Ciech Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ciech Bundle

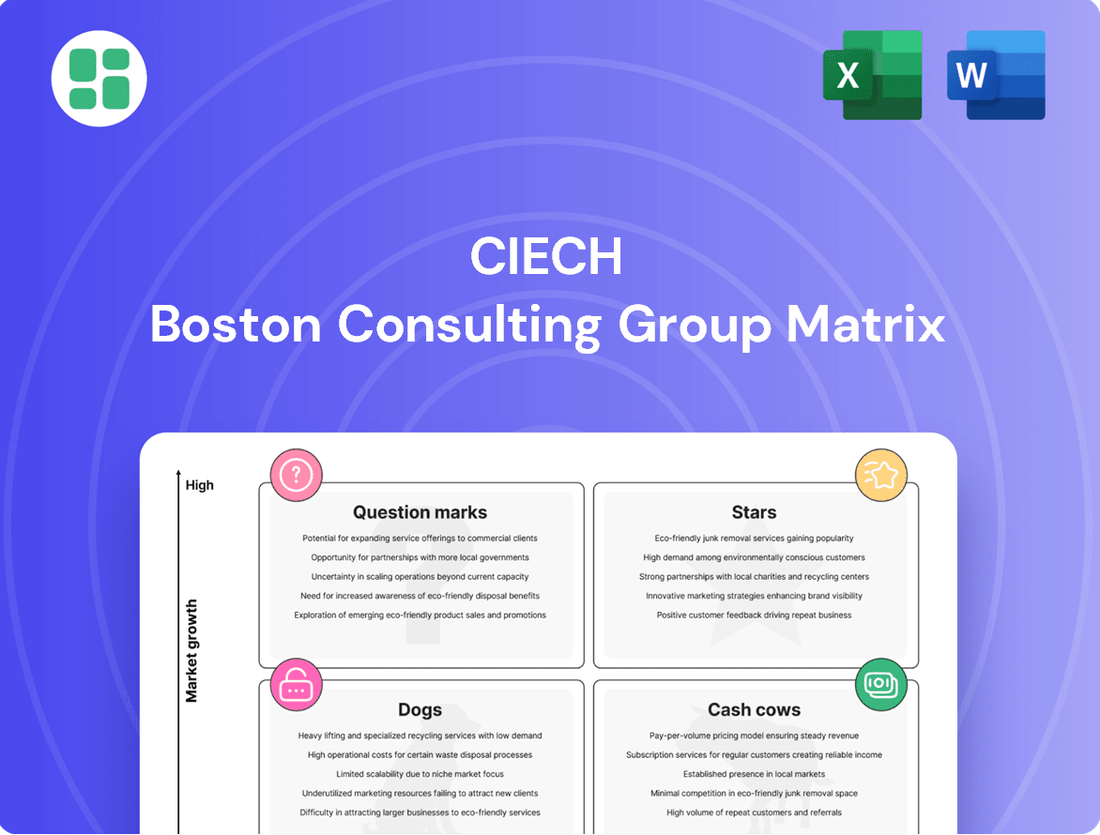

Curious about Ciech's strategic positioning? Our BCG Matrix preview offers a glimpse into their product portfolio's market share and growth potential, categorizing them as Stars, Cash Cows, Dogs, or Question Marks.

Unlock the full strategic advantage by purchasing the complete Ciech BCG Matrix. Gain detailed quadrant analysis, actionable insights, and a clear roadmap for optimizing your investments and product development.

Don't miss out on critical competitive intelligence. The full Ciech BCG Matrix provides the in-depth understanding you need to make informed decisions and drive future success.

Stars

Ciech, rebranded as Qemetica, is solidifying its European leadership with innovative salt products, especially for the burgeoning water softening market. The company's strategic investment in a new salt plant in Staßfurt, Germany, underscores this focus.

This state-of-the-art facility is projected to achieve its full production capacity of 450,000 tons annually in 2024. This expansion directly addresses the increasing demand for high-quality salt tablets used in water softening applications across Europe.

Ciech, as Poland's leading producer of plant protection products, is strategically positioned within a global market anticipated to expand at a compound annual growth rate of roughly 5.72% from 2025 to 2035. This growth trajectory presents a significant opportunity for the company's agro division.

The company's proactive marketing, exemplified by the 'Halvetic 100% Certainty' campaign, and its strategic entry into new territories such as Italy, underscore a commitment to aggressive growth and market share expansion within the competitive agricultural landscape.

