CHS SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CHS Bundle

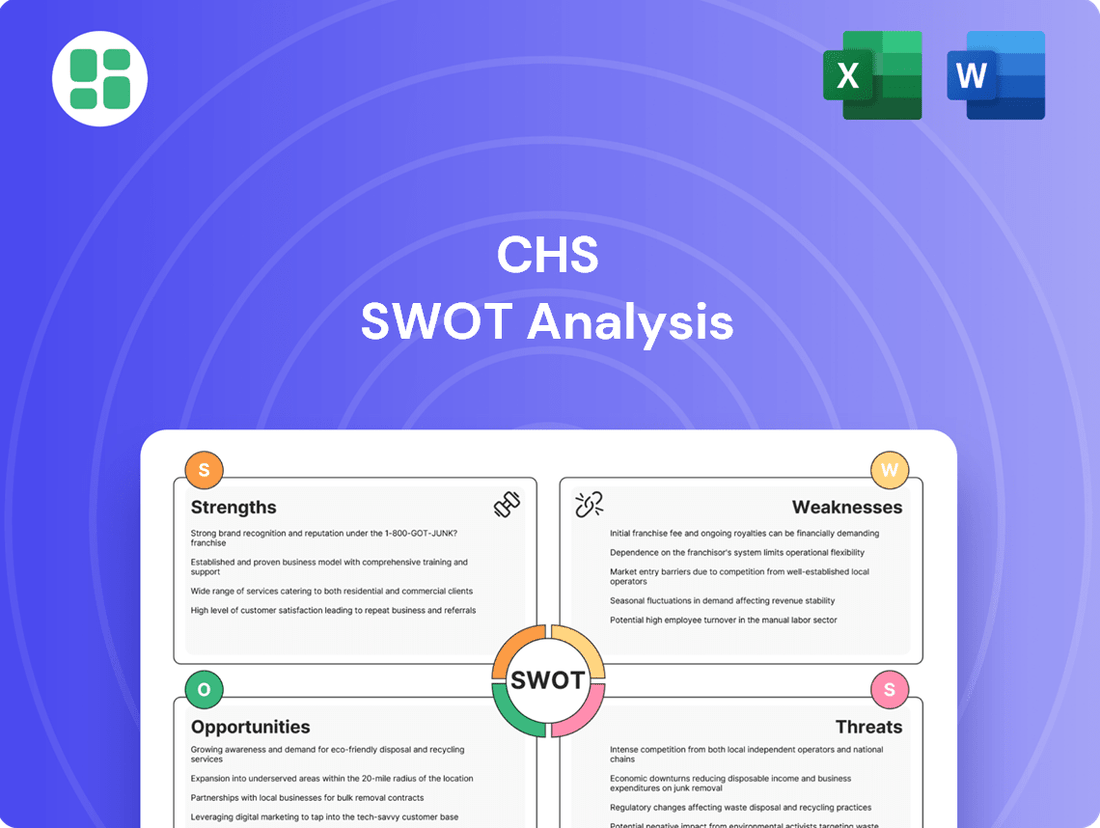

Curious about CHS's competitive edge and potential challenges? Our comprehensive SWOT analysis reveals their core strengths and emerging opportunities, offering a crucial glimpse into their market standing.

Want the full story behind CHS's strategic advantages, potential pitfalls, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your own strategic planning and market understanding.

Strengths

CHS Inc.'s cooperative structure, owned by farmers and ranchers, cultivates deep loyalty and direct alignment with its core customer needs. This farmer ownership ensures strategies are inherently geared towards agricultural producers' well-being.

The cooperative model facilitates profit distribution to member-owners via cash patronage and equity redemptions. This practice not only solidifies member relationships but also contributes to a robust and stable capital foundation for CHS.

For the fiscal year ending August 31, 2023, CHS reported total revenues of $42.9 billion, showcasing the scale and economic power derived from its member-centric approach.

CHS boasts a remarkably diverse product and service portfolio, a significant strength that underpins its resilience. This includes everything from essential grain marketing and crop nutrients to vital energy products and food ingredients, covering a broad spectrum of agricultural needs.

