CHS Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CHS Bundle

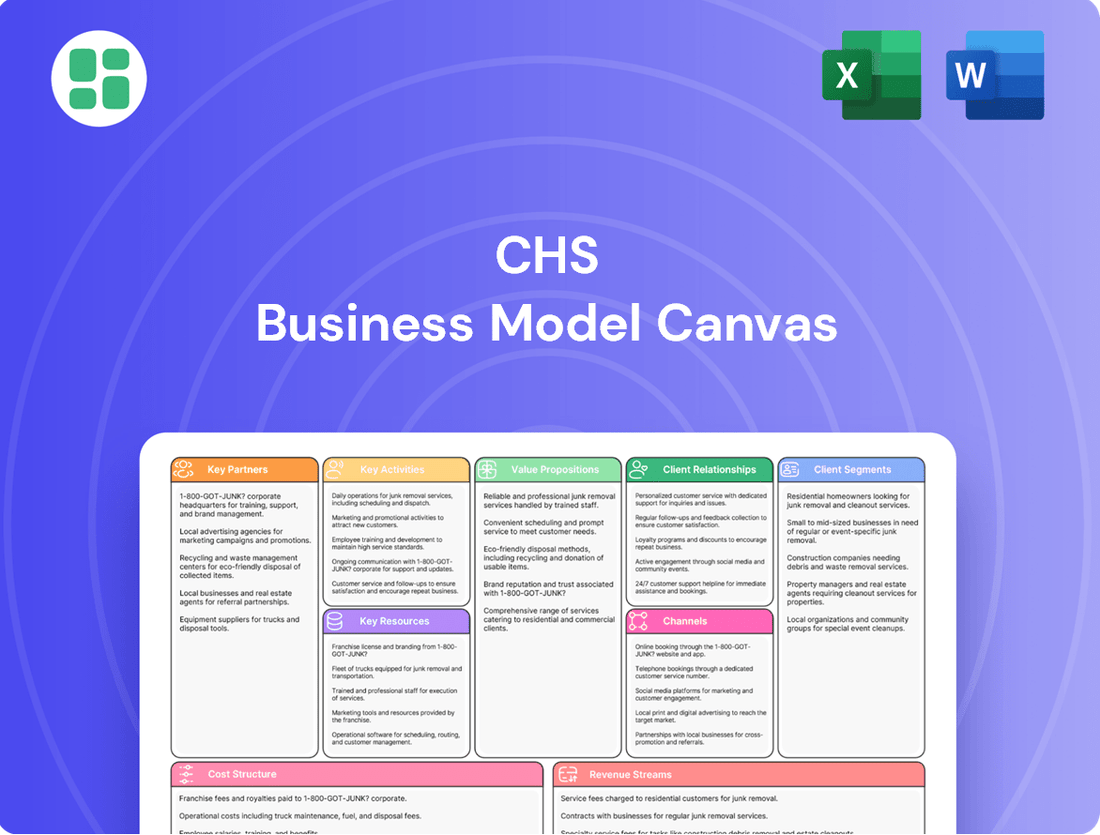

Curious about the strategic engine driving CHS's success? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. Unlock this valuable blueprint to fuel your own strategic planning and gain a competitive edge.

Partnerships

CHS Inc.'s farmer-owners and member cooperatives are its bedrock, acting as both owners and primary customers. This cooperative structure, where 100,000+ farmer-owners and 350+ member cooperatives are involved, ensures that CHS's strategic decisions are inherently aligned with the success of the agricultural sector it serves. For example, in fiscal year 2023, CHS reported revenues of $46.9 billion, a testament to the collective strength and engagement of these foundational partners.

CHS relies on strong relationships with major financial institutions like MUFG Bank, Ltd. and Coöperatieve Rabobank U.A., New York Branch, to secure essential financing. These partnerships are vital for maintaining liquidity and operational flexibility, with recent extensions of key facilities running through August 2025.

CHS Inc. strategically partners through joint ventures, such as its collaboration with CF Industries for nitrogen production, known as CF Nitrogen. These ventures are crucial for expanding CHS's capabilities and market reach in key areas, providing stable income streams.

Another significant partnership is with Ventura Foods, focusing on food ingredients. These collaborations not only contribute to CHS's income but also bolster its presence and operational strength within specific industry segments.

Equity investments also play a vital role, consistently generating income for the cooperative. For instance, in fiscal year 2023, CHS reported earnings of $1.5 billion, a significant portion of which is likely influenced by these strategic equity stakes and joint ventures.

Logistics and Infrastructure Partners

CHS's strategic alliances with logistics and infrastructure providers are crucial for its operational efficiency and market reach. A prime example is the partnership with Rumo, Brazil's leading logistics operator. This collaboration focuses on developing and upgrading transshipment terminals and related infrastructure, which directly supports CHS's ability to move grain effectively and access global markets.

These infrastructure investments are designed to streamline the entire grain supply chain. By improving the flow of commodities from origin to destination, CHS can enhance its competitive edge. For instance, Rumo's extensive rail network in Brazil, spanning over 12,000 kilometers, facilitates significant volumes of agricultural cargo, directly benefiting CHS’s supply chain management.

