Ciech Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ciech Bundle

Discover how Ciech masterfully navigates the market with a strategic approach to its Product, Price, Place, and Promotion. This analysis reveals the core elements of their success, offering a blueprint for competitive advantage.

Unlock the full story behind Ciech's marketing prowess. Our comprehensive 4Ps analysis delves into their product innovation, pricing strategies, distribution networks, and promotional campaigns, providing actionable insights.

Ready to elevate your marketing understanding? Get immediate access to a detailed, editable 4Ps Marketing Mix Analysis for Ciech, saving you valuable research time and delivering expert-level strategic thinking.

Product

Ciech, soon to be Qemetica, boasts a diverse chemical portfolio crucial for many industries. Their offerings include essential chemicals like soda ash, sodium bicarbonate, and salt, alongside specialized products such as plant protection agents, polyurethane foams, and silicates. This broad range underpins sectors from glass manufacturing and food production to agriculture, construction, and detergents.

The company holds a leading position in many of these chemical segments across Europe. For instance, in 2024, Ciech remained a significant European producer of soda ash, a key ingredient in glass and detergents. Their commitment to innovation and market leadership ensures a steady supply of these foundational chemicals.

Ciech's commitment to innovation is a cornerstone of its strategy, with a clear objective to secure ten new patents by 2026. This drive for intellectual property is designed to bolster its market position and introduce novel solutions.

The company is actively developing cutting-edge products, such as hybrid offerings specifically tailored for the agricultural industry. These advanced solutions aim to provide enhanced performance and address evolving market needs.

By prioritizing innovation, Ciech seeks to not only improve its existing product portfolio but also to fundamentally reshape the chemical industry. This forward-thinking approach is crucial for tackling current global challenges and maintaining a competitive edge.

Ciech's product strategy emphasizes sustainability, demonstrated by their development of low-carbon soda and silicates. This focus extends to innovative foams that increasingly utilize sustainably sourced alternatives to petroleum-based raw materials.

This commitment directly supports Ciech's ambitious Environmental, Social, and Governance (ESG) targets. Notably, the company aims for substantial reductions in CO2 emissions, with a clear objective of achieving climate neutrality.

Strategic Business Segments

Ciech's strategic business segments are the bedrock of its diversified operations, encompassing seven distinct areas: soda, salt, agro, foams, silicates, packaging, and cargo. Each segment is guided by tailored strategic objectives designed to foster growth and market leadership within its specific chemical niche.

This granular segmentation enables Ciech to pursue focused development strategies and penetrate distinct markets effectively. For example, the Agro business is actively pursuing international expansion, aiming to broaden its global footprint and capitalize on emerging agricultural opportunities. In 2024, the company continued to invest in its Agro segment, with reported revenue growth indicating positive traction in its expansion efforts.

- Soda: Focus on optimizing production and maintaining market share in key European regions.

- Salt: Emphasis on product innovation and expanding offerings for food and industrial applications.

- Agro: Strategic international expansion and development of new crop protection solutions.

- Foams: Driving innovation in specialized foam products for automotive and furniture industries.

- Silicates: Enhancing production efficiency and exploring new applications in detergents and construction.

- Packaging: Expanding capacity and developing sustainable packaging solutions.

- Cargo: Optimizing logistics and expanding service offerings for chemical transportation.

Value-Added Expansion

Ciech is strategically moving into higher-value product areas. This is evident in the expansion of its salt business, which includes the launch of specialized salt tablets under the AQUA PRO brand, specifically designed for water treatment applications. This focus on specialized products directly addresses growing market needs for efficient and effective solutions.

The acquisition of PPG Industries' Silicas Business is a significant step in this value-added expansion. It bolsters Ciech's portfolio of specialized chemicals, opening doors to new markets and applications. This move diversifies revenue streams and strengthens the company's position in the specialty chemicals sector.

This strategic diversification enhances both the intrinsic value of Ciech's product offerings and its overall market reach. By focusing on specialized and higher-margin segments, Ciech aims to capture greater market share and improve profitability.

