CHS PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CHS Bundle

Unlock the hidden forces shaping CHS's future with our meticulously researched PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both opportunities and challenges for the cooperative. Equip yourself with actionable intelligence to navigate this complex landscape and secure your strategic advantage. Download the full PESTLE analysis now and gain the clarity you need to make informed decisions.

Political factors

Government agricultural policies, such as the U.S. Farm Bill, are pivotal for CHS Inc. These policies directly shape the financial landscape for CHS's farmer-owners, influencing their purchasing power and the cooperative's overall business health.

Anticipated shifts in the 2025 Farm Bill, particularly concerning commodity support and reference prices, represent a key political factor. For instance, changes to crop insurance subsidies could alter farmer profitability, impacting their demand for CHS's inputs and services. In 2023, federal crop insurance paid out an estimated $17.7 billion to farmers, highlighting the significance of these programs.

International trade agreements and the potential imposition of tariffs represent significant political factors for CHS Inc. These policies directly influence the cooperative's grain marketing and origination segments by altering global supply chains and affecting commodity prices. For instance, past retaliatory tariffs on U.S. agricultural exports demonstrated the disruptive power of trade disputes on export volumes.

The evolving landscape of agricultural trade policies in 2025 will be a crucial determinant for CHS's international business operations. Fluctuations in trade relations and the stability of existing agreements, such as the USMCA, will continue to shape market access and pricing for CHS's globally traded commodities.

Global political stability and ongoing geopolitical tensions, such as those impacting energy and grain markets, can create volatility in commodity prices and supply chains, directly affecting CHS's energy and grain businesses. For instance, the ongoing conflict in Eastern Europe continued to influence global energy prices through 2024, with Brent crude oil futures fluctuating significantly. This instability necessitates agile risk management for CHS.

Disruptions due to conflicts or political unrest in key agricultural regions can lead to tightening supplies and impact global trade flows. For example, weather patterns exacerbated by geopolitical instability in certain grain-producing nations in 2024 led to a projected 5% decrease in global wheat production compared to 2023 figures, according to the USDA. CHS must adapt its sourcing and distribution strategies to navigate these challenges.

Energy Policy and Regulations

Government policies surrounding energy, such as renewable fuel credits and refinery capacity utilization, significantly shape CHS's energy business. These regulations directly affect the cooperative's refining margins and overall profitability. For instance, a tightening of renewable fuel credit mandates could boost margins, while a relaxation might have the opposite effect.

The regulatory landscape for both energy production and consumption is a critical determinant of CHS's operational expenses and revenue streams. Changes in environmental standards or fuel efficiency mandates can necessitate costly upgrades or alter demand patterns, impacting CHS's financial performance. For fiscal year 2025, CHS experienced lower refined fuel margins, partly influenced by these evolving regulatory and policy dynamics.

- Government policies on renewable fuels directly impact CHS's energy segment profitability.

- Refinery capacity utilization is a key regulatory factor influencing CHS's operations.

- Lower refined fuel margins were observed in fiscal year 2025, partly due to policy shifts.

- The broader energy regulatory environment affects CHS's costs and revenue generation.

Support for Agricultural Cooperatives

The United Nations' designation of 2025 as the International Year of Cooperatives signals a growing global recognition of the cooperative business model. This emphasis could translate into increased government support and more favorable policy environments for agricultural cooperatives like CHS. For instance, in 2024, several countries introduced or expanded tax incentives for member-owned businesses, with projections suggesting further policy evolution by 2025.

This global focus may spur policy reforms, including streamlined regulatory processes and the establishment of dedicated financial mechanisms to bolster cooperative networks. Such initiatives are designed to foster sustainable development through collective action, potentially unlocking new avenues for investment and operational efficiency for entities such as CHS.

Key potential policy developments by 2025 include:

- Expanded access to low-interest loans and grants specifically for cooperative development.

- Tax credits or deductions for cooperatives reinvesting profits into member services or community projects.

- Streamlined legal frameworks that simplify cooperative formation and governance.

- Government-backed educational programs promoting cooperative principles and best practices.

Government agricultural policies, particularly those concerning the Farm Bill and crop insurance, directly impact CHS's farmer-owners and their demand for cooperative services. Anticipated shifts in the 2025 Farm Bill could alter commodity support and farmer profitability, influencing input purchases. For example, federal crop insurance paid out an estimated $17.7 billion in 2023.

International trade agreements and potential tariffs significantly affect CHS's grain marketing and origination segments by influencing global supply chains and commodity prices. Past retaliatory tariffs on U.S. agricultural exports demonstrated the disruptive power of trade disputes on export volumes.

