CIFI Holdings Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CIFI Holdings Group Bundle

Navigate the complex external environment impacting CIFI Holdings Group with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its operations and future growth. Gain a critical edge by identifying potential risks and opportunities. Download the full analysis now to unlock actionable intelligence and refine your strategic planning.

Political factors

The Chinese government's commitment to stabilizing the property market intensified in late 2024 and is projected to continue through 2025. Key policy initiatives include the expansion of the 'white list' system, designed to direct financial aid to eligible developers facing liquidity challenges. This proactive approach aims to mitigate the impact of declining sales and developer solvency issues, directly shaping the operating landscape for companies like CIFI Holdings.

Further bolstering market stability, the government is accelerating urban housing renovation projects, a move expected to inject capital and stimulate demand. For CIFI Holdings, these government-led initiatives represent both potential opportunities for project acquisition and critical pathways for securing necessary financing in a challenging economic climate. The effectiveness of these 2024-2025 policies will be a significant determinant of the group's financial health and strategic flexibility.

Many major Chinese cities, including Beijing, Shanghai, Guangzhou, and Shenzhen, have eased or removed home purchase restrictions starting in early 2024. This policy adjustment is designed to invigorate housing demand and increase sales activity.

For CIFI Holdings, this relaxation presents a significant opportunity for enhanced sales performance and a more supportive environment for its residential developments, potentially leading to improved revenue streams.

The Chinese government's 'ensuring delivery' mandate is a critical political factor for real estate developers like CIFI Holdings. This directive aims to complete pre-sold but unfinished housing projects, a key concern for homebuyers and social stability.

CIFI Holdings has actively responded to this mandate, successfully delivering a substantial volume of housing units. Between 2022 and the first half of 2024, the company reported the completion and handover of over 40,000 units across various projects, showcasing its adherence to government policy and its commitment to restoring buyer confidence.

Debt Restructuring Support and Oversight

Government initiatives to support property developers through debt resolution, such as the 'white list' mechanism, directly impact companies like CIFI Holdings. This political backing aims to prevent widespread defaults within the sector. CIFI Holdings has demonstrated progress in its offshore debt restructuring, securing agreements with bondholders, which is a direct benefit of this supportive policy environment.

The emphasis on preventing debt defaults underscores a political commitment to stabilizing the real estate market. This stability is vital for CIFI Holdings as it navigates its financial obligations. The company's successful offshore debt restructuring, as reported in early 2024, highlights the effectiveness of these government-led efforts in fostering financial resilience among developers.

- Government Support: The 'white list' mechanism actively facilitates debt resolution for developers.

- CIFI's Progress: CIFI Holdings has achieved significant milestones in its offshore debt restructuring.

- Financial Stability: Political support is crucial for CIFI to manage its liabilities and ensure operational continuity.

- Market Impact: These policies aim to prevent systemic risk and promote stability in the property sector.

Urban Village Renovation Initiatives

The Chinese government is significantly increasing its backing for urban village and dilapidated housing renovation, aiming to transform millions of residential units. This push often includes direct financial compensation for residents and a focus on boosting the availability of affordable housing options. For CIFI Holdings, these government-led urban renewal efforts could translate into new development opportunities within these revitalized areas or collaborations on affordable housing projects.

These initiatives are a key component of China's broader urban development strategy. For instance, in 2024, the government reiterated its commitment to accelerating these renovations, with reports indicating that hundreds of thousands of units were targeted for improvement in the first half of the year alone. This policy shift directly impacts real estate developers like CIFI by creating a more favorable environment for projects focused on upgrading existing urban infrastructure and housing stock.

- Government Support: Increased policy and financial backing for urban village and dilapidated housing renovation projects.

- Resident Compensation: Monetary compensation is a common element, potentially freeing up capital for new housing demand.

- Affordable Housing Focus: Initiatives aim to increase the supply of affordable housing, aligning with CIFI's potential social responsibility and market expansion strategies.

- Development Opportunities: CIFI can leverage these programs for new urban renewal development projects or partnerships.

Government policies aimed at stabilizing the property market, including the 'white list' system and accelerated urban housing renovation, are crucial for CIFI Holdings. These initiatives, active through late 2024 and into 2025, aim to provide financial aid and stimulate demand, directly influencing CIFI's operational and financial strategies.