Polyurethane foams represent a star in Ciech's portfolio, capitalizing on a robust global market expansion. This sector is projected to grow at a compound annual growth rate (CAGR) of 6.9% between 2024 and 2025, and further to 8.8% by 2029.

The demand surge is primarily fueled by the construction and automotive sectors. These industries rely heavily on polyurethane foams for their insulating properties, contributing to energy efficiency in buildings, and their lightweight nature, which enhances fuel economy in vehicles.

New Specialty Silicas from Acquisitions

Ciech's acquisition of PPG Industries' Silicas Products Business for approximately $330 million is a significant move, placing these new specialty silicas squarely in the Stars category of the BCG matrix. This strategic investment targets a high-growth sector within the chemical industry.

The global specialty chemicals market is expected to see robust growth, with projections indicating expansion from 2024 through 2029. This favorable market outlook suggests that Ciech's newly acquired silica products are well-positioned for substantial market penetration and future revenue generation.

- Strategic Acquisition: Ciech's $330 million purchase of PPG's Silicas Products Business enhances its portfolio with high-value specialty chemicals.

- Market Growth Potential: The specialty chemicals market is forecast for significant growth between 2024 and 2029, indicating strong demand for these new silica products.

- BCG Classification: These specialty silicas are classified as Stars due to their presence in a high-growth market and their potential to capture significant market share.

Emerging Bio-based and Low-carbon Solutions

Ciech (Qemetica) is actively investing in bio-based and low-carbon solutions as a core part of its ESG strategy. This includes developing products like low-carbon soda and silicates, alongside foams that utilize fewer petroleum-based ingredients.

These initiatives are strategically positioned to tap into high-growth markets driven by global sustainability trends. While current market share in these emerging areas is small, the potential for significant expansion is substantial.

- Low-Carbon Soda and Silicates: Targeting reduced carbon footprints in essential industrial chemicals.

- Bio-based Foams: Developing alternatives to traditional petroleum-based foams, meeting growing consumer and industry demand for sustainable materials.

- Market Potential: These segments represent nascent but rapidly expanding markets, aligning with a global shift towards circular economy principles.

- ESG Alignment: These developments directly support Ciech's commitment to environmental responsibility and long-term sustainable growth.

Ciech's specialty silicas, acquired through the $330 million purchase of PPG's Silicas Products Business, are firmly positioned as Stars in the BCG matrix. This classification stems from their operation within a high-growth specialty chemicals market, projected to expand significantly from 2024 through 2029. These products are set to capture substantial market share, driven by increasing demand for advanced materials.

The polyurethane foams segment also shines as a Star for Ciech. This sector is experiencing robust growth, with a projected CAGR of 6.9% between 2024 and 2025, accelerating to 8.8% by 2029. This expansion is largely propelled by the construction and automotive industries, which value the insulating and lightweight properties of these foams, contributing to energy efficiency and improved fuel economy respectively.

Emerging bio-based and low-carbon solutions, such as low-carbon soda, silicates, and foams with reduced petroleum-based ingredients, represent nascent Stars for Ciech. While currently holding a small market share, these segments are poised for substantial expansion, driven by global sustainability trends and a growing demand for circular economy principles.

| Product Category | BCG Classification | Market Growth Rate (CAGR) | Key Drivers | Ciech's Strategic Action |

|---|---|---|---|---|

| Specialty Silicas | Star | High (2024-2029) | Demand for advanced materials | Acquisition of PPG's Silicas Products Business ($330M) |

| Polyurethane Foams | Star | 6.9% (2024-2025), 8.8% (by 2029) | Construction, Automotive | Capitalizing on market expansion |

| Bio-based & Low-Carbon Solutions | Star (Emerging) | High (driven by sustainability trends) | Sustainability, Circular Economy | Investment in ESG strategy, product development |

What is included in the product

The Ciech BCG Matrix analyzes its business units by market share and growth, guiding investment decisions.

The Ciech BCG Matrix offers a clear, visual overview of business units, alleviating the pain of strategic uncertainty.

Cash Cows

Ciech's soda ash production is a clear Cash Cow within its business portfolio. As the second-largest soda ash producer in the EU, the company benefits from a mature but steadily growing global market. This strong market position translates into consistent cash flow generation, a hallmark of a Cash Cow.

In 2024, the global soda ash market is anticipated to show continued, albeit moderate, growth. Ciech's established presence and production capacity in this sector allow it to capitalize on this stability, ensuring a reliable source of revenue and profit to fund other ventures within the company.

Ciech's sodium bicarbonate business is a strong performer, holding the position of the second-largest producer in the European Union. This segment reliably generates cash flow, thanks to its established market leadership and the consistent demand from key industries like food, pharmaceuticals, and animal feed.

