, discussions around federal backstop programs for cyber insurance or natural catastrophes in 2025 will heavily involve industry input to ensure workable frameworks that don't unduly burden insurers or policyholders.

- Industry Associations: APCIA and NAMIC represent a significant portion of the property and casualty insurance market, providing a unified voice for policy advocacy.

- Key Advocacy Areas: Focus on legislative and regulatory changes affecting capital requirements, risk management, and consumer protection.

- 2024-2025 Priorities: Continued engagement on climate risk, tort reform, and potential federal insurance backstops.

Consumer Protection Regulations and Political Pressure

Political pressure for stronger consumer protection is a significant factor for Cincinnati Financial. This pressure often translates into new regulations affecting how insurance products are designed, priced, and how claims are managed. For instance, there's ongoing political discussion around ensuring fair value in insurance products and increasing transparency in data usage by financial institutions.

These evolving regulatory landscapes can directly impact Cincinnati Financial's operations. Increased compliance requirements can lead to higher operational costs. Furthermore, a proactive approach to data privacy and transparent claims handling is crucial to maintain public trust and avoid negative political attention.

- Increased Compliance Costs: New regulations, such as those mandating clearer policy language or stricter data handling protocols, can necessitate investment in new systems and training, potentially increasing operational expenses.

- Product Design Adjustments: Political pressure may lead to requirements for more standardized or easily understandable product features, potentially limiting product innovation or requiring adjustments to existing offerings.

- Claims Handling Scrutiny: Regulators may impose stricter timelines or transparency requirements for claims processing, requiring enhanced operational efficiency and customer communication strategies.

Government policy and regulation are paramount for Cincinnati Financial, influencing everything from product offerings to capital requirements. In 2024, legislative debates surrounding economic stability and environmental regulations continue to shape the insurance sector's operating environment. Industry associations like APCIA and NAMIC actively engage in advocacy, focusing on key areas such as climate risk and tort reform to mitigate potential negative impacts from new legislation.

The political climate, including the approach of the current US administration to financial services, directly impacts the regulatory landscape. Shifts in capital requirements or solvency standards, for example, affect how Cincinnati Financial manages its balance sheet. Geopolitical risks, such as ongoing global trade tensions in 2024, could also indirectly influence the company through supply chain disruptions and their impact on investment returns.

Monetary policy, particularly the Federal Reserve's stance on interest rates, significantly affects Cincinnati Financial's investment income. As of early 2024, elevated rates generally benefit insurers' fixed-income portfolios. However, persistent inflation remains a concern, potentially increasing claims costs for property and casualty lines and impacting underwriting profitability.