- Value-Added Expansion: Ciech is focusing on specialized products like AQUA PRO salt tablets for water treatment.

- Strategic Acquisition: The acquisition of PPG Industries' Silicas Business broadens its specialized chemical portfolio.

- Market Reach Enhancement: Diversification into higher-value segments improves market penetration and customer appeal.

Ciech's product strategy is centered on a diversified portfolio, ranging from foundational chemicals like soda ash to specialized offerings such as agrochemicals and foams. The company is actively pursuing value-added expansion, evident in new product launches like AQUA PRO salt tablets for water treatment. This strategic focus is further bolstered by acquisitions, such as the integration of PPG Industries' Silicas Business, which enhances their specialized chemical capabilities and market reach.

| Product Segment | Key Offerings | Strategic Focus | 2024/2025 Data Highlight |

|---|---|---|---|

| Soda | Soda ash, sodium bicarbonate | Production optimization, European market share | Continued significant European producer of soda ash. |

| Salt | Industrial and food-grade salt, water treatment tablets | Product innovation, market expansion | Launch of AQUA PRO tablets for water treatment. |

| Agro | Plant protection agents | International expansion, new solutions | Continued investment in Agro segment, reporting revenue growth. |

| Foams | Polyurethane foams | Innovation in automotive and furniture applications | Focus on developing foams with sustainably sourced alternatives. |

| Silicates | Various silicate products | Production efficiency, new applications | Acquisition of PPG Industries' Silicas Business strengthens portfolio. |

