CIFI Holdings Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CIFI Holdings Group Bundle

CIFI Holdings Group navigates a complex real estate landscape, where buyer bargaining power significantly influences pricing and profitability. The threat of new entrants, while present, is somewhat mitigated by high capital requirements and established brand recognition.

The full Porter's Five Forces Analysis reveals the real forces shaping CIFI Holdings Group’s industry—from supplier influence to substitute threats. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The Chinese real estate sector's dependence on land, largely controlled by local governments, grants them substantial bargaining power over developers like CIFI Holdings. This leverage is exercised through land policies and auctions, directly impacting acquisition costs and availability for CIFI. In 2023, land sales continued to be a vital income stream for many Chinese municipalities, underscoring their ongoing influence on the property market.

CIFI Holdings, like other developers, depends heavily on consistent access to key construction materials such as steel, cement, and concrete blocks. The bargaining power of suppliers in this sector can significantly impact CIFI's project costs and timelines.

While global commodity markets saw some price stabilization or even slight decreases in materials like steel and cement in early 2025, overall construction material costs are anticipated to remain elevated compared to pre-2020 figures. This sustained higher cost environment is largely driven by persistent global demand and ongoing inflationary pressures.

Labor costs in China's construction sector are experiencing a steady increase, a trend expected to continue at a more measured pace through 2025. This rise is driven by evolving demographics and a concerted push for enhanced productivity across the industry.

CIFI Holdings Group, like its peers, faces the challenge of managing these escalating labor expenses, especially for specialized and skilled labor. Successfully navigating these costs is crucial for preserving profit margins and ensuring timely project completion.

Financing and Credit Availability

The bargaining power of suppliers, particularly those providing financing, remains a significant factor for real estate developers like CIFI Holdings Group. Access to capital from banks and bond markets is essential for ongoing operations and project development.

While mortgage and financing conditions for end-buyers saw some easing in 2025, the broader liquidity environment continues to be challenging for many developers. This tightness impacts companies, including CIFI, who are actively engaged in debt restructuring processes.

- Financing Dependency: Real estate developers are inherently reliant on external financing to fund land acquisition, construction, and general operations.

- Credit Market Conditions: The availability and cost of credit from banks and bond markets directly influence a developer's ability to execute projects and manage its balance sheet.

- Impact of Restructuring: Companies undergoing debt restructuring often face heightened scrutiny from lenders, potentially increasing borrowing costs and limiting access to new capital, thereby strengthening the bargaining power of their financial suppliers.

Specialized Services and Technology Providers

Architects, engineers, and other specialized service providers, along with technology vendors for smart building solutions, hold moderate bargaining power. Their unique expertise and proprietary technologies can command premium prices. For instance, in 2024, the demand for sustainable and smart building technologies in China's real estate sector continued to grow, allowing specialized firms to negotiate favorable terms. However, the sheer size of the Chinese market means there are often multiple qualified providers, which can temper the individual bargaining power of any single supplier.

CIFI Holdings Group, like other major developers, navigates this by fostering long-term relationships with key service providers and technology partners. This strategy can lead to more stable pricing and access to innovative solutions. In 2023, CIFI reported significant investments in digital transformation, indicating a reliance on technology vendors, but also suggesting opportunities for bulk purchasing and strategic alliances to manage costs.

- Specialized Expertise: Architects and engineers with proven track records in complex urban developments can leverage their skills.

- Technology Integration: Vendors offering advanced smart building systems, such as AI-driven energy management or integrated security platforms, have leverage.

- Market Saturation: The presence of numerous competent firms in China's vast construction and technology landscape moderates individual supplier power.

- Strategic Partnerships: Developers like CIFI can mitigate supplier power by forming long-term alliances, potentially securing better rates and preferential service.

The bargaining power of suppliers for CIFI Holdings Group is multifaceted, encompassing raw materials, labor, and crucially, financing. While material costs saw some stabilization in early 2025, overall expenses remain elevated due to global demand and inflation, impacting CIFI's project budgets. Labor costs, particularly for skilled workers, are also on a steady upward trajectory through 2025, directly affecting CIFI's operational expenses and profit margins.

