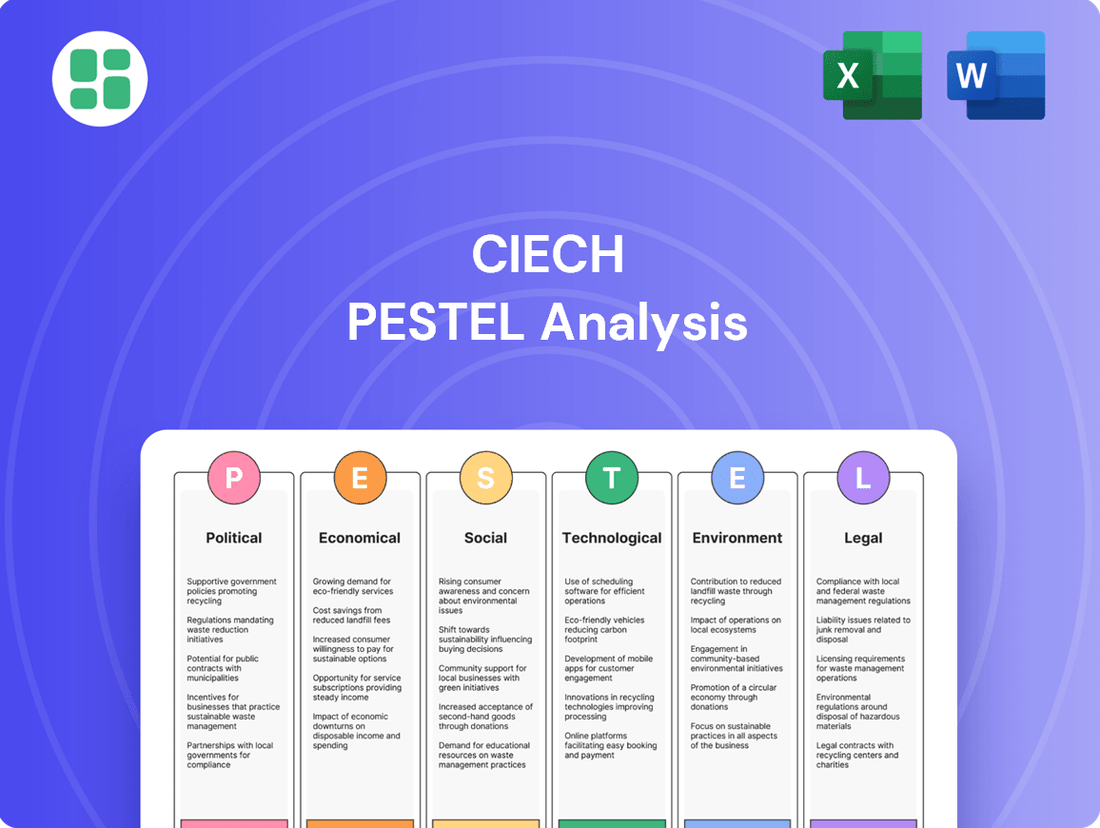

Ciech PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ciech Bundle

Navigate the complex external landscape impacting Ciech with our detailed PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its operations and future growth. Equip yourself with actionable intelligence to make informed strategic decisions and gain a competitive edge. Download the full version now for a comprehensive understanding.

Political factors

Government policies, such as industrial subsidies and trade agreements, directly shape Ciech's operational landscape and profitability. For instance, the European Union's Green Deal initiatives, which aim for climate neutrality by 2050, are influencing chemical production processes and encouraging investment in sustainable technologies.

Regulatory stability is paramount for long-term strategic planning in the chemical sector, as shifts in environmental regulations or product standards can necessitate costly adjustments. In 2024, the ongoing implementation of REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) continues to impact chemical manufacturers in Europe, requiring rigorous compliance and data submission.

Changes in energy regulations, particularly concerning carbon pricing mechanisms like the EU Emissions Trading System (ETS), can significantly affect Ciech's production costs. The ETS allowance price, which has seen fluctuations, directly impacts the energy expenditure for chemical manufacturing operations.

Ciech's export performance is significantly influenced by international trade policies, including tariffs and non-tariff barriers. For instance, the European Union's trade agreements, such as those with North American countries, can ease access for Ciech's products, while potential new tariffs could increase costs and reduce competitiveness. In 2023, the EU maintained its commitment to free trade principles, though specific sector-focused regulations continued to evolve.

Geopolitical tensions, like those impacting energy markets in Eastern Europe, can disrupt Ciech's supply chains and alter market access. For example, disruptions in natural gas supply, a key input for chemical production, can lead to increased operational costs. The ongoing global focus on supply chain resilience, highlighted by events in 2022 and 2023, underscores the need for strategic diversification of sourcing and markets.

Maintaining robust international relations and leveraging favorable trade agreements is paramount for Ciech, given its substantial presence across Europe and beyond. The company's ability to navigate complex trade landscapes, including those shaped by the ongoing evolution of global trade blocs and bilateral agreements, directly impacts its market penetration and profitability. For example, the EU's continued efforts to foster trade relationships within the European Economic Area remain a critical factor for Ciech's operational stability.