What is included in the product

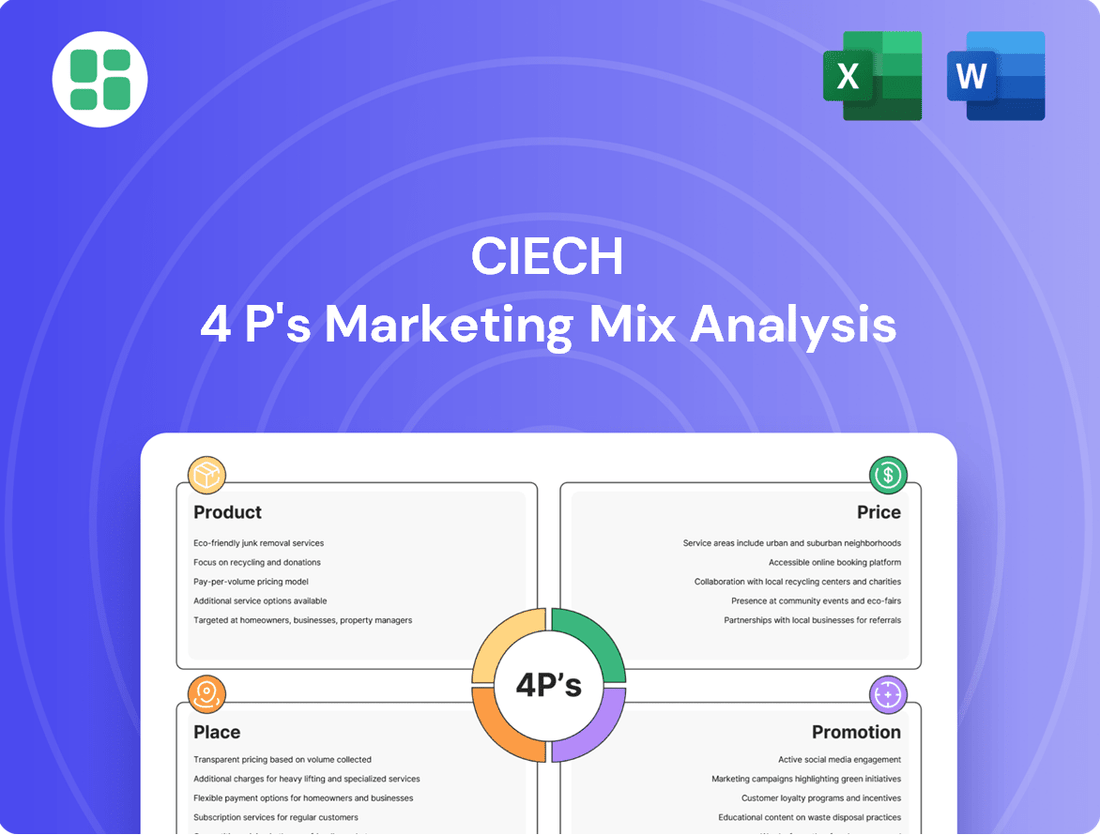

This analysis offers a comprehensive examination of Ciech's Product, Price, Place, and Promotion strategies, providing actionable insights for marketing professionals.

It delves into Ciech's actual marketing practices and competitive positioning, making it a valuable resource for strategic planning and benchmarking.

Provides a clear, actionable framework for addressing marketing challenges, transforming complex strategies into manageable solutions.

Simplifies the evaluation of Ciech's product, price, place, and promotion, alleviating the burden of fragmented marketing analysis.

Place

Ciech's production network is anchored by strategically positioned manufacturing facilities in Poland, Germany, and Romania. This multi-country presence is crucial for optimizing production costs and ensuring efficient supply chains across Europe.

These European plants act as vital distribution hubs, facilitating timely delivery to regional markets and supporting Ciech's international export activities. The company's robust European manufacturing footprint, with facilities like the soda ash plant in Inowrocław, Poland, highlights its commitment to serving a broad customer base.

Ciech, a significant player in the chemical industry, boasts an impressive global distribution network, reaching almost every continent. As one of Poland's leading exporters, this wide reach ensures their diverse chemical offerings are available to a broad spectrum of industries and clients across the globe. In 2023, Ciech reported that its products were exported to 170 countries, underscoring its extensive international footprint.

Ciech has significantly boosted its production capabilities, with a key focus on its German saltworks in Stassfurt. The company is targeting a full production capacity of 450,000 tons per year by the end of 2024.

This strategic capacity expansion is designed to directly address increasing market demand and solidify Ciech's competitive standing, especially within the European salt tablet sector.

Direct Sales and B2B Channels

Ciech predominantly employs direct sales and B2B channels for its industrial chemical offerings, serving key sectors like construction, automotive, and agriculture. This direct engagement facilitates the development of customized solutions and fosters robust, long-term client partnerships.

For certain consumer-oriented products, such as AQUA PRO salt tablets, distribution is broadened to include retail networks, notably DIY stores, expanding market reach beyond industrial clients.

In 2023, Ciech's Soda business segment, a core component of its B2B operations, reported revenue of PLN 2.2 billion, underscoring the significance of these channels. The company's strategy emphasizes building strong relationships within these B2B markets, a factor contributing to its stable market position.

- Direct Engagement: Ciech's primary sales strategy involves direct interaction with industrial customers, enabling tailored product solutions.

- Sector Focus: Key B2B sectors served include construction, automotive, and agriculture, highlighting the industrial nature of its chemical products.

- Retail Expansion: For specific products like AQUA PRO salt tablets, distribution extends to retail channels like DIY stores.

- Revenue Contribution: In 2023, the Soda segment, heavily reliant on B2B sales, generated PLN 2.2 billion in revenue.

Logistical Efficiency and Supply Chain Management

Ciech prioritizes logistical efficiency and supply chain management to ensure customers receive products promptly and conveniently. This involves meticulous inventory control and agile responses to market shifts, directly impacting customer satisfaction and sales across its diverse product portfolio.

The company's commitment to optimizing its supply chain is evident in its efforts to manage warehousing and transportation costs effectively. For instance, in 2023, Ciech continued to invest in modernizing its logistics infrastructure, aiming to reduce delivery times and enhance reliability for its B2B and B2C clients.

- Inventory Optimization: Implementing advanced forecasting models to maintain optimal stock levels, minimizing both stockouts and excess inventory.

