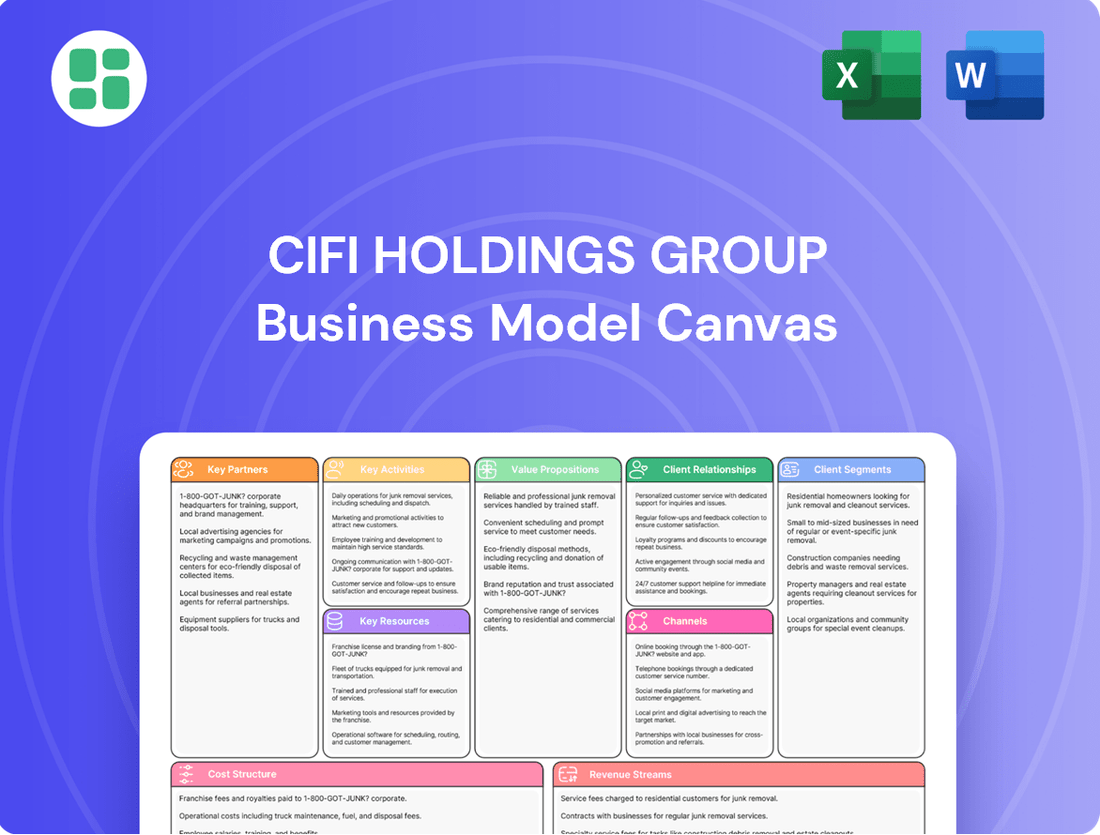

CIFI Holdings Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CIFI Holdings Group Bundle

Discover the strategic core of CIFI Holdings Group with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear view of their operational success.

Unlock the full strategic blueprint behind CIFI Holdings Group's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

CIFI Holdings Group actively cultivates robust ties with local governments throughout China, a critical step in securing land acquisition rights and obtaining essential development permits. These alliances are fundamental for CIFI's extensive urban development initiatives, enabling them to navigate the intricate regulatory framework governing China's real estate sector.

By fostering these governmental partnerships, CIFI can also collaborate on surrounding infrastructure improvements, thereby boosting the attractiveness and accessibility of its projects. This strategic engagement ensures CIFI's long-term operational resilience and facilitates its expansion into new urban markets across the country.

CIFI Holdings Group maintains robust relationships with major banks, investment funds, and other financial institutions. These partnerships are critical for securing the substantial financing needed for land acquisition and construction, supporting the company's significant capital expenditure. For instance, in 2024, CIFI actively managed its debt profile, leveraging these relationships to ensure liquidity and fund its ongoing development pipeline.

CIFI Holdings Group relies on a robust network of construction companies and specialized contractors to bring its diverse property developments to life. These collaborations are fundamental to ensuring projects, from residential complexes to commercial hubs, are completed on time and to a high standard.

In 2024, CIFI continued to emphasize strong relationships with its construction partners, recognizing that efficient project execution hinges on their expertise. Effective coordination and adherence to schedules are paramount for managing costs and meeting the intricate design specifications of their developments.

The company's strategy involves cultivating long-term partnerships with contractors who have a proven track record. This approach fosters greater efficiency and contributes to the consistent quality that CIFI aims for across its portfolio, ultimately supporting its market position.

Material Suppliers and Technology Providers

CIFI Holdings Group's strategic alliances with material suppliers are crucial for maintaining a consistent and affordable supply of construction essentials, fixtures, and decorative elements. These partnerships are vital for upholding quality benchmarks, mitigating procurement uncertainties, and realizing bulk purchasing advantages. For instance, in 2024, CIFI continued to focus on diversifying its supplier base to ensure resilience against market fluctuations.

Collaborations with technology firms are equally important, bringing smart home capabilities, advanced building management systems, and efficient digital sales tools to CIFI's projects. By integrating cutting-edge technology, CIFI can elevate its property appeal and gain a competitive edge. In 2024, CIFI actively explored partnerships to enhance its digital customer experience and property management efficiency.

- Stable Supply Chain: Partnerships ensure timely access to quality construction materials, reducing project delays and cost overruns.

- Cost Management: Strong supplier relationships allow for negotiation of favorable pricing and potential volume discounts, contributing to better project economics.

- Quality Assurance: Collaborations with reputable suppliers help CIFI maintain high standards for the materials used in its developments.

- Technological Advancement: Partnerships with tech providers integrate smart features and digital solutions, enhancing property value and marketability.

Design and Architectural Firms

CIFI Holdings Group partners with premier design and architectural firms to craft properties that are not only functional and innovative but also visually appealing. These collaborations are key to developing distinct value propositions, ensuring CIFI's projects resonate with current market trends and buyer desires.

