CIFI Holdings Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CIFI Holdings Group Bundle

Curious about CIFI Holdings Group's product portfolio performance? This glimpse into their BCG Matrix highlights key areas, but the full report unlocks the complete picture of their Stars, Cash Cows, Dogs, and Question Marks.

Don't miss out on the strategic advantage! Purchase the full BCG Matrix for CIFI Holdings Group and receive a detailed breakdown of each product's market share and growth rate, empowering you to make informed investment decisions.

Unlock actionable insights and a clear path forward for CIFI Holdings Group's product strategy. Get the complete BCG Matrix today and transform your understanding of their market position.

Stars

CIFI Holdings Group's focus on high-quality projects in resilient first-tier cities like Beijing and Shanghai positions these developments as potential Stars in a BCG Matrix analysis. Despite a broader market slowdown, these key urban centers demonstrated notable resilience in 2024, with new home sales showing pockets of growth. For instance, Shanghai's property market saw a year-on-year increase in transaction volumes for new homes in early 2024, indicating sustained buyer interest.

If CIFI's developments in these premium locations are capturing substantial market share within their respective segments, they represent strong contenders for the Star category. This strategic concentration on cities with robust underlying demand and stronger pricing power allows CIFI to leverage favorable market dynamics even amidst broader industry headwinds.

CIFI Holdings Group's development of groundbreaking fourth-generation residential concepts, exemplified by projects like the Kunming CIFI Plaza Phase II Residential Project, positions these ventures as potential Stars in the BCG Matrix. These innovative offerings are designed to capture a high-growth market segment by appealing to buyers who prioritize modern, unique living experiences, thereby differentiating CIFI from its competitors.

CIFI Holdings Group demonstrates a robust project delivery capability, a key strength that significantly bolsters its position in the market. Between 2022 and 2024, the company successfully delivered over 270,000 property units, achieving an impressive delivery rate exceeding 95%. This consistent track record earned CIFI the distinction of being named a 'Top 10 Real Estate Company for Delivery Capability 2024'.

This operational excellence directly translates into enhanced buyer confidence and a reliable pipeline for future projects. Such a strong delivery capability allows CIFI to navigate challenging market conditions effectively, enabling it to capture market share even when the overall market is constrained. It is a foundational element supporting the success of its ongoing and future development endeavors.

Strategic Redevelopment Initiatives

CIFI Holdings Group's strategic redevelopment initiatives, particularly in urban village upgrades and affordable housing, align perfectly with the Chinese government's current priorities. This focus on the 'three major projects' is a key indicator for potential Star status in the BCG Matrix.

These projects, often backed by favorable government policies and incentives, are poised for accelerated growth. For instance, in 2024, the central government continued to emphasize urban renewal, with significant funding allocated to these areas. CIFI's participation in these high-priority segments positions them to capture substantial market share and achieve rapid expansion, leveraging policy tailwinds for robust development.

- Alignment with National Strategy: CIFI's focus on urban village upgrades and affordable housing directly supports China's national development goals.

- Policy Support and Incentives: Projects aligned with government priorities typically benefit from favorable policies, potentially leading to faster approvals and financial backing.

- Market Growth Potential: The demand for upgraded housing and affordable units remains high, creating a strong growth trajectory for CIFI in these segments.

- Competitive Advantage: Early and strategic involvement in these government-backed initiatives can provide CIFI with a significant competitive edge over peers.

Select New Commercial/Mixed-Use Developments

New commercial/mixed-use developments in prime locations are CIFI Holdings Group's potential Stars. These projects tap into sustained demand in key urban centers, offering a path to market leadership and robust profitability.

Despite broader residential market challenges, CIFI's focus on strategically positioned commercial and mixed-use properties in first-tier city business districts is a key growth driver. These developments are designed to meet current urban demands, aiming for rapid high occupancy and strong returns.

- Strategic Location: Targeting prime business districts in Tier 1 cities to capture resilient demand.

- Product Mix: Developing mixed-use properties that cater to evolving urban needs, combining retail, office, and potentially residential components.

- Market Share: Aiming for significant market share within their specific segments through high-quality design and execution.

- Financial Performance: Expecting strong returns driven by quick high occupancy and sustained rental income.