Political stability in Poland, Germany, and Romania, key operating regions for Ciech, directly influences its business continuity and investment security. Unforeseen policy shifts or governmental changes in these nations can introduce significant uncertainty and operational risks.

For instance, Poland, representing a substantial portion of Ciech's revenue, experienced a change in government following the October 2023 elections, which could lead to adjustments in industrial policy or environmental regulations impacting the chemical sector.

Similarly, Germany's ongoing energy transition policies and Romania's infrastructure development plans, driven by political will and EU funding, create both opportunities and potential challenges for Ciech's supply chain and production costs.

State Aid and Industrial Support

Governmental support, particularly state aid for industries like chemicals or those driving the green transition, can significantly shape the competitive landscape. Ciech, a major player in the chemical sector, stands to gain from initiatives designed to bolster sustainable production methods and overall industrial competitiveness.

For instance, the European Union's Green Deal and related funding mechanisms, such as the Innovation Fund, offer substantial opportunities for companies investing in low-carbon technologies. In 2024, the Innovation Fund is expected to allocate billions of euros to projects demonstrating innovative climate technologies. Ciech's strategic decisions regarding investments in areas like green soda ash production or advanced materials could be directly influenced by the availability and accessibility of such aid.

- EU Green Deal Funding: The European Union continues to prioritize funding for green initiatives, with programs like the Innovation Fund supporting projects that reduce greenhouse gas emissions.

- National Industrial Strategies: Individual member states often have their own industrial support programs, which may include tax incentives, grants, or low-interest loans for companies investing in modernization and sustainability.

- Impact on Investment: The terms, eligibility criteria, and scale of state aid can heavily influence Ciech's capital allocation, particularly for large-scale projects focused on environmental performance and technological advancement.

- Competitive Advantage: Companies that successfully leverage state aid can secure a competitive edge through reduced operational costs or accelerated innovation cycles, enabling them to outperform rivals not receiving similar support.

Compliance with International Sanctions

Compliance with international sanctions is a significant political factor for chemical companies like Ciech. Navigating these complex regulations is crucial to avoid severe penalties, reputational damage, and disruptions to global operations. For instance, the ongoing geopolitical tensions in 2024 and 2025 continue to shape sanction regimes, requiring constant vigilance.

Ciech must ensure its supply chain and sales markets are fully compliant with all applicable international restrictions. Failure to do so can result in substantial fines and trade limitations. The company's proactive approach to monitoring and adapting to evolving sanctions is key to maintaining its international market access and business continuity.

- Monitoring evolving sanctions: Ciech actively tracks changes in international sanctions impacting the chemical industry.

- Supply chain integrity: Ensuring all suppliers and partners adhere to sanctions is vital for operational continuity.

- Market access: Compliance safeguards Ciech's ability to operate in and export to key international markets.

- Risk mitigation: Adherence to sanctions prevents severe financial penalties and reputational harm.

Governmental support, particularly state aid for industries like chemicals or those driving the green transition, can significantly shape the competitive landscape. Ciech, a major player in the chemical sector, stands to gain from initiatives designed to bolster sustainable production methods and overall industrial competitiveness. For instance, the European Union's Innovation Fund is expected to allocate billions of euros to projects demonstrating innovative climate technologies in 2024, directly influencing Ciech's investment decisions in green soda ash production.

Political stability in Poland, Germany, and Romania, key operating regions for Ciech, directly influences its business continuity and investment security. Poland's October 2023 election outcome could lead to adjustments in industrial policy, while Germany's energy transition and Romania's infrastructure plans present both opportunities and challenges for Ciech's operations.

Compliance with international sanctions is a significant political factor, with evolving regimes in 2024 and 2025 requiring constant vigilance from companies like Ciech to avoid severe penalties and maintain global operations. Ensuring supply chain and sales market adherence to all applicable restrictions is vital for continued market access.

Trade policies, including tariffs and non-tariff barriers, significantly influence Ciech's export performance. The EU's commitment to free trade principles in 2023, while generally beneficial, requires adaptation to sector-specific evolving regulations that can impact competitiveness.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Ciech across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a clear, actionable framework of external factors impacting Ciech, enabling proactive strategy development and mitigating potential disruptions.

Economic factors

The chemical sector, including companies like Ciech, is deeply reliant on energy, making it sensitive to price swings in natural gas and electricity. For instance, European natural gas prices saw significant increases throughout 2022 and into early 2023, impacting operational costs for energy-intensive manufacturers.

Fluctuations in the cost of essential raw materials such as limestone, salt, and ammonia directly affect Ciech's production expenses and, consequently, its profit margins. For example, global ammonia prices can be influenced by natural gas costs and geopolitical events, creating a ripple effect on fertilizer and chemical production.

To navigate these economic uncertainties, Ciech's success hinges on robust hedging strategies for energy and raw materials, alongside a strong focus on efficient resource utilization. Companies that can effectively manage these costs are better positioned to maintain profitability amidst market volatility.

Rising inflation in 2024 and projected into 2025 directly impacts Ciech's operational expenses. We're seeing increased costs for raw materials, energy, and logistics, with some estimates suggesting an average increase of 5-7% in these areas for European chemical producers. This can squeeze profit margins if Ciech cannot fully pass these higher costs onto its customers through price increases.