The firm's commitment to high-quality design directly enhances property value and marketability, effectively drawing in desired customer demographics. For instance, CIFI's focus on sophisticated urban living spaces, often realized through collaborations with renowned architects, has been a consistent driver of sales and brand recognition.

These strategic alliances also extend to incorporating sustainable and green building principles. This focus aligns with growing environmental consciousness and regulatory shifts, ensuring CIFI's developments meet contemporary ecological standards and appeal to environmentally-minded buyers.

- Innovation in Design: Collaborations with firms like Aedas and P&T Group have resulted in award-winning projects, showcasing CIFI's dedication to cutting-edge architectural solutions.

- Market Appeal: High-quality design, a direct outcome of these partnerships, is instrumental in CIFI's ability to command premium pricing and maintain strong sales momentum, as seen in its consistent delivery of sought-after residential and commercial spaces.

- Sustainability Focus: Partnerships increasingly emphasize green building certifications and energy-efficient designs, reflecting CIFI's commitment to environmental responsibility and long-term value creation.

CIFI Holdings Group's key partnerships are foundational to its operational success and market positioning. These include strong alliances with local governments for land acquisition and permits, crucial for navigating China's real estate regulations and enhancing project accessibility through infrastructure collaboration.

The company also maintains vital relationships with financial institutions, securing necessary funding for its extensive development pipeline. In 2024, CIFI actively managed its debt, leveraging these partnerships to ensure liquidity and support ongoing projects.

Furthermore, CIFI relies on a network of construction companies and material suppliers to ensure timely, high-quality project completion and cost management. Collaborations with technology firms are also key to integrating smart features and improving digital customer experiences.

Finally, partnerships with design and architectural firms are essential for creating innovative, appealing, and sustainable properties, directly contributing to enhanced property value and marketability.

What is included in the product

This Business Model Canvas outlines CIFI Holdings Group's strategy of developing and selling residential properties to a broad customer base, leveraging efficient construction and sales channels.

It details CIFI's value proposition of providing quality, affordable housing, supported by strong partnerships and a focus on customer satisfaction.

CIFI Holdings Group's Business Model Canvas offers a clear, one-page snapshot of their strategy, effectively relieving the pain point of complex business model understanding for stakeholders.

This concise and shareable canvas allows for quick identification of CIFI's core components, simplifying strategic discussions and adaptation for new insights.

Activities

CIFI Holdings Group's key activities center on strategically identifying, acquiring, and securing land parcels throughout China's urban centers. This crucial first step involves in-depth market analysis and navigating complex local land regulations to ensure future development potential.

The company's success hinges on its proficiency in these land acquisition processes, as securing prime locations provides a significant competitive edge in the dynamic real estate market. For instance, CIFI's land bank is a testament to its ability to execute this core activity effectively.

CIFI Holdings Group's property construction and project management activities are central to bringing its developments to life. This involves meticulous oversight from initial planning and design through to the final finishing touches. Effective management is crucial for staying on schedule and within budget, while also upholding stringent quality benchmarks across residential, commercial, and mixed-use projects.

The company actively coordinates a network of contractors and manages resources efficiently. Ensuring site safety is a constant priority throughout the entire development process. For example, in 2023, CIFI Holdings reported a significant number of projects under construction, demonstrating the scale of its development pipeline and the importance of robust project management in delivering these properties.

CIFI Holdings Group actively promotes its developed properties through extensive sales and marketing initiatives. These efforts encompass crafting targeted marketing strategies, hosting sales events, and managing dedicated sales teams, all while leveraging digital channels to connect with potential buyers. In 2024, CIFI continued to emphasize brand building and customer trust as crucial elements for driving property sales and ensuring consistent revenue generation.

Property Management Services

CIFI Holdings Group extends its operations beyond property development by offering comprehensive property management services for its completed residential, commercial, and mixed-use projects. This ensures the ongoing value and functionality of its real estate portfolio.

These services encompass essential aspects such as facility maintenance, robust security measures, community engagement programs, and dedicated tenant relations. This holistic approach aims to create positive living and working environments for all occupants.

The property management segment is crucial for CIFI as it generates a consistent, recurring revenue stream. This recurring income diversifies the company's financial base and contributes to its overall profitability and stability.

Furthermore, by providing excellent property management, CIFI cultivates strong customer satisfaction and loyalty. This focus on tenant experience fosters a positive brand image and encourages repeat business and favorable word-of-mouth referrals.

- Recurring Revenue Generation: Property management provides a stable income stream independent of development cycles.

- Asset Value Enhancement: Proactive maintenance and management preserve and increase property values over time.

- Customer Loyalty: High-quality services lead to satisfied tenants, improving retention rates.

- Operational Efficiency: Streamlined management processes optimize resource allocation and cost control.

Real Estate Investment and Portfolio Management

CIFI actively invests in real estate projects, frequently partnering with other entities through joint ventures. This approach allows for shared risk and access to a wider range of opportunities. The company also focuses on the strategic management of its existing property portfolio to maximize returns.

Key activities include rigorous assessment of market trends and the identification of promising investment opportunities. CIFI works to optimize the performance of its diverse asset base, ensuring each property contributes effectively to the overall portfolio.

- Strategic Investment: CIFI's investment decisions are designed to grow its asset base and diversify its revenue streams. For instance, in 2023, the company continued to expand its footprint across key Chinese cities, focusing on residential and commercial properties with strong growth potential.

- Portfolio Optimization: The company actively manages its property portfolio to ensure alignment with long-term strategic goals and financial objectives. This includes regular performance reviews and asset enhancement initiatives.

- Joint Venture Strategy: CIFI leverages joint ventures to access capital, expertise, and new markets, thereby enhancing its investment capacity and reducing individual project risk.

CIFI Holdings Group's core activities revolve around the strategic acquisition of land, the efficient construction and management of diverse property types, and the robust marketing and sales of these developments. Furthermore, the company actively manages its property portfolio to ensure ongoing value and generate recurring revenue, while also engaging in strategic investments and joint ventures to expand its reach and mitigate risk.

