Ciech Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ciech Bundle

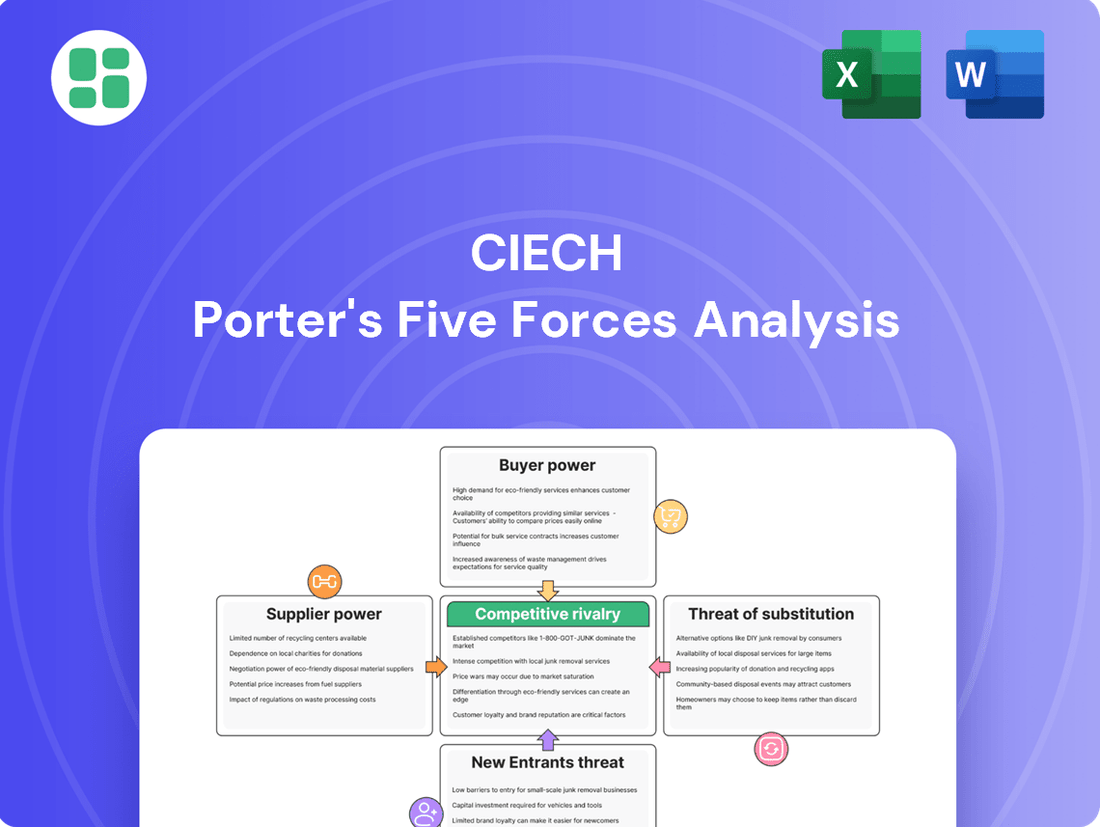

Ciech navigates a landscape shaped by significant buyer power and the constant threat of substitutes, impacting its pricing and product development. Understanding these forces is crucial for any stakeholder.

The full Porter's Five Forces Analysis for Ciech provides a comprehensive, data-driven examination of these dynamics, revealing the true competitive intensity and strategic levers available. Unlock actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The chemical industry, including players like Ciech, often depends on a limited number of suppliers for essential raw materials such as energy, limestone, and salt. This concentration means suppliers can wield considerable power, particularly over pricing. For instance, in 2023, European natural gas prices remained significantly elevated compared to other global regions, granting energy suppliers substantial leverage over chemical manufacturers.

For core products like soda ash and sodium bicarbonate, the essential raw materials have very few direct substitutes. This scarcity of alternative inputs for Ciech's critical production processes significantly boosts the bargaining power of its suppliers.

Ciech's dependence on specific mineral resources, such as salt and limestone, and also on energy sources like natural gas, means that securing these inputs reliably is paramount. In 2024, the global market for soda ash, a key input for Ciech, saw prices fluctuate, with some regions experiencing supply chain pressures that further consolidated supplier leverage.