The relaxation of home purchase restrictions in major Chinese cities since early 2024 is a significant political factor, designed to boost housing demand and sales activity for developers like CIFI. Furthermore, the government's 'ensuring delivery' mandate, which CIFI has actively addressed by completing over 40,000 units between 2022 and mid-2024, underscores a political commitment to market stability and buyer confidence.

Government support for debt resolution, exemplified by the 'white list' mechanism, has directly aided CIFI Holdings in its offshore debt restructuring efforts, as reported in early 2024. This political backing is vital for CIFI's financial resilience and operational continuity, aiming to prevent systemic risks within the real estate sector.

Increased government backing for urban village and dilapidated housing renovation, with hundreds of thousands of units targeted in early 2024, presents new development opportunities for CIFI. This policy shift, coupled with a focus on affordable housing, aligns with CIFI's potential expansion strategies and social responsibility commitments.

| Policy Area | Key Initiative (2024-2025) | Impact on CIFI Holdings | Data Point |

| Market Stabilization | 'White List' System Expansion | Facilitates developer financing and debt resolution. | N/A (Mechanism details) |

| Demand Stimulation | Relaxation of Home Purchase Restrictions | Increased sales activity and revenue potential. | Major cities like Beijing, Shanghai, Guangzhou, Shenzhen eased restrictions. |

| Project Delivery | 'Ensuring Delivery' Mandate | Ensures completion of pre-sold units, builds buyer confidence. | CIFI delivered >40,000 units (2022-H1 2024). |

| Urban Renewal | Support for Village/Dilapidated Housing Renovation | Creates new development and partnership opportunities. | Hundreds of thousands of units targeted for improvement in H1 2024. |

What is included in the product

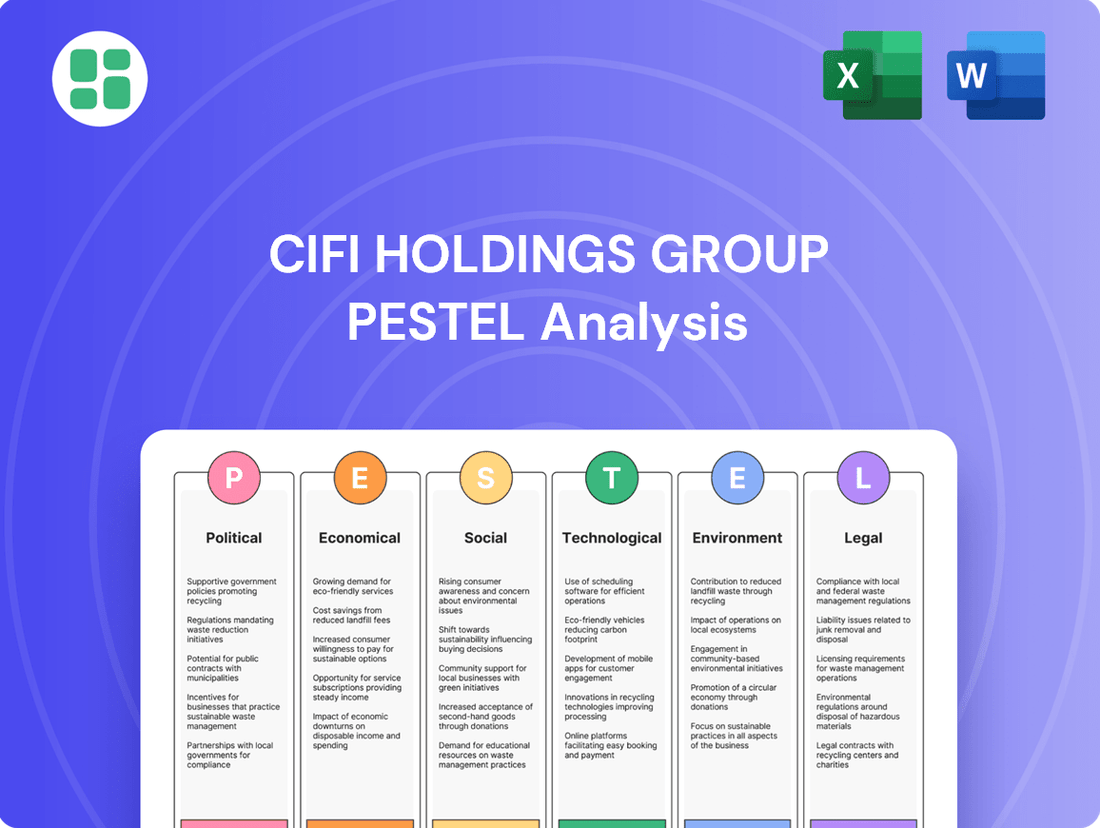

This PESTLE analysis of CIFI Holdings Group examines the influence of political, economic, social, technological, environmental, and legal factors on its operations and strategic planning.