What is included in the product

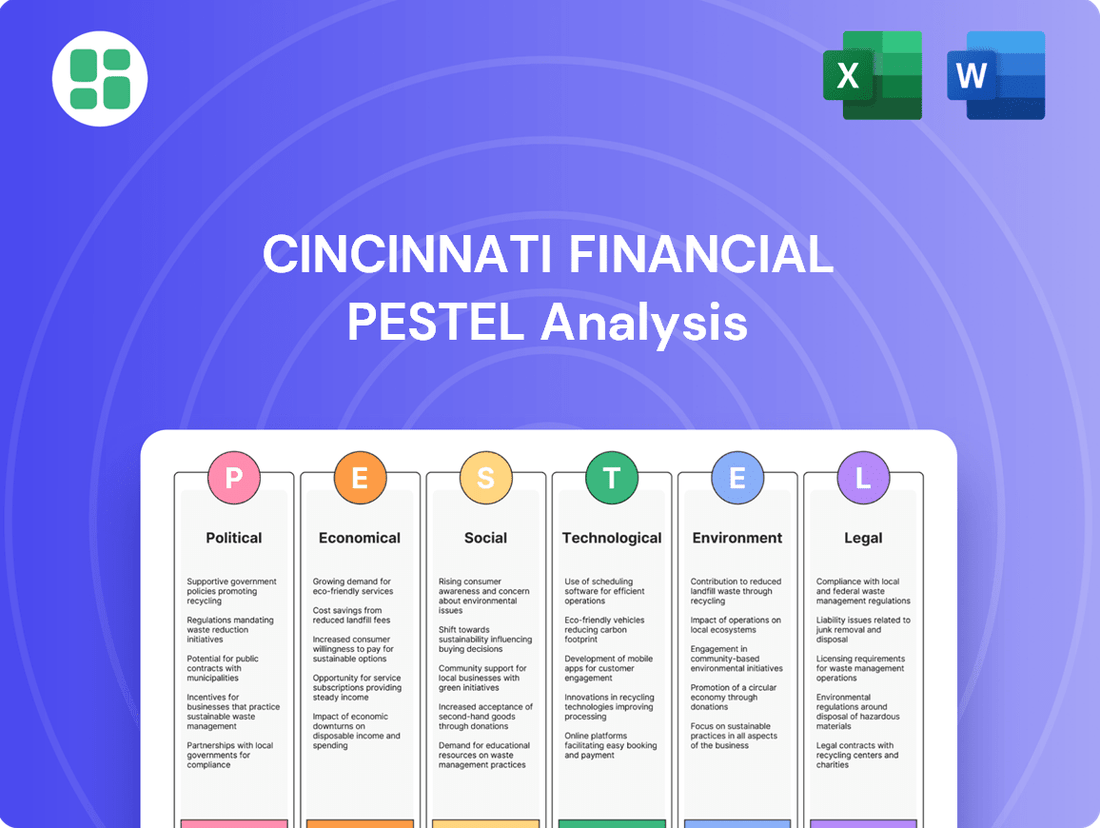

This PESTLE analysis provides a comprehensive examination of the external forces impacting Cincinnati Financial, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It offers actionable insights into how these macro-environmental trends present both challenges and strategic opportunities for the company.

A concise Cincinnati Financial PESTLE analysis summary provides a clear overview of external factors, relieving the pain point of wading through lengthy reports during critical decision-making.

Economic factors

The U.S. economy is showing resilience, with real GDP growth projected at 2.3% for 2024 and 1.9% for 2025, according to the Congressional Budget Office (CBO) as of May 2024. This sustained growth generally supports demand for Cincinnati Financial's insurance products, as businesses and individuals are more likely to invest in coverage during expansionary periods.

However, recession risks, while moderated, remain a consideration. The CBO's baseline forecast anticipates a slowdown in GDP growth in the latter half of 2024, though it does not project a recession. Should economic conditions worsen, leading to a contraction, Cincinnati Financial could experience reduced premium growth and potentially higher claims frequency in certain insurance lines, impacting overall profitability.

Interest rate fluctuations significantly impact Cincinnati Financial's profitability, especially within its life insurance and annuity offerings and the income derived from its extensive bond holdings. As of early 2024, the Federal Reserve maintained a hawkish stance, with benchmark rates hovering around 5.25%-5.50%, a level not seen in decades, which generally benefits investment income for insurers.

However, this environment presents a double-edged sword. While higher rates bolster investment income, they can also dampen consumer appetite for certain fixed-income products due to increased competition from higher-yielding alternatives like Treasury bills. Conversely, a projected decline in rates, anticipated by many economists for late 2024 and into 2025, could compress investment margins and necessitate strategic adjustments to product pricing to maintain competitive returns.

Inflation significantly impacts Cincinnati Financial by increasing the cost of claims. For example, the U.S. Consumer Price Index (CPI) saw a notable rise, reaching 4.9% year-over-year in April 2024, up from 3.4% in March. This means repairing vehicles or rebuilding homes after an insured event becomes more expensive, directly affecting claims payouts.