Consequently, central banks are likely to maintain higher interest rates to combat inflation. For Ciech, this translates to a higher cost of capital for new projects or ongoing working capital needs. For instance, a 1% increase in interest rates could add millions to annual financing costs, affecting investment decisions and overall financial health.

Effectively managing these inflationary pressures and the associated cost of capital is paramount for Ciech's financial stability and continued growth. Strategic pricing, operational efficiency improvements, and prudent debt management will be key to navigating this challenging economic environment.

Ciech's diverse product range, catering to essential sectors like glass, agriculture, and construction, means its fortunes are closely linked to the economic performance of these end-user industries. For instance, robust growth in the construction sector directly fuels demand for Ciech's soda products, a key ingredient in glass manufacturing and building materials.

In 2024, many of these sectors are experiencing varied growth trajectories. The European agricultural sector, a significant market for Ciech's crop protection products, faced challenges due to weather patterns in early 2024, but is projected to see moderate recovery. Similarly, the construction industry in Poland, a core market for Ciech, showed resilience, with industrial construction activity picking up pace in the latter half of 2024.

Conversely, any economic downturn impacting consumer spending can ripple through to sectors like detergents and food, indirectly affecting Ciech's sales volumes. A slowdown in manufacturing output, for example, could reduce demand for chemicals used in producing household goods.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for Ciech, an international chemical group. As a Polish-based company, its financial performance is directly influenced by the value of the Polish Zloty (PLN) against major trading currencies like the Euro (EUR) and US Dollar (USD). For instance, in early 2024, the PLN experienced some volatility, which could impact the cost of imported raw materials and the value of export sales denominated in foreign currencies.

Favorable exchange rates can enhance Ciech's profitability by increasing the PLN value of its foreign currency earnings and reducing the cost of goods purchased internationally. Conversely, a strengthening PLN can make its exports more expensive for foreign buyers and increase the cost of imported inputs. For example, if Ciech exports a significant portion of its soda ash to the Eurozone, a weaker Euro against the Zloty would directly reduce its revenue in PLN terms.

- Impact on Exports: A weaker PLN generally boosts export competitiveness, as products become cheaper for foreign buyers.

- Impact on Imports: Conversely, a stronger PLN reduces the cost of imported raw materials and energy, potentially lowering production costs.

- Hedging Strategies: Ciech likely employs financial instruments like forward contracts or options to mitigate the risk of adverse currency movements, aiming to stabilize its financial results.

- 2024/2025 Outlook: Analysts anticipate continued currency volatility in 2024 and 2025, driven by global economic conditions and central bank policies, necessitating ongoing vigilance from companies like Ciech.

Global Supply Chain Disruptions

Global supply chains faced considerable strain throughout 2024, driven by lingering effects of geopolitical tensions and localized natural disasters. These disruptions directly impacted raw material availability and logistics costs for companies like Ciech. For instance, shipping container costs saw a notable increase in early 2024, with the average cost of shipping a 40-foot container from Asia to Europe fluctuating significantly, impacting import expenses for essential chemicals and manufacturing components.

Ciech's reliance on a robust supply chain for its diverse product portfolio, including soda ash and agrochemicals, means that any interruption can affect production schedules and market responsiveness. The company's ability to navigate these challenges hinges on its supply chain resilience strategies. For example, in 2024, many chemical manufacturers explored diversifying their supplier base and increasing inventory levels for critical inputs to mitigate risks associated with single-source dependencies.

The economic implications of these disruptions are substantial, often leading to increased operational expenditures and potentially impacting profit margins. According to industry reports from late 2024, the chemical sector, in particular, experienced an average increase of 5-10% in logistics and raw material costs due to these ongoing supply chain vulnerabilities. This necessitates proactive management and strategic planning to maintain competitiveness.

- Geopolitical instability continued to be a primary driver of supply chain volatility in 2024, affecting key shipping routes and raw material sourcing.

- Rising logistics costs, particularly for maritime transport, presented a significant challenge, with freight rates experiencing upward pressure due to capacity constraints and demand fluctuations.

- Increased raw material prices for key inputs, such as energy and certain minerals, directly impacted production costs for chemical manufacturers like Ciech.

- The need for supply chain diversification became more pronounced, pushing companies to explore alternative suppliers and regional sourcing options to enhance resilience.

Economic factors significantly shape Ciech's operational landscape, with energy prices, particularly natural gas and electricity, being a primary concern. Inflationary pressures in 2024 and 2025 are increasing raw material, energy, and logistics costs, with estimates pointing to 5-7% rises for European chemical producers. Higher interest rates, a consequence of inflation, also increase Ciech's cost of capital, impacting investment decisions.

Ciech's performance is intrinsically tied to the economic health of its end-user industries, such as construction and agriculture. While the Polish construction sector showed resilience in late 2024, the agricultural sector faced weather-related challenges earlier in the year. Currency exchange rate volatility, especially concerning the Polish Zloty against the Euro and USD, directly affects export revenues and import costs.