It provides actionable insights into market dynamics and regulatory landscapes relevant to CIFI's real estate development business in China.

A PESTLE analysis for CIFI Holdings Group acts as a pain point reliever by providing a structured framework to proactively identify and strategize around external factors, mitigating potential disruptions and enhancing market responsiveness.

Economic factors

China's real estate sector has been navigating a challenging period since 2020, marked by falling sales prices and substantial unsold inventory, with this trend continuing into 2024. By the first quarter of 2025, however, there are indications that the rate of decline is decelerating, and some stabilization is appearing, especially in major urban centers.

Despite these nascent signs of improvement, the broader real estate market continues to face considerable headwinds. This environment directly influences CIFI Holdings Group's financial results, with its revenue streams and net loss figures showing a clear correlation to these prevailing market dynamics.

In late 2023 and early 2024, China's central bank and financial regulators actively eased mortgage policies. This included reducing minimum down payment ratios and urging commercial banks to lower interest rates on existing home loans. For instance, by the end of 2023, many cities had lowered down payment requirements for first-time homebuyers to as low as 15% and for second homes to 25%.

These policy shifts are designed to alleviate financial pressure on homeowners and reignite the property market. For CIFI Holdings Group, lower mortgage rates directly translate to increased affordability for potential buyers. This can lead to a significant boost in sales volume and a general improvement in consumer confidence within the real estate sector, directly impacting CIFI's revenue streams.

The significant downturn in real estate investment and a sharp drop in land sales, evidenced by a contraction in China's property investment by 9.8% year-on-year in the first four months of 2024, have widened local government fiscal deficits. This directly affects their capacity to fund infrastructure projects or provide support for the property sector.

CIFI Holdings Group's operations in numerous cities mean that the financial stability of these local governments is a crucial indirect factor. A weakened fiscal position for municipalities could limit their ability to invest in public amenities or offer incentives that might benefit CIFI's development projects and future land acquisition plans.

Consumer Confidence and Household Debt

Economic uncertainty and weak consumer confidence are significant headwinds for CIFI Holdings. Surging household debt, a trend observed globally and particularly in markets where CIFI operates, further dampens consumer willingness and ability to commit to major purchases like real estate. For instance, in China, while specific household debt figures for late 2024 or early 2025 are still emerging, the trend of increasing leverage has been a concern for several years, impacting discretionary spending.

CIFI's sales performance is intrinsically linked to this consumer sentiment. When households are burdened by debt and uncertain about the future, their propensity to invest in new homes diminishes. This directly affects CIFI's revenue streams and project pipelines.

- Consumer Confidence: Surveys in key markets often show fluctuating or declining consumer confidence, impacting housing demand.

- Household Debt Levels: Rising household debt ratios indicate less disposable income for new property purchases.

- Impact on Sales: CIFI's sales figures are a direct reflection of consumer purchasing power and willingness.

- Company Strategy: CIFI's focus on quality and timely delivery is a strategic response to rebuild buyer trust in a challenging economic environment.

Industry Consolidation and Competition

The ongoing property market challenges in China have accelerated industry consolidation. State-owned developers are increasingly acquiring assets and expanding their market presence, often benefiting from more robust financial backing and government support.

CIFI Holdings, as a significant private developer, faces heightened competition from these larger, state-backed entities. This dynamic puts pressure on CIFI to differentiate itself and maintain its market position through efficient project execution and superior product quality.

For instance, by the end of 2023, the market share of the top 100 developers in China saw a notable shift, with state-owned enterprises playing a more dominant role. This trend is expected to continue through 2024 and into 2025, intensifying the competitive landscape for private developers like CIFI.

- Increased Competition: State-owned developers are gaining market share, creating a more challenging environment for private firms.

- Financing Advantages: State-backed entities often secure more favorable loan terms and access to capital.

- Strategic Imperative: CIFI must focus on operational excellence and product differentiation to maintain its competitive edge.

- Market Dynamics: The trend of consolidation is likely to persist, requiring continuous adaptation from all industry players.