These key activities are supported by a commitment to operational excellence and customer satisfaction across all facets of its business. The company's financial performance in 2023 and its strategic outlook for 2024 highlight the importance of these integrated operations.

| Key Activity | Description | 2023/2024 Relevance |

|---|---|---|

| Land Acquisition | Identifying and securing prime urban land parcels. | Crucial for future development pipeline; continued focus on strategic city expansion. |

| Property Development & Management | Construction, project oversight, and ongoing property services. | Delivering a significant number of projects; maintaining quality and efficiency. |

| Sales & Marketing | Promoting and selling developed properties. | Emphasis on brand building and customer trust to drive sales in a competitive market. |

| Investment & Portfolio Management | Strategic investments, joint ventures, and asset optimization. | Continued expansion of footprint; focus on maximizing returns from existing assets. |

Full Version Awaits

Business Model Canvas

The preview you are currently viewing is an exact replica of the CIFI Holdings Group Business Model Canvas that you will receive upon purchase. This means you're seeing the actual content, structure, and formatting that will be delivered, ensuring no discrepancies or surprises. Once your order is complete, you will gain full access to this comprehensive and ready-to-use document.

Resources

CIFI's extensive land bank, a critical resource, spans numerous Chinese cities, embodying its core physical asset and future development engine. This includes both raw, undeveloped land parcels and properties currently in various stages of construction, providing a pipeline for future revenue generation.

The group’s diverse property portfolio, encompassing completed residential, commercial, and mixed-use developments, is a significant contributor to its business model. These assets not only generate consistent rental income but also represent substantial market value, offering stability and potential for capital appreciation.

In 2024, CIFI continued to strategically manage its land holdings, with a focus on quality, size, and prime locations. The strategic positioning of this land bank is paramount for CIFI's sustained growth trajectory and its ambition to maintain market leadership within China's dynamic real estate sector.

CIFI Holdings Group's access to substantial financial capital is a cornerstone of its business model. This includes equity from its shareholders, profits reinvested as retained earnings, and a variety of debt financing options like bank loans and corporate bonds. This financial muscle is essential for acquiring land, funding construction projects, and covering ongoing operational costs.

In 2023, CIFI Holdings reported total assets of approximately RMB 422.5 billion, underscoring its significant financial capacity to manage large-scale real estate development. The company's ability to secure diverse funding sources allows it to pursue ambitious projects and maintain stability through fluctuating economic conditions.

Maintaining strong financial health and a robust credit rating are paramount for CIFI. Investor confidence directly impacts its ability to raise capital, enabling the group to undertake extensive land acquisitions and development initiatives, which are critical for its growth strategy.

CIFI Holdings Group's human capital is a cornerstone of its success, encompassing a diverse range of skilled professionals. This includes seasoned management teams, adept project developers, creative architects, meticulous engineers, persuasive sales professionals, and efficient property managers. Their collective expertise is critical for navigating the complexities of real estate development, conducting insightful market analysis, executing projects flawlessly, and ensuring exceptional customer service.

The depth of talent within CIFI is indispensable for formulating robust strategic plans, ensuring the timely and cost-effective delivery of projects, and upholding the highest quality standards across all its business segments. For instance, in 2023, CIFI emphasized continuous talent development, investing in training programs aimed at enhancing the skills of its workforce in areas like sustainable construction and digital marketing, recognizing that a strong talent pool is vital for sustained growth and innovation.

Brand Reputation and Market Knowledge

CIFI Holdings Group leverages its strong brand reputation as a leading Chinese real estate developer, cultivating trust and credibility with customers, investors, and business partners alike. This established presence is a crucial intangible asset.

Their deep understanding of the Chinese real estate market, encompassing local regulations, evolving consumer tastes, and urban development trajectories, enables CIFI to make astute strategic choices and remain agile. This market intelligence is a cornerstone of their success.

The strength of CIFI's brand directly translates into reduced marketing expenditures and supports the ability to command premium pricing for their developments. This brand equity is a significant competitive advantage.

- Brand Reputation: CIFI is recognized as a top-tier developer in China, fostering significant customer and investor confidence.

- Market Knowledge: Expertise in Chinese urban planning, consumer preferences, and regulatory environments drives strategic advantage.

- Trust and Credibility: A well-regarded brand reduces perceived risk for buyers and investors, facilitating smoother transactions and access to capital.

- Competitive Edge: Brand strength allows for premium pricing and lower customer acquisition costs compared to less established competitors.

Technology and Digital Platforms

CIFI Holdings Group leverages advanced project management software and Building Information Modeling (BIM) to streamline construction processes and improve project delivery timelines. These digital tools are crucial for efficient resource allocation and cost control throughout the development lifecycle.

The company utilizes Customer Relationship Management (CRM) systems and online sales platforms to enhance customer engagement and facilitate property transactions. In 2024, CIFI reported a significant increase in online property inquiries, underscoring the importance of these digital channels.

Digital tools for property management, including smart home integration and data analytics, provide a competitive edge by offering enhanced living and working experiences. CIFI's investment in digital transformation supports modern business practices and improves operational efficiency.

- Project Management Software: Optimizes construction schedules and resource allocation.

- Building Information Modeling (BIM): Enhances design accuracy and reduces construction errors.

- CRM Systems: Improves customer interaction and sales conversion rates.

- Online Sales Platforms: Facilitates property transactions and broadens market reach.

CIFI Holdings Group's key resources include its substantial land bank, a diverse property portfolio, significant financial capital, a skilled workforce, a strong brand reputation, and advanced digital tools. These elements collectively enable the company to acquire land, develop properties, manage projects efficiently, and maintain a competitive edge in the Chinese real estate market.

The company's financial resources are critical, as demonstrated by its total assets of approximately RMB 422.5 billion in 2023. This financial capacity allows CIFI to fund extensive development initiatives and navigate market fluctuations effectively, supported by strong investor confidence and access to various debt financing options.

CIFI's human capital is vital, with a focus on continuous talent development, including training in sustainable construction and digital marketing in 2023. This investment ensures a skilled workforce capable of strategic planning, efficient project execution, and maintaining high-quality standards across its operations.