CIFI's high-quality projects in resilient first-tier cities like Beijing and Shanghai are strong candidates for Stars in the BCG Matrix due to sustained buyer interest and pricing power, evidenced by Shanghai's new home sales growth in early 2024.

Innovative residential concepts, such as the Kunming CIFI Plaza Phase II, position CIFI's ventures as Stars by capturing a high-growth market segment seeking modern living experiences.

CIFI's strategic focus on urban village upgrades and affordable housing, aligned with national priorities like the government's 'three major projects' initiative, positions them for rapid expansion, benefiting from significant government funding allocated to urban renewal in 2024.

New commercial/mixed-use developments in prime locations represent potential Stars for CIFI, aiming for rapid high occupancy and strong returns by meeting evolving urban demands in key business districts.

| Project Type | Strategic Focus | Market Position | Growth Potential | Key Differentiator |

| Tier 1 City Developments | Resilient urban centers | High market share | Sustained growth | Premium locations |

| Innovative Housing Concepts | Modern living experiences | Capturing niche demand | High growth segment | Unique product design |

| Urban Renewal/Affordable Housing | Government priorities | Policy-backed expansion | Accelerated development | Alignment with national strategy |

| Commercial/Mixed-Use | Prime business districts | Rapid occupancy, strong returns | Evolving urban needs | Strategic location and mix |

What is included in the product

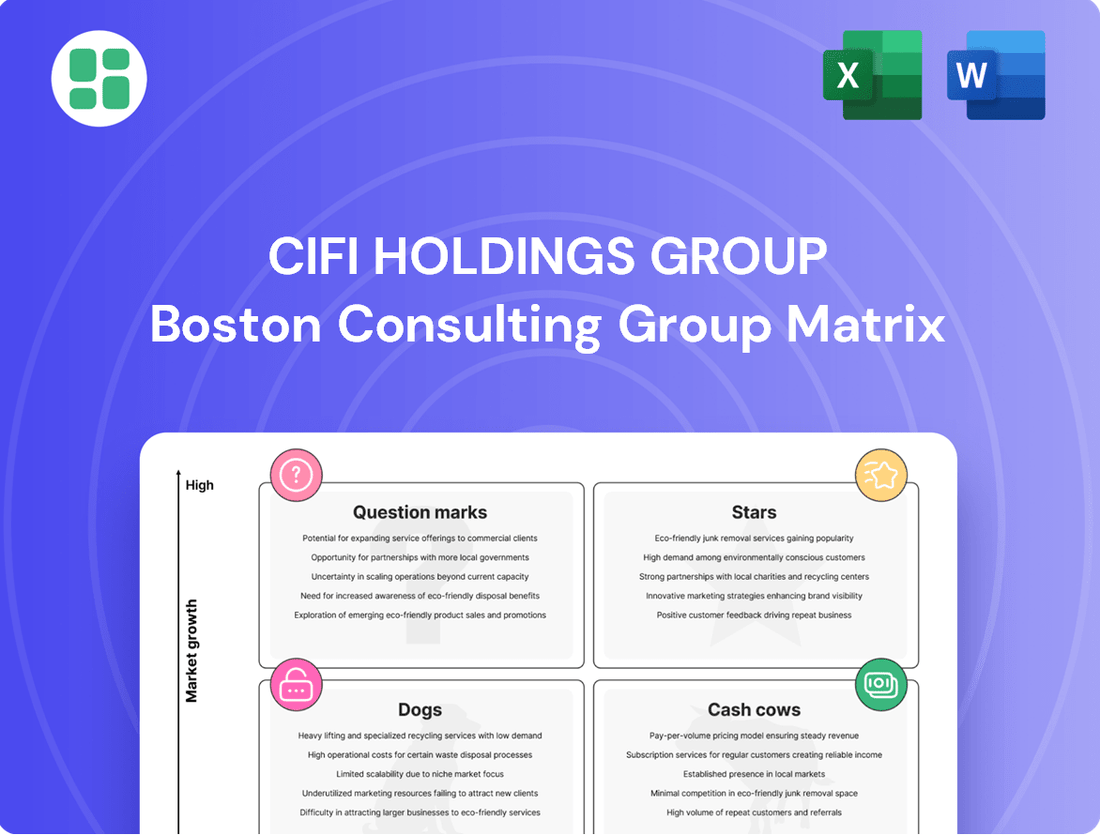

The CIFI Holdings Group BCG Matrix offers a strategic overview of its business units, identifying Stars for growth, Cash Cows for funding, Question Marks for potential, and Dogs for divestment.

