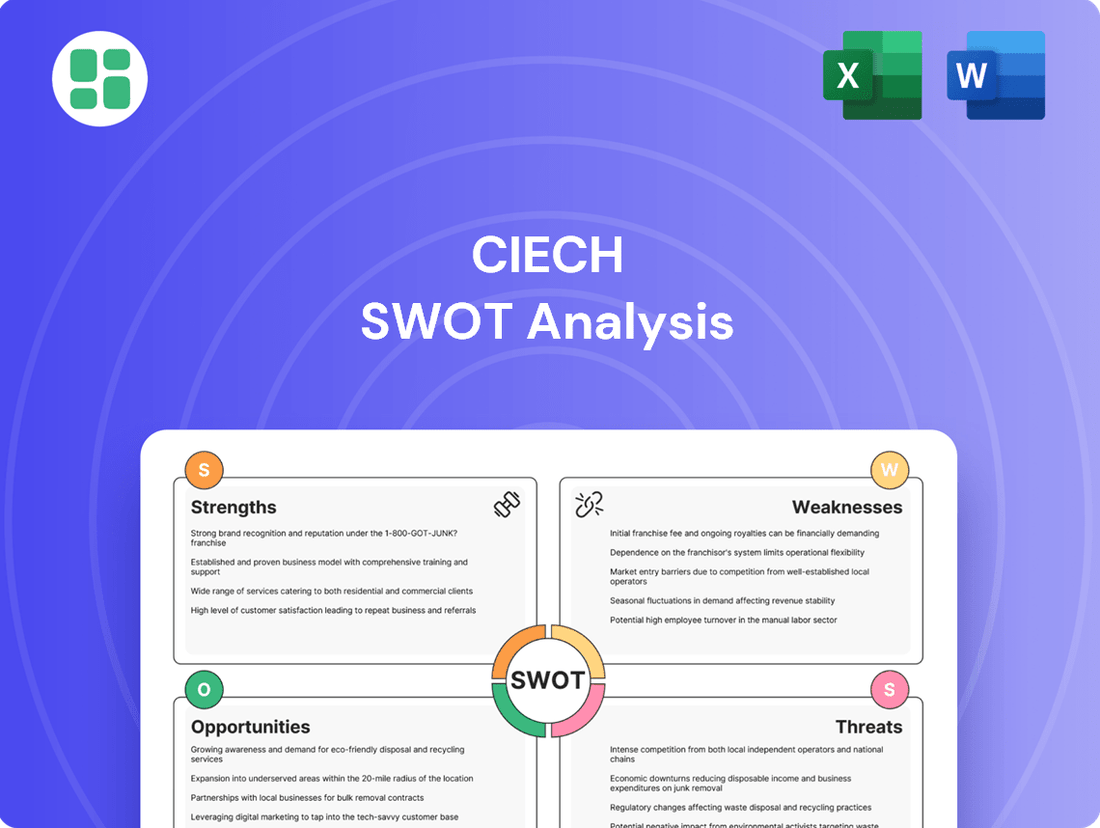

Ciech SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ciech Bundle

Ciech demonstrates robust market positions and a diversified product portfolio, but faces potential challenges from evolving regulations and competitive pressures. Understanding these dynamics is crucial for navigating its future.

Want the full story behind Ciech’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Ciech S.A. stands as a formidable player in the European chemical landscape, securing its position as the second-largest producer of soda ash and sodium bicarbonate within the European Union. This strong market standing is a testament to its substantial production capacity and well-developed distribution channels that span the continent, giving it a distinct competitive edge in these crucial chemical segments.

Ciech's strength lies in its significantly diversified product portfolio, extending well beyond its foundational soda ash business. The company offers a wide array of products, including essential items like evaporated salt, critical agricultural inputs such as plant protection products, and versatile materials like polyurethane foams and sodium silicates. This broad offering also encompasses packaging solutions and cargo services, demonstrating a comprehensive approach to market needs.

This strategic diversification is a key advantage, as it mitigates the inherent risks associated with over-reliance on a single product line. By serving a multitude of industries, including glass manufacturing, food processing, agriculture, construction, and the detergent sector, Ciech ensures a more stable and resilient revenue stream. This broad market penetration enhances the company's ability to weather economic fluctuations and maintain consistent performance.

Ciech's commitment to modernizing its production capabilities is a significant strength. The company has made substantial investments in upgrading its facilities, exemplified by the new, state-of-the-art salt plant in Staßfurt, Germany.