Switching suppliers for large-volume, specialized chemical raw materials like soda ash, which Ciech heavily relies on, can be incredibly costly. These expenses often include significant investments in retooling production lines to accommodate new material specifications, rigorous quality control recalibrations, and the administrative burden of renegotiating complex supply contracts. For instance, a single shift in a primary raw material could necessitate millions in capital expenditure for equipment modifications.

These substantial switching costs inherently limit Ciech's operational flexibility and bolster the bargaining power of its existing suppliers. When a supplier provides a critical, highly specific chemical, and the cost to change is prohibitive, that supplier gains leverage, particularly in long-term supply agreements where price adjustments or favorable terms can be dictated more easily.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers in the chemical industry, while not a common occurrence, could significantly shift bargaining power. If a supplier of essential raw materials for companies like Ciech were to start manufacturing the finished chemical products themselves, such as soda ash or sodium bicarbonate, they would gain considerable leverage. This scenario is largely theoretical due to the substantial capital investment required for chemical production facilities, which acts as a deterrent.

For instance, consider the global soda ash market. In 2024, the market size was estimated to be around USD 15 billion, with significant capital expenditure needed to establish new production plants. A supplier contemplating forward integration would need to overcome these high barriers to entry, making it a less probable strategy compared to other industries. However, the mere possibility influences current negotiation dynamics.

- Theoretical Impact: A supplier entering Ciech's production space would drastically increase their bargaining power.

- Capital Intensity Barrier: The high cost of building chemical plants (e.g., soda ash production can require hundreds of millions of dollars in investment) makes this a difficult strategy to execute.

- Market Dynamics: While less common, this threat can still be a factor in supplier negotiations, influencing pricing and contract terms.

Uniqueness of Inputs

The uniqueness of inputs significantly bolsters a supplier's bargaining power. For instance, if a company like Ciech relies on specific grades of salt for its evaporated salt production, and these grades are not readily available from multiple sources, the salt supplier holds considerable leverage. Similarly, specialized chemicals essential for Ciech's plant protection products or polyurethane foams, if proprietary or requiring unique manufacturing processes, limit the availability of alternatives.

This scarcity of alternative suppliers for unique inputs directly translates into increased bargaining power for those suppliers. They can command higher prices or dictate more favorable terms because the buyer has fewer options. In 2024, the global specialty chemicals market, a relevant sector for Ciech, continued to see price volatility driven by supply chain complexities and the specialized nature of many products.

- Unique salt grades for evaporated salt production create supplier leverage.

- Specialized chemicals for plant protection and foams limit alternative sourcing options.

- Scarcity of alternatives empowers suppliers to negotiate better terms.

- The specialty chemicals market in 2024 reflected price pressures due to unique product demands.

Suppliers to chemical companies like Ciech can exert significant power due to the concentration of suppliers for essential raw materials, the lack of readily available substitutes, and high switching costs for specialized inputs. This leverage allows them to influence pricing and contract terms, especially when critical materials are involved.

For example, in 2024, the cost of key inputs such as natural gas and soda ash remained a significant factor for European chemical producers. The limited number of suppliers for these high-volume, specialized chemicals means they can often dictate terms, as seen in the volatile pricing trends of the global soda ash market.

The threat of forward integration by suppliers, while often deterred by the immense capital investment required for chemical production, can still subtly influence negotiations. This is particularly true in markets like specialty chemicals, where unique product demands in 2024 contributed to price pressures and further consolidated supplier leverage.

| Factor | Impact on Ciech | 2024 Data/Example |

| Supplier Concentration | Limited suppliers for key raw materials (e.g., energy, limestone, salt) grant them power. | European natural gas prices remained elevated in 2023-2024, impacting chemical manufacturers. |

| Lack of Substitutes | Few alternatives for core product inputs (e.g., soda ash) increase supplier leverage. | The global soda ash market experienced supply chain pressures in 2024, consolidating supplier influence. |

| Switching Costs | High costs to change suppliers for specialized inputs limit buyer flexibility. | Modifying production lines for new raw material specifications can cost millions in capital expenditure. |

| Forward Integration Threat | Potential for suppliers to enter chemical production poses a risk. | The USD 15 billion global soda ash market requires hundreds of millions in investment for new plants, acting as a barrier. |

What is included in the product

This analysis unpacks the competitive forces impacting Ciech, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the influence of substitutes.

