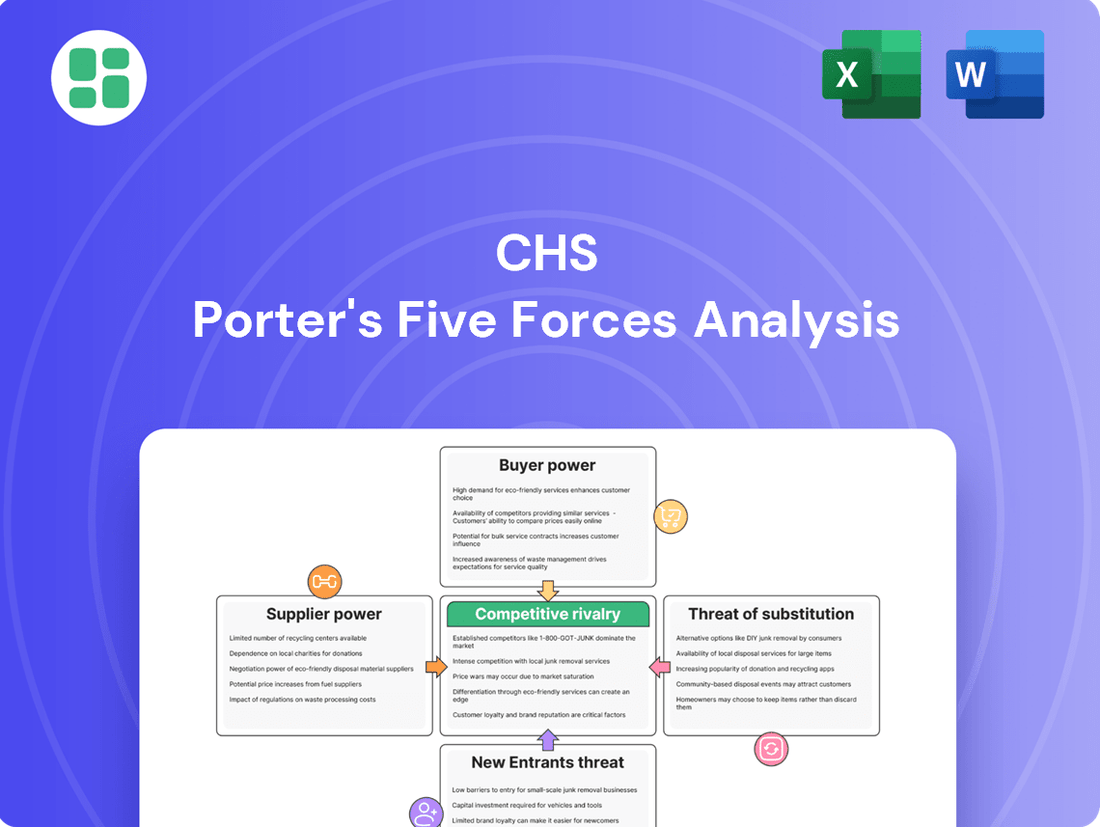

CHS Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CHS Bundle

Understanding the competitive landscape of CHS is crucial for any strategic decision. Our Porter's Five Forces analysis delves into the core pressures shaping its market, from the bargaining power of buyers and suppliers to the intensity of rivalry and the threat of substitutes and new entrants. This initial glimpse offers a foundational understanding, but the true strategic advantage lies in a comprehensive view.

The complete report reveals the real forces shaping CHS’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration significantly influences bargaining power. While the agricultural sector typically boasts many farmers, diffusing power for basic commodities, the market for specialized agricultural inputs like advanced crop protection chemicals or high-tech farm machinery often features fewer, highly concentrated suppliers. This concentration can give these specialized suppliers considerable leverage over agricultural cooperatives like CHS.

For instance, in 2024, the global agrochemical market, dominated by a few major players, saw continued consolidation. Companies like Syngenta, Bayer Crop Science, and Corteva Agriscience held substantial market shares, meaning CHS might have limited options when sourcing these critical inputs, potentially leading to less favorable pricing or contract terms.

Switching costs for CHS can be quite varied. For basic agricultural commodities, finding alternative suppliers might not be overly difficult. However, when it comes to specialized inputs or energy products, moving away from current suppliers can become expensive and disrupt operations significantly.