China's property market stabilization is showing early signs by early 2025, with a deceleration in price declines, particularly in major cities. However, the sector still faces significant challenges, impacting CIFI Holdings Group's financial performance directly, as seen in its revenue and net loss figures which remain sensitive to these market conditions.

Government efforts to boost the market through eased mortgage policies, such as lower down payments (e.g., 15% for first-time buyers by late 2023) and reduced interest rates, aim to improve affordability. These measures are crucial for CIFI, as they directly influence buyer demand and CIFI's sales volumes.

The broader economic climate, marked by weak consumer confidence and high household debt, continues to be a major concern. This dampens the willingness and ability of consumers to make significant purchases like property, directly affecting CIFI's sales pipeline and revenue generation through 2024 and into 2025.

Industry consolidation, with state-owned developers gaining market share due to stronger financial backing, intensifies competition for private firms like CIFI. This trend, evident in the shifting market share by late 2023, necessitates CIFI's focus on operational efficiency and product differentiation to maintain its competitive standing through 2025.

| Economic Factor | Description | Impact on CIFI Holdings Group | Data Point/Trend (as of early 2025) |

| Property Market Performance | Stabilizing but still challenged | Directly affects sales and revenue | Decelerating price declines in major cities |

| Monetary Policy | Easing mortgage policies | Increases buyer affordability and demand | Lower down payment ratios, reduced mortgage rates |

| Consumer Confidence & Debt | Weak consumer sentiment, high household debt | Reduces purchasing power and willingness to buy | Continued concern over household leverage |

| Industry Consolidation | Rise of state-owned developers | Increases competition, pressures private firms | State-owned developers expanding market share |

What You See Is What You Get

CIFI Holdings Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of CIFI Holdings Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides critical insights into the external forces shaping CIFI's strategic landscape.

Sociological factors

China's ongoing urbanization remains a significant driver for real estate, with the urban population expected to hit 1 billion by 2035. This demographic shift directly fuels demand for housing and urban infrastructure, areas where CIFI Holdings Group actively operates.

CIFI's focus on residential and mixed-use developments in numerous Chinese cities positions it to capitalize on this sustained urbanization trend. While the long-term outlook is strong, immediate housing demand is also sensitive to prevailing economic conditions and government policies impacting the property sector.

Consumers are increasingly valuing 'livable quality' in their housing choices, moving beyond mere shelter to seek integrated intelligent home systems, sustainable, eco-friendly designs, and comprehensive community amenities. This shift signifies a demand for homes that enhance overall well-being and offer a richer living experience.

CIFI Holdings Group must therefore recalibrate its development approach, emphasizing the creation of high-quality projects that incorporate these sought-after features to remain competitive and appeal to discerning buyers. For instance, in 2024, the demand for smart home technology in new developments saw a significant uptick, with surveys indicating over 65% of potential buyers considering it a key factor.

Sociological shifts like China's 'lying flat' movement, where younger generations opt for less ambitious lifestyles, and persistently declining birth rates are reshaping consumer preferences. For CIFI Holdings, this could mean a long-term recalibration of demand for traditional family-sized housing. In 2023, China's birth rate fell to a record low of 6.39 births per 1,000 people, a significant drop that underscores the trend.

As household sizes potentially shrink and lifestyle choices diverge, CIFI may need to adapt its property development strategies. This could involve a greater emphasis on smaller, more adaptable living spaces or exploring niche markets catering to different demographic needs, moving beyond its current focus on family-oriented residences.

Demand for Affordable and Rental Housing

The increasing demand for affordable and rental housing is a significant sociological trend. Governments worldwide are implementing policies to boost the supply of such units, aiming to alleviate housing affordability issues for lower and middle-income segments of the population. For instance, China's 14th Five-Year Plan (2021-2025) emphasizes the development of rental housing, with targets to increase the number of rental units in major cities.

This presents a strategic opportunity for companies like CIFI Holdings Group. By venturing into the affordable and rental housing sector, either through direct development or strategic collaborations, CIFI can align its business objectives with national housing priorities. This move can also serve as a diversification strategy, tapping into a growing market segment.

- Government Support: National policies, such as those in China's 14th Five-Year Plan, actively encourage rental housing development.

- Market Gap: A substantial portion of the population faces affordability challenges, creating a strong demand for rental options.

- Diversification Potential: CIFI can leverage its development expertise to enter this growing market, potentially reducing reliance on traditional property sales.

- Alignment with Social Goals: Investing in affordable housing contributes to social stability and meets a critical societal need.