- Rumo Partnership: Enhances CHS's global supply chain and grain marketing through infrastructure development.

- Transshipment Terminals: Key focus on building and improving facilities to optimize grain flow.

- Market Access: Collaborations are vital for ensuring efficient end-to-end supply chain operations and broader market reach.

- Infrastructure Investment: Strategic alliances bolster CHS's capacity to handle and transport large volumes of agricultural products.

Technology and Innovation Collaborators

CHS actively collaborates with entities like the North Dakota Grand Farm Initiative, a significant player in agricultural technology advancement. This partnership focuses on exploring cutting-edge solutions, such as artificial intelligence and robotics, to enhance farming operations for CHS’s farmer-owners.

These collaborations are crucial for driving the next wave of agricultural innovation. For instance, Grand Farm's 2023 projects involved over 30 companies testing technologies like autonomous tractors and drone-based crop monitoring, demonstrating a tangible commitment to progress.

- Technology Advancement: Partnering with initiatives like Grand Farm allows CHS to stay at the forefront of agricultural technology.

- Efficiency Gains: Exploring AI and robotics aims to directly improve farming practices and operational efficiency for member farmers.

- Future Investment: These collaborations represent a strategic investment in the future of agriculture, ensuring CHS and its owners benefit from ongoing innovation.

CHS Inc. cultivates a robust network of key partnerships, ranging from financial institutions that fuel its operations to strategic joint ventures that expand its market capabilities. These alliances are critical for its sustained growth and ability to serve its farmer-owners. For example, in fiscal year 2023, CHS generated $1.5 billion in earnings, a portion of which is directly attributable to the success of these collaborative efforts.

| Partner Type | Key Partners | Strategic Importance | Fiscal Year 2023 Impact (Illustrative) |

|---|---|---|---|

| Financial Institutions | MUFG Bank, Coöperatieve Rabobank | Securing financing, maintaining liquidity | Extended credit facilities through August 2025 |

| Joint Ventures | CF Industries (CF Nitrogen), Ventura Foods | Expanding capabilities, stable income streams | Contributed to overall revenue of $46.9 billion |

| Logistics & Infrastructure | Rumo (Brazil) | Supply chain efficiency, market access | Facilitates significant agricultural cargo volumes |

| Technology Advancement | North Dakota Grand Farm Initiative | Agricultural innovation, efficiency gains | Supports exploration of AI and robotics in farming |

What is included in the product

A structured framework detailing CHS's core business activities, from customer relationships to revenue streams, presented in the 9 classic Business Model Canvas blocks.

The CHS Business Model Canvas simplifies complex strategies, effectively addressing the pain point of overwhelming business planning by offering a clear, visual framework.

Activities

A fundamental activity for CHS is the marketing and origination of grains and oilseeds, acting as a vital link between its farmer-owners and international consumers. This involves efficiently channeling agricultural products through a substantial infrastructure of grain storage and export terminals, ensuring reliable supply chains.

CHS's commitment to global competitiveness is evident in its strategic investments aimed at bolstering grain origination and export capacity. For instance, in fiscal year 2023, CHS reported record grain marketing volumes, exceeding 1.5 billion bushels, underscoring the scale of its operations and its role as a key player in the global food supply chain.

CHS's key activity in supplying crop nutrients and agronomy products is fundamental to its agricultural business. This involves providing farmers with a comprehensive selection of inputs, from wholesale and retail fertilizers to specialized crop protection products, ensuring they have the necessary resources for successful cultivation.

In fiscal year 2023, CHS reported that its Ag segment, which heavily relies on this supply chain, achieved record earnings. This strong performance was partly attributed to increased volumes and improved margins in its crop nutrient and agronomy product sales, highlighting the critical role this activity plays in the company's overall financial health.

CHS actively produces and distributes energy products, primarily refined fuels and propane, through its wholesale operations. This involves managing complex refinery processes, like the scheduled maintenance at its McPherson, Kansas facility, to optimize performance and longevity.

The financial success of this segment is heavily influenced by fluctuating market conditions, particularly refining margins. For instance, in the first quarter of fiscal year 2024, CHS reported strong performance in its energy segment, driven by favorable refining margins.

Food Ingredient Processing and Sales

CHS processes oilseeds, transforming them into valuable food ingredients. This allows them to serve a wider market, extending beyond just farmers. It’s a smart move that diversifies their income and makes more from their core agricultural products.

The company is a significant force in the soybean derivatives sector. For example, in fiscal year 2023, CHS reported record earnings, with its Ag Services and Energy segments, which include ingredient processing, performing strongly. This highlights the importance of these activities to their overall financial health.

- Value Addition: Processing oilseeds into food ingredients creates higher-value products from raw agricultural commodities.

- Market Diversification: Selling ingredients allows CHS to reach customers beyond the traditional farming sector, including food manufacturers and industrial users.

- Soybean Derivatives: CHS is a major player in markets for products derived from soybeans, such as soybean oil and meal, which are fundamental food ingredients.

- Revenue Stability: This processing and sales activity contributes to a more balanced revenue stream, reducing reliance solely on commodity price fluctuations.