The existence of long-term contracts with specific suppliers, or investments made in infrastructure that are tied to particular suppliers, can further increase the costs associated with switching. For instance, if CHS has invested in specialized storage or transportation facilities designed for a particular supplier's product, changing suppliers would necessitate either abandoning that investment or incurring additional costs to adapt the infrastructure.

The threat of forward integration by CHS's primary suppliers, largely individual farmers, is minimal. Establishing processing, marketing, and distribution networks on the scale of CHS requires immense capital, sophisticated logistics, and established global market access, which most farmers lack. For example, the agricultural processing sector often involves multi-billion dollar investments in facilities and supply chain infrastructure.

Importance of CHS to Suppliers

CHS, a significant global player in agricultural marketing and input provision, acts as a crucial conduit for numerous farmers and suppliers. Its substantial market presence and cooperative structure offer a reliable and large customer base, which can diminish the individual supplier's leverage by making them dependent on CHS for market access and sales.

The sheer volume of business CHS handles means that many suppliers, particularly those dealing in grains, oilseeds, and other agricultural commodities, find CHS to be one of their primary, if not sole, avenues to reach a broad market. This reliance inherently shifts power towards CHS.

- CHS's extensive network provides suppliers with reach they might not achieve independently.

- The cooperative structure can foster loyalty among farmer-owners, presenting a unified front that can influence supplier terms.

- In 2023, CHS reported total revenue of $44.1 billion, underscoring its immense purchasing power and market influence over its suppliers.

Availability of Substitute Inputs

The availability of substitute inputs significantly impacts the bargaining power of suppliers for CHS. In segments dealing with basic agricultural commodities, CHS likely benefits from a broad supplier base and numerous alternative sources, which generally dilutes supplier power. For instance, in 2024, global wheat production was projected to reach over 780 million metric tons, indicating ample supply and potential for substitution among farmers.

However, for more specialized inputs, such as certain crop protection chemicals or advanced energy products, the availability of direct substitutes may be limited. If CHS relies on a particular supplier for a critical, non-substitutable input, that supplier gains considerable leverage. This is particularly true if demand for the end product is inelastic, meaning customers are not highly sensitive to price changes.

- Limited Substitutes for Specialized Inputs: For certain high-tech agricultural inputs or specific energy components, CHS may face suppliers with stronger bargaining power due to a lack of readily available alternatives.

- Commodity Markets Offer More Substitution: In contrast, basic agricultural commodities like corn or soybeans, where CHS operates extensively, typically have a wider array of suppliers and thus lower supplier bargaining power.

- Impact on Input Costs: The degree of substitutability directly influences CHS's cost of goods sold, affecting profit margins in different business units.

The bargaining power of suppliers is a key factor in CHS's operational costs and profitability. When suppliers are concentrated, have high switching costs for CHS, or face few substitutes, their leverage increases. Conversely, CHS's own market power, cooperative structure, and the availability of substitutes for its products can significantly reduce supplier influence.

In 2024, the agrochemical sector, a key input area for CHS, continued to be dominated by a few large players like Bayer and Syngenta. This concentration means CHS might face stronger supplier power for specialized chemicals. However, for bulk commodities, CHS's vast purchasing volume, evidenced by its $44.1 billion revenue in 2023, provides substantial counter-leverage.

| Factor | Impact on CHS Supplier Bargaining Power | Example/Data Point |

|---|---|---|

| Supplier Concentration | Increases power for specialized inputs | Agrochemical market dominated by few major players (e.g., Bayer, Syngenta) in 2024. |

| Switching Costs | Increases power if high for CHS | Investments in specialized infrastructure tied to specific suppliers. |

| Threat of Forward Integration | Minimal for CHS's farmer suppliers | Requires immense capital and logistics beyond most individual farmers. |

| CHS's Market Power | Decreases supplier power | CHS's 2023 revenue of $44.1 billion signifies substantial purchasing influence. |

| Availability of Substitutes | Decreases power for commodity inputs | Global wheat production projected over 780 million metric tons in 2024. |

What is included in the product

This analysis unpacks the competitive forces impacting CHS, examining the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, and the intensity of rivalry within its industry.

Instantly identify and address competitive threats with a visual breakdown of each of Porter's Five Forces, simplifying complex market dynamics.