This new plant, designed with environmental friendliness in mind, is projected to achieve its full production capacity of 450,000 tons annually in 2024. Such strategic capital expenditures not only boost operational efficiency but also contribute to reduced emissions, reinforcing Ciech's standing as a premier evaporated salt manufacturer across Europe.

Commitment to Innovation and Sustainability (ESG)

Ciech is strongly committed to innovation and sustainability, evidenced by its ambitious ESG targets. The company aims for a 45% reduction in CO2 emissions by 2029 and has set a long-term goal of climate neutrality by 2040. This includes a significant commitment to eliminate coal from its energy production by 2033.

This forward-thinking approach to sustainable development, coupled with investments in clean technologies and research and development, positions Ciech favorably for future growth. Such initiatives are crucial for navigating an increasingly environmentally conscious global market.

- ESG Goal: 45% CO2 reduction by 2029.

- Climate Neutrality Target: By 2040.

- Coal Phase-out: By 2033.

- Strategic Focus: Investment in clean technologies and R&D.

International Presence and Strategic Rebranding

Ciech's international footprint is a significant strength, with production facilities strategically located in Poland, Germany, and Romania. This geographical diversification allows for efficient market access and production capabilities across Europe. Furthermore, the company’s export network extends to over 100 countries, underscoring its robust global market penetration and established customer base.

The company's strategic rebranding to Qemetica in June 2024 marks a pivotal moment, signaling a forward-looking approach to the chemical industry. This rebranding is not merely cosmetic; it represents a commitment to innovation, sustainability, and enhanced global competitiveness. The new identity aims to position Qemetica as a leader in redefining industry standards, with a clear focus on climate protection and resource management.

- Global Reach: Operates factories in Poland, Germany, and Romania, exporting to over 100 countries.

- Strategic Rebranding: Transitioned to Qemetica in June 2024, signifying a new era focused on industry leadership and sustainability.

- Future Focus: The rebranding emphasizes protecting climate and resources, aiming to boost global competitiveness.

Ciech's market leadership as the second-largest soda ash producer in the EU is a significant strength, bolstered by extensive production capacity and a well-established European distribution network.

The company boasts a highly diversified product portfolio, extending beyond soda ash to include salt, agricultural chemicals, and polyurethane foams, which reduces reliance on any single market segment and enhances revenue stability.

Substantial investments in modernizing production, such as the new 450,000-ton annual capacity salt plant in Staßfurt, Germany, which reached full capacity in 2024, improve operational efficiency and environmental performance.

Ciech’s commitment to ambitious ESG targets, including a 45% CO2 reduction by 2029 and climate neutrality by 2040, alongside a coal phase-out by 2033, positions it favorably for future sustainable growth and market competitiveness.

| Strength Area | Key Aspect | Supporting Data/Fact |

|---|---|---|

| Market Position | Soda Ash & Sodium Bicarbonate Production | 2nd largest producer in the EU |

| Product Diversification | Broad Product Range | Includes salt, plant protection products, polyurethane foams, sodium silicates |

| Operational Excellence | Production Modernization | New Staßfurt salt plant (450,000 tons/year capacity) reached full production in 2024 |

| Sustainability Focus | ESG Commitments | 45% CO2 reduction target by 2029, climate neutrality by 2040, coal phase-out by 2033 |

What is included in the product

Delivers a strategic overview of Ciech’s internal and external business factors, highlighting its market strengths and operational challenges.

Identifies key competitive advantages and areas for improvement, offering clear direction for strategic development.

Weaknesses

Ciech, as a significant chemical producer, faces considerable vulnerability due to its reliance on energy and raw material costs. These input expenses represent a substantial segment of the company's overall expenditure, directly influencing its profitability and profit margins, particularly during periods of market instability.

For instance, in 2023, the cost of natural gas, a key energy source for Ciech, experienced significant volatility, impacting production costs across the chemical industry. While specific figures for Ciech's raw material cost percentage are proprietary, industry benchmarks suggest these can easily exceed 40-50% of total operating costs for similar chemical manufacturers, highlighting the material impact of price swings.

Ciech's financial results demonstrate a vulnerability to economic downturns. For instance, the company experienced a decline in net profit to PLN 306 million and adjusted EBITDA to PLN 739 million in 2023 compared to the previous year, reflecting this sensitivity.

Economic slowdowns directly impact demand across the various industries Ciech supplies, such as construction and agriculture. This reduced demand can translate into lower sales volumes and ultimately affect the company's revenue streams.