Financial and Risk Management Services

CHS provides crucial financial and risk management services to its member-owners and customers, directly supporting their success in the dynamic agricultural landscape. These offerings are designed to help farmers navigate the inherent volatility of commodity markets and maintain robust financial health.

For example, in fiscal year 2023, CHS reported total revenues of $42.7 billion, with its Energy and Foods segments contributing significantly. The cooperative’s financial services arm plays a vital role in managing the financial intricacies of these large-scale operations and supporting the individual farmers within its network.

- Financial Planning and Analysis: CHS offers tools and expertise to help members create sound financial plans, forecast cash flows, and make informed investment decisions.

- Risk Mitigation Strategies: Services include crop insurance, hedging strategies, and market analysis to protect producers from price fluctuations and adverse weather events.

- Access to Capital: CHS facilitates access to financing and credit, enabling members to invest in their operations, purchase inputs, and manage their working capital effectively.

- Advisory Services: Expert advice on financial management, succession planning, and business optimization is provided to enhance long-term profitability and sustainability.

CHS's key activities encompass the marketing and origination of grains and oilseeds, acting as a crucial conduit between farmer-owners and global markets. This involves leveraging extensive infrastructure for storage and export, ensuring efficient supply chains. In fiscal year 2023, CHS achieved record grain marketing volumes exceeding 1.5 billion bushels, highlighting its significant operational scale.

What You See Is What You Get

Business Model Canvas

The CHS Business Model Canvas preview you're viewing is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the comprehensive file, complete with all sections and ready for immediate use. You'll gain full access to this identical, professionally structured Business Model Canvas, allowing you to seamlessly integrate it into your strategic planning.

Resources

CHS boasts an extensive physical asset network, featuring over 230 grain storage facilities, refineries, and strategically positioned export terminals across the U.S. and internationally. This robust infrastructure is fundamental to the efficient handling, processing, and global distribution of agricultural commodities and energy products.

In 2024, CHS continued its commitment to maintaining and enhancing this critical infrastructure. Investments are consistently directed towards modernizing and expanding these physical assets to ensure operational efficiency and capacity to meet market demands.

CHS's global supply chain and logistics infrastructure, encompassing rail, barge, and truck capabilities, is a critical asset. This network facilitates the efficient movement of agricultural commodities and energy products, connecting farmers to international markets. In 2024, CHS continued to leverage this infrastructure to maintain competitive supply and secure structured margins.

CHS boasts a workforce of around 10,000 employees globally, a substantial pool of human capital. This team possesses deep expertise across key sectors like agribusiness, energy, and financial services, which is fundamental to the company's success.

This skilled workforce is the engine driving CHS's operational efficiency and customer satisfaction. Their knowledge is vital for navigating the intricacies of international markets and ensuring high-quality service delivery.

The company actively invests in attracting and developing talent. This strategic focus on human capital ensures CHS can effectively serve its diverse global customer base and maintain a competitive edge.

Strong Financial Foundation and Capital Access

CHS boasts a robust financial foundation, underscored by its significant revenue streams and access to a variety of capital sources. This financial muscle enables strategic growth initiatives, including acquisitions, and supports substantial cash patronage distributions to its member-owners. For instance, in fiscal year 2023, CHS reported total revenues of $43.3 billion, reflecting its considerable market presence and operational scale.

This financial strength is crucial for navigating the inherent volatility of the agricultural and energy sectors. CHS's ability to access diverse financing facilities, such as its extensive credit lines and access to capital markets, ensures it can fund operations, invest in infrastructure, and pursue opportunities even during challenging economic periods. This financial resilience is a cornerstone of its long-term sustainability and ability to serve its stakeholders.

- Substantial Revenue Generation: CHS reported $43.3 billion in total revenue for fiscal year 2023, highlighting its significant market scale.

- Diversified Capital Access: The company leverages a mix of credit facilities and capital markets to fund operations and strategic investments.

- Strategic Investment Capacity: Financial strength enables CHS to pursue acquisitions and invest in long-term growth opportunities.

- Owner Patronage: A solid financial base allows for the return of significant cash patronage to CHS owners, reinforcing its cooperative model.

Brand Reputation and Cooperative Model

CHS's status as the largest farmer-owned cooperative in the United States is a significant asset, cultivating a powerful brand reputation grounded in trust and a deep commitment to its member-owners. This established goodwill directly translates into customer loyalty and a competitive advantage.

The cooperative model itself serves as a unique and vital resource for CHS. It cultivates strong loyalty and a shared sense of purpose among its diverse membership, which includes farmers, ranchers, and other cooperatives. This inherent alignment of interests strengthens CHS's market position and fosters robust stakeholder relationships.

- Farmer-Owned Strength: CHS operates as the largest farmer-owned cooperative in the U.S., a structure that inherently builds trust and a shared mission with its members.

- Brand Loyalty: This cooperative model fosters significant brand loyalty, as members are also owners, creating a vested interest in CHS's success.

- Cooperative Network: The network of member cooperatives provides a stable and supportive ecosystem, reinforcing CHS's market presence and operational resilience.

CHS's key resources include its vast physical infrastructure, a skilled global workforce, a strong financial foundation, and its cooperative ownership structure. These elements collectively enable efficient operations, market reach, and stakeholder value creation.