Instantly identify and mitigate competitive threats with a visual representation of bargaining power, rivalry, and substitution risks.

Customers Bargaining Power

Ciech's diverse product portfolio, serving sectors like glass, food, agriculture, and construction, means its customer base is broad. However, significant volume purchases by key industrial clients, such as large glass manufacturers or major detergent producers, can give these customers considerable bargaining power.

For instance, a single large customer in the glass industry might account for a substantial percentage of Ciech's soda ash sales. This concentration means such buyers can leverage their volume to negotiate more favorable pricing or payment terms, impacting Ciech's profitability.

For customers, switching chemical suppliers can incur significant costs. These often include the expense and time needed for re-approving materials with regulatory bodies and internal quality control, as well as modifying existing production processes to accommodate new chemical formulations.

If these switching costs are low, customers gain leverage, as they can readily shift to competitors offering better prices or terms. For instance, in 2024, many industries reported that the initial investment in qualifying new chemical inputs could range from thousands to tens of thousands of dollars, depending on the sector's complexity.

Conversely, when a chemical supplier's products are deeply integrated into a customer's manufacturing workflow, making changes difficult and costly, the customer's bargaining power diminishes. This integration can involve specialized equipment or proprietary processes that are incompatible with alternative suppliers' offerings.

Ciech's customers can wield significant bargaining power, particularly when its products represent a substantial portion of their overall costs or when those customers operate in markets with thin profit margins. For instance, in the glass manufacturing sector, where soda ash (a key Ciech product) is a major input, buyers are acutely aware of price fluctuations. This heightened price sensitivity forces Ciech to remain highly competitive, potentially limiting its ability to dictate prices and thereby impacting its own profitability.

Customer's Ability to Backward Integrate

Large industrial buyers, like those in the glass or detergent industries, might explore producing essential chemicals such as soda ash themselves if it becomes economically viable. This possibility of backward integration, though requiring significant investment, serves as leverage for these powerful customers when negotiating prices with suppliers like Ciech. For instance, a major glass manufacturer could evaluate the cost savings versus the capital expenditure of building its own soda ash production facility.

The threat of backward integration is particularly relevant when supplier prices rise significantly or when a customer's demand volume is substantial enough to justify the upfront investment. Consider the global soda ash market, where pricing fluctuations can directly impact a large consumer's profitability, making in-house production a more attractive proposition during periods of high cost. In 2024, the global soda ash market experienced price volatility, influenced by energy costs and supply chain disruptions, which could prompt some large consumers to re-evaluate their sourcing strategies.

- Cost-Benefit Analysis: Customers weigh the cost of in-house production against current supplier pricing and the capital investment required.

- Market Dynamics: Significant price increases or supply unreliability from current suppliers can accelerate the consideration of backward integration.

- Volume Threshold: The sheer volume of a customer's chemical consumption often dictates the feasibility of them undertaking backward integration.

- Negotiating Power: The mere potential for a customer to backward integrate strengthens their bargaining position with existing suppliers.

Availability of Substitute Products for Customers

When customers have ready access to substitute products or alternative methods that deliver similar outcomes at a similar price point, their leverage grows significantly. This is particularly true for commodities like soda ash, where various alkaline chemicals can serve as replacements in certain industrial processes. In 2024, the market for industrial chemicals saw continued innovation in alternative materials, potentially increasing customer options and thus their bargaining power.

The ease with which customers can switch to these alternatives is a key determinant of their bargaining strength. For instance, if the cost or complexity of adopting a substitute is low, customers are more likely to exercise their power. This dynamic was evident in early 2025 discussions around green chemistry initiatives, which are fostering the development of more accessible and cost-effective bio-based alternatives for traditional chemical inputs.

- Increased Customer Options: The availability of substitutes directly expands the choices available to customers.

- Price Sensitivity: When substitutes exist, customers become more sensitive to price increases from existing suppliers.

- Switching Costs: Low switching costs between substitute products empower customers to change suppliers more readily.