Ciech's performance is susceptible to the inherent volatility within the construction sector. The industry faced significant headwinds in 2023 and into 2024, driven by persistent high inflation and increased borrowing costs, which directly impacted demand for certain chemical products within Ciech's portfolio.

While Ciech benefits from diversification across various business segments, a prolonged slump in crucial areas such as residential construction could continue to pressure sales of its chemical offerings. For instance, in 2023, the European construction sector experienced a contraction, with new housing starts declining in several key markets, a trend that directly affects demand for building materials and related chemicals.

Potential for Reduced Public Market Visibility

Following Kulczyk Investments' acquisition and the delisting from the Warsaw Stock Exchange in March 2024, Ciech, now operating as Qemetica, faces a potential decrease in its public profile. This shift from a publicly traded entity to a private one can diminish its visibility among a broader investor base.

The withdrawal from public markets may restrict Qemetica's future access to capital through public offerings, potentially necessitating a greater reliance on private equity or debt financing. This could impact the company's flexibility in funding growth initiatives or acquisitions.

- Reduced Public Scrutiny: While potentially limiting broad visibility, the delisting also means less frequent public reporting requirements and fewer analysts tracking the company's performance, which can be a double-edged sword.

- Shift in Funding Landscape: Qemetica's future capital needs will likely be met through private placements, strategic partnerships, or bank loans, rather than the more liquid public equity markets.

- Potential for Strategic Agility: Operating privately could allow Qemetica to make strategic decisions with less immediate pressure from public market expectations and short-term stock price fluctuations.

Challenges in Integrating New Acquisitions

While acquisitions, such as the precipitated silica business, are strategic for growth, integrating these new entities effectively presents significant hurdles. These challenges often span operational alignment and cultural harmonization, demanding substantial management focus.

Ensuring that newly acquired assets are seamlessly woven into the existing structure while maintaining overall operational efficiency across an expanding portfolio requires dedicated resources. This integration process can strain management bandwidth and necessitate careful planning to avoid disruptions.

- Operational Integration: Merging different IT systems, supply chains, and production processes can be complex and time-consuming.

- Cultural Assimilation: Bridging differing corporate cultures and employee expectations is crucial for a unified workforce.

- Synergy Realization: Achieving the anticipated cost and revenue synergies from an acquisition often depends heavily on the success of the integration phase.

- Management Bandwidth: The demands of integrating new businesses can divert attention from core operations, potentially impacting existing performance.

Ciech's substantial reliance on fluctuating energy and raw material costs remains a key weakness. For instance, the volatile natural gas market in 2023 directly impacted production expenses across the chemical sector, affecting companies like Ciech. While precise figures are private, industry norms suggest these input costs can exceed 40-50% of operating expenses, making price swings highly impactful.

The company's financial performance is sensitive to economic downturns, as evidenced by the decline in net profit to PLN 306 million and adjusted EBITDA to PLN 739 million in 2023. This sensitivity is amplified by reduced demand in sectors like construction, which saw a contraction in Europe during 2023, impacting sales of building material chemicals.

Following its delisting in March 2024, Ciech, now Qemetica, faces reduced public visibility and potentially more constrained access to capital markets. This shift to private status may necessitate greater reliance on debt or private equity for future growth initiatives.

Integrating newly acquired businesses, such as the precipitated silica segment, presents significant operational and cultural challenges. Successfully merging diverse systems and fostering a unified workforce requires substantial management attention, potentially straining resources and impacting core operations.

Preview the Actual Deliverable

Ciech SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You are previewing the actual analysis document. Buy now to access the full, detailed report.

Opportunities

Global demand for sustainable chemicals is a significant growth driver, with the water treatment sector showing particular interest in salt tablets. Ciech's commitment to green production and low-carbon products, including specialized offerings, aligns perfectly with this trend, allowing them to capture market share.

Ciech's Agro business is actively pursuing international expansion, aiming to tap into new customer bases and diversify its revenue. The development of hybrid products specifically designed for farmers represents a significant opportunity to capture greater market share and offer enhanced value.

Further bolstering growth prospects, Ciech is investing in research and development and exploring ventures with innovative startups. These initiatives, including a focus on plastic and rare metal recycling, signal a strategic move into emerging markets and novel business segments, potentially creating new revenue streams and competitive advantages.

Ciech's strategic push towards energy transformation presents a substantial opportunity, particularly with its plan to construct a thermal waste treatment installation by 2026. This facility is designed to meet the company's energy needs, aiming to phase out coal-fired boilers. This move directly addresses the growing global demand for sustainable practices and enhances energy independence.

