CIFI Holdings Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CIFI Holdings Group Bundle

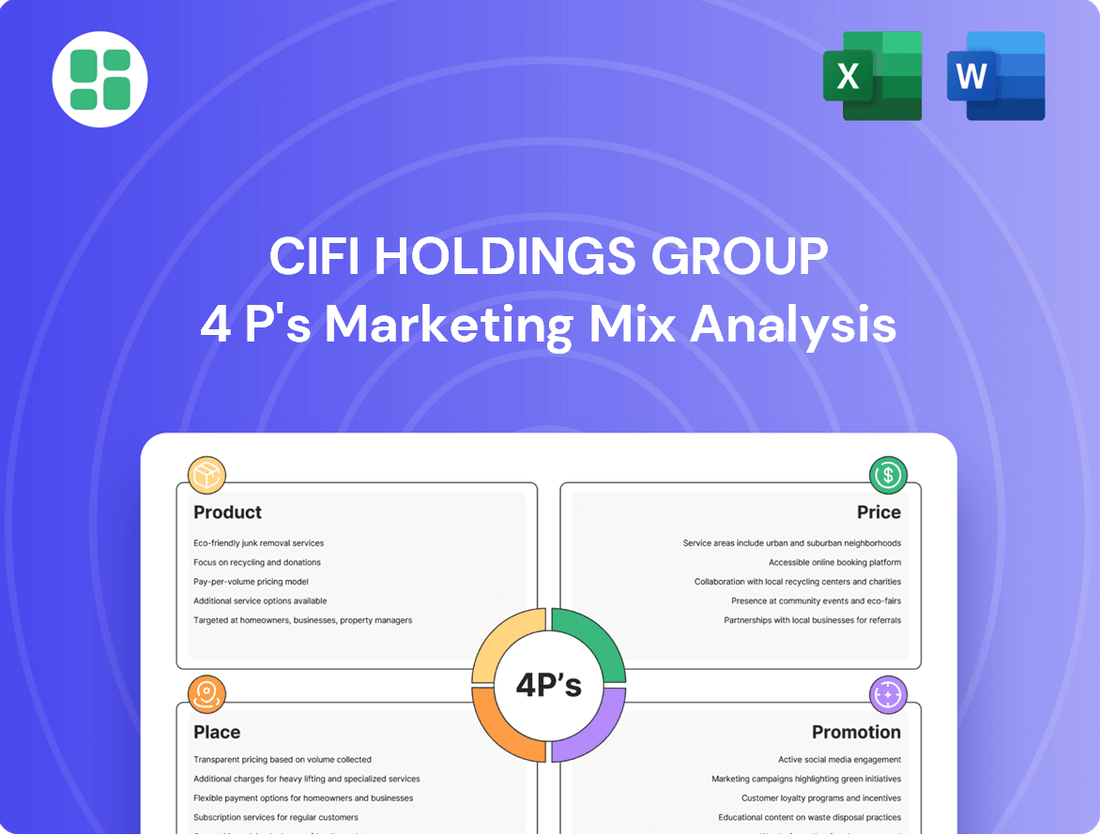

Discover how CIFI Holdings Group masterfully crafts its product offerings, sets competitive pricing, strategically places its developments, and executes impactful promotions. This analysis reveals the synergy behind their market presence.

Go beyond this snapshot and unlock a comprehensive, editable 4Ps Marketing Mix Analysis for CIFI Holdings Group, perfect for strategic planning, academic study, or business benchmarking.

Save invaluable time on research and gain actionable insights into CIFI Holdings Group's marketing engine. Get the full, professionally written report now to elevate your understanding and application of marketing strategy.

Product

CIFI Holdings Group's diverse property portfolio is a cornerstone of its marketing strategy, encompassing residential, commercial, and mixed-use developments. This breadth allows them to tap into various market segments, from individual homebuyers to corporate clients needing office or retail spaces. As of the first half of 2024, CIFI reported a total contracted sales area of 4.6 million square meters, showcasing the scale of their diverse offerings.