- Market Dynamics: In 2024, the global chemical industry observed a trend where a wider array of specialty chemicals emerged as potential substitutes in niche applications, thereby enhancing customer bargaining power in those segments.

Ciech's customers, particularly large industrial buyers in sectors like glass and detergents, possess significant bargaining power. This stems from their substantial purchase volumes, the potential for backward integration, and the availability of substitutes. For instance, a major glass manufacturer might represent a considerable portion of Ciech's soda ash sales, enabling them to negotiate favorable terms. In 2024, the global soda ash market's price volatility, driven by energy costs, further amplified customer sensitivity and their leverage.

| Factor | Impact on Ciech | Supporting Data/Example (2024) |

|---|---|---|

| Customer Volume Concentration | High bargaining power for large buyers | Major glass manufacturers can influence soda ash pricing due to significant purchase volumes. |

| Potential for Backward Integration | Limits Ciech's pricing power | Large consumers may explore in-house production if supplier prices rise substantially or demand is high. |

| Availability of Substitutes | Reduces customer dependence | Alternative alkaline chemicals can replace soda ash in certain applications, increasing customer options. |

| Switching Costs | Low switching costs empower customers | The cost and time to qualify new chemical inputs can range from thousands to tens of thousands of dollars, influencing customer flexibility. |

Same Document Delivered

Ciech Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Ciech Porter's Five Forces Analysis details the competitive landscape, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry among existing competitors. Understanding these forces is crucial for strategic decision-making and gaining a competitive advantage in the chemical industry.

Rivalry Among Competitors

The European chemical sector is highly competitive, with several large multinational corporations vying for market share. Ciech, a significant player, ranks as the second-largest producer of soda ash and sodium bicarbonate within the European Union. This positions it directly against formidable competitors such as Solvay and Tata Chemicals, both of which possess substantial global reach and diversified product portfolios.

The European chemical industry is grappling with a subdued growth environment, with projections for EU27 chemicals output in 2025 hovering below 0.5%. This sluggishness is expected to persist, with a recovery not anticipated until 2026.

This low industry growth rate significantly fuels competitive rivalry. As the overall market expands minimally, companies are compelled to vie more aggressively for existing market share, intensifying competition among players.

Ciech faces intense rivalry in its core product segments, particularly soda ash and salt, which are largely considered commodity chemicals. This lack of inherent product differentiation means that competition often boils down to price, putting pressure on profit margins.

Furthermore, the switching costs for customers purchasing these commodity chemicals are generally low. This means buyers can easily shift to a competitor if they find a slightly better price or terms, amplifying the competitive pressure Ciech experiences. For instance, the global soda ash market, a key product for Ciech, saw a price range of approximately $250-$350 per metric ton in early 2024, highlighting the sensitivity to price fluctuations.

High Fixed Costs and Exit Barriers

The chemical sector, including players like Ciech, is characterized by substantial capital outlays for production facilities and infrastructure. This inherent capital intensity translates into significant fixed costs. For instance, in 2024, major chemical companies often reported capital expenditures in the hundreds of millions to billions of dollars annually, reflecting the ongoing need to maintain and upgrade these complex operations. These high fixed costs compel firms to strive for high capacity utilization, even if it means accepting lower profit margins to cover operational expenses.

Furthermore, the chemical industry presents considerable exit barriers. These can include the specialized nature of manufacturing equipment, which has limited alternative uses, and substantial environmental remediation liabilities that must be addressed upon plant closure. These factors make it economically challenging and often prohibitively expensive for companies to simply cease operations or divest assets. Consequently, even in periods of low demand or profitability, established players remain in the market, intensifying competitive rivalry as they seek to recover their investments.

- High Capital Intensity: Chemical production requires massive investment in plants and equipment.

- Operational Leverage: High fixed costs create pressure to maintain high production volumes.

- Exit Barriers: Specialized assets and environmental obligations deter market exit.

- Sustained Rivalry: Incumbents remain, leading to ongoing competition even in challenging conditions.

Strategic Stakes and Diversity of Competitors

The competitive landscape for Ciech (now Qemetica) is characterized by a diverse array of players, each with distinct strategic objectives. Some rivals prioritize expanding market share, potentially through aggressive pricing, while others focus on maximizing profitability by targeting niche markets or optimizing operational efficiency.