The successful implementation of these decarbonization initiatives offers multiple benefits. By reducing carbon emissions, Ciech not only aligns with stringent environmental regulations but also capitalizes on the increasing investor preference for ESG-compliant companies. This can lead to improved access to capital and a stronger public image, potentially attracting new customers and talent.

Financial projections from 2024-2025 highlight the economic advantages of such transformations. Companies investing in renewable energy and efficiency measures are seeing operational cost reductions. For Ciech, replacing coal with waste-derived energy could translate into significant savings on fuel procurement and carbon taxes, bolstering profitability.

Strategic Acquisitions and Organic Growth Potential

Ciech, now operating as Qemetica, boasts a robust balance sheet, providing a solid foundation for pursuing both internal expansion and external growth through strategic acquisitions. This financial strength is crucial for navigating the competitive chemical industry landscape.

The company’s financial flexibility enables it to invest in research and development for organic growth, as well as to identify and integrate businesses that offer synergistic benefits. For instance, in 2023, Ciech's revenue reached PLN 4.7 billion (approximately EUR 1.1 billion), indicating a stable operational base from which to fund expansion initiatives.

Strategic acquisitions can allow Qemetica to:

- Expand its geographical reach into new markets.

- Acquire advanced technologies or specialized product lines.

- Diversify its business portfolio, reducing reliance on single product categories.

- Enhance its competitive positioning against larger industry players.

Leveraging the Qemetica Rebranding for Market Positioning

The rebranding to Qemetica presents a significant opportunity to reposition the company, highlighting its commitment to innovation and a sustainable future within the chemical sector. This refreshed identity can be a powerful tool for attracting top-tier talent, bolstering investor confidence, and deepening connections with stakeholders who prioritize forward-thinking solutions.

By emphasizing its new vision, Qemetica can differentiate itself in a competitive market. This strategic shift aims to attract partnerships and customers aligned with modern chemical industry demands, potentially leading to increased market share and revenue growth. For instance, in 2024, the chemical industry saw a growing emphasis on ESG (Environmental, Social, and Governance) factors, with companies demonstrating strong sustainability practices often outperforming their peers.

- Enhanced Brand Perception: Qemetica can cultivate an image synonymous with cutting-edge chemical solutions and environmental responsibility.

- Talent Acquisition: A modern, forward-looking brand is more appealing to skilled professionals seeking innovative work environments.

- Investor Attraction: The rebranding signals a strategic evolution, potentially attracting investors focused on sustainable and growth-oriented chemical companies.

- Customer Loyalty: Emphasizing innovation and sustainability can resonate with customers looking for partners committed to these values, fostering stronger relationships and potentially driving sales.

Ciech's (now Qemetica) strategic focus on sustainable chemicals, particularly in water treatment with salt tablets, capitalizes on a growing global demand. The company's investment in R&D and ventures with startups, including plastic and rare metal recycling, opens doors to new, high-growth markets. Furthermore, the planned thermal waste treatment installation by 2026 positions the company for energy independence and cost savings, aligning with ESG trends that saw companies with strong sustainability practices often outperforming peers in 2024.

| Opportunity Area | Description | Potential Impact | Relevant Data (2024-2025 Focus) |

|---|---|---|---|

| Sustainable Chemicals Demand | Growing global need for eco-friendly chemical solutions, especially in water treatment. | Increased market share, premium pricing for green products. | Water treatment market projected to grow significantly; Ciech's green product portfolio aligns with this. |

| International Expansion (Agro) | Expanding the Agro business into new international markets with specialized hybrid products. | Revenue diversification, increased global footprint. | Targeting new customer bases in regions with high agricultural output. |

| Innovation & New Ventures | Investing in R&D and startups for plastic/rare metal recycling and other emerging sectors. | Entry into novel business segments, new revenue streams, competitive advantage. | Focus on circular economy solutions and advanced material recycling. |

| Energy Transformation | Constructing a thermal waste treatment installation by 2026 to replace coal-fired boilers. | Reduced energy costs, enhanced energy independence, lower carbon footprint. | Potential for significant savings on fuel procurement and carbon taxes; aligns with 2024 ESG investment trends. |

Threats

Ciech navigates a fiercely competitive global chemical landscape, contending with established multinational giants and agile regional players. This intense rivalry frequently translates into significant pricing pressures, potentially squeezing profit margins and demanding substantial ongoing investment in research, development, and operational efficiency to simply hold onto its market position.