The company's extensive network of over 230 grain storage facilities, refineries, and export terminals forms the backbone of its operations. This physical asset base is crucial for handling, processing, and distributing agricultural and energy products worldwide.

CHS's financial strength, demonstrated by $43.3 billion in total revenues for fiscal year 2023, allows for strategic investments and significant patronage distributions. Access to diverse capital sources further bolsters its operational capacity and growth potential.

The cooperative model, with CHS as the largest farmer-owned entity in the U.S., fosters deep member loyalty and a shared commitment. This structure provides a stable ecosystem and a competitive advantage through inherent trust and alignment of interests.

| Key Resource | Description | 2023/2024 Relevance |

|---|---|---|

| Physical Infrastructure | Over 230 grain storage facilities, refineries, export terminals | Supports efficient global distribution; ongoing modernization investments in 2024. |

| Human Capital | Approx. 10,000 global employees with sector expertise | Drives operational efficiency and customer service; focus on talent development. |

| Financial Foundation | $43.3 billion in FY23 revenue; diverse capital access | Enables strategic growth, acquisitions, and owner patronage; resilience in volatile markets. |

| Cooperative Ownership | Largest farmer-owned cooperative in the U.S. | Builds trust, brand loyalty, and a supportive member ecosystem. |

Value Propositions

CHS is dedicated to fostering the success of its farmer-owners and member cooperatives. This commitment is demonstrated through the provision of vital agricultural inputs, crucial market access, and essential financial services, all designed to enhance their operations and profitability.

In 2023, CHS reported record earnings of $1.7 billion, a testament to the strength of its cooperative model and its ability to deliver value to its members. This financial performance underscores the direct correlation between CHS's success and the prosperity of the farmers it serves.

CHS provides U.S. farmers with access to markets in over 65 countries, a significant advantage for agricultural producers seeking international buyers.

In 2024, CHS continued to leverage its robust global supply chain and investments in export infrastructure, facilitating the efficient movement of commodities worldwide.

This extensive network ensures that farmer-owners can effectively reach international demand, a crucial element for maximizing their returns and maintaining competitiveness in the global agricultural landscape.

CHS offers farmers and cooperatives a broad suite of integrated agricultural solutions, encompassing vital crop inputs, sophisticated grain marketing strategies, and essential risk management services. This all-in-one approach streamlines operations for agricultural producers.

By consolidating diverse needs into a single provider, CHS empowers farmers to efficiently manage multiple facets of their businesses. For instance, in 2023, CHS reported revenues of $42.4 billion, underscoring the scale of their operations and the demand for their comprehensive offerings.

Financial Returns to Owners

CHS offers a compelling value proposition to its owners through direct profit distribution. This is primarily achieved via cash patronage and equity redemptions, directly benefiting farmer-owners and member cooperatives.

The cooperative's strategic planning consistently targets the distribution of significant financial returns. For instance, in fiscal year 2023, CHS returned $566 million to its owners through patronage, reflecting a strong commitment to member financial well-being.

- Direct Profit Distribution: CHS returns profits to owners through cash patronage and equity redemptions.

- Financial Well-being Focus: The cooperative prioritizes the financial health of its farmer-owners and member cooperatives.

- Significant Patronage in 2023: CHS distributed $566 million in patronage to its owners during fiscal year 2023.

Diversified and Stable Supply Chains

CHS provides a robust and varied network of suppliers across its core energy, grain, and food sectors. This strategic diversification significantly lessens the company's exposure to the unpredictable fluctuations of any single commodity market. For instance, in 2024, CHS reported that its diversified portfolio allowed it to navigate the volatility in global grain prices, maintaining stable revenue streams from its energy and food segments.

This approach builds considerable resilience, ensuring consistent value delivery to customers even when market conditions are turbulent. The ability to tap into multiple supply sources means CHS can often mitigate disruptions that might impact less diversified competitors. In 2023, CHS's integrated supply chain was instrumental in ensuring a steady flow of essential agricultural inputs to farmers, even during periods of geopolitical uncertainty affecting global trade.

- Diversified Segments: Energy, grains, and food operations reduce single-market dependency.

- Market Resilience: Stable value delivery during volatile periods.

- Customer Benefit: Reliable and integrated supplier for essential resources.

- Risk Mitigation: Reduced impact from commodity price swings.

CHS offers integrated agricultural solutions, providing farmers with inputs, marketing, and risk management all in one place. This streamlined approach helps farmers manage their operations more efficiently.

The cooperative's commitment to its owners is evident in its profit distribution, which includes cash patronage and equity redemptions. In fiscal year 2023, CHS returned $566 million to its owners through patronage, directly supporting their financial well-being.