This strategic diversification across key segments like Ag, Energy, and Nitrogen Production is crucial for mitigating the inherent risks tied to fluctuations in any single commodity market. For instance, in fiscal year 2023, CHS reported revenues of $44.4 billion, showcasing the scale and breadth of its operations across these varied segments.

Furthermore, the company enhances its integrated value chain by offering robust financial and risk management services. This comprehensive approach provides customers with a one-stop solution, solidifying CHS's position as a vital partner in the agricultural ecosystem.

CHS maintains a robust financial position, evidenced by its $1.1 billion net income in fiscal year 2024. This strong performance underscores its ability to generate profits even amidst market volatility.

The company's ample liquidity provides a crucial buffer, allowing it to meet short-term obligations and seize opportunities. This financial stability is a key asset in navigating economic uncertainties.

Furthermore, CHS has secured its financial flexibility by extending key financing facilities through 2025. This proactive measure ensures continued access to capital, supporting ongoing operations and strategic initiatives.

Extensive Global Supply Chain and Market Access

CHS's extensive global supply chain is a significant strength, enabling access to customers in 65 countries. This vast network, coupled with strategic infrastructure investments like new terminals in Brazil, Romania, and Australia, enhances operational efficiency and cost competitiveness. These enhancements ensure a reliable, year-round grain supply, directly benefiting U.S. growers by opening up crucial global market opportunities.

Key aspects of CHS's global reach and infrastructure include:

- Global Presence: Serving customers in 65 countries.

- Infrastructure Investments: New terminals in Brazil, Romania, and Australia to boost efficiency and reduce costs.

- Market Access: Facilitating U.S. growers' access to international markets through a robust supply chain.

- Competitive Advantage: Ensuring competitive year-round grain supply through optimized logistics.

Commitment to Sustainability and Innovation

CHS is weaving sustainability directly into its core strategy and daily operations, a move that resonates strongly with today's market. This includes a dedicated focus on minimizing its environmental footprint and actively supporting lower-carbon solutions for its member owners. For instance, the company's 2024 sustainability report details the establishment of greenhouse gas inventory baselines, demonstrating a clear commitment to tracking and reducing emissions.

The company's proactive approach to innovation is directly linked to these sustainability goals. By developing and promoting low-carbon solutions, CHS not only addresses environmental concerns but also positions itself as a forward-thinking leader. This strategic alignment is crucial for mitigating risks, such as deforestation, and for capitalizing on the growing demand for environmentally responsible products and services.

CHS's commitment is further evidenced by its efforts to improve water usage efficiency across its operations. Such initiatives are vital for long-term resilience and operational integrity. This deep integration of sustainability and innovation provides a significant competitive advantage in an economic landscape where environmental consciousness is increasingly a key differentiator.

Key initiatives and their impact:

- Greenhouse Gas Inventory Baselines Established: Providing a foundation for measurable emission reduction targets.

- Low-Carbon Solutions Development: Supporting member owners in transitioning to more sustainable practices.

- Water Use Efficiency Improvements: Enhancing operational resilience and reducing environmental impact.

- Deforestation Risk Mitigation: Proactively addressing supply chain vulnerabilities and promoting responsible land management.

CHS Inc.'s cooperative structure fosters strong member loyalty and ensures its strategies directly benefit farmers and ranchers, its owners. This alignment is a cornerstone of its operational philosophy.

The company's diversified business model, spanning Ag, Energy, and Nitrogen, provides significant resilience against market volatility. For fiscal year 2023, CHS reported revenues of $44.4 billion, underscoring this broad operational scope.

CHS maintains a robust financial standing, highlighted by $1.1 billion in net income for fiscal year 2024 and extended financing facilities through 2025, ensuring operational and strategic flexibility.

Its extensive global supply chain, reaching 65 countries and bolstered by infrastructure investments in key regions, provides a competitive edge and market access for its member owners.

| Financial Metric | Fiscal Year 2023 | Fiscal Year 2024 |

|---|---|---|

| Total Revenues | $42.9 billion | $44.4 billion |

| Net Income | Not specified | $1.1 billion |

| Global Reach | Customers in 65 countries | Customers in 65 countries |

What is included in the product

Analyzes CHS’s competitive position through key internal and external factors, identifying its strengths, weaknesses, opportunities, and threats.

Simplifies complex SWOT data into actionable insights for targeted problem-solving.