Geopolitical tensions and global political stability create volatility in commodity prices and supply chains, impacting CHS's energy and grain businesses. For instance, ongoing conflicts in Eastern Europe continued to influence global energy prices through 2024, with Brent crude oil futures fluctuating significantly.

Government policies on renewable fuels and refinery capacity utilization are critical for CHS's energy segment profitability. Changes in environmental standards or fuel efficiency mandates can affect operational expenses and revenue. CHS observed lower refined fuel margins in fiscal year 2025, partly influenced by these policy dynamics.

| Policy Area | Impact on CHS | Relevant Data/Trends |

|---|---|---|

| Farm Bill (2025) | Farmer profitability, input demand | Projected changes in commodity support and reference prices. |

| Trade Agreements/Tariffs | Grain marketing, export volumes | Impact of past retaliatory tariffs on U.S. agricultural exports. |

| Geopolitical Stability | Commodity price volatility, supply chains | Influence of conflicts on energy prices (e.g., Brent crude futures in 2024). |

| Renewable Fuel Standards | Energy segment margins, regulatory compliance | Observed lower refined fuel margins in FY2025 due to policy shifts. |

What is included in the product

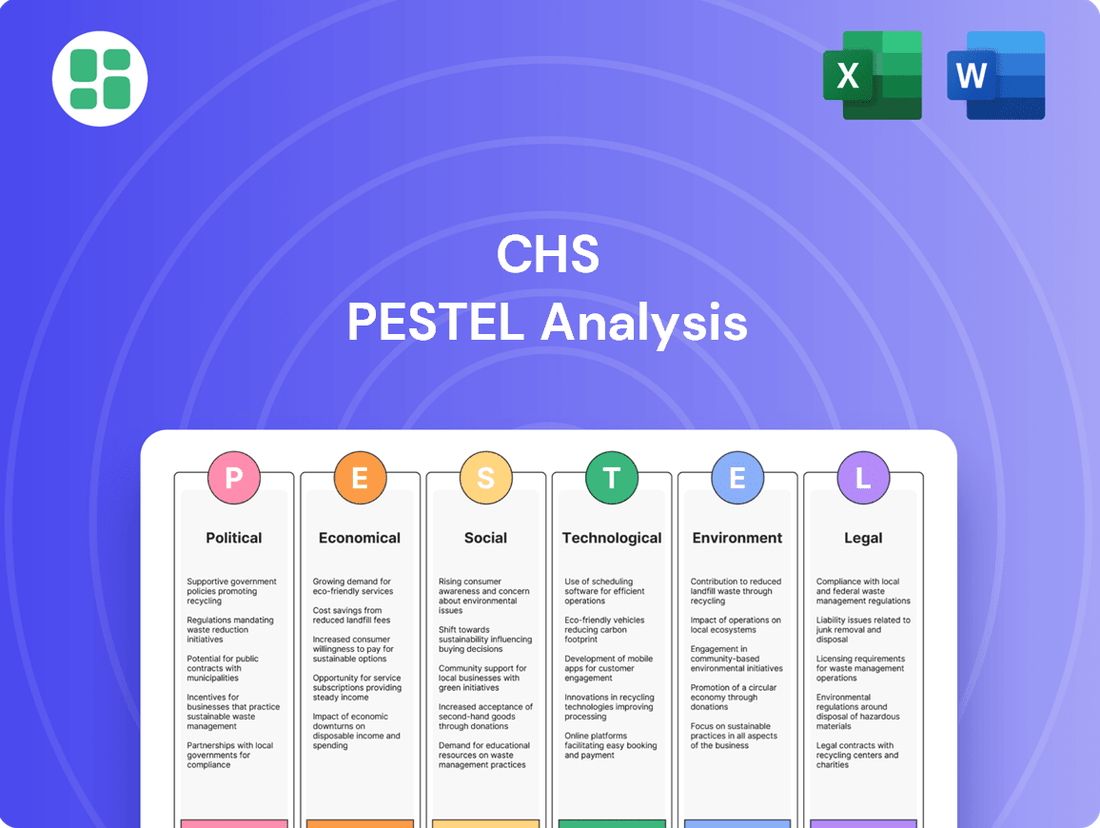

This CHS PESTLE analysis examines the influence of external macro-environmental factors – Political, Economic, Social, Technological, Environmental, and Legal – on the organization's strategic landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex external factors into actionable insights.

Economic factors

Fluctuations in global commodity prices, particularly for grains, oilseeds, and energy products, directly influence CHS Inc.'s financial performance. These price swings can significantly impact the company's revenues and overall profitability.

The 2024-2025 agricultural season has been marked by a notable decrease in global grain trade volumes and dwindling reserves. While projections for the 2025-2026 season suggest a potential rebound, the market remains susceptible to disruptions caused by adverse weather patterns, creating ongoing uncertainty.