Financial institutions wield significant leverage over developers like CIFI, especially given the ongoing challenging liquidity environment and the company's involvement in debt restructuring. This dependency on capital makes lenders powerful arbiters of CIFI's financial flexibility and project execution capabilities.

| Supplier Category | Bargaining Power Influence | Key Factors for CIFI | 2024/2025 Trend Impact |

|---|---|---|---|

| Land (Governments) | High | Land acquisition costs, availability | Continued revenue stream for municipalities |

| Construction Materials | Moderate to High | Steel, cement, concrete prices | Elevated costs due to global demand/inflation |

| Labor | Moderate | Skilled and unskilled wages | Steady increase, particularly for specialized roles |

| Financing (Banks, Bond Markets) | High | Access to capital, borrowing costs | Challenging liquidity, impact of debt restructuring |

| Specialized Services & Technology | Moderate | Expertise, proprietary tech | Growing demand for smart/sustainable solutions, tempered by market size |

What is included in the product

This analysis of CIFI Holdings Group's competitive environment reveals the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes on its profitability.

CIFI Holdings Group's Porter's Five Forces analysis provides a clear, actionable roadmap to navigate industry complexities, alleviating the pain of strategic uncertainty.

Effortlessly visualize competitive pressures and identify opportunities for differentiation, transforming complex market data into easily digestible insights.

Customers Bargaining Power

Market sentiment and buyer confidence in China's real estate sector, a key factor in customer bargaining power, have shown signs of stabilization but remain sensitive. Economic uncertainties and concerns about job security continue to influence purchasing decisions, giving buyers more leverage.

In 2024, buyer confidence indices, while improving from previous lows, still reflect a degree of caution. This cautiousness translates into a stronger bargaining position for customers, as developers like CIFI Holdings Group may need to offer more attractive pricing or incentives to secure sales amidst a competitive landscape.

CIFI Holdings Group faces significant customer bargaining power due to the abundance of housing alternatives in China. With a substantial inventory of unsold homes, buyers have many options, directly impacting CIFI's pricing flexibility and negotiation leverage. This situation is further amplified by the ready availability of both new and pre-owned properties on the market.

The growing presence of government-backed rental housing programs also contributes to customer power. These initiatives offer alternative living solutions, providing buyers with more choices and reducing their reliance on purchasing new homes from developers like CIFI. This increased competition for customer attention and spending naturally strengthens the buyer's position.

Government policies significantly influence the bargaining power of customers in the home purchasing market. Recent easing measures, like reduced mortgage rates and lower down payments, aim to boost demand. For instance, in early 2024, several Chinese cities relaxed property purchase restrictions, directly impacting buyer affordability and thus their leverage.

These policy shifts, while intended to stimulate the market, inherently empower potential buyers. By improving financing options and creating more favorable market conditions, customers gain greater confidence and can negotiate more effectively with developers like CIFI Holdings Group.

Price Sensitivity and Affordability

Customers in the Chinese real estate market, including those considering CIFI Holdings Group properties, exhibit significant price sensitivity. This is particularly evident with the ongoing downward pressure on residential property prices observed across numerous Chinese cities throughout 2024 and into early 2025. For instance, data from the National Bureau of Statistics of China indicated a year-on-year decline in new home prices in a majority of 70 major cities during late 2024.

The persistent affordability gap, especially impacting younger demographics and first-time homebuyers, necessitates that CIFI Holdings Group maintain competitive pricing strategies. This is crucial for attracting and securing a broad base of potential buyers in a market where economic conditions and consumer confidence play a vital role in purchasing decisions. The ability of a significant portion of the population to afford housing remains a key consideration.

- Price Sensitivity: Chinese property buyers are highly attuned to price fluctuations, a trend amplified by the property market's performance in 2024.

- Affordability Challenges: Younger generations face significant hurdles in affording property, making competitive pricing by developers like CIFI essential.

- Market Dynamics: Declining property prices in many cities in 2024 and early 2025 directly increase the bargaining power of customers.

- Competitive Landscape: CIFI must balance pricing to attract buyers against the backdrop of a market where affordability is a primary concern.

Rental Market Dynamics

The growing rental market, bolstered by increased government-subsidized housing, presents a strong alternative to homeownership, thereby amplifying customer bargaining power. This trend is particularly evident in major urban centers where the cost of living often makes renting a more accessible option.

Declining rental yields in some key metropolitan areas, such as a reported average yield of 2.5% in London as of late 2024, can shift the buy-versus-rent calculus for individuals. This economic consideration directly impacts investor demand and can lead to more discerning tenant behavior.