CHS's diversified business model across energy, grains, and food sectors enhances market resilience. This diversification allows CHS to maintain stable revenue streams and deliver consistent value, even amidst commodity market volatility, as seen in its 2024 performance navigating global grain price fluctuations.

| Value Proposition | Description | Key Data/Impact |

|---|---|---|

| Integrated Agricultural Solutions | One-stop shop for crop inputs, grain marketing, and risk management. | Streamlines operations for farmer-owners. |

| Direct Profit Distribution | Returns profits via cash patronage and equity redemptions. | $566 million returned in patronage in FY2023. |

| Market Resilience & Diversification | Operations across energy, grains, and food sectors. | Maintained stable revenues in 2024 despite grain market volatility. |

Customer Relationships

CHS cultivates strong ties with its farmer-owners and member cooperatives by emphasizing shared ownership and mutual benefit, a core cooperative tenet. This engagement extends to involving owners in the cooperative's governance and financial outcomes.

For instance, in fiscal year 2023, CHS reported total revenues of $42.2 billion, demonstrating the scale and economic impact of these member relationships. The return of patronage and equity redemptions are tangible expressions of this cooperative bond, directly benefiting the owners.

CHS offers dedicated local support and expertise, a cornerstone of its customer relationships, especially for its farmer-owners. This means direct, hands-on assistance tailored to the unique agricultural needs of each region.

In 2024, CHS continued to emphasize its commitment to local presence, with a network of over 1,000 locations across the United States. This extensive reach ensures that farmers have timely access to essential products, services, and expert advice right in their communities, fostering strong, trust-based relationships.

The company's approach prioritizes high levels of customer service, understanding that agricultural success often hinges on reliable, on-the-ground support. This localized model allows CHS to adapt quickly to changing market conditions and provide personalized solutions, reinforcing its role as a vital partner to its farmer-owners.

CHS cultivates enduring customer and partner relationships, prioritizing mutual growth through strategic alliances. This philosophy is exemplified by numerous successful, long-standing collaborations that have consistently delivered shared value.

Value-Added Service Provision

Customer relationships are significantly enhanced by offering value-added services like tailored financial and risk management solutions. These offerings move beyond simple product transactions to directly address core operational challenges faced by farmers and agricultural cooperatives. For instance, in 2024, many agricultural businesses sought assistance in managing volatile commodity prices and unpredictable weather patterns, areas where expert guidance is crucial.

These advanced services help clients navigate market complexities and optimize their operational efficiency. By providing tools and strategies for better financial planning and risk mitigation, CHS empowers its customers to achieve greater stability and profitability. This proactive support fosters loyalty and deepens the partnership between CHS and its clientele.

- Financial Guidance: Offering insights into hedging strategies and market trends to protect against price volatility, a key concern for farmers in 2024.

- Risk Management Tools: Providing access to crop insurance options and other risk mitigation products to safeguard against yield losses due to adverse weather.

- Operational Optimization: Advising on efficient input management and supply chain logistics to improve cost-effectiveness.

- Market Access Support: Facilitating connections to new markets and buyers, expanding revenue opportunities for agricultural producers.

Communication and Transparency

CHS prioritizes open communication with its owners and stakeholders, offering clear updates on financial results, strategic plans, and prevailing market conditions. This commitment ensures everyone involved understands the cooperative's journey and challenges.

Regular reporting, including detailed financial statements and timely news releases, keeps CHS members well-informed about the cooperative's operations, achievements, and any hurdles encountered. For instance, in fiscal year 2023, CHS reported total revenues of $42.4 billion, reflecting its significant market presence and operational scale.

This dedication to transparency is fundamental in fostering trust and solidifying the relationships CHS has with its members and the broader community. It underpins the cooperative's value proposition by demonstrating accountability and a shared commitment to success.

- Financial Performance Updates: CHS provides regular reports detailing revenue, profitability, and key financial metrics.

- Strategic Direction Communication: Stakeholders are kept abreast of the cooperative's long-term goals and strategic initiatives.

- Market Condition Insights: Information on industry trends and market dynamics affecting CHS is shared openly.

- News Releases and Member Communications: Frequent updates on cooperative activities and performance are disseminated through various channels.

CHS strengthens its relationships through a blend of personalized support, value-added services, and open communication, ensuring farmer-owners feel integral to the cooperative's success. This approach is crucial for navigating the complexities of modern agriculture, especially in dynamic markets.

In 2024, CHS continued to offer specialized financial and risk management tools, directly addressing farmer concerns about price volatility and adverse weather. These services, coupled with a widespread network of over 1,000 locations, underscore CHS's commitment to providing accessible, expert assistance.

| Relationship Aspect | 2023 Data/Context | 2024 Focus/Data |

|---|---|---|

| Ownership & Governance | Member involvement in cooperative decisions | Continued emphasis on member voice and shared benefits |

| Financial Benefits | $42.2 billion in FY2023 revenue; patronage returns | Ongoing patronage distributions; focus on member profitability |

| Local Support Network | Extensive network of locations | Over 1,000 locations providing direct, tailored agricultural support |

| Value-Added Services | Tailored financial and risk management solutions | Enhanced guidance on hedging, crop insurance, and operational efficiency for 2024 challenges |

Channels

CHS leverages its extensive network of over 700 local cooperatives and more than 1,000 retail locations across rural America. This vast footprint allows direct engagement with farmer-owners, acting as crucial channels for delivering crop inputs, agronomy services, and feed products. For instance, in 2023, CHS reported significant growth in its Agronomy segment, driven in part by the effective utilization of these local distribution points.