Reflecting these market conditions, CHS reported lower revenues in its fiscal year 2025, a direct consequence of reduced selling prices for key commodities like grains, oilseeds, and refined fuels. This trend underscores the sensitivity of CHS's financial results to global commodity market dynamics.

Changes in interest rates directly influence CHS Inc.'s ability to offer competitive financial and risk management services, impacting both its operational costs and the borrowing expenses for its member-owners. For instance, if the Federal Reserve were to increase the federal funds rate in late 2024 or 2025, CHS's own borrowing costs could rise, potentially affecting margins on its financial products.

CHS has proactively managed its capital structure by extending key financing facilities through August 2025, demonstrating a strategic approach to securing necessary funds. This move provides a degree of stability amidst potential shifts in the economic landscape, allowing for continued planning and investment.

Affordable access to capital remains a critical determinant of success for CHS and its member-owners. Investments in vital areas like agricultural infrastructure, technological advancements in farming, and everyday operational needs are heavily reliant on the availability of reasonably priced financing, especially as the economic environment evolves through 2025.

Inflationary pressures are a significant concern for CHS, directly impacting the cost of essential agricultural inputs like crop nutrients and energy. For instance, the U.S. Producer Price Index for fertilizers and related products saw a notable increase in late 2023 and early 2024, reflecting these rising input expenses. This surge in costs for CHS's farmer-owners can strain their operational budgets and potentially reduce their purchasing power for other goods and services.

These increased input costs inevitably translate to higher supply chain expenses for CHS. While the cooperative benefits from its extensive global supply chain network, which helps mitigate some of these pressures, the overall rise in commodity prices and transportation fees can still compress profit margins across its various business segments. For example, higher energy costs directly affect the cost of moving agricultural products, a key component of CHS's logistics operations.

Global Economic Growth and Demand

Global economic growth is a significant driver for CHS, directly impacting demand for its agricultural products and food ingredients. A robust global economy generally translates to increased consumer spending power and greater stability in food markets worldwide. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight acceleration from 2023, signaling a potentially supportive environment for agricultural commodity demand.

This growth influences how much consumers can afford to spend on food and other agricultural-based products. When economies expand, disposable incomes tend to rise, leading to higher consumption of both basic and value-added food items. Conversely, economic slowdowns or recessions can dampen demand, putting pressure on prices and sales volumes for companies like CHS.

Key factors to monitor include:

- Consumer Confidence: Higher confidence often correlates with increased spending on food and agricultural products.

- Inflation Rates: Persistent inflation can erode purchasing power, potentially leading to shifts towards less expensive food options.

- Geopolitical Stability: Conflicts and trade disputes can disrupt supply chains and impact global food prices, affecting demand patterns.

Farm Income and Farmer Financial Health

The financial well-being of CHS's farmer-owners is a critical determinant of the cooperative's overall performance. A challenging farm economy, marked by depressed commodity prices and escalating input expenses, directly impacts farmer profitability. This, in turn, can curb their capacity for investment and their patronage of CHS services.

In 2024, farmers faced a mixed economic landscape. While some commodity prices showed resilience, others experienced downward pressure. For instance, U.S. average prices for corn were projected to be around $4.60 per bushel in the 2024/2025 marketing year, a slight decrease from the previous year. Simultaneously, input costs, including fertilizer and fuel, remained elevated, squeezing profit margins.

- Farmer Income Strain: Reduced net farm income in 2024, influenced by fluctuating commodity prices and persistent high input costs, directly impacts farmers' purchasing power.

- Investment Capacity: Lower profitability can limit farmers' ability to invest in new equipment, technology, or services offered by cooperatives like CHS.

- Patronage Reduction: Financial strain may lead farmers to scale back their use of cooperative services, affecting CHS's revenue streams and market share.

- Debt Levels: Rising interest rates in 2024 and 2025 could increase the debt burden on farmers, further impacting their financial health and their ability to engage with CHS.

Economic factors significantly shape CHS's operating environment, with global commodity price volatility directly impacting revenues. The 2024-2025 agricultural season saw reduced grain trade, with projections for 2025-2026 indicating a potential rebound but still susceptible to weather disruptions.

Inflationary pressures, particularly on agricultural inputs like fertilizer, increase costs for CHS's farmer-owners and elevate supply chain expenses. The U.S. Producer Price Index for fertilizers saw a notable increase in late 2023 and early 2024.

Global economic growth, projected by the IMF at 3.2% for 2024, generally supports demand for agricultural products. However, consumer confidence and inflation rates remain key indicators to monitor for shifts in food consumption patterns through 2025.