Global supply chain disruptions in 2024, driven by geopolitical tensions and natural disasters, have led to increased logistics and raw material costs, with some reports indicating 5-10% hikes for the chemical sector. This necessitates strategies like supplier diversification and increased inventory for critical inputs.

| Economic Factor | Impact on Ciech | 2024/2025 Data/Outlook |

| Energy Prices | Increased operational costs | European natural gas prices remained elevated through early 2023, with continued volatility expected. |

| Inflation | Higher raw material, energy, and logistics costs | Projected 5-7% increase in operational expenses for European chemical producers in 2024/2025. |

| Interest Rates | Increased cost of capital | Central banks maintaining higher rates to combat inflation. |

| End-User Industry Performance | Demand fluctuations for Ciech's products | Polish construction sector resilience in late 2024; agricultural sector facing weather impacts. |

| Currency Exchange Rates | Impact on export revenue and import costs | Continued PLN volatility against EUR and USD anticipated. |

| Supply Chain Disruptions | Increased logistics and raw material costs | 5-10% increase in logistics/raw material costs reported for the chemical sector in 2024. |

Same Document Delivered

Ciech PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Ciech delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a thorough understanding of the external forces shaping Ciech's strategic landscape.

Sociological factors

Consumers are increasingly prioritizing sustainability, with a significant portion willing to pay more for eco-friendly products. Surveys in 2024 indicated that over 60% of consumers consider sustainability when making purchasing decisions, directly impacting demand for chemical inputs used in manufacturing.

Ciech's strategic emphasis on sustainable development and its portfolio of greener chemical solutions positions it favorably to meet this growing demand. This alignment is expected to boost sales of its environmentally conscious products and spur further innovation in eco-friendly chemical alternatives.

Demographic shifts, like the aging population in many European countries, could impact the availability of skilled labor for Ciech's specialized chemical operations. For instance, in Poland, the share of the population aged 65 and over is projected to increase significantly in the coming years, potentially leading to a smaller pool of experienced workers.

Attracting and retaining talent in technical and scientific fields remains a critical challenge for innovation and operational efficiency. Ciech's reliance on chemical engineers and researchers means that competition for these roles is likely to intensify, especially as demand for advanced materials grows.

Labor market trends, including rising wage expectations across the EU, directly affect Ciech's operational costs. In 2023, average wage growth in the manufacturing sector in Poland hovered around 10-12%, a factor that Ciech must carefully manage to maintain its competitive edge.

Societal expectations for high standards of employee health, safety, and well-being are continuously rising, especially in sectors like chemical manufacturing where Ciech operates. Meeting these elevated demands requires rigorous safety protocols and a deeply ingrained safety culture to prevent reputational harm and regulatory fines.

In 2023, the European Agency for Safety and Health at Work (EU-OSHA) reported that workplace accidents still cause significant disruption, emphasizing the ongoing need for vigilance. Ciech's commitment to employee well-being directly impacts its productivity and ability to attract and retain skilled talent in a competitive market.

Corporate Social Responsibility (CSR) Expectations

Stakeholders, from investors to local communities, increasingly demand that companies like Ciech actively engage in corporate social responsibility (CSR). This translates to a need for ethical operations, meaningful community involvement, and clear, open reporting on social and environmental impacts. For instance, in 2023, the European Union's Corporate Sustainability Reporting Directive (CSRD) expanded mandatory reporting for many companies, including those in the chemical sector, pushing for greater transparency in these areas.

A robust CSR strategy can significantly boost a company's brand image and appeal to a growing segment of socially conscious investors. Many investment funds now explicitly screen companies based on their environmental, social, and governance (ESG) performance. In 2024, ESG investing continued its upward trajectory, with global sustainable investment assets projected to reach new highs, demonstrating a clear market preference for responsible corporate behavior.

Ciech's commitment to CSR can influence customer loyalty and purchasing decisions. Consumers are more likely to support brands that align with their values, especially concerning environmental protection and fair labor practices. Research from 2024 indicates that a significant percentage of consumers are willing to pay a premium for products from companies with strong sustainability credentials.

- Growing Investor Demand: In 2023, sustainable investment funds saw substantial inflows, highlighting the financial sector's focus on ESG criteria.

- Consumer Preferences: A 2024 survey revealed that over 60% of consumers consider a company's social and environmental impact when making purchasing decisions.

- Regulatory Landscape: The implementation of directives like the CSRD in 2024 mandates more rigorous CSR reporting, increasing stakeholder scrutiny.

- Brand Reputation: Companies with strong CSR profiles, such as those actively involved in community development or emission reduction, often enjoy higher brand trust and loyalty.

Public Perception of the Chemical Industry

The chemical industry, including companies like Ciech, frequently navigates public scrutiny concerning its environmental footprint and safety practices. Negative public perception can directly impact regulatory landscapes, the market acceptance of chemical products, and the crucial community relationships surrounding manufacturing facilities.

For instance, a 2024 survey indicated that over 60% of consumers express concern about the environmental impact of chemical production. This sentiment underscores the need for companies to actively manage their public image.

- Environmental Concerns: Public anxiety regarding pollution and waste disposal remains a significant factor.

- Safety Record: Incidents, even if isolated, can disproportionately shape public opinion.