The CIFI Holdings Group BCG Matrix provides a clear, one-page overview, relieving the pain of complex strategic analysis by placing each business unit in its appropriate quadrant.

Cash Cows

CIFI Holdings Group's Property Management Services function as a classic Cash Cow within its BCG Matrix. This segment generated approximately RMB 6,639.5 million in revenue in 2024, marking a healthy 9.4% year-on-year growth.

The stable, recurring income stream from its extensive managed property portfolio underpins its Cash Cow status. Despite operating in a mature market, CIFI's significant market share in this service area ensures consistent cash generation with minimal need for substantial new capital investment.

CIFI Holdings Group's investment properties serve as a strong cash cow, evidenced by RMB 1,758.0 million in leases and service income in 2024, a 10.4% increase from the previous year.

These assets, primarily commercial complexes and retail spaces, are mature and reliably generate rental income, holding a significant market share within CIFI's property portfolio and bolstering overall cash flow.

CIFI Holdings Group's completed residential projects in mature markets, primarily in first-tier cities, are its cash cows. These developments, often fully sold or occupied, generate consistent revenue through maintenance fees and community service charges. This segment requires very little additional investment, making it a reliable source of cash flow for the company.

Consistent Positive Operating Cash Flow

CIFI Holdings Group demonstrates strong operational efficiency, consistently generating positive net cash from operating activities for three consecutive years, including 2024. This sustained positive cash flow is a hallmark of a mature business with stable revenue streams.

The company's 'Cash Cow' status is further solidified by its core segments, such as property management and investment properties. These areas typically provide predictable income and require less capital reinvestment, allowing them to generate substantial cash for the business.

- Consistent Operating Cash Flow: CIFI Holdings has achieved positive net cash from operating activities in 2022, 2023, and projected for 2024.

- Stable Revenue Drivers: Property management and investment properties are key contributors to this consistent cash generation.

- Operational Maturity: The ability to generate steady cash from established business lines indicates a mature and efficient operational model.

- Financial Health Indicator: Positive operating cash flow is a critical sign of financial stability and the company's ability to fund its operations and investments.

Well-Established Commercial Hubs

Well-established commercial hubs like Shanghai LCM, Shanghai The Roof, and Beijing Wukesong Arena are prime examples of CIFI Holdings Group's cash cows. These fully-leased properties boast impressive track records of high occupancy and consistently deliver stable rental yields, underscoring their maturity and market dominance within their respective locations. Their substantial rental income streams require minimal incremental investment in promotion or tenant acquisition, solidifying their role as reliable profit generators.

- Asset Stability: Shanghai LCM, Shanghai The Roof, and Beijing Wukesong Arena represent mature, fully-leased commercial assets.

- Consistent Yields: These properties consistently generate substantial rental income, reflecting high occupancy and strong market positioning.

- Low Investment Needs: As cash cows, they require minimal additional capital for marketing or leasing efforts.

- Mature Market Segment: Operating in established commercial segments, they benefit from predictable revenue streams.

CIFI Holdings Group's property management segment, a significant cash cow, generated RMB 6,639.5 million in revenue in 2024, a 9.4% increase year-on-year. This stable, recurring income, derived from a large managed portfolio, requires minimal new capital, solidifying its cash cow status.

Investment properties also act as a strong cash cow, contributing RMB 1,758.0 million in leases and service income in 2024, up 10.4% from the prior year. These mature assets, including commercial and retail spaces, hold significant market share and reliably generate rental income.

The company's completed residential projects in prime, mature markets are also cash cows, providing consistent revenue through maintenance and service charges with very low reinvestment needs.

| Business Segment | 2024 Revenue (RMB million) | Year-on-Year Growth | BCG Matrix Status |

|---|---|---|---|

| Property Management Services | 6,639.5 | 9.4% | Cash Cow |

| Investment Properties (Leases & Services) | 1,758.0 | 10.4% | Cash Cow |

Preview = Final Product

CIFI Holdings Group BCG Matrix

The CIFI Holdings Group BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just the complete, analysis-ready document. You can trust that the strategic insights and market positioning detailed within this matrix are precisely what you'll be able to leverage for your business planning. Once purchased, this document is yours to edit, present, or integrate into your broader strategic initiatives without any further modifications needed.