If Cincinnati Financial's premium rates don't rise in tandem with these escalating claims costs, underwriting profitability can be squeezed. This requires the company to implement dynamic pricing strategies and closely monitor economic trends to ensure premiums adequately cover potential losses, especially in a high-inflation environment.

Unemployment Rates and Consumer Spending

Unemployment rates significantly impact Cincinnati Financial's ability to sell insurance, especially for individuals. When more people are out of work, they have less disposable income, making it harder to pay for premiums on things like auto or homeowners insurance. This can lead to policy cancellations or people opting for less coverage to save money.

For instance, the U.S. unemployment rate remained relatively low in early 2024, hovering around 3.9% as of April 2024. While this generally supports consumer spending, any uptick could directly affect demand for personal insurance lines.

Consumer spending habits also play a crucial role, influencing Cincinnati Financial's commercial insurance business. If consumers are spending less, businesses may scale back operations, reduce inventories, or delay investments, all of which can alter the types and values of assets that need insuring. This shift affects the company's exposure and the types of commercial policies in demand.

- U.S. Unemployment Rate (April 2024): Approximately 3.9%.

- Impact on Personal Lines: Higher unemployment can lead to policy cancellations and reduced coverage as consumers prioritize essential spending.

- Impact on Commercial Lines: Weak consumer spending can cause businesses to reduce assets, altering insurance needs.

- Economic Sensitivity: Insurance demand is closely tied to consumer confidence and the overall health of the economy, directly influenced by employment levels.

Investment Market Performance

The performance of equity and fixed-income markets directly influences Cincinnati Financial's investment portfolio, a key driver of its profitability. For instance, in the first quarter of 2024, the S&P 500 saw a notable increase, contributing positively to investment income for companies with significant equity holdings. Conversely, shifts in interest rates, as seen with the Federal Reserve's monetary policy adjustments throughout 2024, can impact the value of fixed-income assets.

Market volatility, such as the fluctuations observed in bond yields during late 2024, can result in investment losses, impacting book value and overall financial stability. This underscores the critical need for robust diversification and diligent risk management across Cincinnati Financial's investment assets to mitigate potential downturns.

Key market performance indicators relevant to Cincinnati Financial's portfolio include:

- Equity Market Returns: The S&P 500's performance in 2024, with its average quarterly returns, directly affects the value of Cincinnati Financial's equity investments.

- Fixed-Income Yields: Changes in U.S. Treasury yields and corporate bond spreads throughout 2024 influence the income generated and the market value of the company's bond holdings.

- Interest Rate Environment: Federal Reserve policy decisions and their impact on the overall interest rate landscape in 2024 are crucial for valuing fixed-income securities.

- Market Volatility Indices: Measures like the VIX, which indicate market uncertainty, provide insights into the risk profile of Cincinnati Financial's investment portfolio.

The U.S. economy is projected to grow, with real GDP expected at 2.3% in 2024 and 1.9% in 2025, supporting insurance demand. However, elevated interest rates around 5.25%-5.50% benefit investment income but could dampen consumer demand for some products. Inflation, with CPI at 4.9% year-over-year in April 2024, increases claims costs, pressuring underwriting profitability if premiums don't keep pace.

The relatively low U.S. unemployment rate of approximately 3.9% in April 2024 generally supports personal insurance sales. However, any increase could reduce disposable income, leading to policy cancellations. Weak consumer spending, influenced by economic conditions, can also impact commercial insurance needs as businesses adjust operations.

| Economic Factor | 2024 Data/Projection | Impact on Cincinnati Financial |

|---|---|---|

| Real GDP Growth | 2.3% (2024) | Supports demand for insurance products. |

| Federal Funds Rate | 5.25%-5.50% (Early 2024) | Boosts investment income, but may affect consumer demand for certain products. |

| Inflation (CPI) | 4.9% YoY (April 2024) | Increases claims costs, potentially squeezing underwriting margins. |

| Unemployment Rate | 3.9% (April 2024) | Low rate supports personal insurance sales; increases could reduce demand. |

What You See Is What You Get

Cincinnati Financial PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Cincinnati Financial delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides actionable insights for strategic planning.