- Increased Rental Supply: Government initiatives to boost affordable rental housing provide more choices for potential renters.

- Shifting Affordability: High property prices in many cities make renting a more practical choice for a larger segment of the population.

- Investor Sentiment: Lower rental yields can deter investors, potentially leading to fewer rental properties and influencing tenant negotiations.

Customers possess considerable bargaining power in China's real estate market, directly impacting CIFI Holdings Group. This is largely due to the significant price sensitivity observed, with many cities experiencing property price declines throughout 2024. For example, data from late 2024 indicated year-on-year price drops in new homes across a majority of 70 major Chinese cities, empowering buyers to negotiate more aggressively.

Affordability remains a critical concern, especially for younger demographics, compelling developers like CIFI to adopt competitive pricing. The availability of numerous housing alternatives, including a substantial inventory of unsold homes and readily available pre-owned properties, further strengthens the buyer's position. Additionally, government-backed rental housing programs offer viable alternatives, reducing customer dependence on purchasing and enhancing their negotiation leverage.

| Factor | Impact on CIFI | Supporting Data/Observation (2024-early 2025) |

|---|---|---|

| Price Sensitivity | High; CIFI must offer competitive pricing. | Year-on-year decline in new home prices in a majority of 70 major Chinese cities (late 2024). |

| Availability of Alternatives | Reduces CIFI's pricing flexibility. | Substantial inventory of unsold homes and readily available pre-owned properties. |

| Government Rental Programs | Increases customer choice, weakening CIFI's position. | Growing supply of government-subsidized housing in urban centers. |

| Affordability Challenges | Necessitates attractive pricing for broad buyer base. | Persistent affordability gap for younger demographics and first-time homebuyers. |