Farmer financial well-being is crucial; for instance, U.S. average corn prices were projected around $4.60 per bushel for 2024/2025, a slight decrease, while input costs remained high, straining farmer profitability and their capacity to invest in CHS services.

| Economic Factor | Impact on CHS | Relevant Data (2024-2025 Focus) |

|---|---|---|

| Commodity Prices | Affects revenue and profitability | Reduced global grain trade volumes in 2024-2025; projected slight decrease in U.S. corn prices for 2024/2025. |

| Inflation | Increases input costs for farmers and supply chain expenses for CHS | Notable increase in U.S. PPI for fertilizers (late 2023/early 2024); elevated fuel costs impact logistics. |

| Global Economic Growth | Drives demand for agricultural products | IMF projected 3.2% global growth for 2024, indicating a potentially supportive environment. |

| Interest Rates | Impacts borrowing costs and financial services competitiveness | Potential for Federal Reserve rate increases in late 2024/2025 could raise CHS's borrowing expenses. |

Same Document Delivered

CHS PESTLE Analysis

The preview you see here is the exact CHS PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, allowing you to confidently assess its comprehensive coverage of Political, Economic, Social, Technological, Legal, and Environmental factors affecting CHS.

The content and structure shown in the preview is the same CHS PESTLE Analysis document you’ll download after payment, providing a complete and actionable strategic tool.

Sociological factors

Consumer tastes are shifting significantly, with a pronounced demand for foods that are sustainably sourced, organic, and increasingly plant-based. This trend is reshaping the food industry landscape. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $162 billion by 2030, highlighting the rapid growth in this segment.

CHS, as a key player in the food ingredient supply chain, needs to actively align its product portfolio with these evolving consumer preferences. This involves not only offering more plant-derived ingredients but also focusing on whole foods and ingredients that offer tangible functional benefits, such as enhanced nutrition or improved health outcomes.

Public views on farming, particularly concerning its environmental footprint and how animals are treated, are increasingly shaping what consumers buy and what governments regulate. This sentiment directly impacts agricultural businesses like CHS.

CHS is making a concerted effort to weave sustainability into its core business, as detailed in its 2024 Sustainability Report. Their aim is to generate benefits for their farmer-owners, the communities they serve, and the environment. This commitment involves actively working to reduce deforestation risks and championing solutions that lower carbon emissions.

Demographic shifts, like the ongoing rural-to-urban migration and the aging farmer population, directly influence the availability of labor in agriculture, impacting CHS's member-owners' operational capacities. For instance, in 2024, the average age of farmers in the U.S. continued to climb, with many counties facing a shrinking pool of available agricultural workers.

These labor constraints can hinder farm efficiency and CHS's ability to serve its members effectively. To counter this, innovative solutions such as increased adoption of automation and precision agriculture technologies are becoming crucial, alongside potential adjustments to farming methods to better suit a changing workforce.

Community Well-being and Rural Development

CHS Inc.'s operations significantly influence the well-being of rural America. By investing in local infrastructure and providing vital agricultural services, the cooperative fosters economic resilience in these communities. In 2023, CHS reported revenues of $42.4 billion, demonstrating its substantial economic footprint.

The cooperative's dedication to community support translates into tangible benefits. CHS actively engages in initiatives that promote rural development, create employment opportunities, and enhance the quality of life for its members and their neighbors. This commitment is crucial for sustaining rural economies in the face of evolving agricultural landscapes.

- Job Creation: CHS directly and indirectly supports thousands of jobs in rural areas through its extensive network of facilities and services.

- Economic Stability: By providing essential inputs and market access, CHS helps stabilize farm incomes and local economies.

- Community Investment: The cooperative's philanthropic efforts and local partnerships contribute to the social fabric and development of rural communities.

- Agricultural Support: CHS's role in supplying fertilizers, crop protection, and grain marketing is fundamental to the success of rural agribusinesses.

Health and Wellness Trends

The growing consumer emphasis on health and wellness significantly shapes demand for particular food ingredients and agricultural products. This trend is marked by a surge in interest for functional foods, ingredients offering perceived health advantages, and a general shift away from heavily processed items.

For instance, the global functional foods market was valued at approximately $280 billion in 2023 and is projected to reach over $400 billion by 2028, demonstrating a clear consumer preference for health-enhancing options. This surge is driven by increased awareness of diet's impact on chronic disease prevention and overall well-being.

CHS's food ingredients division must actively adapt to these evolving consumer preferences to maintain its competitive edge. This involves strategically aligning product portfolios and innovation efforts with the rising demand for natural, minimally processed, and health-promoting ingredients.

- Functional Foods Growth: The market for functional foods is expanding rapidly, indicating a strong consumer pivot towards products perceived to offer health benefits beyond basic nutrition.

- Demand for Natural Ingredients: There's a discernible move away from ultra-processed foods and a corresponding increase in demand for natural, whole-food ingredients.