Sociological factors

Demographic shifts significantly influence insurance demand. As the U.S. population ages, projected to have over 73 million people aged 65 and older by 2030, there's a growing need for products like annuities and long-term care insurance. This trend, coupled with changing household compositions, requires insurers like Cincinnati Financial to adapt their product portfolios to meet evolving customer needs.

Evolving lifestyles are reshaping risk landscapes for insurers like Cincinnati Financial. Increased urbanization, for instance, can lead to higher concentrations of property risk, while shifts in commuting habits, such as a rise in remote work, might alter auto insurance needs. The adoption of smart home technology also introduces new cyber and property risks that insurers must consider.

Public perception of risk significantly influences demand for insurance products. Following major cyberattacks in 2024, for example, businesses are increasingly seeking robust cyber insurance policies. Similarly, heightened awareness of climate-related events is driving greater interest in specialized property coverage, impacting the types of policies Cincinnati Financial might see increased demand for.

Modern consumers, across demographics, now demand intuitive digital interactions and personalized services from their insurance providers. This societal trend means Cincinnati Financial must continually enhance its online platforms and mobile applications to meet these evolving expectations for convenience and transparency.

The increasing reliance on digital channels for communication and transactions is a significant sociological factor. For instance, a 2024 survey indicated that over 70% of insurance policyholders prefer managing their accounts and claims online, highlighting the need for robust digital infrastructure.

Cincinnati Financial's ability to adapt to these consumer preferences for digitalization directly impacts customer acquisition and retention. By investing in user-friendly digital tools and personalized communication strategies, the company can better align with societal shifts and maintain a competitive edge in the market.

Social Awareness of ESG Issues

Societal awareness of Environmental, Social, and Governance (ESG) issues is increasingly shaping corporate behavior and investment strategies. Consumers and investors alike are scrutinizing companies' impacts beyond financial performance, demanding greater accountability in areas like climate change, labor practices, and board diversity. This heightened awareness directly influences corporate reputation and the cost of capital.

Cincinnati Financial's proactive stance on ESG can significantly enhance its appeal. For instance, a strong commitment to sustainability and ethical operations, coupled with transparent ESG reporting, can attract environmentally conscious customers and socially responsible investors. In 2023, for example, the global sustainable investment market reached an estimated $37.4 trillion, indicating a substantial pool of capital seeking ESG-aligned opportunities.

Key aspects of social awareness impacting Cincinnati Financial include:

- Growing demand for sustainable products and services: Customers are increasingly favoring companies with demonstrable environmental and social responsibility.

- Investor focus on ESG metrics: Investment firms and shareholders are integrating ESG factors into their due diligence and portfolio selection. In 2024, over 80% of institutional investors reported considering ESG factors in their investment decisions.

- Employee expectations for ethical workplaces: A company's social impact and internal governance practices influence its ability to attract and retain top talent.

- Regulatory and public pressure for transparency: Companies are facing increased scrutiny and expectations for clear, comprehensive ESG disclosures.

Workforce Dynamics and Talent Availability

Societal shifts are significantly reshaping the workforce, impacting companies like Cincinnati Financial. An aging population, for instance, means a potential loss of experienced professionals, while younger generations, like Gen Z, bring different expectations regarding work-life balance and company culture. This dynamic necessitates adaptive strategies for talent acquisition and retention.

The availability of skilled talent, especially in critical areas, is a key concern. The insurance industry, for example, faces a growing need for professionals proficient in data analytics and artificial intelligence to drive innovation and operational efficiency. Cincinnati Financial's ability to attract and keep these specialized individuals will directly influence its competitive edge.

Consider these workforce dynamics:

- Aging Workforce Impact: As of 2023, the U.S. Bureau of Labor Statistics projected that by 2030, 22% of the workforce will be 65 and older, potentially leading to knowledge gaps and increased demand for succession planning.