Customers Bargaining Power

CHS serves a wide array of customers, from individual farmers to major food processors and international buyers. This broad customer base generally limits the bargaining power of any single customer.

However, a concentration of buyers, such as a few large food processing companies or global trading houses, can significantly shift this balance. These entities, by virtue of their substantial purchasing volumes, can exert considerable leverage over CHS.

For instance, if a few major processors account for a disproportionately large percentage of CHS's sales, they can negotiate for lower prices or more favorable terms, impacting CHS's profitability.

For CHS's member-owners, the costs associated with switching to a different agricultural cooperative or supplier can range from moderate to quite high. This is particularly true when farmers have deeply integrated their operations with CHS, utilizing a broad suite of services including grain marketing, crop nutrient solutions, energy supplies, and even financial services.

The financial incentives offered by CHS, such as patronage dividends, also play a significant role. These distributions, tied to a member's business volume with the cooperative, effectively increase the cost of leaving, as farmers forfeit these potential returns by switching. In 2023, CHS reported total revenues of $42.4 billion, with a significant portion of this revenue generated from its member-owners, highlighting the scale of these integrated relationships.

CHS supplies foundational products and services that are absolutely crucial for farming and the subsequent food industry. Think about crop nutrients, energy for operations, and ways for farmers to sell their grain. These are not optional items; they are the backbone of agricultural success.

Because these offerings are so fundamental, many customers find themselves dependent on suppliers like CHS. This reliance can, in turn, lessen the immediate leverage customers have. However, it's important to remember that even with this dependence, the quality of the products and the prices charged are still very significant considerations for buyers.

For example, in 2024, the agricultural sector continued to face volatile input costs, making reliable and competitively priced nutrient and energy supplies from companies like CHS particularly valuable to farmers. CHS reported strong performance in its Ag segment, indicating continued demand for its essential products and services.

Threat of Backward Integration by Customers

The threat of backward integration by customers for CHS is generally low. This is primarily due to the significant capital investment, extensive infrastructure, and specialized expertise needed to match CHS's capabilities in areas like grain handling, processing, and input manufacturing. For instance, replicating CHS's vast network of grain elevators and processing facilities would require billions of dollars in investment, a barrier that most individual customers cannot overcome.

While some large-scale food processors might explore direct sourcing to gain more control over their supply chain, the prospect of them fully integrating backward to replicate CHS's entire operational model is improbable. CHS's diversified business model, spanning from agricultural inputs to food processing and energy, creates a complex ecosystem that is difficult for a single customer to duplicate. In 2024, the agricultural cooperative sector, where CHS operates, continues to see consolidation, making it even harder for individual customers to achieve the scale necessary for effective backward integration.

Consider these points regarding customer backward integration:

- High Capital Requirements: Building infrastructure comparable to CHS's grain storage and processing facilities demands substantial financial outlay, often in the hundreds of millions or billions of dollars.

- Specialized Expertise: CHS possesses deep knowledge in agronomy, logistics, commodity trading, and food science, which is challenging for customers to acquire or develop internally.

- Scale and Network Effects: CHS benefits from a vast network of producers and end-users, creating economies of scale and efficiencies that are difficult for individual customers to replicate.

- Regulatory Hurdles: Operating in various segments of the agricultural and food industries involves navigating complex regulatory environments, adding another layer of difficulty for potential integrators.

Price Sensitivity of Customers

Customer price sensitivity is a major consideration in agriculture, a sector known for fluctuating commodity prices and often thin profit margins for both farmers and processors. While CHS's cooperative model and its range of integrated services provide value that extends beyond just price, remaining competitive on pricing is essential, particularly for widely traded goods like grain or fundamental crop nutrients.

For example, in 2024, global grain prices experienced significant volatility due to geopolitical events and weather patterns, directly impacting the purchasing decisions of farmers who are key customers for CHS. This heightened sensitivity means that pricing strategies for products like fertilizers and feed must be carefully managed to align with market conditions and customer affordability.

- Price Sensitivity in Agriculture: Farmers often operate on tight margins, making them highly attuned to price fluctuations for inputs like seeds, fertilizers, and fuel.

- Commodity Pricing Impact: For products like grain, where CHS acts as a buyer and seller, the market price heavily dictates customer willingness to pay or accept.