Demographic Shifts and Regional Disparities

China's housing market is experiencing a significant divergence. While major metropolitan areas like Beijing and Shanghai are seeing modest price adjustments and a move towards stability, many smaller, lower-tier cities are still grappling with prolonged market downturns. This polarization directly impacts CIFI Holdings Group, as its development footprint covers a wide range of urban centers.

CIFI's operational strategy must adapt to these regional differences. The company's success hinges on its ability to navigate these varying market conditions, recognizing that a one-size-fits-all approach is no longer effective. For instance, prioritizing investments in cities with strong demographic inflows and economic growth potential becomes crucial for mitigating risks associated with weaker markets.

- Regional Housing Market Trends: Tier-one cities like Shenzhen saw average housing prices decrease by approximately 3.5% year-on-year in early 2024, while some lower-tier cities experienced declines exceeding 7%.

- CIFI's Geographic Exposure: CIFI Holdings has significant project presence in both rapidly developing tier-one and tier-two cities, as well as in secondary and tertiary markets, necessitating a nuanced approach to project selection and sales strategies.

- Demographic Drivers: Urbanization rates and inter-city migration patterns are key indicators. Cities attracting young talent and skilled labor tend to show more resilient housing demand, a factor CIFI likely considers in its strategic planning.

- Economic Disparities: Local economic growth, employment opportunities, and disposable income levels vary considerably across China's urban landscape, directly influencing housing affordability and demand, which CIFI must analyze for each market it operates in.

China's declining birth rate, reaching a record low of 6.39 births per 1,000 people in 2023, alongside the 'lying flat' movement, suggests a potential long-term shift in housing demand away from traditional family-sized units. This sociological trend necessitates that CIFI Holdings Group consider developing more adaptable living spaces and exploring niche markets catering to evolving lifestyle preferences.

The growing emphasis on 'livable quality' is another key sociological factor, with consumers increasingly valuing intelligent home systems and eco-friendly designs. In 2024, demand for smart home technology in new developments saw a significant uptick, with over 65% of potential buyers considering it a key factor, indicating CIFI must integrate these features to remain competitive.

Societal demand for affordable and rental housing is also on the rise, with China's 14th Five-Year Plan prioritizing rental unit development. This presents a strategic opportunity for CIFI Holdings to diversify its portfolio by entering this growing market segment, aligning with national housing priorities and addressing affordability challenges.

| Sociological Factor | Impact on CIFI Holdings | Supporting Data/Trend |

| Declining Birth Rate & 'Lying Flat' | Potential shift in demand from family-sized homes to adaptable living spaces and niche markets. | China's 2023 birth rate: 6.39 per 1,000 people. |

| Emphasis on Livable Quality | Need to integrate intelligent home systems, sustainable design, and community amenities. | Over 65% of potential buyers in 2024 considered smart home technology key. |

| Demand for Affordable/Rental Housing | Opportunity for portfolio diversification into rental development. | China's 14th Five-Year Plan prioritizes rental housing development. |

Technological factors

The China PropTech market is booming, with projections indicating continued robust expansion through 2025. CIFI Holdings can harness these advancements for streamlined property management, optimized leasing, and improved operational efficiency. By integrating technologies like AI, IoT, and advanced data analytics, CIFI can unlock significant value, potentially boosting its competitive edge in the evolving real estate landscape.

The increasing integration of smart home technologies and the Internet of Things (IoT) in residential properties is a significant technological factor, aiming to boost operational efficiency and elevate the resident experience. This trend is particularly evident in the 2024-2025 period, with a noticeable uptick in consumer demand for connected living solutions.

CIFI Holdings Group can leverage this by distinguishing its developments through advanced smart home features. Imagine AI-powered systems that intelligently manage energy consumption, bolster security, and offer seamless appliance control. Such innovations directly address the preferences of today's homebuyers who are actively seeking technologically advanced and convenient living environments.

CIFI Holdings Group can leverage advanced data analytics to gain deeper market insights, predicting trends and pinpointing lucrative investment opportunities. For instance, in 2024, the real estate technology sector saw significant investment, with PropTech firms raising billions globally, indicating a strong push towards data-driven operations.

By integrating these predictive tools, CIFI can refine its land acquisition, project development, and sales strategies, enhancing its ability to adapt to market shifts and optimize resource allocation. This data-centric approach is crucial for navigating the complexities of the 2025 real estate landscape.