- Generational Expectations: Surveys in 2024 consistently show younger workers prioritizing flexible work arrangements and meaningful company missions, influencing recruitment strategies.

- Talent Shortages: The demand for data scientists and AI specialists outstrips supply, with industry reports in late 2024 indicating a significant deficit in qualified candidates across various sectors, including finance and insurance.

Societal expectations for ethical business practices and corporate social responsibility are intensifying, influencing consumer trust and investor decisions. Consumers are increasingly aligning their purchasing habits with companies demonstrating genuine commitment to social good, a trend amplified by social media's reach. This societal shift means companies like Cincinnati Financial must actively showcase their positive impact beyond profit margins to maintain relevance and a strong brand reputation.

Technological factors

Cincinnati Financial's strategic advantage hinges on its embrace of digital transformation and automation. The insurance sector is rapidly adopting AI and machine learning for underwriting, claims, and customer interactions, aiming for greater efficiency and lower costs. For instance, by 2024, it's projected that AI in insurance will save the industry billions annually through optimized processes.

Leveraging these advancements allows Cincinnati Financial to streamline its operations, minimize human error, and boost overall productivity. Companies that effectively integrate automation are seeing significant improvements in turnaround times and customer satisfaction. This digital shift is not just about technology; it's about fundamentally improving how business is conducted to remain competitive.

Artificial intelligence and machine learning are fundamentally reshaping how Cincinnati Financial operates, particularly in risk assessment and fraud detection. These technologies allow for more sophisticated analysis of vast datasets, leading to improved underwriting accuracy and faster claims processing.

By leveraging AI-driven tools, the company can gain deeper insights into customer behavior and identify potential risks more effectively. For instance, AI can analyze patterns that might indicate fraudulent activity, saving significant costs. In 2024, the insurance industry saw a notable increase in AI adoption for these purposes, with many firms reporting enhanced efficiency.

However, the increasing reliance on AI also brings ethical considerations and regulatory scrutiny. Ensuring fairness, transparency, and data privacy in AI algorithms is paramount. As of early 2025, discussions around AI governance in financial services are intensifying, with regulators keen to establish clear guidelines for its responsible implementation.

Cincinnati Financial leverages big data analytics and predictive modeling to refine its insurance offerings. This allows for more accurate risk assessment, which is crucial in the insurance sector. For instance, by analyzing vast amounts of historical claims data and external factors, the company can better predict future losses and adjust premiums accordingly, ensuring profitability and competitiveness.

The ability to process and interpret large datasets provides a significant technological edge. In 2024, the insurance industry saw a continued surge in data utilization, with companies investing heavily in AI and machine learning for underwriting and claims processing. Cincinnati Financial's focus on these areas helps them identify emerging market trends and tailor products to specific customer segments more effectively than competitors relying on traditional methods.

Predictive analytics is paramount for Cincinnati Financial to maintain its market position. By anticipating customer needs and potential risks through sophisticated data analysis, the company can proactively develop new insurance products and services. This data-driven approach is essential for staying ahead in an increasingly competitive and data-intensive financial services landscape, as evidenced by the industry-wide trend of increased spending on data analytics solutions throughout 2024 and projected into 2025.

Cybersecurity and Data Protection Technologies

As Cincinnati Financial's operations increasingly rely on digital platforms, advanced cybersecurity and data protection technologies are absolutely crucial. Safeguarding sensitive policyholder information against breaches and cyberattacks is paramount for preserving customer trust and preventing severe financial and reputational harm. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the immense financial risk involved.

The company must stay ahead of evolving data security regulations, such as GDPR and CCPA, which impose strict requirements on data handling and privacy. Failure to comply can result in substantial fines. In 2023, regulatory fines for data privacy violations globally exceeded $3.5 billion, underscoring the financial penalties for non-compliance.