CIFI Holdings Group prioritizes high-quality, end-user driven design, focusing on mature segments in China's first and second-tier cities. This strategy centers on meeting customer needs to deliver enhanced living and working environments.

Their dedication to quality is exemplified by the Tianjin Park Mansion project, which earned recognition as one of China's Top 10 Premium Delivery Projects of 2024. This award underscores CIFI's commitment to excellence in property development.

CIFI Holdings Group's product strategy for integrated mixed-use developments is exemplified by projects like the Kunming CIFI Plaza Phase II Residential Project. This initiative showcases a sophisticated approach, positioning itself as a 'vertical fourth-generation habitat above an integrated complex.'

This product strategy focuses on creating comprehensive lifestyle solutions by blending residential, commercial, and other essential facilities within a single, cohesive development. Such integration aims to enhance convenience and community living for residents.

In 2024, CIFI continued to emphasize these integrated developments, contributing significantly to their overall sales. For instance, their commitment to urban renewal and mixed-use projects aligns with evolving consumer demand for accessible, amenity-rich living environments.

Comprehensive Property Management Services

CIFI Holdings Group's property management services extend well beyond their development and investment arms, catering to both residential and commercial clients. This crucial aspect of their business is a significant revenue driver, demonstrating a commitment to ongoing property value and client satisfaction.

The financial performance of this segment is robust. In 2024, property management and other services generated approximately RMB6,639.5 million in revenue. This highlights the substantial contribution of these services to the group's overall financial health, underscoring their strategic importance.

- Revenue Generation: Property management and other services brought in RMB6,639.5 million in 2024.

- Customer Focus: Services are offered to both residential and commercial property owners.

- Value Enhancement: The segment ensures continued maintenance and value for CIFI's developed properties.

- Recurring Income: This business line builds strong recurring revenue streams for the group.

Commitment to Delivery and Service

CIFI Holdings Group prioritizes 'ensuring delivery, quality and service' as a cornerstone of its product strategy, even as the property market navigates adjustments. This focus on reliable execution is crucial for maintaining customer trust and brand reputation.

The company demonstrated this commitment by successfully delivering over 8,100 new homes across 18 projects in 15 cities during the first quarter of 2025. This performance highlights CIFI's operational capability in a dynamic market environment.

- Delivery Rate: CIFI achieved an overall delivery rate exceeding 95% between 2022 and 2024.

- Q1 2025 Deliveries: Over 8,100 homes were delivered in the first three months of 2025.

- Geographic Reach: These deliveries spanned 18 projects across 15 cities nationwide.

- Core Mission: The company's unwavering commitment to delivery, quality, and service underpins its product offering.

CIFI Holdings Group's product strategy centers on a diversified portfolio of residential, commercial, and mixed-use properties, with a strong emphasis on quality and end-user driven design in China's key cities. This approach is supported by a robust property management segment that ensures ongoing value and recurring revenue.

The company's commitment to reliable delivery is a key differentiator, as evidenced by their substantial home delivery figures in early 2025. This focus on execution, quality, and service is fundamental to their product offering and customer trust.

| Product Segment | Key Characteristics | 2024/2025 Data Point |

|---|---|---|

| Residential & Mixed-Use | High-quality, end-user driven design in Tier 1 & 2 cities; integrated lifestyle solutions. | Contracted sales area of 4.6 million sqm (H1 2024). Tianjin Park Mansion recognized as Top 10 Premium Delivery Project (2024). |

| Property Management | Services for residential and commercial clients; value enhancement and recurring revenue. | Revenue of RMB6,639.5 million (2024). Overall delivery rate exceeding 95% (2022-2024). |

| Delivery Performance | Commitment to ensuring delivery, quality, and service. | Over 8,100 homes delivered across 18 projects in 15 cities (Q1 2025). |

What is included in the product

This analysis delves into CIFI Holdings Group's marketing mix, examining their diverse product portfolio, competitive pricing strategies, strategic placement in key urban centers, and targeted promotional activities. It offers a comprehensive overview for understanding CIFI's market positioning and operational approach.