Prefabricated Construction and Building Efficiency

CIFI Holdings Group is significantly leveraging prefabricated construction methods across its new developments to boost efficiency and elevate building quality. This technological shift is not just about speed; it’s a strategic move towards reducing energy consumption and lowering carbon footprints, aligning with global green building initiatives.

The adoption of prefabrication by CIFI is a direct response to the growing demand for sustainable and faster construction solutions. This approach allows for greater control over the manufacturing process, leading to higher precision and less waste on-site, contributing to a more environmentally responsible building sector.

- Increased Efficiency: Prefabricated components are manufactured off-site in controlled environments, leading to quicker assembly times and reduced project timelines.

- Enhanced Quality Control: Factory production allows for stringent quality checks at each stage, ensuring a higher and more consistent standard of finished products.

- Sustainability Focus: This method inherently reduces construction waste and can lead to significant energy savings during the operational phase of buildings, supporting CIFI's environmental goals.

- Cost Optimization: While initial investment in prefabrication technology might be higher, the long-term benefits include reduced labor costs, less material waste, and faster project completion, contributing to overall cost savings.

Digital Marketing and Sales Platforms

The real estate sector is rapidly embracing digital transformation, making sophisticated online marketing and sales platforms essential for developers like CIFI Holdings. As more transactions move online, CIFI needs to enhance its digital presence to connect with a tech-savvy customer base.

This involves investing in user-friendly websites, virtual reality property tours, and seamless online transaction capabilities. For instance, by mid-2024, a significant portion of property inquiries in major Chinese cities were originating from digital channels, highlighting the critical need for CIFI to maintain and expand its digital marketing investments.

- Digitalization of Real Estate: CIFI must leverage online platforms to market and sell properties effectively.

- Virtual Tours and Online Transactions: Investment in virtual tours and streamlined online purchase processes is crucial for engaging modern buyers.

- Market Reach: Digital channels are key to reaching a wider, tech-literate audience in the competitive property market.

- Customer Engagement: Robust digital platforms enhance customer interaction and streamline the buying journey.

CIFI Holdings Group is actively integrating advanced technologies like AI and IoT to enhance property management and resident experiences, a trend strongly supported by the booming China PropTech market expected to grow significantly through 2025. The company can leverage these innovations for greater efficiency and a competitive edge.

The increasing adoption of smart home features, driven by consumer demand for connected living solutions through 2024-2025, allows CIFI to differentiate its developments. AI-powered energy management and enhanced security systems are key examples of how CIFI can meet the preferences of tech-savvy homebuyers.

CIFI is also utilizing prefabricated construction methods to boost efficiency and sustainability, aligning with global green building trends. This approach leads to quicker assembly, better quality control, and reduced waste, contributing to a more environmentally responsible construction sector.

The digitalization of real estate necessitates robust online marketing and sales platforms. CIFI's investment in user-friendly websites and virtual tours is crucial, as digital channels are increasingly the primary source of property inquiries, as observed in major Chinese cities by mid-2024.

Legal factors

CIFI Holdings navigates China's intricate property legal landscape, encompassing land use rights, ownership, and development regulations. These laws, constantly evolving, directly influence project viability and compliance. For instance, changes in land auction rules or zoning ordinances can significantly alter development costs and timelines for CIFI.

The company's adherence to these regulations is paramount for its operations and reputation. In 2024, China continued to emphasize stricter enforcement of construction quality and safety standards, requiring CIFI to invest more in quality control and potentially impacting its development pace.

The introduction of the 'white list' mechanism in January 2024 by Chinese regulators aims to direct financial resources towards specific, qualifying real estate projects. This initiative is designed to stabilize the property market by ensuring access to funding for viable developments.

CIFI Holdings Group has demonstrated its engagement with this new regulatory framework, securing a position on the 'white list' for 55 of its projects. This strong participation highlights CIFI's adherence to the updated financing coordination rules and its ability to access crucial loan facilities under the new system.

CIFI Holdings' offshore debt restructuring necessitates navigating intricate legal landscapes, particularly in Hong Kong where a Scheme of Arrangement is being pursued. This legal avenue allows for a court-sanctioned agreement with creditors, a crucial step for financial rehabilitation.

The company has reported substantial progress in its restructuring efforts, including reaching agreements with a significant portion of its creditors. This demonstrates a commitment to working within established legal frameworks to achieve a resolution, a process that began in earnest during 2024.