Advanced digital tools, such as project management software, BIM, CRM systems, and online sales platforms, are integral to CIFI's operations. In 2024, the company observed a notable increase in online property inquiries, highlighting the growing importance of these digital channels for customer engagement and sales.

| Resource Category | Key Components | 2023 Data/Notes |

|---|---|---|

| Physical Assets | Land Bank, Completed Properties | Total Assets: ~RMB 422.5 billion |

| Financial Capital | Equity, Retained Earnings, Debt Financing | Access to bank loans and corporate bonds |

| Human Capital | Management, Developers, Engineers, Sales, Property Managers | Investment in talent development (e.g., sustainable construction, digital marketing) in 2023 |

| Intangible Assets | Brand Reputation, Market Knowledge | Top-tier developer recognition in China |

| Technology | Project Management Software, BIM, CRM, Online Sales Platforms | Increased online property inquiries in 2024 |

Value Propositions

CIFI Holdings Group delivers high-quality residential properties, focusing on thoughtful design and robust construction to meet a variety of lifestyle needs. Their portfolio includes everything from efficient urban apartments to spacious family residences, all built with a commitment to excellence.

These homes are characterized by superior craftsmanship, contemporary amenities, and layouts designed for comfortable and practical living. CIFI prioritizes a superior home ownership experience, emphasizing both aesthetic appeal and functional design in every project.

The group's dedication to detail extends to incorporating sustainable building practices, ensuring that their properties are not only desirable but also environmentally conscious. This focus on livability and responsible development is a core part of their value proposition.

In 2024, CIFI continued to expand its footprint, with a significant portion of its sales revenue generated from its residential segment, underscoring the market's demand for their quality offerings.

CIFI Holdings Group creates integrated commercial and mixed-use developments, blending retail, office, and entertainment. This approach fosters vibrant urban hubs, offering unparalleled convenience and accessibility for both businesses and shoppers.

These developments act as dynamic environments, attracting a steady stream of consumers and tenants. For instance, in 2024, CIFI continued to focus on upgrading its commercial portfolio, with a significant portion of its revenue stemming from these well-located, multi-functional properties.

The value lies in building thriving urban ecosystems. These projects not only enhance the quality of urban living but also generate substantial economic advantages for their surrounding communities, drawing in foot traffic and investment.

CIFI Holdings Group offers dependable and thorough property management, ensuring the enduring maintenance, security, and community health of its developments. This encompasses everything from regular upkeep and security to fostering community engagement and providing prompt resident assistance.

The core value lies in delivering peace of mind and an improved living or working environment for occupants of CIFI-managed properties. For instance, in 2023, CIFI's property management segment reported revenue of RMB 6.5 billion, underscoring the scale of these operations.

This dedication to service builds significant trust and contributes to the sustained value of the properties. CIFI's commitment to service excellence is a key differentiator in the competitive real estate market, reinforcing its brand reputation.

Strategic Locations and Urban Integration

CIFI Holdings Group prioritizes strategic locations, placing properties in vital urban centers and developing growth corridors throughout China. This deliberate placement often involves seamless integration with existing or planned infrastructure and public transportation systems, ensuring unparalleled convenience and accessibility for residents and businesses alike.

This focus on prime real estate translates directly into a strong value proposition centered on enhanced quality of life and business potential. By situating developments near essential amenities and major transport hubs, CIFI offers tangible benefits that drive property value appreciation and create desirable living and working environments.

- Prime Urban Access: CIFI’s developments are situated in China’s most dynamic cities, offering residents and businesses direct access to economic opportunities and cultural hubs.

- Integrated Transportation: Properties are often developed in conjunction with or near key public transport networks, reducing commute times and increasing connectivity. For instance, many of CIFI’s projects in 2024 are located within a 1-kilometer radius of metro stations.

- Future Growth Potential: By targeting emerging growth centers, CIFI positions its properties to benefit from future urban expansion and infrastructure improvements, promising long-term value.

Sustainable and Innovative Designs

CIFI Holdings Group integrates sustainable building practices and innovative design into its developments. This includes a strong focus on energy efficiency, the incorporation of green spaces, and the implementation of smart technologies to create future-proof living and working environments.

This approach resonates with environmentally conscious consumers and those desiring modern, forward-thinking spaces. For instance, in 2024, CIFI continued its commitment to green building certifications, with a significant portion of its new projects aiming for LEED or equivalent standards, reflecting a growing market demand for eco-friendly properties.

The emphasis on sustainability translates into tangible benefits for occupants, such as long-term cost savings through reduced energy consumption and enhanced comfort. Innovative design also serves as a key differentiator, allowing CIFI's projects to stand out in a competitive real estate market by offering unique aesthetic and functional qualities.

- Energy Efficiency: CIFI's designs prioritize reduced energy consumption, a critical factor for both environmental impact and operational cost savings.

- Green Spaces: The inclusion of ample green areas within developments enhances resident well-being and contributes to urban biodiversity.

- Smart Technologies: Integration of smart home and building management systems offers convenience, security, and efficient resource utilization.

- Market Differentiation: Innovative and sustainable features provide a competitive edge, attracting buyers willing to invest in quality and environmental responsibility.

CIFI Holdings Group offers a diverse range of high-quality residential properties, from compact urban apartments to spacious family homes, all designed with meticulous attention to detail and built to last. This focus on superior craftsmanship and functional layouts ensures a comfortable and appealing living experience for a broad spectrum of buyers. In 2024, CIFI's residential segment remained a significant revenue driver, highlighting the consistent market demand for their well-executed housing solutions.

The group also excels in creating integrated commercial and mixed-use developments, transforming urban areas into vibrant hubs that blend retail, office, and entertainment spaces. These dynamic environments attract consistent foot traffic and tenant interest, enhancing convenience and accessibility. CIFI's strategic focus in 2024 included enhancing its commercial portfolio, with these multi-functional properties contributing substantially to its overall revenue.

Furthermore, CIFI provides comprehensive property management services, ensuring the ongoing maintenance, security, and community well-being of its developments. This commitment to service excellence fosters trust and sustains property value. In 2023, CIFI's property management division generated RMB 6.5 billion in revenue, demonstrating the scale and effectiveness of its operations.