This CIFI Holdings Group 4Ps analysis acts as a pain point reliever by clearly outlining how their product, price, place, and promotion strategies address market challenges and customer needs.

It serves as a concise, actionable guide for stakeholders to understand CIFI's competitive positioning and identify opportunities for enhanced market performance.

Place

CIFI Holdings Group has strategically positioned itself in numerous Chinese cities, prioritizing major first- and second-tier urban centers and key economic hubs. This focus ensures access to markets with robust demand and considerable growth opportunities.

The company’s extensive footprint covers four vital economic zones: the Yangtze River Delta, the Pan Bohai Rim, the Central Western Region, and South China. For instance, as of the first half of 2024, CIFI reported a land bank of approximately 57.8 million square meters, with a significant portion concentrated in these high-tier cities, demonstrating their commitment to prime urban locations.

CIFI Holdings Group boasts impressive nationwide operating coverage, extending its property development, investment, and management services across China. This broad footprint allows CIFI to tap into a wide array of regional growth opportunities and effectively diversify its market exposure, reducing reliance on any single locale.

As of June 30, 2023, CIFI's substantial land bank, amounting to 43.7 million square meters, underpins this extensive operational reach. This strategically positioned land inventory across various cities and provinces is crucial for sustaining its nationwide development pipeline and ensuring continued market penetration.

CIFI Holdings Group leverages direct sales channels, often featuring dedicated sales centers within each development and regional offices, to connect with potential buyers. These physical touchpoints are vital for real estate, allowing customers to experience show units firsthand and engage directly with sales professionals to complete transactions.

For instance, in 2023, CIFI's sales and marketing expenses amounted to RMB 12.5 billion, reflecting the significant investment in these direct sales infrastructures to facilitate property purchases and enhance customer engagement.

Digital and Online Platforms

CIFI Holdings Group, like other forward-thinking developers, leverages digital and online platforms to expand its market reach and enhance customer engagement. These platforms are crucial for showcasing properties, providing virtual tours, and managing initial customer inquiries, offering a convenient touchpoint for potential buyers. In 2024, the real estate sector saw a significant shift towards digital marketing, with online channels becoming primary sources of property discovery for many consumers.

The strategic use of online channels allows CIFI to connect with a wider audience, transcending geographical limitations and offering 24/7 access to property information. This digital presence complements their physical sales efforts, creating a more integrated and accessible customer journey. By 2025, it's projected that over 70% of property searches will begin online, underscoring the critical importance of a robust digital strategy.

- Digital Marketing Investment: CIFI likely allocates a substantial portion of its marketing budget to digital channels, including social media advertising, search engine optimization (SEO), and content marketing, to attract and engage prospective buyers.

- Virtual Property Showcases: High-quality virtual tours and interactive property listings on their website and third-party platforms provide immersive experiences, allowing potential buyers to explore properties remotely.

- Online Lead Generation: Digital platforms serve as key channels for generating leads through website forms, online inquiries, and direct messaging, streamlining the initial contact process.

- Data Analytics for Optimization: CIFI would utilize website analytics and customer data to refine its online marketing strategies, identifying effective channels and optimizing content for better conversion rates.

Participation in Whitelist Projects

CIFI Holdings Group's participation in whitelist projects is a significant aspect of its market strategy, particularly within the 'Promotion' element of the 4Ps. This engagement demonstrates a proactive approach to navigating the evolving real estate landscape. The company's involvement in these government-backed initiatives directly influences its product development and market access.

The company's active role in financing coordination mechanisms has yielded tangible results. In 2024, CIFI had 55 projects successfully shortlisted on the crucial 'real estate projects whitelist'. This achievement is more than just a number; it signifies strong governmental recognition and support.