Preview Before You Purchase

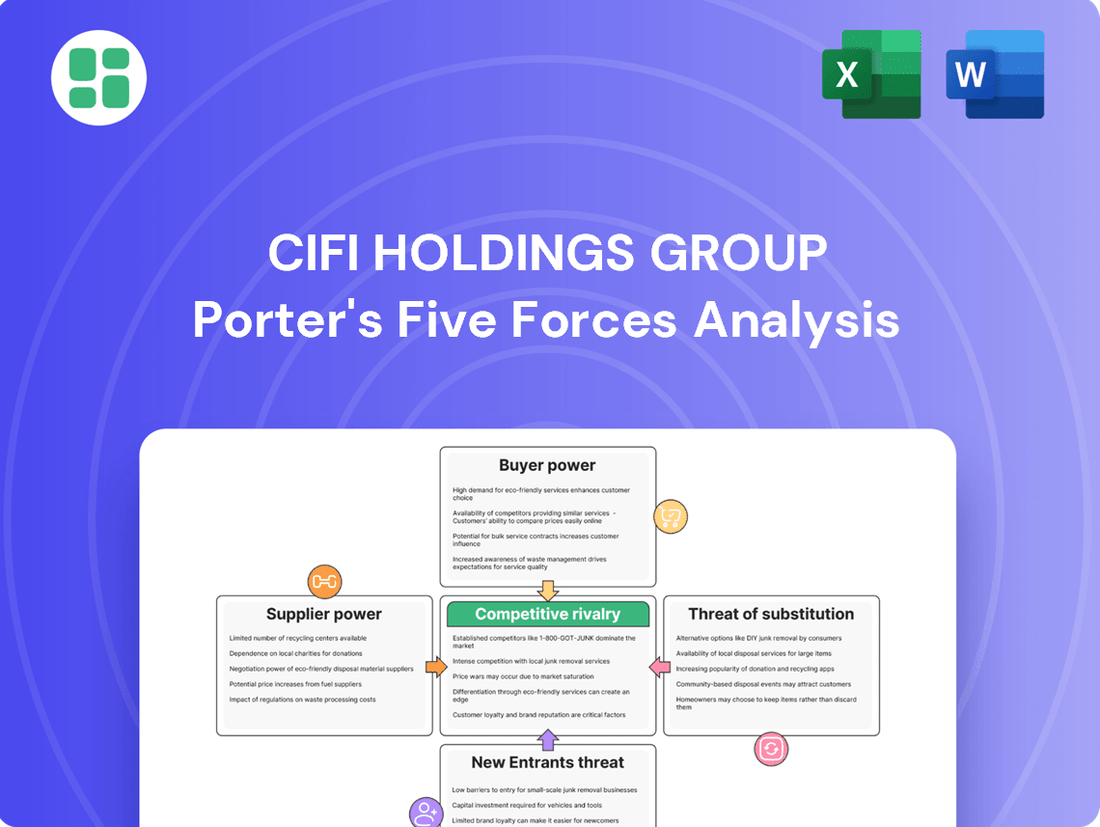

CIFI Holdings Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of CIFI Holdings Group, detailing competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. This in-depth examination provides actionable insights into the strategic landscape CIFI operates within, enabling informed decision-making.

Rivalry Among Competitors

CIFI Holdings Group operates within a Chinese real estate market teeming with developers, creating a highly competitive landscape. This intense rivalry is a defining characteristic, pushing companies to constantly innovate and optimize their strategies to capture market share.

Despite ongoing consolidation trends where major developers are increasingly dominating, the market, especially in smaller cities, remains notably fragmented. This means that while the top players are growing, many smaller and regional developers still contribute to the overall competitive intensity.

For example, in 2024, the top 100 Chinese developers accounted for approximately 60% of total sales, a figure that has been steadily increasing, indicating the ongoing consolidation. However, this still leaves a significant portion of the market accessible to a multitude of other players, underscoring the persistent fragmentation.

The Chinese real estate market is experiencing a notable slowdown, with many segments facing significant oversupply. This situation directly fuels intense competitive rivalry among developers like CIFI Holdings Group.

As the demand for properties wanes and the available inventory grows, developers are compelled to compete more fiercely for a diminishing base of potential buyers. This often translates into aggressive pricing strategies, which inevitably squeeze profit margins across the industry.

For instance, in 2023, China's property investment fell by 9.6% year-on-year, and new housing sales volume also saw a decline, highlighting the challenging market conditions. This environment forces companies to differentiate through more than just price, focusing on quality, location, and services.

CIFI Holdings Group operates in an industry characterized by significant exit barriers. The real estate development sector demands massive upfront investment in land acquisition, construction, and marketing, locking companies into long-term commitments. These substantial fixed assets and the multi-year nature of development projects make it incredibly difficult for firms to divest or cease operations quickly, even when facing financial headwinds.

Consequently, even companies experiencing financial distress often remain active market participants for extended periods. This persistence, driven by the inability to easily exit, can lead to prolonged periods of intense competition and market saturation. Instead of a swift consolidation or exit of weaker players, the market might see a drawn-out struggle, impacting overall industry profitability and pricing power for all involved, including CIFI.

Product Differentiation and Brand Reputation

Developers in the real estate sector, including CIFI Holdings Group, strive to differentiate their offerings through various avenues such as prime locations, superior construction quality, innovative design, and robust after-sales services. This constant effort to stand out is crucial in a highly competitive landscape.

CIFI Holdings Group, recognizing this, has strategically focused on enhancing its property management services and its ability to deliver projects efficiently. These areas are intended to build a strong brand reputation and foster customer loyalty, aiming to carve out a distinct market position.

However, despite these efforts, achieving substantial differentiation in the intensely crowded Chinese property market presents a significant ongoing challenge. Many developers are pursuing similar strategies, making it difficult for any single entity to gain a truly unique advantage.

For instance, in 2024, the Chinese property market continued to grapple with oversupply in certain segments, intensifying the need for developers to clearly articulate their value propositions. CIFI's reported revenue for the first half of 2024 was RMB 49.2 billion, with a net profit of RMB 1.2 billion, indicating the pressures faced even by established players in differentiating themselves effectively.

- Location: Developers compete for land in high-demand urban centers.

- Quality & Design: Emphasis on premium materials and modern architectural aesthetics.

- After-Sales Service: Focus on customer satisfaction post-purchase, including property management.

- Brand Reputation: Building trust and recognition through consistent delivery and service.

Policy-Driven Competition and 'White List' Projects

Government intervention significantly shapes competitive rivalry in China's property sector. Initiatives like the 'white list' for project financing, actively promoted by authorities in 2024, aim to ensure the completion of pre-sold homes. Developers whose projects are included on these lists often find it easier to secure bank loans and maintain construction momentum, creating a distinct advantage over competitors whose projects are not prioritized.