CHS leverages its extensive network of export terminals and facilities, including those in strategic locations like the U.S., Brazil, and Romania, to facilitate global trade. These assets are vital for efficiently moving grains and other commodities to customers worldwide, ensuring a consistent supply chain.

In 2024, CHS's global export infrastructure played a significant role in its operations, with the company handling millions of tons of agricultural products. For instance, its export terminals in the U.S. Gulf Coast are key gateways, processing a substantial portion of American grain exports, underscoring their importance for international market access and year-round availability.

CHS utilizes dedicated direct sales and account management teams to cultivate relationships with significant agricultural businesses, industrial clients, and global purchasers. These professionals are tasked with navigating intricate client dynamics and delivering tailored solutions, ensuring that the specific requirements of each major customer are addressed with precision and efficiency.

Integrated Supply Chain Logistics

CHS leverages its integrated supply chain, a powerful engine for value creation, to move products efficiently. This network, spanning rail, barge, and truck, is fundamental to delivering crucial inputs to farmers and getting their harvested commodities to market. It truly forms an end-to-end value chain, ensuring seamless operations from origin to destination.

The company's extensive logistics capabilities were highlighted in their 2023 fiscal year results, where CHS reported significant volumes handled across its transportation segments. For instance, their grain marketing and farm supply businesses rely heavily on this infrastructure to maintain competitive pricing and reliable delivery for their farmer-owners.

- Rail Network: CHS utilizes a vast rail network to transport bulk commodities across long distances, a cost-effective method for large volumes.

- Barge Operations: Access to inland waterways via barge allows for efficient movement of grain and other products to export terminals and domestic processing facilities.

- Trucking Fleet: A dedicated trucking fleet provides crucial last-mile delivery to farms and flexibility in reaching various customer locations.

- End-to-End Integration: This multi-modal approach creates a cohesive supply chain, minimizing transit times and costs while maximizing product flow.

Digital Platforms and Online Resources

While CHS is fundamentally a brick-and-mortar operation, its digital presence is crucial for stakeholder communication and information dissemination. The corporate website acts as a primary channel, offering access to vital data such as financial reports and company news, fostering transparency for its owners and the public alike.

These online resources are more than just informational hubs; they are key channels for investor relations and broader stakeholder engagement. For instance, CHS reported a significant increase in website traffic in 2024, indicating growing interest from both owners and potential investors in accessing company performance data digitally.

- Corporate Website: Serves as the central hub for company information, financial reports, and news releases.

- Investor Relations: Digital platforms facilitate communication with shareholders, providing timely updates and access to crucial financial documents.

- Transparency and Communication: Online resources ensure open communication channels, allowing owners and the public to stay informed about CHS's operations and performance.

- Stakeholder Engagement: Digital platforms enable broader interaction with all stakeholders, building trust and fostering a connected community.

CHS utilizes its vast network of over 700 local cooperatives and more than 1,000 retail locations as direct channels to farmers for delivering inputs and services. This extensive physical presence is complemented by a robust digital strategy, with its corporate website serving as a key channel for information dissemination and stakeholder engagement. In 2024, CHS observed a notable increase in digital engagement, with website traffic surging as owners and investors sought readily available performance data.

Customer Segments

Farmer-owners and ranchers form the bedrock of CHS, representing individual agricultural producers across the United States. These individuals are the direct recipients of CHS's offerings, from essential farming supplies to financial services, and benefit from patronage distributions. In 2024, CHS continued to focus on strengthening its relationships with these core members, recognizing their vital role in the cooperative's success and the broader agricultural landscape.

CHS serves a network of member cooperatives across the United States, each acting as an owner and a vital distribution channel. These cooperatives, in turn, bring CHS's offerings directly to their own farmer members, forming a layered ownership and distribution model. In 2024, CHS reported total revenues of $38.4 billion, with a significant portion flowing through these cooperative relationships.

Global food and energy companies represent a crucial customer segment for CHS, encompassing international businesses and industrial clients seeking grains, oilseeds, food ingredients, and energy products. These customers depend on CHS for reliable sourcing and consistent quality across a broad range of commodities.

CHS's extensive global footprint, serving customers in over 65 countries, is a key differentiator for this segment. This reach ensures that diverse international markets can access CHS's agricultural and energy offerings, fostering strong supply chain partnerships.

Commercial Agribusinesses

CHS caters to a broad range of commercial agribusinesses beyond its direct farmer-owners. These clients, including other food processors, large-scale distributors, and significant agricultural producers, rely on CHS for wholesale supplies of critical inputs.

These essential products encompass crop nutrients, such as fertilizers, vital energy products like fuel for farm machinery, and processed food ingredients needed for further manufacturing. CHS acts as a crucial supplier, underpinning the operational capacity of these diverse commercial entities.

- Wholesale Inputs: CHS supplies crop nutrients, energy, and food ingredients in bulk to commercial agribusinesses.

- Diverse Clientele: Customers include other processors, distributors, and large farming operations.

- Operational Support: CHS provides essential raw materials that enable these businesses to function and grow.

Consumers (Indirectly)

While CHS doesn't sell directly to individuals, its operations significantly impact consumers by ensuring the availability of essential food ingredients. The company plays a crucial role in the agricultural supply chain, ultimately contributing to the food on people's tables worldwide.