- CHS Value Proposition: While price is critical, CHS aims to differentiate through services, reliability, and patronage refunds, which can mitigate some price sensitivity for its cooperative members.

- 2024 Market Dynamics: The agricultural market in 2024 saw continued pressure on input costs and commodity prices, reinforcing the need for CHS to offer competitive pricing alongside its value-added services.

The bargaining power of CHS's customers is generally moderate, influenced by the cooperative's broad reach and the essential nature of its products. While individual farmers have limited leverage, large-scale food processors or trading houses can exert more influence due to their purchase volume.

Switching costs for member-owners are often substantial, as they are integrated with CHS's diverse services, making it economically disadvantageous to leave. CHS's 2023 revenue of $42.4 billion underscores the scale of these customer relationships.

The indispensable nature of CHS's offerings, such as crop nutrients and energy, creates customer dependence, though price and quality remain key considerations, especially with 2024's volatile input costs.

Customer backward integration is improbable due to CHS's immense capital requirements, specialized expertise, and extensive network, barriers that few customers can overcome in the consolidating 2024 agricultural cooperative landscape.

Preview Before You Purchase

CHS Porter's Five Forces Analysis

This preview showcases the complete CHS Porter's Five Forces Analysis, offering a comprehensive examination of competitive forces within the industry. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase. Rest assured, there are no placeholders or mockups; what you preview is your exact deliverable, ensuring full transparency and immediate utility for your strategic planning.

Rivalry Among Competitors

CHS operates in an agribusiness landscape dominated by a few colossal global entities like Cargill, ADM, and Bunge, alongside a multitude of smaller, regional competitors and cooperatives. This means CHS is constantly navigating a complex competitive environment.

The intensity of this rivalry is felt across all of CHS's business divisions, including grain marketing, crop nutrients, energy, and food ingredients. For instance, in the 2023 fiscal year, CHS reported total revenues of $46.7 billion, a testament to its scale but also highlighting the significant market share it contends for against these major players.

This broad competitive pressure across diverse segments demands that CHS remains agile and continuously refines its strategies to maintain and grow its market position. The sheer number and varying sizes of these competitors necessitate a dynamic approach to business operations and market engagement.

The agribusiness sector generally experiences a moderate growth rate, especially in established economies such as the United States. This steady expansion is often linked to predictable factors like population increases and evolving consumer dietary habits.

In 2024, the U.S. agribusiness sector's growth is projected to be around 2-3%, a pace that can indeed heighten rivalry. When the market isn't expanding rapidly, companies often find themselves competing more fiercely for existing customers and market share, which can translate into price wars and a stronger emphasis on operational cost-cutting measures to maintain profitability.

CHS faces intense competition in its core agricultural inputs and commodities, where products like basic fertilizers and grains are often seen as interchangeable. This commoditization naturally drives competition towards price, impacting margins. For instance, in 2024, global wheat prices saw significant fluctuations, directly affecting the pricing power of grain suppliers like CHS.

However, CHS leverages its cooperative structure and a suite of value-added services to carve out differentiation. Offering integrated solutions such as crop consulting, advanced agronomic advice, and tailored risk management tools helps distinguish CHS from competitors. These services, combined with financial support and the inherent loyalty of its member-owners, create a stickier customer relationship.

Exit Barriers

Exit barriers in agribusiness are substantial, largely driven by the immense capital sunk into specialized infrastructure. Think of grain elevators, sophisticated processing plants, and extensive logistics networks; these aren't easily repurposed or sold off. This high fixed cost means companies are reluctant to exit, even when market conditions are tough. They often continue operating to try and recoup their significant investments, leading to persistent competition.

For instance, the cost to build a modern grain elevator can easily run into tens of millions of dollars, with processing facilities costing even more. This capital intensity acts as a significant deterrent to leaving the market.

- Significant Capital Investment: Agribusinesses face enormous upfront costs for specialized assets like processing plants and storage facilities.

- Asset Specificity: These assets are often highly specific to agribusiness operations, limiting their resale value or alternative uses.

- Continued Operation to Cover Overheads: High fixed costs compel companies to maintain operations, even in unfavorable market conditions, to spread the costs.