This policy-driven environment can lead to an uneven playing field. For instance, by mid-2024, reports indicated that a substantial portion of new financing approvals were directed towards projects on these government-backed lists. This means that developers with strong government relations or projects deemed strategically important may bypass the intense capital constraints faced by others, directly impacting their ability to compete on project delivery and market share.

- Government Support for 'White List' Projects: In 2024, Chinese authorities actively supported a 'white list' system for property projects to ensure completion of pre-sold homes.

- Financing Advantage: Projects on these 'white lists' often gain preferential access to bank loans and other forms of financing, easing capital constraints for developers.

- Uneven Competitive Landscape: This preferential treatment can create an uneven playing field, benefiting developers with prioritized projects over those not on the lists.

- Impact on Project Completion: The 'white list' initiative aims to boost confidence and ensure project delivery, a critical factor in a market facing liquidity challenges.

The competitive rivalry within China's real estate sector, where CIFI Holdings Group operates, is exceptionally fierce. This intense competition stems from a market characterized by numerous developers, significant oversupply in certain segments, and substantial exit barriers that keep even financially strained firms active. Developers are compelled to employ aggressive pricing and focus on differentiation through location, quality, design, and services to capture market share.

Government intervention, particularly through initiatives like the 'white list' for project financing in 2024, further shapes this rivalry by creating an uneven playing field. Projects on these lists receive preferential financing, giving those developers a distinct advantage in project completion and market presence.

| Metric | 2023 Data | 2024 Data (H1) | Implication for Rivalry |

|---|---|---|---|

| China Property Investment Change | -9.6% | N/A (Full Year Data Pending) | Continued market slowdown intensifies competition for buyers. |

| Top 100 Developers' Market Share | Approx. 60% | N/A (Trend Continues) | Consolidation is ongoing, but fragmentation persists, fueling rivalry. |

| CIFI Holdings Group Revenue | N/A (Full Year Data Pending) | RMB 49.2 billion | Indicates continued operational scale despite market pressures. |

| CIFI Holdings Group Net Profit | N/A (Full Year Data Pending) | RMB 1.2 billion | Profitability under pressure, highlighting the need for effective differentiation. |

SSubstitutes Threaten

Renting presents a compelling substitute to property ownership for many, particularly younger demographics grappling with economic uncertainties and elevated housing costs. In 2024, for instance, the median home price in many major metropolitan areas continued to outpace wage growth, making renting a more accessible option. This trend is further amplified by evolving lifestyle preferences that prioritize flexibility over long-term commitment.

Government efforts to bolster the rental market by increasing the supply of affordable, long-term housing options directly enhance the attractiveness of renting as a substitute. For example, several cities in 2024 launched or expanded programs aimed at developing new rental units or providing subsidies, thereby increasing the competitive pressure on the buying market. This strategic push makes it easier for individuals to opt for renting, potentially impacting CIFI Holdings Group's sales volumes.

The threat of substitutes for CIFI Holdings Group is amplified by the growing appeal of alternative asset classes. With real estate markets experiencing prolonged challenges and an uncertain recovery, investors are increasingly looking towards stocks, bonds, and other industries. For instance, in 2024, global equity markets saw significant inflows as investors sought growth opportunities, potentially diverting capital away from traditional property investments.

The availability of existing homes in the secondary market presents a significant threat of substitution for CIFI Holdings Group's new property developments. Buyers often consider pre-owned properties as a viable alternative, especially if they offer better value or are located in established neighborhoods. This can directly siphon demand away from CIFI's projects.

During economic downturns, the secondary market can become particularly competitive. Secondhand home prices might not fall as steeply or may recover more slowly than new builds, making them a more attractive option for price-sensitive buyers. For instance, in late 2023, while new home sales saw fluctuations, the resale market in many regions demonstrated resilience, offering a broader range of price points that could pull potential customers from CIFI's offerings.

Government-Subsidized Housing Programs

Government-subsidized housing programs, such as public rental housing and shared ownership schemes, present a significant threat of substitution for CIFI Holdings Group. These initiatives offer more affordable alternatives to commercial property purchases, particularly for lower and middle-income segments of the market. For instance, in 2024, many cities continued to expand their affordable housing initiatives, with some regions reporting a substantial increase in available subsidized units. This directly impacts demand for CIFI's market-rate residential offerings.