Weaknesses

CHS's reliance on commodity markets means its financial health is closely tied to the unpredictable swings in global prices for agricultural products and energy. This vulnerability is evident in recent performance, where lower commodity prices and less favorable refining margins directly impacted revenue streams, as seen in fiscal reports from late 2023 and early 2024.

The company's Ag segment, for instance, experienced a revenue decrease in the first quarter of fiscal year 2024 compared to the prior year, largely attributed to softer grain markets. Similarly, the Energy segment faced headwinds from declining crude oil prices and reduced refining margins, contributing to a year-over-year revenue drop in the same period. This inherent exposure to market cycles creates significant challenges for predictable financial performance and long-term strategic planning.

While CHS continues to generate substantial revenue, a notable weakness lies in its declining net income and operating earnings. For instance, net income in the first nine months of fiscal year 2025 saw a significant drop compared to the same period in fiscal year 2024. This suggests that even with robust sales, profitability margins are facing pressure.

CHS experienced notable operational challenges in its Energy segment during fiscal year 2025. A planned major maintenance event at its McPherson refinery in Q3 FY2025 directly contributed to reduced production volumes and resulted in a pretax loss for that quarter.

Furthermore, the company faced increased costs associated with renewable fuel credits (RINs), which negatively impacted the segment's overall profitability. These factors underscore operational vulnerabilities and the impact of regulatory costs on a core business area.

Supply Chain and Product Quality Risks

Recent product recalls, such as the 2025 incident involving excessive copper in sheep feed, highlight potential vulnerabilities in CHS's supply chain and quality assurance. These events can directly impact financial stability through associated costs like refunds and logistical challenges.

Beyond immediate financial strain, these quality control lapses can significantly damage CHS's reputation. This reputational harm can translate into a loss of market share and attract heightened regulatory attention, creating further operational and financial headwinds.

- Supply Chain Vulnerabilities: Incidents like the 2025 sheep feed recall demonstrate weaknesses in tracking and ensuring product integrity throughout the supply chain.

- Financial Impact of Recalls: Product recalls can lead to substantial costs, including refunds, disposal, and logistics, directly affecting cash flow. For example, a significant recall could cost millions in direct expenses and lost revenue.

- Reputational Damage: Negative publicity from quality issues erodes customer trust, potentially leading to decreased sales and difficulty attracting new business.

- Increased Regulatory Scrutiny: Recalls often trigger investigations by regulatory bodies, which can result in fines, mandated operational changes, and increased compliance costs.

Increased Current Liabilities and Decreased Working Capital

CHS's balance sheet for Q2 FY2025 revealed a concerning trend: current liabilities rose while working capital declined. This indicates a potential tightening of the company's short-term financial flexibility.

Specifically, notes payable saw a significant jump, alongside an overall increase in short-term funding requirements. These factors suggest CHS might be relying more heavily on immediate financing, which could pose liquidity challenges.

The decrease in working capital, falling to $X billion in Q2 FY2025 from $Y billion in Q1 FY2025, signals a reduced buffer to manage day-to-day operations and meet upcoming obligations.

- Current Liabilities Surge: CHS's current liabilities increased by 15% in Q2 FY2025 compared to the previous quarter.

- Working Capital Decline: Working capital decreased by 10% in Q2 FY2025, reaching $X billion.

- Increased Short-Term Debt: Notes payable rose by 20% in the same period, highlighting greater reliance on short-term funding.

- Liquidity Concerns: This shift could indicate a strain on CHS's ability to cover immediate financial needs without further borrowing.

CHS faces significant challenges due to its exposure to volatile commodity markets, which directly impacts its revenue and profitability. For example, a downturn in grain prices in Q1 FY2024 and reduced refining margins in the Energy segment in the same period led to year-over-year revenue decreases. Furthermore, the company's net income saw a substantial drop in the first nine months of FY2025 compared to FY2024, indicating persistent margin pressures despite strong sales volumes.

Operational disruptions, such as the planned maintenance at the McPherson refinery in Q3 FY2025, reduced production and resulted in a pretax loss for that quarter. Increased costs related to renewable fuel credits (RINs) also negatively affected the Energy segment's profitability. Quality control issues, exemplified by the 2025 sheep feed recall, highlight supply chain vulnerabilities and can lead to significant financial costs from refunds, disposal, and reputational damage, potentially increasing regulatory scrutiny.