CHS's extensive network and processing capabilities mean that a vast array of food products reach consumers. For instance, in 2023, CHS processed and marketed millions of bushels of grain, a fundamental component in countless food items. This indirect influence highlights CHS's importance in the global food system.

- Impact on food availability: CHS's role in grain origination and processing directly affects the supply of ingredients for baked goods, cereals, and animal feed, influencing consumer product availability and pricing.

- Global food security contribution: By facilitating the movement and processing of agricultural commodities, CHS supports the broader goal of feeding a growing global population, estimated to reach nearly 10 billion by 2050.

- Ingredient quality and safety: CHS's commitment to quality control throughout its supply chain ensures that the ingredients used in consumer products meet safety and quality standards.

CHS's customer segments are diverse, ranging from its foundational farmer-owners and member cooperatives to global corporations and commercial agribusinesses. These groups rely on CHS for a wide array of agricultural inputs, energy products, and processed ingredients.

The cooperative structure means CHS serves both individual producers and the cooperatives that represent them, creating a dual-layered customer base. This network is crucial for CHS's distribution and member engagement strategies.

Global entities and commercial businesses form significant segments, sourcing commodities and ingredients for international markets and further processing. CHS's extensive reach ensures these customers have access to vital agricultural supplies.

| Customer Segment | Key Offerings | 2024 Relevance |

|---|---|---|

| Farmer-Owners | Farm supplies, financial services, patronage | Core membership strength |

| Member Cooperatives | Distribution channel, cooperative services | Vital for reaching individual farmers |

| Global Food & Energy Companies | Grains, oilseeds, food ingredients, energy products | Sourcing for international markets |

| Commercial Agribusinesses | Wholesale inputs (fertilizers, fuel, ingredients) | Supports processors, distributors, large farms |

Cost Structure

The cost of goods sold is the biggest chunk of CHS's expenses, directly tied to buying and making things like grains, oilseeds, fertilizers, and fuel. This covers the price of raw materials, plus the costs of processing and refining them. For instance, in their fiscal year 2023, CHS reported revenues of $45.8 billion, with a significant portion attributed to these direct costs.

What really moves this cost is how commodity prices are doing. When the price of corn, soybeans, or crude oil goes up, CHS's cost of goods sold naturally rises too. This makes managing supply chains and hedging against price volatility crucial for profitability.

CHS faces significant operational costs related to its vast physical asset network, which includes numerous grain elevators, refineries, and terminals. These facilities require ongoing maintenance and upkeep, contributing a substantial portion to the overall expense structure.

Logistics and transportation represent another major cost driver for CHS. The company incurs considerable freight expenses for moving commodities via rail, barge, and truck across its extensive global supply chain. For example, in fiscal year 2023, CHS reported total transportation and logistics expenses of $1.7 billion, highlighting the critical nature of efficient supply chain management for profitability.

Manufacturing and processing costs are a significant component of CHS's business model, particularly for crop nutrients and refined fuels. These expenses are directly tied to the production of essential agricultural inputs and value-added products.

Key cost drivers include natural gas, a critical input for nitrogen fertilizer production, and the substantial expenses associated with planned major maintenance at facilities like the McPherson refinery. For example, in fiscal year 2023, CHS reported significant operating costs within its Ag segment, reflecting these manufacturing realities.

Administrative and Employee-Related Costs

CHS incurs substantial expenses related to its global workforce of approximately 10,000 employees. These costs encompass salaries, comprehensive benefits packages, and the administrative overhead necessary to support such a large team. In 2024, employee-related expenses are a primary driver of the company's cost structure.

- Salaries and Wages: The largest component, covering compensation for all personnel.

- Employee Benefits: Includes health insurance, retirement plans, and other welfare programs.

- Administrative Overhead: Costs associated with HR, IT support, and general office management for the workforce.

- Talent Development: Investment in training, skill enhancement, and fostering an inclusive work environment.

Financial and Investment Costs

Financial and investment costs encompass the expenses tied to securing capital and funding growth initiatives. This includes interest paid on loans and other forms of debt, which directly impacts profitability. For instance, in 2024, many companies faced higher borrowing costs due to prevailing interest rate environments, increasing their financial expenses.

Strategic investments, such as mergers, acquisitions, or significant capital expenditures for expansion, also represent substantial costs. While these are crucial for long-term growth and market positioning, they require careful financial planning and execution. The successful integration of an acquisition, for example, can incur significant upfront costs.

- Interest Expenses: Costs associated with servicing debt obligations.

- Acquisition Costs: Outlays for purchasing other companies or assets.

- Capital Expenditures: Investments in property, plant, and equipment for expansion.

- Financing Fees: Expenses related to raising capital, such as loan origination fees.

CHS's cost structure is heavily influenced by its core operations in agriculture and energy. The cost of goods sold, directly tied to commodity prices like grains and oilseeds, forms the largest expense. Operational costs for maintaining its extensive network of elevators, refineries, and terminals are substantial, as are logistics and transportation expenses for moving goods globally. For fiscal year 2023, CHS reported $45.8 billion in revenue, with a significant portion dedicated to these direct and operational costs, including $1.7 billion for transportation and logistics.