The availability of these subsidized options can dampen demand for CIFI's residential projects by providing a more budget-friendly pathway to homeownership or stable rental accommodation. This is particularly relevant in areas where CIFI has a strong presence and where government housing policies are actively promoting affordability. The economic climate in 2024, marked by persistent inflation in some regions, further amplifies the attractiveness of these subsidized programs for a broader base of potential homebuyers.

- Increased Affordability: Subsidized housing directly competes by offering lower entry costs and rental rates than market-rate developments.

- Government Support: Active government policies and funding for affordable housing create a consistent supply of substitute options.

- Market Segmentation: These programs target specific income brackets, diverting a portion of CIFI's potential customer base.

Delayed Purchase Decisions or Downsizing

Economic uncertainty, a significant factor influencing consumer behavior, can directly impact the real estate market. When the economic outlook is clouded, potential buyers often adopt a wait-and-see approach. This hesitation can lead to a slowdown in sales for developers like CIFI Holdings Group.

Declining property income, whether due to broader market trends or specific economic pressures, further amplifies buyer caution. If individuals anticipate lower returns on investment or a decrease in their disposable income, they become more risk-averse. This sentiment directly translates into delayed purchasing decisions for new homes.

Furthermore, a cautious outlook can drive buyers towards more affordable alternatives. Instead of purchasing a premium or larger new build, consumers might opt for smaller properties or even consider pre-owned homes. This shift in preference acts as a direct substitute, reducing demand for CIFI’s primary offerings.

- Economic Uncertainty: Global economic forecasts for 2024 indicate a mixed picture, with some regions experiencing slower growth, potentially impacting consumer confidence and large purchase decisions.

- Declining Property Income: In some key markets, rental yields have seen modest declines in late 2023 and early 2024, making new property investments less attractive compared to other asset classes.

- Buyer Behavior Shift: Surveys in late 2023 showed a notable increase in the number of potential homebuyers delaying their purchase plans, with a significant portion citing affordability and economic concerns as primary reasons.

- Substitution Effect: The rise in demand for smaller, more affordable starter homes or refurbished older properties represents a clear substitute for larger, newly constructed units, impacting the sales volume for developers focused on premium segments.

The threat of substitutes for CIFI Holdings Group is multifaceted, encompassing both renting and alternative investments. In 2024, the persistent gap between home prices and wage growth made renting a more accessible option for many, a trend supported by government initiatives to boost rental supply. Furthermore, investors increasingly diverted capital to equities in 2024 due to perceived growth opportunities, a clear substitute for real estate investment.

The secondary housing market also poses a significant threat, particularly during economic slowdowns. In late 2023, resale properties demonstrated resilience against fluctuating new home sales, offering a broader price spectrum that appealed to budget-conscious buyers. Similarly, government-subsidized housing programs in 2024 provided more affordable alternatives, directly impacting demand for CIFI's market-rate residential projects.

Economic uncertainty in 2024, coupled with concerns about declining property income, further fueled buyer caution. This led to a shift towards smaller, more affordable starter homes or refurbished older properties, directly substituting CIFI's larger, newly constructed units.

| Substitute Type | 2024 Trend/Data Point | Impact on CIFI |

|---|---|---|

| Renting | Median home prices outpaced wage growth in major metros. | Increases demand for rental market over ownership. |

| Alternative Investments (Stocks) | Significant inflows into global equity markets. | Diverts capital away from property investments. |

| Secondary Housing Market | Resale market showed resilience vs. new builds in late 2023. | Offers competitive pricing and location advantages. |

| Government-Subsidized Housing | Expansion of affordable housing initiatives. | Provides budget-friendly alternatives to market-rate projects. |

Entrants Threaten

Entering China's real estate development sector demands substantial upfront investment. Land acquisition alone can cost billions, coupled with extensive construction and ongoing operational expenditures. This financial hurdle acts as a significant deterrent for potential new players.

The current financing climate further tightens this barrier. In 2023, the total value of property sales in China was approximately 11.7 trillion yuan, a figure that underscores the sheer scale of capital required for even a modest development. Accessing the necessary funding in a stricter regulatory environment makes it exceptionally difficult for newcomers to compete with established entities like CIFI Holdings.