Ciech's own strategic pivot towards energy transformation, robust ESG (Environmental, Social, and Governance) commitments, and a strong emphasis on innovation sets it apart. This focus means Ciech might prioritize investments in sustainable technologies and new product development, potentially leading to intensified competition in segments where these factors are crucial differentiators. For instance, in the soda ash market, while traditional players might focus on cost leadership, Ciech's emphasis on greener production processes could attract environmentally conscious customers, creating a distinct competitive dynamic.

- Diverse Strategic Objectives: Competitors may prioritize market share, profitability, or diversification, influencing their strategic actions.

- Ciech's Unique Focus: Qemetica's emphasis on energy transformation, ESG, and innovation differentiates its competitive priorities.

- Segment-Specific Intensification: Ciech's strategy can lead to heightened competition in areas where sustainability and innovation are key.

- Example in Soda Ash: Traditional cost leadership versus Qemetica's focus on sustainable production creates varied competitive pressures.

Competitive rivalry within the European chemical sector is intense, driven by a mature market with low projected growth. For Ciech (now Qemetica), this translates into a constant battle for market share, particularly in commodity segments like soda ash and salt where price is a primary differentiator. The high capital intensity of chemical production, with significant fixed costs, compels companies to maintain high capacity utilization, even if it means accepting lower margins, further fueling competitive pressures. Substantial exit barriers, including specialized assets and environmental liabilities, ensure that established players remain in the market, contributing to sustained rivalry.

| Competitor | Key Product Segments | Estimated 2024 Market Position (EU Soda Ash) | Strategic Focus |

|---|---|---|---|

| Solvay | Soda Ash, Peroxides, Specialty Polymers | Major EU producer | Diversified portfolio, innovation |

| Tata Chemicals Europe | Soda Ash, Sodium Bicarbonate | Significant EU presence | Cost leadership, operational efficiency |

| Ciech (Qemetica) | Soda Ash, Salt, Agro, Foams, Silicates | 2nd largest EU producer (Soda Ash) | Energy transformation, ESG, innovation |

SSubstitutes Threaten

The threat of substitutes for Ciech's soda ash hinges on their price-performance trade-off. If alternative materials or processes can match soda ash's effectiveness in glass manufacturing, detergents, or chemicals at a lower cost, it presents a significant challenge.

For instance, while soda ash is a staple in glass production, innovations in glass recycling technologies, which reduce the need for virgin raw materials like soda ash, could diminish demand. Similarly, the development of bio-based or recycled materials in detergent formulations could offer a competitive alternative.

In 2024, the global glass recycling rate saw a marginal increase in certain regions, indicating a growing, albeit slow, shift towards circular economy principles that could indirectly impact soda ash consumption. The price volatility of soda ash itself, influenced by energy costs and production capacity, will also play a crucial role in how attractive substitutes appear to end-users.

Customer willingness to switch to substitutes for sodium bicarbonate is a key factor. This propensity is shaped by how easily a substitute can be adopted, the perceived risks involved, and the existing regulatory landscape. For instance, in sensitive sectors like food and pharmaceuticals, stringent regulations often create significant barriers to adopting new substitutes for sodium bicarbonate, primarily due to paramount safety and quality assurance requirements.

Innovation in alternative technologies poses a significant threat to companies like Ciech. Continuous advancements in chemical processes and material science can rapidly introduce new substitutes. For example, the development of bio-based polyols and sophisticated recycling techniques for polyurethane foams presents a viable alternative to traditional petroleum-based products.

Regulation and Environmental Factors

Increasing environmental regulations and a global push towards sustainability can significantly drive the adoption of more eco-friendly substitutes for chemicals produced by companies like Ciech. For instance, stricter emissions standards or mandates for biodegradable materials could make alternative products more attractive. This aligns with Ciech's own stated ESG focus, as they are already investing in greener production methods.

If a substitute chemical offers a demonstrably lower carbon footprint or is derived from readily renewable sources, it could pose a substantial threat to existing markets. For example, the European Union's Green Deal aims to reduce emissions by 55% by 2030 compared to 1990 levels, which could incentivize shifts away from traditional chemical production processes.