- Government Endorsement: Being on the whitelist signals to financial institutions and regulatory bodies that CIFI's projects meet specific criteria, potentially easing financing hurdles.

- Streamlined Approvals: This recognition can accelerate project approval processes, allowing CIFI to bring developments to market more efficiently.

- Enhanced Market Access: The whitelist status can improve CIFI's ability to secure necessary funding and resources, ultimately making its projects more accessible to a wider consumer base.

- Strategic Advantage: This participation positions CIFI favorably in a competitive market by leveraging policy support for its development pipeline.

CIFI Holdings Group's strategic placement focuses on China's high-tier cities and key economic zones, ensuring access to robust demand. Their extensive land bank, totaling 43.7 million square meters as of June 30, 2023, is concentrated in these prime locations, supporting nationwide development. This geographical concentration, particularly in the Yangtze River Delta, Pan Bohai Rim, Central Western Region, and South China, underpins their market penetration strategy.

| Region | Land Bank Concentration (as of H1 2024, est.) | Key Cities |

|---|---|---|

| Yangtze River Delta | High | Shanghai, Hangzhou, Nanjing |

| Pan Bohai Rim | Moderate | Beijing, Tianjin, Qingdao |

| Central Western Region | Developing | Chongqing, Chengdu, Wuhan |

| South China | High | Guangzhou, Shenzhen, Xiamen |

Same Document Delivered

CIFI Holdings Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of CIFI Holdings Group's 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

CIFI Holdings Group's commitment to 'ensuring delivery, quality, and service' is a powerful promotional cornerstone, particularly relevant in today's real estate market. This focus directly addresses buyer concerns about project completion and standards.

By showcasing their track record, such as the successful delivery of over 270,000 property units between 2022 and 2024 with an impressive 95%+ delivery rate, CIFI builds significant trust and enhances its reputation with prospective customers. This demonstrable reliability serves as a compelling testimonial.

CIFI Holdings Group leverages public relations and corporate communications as a key element of its marketing mix. The company actively disseminates information through press releases, announcements, and comprehensive annual reports, detailing its financial performance, operational milestones, and strategic outlook. This proactive approach aims to foster transparency and build trust with a broad range of stakeholders, including investors, analysts, and the general public.

A significant focus of CIFI's communication strategy in 2024 and early 2025 has been on managing perceptions surrounding its debt restructuring efforts. By providing clear updates on progress and highlighting positive financial indicators, such as a reported positive net operating cash flow, the company seeks to reassure stakeholders and maintain confidence in its long-term viability. For instance, in its 2024 disclosures, CIFI detailed specific advancements in its debt management plan, aiming to demonstrate its commitment to financial stability.

CIFI Holdings Group effectively utilizes its awards and recognitions as a key component of its marketing strategy. For instance, being named one of China's Top 10 Real Estate Companies for Delivery Capability in 2024, alongside the Tianjin Park Mansion project’s recognition as one of China's Top 10 Premium Delivery Projects of 2024, provides powerful third-party validation.

These accolades directly bolster CIFI's brand image, communicating a strong message of quality, reliability, and execution excellence to both prospective homebuyers and the investment community. Such endorsements are crucial in a competitive market, helping to differentiate CIFI and build trust.

Investor Relations and Transparency

CIFI Holdings Group places significant emphasis on investor relations as a key promotional tool, maintaining open communication channels through regular announcements. This includes the timely release of financial results, details regarding Annual General Meetings (AGMs), and crucial updates on their debt restructuring progress. For instance, in their 2024 interim report, CIFI highlighted efforts to optimize their capital structure, aiming for greater financial flexibility.

This commitment to transparency, while primarily serving financial stakeholders, indirectly acts as a powerful promotional element for the broader market. By demonstrating a clear and consistent approach to financial management and corporate governance, CIFI aims to build confidence in its stability and long-term viability. This assurance can positively influence potential homebuyers, who increasingly scrutinize a developer's financial health before making significant purchase decisions.