For CIFI Holdings Group, the threat of new entrants is significantly mitigated by the substantial challenges in acquiring land and navigating complex regulatory environments. New developers face immense difficulty in securing prime land banks, a critical component for success in the real estate sector.

The government's tight grip on land supply, particularly in major urban centers, acts as a formidable barrier. For instance, in 2024, land auction prices in tier-1 cities often saw significant premiums, making it economically unfeasible for smaller or new entrants to compete effectively with established players like CIFI who have existing relationships and financial capacity.

Furthermore, the intricate web of local government regulations, zoning laws, and licensing procedures presents another major hurdle. Obtaining the necessary permits and approvals can be a lengthy and costly process, demanding considerable expertise and resources that new companies may lack, thereby protecting CIFI's market position.

CIFI Holdings Group, like other major developers, benefits significantly from its established brand reputation and deep-seated relationships within the industry. This makes it challenging for new entrants to quickly gain the trust of customers and secure favorable terms with suppliers and financial institutions. For instance, in 2024, CIFI’s strong brand allowed it to continue accessing capital markets, albeit with careful management of its debt profile, a feat a newcomer would find considerably harder.

Intense Competition from Existing Players

The threat of new entrants for CIFI Holdings Group is significantly mitigated by the existing intense competition and market oversupply. New players entering the Chinese real estate market would face considerable hurdles in establishing a foothold. This is because established developers like CIFI have already secured prime land, built strong brand recognition, and developed efficient operational models. For instance, in 2024, the Chinese property market continued to grapple with oversupply in many tier-3 and tier-4 cities, making it difficult for newcomers to achieve profitability without substantial capital or unique value propositions.

New entrants would likely need to engage in aggressive pricing strategies or invest heavily in differentiation to attract customers. This heightened risk discourages many potential new companies from entering the market. CIFI, having navigated these challenging conditions, possesses a more resilient business structure. The ongoing regulatory environment in China also tends to favor larger, more established developers who can better manage compliance and financial stability.

Key factors that deter new entrants include:

- High Capital Requirements: Acquiring land and developing projects demands significant upfront investment, a barrier for many new firms.

- Established Brand Loyalty: CIFI and other major players benefit from existing customer trust and brand recognition, making it hard for new entrants to compete on reputation alone.

- Economies of Scale: Larger developers like CIFI leverage economies of scale in procurement, construction, and marketing, offering cost advantages that new entrants struggle to match.

Access to Financing and Debt Restructuring Environment

The current financial landscape presents a significant barrier for new entrants. Many established developers are navigating debt restructuring, making it harder for them to access new capital. This tightening of credit means that securing the substantial financing required for new real estate projects is exceptionally challenging for potential competitors.

For instance, in 2024, global commercial real estate debt issuance saw a notable slowdown compared to previous years, reflecting increased caution from lenders. This environment directly impacts the ability of newcomers to raise the funds needed to compete with established players like CIFI Holdings Group, who may have existing banking relationships and more flexible financing options.

- Financing Difficulty: Securing large-scale project financing is a major hurdle for new real estate developers in 2024.

- Debt Restructuring Impact: The prevalence of debt restructuring among existing developers signals a tighter lending environment.

- Competitive Disadvantage: New entrants face a significant disadvantage in capital acquisition compared to established firms.

The threat of new entrants for CIFI Holdings Group remains relatively low due to significant capital requirements and regulatory complexities in China's real estate sector. Acquiring land, especially in prime urban areas, demands billions, a sum that deters many potential new players. For example, land auction prices in tier-1 cities in 2024 often saw substantial premiums, making it economically unfeasible for smaller firms to compete effectively with established entities like CIFI.

| Factor | Impact on New Entrants | CIFI's Advantage |

|---|---|---|

| Capital Requirements | Extremely High (Billions for land acquisition) | Established financial capacity and access to capital markets |

| Regulatory Hurdles | Complex and time-consuming (permits, zoning) | Existing expertise and relationships with local governments |

| Market Saturation & Competition | Intense, especially in lower-tier cities (oversupply in 2024) | Strong brand recognition and established operational models |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for CIFI Holdings Group is built upon a robust foundation of data, including CIFI's annual reports, investor presentations, and official company disclosures. We supplement this with industry-specific research from reputable real estate analytics firms and macroeconomic data from government agencies to capture the broader market landscape.