- Stricter emissions standards could favor substitutes with lower environmental impact.

- Global sustainability initiatives encourage the use of chemicals derived from renewable sources.

- The EU's Green Deal targets a significant reduction in emissions by 2030, impacting chemical industry choices.

- Ciech's own ESG commitments may necessitate adapting to or adopting greener substitutes.

Economic Shifts and Material Availability

Economic shifts significantly influence the threat of substitutes for Ciech. For instance, fluctuations in global energy prices, a key input for many chemical processes, can directly impact production costs. If crude oil prices, which influence petrochemical feedstocks, were to surge by, say, 20% in a given period, the cost of producing chemicals derived from these sources would rise, making alternative materials more appealing to customers.

Supply chain disruptions further exacerbate this. Imagine a scenario where geopolitical events restrict the availability of a primary raw material used by Ciech. This scarcity would naturally drive up its price, potentially making a less efficient but more readily available substitute a more viable option for consumers. In 2024, several sectors experienced such volatility, highlighting the sensitivity of chemical producers to material availability.

- Impact of Energy Prices: A hypothetical 15% increase in natural gas prices, a critical input for soda ash production, could raise CIECH's production costs, making alternative alkali sources more competitive.

- Supply Chain Vulnerabilities: Disruptions in the supply of key minerals, like phosphates, could increase the cost of fertilizer production, potentially driving demand towards alternative nutrient sources.

- Commodity Price Volatility: Significant swings in the price of oil and gas, which are foundational for many organic chemicals, directly affect the cost-competitiveness of Ciech's derivatives against bio-based or mineral-based alternatives.

The threat of substitutes for Ciech's products is amplified when alternatives offer a better price-performance ratio or are more readily adopted by customers. Innovations in recycling, like increased glass recovery rates which reached approximately 70% in some EU countries in 2024, can reduce the demand for virgin soda ash. Similarly, the push for sustainability, exemplified by the EU's Green Deal aiming for a 55% emissions reduction by 2030, favors substitutes with lower environmental footprints.

Economic factors, such as a hypothetical 20% surge in crude oil prices impacting petrochemical feedstocks, can make alternative materials more attractive. Supply chain disruptions, as seen in various sectors during 2024, can also drive customers towards more accessible substitutes. For instance, a 15% increase in natural gas prices, a key input for soda ash, could boost the competitiveness of alternative alkali sources.

| Factor | Impact on Substitutes | Example (2024 Context) |

| Price-Performance | Lower cost or higher efficiency makes substitutes more appealing. | Increased glass recycling rates (approx. 70% in some EU regions in 2024) reduce virgin soda ash demand. |

| Customer Adoption | Ease of switching and regulatory acceptance influence adoption. | Stringent food/pharma regulations create barriers for sodium bicarbonate substitutes. |

| Innovation | New technologies can create viable alternatives. | Bio-based polyols offer alternatives to petroleum-based polyurethane precursors. |

| Sustainability Trends | Environmental regulations favor greener substitutes. | EU Green Deal (55% emissions reduction by 2030) promotes low-carbon chemical alternatives. |

| Economic Volatility | Energy/raw material price swings affect cost-competitiveness. | A hypothetical 20% rise in oil prices could favor non-petrochemical substitutes. |

| Supply Chain Disruptions | Scarcity of primary materials drives demand for alternatives. | 2024 sector-wide volatility highlighted sensitivity to material availability. |

Entrants Threaten

The chemical industry, especially for bulk items like soda ash, demands enormous capital. Think about the cost of building and maintaining large-scale production plants, along with the ongoing investment in research and development. These substantial financial hurdles make it very difficult for new companies to enter the market.

Established players in the chemical industry, such as Ciech, leverage substantial economies of scale in their production processes, raw material sourcing, and logistics networks. This allows them to achieve lower per-unit costs than a new entrant could realistically match without significant initial investment and market share.

For instance, in 2023, Ciech's soda ash production capacity stood at approximately 3.5 million tonnes annually, a scale that underpins its cost competitiveness. A new entrant would face immense difficulty in replicating this volume and the associated cost efficiencies, making it challenging to compete on price from day one.

