CHS Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CHS Bundle

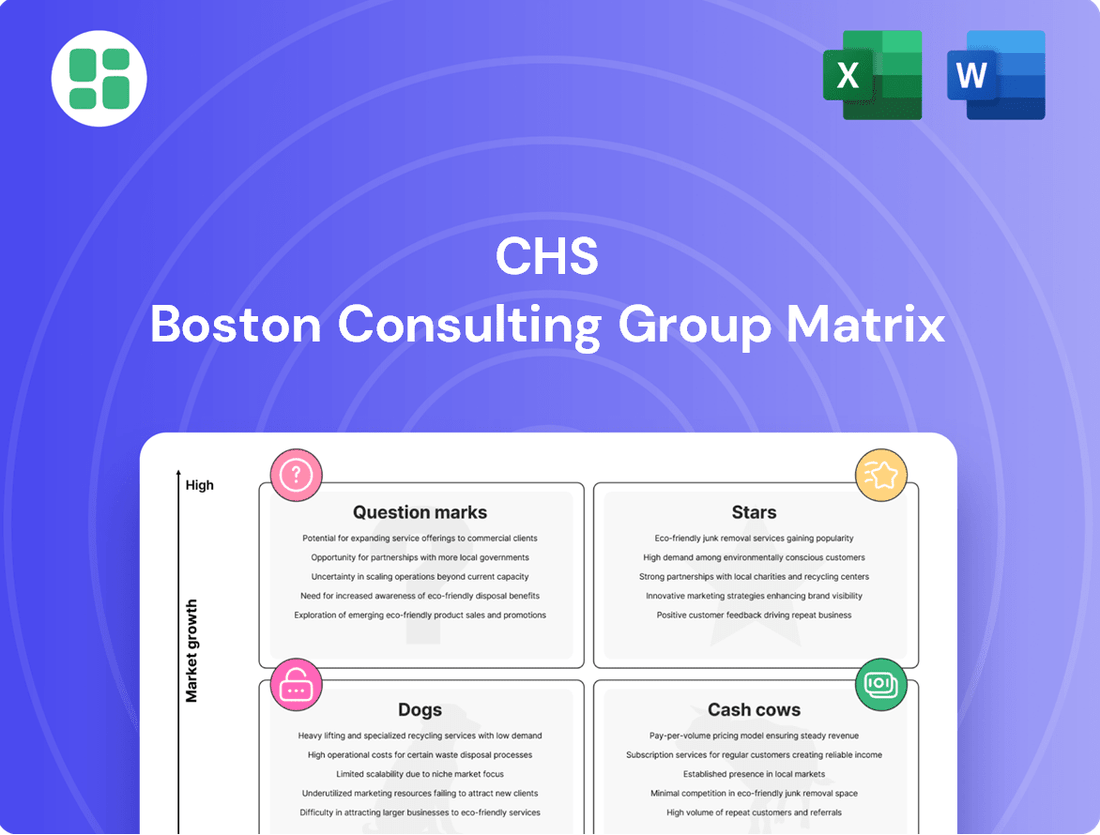

Unlock the strategic potential of your product portfolio with the BCG Matrix! This powerful tool categorizes your offerings into Stars, Cash Cows, Dogs, and Question Marks, revealing their market share and growth potential. Understand where to invest, divest, or nurture your products for optimal business growth.

Don't just guess about your product's future; know it. The full BCG Matrix report provides a granular breakdown of each product's position, offering actionable insights and data-driven recommendations to guide your strategic decisions and maximize profitability.

Ready to transform your business strategy? Purchase the complete BCG Matrix today and gain a clear, visual roadmap to understanding your market position and making informed investment choices. It's the essential tool for any forward-thinking business leader.

Stars

Advanced Agronomy Solutions represents a Stars category for CHS, driven by the strategic introduction of innovative products like Verium™, Velora™, Anoculare™, and Trivar® EZ slated for 2025 and 2026. These offerings are engineered to elevate crop performance and nutrient efficiency, positioning CHS for significant growth in the agricultural inputs market.

The company's recent performance underscores this trajectory. For fiscal year 2025 Q3, the Ag segment demonstrated robust growth, with a notable increase in volumes and improved margins for its wholesale and retail agronomy products. This financial uptick directly correlates with the anticipated success of its advanced agronomy portfolio.