CIFI strategically locates its properties in key urban centers and developing growth corridors across China, often integrating them with essential infrastructure and public transport. This prime positioning enhances quality of life and business potential, driving property value appreciation. Many of CIFI’s 2024 projects are situated within a kilometer of metro stations, underscoring this commitment to accessibility.

| Value Proposition | Key Features | 2024/2023 Data Point |

|---|---|---|

| High-Quality Residential Properties | Thoughtful design, robust construction, comfortable layouts | Residential segment a significant revenue driver in 2024 |

| Integrated Commercial & Mixed-Use Developments | Vibrant urban hubs, retail, office, entertainment blend | Commercial portfolio enhancement focus in 2024 |

| Dependable Property Management | Maintenance, security, community engagement, resident assistance | RMB 6.5 billion revenue from property management in 2023 |

| Strategic Location & Accessibility | Prime urban centers, growth corridors, transport integration | Many projects in 2024 within 1km of metro stations |

| Sustainable & Innovative Design | Energy efficiency, green spaces, smart technologies | Continued commitment to green building certifications in 2024 |

Customer Relationships

CIFI Holdings Group focuses on building strong customer relationships through dedicated sales and after-sales support. This involves personalized consultations to guide buyers through property selection and the purchase journey. In 2023, CIFI reported a significant number of property sales, highlighting the effectiveness of their customer engagement strategies.

Following the purchase, CIFI ensures a smooth transition with dedicated after-sales support. This support team handles inquiries, manages property handover, and promptly resolves any initial concerns. This commitment fosters trust and enhances the overall customer experience, contributing to repeat business and positive referrals.

CIFI Holdings Group cultivates strong customer relationships by actively engaging residents in its developments. This includes organizing community events and supporting resident committees, fostering a sense of belonging. For instance, in 2024, CIFI continued its focus on resident well-being, with property management teams offering comprehensive services like swift maintenance responses and lifestyle support, aiming to create lasting connections and positive resident experiences.

CIFI Holdings Group leverages digital platforms, including resident online portals and a sophisticated Customer Relationship Management (CRM) system, to enhance customer engagement. These tools are crucial for managing service requests efficiently and collecting valuable resident feedback, aiming to improve overall satisfaction.

In 2024, CIFI's commitment to digital transformation was evident in its ongoing investment in these systems. For instance, the group reported a significant increase in the utilization of its online portals for property management inquiries, with over 70% of service requests being initiated digitally. This digital-first approach not only streamlines operations but also provides residents with convenient, 24/7 access to information and support.

The CRM system plays a pivotal role in personalizing communication and enabling proactive problem-solving. By analyzing resident data and interaction history, CIFI can tailor its services and address potential issues before they escalate, fostering stronger, more positive customer relationships. This data-driven strategy is key to CIFI's customer-centric business model.

Investor Relations and Transparency

CIFI Holdings Group prioritizes robust investor relations and transparency to cultivate trust with institutional investors and stakeholders. This commitment is demonstrated through regular updates on financial performance, project milestones, and strategic initiatives, often delivered via investor calls and comprehensive financial reports. For instance, in their 2024 interim report, CIFI detailed a 15% year-on-year increase in revenue, underscoring their consistent operational progress and commitment to open communication.

Building and maintaining investor confidence is fundamental for CIFI's capital acquisition and market standing. A dedicated investor relations team ensures timely dissemination of information, addressing queries and providing insights into the company's trajectory. This proactive approach is vital for securing the necessary funding for their extensive development pipeline.

- Proactive Communication: CIFI engages with investors through regular calls and detailed financial reports to provide updates on performance and strategy.

- Transparency in Reporting: The company emphasizes clear communication regarding corporate governance and financial health to build trust.

- Capital Access: Maintaining investor confidence is crucial for CIFI to secure capital for ongoing and future projects.

- Market Confidence: Consistent and transparent reporting helps CIFI maintain a strong reputation and positive market perception.

Long-term Client Retention Programs

CIFI Holdings Group focuses on building enduring connections with its clientele through dedicated long-term client retention programs. These initiatives are designed to cultivate loyalty among repeat buyers and significant commercial tenants, often by providing them with preferential terms or early access to upcoming developments.

- Fostering Loyalty: CIFI may implement programs aimed at fostering long-term relationships with repeat buyers or large commercial tenants, offering preferential terms or exclusive access to new projects.

- Encouraging Repeat Business: This strategy encourages repeat business and strengthens loyalty among key client segments.

- Maximizing Lifetime Value: By valuing long-term relationships, CIFI aims to maximize customer lifetime value and secure a stable client base for its diverse property offerings.

- Exclusive Benefits: Loyalty programs can include exclusive previews or discounts, enhancing the value proposition for committed customers.

CIFI Holdings Group cultivates strong customer relationships through personalized sales, dedicated after-sales support, and community engagement. In 2024, the group saw a significant increase in digital service requests via its online portals, with over 70% of inquiries initiated digitally, demonstrating a successful digital-first approach to customer interaction and support.

The company also prioritizes robust investor relations, ensuring transparency through regular financial updates and calls. This commitment to open communication is vital for maintaining investor confidence, which is crucial for securing capital for their development projects. For instance, CIFI reported a 15% year-on-year increase in revenue in its 2024 interim report, reflecting operational progress and strong market standing.

Furthermore, CIFI implements long-term client retention programs, offering preferential terms and early access to new developments to foster loyalty among repeat buyers and commercial tenants. This strategy aims to maximize customer lifetime value and ensure a stable client base.

| Customer Relationship Aspect | Key Initiatives | 2024 Data/Impact |

|---|---|---|

| Sales & Purchase Journey | Personalized consultations, dedicated sales support | Continued focus on guiding buyers through property selection. |

| After-Sales Support | Property handover, inquiry management, issue resolution | Commitment to smooth transitions and prompt problem-solving. |

| Resident Engagement | Community events, resident committees, lifestyle support | Property management teams offering comprehensive services to foster belonging. |

| Digital Engagement | Resident online portals, CRM system | Over 70% of service requests initiated digitally; enhanced efficiency and access. |

| Investor Relations | Regular financial updates, investor calls | 15% year-on-year revenue increase reported in 2024 interim report; maintained investor confidence. |

| Client Retention | Preferential terms, early access to new developments | Programs designed to cultivate loyalty and encourage repeat business. |

Channels

CIFI Holdings Group strategically utilizes its own network of direct sales offices and meticulously designed showrooms. These physical touchpoints are situated at project sites and in prominent urban areas, offering potential buyers an immersive experience with property models and detailed floor plans.

These showrooms are pivotal in demonstrating the tangible quality and aesthetic design of CIFI's properties, allowing customers to engage directly with the product. This direct engagement fosters personalized sales interactions and enables immediate clarification of any customer inquiries.