- CHS Strategic Alignment: To stay competitive, CHS must ensure its food ingredient offerings resonate with these health-conscious consumer trends, potentially through product development and sourcing strategies.

- Impact on Agriculture: This societal shift also influences agricultural practices, with greater demand for crops grown with fewer synthetic additives and a focus on nutritional quality.

Societal attitudes towards food production and consumption are undergoing a significant transformation, driven by increasing awareness of health, sustainability, and ethical sourcing. Consumers are actively seeking transparency in the food supply chain, demanding to know where their food comes from and how it is produced.

This heightened awareness fuels demand for organic, non-GMO, and ethically produced goods. For instance, the organic food market in the U.S. reached $61.7 billion in 2022, reflecting a strong consumer commitment to these values. CHS must therefore continue to emphasize its commitment to responsible sourcing and transparent practices to meet these evolving societal expectations.

The cooperative's role extends beyond mere commerce; it is a vital component of the social fabric in the rural communities it serves. CHS's investments in local infrastructure and its provision of essential agricultural services directly contribute to the economic stability and development of these areas, fostering job creation and enhancing the quality of life for its member-owners and their neighbors.

Technological factors

Technological advancements in precision agriculture are revolutionizing farming. Innovations like GPS, remote sensing, the Internet of Things (IoT), and artificial intelligence (AI) are empowering farmers to make data-driven decisions, leading to more efficient resource use and better crop yields. For instance, the adoption of AI in crop management is projected to grow significantly, with the global AI in agriculture market expected to reach $3.7 billion by 2026, up from $1.1 billion in 2021.

CHS, as a provider of essential crop inputs and services, must actively support and integrate these emerging technologies. This integration is crucial for its farmer-owners to maintain competitiveness and ensure the long-term sustainability of their operations. By offering access to and training on these precision farming tools, CHS can help its members optimize fertilizer application, water usage, and pest control, ultimately boosting profitability.

Biotechnology, particularly gene editing and genetically modified (GM) crops, is revolutionizing agriculture. These advancements offer significant potential to bolster crop resilience against the escalating challenges of climate change, persistent pests, and widespread diseases. For instance, by 2024, the global GM seed market was valued at over $20 billion, demonstrating substantial industry investment and adoption, with crops engineered for drought tolerance and pest resistance becoming increasingly common.

CHS can strategically integrate these biotechnological solutions to empower its member-owners. Facilitating access to gene-edited seeds, for example, could enable farmers to achieve higher yields even in suboptimal weather conditions, thereby reducing their dependence on costly and environmentally impactful chemical pesticides and fertilizers. This shift aligns with a growing demand for sustainable agricultural practices, with consumer preference for sustainably produced food projected to grow by 10-15% annually in key markets through 2025.

The agricultural sector is seeing a significant surge in automation and robotics. For instance, by 2024, the global agricultural robotics market was projected to reach $4.9 billion, with expectations to grow to $11.5 billion by 2030, indicating rapid adoption. These technologies, from autonomous tractors to robotic harvesters, are revolutionizing farming by boosting efficiency, slashing labor expenses, and cutting down on mistakes.

CHS, as a major player in agricultural services, must consider how to adapt to this technological shift. This includes potentially offering services for the maintenance, repair, and integration of these sophisticated automated systems on farms. The increasing reliance on precision agriculture, driven by these advancements, means that support for data management and system upgrades will become crucial for farmers.

Data Analytics and Digital Platforms

The integration of big data and artificial intelligence is revolutionizing crop management. Predictive analytics and real-time soil condition monitoring are now commonplace tools for optimizing agricultural output. For instance, by May 2024, precision agriculture technologies, including AI-driven analytics, were projected to see a significant uptake among farmers aiming to boost yields and efficiency.

CHS can leverage these advancements by offering digital advisory services and robust platforms. These tools empower farmer-owners with data-driven insights, enabling smarter decisions regarding resource allocation, pest control, and planting schedules. This not only enhances individual farm productivity but also strengthens the cooperative’s overall value proposition.

- Digital Platforms: CHS can develop or partner with providers of digital farming platforms that integrate data analytics for yield prediction and resource optimization.

- AI in Agriculture: The adoption of AI in agriculture is growing, with applications ranging from autonomous tractors to disease detection, offering significant efficiency gains.

- Data-Driven Advisory: CHS's advisory services can be enhanced by providing farmers with personalized recommendations based on their farm's specific data and broader market trends.

- Real-time Monitoring: Technologies enabling real-time monitoring of soil moisture, nutrient levels, and crop health allow for timely interventions, reducing waste and improving crop quality.