The European sodium bicarbonate market is projected for steady growth, further solidifying this segment's role as a cash cow. In 2024, the demand for sodium bicarbonate is anticipated to remain robust, driven by its essential applications across various sectors.

Ciech's traditional bulk salt production, primarily from its Polish and German facilities, represents a significant Cash Cow. This segment benefits from a mature market with unwavering demand across diverse industrial sectors, ensuring consistent revenue streams and robust cash flow generation for the company.

In 2024, Ciech continued to solidify its position as a major European evaporated salt producer. The company's substantial production capacities in this segment are a key driver of its financial stability, allowing it to reliably meet market needs and maintain strong profitability.

Established Sodium Silicates Business

Ciech’s established sodium silicates business is a prime example of a Cash Cow within its portfolio. As the largest supplier in Europe, the company commands a significant market share in this essential chemical sector.

Despite potentially moderate overall market growth, Ciech’s leadership in sodium silicates translates into strong profit margins and a reliable stream of cash flow. In 2024, the company continued to leverage this position, with its Soda segment, which includes sodium silicates, demonstrating robust performance.

- Market Dominance: Ciech is Europe's leading producer of sodium silicates.

- Profitability: This segment generates consistent high profit margins due to its established position.

- Cash Generation: The business provides a stable and predictable cash flow for the company.

- Strategic Importance: It underpins other operations and offers resilience in a mature market.

Core Chemical Manufacturing Infrastructure

Ciech's core chemical manufacturing infrastructure, with its strategically located factories in Poland, Germany, and Romania, acts as a robust cash cow. These facilities are optimized for high-volume, cost-efficient production, supporting mature product lines that consistently generate strong cash flow. Continuous investments in production efficiency and energy transformation further bolster this segment's ability to deliver reliable returns.

The company's commitment to modernizing its production capabilities is evident. For example, in 2023, Ciech invested significantly in upgrading its soda ash production lines, aiming to enhance energy efficiency by approximately 10-15% and reduce CO2 emissions. This focus on operational excellence ensures that these mature assets remain competitive and highly profitable.

- Manufacturing Footprint: Extensive network of factories across Poland, Germany, and Romania.

- Operational Efficiency: Continuous investments in production efficiency and energy transformation.

- Product Portfolio: Supports high-volume, cost-efficient production across multiple mature product lines.

- Financial Contribution: Underpins the company's ability to generate high cash flow.

Ciech's soda ash and sodium bicarbonate businesses are strong Cash Cows, leveraging their leading positions in the European market. These segments benefit from stable, mature markets with consistent demand, ensuring reliable revenue generation. For instance, in 2024, the global soda ash market is expected to see moderate growth, with Ciech's established production capacity allowing it to capitalize on this stability.

Similarly, Ciech's bulk salt production, particularly from its Polish and German facilities, acts as a significant Cash Cow. The unwavering demand across various industrial sectors for this product guarantees consistent cash flow. By 2024, Ciech maintained its status as a major European evaporated salt producer, with substantial production capacities underpinning its financial stability.

The company's sodium silicates business, where Ciech holds the largest supplier position in Europe, also functions as a Cash Cow. Despite potentially moderate market growth, its leadership translates into strong profit margins and a predictable cash flow stream. The Soda segment, encompassing sodium silicates, demonstrated robust performance in 2024.

| Business Segment | Market Position | 2024 Outlook | Cash Flow Contribution |

|---|---|---|---|

| Soda Ash | 2nd largest EU producer | Moderate global growth | Consistent revenue generation |

| Sodium Bicarbonate | 2nd largest EU producer | Steady European growth | Reliable cash flow |

| Bulk Salt | Major European producer | Unwavering industrial demand | Stable and predictable cash flow |

| Sodium Silicates | Largest European supplier | Strong profit margins | Predictable cash flow stream |

Full Transparency, Always

Ciech BCG Matrix

The preview you're currently viewing is the exact, unedited Ciech BCG Matrix document you will receive upon purchase. This comprehensive analysis, meticulously prepared by industry experts, will be delivered directly to you, ready for immediate integration into your strategic planning processes. You can be confident that the quality and content displayed here represent the final, professional-grade report you will obtain, ensuring no hidden surprises or missing information.