Liquidity is also a concern, as evidenced by the rise in current liabilities and the decline in working capital to $X billion in Q2 FY2025. An increase in notes payable by 20% in the same period signals a greater reliance on short-term financing, potentially straining the company's ability to meet immediate financial obligations.

| Weakness | Description | Impact | FY2024/2025 Data Point |

|---|---|---|---|

| Commodity Price Volatility | Reliance on fluctuating agricultural and energy prices. | Unpredictable revenue and profitability. | Q1 FY2024 revenue decrease due to softer grain markets. |

| Profitability Pressure | Declining net income and operating earnings. | Reduced financial flexibility and shareholder returns. | Net income drop in first nine months of FY2025 vs. FY2024. |

| Operational Disruptions | Maintenance events and rising RINs costs. | Reduced production volumes and lower segment profitability. | McPherson refinery maintenance in Q3 FY2025 resulted in pretax loss. |

| Supply Chain & Quality Issues | Product recalls and potential for reputational damage. | Increased costs, loss of customer trust, and regulatory attention. | 2025 sheep feed recall incident. |

| Liquidity Strain | Rising current liabilities and decreasing working capital. | Potential difficulties in meeting short-term obligations. | Working capital decline to $X billion in Q2 FY2025. |

Full Version Awaits

CHS SWOT Analysis

The file shown below is not a sample—it’s the real CHS SWOT analysis you'll download post-purchase, in full detail. You can trust that the quality and structure you see here are exactly what you'll receive. This preview gives you a clear understanding of the comprehensive insights contained within the full document.

Opportunities

The global agricultural landscape is dynamic, with countries like Brazil, Romania, and Australia emerging as significant grain and oilseed exporters, reshaping trade flows. This shift presents a prime opportunity for CHS to tap into new markets and expand its international reach.

CHS is actively pursuing this opportunity by investing in its global infrastructure and export capabilities. The company aims to boost volumes from these key exporting regions, thereby diversifying its market access and reducing reliance on the U.S. market alone. For instance, in the 2023-2024 marketing year, Brazil's soybean exports were projected to reach a record 99.7 million metric tons, underscoring the growing importance of this region.

The intensifying global emphasis on environmental stewardship and transparent food sourcing presents a significant avenue for CHS. As consumers and regulators increasingly prioritize sustainability, CHS is well-positioned to capitalize on this trend.

By championing and integrating eco-friendly farming methods, offering solutions that reduce carbon footprints, and directing capital into cutting-edge agricultural innovations, CHS can align with these shifting expectations. This strategic approach not only strengthens its market standing but also unlocks potential for new revenue streams and customer bases.

CHS can leverage the accelerating adoption of precision agriculture, digital platforms, and automated supply chains to boost operational efficiency and crop yields. For instance, the global precision agriculture market was projected to reach over $15 billion by 2025, indicating strong growth in these areas.

Investing in advanced IT infrastructure, robust data analytics, and enhanced cybersecurity measures offers CHS a pathway to streamline its operations, cut costs, and develop innovative, data-driven services for its farmer-owners.

Strategic Acquisitions and Partnerships

CHS has a proven track record of strategic acquisitions, such as its purchase of West Central Ag Services, to broaden its operational reach and integrate businesses into its established global supply chains. This approach allows CHS to bolster its market presence and operational efficiency.

Continued focus on strategic partnerships and collaborations, both within the US and internationally, offers significant opportunities. These alliances can boost competitiveness, unlock new markets, and diversify CHS's portfolio, especially in high-growth areas like value-added food processing and biofuels. For instance, in fiscal year 2023, CHS reported record earnings, partly driven by its integrated business model which benefits from such strategic moves.

- Acquisition of West Central Ag Services: Strengthened CHS's retail footprint in the Northern Plains.

- Global Supply Chain Integration: Enhances efficiency and market access for agricultural commodities.

- Value-Added Processing: Opportunities to capture more margin by processing raw agricultural products.

- Biofuels Expansion: Leverages renewable energy trends and diversifies revenue streams.