- Regulatory Influence: Societal pressure often translates into stricter environmental and safety regulations.

- Brand Reputation: Positive public perception is vital for market access and stakeholder trust.

Societal expectations for corporate responsibility are increasingly shaping business operations, with a strong emphasis on sustainability and ethical practices. In 2024, consumer surveys consistently showed that over 60% of individuals consider a company's social and environmental impact when making purchasing decisions, directly influencing brand loyalty and market share.

This heightened awareness translates into greater demand for transparency and accountability from companies like Ciech. The implementation of directives such as the Corporate Sustainability Reporting Directive (CSRD) in 2024 mandates more detailed reporting on social and environmental performance, increasing stakeholder scrutiny and driving a focus on robust Corporate Social Responsibility (CSR) strategies.

Investor sentiment also reflects this shift, with sustainable investment funds experiencing significant inflows throughout 2023. This trend underscores the financial sector's growing prioritization of Environmental, Social, and Governance (ESG) criteria, rewarding companies that demonstrate strong CSR profiles and a commitment to positive societal impact.

Public perception remains a critical factor, with concerns about environmental footprints and safety practices in the chemical industry influencing regulatory approaches and community relations. Companies with strong CSR initiatives, such as those actively involved in community development or emission reduction, often benefit from enhanced brand trust and a more favorable operating environment.

| Sociological Factor | 2023/2024 Data Point | Impact on Ciech | Strategic Implication |

|---|---|---|---|

| Consumer Sustainability Prioritization | Over 60% of consumers consider sustainability in purchasing (2024) | Increased demand for eco-friendly products | Leverage green chemical solutions, enhance marketing of sustainable offerings |

| Corporate Social Responsibility (CSR) Expectations | CSRD reporting mandates increased transparency (2024) | Need for robust CSR strategy and reporting | Strengthen CSR initiatives, ensure compliance with reporting standards |

| Investor ESG Focus | Significant inflows into sustainable investment funds (2023) | Attractiveness to ESG-focused investors | Maintain and improve ESG performance, communicate sustainability efforts |

| Public Perception of Chemical Industry | Concerns over environmental impact (60%+ in 2024 survey) | Potential impact on brand reputation and regulatory scrutiny | Proactive communication on safety and environmental stewardship, community engagement |

Technological factors

Ciech's competitiveness hinges on continuous technological advancements in chemical engineering and process optimization, directly impacting operational costs. For instance, in 2023, the company reported a significant focus on modernizing its soda plants, aiming for enhanced energy efficiency, a key driver in reducing production expenses.

The integration of advanced automation, artificial intelligence, and data analytics offers substantial improvements in efficiency, energy consumption, and product quality. Ciech's ongoing digitalization initiatives, particularly in its soda ash production, are designed to leverage these technologies to streamline operations and minimize waste.

Investing in research and development for novel production methods remains paramount for Ciech's long-term strategy. The company's commitment to innovation is reflected in its R&D expenditures, which aim to explore more sustainable and cost-effective manufacturing processes, ensuring it stays ahead in a dynamic market.

The global push for sustainability is increasingly driving the adoption of green chemistry, aiming to minimize hazardous substances and environmental footprints. Ciech's focus on sustainable production, including CO2 utilization and bio-based chemicals, directly addresses this trend, potentially unlocking new market avenues.

Ciech's commitment to digital transformation and Industry 4.0 is crucial for its future. By integrating technologies like the Internet of Things (IoT) and predictive maintenance, the company can gain deeper insights into its operations, leading to greater agility and smarter decision-making. For instance, adopting IoT sensors across its production lines can provide real-time data, enabling proactive issue resolution and minimizing downtime, thereby boosting overall efficiency.

The adoption of digital twins, which are virtual replicas of physical assets, offers Ciech a powerful tool for optimizing performance and planning maintenance. This technology allows for simulation and testing of various scenarios without impacting live operations. In 2024, many chemical industry leaders reported significant cost savings and productivity gains from such digital initiatives, with some seeing improvements of up to 15% in asset utilization.

Furthermore, these advancements are essential for streamlining Ciech's supply chain and resource management. Enhanced operational visibility through digitalization allows for better inventory control, more accurate demand forecasting, and optimized logistics. This not only reduces waste but also improves the company's responsiveness to market changes, a key factor for sustained competitiveness in the evolving chemical sector.

Research and Development for New Products

Ciech's commitment to research and development is a crucial driver for its future growth, particularly in specialized and high-value chemical segments. By investing in innovation, the company aims to expand its product offerings and maintain a competitive edge. For instance, in 2023, Ciech Group allocated PLN 105 million towards investments, a significant portion of which fuels R&D initiatives focused on developing new, sustainable, and functional chemical solutions. This strategic focus on R&D directly supports the creation of new revenue streams and solidifies market positions.

The company's R&D efforts are geared towards developing novel materials, advanced formulations, and innovative applications. This forward-looking approach is essential for staying ahead in a dynamic market. Ciech's strategy emphasizes creating products with enhanced functionalities and improved environmental profiles. This aligns with the growing global demand for greener chemical alternatives.

- Innovation Focus: R&D is central to Ciech's strategy for introducing specialized chemicals and high-value-added products.