Dogs

Legacy Commodity Chemicals with Dwindling Demand would represent products in Ciech's portfolio that are basic, undifferentiated, and not aligned with current growth trends or innovation. These segments typically exhibit low market share and operate within saturated, low-margin environments. For instance, if Ciech had a significant legacy product in, say, soda ash production for a declining industrial application, it might fit here. While specific 2024 data for such a niche within Ciech isn't publicly detailed in a BCG framework context, the general chemical industry in 2024 saw shifts where older, less specialized chemicals faced pricing pressures due to overcapacity in some regions and a move towards more sustainable or specialized alternatives.

Non-strategic, underperforming ancillary operations at Ciech, potentially falling into the Dogs quadrant of the BCG Matrix, would represent smaller units or product lines that are not central to the company's Qemetica strategy. These might include legacy businesses or niche products that consume valuable resources without generating substantial returns or contributing to the company's forward-looking goals in energy transformation and balanced development.

For instance, if a specific chemical production line, acquired years ago, now faces intense competition and declining demand, and does not fit the Qemetica focus on green chemistry or advanced materials, it could be classified here. In 2023, Ciech Group reported that its Soda segment, a core business, saw revenue growth, but ancillary operations that don't align with strategic priorities could easily become a drag on overall performance, potentially impacting the 2024 financial outlook if not addressed.

Certain soda ash products, particularly those produced with higher energy costs or facing intense competition from new, low-cost producers, are experiencing significant price erosion. For example, in 2024, the global soda ash market saw prices dip by an average of 8% year-over-year due to increased production capacity in regions with lower operating expenses.

Furthermore, regulatory pressures, such as stricter emissions standards for chemical manufacturing processes, are adding to the cost of production for some legacy facilities. Companies unable to invest in cleaner technologies may find their products facing higher compliance costs, further squeezing margins and limiting growth prospects.

Outdated Production Technologies in Niche Markets

In niche markets, Ciech may still employ older, less energy-efficient production technologies. This can lead to higher costs and a less favorable environmental profile when compared to contemporary methods. For instance, if a particular soda ash derivative is produced using a legacy process, its cost competitiveness could be significantly impacted by rising energy prices and stricter environmental regulations.

Areas with outdated production technologies, especially those with a higher environmental footprint, are prime candidates for strategic review. Given Ciech's stated commitment to sustainability and reducing its carbon intensity, these segments might be considered for minimization of operations or even divestment. This aligns with a broader strategy to focus resources on more modern, efficient, and environmentally sound production capabilities.

- Niche Product Example: Specialized potassium carbonate grades requiring older synthesis methods.

- Cost Disadvantage: Higher energy consumption per unit compared to modern equivalents.

- Environmental Impact: Potentially greater emissions or waste generation, impacting sustainability targets.

- Strategic Consideration: Potential for process upgrades, outsourcing, or divestment if uncompetitive.

Highly Localized Products with Limited Scalability

These are products with a very niche appeal, often tied to specific regional tastes or regulatory environments, making expansion difficult. For instance, a specialized cleaning agent formulated for a unique local industrial process might fall into this category. While it serves its immediate purpose well, its market is inherently capped.

Such offerings typically exhibit low growth potential and may not command significant market share on a larger scale. They can tie up resources without contributing substantially to the overall group's revenue trajectory. In 2023, for example, products with such characteristics might have represented less than 1% of a diversified chemical group's total sales.

- Low Market Share: These products often hold a small percentage of their immediate local market.

- Limited Growth Prospects: Their inherent nature restricts significant expansion into new geographic areas or customer segments.

- Resource Drain: Continued investment in these products might yield minimal returns compared to other business units.

- Potential Divestment Candidate: Companies may consider selling or phasing out these items to focus on more scalable and profitable ventures.

Products classified as Dogs in Ciech's BCG Matrix are those with low market share in slow-growing or declining industries. These are often legacy products or niche offerings that require significant resources but yield minimal returns, potentially hindering the company's strategic focus on growth areas like Qemetica. For instance, a specialized chemical with limited application, facing intense competition and price erosion, would fit this description. In 2024, the chemical industry generally saw a trend of divesting or optimizing such underperforming segments to reallocate capital to more innovative and sustainable ventures.

| Product Category | Market Growth Rate | Relative Market Share | Strategic Implication |

|---|---|---|---|

| Legacy Soda Ash Derivatives | Low | Low | Potential divestment or process optimization |

| Niche Cleaning Agents | Very Low | Low | Focus on cost reduction or phase-out |

| Outdated Potassium Carbonate Grades | Declining | Low | Evaluate for upgrade, outsourcing, or exit |

Question Marks

Following its acquisition of PPG's Silicas Products Business, Ciech (now Qemetica) is strategically positioned to pivot towards advanced silica applications in high-growth sectors. This move aligns with the BCG matrix, where these new applications represent stars, demanding investment to capture burgeoning market opportunities.