New Regulations on Property Rentals

New regulations on residential property rentals, set to take effect in September 2025, are designed to bring greater standardization to rental processes and enhance protections for all parties involved. While CIFI Holdings Group is primarily known for property development and sales, its existing property management services and any future expansion into the rental housing market will require meticulous adherence to these new legal frameworks.

These regulations could impact CIFI's operational costs and strategic planning for its property management division. For instance, increased compliance burdens, such as enhanced tenant screening or mandatory maintenance schedules, may arise. The group's ability to adapt swiftly to these changes will be crucial for maintaining its competitive edge in the property sector.

- Standardized Rental Procedures: The new laws aim to create a more uniform approach to lease agreements, deposit handling, and eviction processes across the industry.

- Stakeholder Rights Protection: Key provisions will focus on strengthening tenant rights regarding property condition and landlord responsibilities, alongside safeguarding landlords from non-compliance.

- Impact on Property Management: CIFI's property management arm will need to invest in updated systems and training to ensure full compliance, potentially affecting service fees and operational efficiency.

- Rental Market Dynamics: The regulations could influence the overall attractiveness and profitability of the rental market, impacting CIFI's long-term strategy for rental-focused developments.

Environmental Protection Laws and Building Codes

CIFI Holdings Group navigates a landscape of increasingly rigorous environmental protection laws and green building codes in China. These regulations directly impact its construction methods, the sourcing of materials, and the fundamental design of its properties. The company is incentivized to integrate sustainable and energy-saving technologies into its developments to ensure compliance.

For instance, China's Ministry of Housing and Urban-Rural Development has been progressively tightening standards for building energy efficiency. By the end of 2023, a significant portion of new urban construction projects were mandated to meet higher energy-saving benchmarks, pushing developers like CIFI to adopt advanced insulation, efficient HVAC systems, and renewable energy integration.

- Stricter Emission Standards: Compliance with evolving air and water quality regulations necessitates investment in pollution control technologies during construction and operation.

- Green Building Certifications: Growing emphasis on obtaining green building certifications (e.g., China's Three Star system) influences material selection and design choices, potentially increasing upfront costs but offering long-term operational benefits.

- Waste Management Regulations: Adherence to new rules on construction waste reduction and recycling impacts project logistics and material sourcing strategies.

- Carbon Neutrality Goals: China's national commitment to peak carbon emissions before 2030 and achieve carbon neutrality by 2060 places long-term pressure on the real estate sector to decarbonize, influencing CIFI's strategic planning for future projects.

CIFI Holdings Group operates within China's dynamic legal framework governing real estate, which includes land use, ownership, and development regulations that are subject to frequent updates. The company's ability to secure financing for its projects is now significantly influenced by regulatory initiatives like the January 2024 'white list' mechanism, a program designed to channel funds to qualifying developments. CIFI's successful inclusion of 55 projects on this list underscores its alignment with new financing coordination rules, facilitating access to essential loan facilities.

The company is also navigating complex offshore debt restructuring, primarily through a Scheme of Arrangement in Hong Kong, a legal process requiring court sanction to finalize agreements with creditors. This restructuring, actively pursued throughout 2024, involves significant legal engagement to achieve financial rehabilitation. Furthermore, upcoming regulations on residential property rentals, effective September 2025, will necessitate meticulous compliance for CIFI's property management services, potentially impacting operational costs and strategic planning for rental-focused ventures.

CIFI Holdings Group must also adhere to increasingly stringent environmental protection laws and green building codes in China, impacting construction methods and material sourcing. For example, by the end of 2023, new urban construction projects were mandated to meet higher energy-saving benchmarks, pushing developers like CIFI to adopt advanced technologies. China's commitment to carbon neutrality by 2060 also places long-term pressure on the real estate sector to decarbonize, influencing CIFI's strategic planning.

| Legal Factor | Description | Impact on CIFI Holdings | Key Developments (2024-2025) | Data/Statistics |

| Property Development Regulations | Laws governing land use, zoning, and construction standards. | Influences project viability, costs, and timelines. | Stricter enforcement of construction quality and safety. | 55 CIFI projects on 'white list' for financing. |

| Financial Regulations | Rules related to project financing and debt restructuring. | Affects access to capital and financial stability. | Introduction of 'white list' financing mechanism. | Ongoing offshore debt restructuring via Scheme of Arrangement. |

| Rental Market Regulations | New laws standardizing rental processes and tenant rights. | Impacts property management services and rental strategies. | Regulations effective September 2025. | Potential increase in compliance costs for property management. |

| Environmental Laws | Standards for green building, emissions, and waste management. | Drives adoption of sustainable practices and technologies. | Tightening building energy efficiency standards. | National commitment to peak carbon emissions before 2030. |

Environmental factors

CIFI Group is actively embracing global green building trends, a significant environmental factor influencing its operations. This commitment is evident in their project delivery, with nearly 70% of CIFI's 2024 projects featuring renewable energy sources.