- Revenue Generation: Developing new materials and formulations creates new revenue streams and strengthens market standing.

- Sustainability Drive: Significant investment in R&D is directed towards creating more sustainable and functional chemical solutions.

- 2023 Investment: Ciech Group invested PLN 105 million in 2023, with a substantial part dedicated to R&D activities.

Automation and Robotics in Manufacturing

The chemical industry is increasingly embracing automation and robotics, promising significant gains in safety and precision. For instance, by 2024, the global industrial robotics market in manufacturing is projected to reach over $100 billion, with chemical sectors being key adopters. This trend allows companies like Ciech to delegate hazardous or repetitive tasks to machines, thereby reducing human exposure to dangerous environments and ensuring greater consistency in output.

The integration of these advanced technologies directly translates to operational efficiencies and cost reductions. By automating processes, Ciech can potentially lower labor costs associated with manual operations and boost production volumes. Reports from 2024 indicate that companies implementing advanced automation have seen up to a 20% increase in production efficiency and a 15% reduction in operational costs. This makes leveraging these advancements a strategic imperative for optimizing production lines.

- Enhanced Safety: Robotics can handle hazardous chemical processes, minimizing risk to human workers.

- Improved Precision: Automated systems ensure consistent quality and reduce errors in complex manufacturing.

- Cost Reduction: Lowering labor expenses and increasing output efficiency contribute to a healthier bottom line.

- Increased Capacity: Automation enables higher production volumes to meet growing market demand.

Technological advancements are pivotal for Ciech, driving efficiency and innovation in chemical production. The company's investment in modernizing soda plants, as seen in 2023, highlights a commitment to energy efficiency, directly impacting cost structures. Digitalization initiatives, including AI and data analytics, are being deployed to optimize operations and reduce waste.

Ciech's research and development efforts are focused on creating specialized chemicals and sustainable solutions. In 2023, the Group invested PLN 105 million, with a significant portion allocated to R&D for new, functional chemical products. This strategic investment aims to unlock new revenue streams and maintain a competitive edge in the evolving chemical market.

The adoption of automation and robotics is enhancing safety and precision in chemical manufacturing. By 2024, the global industrial robotics market is expected to exceed $100 billion, with chemical sectors being key adopters. This allows Ciech to delegate hazardous tasks, reducing risks and ensuring consistent product quality, potentially leading to significant operational cost reductions.

| Technology Area | Impact on Ciech | Key Trend/Data Point |

|---|---|---|

| Process Optimization & Automation | Increased efficiency, reduced operational costs, enhanced safety | Automation adoption projected to increase production efficiency by up to 20% (2024 reports) |

| Digitalization (AI, IoT, Data Analytics) | Streamlined operations, waste reduction, improved decision-making | Digital twins can improve asset utilization by up to 15% (Industry benchmarks) |

| Research & Development (Green Chemistry, New Materials) | New revenue streams, competitive advantage, sustainable solutions | Ciech Group invested PLN 105 million in 2023, with a substantial R&D allocation |

Legal factors

Ciech operates within a framework of rigorous environmental protection laws, encompassing critical areas like air emissions, wastewater discharge, hazardous waste handling, and soil contamination. These regulations, often mirroring EU directives such as the Industrial Emissions Directive, are paramount for avoiding penalties, legal entanglements, and damage to its public image.

The company's commitment to compliance necessitates ongoing environmental monitoring and sustained investment in control technologies. For instance, in 2023, the chemical industry globally saw increased scrutiny on carbon footprint reduction, with many companies allocating significant capital towards greener production processes to meet evolving regulatory demands and stakeholder expectations.

The chemical sector, including companies like Ciech, operates under stringent legal frameworks governing product safety, chemical handling, storage, and transportation of hazardous materials. For instance, the European Union's REACH regulation mandates extensive data submission and risk assessment for chemicals, directly impacting Ciech's product development and market access.

Compliance with these regulations, such as those pertaining to chemical safety and product liability, is not merely a procedural requirement but a critical element for maintaining operational integrity and avoiding substantial financial penalties and reputational damage. Failure to adhere to these legal obligations can lead to significant fines; for example, non-compliance with REACH can result in penalties up to 5% of a company's annual turnover in the EU.

Ciech operates under a complex web of national and international labor laws. These regulations govern crucial aspects of employment, including maximum working hours, minimum wage requirements, the right to collective bargaining, and prohibitions against discrimination. For instance, in Poland, where Ciech has significant operations, the Labor Code sets standards for employment contracts, working time, and employee rights.

Adherence to occupational health and safety (OHS) regulations is not merely a best practice but a legal imperative. Ciech must ensure its workplaces are safe, implementing measures to mitigate risks associated with chemical handling and industrial processes. The European Agency for Safety and Health at Work (EU-OSHA) actively promotes OHS standards across member states, influencing national legislation that Ciech must follow.

Failure to comply with these labor and OHS mandates carries substantial risks. Non-compliance can result in costly legal battles, significant financial penalties, and severe damage to Ciech's reputation. For example, in 2023, the European Commission continued to emphasize strong enforcement of OHS directives, with fines for violations varying significantly by member state, underscoring the financial impact of non-adherence.