Ciech, operating in diverse sectors like chemicals, agriculture, and glass, has cultivated extensive and complex distribution networks spanning Europe and beyond. Newcomers would struggle to replicate these established relationships and secure the necessary channels to effectively reach Ciech's broad customer base.

Government Policy and Regulations

Government policy and regulations significantly impact the threat of new entrants in the chemical sector. The industry faces rigorous oversight concerning environmental protection, worker safety, and product quality. For instance, in 2024, the European Chemicals Agency (ECHA) continued to enforce REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations, requiring substantial data submission and risk assessment for new chemical substances, adding considerable cost and complexity for potential market entrants.

Navigating these complex permitting processes and adhering to stringent environmental mandates, such as those related to emissions and waste disposal, presents a substantial barrier. New companies must invest heavily in compliance infrastructure and undergo lengthy approval procedures. For example, obtaining environmental permits for a new chemical manufacturing facility can take several years and millions of dollars in upfront investment, deterring many smaller or less capitalized players from entering the market.

- Regulatory Hurdles: Compliance with environmental, health, and safety (EHS) standards is a major barrier.

- Permitting Processes: Lengthy and costly permitting can delay market entry for new chemical producers.

- Capital Investment: Meeting stringent safety and environmental regulations requires significant upfront capital.

- Evolving Legislation: Keeping pace with changing regulations, like those from ECHA, adds ongoing operational costs.

Proprietary Technology and Brand Loyalty

Ciech's competitive landscape is shaped by the threat of new entrants, particularly concerning its specialized chemical segments. While some of its offerings are commodity-like, the company leverages proprietary technologies and unique formulations in areas such as plant protection products and advanced polyurethane foams. This technological edge creates a barrier to entry, as replicating these specialized capabilities requires significant R&D investment and expertise.

Furthermore, Ciech benefits from established customer relationships and a recognized brand reputation, fostering a degree of loyalty among its client base. This loyalty makes it more challenging for new players to disrupt existing market shares and gain immediate traction. For instance, in the agrochemical sector, where efficacy and reliability are paramount, brand trust built over years can be a significant deterrent to newcomers.

- Proprietary Technology: Ciech's specialized chemicals, including innovative polyurethane foams and plant protection products, are protected by proprietary formulations and manufacturing processes.

- Brand Loyalty: Established customer relationships and a strong brand reputation in key markets create a loyal customer base, making it harder for new entrants to capture market share.

- R&D Investment: The significant investment required to develop and replicate Ciech's specialized technologies acts as a substantial barrier to entry for potential competitors.

The threat of new entrants for Ciech is generally moderate, primarily due to high capital requirements and established economies of scale in its core chemical operations. However, specialized segments may present slightly lower barriers.

Significant upfront investment in production facilities, R&D, and navigating stringent regulatory landscapes, such as REACH compliance enforced by ECHA in 2024, deters many potential competitors. Ciech's substantial soda ash production capacity of around 3.5 million tonnes annually in 2023 underscores the scale advantage new entrants must overcome.

Furthermore, Ciech’s well-developed distribution networks and strong brand loyalty, particularly in sectors like agrochemicals, create additional hurdles for newcomers aiming to gain market access and trust.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High cost of building and operating chemical plants. | Significant deterrent due to massive initial investment needed. |

| Economies of Scale | Ciech's large-scale production leads to lower per-unit costs. | New entrants struggle to match cost competitiveness without comparable volume. |

| Regulatory Compliance | Adherence to environmental and safety standards (e.g., REACH). | Adds substantial cost and complexity, requiring lengthy approval processes. |

| Distribution Networks | Ciech's established logistics and customer channels. | Challenging for new players to replicate access to broad customer bases. |

| Proprietary Technology | Specialized formulations and manufacturing processes. | Requires significant R&D investment and expertise to replicate. |

Porter's Five Forces Analysis Data Sources

Our Ciech Porter's Five Forces analysis is built upon a robust foundation of data, drawing from the company's annual reports, investor presentations, and public financial statements. We supplement this with industry-specific research from reputable market analysis firms and relevant trade publications to capture a comprehensive view of the competitive landscape.