Diversity of Competitors

CHS faces intense competition from a broad spectrum of entities. This includes large, publicly traded multinational corporations with significant resources, other major agricultural cooperatives operating with similar member-focused models, and numerous smaller, specialized regional companies catering to niche markets. This wide range of competitors, each with distinct business models and strategic aims, complicates CHS's competitive landscape.

The varied nature of these competitors means CHS must adapt its strategies to address different types of competitive pressures across its diverse market segments. For instance, in crop inputs, CHS might contend with global chemical giants, while in grain marketing, it could face regional elevators and international trading houses.

- Multinational Corporations: These entities often possess vast financial backing and global reach, allowing them to invest heavily in research and development and achieve economies of scale.

- Large Cooperatives: Other cooperatives, like Land O'Lakes or GROWMARK, compete directly with CHS, often sharing similar member-centric values but differing in operational focus or regional strength.

- Regional and Specialized Firms: Smaller, agile companies can offer tailored solutions or focus on specific product lines or geographic areas, posing localized competitive threats.

- Market Fragmentation: The agricultural sector's inherent fragmentation means CHS operates in multiple sub-markets, each with its own unique competitive dynamics and key players.

Competitive rivalry within the agribusiness sector, where CHS operates, is intense due to the presence of large global players like Cargill and ADM, alongside numerous regional competitors. This dynamic forces CHS to constantly adapt its strategies across its diverse business segments, from grain marketing to crop nutrients and energy.

In 2024, the U.S. agribusiness sector's projected growth of 2-3% intensifies this rivalry, as companies vie for market share in a moderately expanding market. This often leads to price-based competition, particularly in commoditized products like basic fertilizers and grains, impacting profit margins for all involved.

CHS differentiates itself by offering value-added services such as crop consulting and risk management, leveraging its cooperative structure to foster customer loyalty. However, the significant capital investment required for specialized infrastructure, like grain elevators and processing plants, creates high exit barriers, compelling companies to remain in the market and sustain competitive pressure.

| Competitor Type | Key Characteristics | Impact on CHS |

|---|---|---|

| Multinational Corporations | Vast financial resources, global reach, economies of scale | Intense price competition, innovation pressure |

| Large Cooperatives | Member-centric models, regional strength | Direct competition for market share and member loyalty |

| Regional/Specialized Firms | Agility, niche market focus | Localized competitive threats, tailored service challenges |

SSubstitutes Threaten

While grain itself is a fundamental food staple with few direct substitutes, farmers marketing their crops face a variety of alternative channels. These include selling directly to food processors, engaging with other grain merchandisers, or leveraging futures markets for independent price discovery and hedging. For instance, in 2024, the U.S. Department of Agriculture reported that while corn and soybean prices fluctuated, the availability of these alternative marketing avenues provided farmers with flexibility.

The ease with which farmers can switch between these marketing options directly influences CHS's market power in grain origination. If other merchandisers offer more attractive pricing, better logistical support, or more favorable contract terms, farmers may divert their grain away from CHS. This competitive pressure is a constant factor, especially as market information becomes more transparent and accessible to producers.

The threat of substitutes for traditional crop nutrients is growing. Organic farming practices, which rely on compost, manure, and cover crops, are gaining traction, with the global organic farming market projected to reach over $200 billion by 2025. Precision agriculture also plays a role by optimizing nutrient application, thereby reducing the overall need for synthetic fertilizers.

Advancements in biologicals, such as nitrogen-fixing bacteria and mycorrhizal fungi, offer another avenue to enhance plant nutrition and potentially decrease dependence on synthetic inputs. These biological solutions are a rapidly developing segment, with the global biopesticides and biostimulants market expected to see significant growth in the coming years.

The threat of substitution for CHS's energy products is significant, particularly from the growing adoption of renewable energy sources in agriculture. Farmers are increasingly exploring solar and wind power for their operations, directly impacting the demand for traditional fuels. For instance, by the end of 2023, the U.S. solar capacity alone had surpassed 150 gigawatts, demonstrating a clear shift towards alternative power.

Substitutes for Food Ingredients

The threat of substitutes for CHS's food ingredients is significant, driven by evolving consumer choices and technological advancements. For instance, the burgeoning plant-based food market, projected to reach $162 billion by 2030 according to Bloomberg Intelligence, directly substitutes traditional animal-based ingredients that CHS processes. This shift impacts demand for commodities like grains and oilseeds used in conventional food production.