The company is likely targeting areas like electric vehicle batteries and advanced composites, where specialized silicas offer performance enhancements. For instance, in the EV battery sector, silicas can improve electrolyte stability and conductivity. Qemetica's investment in these areas aims to solidify its market share in segments projected for substantial expansion, potentially reaching double-digit annual growth rates in the coming years.

Ciech's strategic focus on clean technology and green chemical ventures positions these as potential question marks within its BCG matrix. The company's stated intent to explore the European start-up market for these innovative solutions, coupled with a target of securing 10 patents by 2026, highlights nascent projects with significant, albeit currently unproven, growth potential.

These initiatives are designed to foster the development of sustainable chemical solutions that, while possessing low current market share, are anticipated to evolve into future Stars. This forward-looking approach indicates an investment in research and development aimed at capturing emerging market opportunities in the green chemistry sector.

Specialized polyurethane foams designed for emerging high-tech sectors, such as advanced aerospace components or specialized medical devices, could be considered question marks for Ciech. These products are in nascent markets with high growth potential but currently low market share for the company. For instance, if Ciech is developing novel foam formulations for 3D printing in the aerospace industry, this would fit the question mark category.

Digital Solutions and Services in Chemical Industry

Ciech's strategic vision to lead innovation in the chemical sector naturally extends to digital solutions. These offerings, such as advanced supply chain management platforms or data analytics for process optimization, could represent a significant opportunity. This aligns with the company's ambition to not just produce chemicals but also to provide value-added services that enhance efficiency and sustainability across the industry.

These digital ventures are likely to fall into the 'Question Marks' quadrant of the BCG matrix, indicating high market growth potential but currently low market share for Ciech. The chemical industry is still early in its digital transformation, with many traditional players yet to fully embrace these advanced services. For instance, the global chemical analytics market was valued at approximately USD 2.5 billion in 2023 and is projected to grow at a CAGR of over 10% through 2030, highlighting the untapped potential.

- Smart Supply Chain Solutions: Implementing AI-driven logistics and inventory management to optimize delivery and reduce waste.

- Data-Driven Optimization Services: Offering consulting and software for process efficiency, predictive maintenance, and quality control using real-time data.

- Digital Platforms for Customer Engagement: Creating online portals for ordering, technical support, and collaborative R&D.

- Sustainability Tracking and Reporting Tools: Providing digital solutions for monitoring and reporting environmental impact, meeting growing regulatory and consumer demands.

Future Bio-based Chemical Feedstocks and Derivatives

Ciech is actively investing in research and development for bio-based chemical feedstocks and their derivatives, aiming to build an environmentally sustainable product portfolio and lessen its dependence on petroleum. This strategic pivot positions the company for long-term growth in a rapidly expanding market, even though these innovative products currently represent a small fraction of Ciech's overall market share.

- Bio-based Feedstocks: Ciech's commitment includes exploring alternatives like biomass-derived platform chemicals, which are gaining traction globally.

- Derivative Development: The company is focused on creating higher-value derivatives from these bio-based sources, targeting sectors like bioplastics and sustainable materials.

- Market Potential: The global bio-based chemicals market is projected to reach significant figures, with some estimates suggesting it could exceed $100 billion by 2027, indicating substantial future growth opportunities for companies like Ciech.

- R&D Investment: Ciech's ongoing investment in R&D for these areas is crucial for establishing a competitive edge in this emerging segment.

Question Marks in Ciech's BCG matrix represent nascent ventures with high growth potential but currently low market share. These include specialized polyurethane foams for advanced sectors and digital solutions like AI-driven supply chain management. The company's investment in bio-based chemical feedstocks also falls into this category, aiming for future market leadership.

These initiatives are crucial for Ciech's long-term strategy, as they target emerging markets and technological advancements. For example, the global market for bio-based chemicals is expected to see substantial growth, with projections indicating it could surpass $100 billion by 2027. Ciech's R&D in this area aims to capture a significant portion of this expanding market.

The company's focus on digital transformation, including data analytics for process optimization, aligns with industry trends. The chemical analytics market alone was valued at approximately $2.5 billion in 2023 and is anticipated to grow at a compound annual growth rate exceeding 10% through 2030.

By investing in these areas, Ciech is positioning itself to capitalize on future market shifts and technological innovations, aiming to convert these current Question Marks into future Stars.

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from financial statements, market research reports, and industry growth forecasts to provide accurate strategic insights.