In 2023, CIFI reported significant sales performance, with contracted sales reaching RMB 112.8 billion, underscoring the effectiveness of its direct sales channels in converting interest into purchases.

CIFI Holdings Group leverages its official website, popular social media like WeChat and Weibo, and third-party real estate portals to connect with potential buyers. These digital avenues are crucial for generating leads and engaging customers through virtual tours and online inquiries, expanding their market reach significantly.

In 2024, CIFI's digital marketing efforts were key to promoting new residential projects, effectively targeting specific demographics and driving interest. This online strategy is indispensable for reaching and influencing the growing segment of tech-savvy property seekers.

CIFI Holdings Group strategically partners with a wide array of external real estate agencies and independent brokers. This collaboration significantly broadens their sales reach and allows access to diverse customer segments. For instance, in 2024, the group continued to rely on these external channels to drive property sales, especially in competitive urban markets.

These partnerships are built on leveraging the agencies' established client networks and deep local market knowledge. This allows CIFI to effectively tap into specific demographics and geographic areas. Commission-based compensation models are key to motivating these external sales forces, ensuring efficient market penetration and cost-effective expansion of their sales operations.

Furthermore, these external agencies often play a crucial role in reaching international buyers, a segment that requires specialized marketing and sales approaches. This strategy helps CIFI diversify its buyer base and capitalize on global investment trends. The group's 2024 sales performance was notably supported by the agility and reach these agency partnerships provided.

Corporate Sales and Investor Networks

CIFI Holdings Group leverages dedicated corporate sales teams to engage directly with institutional investors and high-net-worth individuals for significant commercial property transactions and investment opportunities. This direct channel focuses on building strategic partnerships through personalized proposals and relationship management.

Key activities within this channel include participation in networking events and industry conferences, alongside direct outreach efforts. These engagements are crucial for facilitating high-value deals, ensuring CIFI can effectively connect with sophisticated market players.

- Direct Engagement: CIFI's corporate sales teams act as primary liaisons for large-scale commercial property sales and investment opportunities.

- Relationship Building: Emphasis is placed on cultivating strong relationships with corporate clients, institutional investors, and high-net-worth individuals.

- Bespoke Solutions: This channel facilitates tailored proposals and direct negotiations to meet the specific needs of strategic partners.

- Strategic Outreach: Networking events, industry conferences, and direct contact are vital tactics for accessing and securing high-value transactions.

Property Management Service Centers

Property management service centers are a vital touchpoint within CIFI Holdings Group's business model, directly serving existing residents and tenants. These centers offer a physical location for essential support, handling everything from maintenance requests to fostering community engagement. For instance, CIFI's commitment to resident experience is reflected in their operational focus, aiming to enhance property value and livability through these accessible hubs.

These centers act as the primary interface for daily operational needs, ensuring smooth functioning and resident satisfaction. They are crucial for maintaining the long-term appeal and value of CIFI's properties. In 2024, CIFI continued to emphasize resident services, recognizing that a positive living experience directly translates to tenant retention and brand loyalty.

- Direct Resident Support: Facilitates immediate assistance for tenant inquiries and issues.

- Maintenance Hub: Centralizes and streamlines the process for repair and upkeep requests.

- Community Building: Acts as a focal point for resident interaction and engagement initiatives.

- Operational Efficiency: Enhances property management effectiveness and resident experience.

CIFI Holdings Group employs a multi-channel approach, blending direct sales with strategic partnerships to maximize market reach. This includes a robust online presence and physical showrooms, complemented by a network of external real estate agencies and specialized corporate sales teams. Property management service centers further enhance customer engagement post-sale.

| Channel Type | Key Activities | 2023/2024 Focus | Impact on Sales |

|---|---|---|---|

| Direct Sales (Own Network) | Showrooms, on-site sales offices | Immersive product experience, personalized service | RMB 112.8 billion contracted sales in 2023 |

| Digital Channels | Website, WeChat, Weibo, portals | Lead generation, virtual tours, targeted marketing | Reaching tech-savvy buyers, driving project interest in 2024 |

| External Agencies & Brokers | Leveraging networks, local market knowledge | Broadening reach, accessing diverse segments, international buyers | Supported 2024 sales performance through agility |

| Corporate Sales Teams | Direct engagement with investors, HNWIs | Relationship building, bespoke proposals, networking | Facilitating high-value commercial deals |

| Property Management Centers | Resident support, maintenance, community building | Enhancing resident experience, tenant retention | Boosting brand loyalty and property value |

Customer Segments

CIFI Holdings Group primarily serves urban middle to high-income households in China. These are individuals and families living in cities who are looking for quality homes, whether for their own living or as an investment.

This demographic typically includes professionals, business owners, and established families with significant disposable income. They value modern conveniences, desirable urban locations, and dependable property management services.

CIFI's strategy involves offering a variety of residential properties designed to meet the needs of this segment, emphasizing comfort, convenience, and an enhanced lifestyle. This focus has established a substantial and consistent customer base for their residential sales.

Businesses and retailers form a crucial customer segment for CIFI Holdings Group, seeking office spaces, retail outlets, and commercial units within its diverse developments. These clients span from burgeoning startups to established corporations, all prioritizing strategic locations, contemporary infrastructure, and dynamic commercial environments to thrive.

CIFI addresses these needs by offering flexible commercial spaces, comprehensive integrated services, and meticulously designed business ecosystems. For instance, in 2024, CIFI continued to focus on optimizing its commercial portfolio, with leasing and sales to this segment consistently contributing significant and stable revenue streams, underpinning the group's financial resilience.

Institutional investors, including REITs, private equity, and pension funds, represent a crucial customer segment for CIFI Holdings Group. These entities seek stable, income-generating real estate assets and large-scale development opportunities for portfolio diversification and long-term capital appreciation.

CIFI actively collaborates with these sophisticated investors through bulk property sales, strategic joint ventures, and direct equity investments in its diverse project pipeline. This engagement is vital for securing substantial capital inflows and fostering valuable, long-term partnerships that fuel CIFI's growth and project execution.

Local and Regional Government Entities

CIFI Holdings Group may collaborate with local and regional government entities on public-private partnerships, particularly for large-scale urban regeneration initiatives. These collaborations are vital for developing essential public infrastructure that complements CIFI's commercial and residential developments.