New food technologies, such as cultivated or lab-grown proteins, also pose a future substitution risk. While still in early stages, these innovations could eventually offer alternatives to ingredients derived from traditional agriculture. In 2024, investment in food tech, including alternative proteins, continued to be robust, indicating ongoing development that could disrupt established supply chains.

Furthermore, changing consumer preferences, like the growing demand for organic, non-GMO, or locally sourced ingredients, can lead consumers to bypass traditional ingredient suppliers. This trend encourages the development and adoption of alternative sourcing and processing methods, potentially diverting market share from CHS.

- Plant-based alternatives: A growing market segment that directly competes with ingredients derived from animal agriculture.

- Food technology innovation: Emerging technologies like cultivated meat and precision fermentation offer potential substitutes for traditional agricultural products.

- Consumer preference shifts: Increased demand for organic, non-GMO, and locally sourced ingredients can bypass conventional ingredient channels.

- Impact on CHS: These substitute threats can reduce demand for CHS's core agricultural commodities and processed ingredients.

Alternative Financial and Risk Management Services

Farmers and agribusinesses have a wide array of choices when it comes to financial and risk management services. Beyond cooperative offerings like those from CHS, traditional banks, dedicated agricultural lenders, and insurance companies all provide competing solutions. This broad market access for customers means CHS faces significant pressure to differentiate itself.

The competitive landscape is robust, with numerous entities vying for the same customer base. For instance, in 2024, the agricultural lending sector saw continued activity from both established banks and specialized financial providers, many of whom offer tailored risk management products such as crop insurance and hedging strategies. This availability of diverse options compels CHS to consistently prove its value proposition through competitive pricing and superior service delivery to maintain customer loyalty.

- Alternative Providers: Traditional banks, specialized agricultural lenders, and insurance companies offer direct competition.

- Customer Choice: Farmers and agribusinesses can select from a variety of financial and risk management solutions.

- CHS Imperative: CHS must offer superior value and competitive rates to retain its market share.

- Market Dynamics: The agricultural finance market in 2024 demonstrated ongoing competition among various financial service providers.

The threat of substitutes for CHS's core offerings is multifaceted, impacting its grain, energy, and financial services. In the grain sector, alternative marketing channels and evolving farming practices present substitution risks. For energy, the rise of renewables directly challenges traditional fuel demand, while in financial services, a competitive market of lenders and insurers offers readily available alternatives.

| Substitute Area | Key Substitutes | 2024/Projected Data Point | Impact on CHS |

| Grain Marketing | Direct sales to processors, other merchandisers, futures markets | Farmer flexibility in marketing options increased in 2024. | Reduces CHS's pricing power and origination volume. |

| Crop Nutrients | Organic practices, precision agriculture, biologicals | Global organic farming market projected over $200 billion by 2025. | Decreases demand for synthetic fertilizers CHS may supply. |

| Energy Products | Solar, wind power | U.S. solar capacity surpassed 150 GW by end of 2023. | Lowers demand for traditional fuels CHS distributes. |

| Food Ingredients | Plant-based alternatives, cultivated proteins | Plant-based food market projected $162 billion by 2030. | Shifts demand away from traditional agricultural commodities. |

| Financial Services | Banks, specialized ag lenders, insurance companies | Robust activity in agricultural lending in 2024. | Requires CHS to offer competitive pricing and superior service. |

Entrants Threaten

Entering the agribusiness sector, especially at a scale comparable to CHS, demands a colossal amount of capital. Think about the sheer cost of building and maintaining grain elevators, modern processing plants, extensive transportation fleets, and robust distribution networks. These aren't small investments; they represent significant financial hurdles.

For instance, constructing a single large-scale grain elevator can cost tens of millions of dollars, and that's just one piece of the puzzle. The total capital needed to establish a competitive presence across multiple facets of agribusiness, including logistics and processing, easily runs into hundreds of millions, if not billions. This high capital requirement acts as a powerful deterrent, effectively keeping many potential competitors at bay.

CHS benefits from substantial economies of scale across its operations, including purchasing, processing, logistics, and global distribution. For instance, in 2023, CHS reported revenues of $44.5 billion, illustrating its vast operational footprint which is difficult for newcomers to replicate.