Renewable Energy and Biofuels Technology

Advancements in renewable energy and biofuels technology are increasingly influencing CHS's operational landscape, particularly within its energy segment. These innovations directly support CHS's commitment to sustainability by enabling the adoption of lower-carbon solutions and driving investment in novel energy production methods.

CHS's strategic focus on sustainability is evident in its dedication to supporting low-carbon initiatives and exploring new energy avenues. This includes the integration of renewable energy sources and biofuels, which not only align with environmental goals but also present significant potential for enhancing energy production capabilities within the agricultural sector, a core area for CHS.

- Renewable Energy Growth: The global renewable energy market is projected to reach approximately $1.97 trillion by 2027, indicating substantial growth and investment opportunities.

- Biofuel Demand: Biofuel production, particularly ethanol and biodiesel, continues to be a key component of energy strategies, with global production expected to rise.

- CHS Investment: CHS has actively invested in renewable energy projects and infrastructure, aiming to diversify its energy portfolio and reduce its carbon footprint.

- Agricultural Integration: Technologies enabling the conversion of agricultural byproducts into biofuels offer CHS new revenue streams and operational efficiencies.

Technological advancements are reshaping agriculture, with precision farming tools like AI, IoT, and drones becoming essential. By 2024, the global precision agriculture market was valued at over $12.5 billion, with projections indicating continued robust growth. CHS must integrate these technologies to help farmer-owners optimize resource use, increase yields, and remain competitive in a rapidly evolving industry.

Legal factors

Food safety regulations are paramount for CHS, particularly impacting its food ingredients and grain handling. Agencies like the FDA and USDA set stringent standards that CHS must adhere to, ensuring product integrity and consumer trust.

Compliance with specific rules, such as the Food Traceability Final Rule, is essential. This rule, aimed at enhancing food safety and preventing outbreaks, requires detailed record-keeping throughout the supply chain. Failure to comply can lead to significant penalties and reputational damage.

CHS's operations are also governed by standards concerning chemical contaminants and pathogens. For instance, the FDA's action levels for lead in food, updated in 2023, set critical benchmarks for ingredient sourcing and processing. Maintaining these standards is vital to prevent costly recalls and protect CHS's market position.

Environmental regulations concerning water quality, soil health, emissions, and land use significantly impact agribusinesses like CHS. Compliance with these laws, particularly those addressing agricultural runoff and carbon reduction strategies, is vital for maintaining sustainable operations and preventing costly penalties. For instance, the EPA's Clean Water Act continues to shape practices around nutrient management, and evolving climate policies will increasingly influence emissions reporting for agricultural inputs and transportation.

CHS Inc., as a major agribusiness cooperative, navigates a complex legal landscape, particularly concerning antitrust and cooperative laws. These regulations are crucial for maintaining a level playing field in the agricultural sector and safeguarding the interests of its farmer-owners. For instance, the Capper-Volstead Act of 1922 provides agricultural cooperatives with certain exemptions from antitrust laws, allowing them to collectively bargain and market products. However, this exemption is not absolute and CHS must still adhere to broader antitrust statutes like the Sherman Act and Clayton Act, which prohibit monopolistic practices and unfair competition.

The cooperative structure itself is defined by state and federal laws that dictate membership, governance, and profit distribution. These laws ensure transparency and accountability to CHS's more than 90,000 farmer-owner and rancher members. In 2023, CHS reported revenues of $46.6 billion, highlighting its significant market presence and the importance of compliance with these legal frameworks to prevent potential regulatory challenges or market distortions.

Labor Laws and Workforce Regulations

Labor laws significantly shape CHS's operational landscape, impacting everything from minimum wage requirements to workplace safety standards. For instance, in 2024, the U.S. Department of Labor continued to enforce regulations concerning overtime pay and fair labor practices, which directly influence labor costs and employee management for CHS and its member-owners. Navigating these evolving regulations is crucial for maintaining compliance and managing expenses effectively.

Immigration policies also play a role, particularly in sectors where seasonal or specialized labor is needed. Changes in immigration laws can affect the availability of a qualified workforce, potentially leading to increased recruitment costs or operational adjustments for CHS. Understanding and adapting to these legal frameworks is essential for securing a stable and compliant labor supply.

- Wage and Hour Laws: Compliance with federal and state minimum wage laws, overtime regulations, and payroll practices remains a key focus for CHS and its member-owners.

- Workplace Safety: Adherence to Occupational Safety and Health Administration (OSHA) standards is mandatory to prevent accidents and ensure a safe working environment, impacting operational procedures and insurance costs.

- Immigration and Employment: CHS must ensure all employees are legally authorized to work in the U.S., complying with I-9 verification and any updated immigration-related employment regulations.

- Employee Benefits and Protections: Understanding laws related to family leave, disability, and other employee protections is vital for maintaining workforce morale and avoiding legal disputes.