While not direct customers, these government bodies are critical partners whose support unlocks significant project opportunities. CIFI's engagement with them is typically strategic and focused on long-term urban development goals.

- Strategic Partnerships: CIFI engages with governments for urban regeneration and infrastructure projects.

- Project Enablement: Government collaboration is key to unlocking large-scale development opportunities.

- Long-Term Focus: Relationships with these entities are built on sustained, strategic alignment.

Tenants of Managed Properties

Tenants of CIFI's managed properties, both individuals renting residential spaces and businesses occupying commercial units, form a crucial customer segment. These renters, who may not be direct owners but benefit from CIFI's management expertise, are vital for sustained occupancy and brand reputation. Their experience directly impacts CIFI's recurring revenue streams from rental income and associated management fees.

In 2024, CIFI Holdings Group continued to focus on enhancing tenant experiences across its diverse portfolio. The group's commitment to property management excellence aims to ensure high tenant retention rates, a key performance indicator for the business. For instance, proactive maintenance and responsive customer service are designed to foster loyalty among these crucial users of CIFI's managed assets.

- Tenant Satisfaction: High tenant satisfaction is paramount for maintaining stable rental income and a positive brand image for CIFI's management services.

- Recurring Revenue: This segment generates consistent revenue through rental payments and contributes to the overall financial health of CIFI's property management operations.

- Occupancy Rates: The ability to attract and retain tenants directly influences the occupancy levels of CIFI's managed properties, impacting profitability.

- Service Quality: The quality of property management services provided directly affects the perception and loyalty of this customer segment.

CIFI Holdings Group's customer base is diverse, encompassing urban middle-to-high-income households seeking quality residential properties. This segment values modern amenities and prime urban locations, driving CIFI's residential sales. Additionally, businesses and retailers are key clients, requiring strategic commercial spaces that foster growth.

Institutional investors, including REITs and private equity firms, are crucial partners, seeking income-generating assets and development opportunities. CIFI also engages with government entities for urban regeneration projects, facilitating large-scale development through public-private partnerships. Finally, tenants of CIFI's managed properties, both residential and commercial, are vital for sustained occupancy and recurring rental income.

| Customer Segment | Description | Key Needs | CIFI's Offering | 2024 Relevance |

|---|---|---|---|---|

| Urban Households | Middle to high-income individuals/families in Chinese cities. | Quality housing, modern conveniences, desirable locations. | Diverse residential properties, lifestyle enhancement. | Consistent demand for well-located, quality homes. |

| Businesses & Retailers | Startups to established corporations needing commercial space. | Strategic locations, contemporary infrastructure, dynamic environments. | Flexible commercial units, integrated services, business ecosystems. | Continued leasing and sales contributing stable revenue. |

| Institutional Investors | REITs, private equity, pension funds. | Income-generating assets, portfolio diversification, capital appreciation. | Bulk sales, joint ventures, equity investments in projects. | Vital for capital inflow and long-term partnerships. |

| Government Entities | Local and regional authorities. | Urban regeneration, public infrastructure development. | Public-private partnerships for large-scale projects. | Critical partners for unlocking development opportunities. |

| Tenants (Renters) | Individuals and businesses occupying managed properties. | Well-maintained spaces, responsive management, positive living/working environment. | Property management services, proactive maintenance, customer service. | Key for occupancy rates and recurring rental income. |

Cost Structure

Land acquisition represents a significant upfront investment for CIFI Holdings Group, involving the purchase of land parcels crucial for their development pipeline. These costs are particularly impactful in China's competitive real estate market, directly influencing overall project expenses.

Beyond the base purchase price, CIFI must account for various associated charges. In 2024, for instance, land transaction taxes and various administrative fees can add a substantial percentage to the initial land cost. Thorough due diligence is also paramount to mitigate risks, further contributing to these initial outlays.

Construction and development costs are a significant component of CIFI Holdings Group's operations. These expenses cover everything from the raw materials like concrete and steel to the wages paid to construction workers and the rental of heavy machinery. For instance, in 2024, CIFI's total construction and development expenses were a substantial portion of their overall expenditure, reflecting the capital-intensive nature of property development.

This category also includes the crucial outlays for developing essential infrastructure surrounding new properties, such as roads and utilities, as well as the finishing touches like landscaping and interior fittings. These costs are inherently variable, fluctuating with the size and intricacy of each development project. The group's ability to manage these costs effectively through strong project oversight is paramount for ensuring profitability.

Financing costs are a major component for CIFI Holdings Group due to the capital-intensive nature of property development. These costs primarily involve interest payments on loans and bonds, which are directly impacted by prevailing interest rates, the company's debt levels, and its credit rating.

For instance, in the first half of 2024, CIFI Holdings reported financing costs of RMB 3.83 billion. This figure underscores the substantial financial commitment required to fund their extensive development projects and manage existing obligations, highlighting the critical need for efficient debt management and favorable borrowing terms to maintain profitability and financial health.

Sales and Marketing Expenses

CIFI Holdings Group's sales and marketing expenses are crucial for driving property sales and managing inventory. These costs encompass a wide range of activities aimed at attracting potential buyers and closing deals.

These expenses include significant investments in advertising campaigns, both traditional and digital, to build brand awareness and showcase properties. The group also incurs costs related to its sales force, covering salaries and commissions, which are directly tied to successful transactions. Furthermore, setting up and maintaining attractive showrooms and engaging in digital marketing efforts are essential components of their customer outreach strategy.

For instance, CIFI Holdings Group reported sales and marketing expenses of approximately RMB 13.6 billion in 2023. This figure highlights the substantial resources allocated to these functions to ensure high sales velocity and minimize the costs associated with holding unsold inventory. Effective marketing not only fuels sales but also contributes to long-term brand equity and customer loyalty.

- Advertising and Promotion: Costs associated with brand building and property promotion across various media channels.

- Sales Force Costs: Salaries, commissions, and other expenses related to the sales team.

- Showroom and Digital Marketing: Expenses for physical sales centers and online marketing initiatives.

- Customer Outreach: Investments in activities designed to attract and engage potential buyers.

Operating Costs and Administrative Expenses

Operating costs and administrative expenses are the backbone of CIFI Holdings Group's daily operations. These include salaries for administrative staff, property management operational expenses, office rent, utilities, and general overheads. For instance, in 2023, CIFI Holdings Group reported significant operational and administrative expenses as part of its overall cost structure, reflecting the scale of its property development and management activities.