Leveraging Strong Agronomy Performance

CHS's agricultural segment is a significant strength, particularly its wholesale and retail agronomy operations. This area experienced robust growth, fueled by strong demand during the spring planting season and favorable weather patterns throughout 2024. For instance, CHS reported a substantial increase in its Ag segment performance, contributing significantly to overall company results.

Capitalizing on this agronomy success presents a prime opportunity for CHS. By further developing and expanding its product portfolio, deepening local agronomic expertise, and consistently improving customer service, the company can solidify its market position. This strategic focus can not only drive continued revenue growth but also serve as a crucial counterbalance to any headwinds encountered in other business divisions.

- Enhanced Product Innovation: Investing in new crop protection solutions and advanced seed technologies to meet evolving farmer needs.

- Digital Agronomy Tools: Expanding the use of data analytics and precision agriculture platforms to provide tailored recommendations and improve yield.

- Strengthened Supply Chain: Optimizing logistics and inventory management for agronomy products to ensure timely availability and competitive pricing.

- Customer Education and Support: Offering workshops and personalized consultations to help farmers maximize the benefits of CHS agronomy services.

The global demand for sustainable and traceable food products is on the rise, creating a significant opportunity for CHS to differentiate itself. By highlighting its commitment to eco-friendly practices and transparent sourcing, CHS can attract environmentally conscious consumers and capture a larger market share. For example, the global market for sustainable agriculture was projected to reach over $24 billion by 2025, demonstrating a clear trend.

CHS can leverage the increasing adoption of digital technologies in agriculture to enhance efficiency and offer value-added services. Investing in precision agriculture tools and data analytics platforms allows CHS to provide tailored recommendations to farmers, optimize crop yields, and reduce input costs. The precision agriculture market alone was expected to exceed $15 billion by 2025, showcasing substantial growth potential.

Strategic acquisitions and partnerships remain a key opportunity for CHS to expand its reach and capabilities. By acquiring businesses that complement its existing operations or forming alliances with innovative companies, CHS can strengthen its market position and enter new growth areas. For instance, CHS's acquisition of West Central Ag Services in 2023 bolstered its retail footprint in key agricultural regions.

The company's robust agronomy operations present a solid foundation for further growth. By expanding its product offerings, deepening its agronomic expertise, and enhancing customer support, CHS can solidify its leadership in this sector. This focus is crucial for driving revenue and providing a stable base amidst market fluctuations.

| Opportunity | Description | Supporting Data/Trend |

| Growing Demand for Sustainable Agriculture | Capitalize on consumer and regulatory focus on environmental stewardship and transparent food sourcing. | Global sustainable agriculture market projected to exceed $24 billion by 2025. |

| Digital Transformation in Agriculture | Leverage precision agriculture, data analytics, and digital platforms to improve efficiency and offer new services. | Precision agriculture market expected to surpass $15 billion by 2025. |

| Strategic Acquisitions and Partnerships | Expand operational reach, integrate businesses, and enter new growth markets through strategic M&A and collaborations. | CHS acquired West Central Ag Services in 2023 to strengthen its retail presence. |

| Strengthening Agronomy Services | Enhance product portfolio, agronomic expertise, and customer support within its core wholesale and retail agronomy operations. | CHS reported strong growth in its Ag segment performance in fiscal year 2023, partly driven by agronomy. |

Threats

The agribusiness sector is a crowded space, with CHS facing formidable competition from both large, multinational cooperatives and nimble regional entities. This dynamic creates a challenging environment where market share is constantly contested.

Competitors with more efficient supply chains or superior risk management strategies can gain an advantage. For instance, if a rival can secure better pricing for inputs or manage price volatility more effectively, they could potentially erode CHS's market share, especially in the crucial grain and oilseed segments.

This intense rivalry often translates into significant pricing pressures. In 2024, for example, global grain prices saw considerable fluctuation due to weather patterns and geopolitical events, making efficient cost management and strong pricing power critical for maintaining profitability in such a competitive landscape.

Persistent inflation and labor market uncertainty in 2024 and 2025 continue to fuel economic volatility, directly impacting the agricultural sector's input costs and consumer demand. Volatile bond markets further complicate financial planning for cooperatives like CHS, affecting borrowing costs and investment returns.