Furthermore, the company demonstrates a strong adherence to sustainability, as 99% of their completed Gross Floor Area (GFA) met stringent green building standards in 2024. This proactive approach aligns with growing environmental awareness and regulatory pressures favoring sustainable construction practices.

CIFI Holdings Group acknowledges the urgency of climate change, aligning with the Paris Agreement's goals for a low-carbon future. The company is actively embedding climate-related risk management into its core business practices, reflecting a strategic commitment to environmental stewardship.

To mitigate its environmental impact, CIFI is focused on reducing energy consumption within its operations. This includes implementing green construction techniques and promoting green office practices across its portfolio, aiming to optimize resource management and lower its carbon footprint.

For instance, in 2023, CIFI reported a reduction in its Scope 1 and Scope 2 greenhouse gas emissions intensity by 5% compared to its 2022 baseline, demonstrating tangible progress in its mitigation efforts. This focus on operational efficiency is a key component of its climate adaptation strategy.

CIFI Holdings Group's commitment to sustainable procurement, initiated in 2016 as part of the Green Supply Chain Action for China's Real Estate Industry, is a cornerstone of its environmental strategy. The company prioritizes sourcing 'green supplies,' ensuring that its partners and materials meet stringent environmental and safety benchmarks. This approach directly contributes to minimizing the ecological impact of CIFI's extensive real estate developments.

Resource Efficiency and Waste Management

CIFI Holdings Group actively manages its environmental footprint by adhering to the 'Design and Construction Standards for Waste Disposal in New Projects.' This ensures rigorous control over construction waste generated throughout its developments.

The company demonstrates a commitment to resource efficiency, notably through efforts to reduce energy consumption intensity within its administrative offices. These initiatives underscore CIFI's dedication to minimizing environmental impact across the entire project lifecycle, from planning to completion.

- Waste Management: Strict adherence to 'Design and Construction Standards for Waste Disposal in New Projects.'

- Resource Efficiency: Focus on reducing energy consumption intensity in administrative offices.

- Lifecycle Impact: Commitment to minimizing environmental impact throughout project development.

Renewable Energy Integration in Projects

CIFI Holdings Group is making strides in integrating renewable energy into its developments. The company is actively installing distributed photovoltaic systems, with a clear objective to embed renewable energy solutions across its entire project portfolio.

This commitment is already evident in their 2024 deliveries. A substantial percentage of projects handed over in 2024 incorporated renewable energy sources, demonstrating CIFI's proactive stance on adopting sustainable energy in the real estate sector.

- Renewable Energy Adoption: CIFI is actively implementing distributed photovoltaic systems.

- Portfolio-Wide Integration: The company aims to incorporate renewable energy across all its developments.

- 2024 Progress: A significant portion of CIFI's delivered projects in 2024 already utilized renewable energy sources.

- Sustainability Focus: This showcases a proactive approach to sustainable energy solutions in real estate.

CIFI Holdings Group is aligning with global green building trends, with nearly 70% of its 2024 projects featuring renewable energy. The company prioritizes sustainable procurement, ensuring partners and materials meet stringent environmental standards, contributing to minimized ecological impact.

CIFI is actively embedding climate-related risk management into its practices, aiming for a low-carbon future in line with the Paris Agreement. In 2023, CIFI reported a 5% reduction in its Scope 1 and 2 greenhouse gas emissions intensity compared to 2022, demonstrating tangible progress in mitigation efforts.

| Environmental Metric | 2023 Performance | Target/Focus |

|---|---|---|

| Renewable Energy in Projects | ~70% of 2024 projects | Portfolio-wide integration |

| Green Building Standards | 99% of completed GFA (2024) | Adherence to stringent standards |

| GHG Emissions Intensity | 5% reduction (Scope 1 & 2 vs 2022) | Lowering carbon footprint |

PESTLE Analysis Data Sources

Our CIFI Holdings Group PESTLE analysis is built on a robust foundation of data from official government publications, reputable financial institutions like the IMF and World Bank, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.