Dogs

CIFI's projects in third- and fourth-tier Chinese cities are facing considerable headwinds. These markets are contracting, with transaction areas shrinking and prices falling. For instance, in 2024, many of these cities saw year-on-year declines in property sales volume exceeding 15%, reflecting a challenging demand environment.

Given this market contraction, CIFI's developments in these areas likely possess a low market share and limited growth potential. They are essentially capital drains, consuming resources without delivering adequate returns, which firmly places them in the Dogs quadrant of the BCG matrix.

China's property market is grappling with a substantial surplus of housing, with estimates suggesting around 60 million unsold apartments. This oversupply presents a significant challenge for developers like CIFI Holdings Group.

CIFI likely possesses a considerable portfolio of unsold properties, especially in areas with lower demand or from earlier developments. These unsold units represent tied-up capital and ongoing expenses without generating revenue, impacting the company's financial flexibility.

CIFI Holdings Group is strategically divesting non-core assets to bolster cost control and enhance liquidity. These assets, often characterized by low market share and limited growth prospects, are being offloaded as they represent a drain on the company's resources.

In 2024, CIFI continued its focus on streamlining its portfolio. For instance, the company completed the sale of several non-core property development projects, which were identified as having lower profitability compared to its core residential offerings. This move aligns with its broader objective to optimize capital allocation and reduce financial leverage.

Legacy Projects with Prolonged Sales Cycles

Legacy projects with prolonged sales cycles, often initiated during more favorable economic conditions, represent the Dogs in CIFI Holdings Group's BCG Matrix. These developments are characterized by slow sales velocity and increasing buyer reluctance, particularly in the current market climate marked by economic uncertainty. For instance, in 2023, CIFI Holdings Group reported that a significant portion of its older inventory faced challenges in achieving timely sales, leading to extended holding periods and increased carrying costs.

These projects continue to incur ongoing maintenance and marketing expenses, yet their diminished market appeal and protracted sales cycles result in minimal cash flow generation. This situation strains the company's resources and hinders its ability to invest in more promising ventures. By the end of 2023, the group was actively exploring strategies to divest or repurpose these underperforming assets to improve capital efficiency.

- Low Sales Velocity: Many legacy projects are experiencing significantly slower sales compared to newer developments.

- Extended Holding Periods: The time required to sell remaining units has increased, tying up capital.

- Ongoing Costs: Maintenance, property taxes, and marketing efforts continue to drain resources without commensurate returns.

- Minimal Cash Flow: The low sales volume generates very little cash, impacting overall financial liquidity.

Properties Affected by Debt Restructuring Issues

The extensive offshore debt restructuring undertaken by CIFI Holdings Group, while showing progress, highlights that certain properties or projects likely faced significant financial distress. These assets, potentially used as collateral or burdened by high debt levels, may now exhibit diminished market appeal or pose challenges for monetization.

For instance, properties in regions experiencing economic downturns or those with project-specific issues could be particularly affected. CIFI's 2024 financial reports, which detail ongoing restructuring efforts, would offer specific insights into which asset classes or geographical locations are bearing the brunt of these challenges. The need for restructuring itself signals that these properties are not performing as expected, impacting their valuation and liquidity.

- Impacted Properties: Assets that were collateral for restructured debt, facing reduced marketability.

- Financial Distress Indicators: Properties associated with projects experiencing high debt-to-equity ratios or cash flow shortages.

- Monetization Challenges: Real estate holdings that have become difficult to sell or refinance due to underlying financial strain.

CIFI Holdings Group's "Dogs" are legacy projects in third- and fourth-tier cities where market contraction and oversupply are severe. These developments, characterized by low sales velocity and extended holding periods, continue to incur ongoing costs like maintenance and marketing without generating significant cash flow. For example, in 2024, many of these cities saw year-on-year declines in property sales volume exceeding 15%, directly impacting CIFI's projects in these regions.