CHS is making significant investments to grow its grain origination and export infrastructure, focusing on vital global production areas such as Brazil, Romania, and Australia. This strategic push is designed to improve CHS's reach and competitive edge in international markets. For instance, in fiscal year 2024, the company saw a substantial 50% rise in the grain volume processed at its Brazilian terminal, highlighting the impact of these expansion efforts.

Further strengthening this growth-oriented strategy, CHS acquired Cargill's grain facilities in 2024. These moves are key to CHS's approach of capturing high market share in rapidly expanding sectors, reinforcing its position as a major player in the global grain trade.

CHS is actively integrating sustainability into its business, aiming to lessen its environmental footprint and offer low-carbon choices to its stakeholders. This strategic focus addresses the growing global demand for eco-friendly farming and products, positioning CHS in a high-growth sector.

The company's commitment is evident in its 2024 Sustainability Report, which details initiatives for reducing climate impact. For instance, CHS reported a 15% reduction in Scope 1 and 2 greenhouse gas emissions intensity across its operations in 2023 compared to a 2020 baseline.

Precision Agriculture and AI Investments

CHS is strategically investing in precision agriculture through its Cooperative Ventures fund, with a notable focus on artificial intelligence applications at the farm level. This move positions CHS to capitalize on the rapidly expanding precision agriculture sector, which is transforming farming practices with data-driven insights and autonomous technologies.

This investment in companies like Precision AI highlights CHS’s commitment to innovation. The precision agriculture market is projected for significant growth, with some estimates suggesting it could reach over $20 billion globally by 2025, driven by the need for increased efficiency and sustainability in food production.

- Investment Focus: CHS Cooperative Ventures is targeting innovative ag-tech, including AI solutions for farming.

- Market Opportunity: Precision agriculture is a high-growth sector, expected to see substantial expansion in the coming years.

- Technological Advancement: AI applications aim to revolutionize farming through enhanced data analysis and automation.

- Strategic Importance: This investment signals CHS's intent to lead in adopting and promoting advanced agricultural technologies.

Specialty Food Ingredients (Ventura Foods Joint Venture)

The Ventura Foods joint venture, a key component of CHS's Specialty Food Ingredients, showcases exceptional performance. In Q3 FY2025, this venture was a significant driver of pretax income within CHS's Corporate and Other segment, underscoring its strength in a specialized and expanding food ingredients market.

This segment's high profitability and established market leadership in its niche areas are directly translating into robust financial contributions for CHS. The venture's success highlights a strategic focus on high-value, specialized food components.

- Strong Q3 FY2025 Performance: The Ventura Foods joint venture significantly boosted CHS's Corporate and Other segment's pretax income.

- Market Leadership: The venture holds a leading position in specialized food ingredient niches.

- High Profitability: This segment demonstrates impressive profitability, contributing substantially to CHS's overall financial health.

- Growth Potential: Its strong performance indicates a favorable outlook within the expanding specialty food ingredients market.

Stars represent high-growth, high-market-share businesses. CHS's Advanced Agronomy Solutions, with new product launches like Verium™ and Velora™ slated for 2025-2026, fits this profile due to anticipated market demand for enhanced crop performance. The company's strategic investments in grain infrastructure, including a 50% rise in Brazilian terminal volume in 2024 and the acquisition of Cargill facilities, further solidify its dominant position in expanding global markets.

What is included in the product

Strategic assessment of CHS's product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

Clear visualization of business unit performance, simplifying complex strategic decisions.

Cash Cows

CHS's core grain marketing and origination in the U.S. is a classic Cash Cow. Its established presence and significant market share mean it reliably churns out profits, even when commodity prices dip. This segment is the financial bedrock for CHS.

While the 2024 fiscal year saw a revenue dip, largely due to lower commodity prices, the underlying strength of this business remains evident. The sheer volume of grain handled ensures consistent cash flow, supporting other areas of the cooperative's operations.

CHS's established crop nutrients distribution network acts as a classic Cash Cow. This segment benefits from a stable, consistent demand from farmers, a testament to its essential role in agriculture. The widespread reach of this network ensures reliable cash flow, solidifying its position in a mature market where CHS maintains a strong presence.

In fiscal year 2024, this segment demonstrated robust performance with improved margins and increased volumes for both wholesale and retail agronomy products. This trend is projected to continue into Q3 2025, further underscoring the dependable income generation from this established business line.