- Increased Investment in AI-driven threat detection: Cincinnati Financial is likely investing in AI to proactively identify and neutralize cyber threats in real-time, a trend seen across the insurance sector.

- Enhanced Data Encryption and Access Controls: Implementing robust encryption for all sensitive data and stringent access controls are fundamental to protecting policyholder information.

- Continuous Employee Training on Cybersecurity Best Practices: Human error remains a significant vulnerability; therefore, ongoing training for employees on phishing awareness and secure data handling is vital.

- Adherence to Emerging Data Privacy Laws: Staying abreast of and complying with new data protection legislation globally is essential to avoid legal repercussions and maintain customer confidence.

InsurTech Innovations and Partnerships

The insurance landscape is being reshaped by InsurTech startups, bringing innovative technologies like telematics, IoT, blockchain, and smart contracts. These advancements are creating new business models and enhancing customer experiences. For instance, telematics data allows for more personalized auto insurance premiums, rewarding safe driving habits.

Cincinnati Financial faces the strategic imperative to engage with these InsurTech advancements. This could involve forging partnerships or even acquiring InsurTech companies to integrate cutting-edge solutions, thereby enriching its product portfolio and maintaining a competitive edge. The global InsurTech market was projected to reach $11.1 billion in 2024, highlighting the significant investment and growth in this sector.

- Telematics Adoption: Increased use of telematics in auto insurance, with projections indicating a substantial rise in connected car policies by 2025, offering data-driven insights for risk assessment.

- IoT Integration: Insurers are exploring Internet of Things (IoT) devices for property and casualty insurance, enabling real-time risk monitoring and faster claims processing.

- Blockchain Potential: Blockchain technology is being piloted for fraud detection and streamlining claims, promising greater transparency and efficiency in transactions.

- Partnership Opportunities: Collaborations with InsurTech firms can provide access to specialized technologies and customer segments, fostering innovation and market expansion.

Cincinnati Financial's technological advancement is driven by AI and big data analytics, enhancing underwriting accuracy and claims processing efficiency. For example, AI in insurance is projected to save the industry billions annually by 2024, a trend Cincinnati Financial leverages. The company utilizes predictive modeling to refine offerings and anticipate customer needs, a strategy supported by the insurance industry's increased spending on data analytics solutions throughout 2024.

Legal factors

The insurance sector operates under a robust web of regulations, spanning both federal and state jurisdictions within the United States. These rules are critical for maintaining industry stability and consumer protection.

Modifications to solvency requirements, capital adequacy mandates, or the intricacies of licensing procedures can directly influence Cincinnati Financial's operational capacity and its avenues for growth. For instance, the National Association of Insurance Commissioners (NAIC) continually reviews and updates solvency standards, with recent discussions in 2024 focusing on enhanced capital requirements for certain lines of business, potentially affecting insurers like Cincinnati Financial.

Adhering to these multifaceted and evolving regulatory landscapes represents an ongoing and substantial commitment for Cincinnati Financial, demanding significant resources for compliance and strategic adaptation.

Cincinnati Financial, like all insurers, must navigate a complex web of data privacy and security laws. Regulations such as the California Consumer Privacy Act (CCPA) and potential federal privacy legislation dictate how personal data can be collected, stored, and utilized, impacting everything from customer onboarding to claims processing.

Industry-specific frameworks, like the National Association of Insurance Commissioners (NAIC) model laws on data security, further mandate robust cybersecurity measures. Failure to comply with these evolving legal requirements can result in significant financial penalties, with CCPA violations potentially leading to fines of $2,500 to $7,500 per violation, and severe reputational damage that can erode customer trust and market share.

Consumer protection laws are a significant legal factor for Cincinnati Financial. These regulations, like the Fair Credit Reporting Act and state-specific unfair claims settlement practices acts, mandate transparency in policy terms and fair handling of claims. For instance, in 2024, the National Association of Insurance Commissioners (NAIC) continued to emphasize consumer protection, with states like California and New York proposing stricter guidelines on data privacy and algorithmic fairness in insurance pricing, directly impacting how Cincinnati Financial underwrites and interacts with its policyholders.