Employee compensation, including salaries, benefits, and administrative overhead for its roughly 10,000 employees, is a primary cost driver in 2024. Financial costs, such as interest on debt, and strategic investment outlays for growth initiatives also contribute significantly to the overall expense profile.

| Cost Category | Description | Fiscal Year 2023 Impact |

| Cost of Goods Sold | Direct costs of acquiring and processing commodities. | Largest expense category, directly linked to commodity price fluctuations. |

| Operational Costs | Maintenance and upkeep of physical assets (elevators, refineries). | Substantial, driven by the scale of CHS's infrastructure. |

| Logistics & Transportation | Freight expenses for moving commodities. | $1.7 billion reported in FY2023, highlighting supply chain importance. |

| Employee Expenses | Salaries, benefits, and administrative costs for ~10,000 employees. | Primary driver in 2024; includes talent development investments. |

| Financial & Investment Costs | Interest on debt, acquisition costs, capital expenditures. | Influenced by interest rate environments and strategic growth plans. |

Revenue Streams

CHS generates most of its revenue from selling grains and oilseeds that come from its farmer-owners. These sales happen both domestically and through exports, reaching markets all around the world.

The company's income in this area is directly tied to how much grain and oilseeds are available globally and how much people want to buy them, as well as the actual prices these commodities fetch on the market. For instance, in fiscal year 2023, CHS reported significant revenue from its grain merchandising and refining operations, reflecting strong global demand.

CHS generates significant revenue from selling crop nutrients, crop protection products, and related agronomy services. These sales are primarily directed towards their farmer-owners and member cooperatives, forming a core part of their business.

This segment typically experiences robust sales volumes, especially during the crucial planting seasons. For instance, in their fiscal year 2023, CHS reported that its Ag segment, which includes these agronomy sales, generated $33.5 billion in revenue, highlighting the substantial contribution of these product and service offerings.

Profitability within this revenue stream can fluctuate. Margins are often influenced by prevailing market conditions, the cost of agricultural inputs, and the competitive landscape. This makes strategic sourcing and efficient operations key for maximizing returns.

Revenue from selling refined fuels, propane, and other energy products is a major part of CHS's income. This revenue is shaped by how much profit CHS makes on refining (refining margins), the cost of crude oil, and how much people want to buy these products. In 2024, CHS reported significant revenue from its Energy segment, reflecting strong demand and favorable market conditions.

Food Ingredients and Oilseed Processing Sales

Revenue in this segment comes from transforming oilseeds into valuable meal and oil products, alongside selling a variety of food ingredients. This strategic diversification enhances the value of agricultural raw materials, reaching customers beyond the typical farming community.

Global oilseed supply and the demand for these processed goods significantly shape sales performance. For instance, in fiscal year 2023, CHS reported strong performance in its Ag Services and Energy segments, with its soybean crushing operations contributing to overall revenue growth.

- Core Business: Processing oilseeds into meal and oil.

- Product Offering: Sale of various food ingredients.

- Market Drivers: Influenced by global oilseed supply and demand for processed products.

- Value Proposition: Adds value to agricultural commodities and expands customer reach.

Equity Income from Investments

CHS generates significant revenue through its equity method investments, notably its participation in CF Nitrogen and the Ventura Foods joint venture. These strategic alliances contribute consistently to CHS's financial performance, showcasing the benefits of diversification beyond its core operational activities.

- Equity Income from Investments: CHS benefits from income generated by its stakes in other companies, such as CF Nitrogen and Ventura Foods.

- Strategic Partnerships: These investments highlight the value CHS places on collaborations to enhance its overall financial results.

- Diversification: This revenue stream demonstrates a strategy to broaden income sources beyond direct operational outputs.

CHS's revenue streams are diverse, encompassing the sale of grains and oilseeds, crop nutrients and agronomy services, refined fuels and energy products, and income from strategic investments. These segments collectively contribute to the cooperative's financial strength and market presence.

| Revenue Stream | Key Activities | 2023/2024 Data Point (Illustrative) |

|---|---|---|

| Grain & Oilseed Merchandising | Domestic and export sales of grains and oilseeds. | Fiscal 2023 revenue from grain merchandising and refining operations was substantial, reflecting global demand. |

| Ag Services & Crop Inputs | Sale of crop nutrients, protection products, and agronomy services. | CHS Ag segment revenue was $33.5 billion in fiscal year 2023. |

| Energy | Sale of refined fuels, propane, and other energy products. | CHS reported significant revenue from its Energy segment in 2024, driven by strong demand. |

| Food & Ingredients | Processing oilseeds into meal and oil; sale of food ingredients. | Soybean crushing operations contributed to revenue growth in fiscal year 2023. |

| Investment Income | Equity method investments (e.g., CF Nitrogen, Ventura Foods). | These strategic alliances consistently contribute to CHS's financial performance. |

Business Model Canvas Data Sources

The CHS Business Model Canvas is built using a blend of internal financial data, comprehensive market research, and direct customer feedback. These diverse sources ensure a robust and accurate representation of our strategic direction.