- Transportation Network: Leveraging strategic partnerships and technology to streamline shipping routes and reduce transit times.

- Warehouse Management: Utilizing modern warehousing techniques to improve storage capacity and order fulfillment accuracy.

- Market Responsiveness: Adapting supply chain strategies to meet fluctuating demand and unexpected market disruptions, ensuring product availability.

Ciech's place strategy centers on a robust European manufacturing base, complemented by a broad global distribution network reaching 170 countries in 2023. This extensive reach ensures product availability across diverse markets, supported by efficient logistics and supply chain management.

The company's production facilities in Poland, Germany, and Romania are key distribution hubs, facilitating timely deliveries and supporting international exports. Ciech's strategic capacity expansion, such as the German saltworks targeting 450,000 tons by end-2024, aims to meet increasing demand and strengthen its market position.

Place also encompasses Ciech's sales channels, primarily direct B2B engagement for industrial chemicals, fostering strong client relationships. For consumer products like AQUA PRO salt tablets, distribution expands to retail networks, broadening market access.

Logistical efficiency is paramount, with investments in modernizing infrastructure to reduce delivery times and enhance reliability for all clients.

| Manufacturing Location | Key Products | Distribution Reach |

|---|---|---|

| Poland | Soda Ash, Agro Chemicals | Europe, Global Exports |

| Germany | Salt (e.g., Stassfurt Saltworks) | Europe, Global Exports |

| Romania | Soda Ash | Europe |

Full Version Awaits

Ciech 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Ciech's 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

CIECH's transition to Qemetica in June 2024 marks a pivotal moment in its corporate identity, supported by a comprehensive communication strategy. This rebranding initiative is designed to clearly articulate Qemetica's future direction, emphasizing its dedication to sustainable practices and technological advancement.

The extensive information campaign aims to ensure seamless understanding of this change among all stakeholders, from business partners to the wider public. Such a strategic communication effort is crucial for solidifying Qemetica's new brand image and fostering trust in its forward-looking vision, especially as the chemical industry increasingly prioritizes ESG factors.

Ciech actively participates in the chemical industry, particularly focusing on the European start-up scene. Their strategy involves seeking innovative solutions in clean technology and new business models, aiming to drive future growth and sustainability.

This proactive engagement is designed to identify potential collaborations and partnerships that can significantly enhance Ciech's existing product portfolio and expand its market presence. By investing in or partnering with promising start-ups, Ciech aims to stay at the forefront of technological advancements in the sector.

Ciech's promotion strategy for its specialized chemical products heavily relies on technical sales teams. These experts engage directly with industrial clients, offering detailed product knowledge and tailored solutions. This focus on technical benefits and applications is vital for B2B success in the chemical industry.

Customer education is a key component, ensuring clients understand the optimal use and advantages of Ciech's offerings. For instance, in 2023, Ciech Soda Poland reported significant growth, underscoring the effectiveness of their client-centric approach in driving sales for complex chemical solutions.

Sustainability and ESG Reporting

Ciech actively promotes its ambitious Environmental, Social, and Governance (ESG) strategy as a core element of its marketing mix. This includes highlighting significant achievements in reducing CO2 emissions, with targets validated by the Science Based Targets initiative, demonstrating a commitment to responsible operations. This narrative strongly appeals to stakeholders increasingly prioritizing sustainability in their investment and partnership decisions.

The company's promotional efforts underscore tangible progress in its ESG journey. For instance, by the end of 2023, Ciech reported a 22% reduction in CO2 emissions intensity compared to its 2019 baseline, a key metric in its sustainability reporting. This focus on measurable outcomes is crucial for building trust and credibility.

- CO2 Emission Reduction: Ciech's target to reduce CO2 emissions intensity by 30% by 2030 (vs. 2019) is a central promotional theme.

- Science Based Targets initiative (SBTi) Validation: The SBTi's approval of Ciech's emission reduction targets lends significant credibility to their ESG claims.