Antitrust and Competition Laws

Antitrust and competition laws are crucial for Cincinnati Financial, as they ensure a level playing field in the insurance sector. These regulations prevent any single entity from dominating the market, which directly impacts how Cincinnati Financial can pursue growth through mergers, acquisitions, or strategic partnerships. For instance, in 2024, regulators continued to scrutinize large insurance deals, signaling ongoing enforcement of these principles.

Compliance with antitrust laws affects Cincinnati Financial's strategic options for market consolidation and expansion. Any proposed combination must demonstrate that it will not substantially lessen competition or create a monopoly. This means that potential deals are thoroughly vetted by bodies like the Department of Justice and the Federal Trade Commission, impacting the timeline and feasibility of such ventures.

- Market Scrutiny: Antitrust laws require careful navigation for any M&A activity by Cincinnati Financial.

- Competitive Landscape: These laws aim to prevent monopolistic practices, ensuring fair competition.

- Strategic Impact: Compliance influences Cincinnati Financial's ability to grow through acquisitions and partnerships.

- Regulatory Oversight: Government agencies actively monitor the insurance market for anti-competitive behavior.

Contract Law and Policy Interpretation

Insurance policies are fundamentally legal contracts, and how they are interpreted is dictated by contract law. This means that shifts in legal precedents or the introduction of new legislation concerning the enforceability of contracts, or even specific wording within policy clauses, can directly influence how claims are settled and the risks insurers face during underwriting. Cincinnati Financial, like all insurers, must continuously monitor and adapt to these legal evolutions.

For instance, in 2024, the U.S. saw ongoing discussions and some state-level legislative actions aimed at clarifying consumer protection in insurance contracts, potentially impacting how ambiguity in policy language is resolved. This necessitates a rigorous and ongoing legal review of Cincinnati Financial's policy wording and its claims handling procedures to ensure compliance and mitigate potential disputes.

- Contractual Basis: Insurance policies are legally binding contracts.

- Legal Interpretation Impact: Changes in contract law affect claims and underwriting.

- Regulatory Scrutiny: 2024 saw continued focus on consumer protection in insurance contracts.

- Proactive Legal Review: Ongoing legal analysis of policy language and claims is crucial.

Cincinnati Financial operates within a highly regulated environment, where compliance with federal and state laws is paramount. Evolving solvency requirements, such as those discussed by the NAIC in 2024 regarding enhanced capital for specific business lines, directly impact operational capacity and growth strategies.

Environmental factors

Cincinnati Financial faces significant headwinds from climate change, with an increasing frequency and intensity of natural disasters like wildfires and hurricanes directly impacting its property and casualty insurance segments. This trend translates to higher claims payouts, as seen in the elevated insured losses from severe weather events in 2023, which reached hundreds of billions globally. The company must continuously refine its risk assessment and pricing strategies to account for these evolving environmental factors, potentially leading to coverage adjustments in high-risk zones.

New environmental regulations, including stricter limits on carbon emissions and pollution, are increasingly shaping the insurance landscape. For Cincinnati Financial, this means potential impacts on the industries it insures, such as manufacturing and transportation, which may face higher compliance costs or shifts in operational models. For instance, the U.S. Environmental Protection Agency's proposed rules for vehicle emissions in 2024 could affect the auto insurance sector.

Furthermore, the growing global emphasis on corporate sustainability is compelling insurers like Cincinnati Financial to integrate Environmental, Social, and Governance (ESG) criteria. This trend influences both investment strategies, steering capital towards more sustainable enterprises, and underwriting decisions, where a company's environmental track record can affect its insurability and premium rates. By mid-2024, many institutional investors were reporting increased allocation to ESG-focused funds, reflecting this broader market shift.