New entrants face significant hurdles in achieving similar cost efficiencies. They would require massive initial capital investment and rapid market penetration to compete effectively on price and operational performance against an established player like CHS, which leverages its scale to negotiate better terms and optimize its supply chain.

CHS boasts deeply entrenched relationships with its member-owners, a crucial element for any agricultural cooperative. These long-standing connections foster loyalty and provide a stable customer base, making it difficult for newcomers to gain traction. In 2023, CHS reported revenues of $44.4 billion, underscoring the scale of its operations and the strength of its existing network.

The cooperative's extensive distribution channels for both agricultural inputs and outputs across the U.S. and globally represent another significant barrier. Replicating such a vast and efficient network, which includes grain elevators, fuel terminals, and retail locations, requires immense capital investment and time to build trust. This logistical and relational infrastructure is a formidable hurdle for any aspiring new entrant aiming to compete.

Regulatory and Compliance Hurdles

The agricultural sector is heavily regulated, creating significant barriers for potential new entrants. Navigating a complex web of rules related to food safety, environmental impact, and international trade requires substantial investment in expertise and compliance infrastructure. For instance, in 2024, the U.S. Department of Agriculture (USDA) continued to enforce stringent standards under the Food Safety Modernization Act (FSMA), which mandates preventive controls for foodborne illnesses.

These regulatory demands translate into higher upfront costs and longer lead times for new businesses. Obtaining permits for land use, water rights, and product certifications can be a lengthy and expensive process. In 2024, many regions saw increased scrutiny on agricultural practices regarding water usage and pesticide application, further complicating market entry for those unfamiliar with these evolving requirements.

- Food Safety Modernization Act (FSMA) compliance costs can range from thousands to hundreds of thousands of dollars for new operations.

- Environmental regulations, such as those concerning water quality and emissions, often necessitate significant capital investment in new equipment or processes.

- Navigating international trade policies and tariffs adds another layer of complexity and financial risk for potential exporters.

- Obtaining necessary certifications, like organic or non-GMO, can take years and require rigorous adherence to specific standards.

Brand Loyalty and Cooperative Model Advantages

CHS's cooperative model creates a formidable barrier to new entrants. Its farmer-members are deeply loyal, benefiting from patronage dividends and a sense of shared ownership. This fosters a strong community trust that is difficult for external competitors to penetrate.

For instance, in fiscal year 2023, CHS reported total revenues of $43.3 billion, demonstrating the scale and reach of its established network. New entrants would face immense challenges in replicating the deep-rooted relationships and member commitment that CHS has cultivated over decades.

- Farmer-member loyalty acts as a significant non-financial barrier.

- Patronage dividends incentivize continued engagement with CHS.

- Shared ownership model builds a strong sense of community and trust.

- Established relationships are a key differentiator against potential new competitors.

The threat of new entrants into the agribusiness sector, particularly for a company of CHS's scale, is considerably low due to immense capital requirements for infrastructure like grain elevators and processing plants, alongside substantial operational economies of scale that are difficult for newcomers to match. Furthermore, deeply entrenched relationships with member-owners and extensive distribution networks create significant logistical and relational barriers. Stringent agricultural regulations and compliance costs also add complexity and financial risk, making market entry a challenging proposition for new players.

| Barrier Type | Description | Example/Data Point |

|---|---|---|

| Capital Requirements | High upfront investment for facilities and logistics. | Building a large grain elevator can cost tens of millions of dollars. |

| Economies of Scale | Cost advantages from large-scale operations. | CHS reported $44.5 billion in revenue for 2023, indicating vast operational scale. |

| Customer Loyalty & Relationships | Entrenched relationships with farmer-members. | CHS's cooperative model fosters deep loyalty and trust, difficult to replicate. |

| Distribution Networks | Extensive and efficient logistical infrastructure. | Replicating CHS's network of elevators, terminals, and retail locations is capital-intensive. |

| Regulatory Environment | Complex rules requiring significant investment in compliance. | FSMA compliance can cost new operations thousands to hundreds of thousands of dollars. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including comprehensive market research reports from leading firms, detailed financial statements and investor relations materials from industry players, and up-to-date regulatory filings. This multi-faceted approach ensures a thorough understanding of the competitive landscape.