- Stakeholder Resonance: This proactive communication of ESG performance directly addresses the growing demand from investors, customers, and employees for environmentally and socially responsible business practices.

Investor Relations and Financial Transparency

Ciech prioritizes investor relations and financial transparency, a key element in its marketing mix. The company regularly publishes detailed financial reports, ensuring stakeholders have access to up-to-date information. This commitment to openness is further evidenced by their participation in competitions for best annual reports, highlighting their dedication to clear and credible financial communication.

This transparent approach is crucial for building trust and attracting investment. For instance, Ciech's 2023 annual report, published in early 2024, detailed significant investments in sustainability initiatives and operational efficiency. Such consistent communication reassures financial decision-makers, from individual investors to institutional portfolio managers, about the company's stability and future prospects.

- Robust Investor Relations: Ciech actively engages with its investor base through regular updates and accessible financial data.

- Financial Transparency: The company consistently publishes comprehensive financial reports, adhering to high standards of disclosure.

- Credibility and Trust: Participation in annual report competitions underscores Ciech's commitment to transparency, fostering confidence among financial professionals and investors.

- Attracting Investment: Clear and consistent communication of financial performance and strategy helps attract and retain capital.

CIECH's promotional strategy, now under the Qemetica brand, emphasizes technical expertise and customer education for its specialized chemical products. This approach is bolstered by a strong focus on ESG initiatives, particularly CO2 emission reductions, with validated targets by the Science Based Targets initiative. Investor relations and financial transparency are also key, with detailed reporting and participation in annual report competitions to build trust and attract capital.

The company's commitment to sustainability is quantifiable. By the end of 2023, CIECH achieved a 22% reduction in CO2 emission intensity compared to its 2019 baseline. Their target is a 30% reduction by 2030, validated by SBTi, a crucial promotional point for environmentally conscious stakeholders.

CIECH's active engagement with the European start-up scene, seeking innovations in clean technology, also serves as a promotional avenue. This outward-looking strategy aims to enhance their product portfolio and market presence, signaling a forward-thinking and adaptable business model to potential partners and investors.

| Promotional Focus | Key Initiatives | Supporting Data (as of end 2023/early 2024) |

|---|---|---|

| Technical Expertise & Customer Education | Direct engagement via technical sales teams; detailed product knowledge sharing. | Ciech Soda Poland reported significant growth in 2023, indicating effectiveness. |

| ESG Commitment | Highlighting CO2 emission reductions; SBTi validation of targets. | 22% reduction in CO2 emission intensity (vs. 2019 baseline); target of 30% by 2030. |

| Investor Relations & Financial Transparency | Regular financial reports; participation in annual report competitions. | 2023 annual report published early 2024 detailing sustainability investments. |

| Innovation & Start-up Engagement | Seeking solutions in clean technology and new business models. | Active participation in European start-up scene. |

Price

For specialized chemicals such as certain silicates or high-purity salts, Ciech likely utilizes value-based pricing. This strategy aligns the product's price with the unique benefits and superior performance it delivers to industrial clients, enabling healthier profit margins over commodity chemicals.

In the competitive soda ash market, Ciech faces intense pricing pressure driven by global supply, demand, and production capacity. For instance, in 2023, the global soda ash market was valued at approximately $50 billion, with significant production concentrated in China and the United States, creating a benchmark for pricing.

Ciech must therefore implement a strategic pricing approach that balances market competitiveness with profitability. This involves closely monitoring competitor pricing, particularly from major global producers, and adjusting its own prices to capture market share without eroding margins. Recent market reports from late 2024 indicate that soda ash prices in Europe have seen fluctuations, averaging between $300-$400 per tonne, depending on grade and delivery terms.

Ciech's pricing for key products, like soda, is directly tied to raw material costs, often using formulas linked to commodities such as coal. This approach ensures that as input expenses fluctuate, selling prices can adjust accordingly, providing a degree of cost pass-through.