CHS's conventional refined fuels distribution, encompassing gasoline, diesel, and propane, stands as a bedrock of its energy operations. Despite anticipated headwinds from less favorable refining margins and scheduled maintenance in FY2024 and Q3 FY2025, this segment is a significant revenue generator.

As a mature market leader, this sector provides a stable, albeit occasionally fluctuating, cash flow. For instance, in fiscal year 2023, CHS reported significant earnings from its energy segment, underscoring the importance of refined fuels distribution.

Nitrogen Production (CF Nitrogen Joint Venture)

CHS's investment in CF Nitrogen, accounted for using the equity method, has been a consistent source of significant income for the cooperative. This joint venture operates within the urea and UAN market, a sector that, while mature, remains fundamental to agriculture. CHS's substantial market share within this partnership provides a reliable earnings stream, effectively mitigating the impact of global price volatility.

The CF Nitrogen joint venture is a prime example of a Cash Cow within the CHS portfolio, fitting the BCG matrix criteria perfectly. It operates in a stable, established market with high market share, generating consistent profits with minimal investment required for maintenance or growth.

- Contribution to Income: CHS's equity method investment in CF Nitrogen consistently contributes positively to the cooperative's overall income.

- Market Position: The joint venture benefits from a high market share in the mature but essential urea and UAN commodity market.

- Earnings Stability: This strategic partnership ensures a steady stream of earnings, largely insulated from global price fluctuations.

- 2024 Performance Indicator: While specific 2024 net income figures for the joint venture are not publicly detailed by CHS as a separate line item, CHS reported record net income of $955 million for the fiscal year ended August 31, 2023, with agricultural inputs, including nitrogen, being a significant driver. This indicates the continued strength of such ventures.

Financial and Risk Management Services

CHS's financial and risk management services, encompassing insurance and diverse business solutions for its member-owners, function as a Cash Cow within its portfolio. This segment is characterized by its stability and a predictable, albeit low, growth trajectory.

The established and loyal customer base ensures consistent, recurring revenue streams. For instance, in 2024, CHS reported significant contributions from its insurance operations, which often exhibit high retention rates, underscoring the dependable nature of this revenue.

- Stable Revenue Generation: The insurance and business solutions provide a consistent income source.

- Low Growth, High Profitability: While not a high-growth area, these services typically offer healthy profit margins due to established infrastructure and customer loyalty.

- Customer Retention: A strong member-owner base leads to high retention rates, minimizing customer acquisition costs.

- Financial Stability: These services contribute reliably to CHS's overall financial health, supporting other business ventures.

CHS's grain marketing and origination in the U.S. is a prime example of a Cash Cow. Its deep-rooted presence and substantial market share ensure consistent profitability, even during periods of fluctuating commodity prices. This segment forms the financial backbone supporting other CHS operations.

In fiscal year 2024, CHS reported total revenues of $43.6 billion, a slight decrease from the previous year, partly due to lower commodity prices. However, the sheer volume of grain handled by CHS, which processed 1.2 billion bushels in FY2023, continues to generate reliable cash flow, underscoring the stability of this core business.

The cooperative's established crop nutrients distribution network also functions as a Cash Cow. It benefits from consistent demand from farmers, reflecting its essential role in agricultural productivity. CHS's extensive network ensures dependable cash flow in this mature market where it holds a strong position.

For the fiscal year ended August 31, 2024, CHS reported earnings from its Ag segment, which includes crop nutrients, of $1.2 billion. This segment saw improved margins and increased volumes for agronomy products, projecting continued dependable income generation.

CHS's refined fuels distribution, covering gasoline, diesel, and propane, is a significant contributor to its energy segment. Despite anticipated challenges like less favorable refining margins and planned maintenance in FY2024 and Q3 FY2025, this segment remains a key revenue generator.

In fiscal year 2023, CHS's energy segment generated substantial earnings, highlighting the consistent cash flow from refined fuels distribution. This segment, while mature, provides a stable income stream that supports the cooperative's overall financial health.

CHS's investment in CF Nitrogen, an equity method investment, consistently provides significant income. Operating in the urea and UAN market, a vital sector for agriculture, this joint venture leverages CHS's substantial market share to deliver a reliable earnings stream, effectively buffering against global price volatility.

The CF Nitrogen joint venture perfectly embodies the Cash Cow characteristics of the BCG matrix. It operates in a stable, established market with a high market share, generating consistent profits with minimal need for further investment.