Competition and Antitrust Legislation

As a significant force in the European chemical sector, especially in soda ash and sodium bicarbonate, Ciech operates within a stringent framework of competition and antitrust legislation. These regulations are designed to foster fair market practices, prohibiting actions like price-fixing, market allocation, and abuse of dominant market positions. For instance, the European Commission actively monitors the chemical industry for potential antitrust violations, with past investigations into sectors like petrochemicals highlighting the serious repercussions of non-compliance, including substantial financial penalties that can run into millions of euros.

Ciech's adherence to these laws is not merely a legal obligation but a strategic imperative. Failure to comply can result in severe financial penalties, reputational damage, and protracted legal battles. For example, in 2023, the European Commission imposed a €676 million fine on several companies for participating in a cartel in the automotive exhaust system market, underscoring the financial risks involved.

Key aspects of competition and antitrust legislation relevant to Ciech include:

- Merger Control: Scrutiny of any acquisitions or mergers to prevent undue market concentration.

- Anti-Cartel Enforcement: Prohibiting agreements between competitors that restrict competition, such as price-fixing or market sharing.

- Abuse of Dominance: Preventing companies with significant market power from exploiting that power to the detriment of consumers or competitors.

- State Aid Rules: Ensuring that government support for companies does not distort competition within the EU single market.

Intellectual Property Rights Protection

Protecting intellectual property rights, such as patents for chemical processes and unique formulations, is fundamental to Ciech's strategy, which heavily relies on innovation. Robust legal frameworks ensure that the company can secure its significant investments in research and development, thereby preserving its competitive advantage in the chemical sector.

The ability to effectively enforce these intellectual property rights is paramount, acting as a critical deterrent against potential infringements that could undermine Ciech's market position and profitability. This legal protection is particularly important in an industry where technological advancements can be quickly replicated.

- Patent Filings: Ciech actively seeks patent protection for novel chemical compounds and manufacturing processes, aiming to secure exclusivity for its innovations.

- Trademark Enforcement: The company vigilantly guards its brand names and product logos against unauthorized use to maintain brand integrity and customer trust.

- Litigation and Defense: Ciech may engage in legal proceedings to defend its IP or challenge infringements, reflecting the high stakes involved in protecting its technological assets.

Ciech operates under a strict regulatory environment concerning product safety, handling, and transportation of chemicals, exemplified by the EU's REACH regulation. Compliance involves extensive data submission and risk assessment, directly impacting product development and market access.

Failure to adhere to these chemical safety and product liability laws can lead to significant financial penalties, with non-compliance with REACH potentially costing up to 5% of a company's annual turnover in the EU.

The company must also navigate complex labor laws, including those related to working hours, minimum wages, collective bargaining, and anti-discrimination, as well as stringent occupational health and safety (OHS) regulations to ensure safe workplaces.

In 2023, the European Commission continued to emphasize OHS enforcement, with fines for violations varying by member state, highlighting the financial risks of non-compliance.

Environmental factors

Global and regional climate change policies, such as the EU's Green Deal and Emissions Trading System (ETS), are increasingly pressuring chemical companies like Ciech to lower their carbon footprint. This means Ciech must navigate stricter regulatory requirements and potential costs associated with its carbon emissions.

For instance, the EU ETS saw carbon prices fluctuate significantly, with allowances trading around €65-€100 per tonne of CO2 in late 2023 and early 2024, directly impacting operational costs for emitters. Investing in decarbonization technologies and enhancing energy efficiency are therefore not just about compliance but are vital for Ciech’s long-term sustainability and competitiveness.

Growing global awareness of resource scarcity, particularly concerning water, raw materials, and energy, compels companies like Ciech to adopt robust resource management strategies. The chemical industry's substantial water footprint means sustainable sourcing and advanced wastewater treatment are paramount for operational continuity and environmental compliance.

In 2024, the increasing cost of water and stricter regulations in many European regions, where Ciech operates, highlight the financial implications of inefficient water use. For instance, some areas experienced a 5-10% increase in industrial water tariffs. By integrating circular economy principles, Ciech can mitigate risks associated with virgin resource depletion and fluctuating commodity prices, potentially reducing raw material costs by 5-15% through recycling and reuse initiatives.

The chemical industry, including companies like Ciech, faces increasing pressure regarding waste management. In 2024, the EU continued to strengthen its waste framework directives, pushing for higher recycling rates and a reduction in landfill waste, with a target of 65% recycling for municipal waste by 2035. This regulatory landscape necessitates robust strategies for waste reduction and responsible disposal.

Ciech actively pursues initiatives to align with these environmental demands. Their commitment to sustainable development involves optimizing production processes to minimize waste at the source. Furthermore, the company is exploring opportunities for waste valorization, aiming to transform by-products into valuable resources, a key tenet of the circular economy. For instance, in 2023, Ciech reported progress in its soda ash production, where efforts to improve energy efficiency also contributed to reduced waste outputs.

Pollution Control and Biodiversity Preservation

Ciech’s environmental stewardship centers on managing pollution from its chemical manufacturing processes, a critical aspect of its operations. The company must adhere to stringent regulations governing air, water, and soil contamination. For instance, in 2023, the European Union continued to emphasize stricter emission standards, impacting chemical producers like Ciech.