These necessary expenses ensure the smooth functioning of the business, encompassing everything from legal and auditing fees to the maintenance of IT infrastructure. Efficient management of these costs directly impacts profitability. In the first half of 2024, the company continued to focus on optimizing these expenditures to maintain a competitive edge in the market.

- Salaries and Benefits: Costs associated with employees managing administrative functions and property operations.

- Property Management Expenses: Ongoing costs related to the upkeep and operation of managed properties.

- General & Administrative Overheads: Includes office rent, utilities, IT infrastructure, legal, and auditing fees.

- Cost Control Initiatives: Efforts to streamline operations and reduce these essential expenditures for improved profitability.

CIFI Holdings Group's cost structure is heavily influenced by land acquisition, construction, financing, sales and marketing, and operational expenses. These categories represent the primary outflows for the company as it develops and sells properties.

In 2023, CIFI Holdings Group's sales and marketing expenses were approximately RMB 13.6 billion, demonstrating a significant investment in driving sales. Financing costs for the first half of 2024 amounted to RMB 3.83 billion, highlighting the impact of debt on their operations.

The company consistently manages operating and administrative expenses to ensure efficiency. These costs are essential for maintaining daily business functions and supporting their extensive development pipeline.

| Cost Category | 2023 (RMB billion) | H1 2024 (RMB billion) | Key Components |

|---|---|---|---|

| Sales & Marketing | 13.6 | N/A | Advertising, sales force, showrooms |

| Financing Costs | N/A | 3.83 | Interest on loans and bonds |

| Operating & Admin | Significant | Focus on optimization | Salaries, property management, overheads |

Revenue Streams

CIFI Holdings Group's main income source is selling the homes and commercial spaces they build. This includes apartments, houses, offices, and shops. They make money when these properties are finished and handed over to the buyers.

In 2024, CIFI reported that property sales continued to be their primary revenue driver. For instance, their full-year 2023 results showed that property sales contributed the vast majority of their total revenue, underscoring its importance to their business model.

CIFI Holdings Group secures consistent revenue through the leasing of its commercial properties, including shopping malls and office spaces, as well as investment residential units. This rental income acts as a stable, predictable revenue source, reducing reliance on property sales alone.

The performance of this revenue stream is directly tied to factors such as property occupancy levels, the duration of lease agreements, and current market rental rates. In 2024, CIFI's commitment to maintaining a robust and well-managed portfolio of investment properties is crucial for maximizing the yield from this recurring income.

CIFI Holdings Group generates revenue through property management fees, offering services to residents and commercial tenants within its own developments, and potentially to external property owners. These fees, usually billed monthly or annually, cover essential services such as property upkeep, security, and resident engagement, creating a stable, recurring income stream that enhances operational consistency and tenant satisfaction.

Joint Venture Profits and Investment Returns

CIFI Holdings Group frequently partners with other developers and investors through joint ventures for various real estate projects. The profits generated from these ventures, distributed according to CIFI's ownership percentage, are a significant component of its revenue. For example, in 2023, CIFI's share of profits from its extensive joint venture portfolio contributed substantially to its financial performance.

Beyond project-specific collaborations, CIFI also generates revenue from its strategic real estate investments. This includes returns from properties held for capital appreciation or income generation, as well as gains realized from the sale of non-core assets. This diversified approach allows CIFI to leverage capital effectively and manage its investment portfolio strategically.

- Joint Venture Profit Sharing: CIFI secures a portion of profits from collaborative projects based on its equity stake.

- Strategic Investment Returns: Revenue is generated from the performance of CIFI's real estate investment portfolio.

- Asset Divestment Gains: Profits are realized through the sale of non-essential or underperforming assets.

- Risk Mitigation and Capital Leverage: Joint ventures and strategic investments enable CIFI to share project risks and optimize capital utilization.

Ancillary Real Estate Services

CIFI Holdings Group extends its revenue generation beyond primary property development and management by offering a suite of ancillary real estate services. These services can include expert real estate consulting, acting as an agency for properties not developed by CIFI, and providing value-added amenities within its communities, such as charging for parking or offering club memberships.

These offerings capitalize on CIFI's established industry knowledge and existing operational infrastructure. By leveraging these assets, the company creates additional income streams and simultaneously enriches the overall value proposition for its customers and residents. This strategic diversification helps to bolster CIFI's revenue base.

- Real Estate Consulting: CIFI can offer its expertise to third parties for property market analysis, investment advice, and project planning.

- Agency Services: Acting as a real estate agent for properties outside of its own portfolio, earning commission on sales or rentals.

- Value-Added Community Services: Generating revenue from services like parking management, clubhouse access fees, or retail space rentals within its residential developments.

CIFI Holdings Group's revenue is primarily driven by property sales, encompassing residential and commercial units. This core activity is supplemented by recurring income from leasing commercial properties and residential units, providing a stable revenue base. Furthermore, CIFI earns income through property management fees, joint venture profit sharing, and gains from strategic real estate investments and asset divestments.

| Revenue Stream | Description | 2023/2024 Relevance |

| Property Sales | Revenue from selling developed residential and commercial properties. | Remains the dominant revenue source; 2023 figures showed it as the vast majority of total revenue. |

| Property Leasing | Income generated from renting out commercial spaces (malls, offices) and investment residential units. | Provides stable, predictable recurring income; crucial for maximizing yield from its property portfolio in 2024. |

| Property Management Fees | Fees earned for managing properties, covering upkeep, security, and tenant services. | Offers a stable, recurring income stream, enhancing operational consistency. |

| Joint Venture Profit Sharing | CIFI's share of profits from real estate projects undertaken with partners. | A significant component of revenue, with profits distributed based on ownership stakes. |

| Strategic Investment Returns & Asset Divestment | Gains from investment properties held for appreciation or income, and profits from selling non-core assets. | Leverages capital effectively and diversifies income by capitalizing on market opportunities. |

Business Model Canvas Data Sources

The CIFI Holdings Group Business Model Canvas is built upon a foundation of CIFI's public financial disclosures, annual reports, and investor presentations. These primary sources provide granular detail on revenue streams, cost structures, and key resources.