The company's proactive engagement with investors and the public disclosure of its financial strategies, including debt management, serve to bolster its reputation. This is particularly relevant in the current real estate market, where developer solvency is a paramount concern for consumers. CIFI's strategy aims to position itself as a reliable and resilient entity, thereby enhancing its brand image and market appeal.

Key aspects of CIFI's investor relations promotion include:

- Regular Financial Reporting: Consistent release of financial statements and performance updates, such as their 2023 annual results which detailed revenue and profit figures.

- Debt Restructuring Updates: Transparent communication regarding ongoing efforts to manage and optimize their debt portfolio.

- Corporate Governance: Information dissemination on AGM proceedings and corporate decision-making processes.

- Market Perception: Leveraging transparency to build trust and signal financial stability to potential customers and investors alike.

Project-Specific Launch Events and Groundbreakings

CIFI Holdings Group strategically utilizes project-specific launch events and groundbreakings to introduce new developments. These events, like the Kunming CIFI Plaza Phase II Residential Project groundbreaking, are designed to capture local media attention and foster community interest.

These direct promotional activities aim to create buzz and engage potential buyers by showcasing new products in specific markets. This approach directly supports the Product and Promotion elements of the 4Ps marketing mix.

- Event Focus: Groundbreaking ceremonies and launch events for new developments.

- Objective: Generate local media attention and community interest.

- Impact: Creates buzz and direct engagement with potential buyers.

- Marketing Role: Serves as direct promotional activities for new products.

CIFI Holdings Group's promotional strategy heavily relies on demonstrating delivery reliability and quality, highlighted by their successful delivery of over 270,000 units between 2022 and 2024 with a delivery rate exceeding 95%. This focus on execution excellence is further amplified by industry accolades, such as being recognized as one of China's Top 10 Real Estate Companies for Delivery Capability in 2024. The company also proactively manages market perception through transparent investor relations, providing regular updates on financial performance and debt restructuring efforts, as seen in their 2024 interim reports detailing capital structure optimization.

CIFI leverages public relations and corporate communications, including press releases and annual reports, to build trust and transparency with stakeholders. Their proactive engagement with investors, such as detailing debt management plans in 2024 disclosures and optimizing capital structure, aims to reassure the market of their financial stability. Furthermore, project-specific launch events and groundbreakings, like the Kunming CIFI Plaza Phase II Residential Project groundbreaking, are employed to generate local buzz and directly engage potential buyers.

| Promotional Activity | Key Metric/Example | Impact |

|---|---|---|

| Delivery Track Record | Over 270,000 units delivered (2022-2024) with 95%+ delivery rate | Builds trust and enhances reputation |

| Industry Awards | China's Top 10 Real Estate Companies for Delivery Capability (2024) | Provides third-party validation and differentiates brand |

| Investor Relations | 2024 Interim Report: Updates on debt restructuring and capital structure optimization | Reassures stakeholders and signals financial stability |

| Project Launches | Kunming CIFI Plaza Phase II Residential Project groundbreaking | Generates local media attention and community interest |

Price

CIFI Holdings Group's pricing strategy demonstrates a keen awareness of market dynamics. For instance, contracted average selling prices in 2025 showed notable shifts, moving from RMB 9,900 per square meter in March to RMB 12,900 per square meter by June. This responsiveness suggests CIFI actively adjusts its pricing based on regional demand, project specifics, and broader economic sentiment within China's real estate sector.

The company's approach is clearly adaptive, aiming to capture value effectively in a fluctuating market. The average selling price for the first half of 2025 settled around RMB 10,800 per square meter, reflecting a blend of these dynamic adjustments and underlying market conditions.