Resource scarcity, such as water shortages or the depletion of key natural resources, directly impacts industries that depend on them. For Cincinnati Financial, this can translate into increased business interruptions and higher operational costs for their commercial clients, ultimately leading to more substantial insurance claims.

Environmental events that disrupt supply chains also have a tangible effect on repair costs for property claims. For instance, a severe drought impacting timber supply could drive up the cost of rebuilding damaged structures, a factor Cincinnati Financial must consider in its risk assessment and pricing models for 2024 and 2025.

Public Perception of Environmental Responsibility

Public and investor scrutiny regarding environmental responsibility significantly impacts a company's brand reputation and customer loyalty. For Cincinnati Financial, demonstrating a proactive stance on climate risks and sustainability initiatives can translate into a tangible competitive edge, attracting environmentally conscious clients and investors. For instance, a growing number of institutional investors, managing trillions in assets, are prioritizing ESG (Environmental, Social, and Governance) factors, with climate risk being a major component. This trend underscores the financial implications of environmental stewardship.

Conversely, a perception of inaction or insufficient commitment to environmental issues can lead to negative public sentiment and potential boycotts or divestment. This can directly affect market share and investor confidence. In 2024, several major corporations faced public backlash and stock price declines due to perceived environmental missteps, highlighting the financial risks associated with poor environmental performance.

- Growing Investor Demand for ESG: As of early 2025, over 70% of global investors consider ESG factors in their investment decisions, with climate change being a primary concern.

- Impact on Brand Loyalty: Surveys in late 2024 indicated that a significant portion of consumers (over 60%) are more likely to support brands with strong environmental commitments.

- Regulatory Scrutiny: Environmental regulations are tightening globally, increasing compliance costs and reputational risks for companies perceived as lagging in sustainability efforts.

- Competitive Differentiation: Insurers like Cincinnati Financial that effectively communicate their climate resilience strategies and sustainable investment portfolios are better positioned to attract and retain customers and capital.

Development in High-Risk Zones

Continued real estate development in high-risk zones, such as floodplains and wildfire-prone areas, is a growing concern for property and casualty insurers like Cincinnati Financial. This trend, often fueled by population migration and housing demand, directly increases exposure to climate-related perils. For instance, the National Association of Realtors reported a significant increase in home sales in coastal areas between 2023 and early 2024, many of which are susceptible to hurricanes and rising sea levels.

This exposure challenges conventional underwriting practices, potentially necessitating higher premiums or even leading to a reduction in available coverage for properties located in these vulnerable regions. Insurers are increasingly re-evaluating risk models to account for the escalating frequency and intensity of natural disasters, a shift that could impact affordability and availability of insurance for homeowners and businesses in affected areas.

- Increased Exposure: Development in flood-prone areas rose by an estimated 10% nationwide from 2020 to 2023, according to FEMA data.

- Underwriting Challenges: Traditional actuarial models struggle to accurately price risk in areas experiencing more frequent extreme weather events.

- Premium Adjustments: Expect potential premium hikes for properties in high-risk zones as insurers adapt to new climate realities.

- Coverage Limitations: Some insurers may limit coverage or exclude certain perils in regions with demonstrably high and increasing risk profiles.

The increasing frequency and severity of climate-related events, such as hurricanes and wildfires, directly impact Cincinnati Financial's property and casualty insurance business, leading to higher claims. Global insured losses from severe weather events in 2023 alone were in the hundreds of billions, a trend expected to continue. This necessitates ongoing refinement of risk assessment and pricing strategies to manage these evolving environmental factors.

PESTLE Analysis Data Sources

Our PESTLE analysis for Cincinnati Financial is built on a robust foundation of data from reputable sources, including financial market reports, government regulatory filings, industry-specific publications, and economic trend analyses. This comprehensive approach ensures that each factor, from political stability to technological advancements, is informed by current and credible information.