The company actively manages this by renegotiating raw material contracts and employing hedging strategies. For instance, in 2024, global coal prices experienced volatility, with benchmarks like the API 4 index fluctuating significantly, impacting energy-intensive industries like soda production.

By hedging, Ciech aims to lock in prices for a portion of its raw material needs, thereby stabilizing its cost base and protecting profit margins from sudden, adverse price movements in the commodity markets throughout 2025.

Long-Term Contracts and Volume Discounts

Ciech, operating within a business-to-business (B2B) framework, strategically employs long-term contracts with its industrial clientele. These agreements often incorporate advantageous volume discounts and tiered pricing models, fostering predictable revenue streams for Ciech and ensuring supply security for its customers.

This approach is exemplified by Ciech's Soda segment, a significant contributor to its revenue. For instance, in 2023, the Soda segment reported revenues of PLN 2.7 billion, underscoring the importance of these stable, volume-driven relationships.

The benefits of such arrangements are twofold:

- Revenue Stability: Long-term contracts provide a predictable revenue base, mitigating short-term market fluctuations.

- Customer Loyalty: Volume discounts incentivize continued business, strengthening client relationships.

- Operational Efficiency: Guaranteed sales volumes allow for better production planning and resource allocation.

- Market Share Protection: Securing key clients through contracts helps maintain and grow market share in competitive sectors.

Economic Conditions and Market Demand Influence

Overall economic conditions, market trends, and consumer demand significantly impact Ciech's pricing decisions. The company must remain agile, adjusting its strategies to navigate factors like economic slowdowns and shifts in demand across various sectors. These external forces directly influence sales volumes and overall profitability, necessitating careful price management.

For instance, during periods of economic contraction, such as the projected slowdowns in some European economies anticipated for late 2024 and into 2025, Ciech might need to re-evaluate its pricing to maintain competitiveness and sales volume. Conversely, strong demand in key markets, like the agricultural sector in Poland which showed resilience in 2023, can support more robust pricing strategies.

- Economic Slowdown Impact: Potential for reduced industrial and consumer spending in 2024-2025 could pressure pricing for chemicals used in construction and manufacturing.

- Sector-Specific Demand: Growth in agriculture and food processing, key markets for Ciech's soda and agrochemicals, provides a buffer against broader economic downturns.

- Inflationary Pressures: While potentially allowing for price increases, persistent inflation in energy and raw materials (as seen in 2022-2023) also raises Ciech's cost base, complicating pricing strategy.

- Geopolitical Factors: Ongoing geopolitical instability can disrupt supply chains and influence commodity prices, indirectly affecting Ciech's cost structure and market pricing power.

Ciech's pricing strategy is multifaceted, balancing competitive pressures in commodity markets like soda ash with value-based approaches for specialized chemicals. For soda ash, where global prices averaged between $300-$400 per tonne in Europe in late 2024, Ciech must align its pricing with market benchmarks and production costs, which are often tied to volatile commodity inputs like coal. Long-term contracts with industrial clients, however, allow for volume discounts and tiered pricing, fostering revenue stability. The company must also remain agile, adapting pricing to economic conditions and sector-specific demand, particularly in resilient markets like agriculture.

| Product Segment | Pricing Strategy | Key Pricing Influences (2024-2025) |

|---|---|---|

| Soda Ash | Market-based, Cost-plus | Global supply/demand, Competitor pricing, Coal prices, Energy costs |

| Specialized Chemicals (e.g., Silicates) | Value-based | Product performance, Customer benefits, R&D investment |

| Agrochemicals | Market-based, Contractual | Agricultural demand, Raw material costs, Competitor offerings |

4P's Marketing Mix Analysis Data Sources

Our Ciech 4P's Marketing Mix Analysis leverages a comprehensive blend of official company disclosures, including annual reports and investor presentations, alongside detailed market intelligence from industry reports and competitive benchmarking. This ensures a robust understanding of their product portfolio, pricing strategies, distribution networks, and promotional activities.