CIFI Holdings Group's pricing strategy for its diverse property portfolio, encompassing residential, commercial, and mixed-use developments, is firmly rooted in value-based principles. This approach ensures that the price point directly correlates with the tangible and intangible benefits delivered to end-users, reflecting the premium quality, innovative design, and enhanced lifestyle or business environments they offer.

The company's commitment to "end-user driven properties" means pricing is meticulously calibrated to match the superior features, architectural excellence, and the overall improved quality of life or operational efficiency that CIFI properties provide. For instance, in 2024, CIFI reported a significant portion of its revenue derived from its high-quality residential segment, where pricing reflects not just square footage but also the integrated amenities and community planning, a trend projected to continue in 2025.

CIFI Holdings Group's aggressive offshore debt restructuring, targeting a reduction of roughly USD5.27 billion or 66% of its debt, directly impacts its financial stability. This move, while not a direct pricing strategy for its properties, is foundational for its future operational capacity and market competitiveness.

The successful execution of this debt overhaul is paramount for CIFI to regain financial resilience. This improved health is expected to empower the company to adopt more flexible and competitive pricing strategies for its real estate developments, a key element in its long-term market positioning.

Strategic Asset Disposals for Liquidity

CIFI Holdings Group has actively pursued strategic asset disposals to bolster its cash reserves and manage liquidity challenges. This approach is crucial for maintaining operational stability and preventing forced sales of its core property portfolio, thereby supporting a more consistent pricing strategy for its main developments.

The company's disposal strategy directly impacts its pricing power by ensuring it doesn't need to liquidate prime assets at a discount. For instance, in the first half of 2024, CIFI reported a significant reduction in its non-core asset holdings, contributing to improved financial flexibility.

- Asset Disposals for Liquidity: CIFI's strategy to sell non-core assets aims to enhance its cash position.

- Pricing Stability: By avoiding distressed sales of core properties, CIFI can maintain more stable pricing for its primary offerings.

- Operational Continuity: These disposals are vital for ensuring the company's continued business operations and market presence.

- Financial Flexibility: The proceeds from asset sales provide CIFI with greater maneuverability in its financial planning and investment decisions.

Consideration of Financing Options and Market Demand

CIFI Holdings Group's engagement with financing coordination mechanisms and its inclusion on 'real estate projects whitelist' programs highlight a strategic approach to market demand. This suggests the company actively considers buyer financing availability when pricing its properties, aiming for competitive attractiveness.

For instance, in early 2024, China's central government actively promoted financial support for developers and homebuyers, including the creation of project whitelists to facilitate bank lending. CIFI's participation in such initiatives directly impacts its ability to offer accessible pricing by ensuring a smoother financing process for potential buyers, thereby boosting market demand.

- Financing Facilitation: CIFI's involvement in financing coordination and whitelists directly addresses buyer affordability.

- Market Responsiveness: This indicates pricing strategies are aligned with the broader financial ecosystem and buyer purchasing power.

- Demand Stimulation: By easing financing, CIFI aims to make its offerings more appealing, directly influencing sales volume.

CIFI Holdings Group's pricing strategy is deeply intertwined with its value proposition, focusing on end-user benefits and market responsiveness. The average selling price for the first half of 2025 was around RMB 10,800 per square meter, a figure that reflects adjustments based on regional demand and project specifics. This adaptability is crucial in China's dynamic real estate market.

| Metric | 2024 (H1) | 2025 (H1 Projection) | Notes |

|---|---|---|---|

| Average Selling Price (RMB/sqm) | ~10,500 | ~10,800 | Reflects market adjustments and value-based pricing. |

| Contracted ASP Shift (March-June 2025) | N/A | RMB 9,900 to RMB 12,900 | Demonstrates pricing flexibility based on demand. |

4P's Marketing Mix Analysis Data Sources

Our CIFI Holdings Group 4P's Marketing Mix Analysis is built upon a foundation of publicly available data, including official company reports, investor presentations, and real estate market analyses. We also incorporate insights from industry publications and news articles to provide a comprehensive view of their strategies.