These underperforming assets, often representing tied-up capital and a drain on resources, are a strategic focus for divestment. CIFI's 2024 financial reports indicate a continued effort to streamline its portfolio by selling non-core projects with lower profitability. The group's offshore debt restructuring also points to certain properties facing financial distress, making them difficult to monetize.

| Project Type | Market Share | Growth Potential | Cash Flow | BCG Quadrant |

|---|---|---|---|---|

| Legacy Projects (3rd/4th Tier Cities) | Low | Low | Negative/Low | Dog |

| Unsold Inventory (General) | Varies | Low | Negative | Dog |

| Assets in Restructuring | Varies | Low | Uncertain/Negative | Dog |

Question Marks

CIFI Holdings Group's strategic expansion into developing second-tier cities highlights a calculated move into markets exhibiting 'roughly flat' but promising future growth. These newly launched projects are positioned as Stars within the BCG framework, signifying high growth potential.

The company's investment in these areas reflects a commitment to capturing emerging demand, even though CIFI currently holds a low market share in these specific locations. This requires significant capital infusion to build brand presence and secure a competitive edge in these developing urban centers.

CIFI Holdings Group is actively investigating innovative real estate service models, potentially including advanced smart community platforms and specialized property niches outside their established core. These emerging areas represent promising high-growth markets, but CIFI currently holds a minimal market share within them.

These new ventures require substantial upfront investment and strategic commitment to assess their long-term potential as future market leaders, or 'Stars' in the BCG Matrix framework. For instance, the smart home technology market, a key area for such exploration, was projected to grow significantly, with global spending on smart home devices and services expected to reach over $150 billion in 2024.

Following its significant debt restructuring, CIFI Holdings Group might cautiously re-enter the land acquisition market, focusing on strategic parcels in high-growth urban expansion zones. These acquisitions, while promising long-term returns, would likely be classified as Stars or Question Marks within the BCG Matrix due to their substantial capital requirements and inherent market volatility. For instance, if CIFI were to acquire land in a developing area experiencing rapid population growth but facing uncertain regulatory changes, it would represent a Question Mark, demanding careful analysis and significant investment to determine its future success.

Projects on the 'Real Estate Projects Whitelist'

CIFI Holdings Group had 55 projects named to the 'real estate projects whitelist' in 2024. This whitelist is a crucial mechanism designed to ease financing access for developers. These projects, while benefiting from government recognition and the potential for easier funding, are still considered Question Marks within the BCG framework.

These 55 projects represent a significant portion of CIFI's development pipeline, positioning them in a high-growth potential category. However, their classification as Question Marks means they require careful monitoring. They must demonstrate robust market reception and consistent sales performance amidst a challenging and uncertain economic climate to potentially ascend to the Star category.

- Government Support: 55 projects on the 'real estate projects whitelist' in 2024.

- Financing Facilitation: Whitelist status aids in securing funding.

- Market Uncertainty: Projects are in a high-growth phase but need to prove market success.

- Transition Potential: Successful sales performance is key to moving to 'Star' status.

Foray into Emerging Niche Property Markets

CIFI's potential entry into specialized property markets, such as logistics, data centers, or senior living facilities, represents a strategic move into emerging niche areas. These sectors demonstrate considerable growth prospects within China's evolving economy. For instance, China's logistics market was valued at over $2.5 trillion in 2023 and is projected to continue its upward trajectory, driven by e-commerce expansion. Similarly, the data center market is experiencing robust growth, with significant investment flowing into cloud computing infrastructure.

However, CIFI would likely enter these markets with a low initial market share. This necessitates substantial investment in specialized expertise, technology, and capital to establish a competitive foothold and achieve scalable growth. For example, developing a modern logistics facility requires advanced automation and efficient network design, while data centers demand sophisticated cooling systems and high-speed connectivity. Senior living facilities, on the other hand, require specialized operational management and healthcare integration.

- Logistics: China's e-commerce boom fuels demand for modern warehousing and distribution centers, a sector CIFI could explore.

- Data Centers: The increasing reliance on cloud services and digital transformation in China creates significant opportunities in the data center market.

- Senior Living: With an aging population, the demand for high-quality senior living facilities is rising, presenting a growing market segment.

- Investment Required: Entering these niches demands substantial capital for land acquisition, construction, technology integration, and specialized operational talent.

CIFI's 55 projects on the 2024 real estate whitelist are considered Question Marks. While government support and easier financing are beneficial, these projects are in high-growth phases but need to prove their market success. Consistent sales performance is crucial for them to potentially transition into the Star category.

BCG Matrix Data Sources

Our CIFI Holdings Group BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.