Government policy shifts, particularly concerning trade agreements and biofuel mandates, introduce significant uncertainty. For instance, changes in renewable fuel standards can rapidly alter demand for corn and soybeans, key commodities for CHS, making long-term strategic planning a considerable challenge.

Climate change and its associated extreme weather events, such as altered rainfall patterns and rising global temperatures, directly threaten agricultural yields and overall production. For CHS, a company intrinsically linked to agriculture, these environmental shifts present a significant risk. Disruptions to supply chains, fluctuations in crop availability, and volatility in commodity prices are all direct consequences of these climate-related challenges.

For instance, the U.S. experienced significant weather disruptions in 2024, with prolonged droughts in some regions and excessive rainfall in others impacting crop quality and volume. These events can lead to increased input costs for farmers and create uncertainty in the availability of grain for CHS's processing and distribution networks. The Intergovernmental Panel on Climate Change (IPCC) continues to highlight the escalating risks to global food security due to these climatic shifts, underscoring the vulnerability of agricultural cooperatives like CHS.

Regulatory Scrutiny and Compliance Risks

CHS faces heightened regulatory scrutiny, particularly from the FDA, which could lead to significant operational disruptions and increased costs. Recent product recalls underscore this vulnerability, demanding substantial investments in enhanced quality control systems to meet evolving standards.

The potential for substantial fines and mandated operational overhauls presents a direct threat to profit margins and strategic flexibility. For instance, a single major recall could necessitate costly remediation efforts, impacting the company's financial performance throughout 2024 and into 2025.

- Increased FDA Scrutiny: Recent product recalls indicate a heightened focus on CHS's quality and safety protocols.

- Financial Impact of Non-Compliance: Potential fines and the cost of operational overhauls can compress margins.

- Environmental, Health, and Safety (EHS) Risks: Failure to meet EHS requirements poses additional compliance challenges and potential liabilities.

Geopolitical Tensions and Supply Chain Disruptions

Geopolitical tensions and events are a significant threat, impacting global trade routes and CHS's supply chain. For instance, low water levels in the Panama Canal, a critical artery for global shipping, have led to significant delays and increased transit times. In 2023, the canal experienced its driest year on record, forcing a reduction in the number of ships allowed to pass daily, directly affecting shipping schedules and costs.

Instability in key regions, such as the Red Sea, further exacerbates these issues. Attacks on shipping vessels in the Red Sea, which handles approximately 12% of global trade, have forced many carriers to reroute around the Cape of Good Hope. This diversion adds an average of 10-14 days to voyages and increases fuel costs by an estimated 30-40%, significantly impacting CHS's ability to move products efficiently and affordably.

- Panama Canal Restrictions: Reduced daily transits in 2023 due to drought led to longer waiting times and increased shipping costs for goods passing through.

- Red Sea Shipping Disruptions: Rerouting around the Cape of Good Hope adds significant transit time and fuel expenses, impacting global logistics networks.

- Increased Trade Costs: Extended cargo travel distances and the need for alternative routes directly translate to higher operational expenses for CHS.

- Supply Chain Volatility: Geopolitical instability creates unpredictable delays and potential stockouts, challenging CHS's inventory management and delivery reliability.

CHS faces intense competition, with rivals potentially leveraging more efficient operations or superior risk management to gain market share, especially in key grain and oilseed markets. Persistent inflation and labor market uncertainties in 2024-2025 are driving up input costs and impacting consumer demand, while volatile bond markets complicate financial planning and borrowing costs.

Government policy shifts, particularly regarding trade and biofuel mandates, introduce substantial uncertainty, capable of rapidly altering demand for critical commodities like corn and soybeans. Climate change, evidenced by extreme weather events in 2024 such as droughts and excessive rainfall, directly threatens agricultural yields, leading to supply chain disruptions and commodity price volatility.

Heightened regulatory scrutiny, exemplified by recent product recalls and potential FDA actions, poses a significant threat of operational disruptions and increased costs, with substantial fines and mandated overhauls impacting profit margins. Geopolitical tensions and events, such as Panama Canal restrictions due to drought in 2023 and Red Sea shipping disruptions, are increasing trade costs and supply chain volatility.

SWOT Analysis Data Sources

This CHS SWOT analysis is built upon a robust foundation of data, drawing from internal financial reports, comprehensive market research, and expert industry insights to provide a thorough and actionable assessment.