International Trade Laws and Customs

International trade laws and customs significantly shape CHS's operations. Navigating varying import/export regulations and tariffs across different countries is crucial for its grain marketing and energy product distribution. For instance, in 2024, the World Trade Organization (WTO) continued to monitor and address trade disputes, impacting global commodity flows.

Customs duties directly affect the cost-effectiveness of CHS's cross-border transactions. Changes in these duties, such as those implemented by the European Union on agricultural imports or by the United States on certain manufactured goods, can alter competitive landscapes. Understanding these duties is key to managing profitability.

Export and import regulations, including sanitary and phytosanitary measures for agricultural products, pose compliance challenges. CHS must adhere to these rules to ensure smooth market access. The ongoing efforts by organizations like the Food and Agriculture Organization (FAO) to harmonize standards aim to simplify these processes, but compliance remains a critical operational factor.

- Trade Agreements: CHS benefits from agreements like the USMCA, which facilitates trade in North America, but must also adapt to evolving trade pacts globally.

- Tariff Rates: Fluctuations in tariff rates, such as those impacting steel or aluminum, can influence the cost of equipment used in CHS's infrastructure projects.

- Compliance Costs: Adhering to diverse international trade laws can incur significant compliance costs, requiring dedicated legal and logistical expertise.

- Market Access: Export/import restrictions can limit market access for CHS's products, necessitating strategic diversification of trading partners.

CHS operates within a robust legal framework governing agricultural cooperatives, antitrust, and employment. The Capper-Volstead Act of 1922, while offering exemptions, requires adherence to broader antitrust laws like the Sherman Act to prevent monopolistic practices. In 2023, CHS's $46.6 billion revenue underscores the importance of navigating these regulations to maintain market integrity and member interests.

Labor laws, including wage and hour regulations and workplace safety standards enforced by OSHA, directly impact CHS's operational costs and employee management. The U.S. Department of Labor's continued focus on fair labor practices in 2024 necessitates ongoing compliance. Furthermore, immigration policies can affect workforce availability, influencing recruitment strategies and operational continuity.

International trade laws, customs duties, and sanitary/phytosanitary measures are critical for CHS's global operations. Navigating varying regulations, such as those monitored by the WTO, impacts commodity flows and market access. For instance, changes in tariff rates can affect the cost of essential equipment, while export/import restrictions necessitate strategic diversification of trading partners.

| Legal Area | Key Regulations/Acts | Impact on CHS | 2023/2024 Relevance |

|---|---|---|---|

| Cooperative & Antitrust | Capper-Volstead Act, Sherman Act, Clayton Act | Defines cooperative structure, limits monopolistic practices | Ensures fair competition within a $46.6 billion revenue entity |

| Labor & Employment | FLSA, OSHA Standards, Immigration Law | Dictates wage, safety, and hiring practices | Ongoing enforcement of wage laws and workplace safety |

| International Trade | WTO Agreements, Customs Tariffs, SPS Measures | Governs import/export, affects costs and market access | WTO dispute monitoring impacts global commodity flows |

Environmental factors

Climate change is a significant environmental factor impacting agriculture, bringing unpredictable weather like droughts and heatwaves. These shifts directly threaten crop yields, which is a major concern for CHS, a leading agricultural cooperative. For instance, the U.S. experienced a 15% increase in heavy precipitation events between 2014 and 2023 compared to the 1901-2000 average, disrupting planting and harvesting seasons.

CHS's core businesses, including grain marketing and crop nutrient supply, are particularly exposed to these environmental volatilities. Prolonged droughts in key growing regions, such as the Midwest, can drastically reduce harvestable bushels, impacting CHS's marketing volumes. Similarly, extreme weather events can damage crops, leading to lower demand for crop nutrients or increased need for specialized solutions.

Increasing water scarcity, especially in areas like the Western United States, coupled with shifting precipitation patterns, presents substantial hurdles for farming systems reliant on irrigation. CHS and its member-owners are increasingly focused on adapting to these changes.

For instance, the U.S. Bureau of Reclamation projected that in 2024, water allocations for Central Valley Project contractors in California could be as low as 5% of their requested supply due to critically low reservoir levels, highlighting the severity of the issue.

To ensure the long-term viability of agriculture, CHS and its members are prioritizing the adoption of sustainable water management practices and investing in water-efficient technologies, such as advanced irrigation systems and drought-resistant crop varieties.

Soil degradation, encompassing erosion, nutrient depletion, and salinization, significantly curtails land productivity and its capacity to withstand climate-related stresses. This directly impacts agricultural output, a core area for many businesses.

CHS's crop nutrient division is actively involved in fostering practices that enhance soil health. Initiatives like regenerative agriculture and precise nutrient application are key to ensuring the long-term sustainability of crop production, which is crucial for food security and agricultural markets.