Investing in advanced pollution control technologies is paramount for Ciech to maintain compliance and minimize its environmental footprint. This includes upgrading equipment to reduce particulate matter and volatile organic compounds, as well as implementing robust wastewater treatment systems. The company’s commitment to these investments directly influences its operational costs and long-term sustainability.

Beyond direct pollution control, Ciech faces growing pressure to integrate biodiversity preservation into its site management strategies. This involves responsible land use planning and implementing measures to protect local ecosystems surrounding its industrial facilities. Such initiatives are increasingly vital for securing a social license to operate and meeting evolving regulatory expectations.

- Emission Standards: Ciech must comply with evolving EU emission limits, which became more stringent in 2023, particularly concerning industrial pollutants.

- Technology Investment: Significant capital is allocated to pollution abatement technologies, essential for meeting environmental targets and avoiding penalties.

- Biodiversity Impact: The company is increasingly focused on minimizing the impact of its operations on local flora and fauna, a key factor in community relations and regulatory approval.

- Regulatory Compliance: Adherence to environmental laws is a non-negotiable operational requirement, directly affecting Ciech's reputation and financial performance.

Product Lifecycle Environmental Impact

Ciech is increasingly focused on understanding and reducing the environmental footprint of its products throughout their entire lifespan, from sourcing raw materials to their ultimate disposal. This involves a thorough assessment of the environmental impact associated with key products like soda ash and salt. For instance, the energy intensity of soda ash production, a core business for Ciech, is a significant consideration in its lifecycle impact.

The company is exploring Life Cycle Assessments (LCAs) to guide its product development and identify opportunities for more sustainable alternatives. These assessments help in quantifying environmental burdens such as greenhouse gas emissions and water usage. For example, in 2023, the chemical industry globally saw a growing emphasis on circular economy principles, with companies investing in technologies to improve resource efficiency and reduce waste.

By evaluating the environmental impact of its entire product portfolio, Ciech aims to enhance its marketability and meet evolving customer and regulatory demands for greener chemical solutions. This strategic approach is crucial for maintaining a competitive edge in a market where sustainability is becoming a key differentiator.

- Soda Ash Production Energy Consumption: Ciech's soda ash production facilities are a focal point for energy efficiency improvements to lower the product's lifecycle environmental impact.

- Salt Extraction and Processing: The environmental considerations for salt production include water usage and land impact, which are being analyzed for mitigation strategies.

- Life Cycle Assessment (LCA) Implementation: Ciech is integrating LCA methodologies to quantify the environmental performance of its chemical products.

- Sustainable Alternatives Research: The company is actively researching and developing more sustainable chemical formulations and production processes.

Environmental regulations continue to shape Ciech's operational landscape, with a strong emphasis on decarbonization and emission reduction. The EU's ongoing commitment to climate targets, including those under the Green Deal, directly influences chemical producers. For instance, the cost of carbon allowances within the EU Emissions Trading System (ETS) remained a significant factor for industrial emitters throughout 2023 and into 2024, with prices often fluctuating between €65 and €100 per tonne of CO2.

Resource management is another critical environmental factor. Increasing global awareness of water scarcity and the need for sustainable raw material sourcing is driving stricter regulations and higher costs for water usage in many European regions where Ciech operates. Some industrial water tariffs saw increases of 5-10% in 2024, underscoring the financial imperative for efficient water management and circular economy principles to mitigate risks associated with virgin resource depletion.

Waste management is also under heightened scrutiny. The EU's strengthened waste framework directives, aiming for higher recycling rates, necessitate robust strategies for waste reduction and responsible disposal. Ciech's efforts to optimize production processes and explore waste valorization are key to aligning with these evolving requirements and potentially reducing raw material costs through recycling initiatives.

Ciech's focus on minimizing its environmental footprint extends to pollution control and biodiversity. Adherence to stringent emission standards for air, water, and soil contamination is paramount, with continued emphasis on upgrading pollution abatement technologies. The company is also increasingly integrating biodiversity preservation into its site management, a crucial aspect for social license and regulatory compliance.

| Environmental Factor | Impact on Ciech | 2023-2024 Data/Trends |

|---|---|---|

| Climate Change Policies (e.g., EU Green Deal) | Pressure to reduce carbon footprint, increased operational costs due to emissions. | EU ETS carbon prices ranged from €65-€100/tonne CO2 in late 2023/early 2024. |

| Resource Scarcity (Water, Raw Materials) | Need for robust resource management, potential for higher operational costs. | Industrial water tariffs increased by 5-10% in some European regions in 2024. |

| Waste Management Regulations | Requirement for waste reduction, higher recycling rates, and responsible disposal. | EU targets for municipal waste recycling, pushing chemical sector for better waste valorization. |

| Pollution Control & Biodiversity | Investment in advanced pollution abatement technologies, focus on minimizing operational impact on ecosystems. | Continued tightening of EU emission standards for industrial pollutants in 2023. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Ciech is meticulously constructed using a blend of official government publications, reports from international organizations like the World Bank and IMF, and reputable industry-specific market research. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting Ciech's operations and strategy.