Global economic uncertainties and escalating geopolitical tensions, including ongoing conflicts and trade disputes, present significant threats. These factors can disrupt international trade, increase energy costs, and dampen consumer and business confidence, impacting demand for Ciech's products.

Inflationary pressures, particularly evident in 2024 and projected to continue into 2025, directly affect input costs for raw materials and energy, squeezing profit margins. This volatility also makes forecasting demand and managing operational stability more challenging for companies like Ciech.

Supply chain disruptions, exacerbated by geopolitical events, can lead to delays and increased logistics costs. For instance, disruptions in key shipping routes or availability of essential chemicals can directly impact Ciech's production schedules and ability to meet customer orders.

Ciech faces significant headwinds from increasingly strict environmental regulations, especially concerning emissions and waste. For instance, the European Union's Green Deal initiatives are driving up compliance costs across industries, and chemical manufacturers are at the forefront of these changes.

Meeting these evolving standards necessitates substantial capital investment in cleaner technologies and operational overhauls. Failure to comply can lead to hefty fines and, more critically, operational shutdowns, impacting production capacity and market access.

Fluctuations in Exchange Rates and Commodity Prices

Ciech faces significant risks from fluctuating exchange rates, especially given its international presence. For instance, a stronger Polish Zloty against currencies where it generates substantial revenue, like the Euro or USD, could reduce the value of those earnings when repatriated. This directly impacts profitability.

Similarly, volatility in commodity prices, beyond just energy, presents a substantial threat. Ciech's reliance on raw materials such as soda ash, salt, and agricultural intermediates means that sudden price hikes can significantly increase production costs. For example, if the global price of soda ash, a key input for Ciech's soda segment, were to surge by 15-20% in a given quarter, it would directly squeeze margins unless passed on to customers.

- Exchange Rate Volatility: Adverse currency movements can reduce the value of international sales and increase the cost of imported raw materials.

- Commodity Price Swings: Unpredictable changes in the cost of key inputs like soda ash, salt, and agricultural chemicals directly impact production expenses and profitability.

- Impact on Profitability: Both currency and commodity price fluctuations create financial uncertainty, potentially leading to lower net income and earnings per share.

- Competitive Disadvantage: If competitors are less exposed to these volatilities or can hedge more effectively, Ciech could lose its competitive edge.

Technological Disruption and Innovation Pace

The chemical industry is experiencing a relentless surge in technological innovation. For Ciech, this rapid evolution presents a significant threat. Emerging production methods that are more efficient or environmentally friendly, alongside the development of entirely new materials, could quickly make current technologies obsolete. For instance, advancements in green chemistry, like bio-based feedstocks, are gaining traction, potentially challenging traditional petrochemical routes that Ciech utilizes.

The pace of this disruption means that failing to adapt swiftly can lead to a loss of competitive edge. Companies that invest heavily in research and development for next-generation processes and products are poised to capture market share. Ciech's continued success hinges on its ability to anticipate and integrate these technological shifts, ensuring its product portfolio and manufacturing capabilities remain relevant and cost-effective in a dynamic global market. For example, in 2023, global R&D spending in the chemical sector saw a notable increase, with a significant portion directed towards sustainable technologies and digitalization, indicating the industry's focus on future-proofing.

- Rapid Technological Advancements: The chemical sector is seeing faster innovation cycles than ever before.

- Emergence of Disruptive Technologies: New, more efficient, or greener production methods could challenge Ciech's existing processes.

- Alternative Materials: The development of substitute materials may reduce demand for Ciech's current offerings.

- Need for Swift Adaptation: Ciech must invest in and adopt new technologies to maintain competitiveness.

Intense competition, particularly from larger global players and nimble regional competitors, exerts constant downward pressure on prices, potentially eroding Ciech's profit margins. This necessitates continuous investment in innovation and operational efficiency to maintain market share.

Geopolitical instability and global economic slowdowns pose significant threats by disrupting trade, increasing energy costs, and dampening demand for chemical products. For instance, ongoing trade disputes in 2024 could further complicate international supply chains.

Rising inflation, a persistent concern through 2024 and into 2025, directly inflates raw material and energy costs, squeezing profitability. This volatility also complicates demand forecasting and operational planning.

Stricter environmental regulations, such as those driven by the EU's Green Deal, are increasing compliance costs and requiring substantial capital investment in cleaner technologies. Failure to adapt can result in penalties and restricted market access.

SWOT Analysis Data Sources

This SWOT analysis for Ciech is built upon a foundation of comprehensive data, drawing from the company's official financial reports, detailed market research, and expert industry analysis to provide a robust and insightful assessment.