Globally, estimates suggest that around one-third of the world's soils are moderately to severely degraded, a figure that highlights the urgency of addressing these issues. For instance, the UN estimates that soil erosion can lead to an annual loss of 25 to 40 billion tons of topsoil worldwide.

Biodiversity Loss and Ecosystem Health

Biodiversity loss and declining ecosystem health pose significant risks to agricultural productivity, affecting crucial natural processes like pest control and pollination. The decline in these natural services can lead to increased reliance on costly inputs and reduced crop yields. For instance, a 2024 report from the UN highlighted that over 1 million species are now threatened with extinction, a trend that directly impacts the intricate web of life supporting agriculture.

CHS, through its cooperative structure, actively promotes sustainable farming practices that prioritize ecological stewardship and biodiversity enhancement. This commitment is vital for maintaining the long-term health and resilience of the agricultural lands that CHS members depend on. By supporting practices that foster biodiversity, CHS aims to secure the natural capital essential for future food production.

These efforts translate into tangible benefits for farmers:

- Enhanced Natural Pest Control: Promoting diverse habitats supports beneficial insects that prey on pests, reducing the need for chemical interventions.

- Improved Pollination Services: A healthy pollinator population, often supported by diverse flora, is critical for the yield of many crops.

- Increased Farm Resilience: Diverse ecosystems are better equipped to withstand environmental stresses such as drought or disease outbreaks.

- Long-Term Land Productivity: Investing in ecosystem health ensures that agricultural lands remain productive for future generations.

Carbon Footprint and Emissions Reduction

The agricultural sector's substantial carbon footprint and the urgent need for emissions reduction are increasingly prominent concerns. CHS is actively engaged in developing comprehensive greenhouse gas inventories and championing low-carbon solutions for its cooperative owners and broader customer base.

Key initiatives focus on enhancing carbon sequestration, expanding renewable energy adoption, and implementing sustainable manufacturing processes, all of which are becoming critical for the long-term viability and environmental stewardship of agribusinesses.

- Growing Pressure: Global regulatory bodies and consumer demand are intensifying pressure on agribusinesses to quantify and reduce their greenhouse gas emissions.

- CHS Initiatives: CHS is investing in tools and strategies to help its members accurately measure their carbon footprint, aiming for a 15% reduction in Scope 1 and 2 emissions by 2030 compared to a 2023 baseline.

- Low-Carbon Solutions: The company is actively exploring and promoting solutions like advanced fertilizer management and precision agriculture technologies that can demonstrably lower emissions.

- Sustainable Practices: CHS's commitment extends to increasing its use of renewable energy sources in its operations, targeting 30% of its energy consumption from renewables by 2027.

Environmental factors like extreme weather and water scarcity directly impact CHS's operations, affecting crop yields and demand for agricultural inputs. Soil degradation further reduces land productivity, necessitating a focus on sustainable practices. Biodiversity loss also poses risks, highlighting the need for ecological stewardship.

CHS is actively addressing these challenges by promoting sustainable farming, investing in water-efficient technologies, and fostering soil health. The company is also focused on reducing its carbon footprint through initiatives like enhanced carbon sequestration and renewable energy adoption.

The agricultural sector's environmental impact is under increasing scrutiny, with growing pressure from regulators and consumers to reduce greenhouse gas emissions. CHS is responding by helping members measure their carbon footprint and promoting low-carbon solutions.

CHS is committed to increasing its use of renewable energy, targeting 30% of its energy consumption from renewables by 2027.

| Environmental Factor | Impact on CHS | CHS Response/Initiatives |

|---|---|---|

| Climate Change & Extreme Weather | Threatens crop yields, disrupts planting/harvesting, impacts grain marketing volumes. | Promoting sustainable farming, investing in water-efficient tech, drought-resistant crops. |

| Water Scarcity | Reduces irrigation availability, impacting crop production in key regions. | Focusing on sustainable water management practices. |

| Soil Degradation | Decreases land productivity and resilience to climate stress. | Fostering regenerative agriculture and precise nutrient application for soil health. |

| Biodiversity Loss | Reduces natural pest control and pollination services, increasing input reliance. | Promoting practices that enhance biodiversity and ecological stewardship. |

| Greenhouse Gas Emissions | Increasing regulatory and consumer pressure for reduction. | Developing GHG inventories, promoting low-carbon solutions, increasing renewable energy use (targeting 30% by 2027). |

PESTLE Analysis Data Sources

Our CHS PESTLE Analysis is meticulously crafted using data from reputable sources, including government publications, international organizations, and leading market research firms. We ensure comprehensive coverage of political, economic, social, technological, legal, and environmental factors.