CHS's financial and risk management services, including insurance and business solutions for its member-owners, act as a Cash Cow. This segment is known for its stability and predictable, albeit modest, growth. The loyal customer base ensures consistent, recurring revenue streams.

In fiscal year 2024, CHS reported strong performance across its portfolio, with its insurance operations contributing significantly due to high retention rates, reinforcing the dependable nature of this revenue stream.

| Business Segment | BCG Category | Key Characteristics | FY2023 Revenue (Billions USD) | FY2024 Contribution Insight |

|---|---|---|---|---|

| Grain Marketing & Origination (US) | Cash Cow | High market share, stable cash flow, mature market | N/A (part of Ag segment) | Reliable profits despite lower commodity prices; processed 1.2 billion bushels in FY2023. |

| Crop Nutrients Distribution | Cash Cow | Essential product, stable demand, extensive network | N/A (part of Ag segment) | $1.2 billion earnings from Ag segment in FY2024; improved margins and volumes. |

| Refined Fuels Distribution | Cash Cow | Mature market leader, consistent revenue, significant energy contributor | N/A (part of Energy segment) | Significant earnings in FY2023; expected headwinds but remains a key revenue generator. |

| CF Nitrogen (Equity Investment) | Cash Cow | High market share in mature market, stable income stream | N/A (equity method) | Consistent positive income contribution; record cooperative net income of $955 million in FY2023 driven by inputs. |

| Financial & Risk Management Services | Cash Cow | Stable revenue, loyal customer base, predictable growth | N/A (part of other segments) | Significant contributions from insurance operations in FY2024; high retention rates. |

Preview = Final Product

CHS BCG Matrix

The CHS BCG Matrix preview you see is the identical, fully-formatted document you will receive upon purchase. This means no watermarks, no demo content, and no hidden surprises—just a professional, analysis-ready strategic tool. You can confidently use this preview as a direct representation of the high-quality, actionable insights you'll gain. Once purchased, this comprehensive matrix will be immediately available for your strategic planning needs, ready for immediate use in presentations or internal analysis.

Dogs

Some of CHS's older grain handling facilities, prior to recent strategic investments, likely fit the profile of a 'Dog' in the BCG matrix. These might have been characterized by low market share within their specific regions and limited growth prospects due to outdated infrastructure or inefficient operations.

For instance, a facility built decades ago might struggle to handle the increased volume and specialized needs of modern grain markets, impacting its competitive standing. In 2023, the agricultural sector saw continued consolidation, making older, less efficient facilities even more vulnerable if they couldn't adapt to larger-scale operations and advanced logistics.

These 'Dog' assets would necessitate careful consideration: either significant capital infusion for modernization and integration into CHS's enhanced supply chain capabilities, or potential divestiture if the return on investment for upgrades is deemed too low compared to their current or potential future performance.

Within the CHS portfolio, underperforming regional retail agronomy locations often fall into the Dogs category of the BCG Matrix. These sites might be grappling with heightened local competition or a downturn in agricultural activity within their specific geographic areas.

These locations typically show both low market share and low market growth. For instance, in 2024, some rural agricultural hubs experienced a contraction in planted acreage due to factors like water scarcity or shifting crop economics, directly impacting the sales volume for local agronomy centers.

Such underperforming units can become cash traps, demanding significant capital for revitalization or operational support without yielding proportional returns. CHS must carefully evaluate whether divesting or restructuring these locations is more beneficial than continued investment.

Certain legacy food ingredient products, particularly those based on older processing methods or ingredients that have fallen out of favor with health-conscious consumers, can be categorized as dogs. For instance, a company might have a line of artificial flavorings that are seeing reduced demand as consumers increasingly seek natural alternatives. In 2024, the global market for natural food ingredients was projected to grow significantly, while the demand for artificial ingredients faced stagnation or decline in many developed markets.

Niche or Unprofitable Energy Distribution Points

Niche or unprofitable energy distribution points, often characterized by their geographically limited scope or very small operational scale, can struggle significantly to achieve economies of scale. These entities may also face intense local competition, making it difficult to capture a substantial market share. For instance, a small rural electricity cooperative in 2024, serving only a few hundred homes, might have a cost per kilowatt-hour that is considerably higher than larger, more integrated utilities. Their low market share and dim growth prospects often signal a need for strategic review or potential divestment.

These specific segments of the energy distribution market, while potentially serving vital local needs, can represent a drag on overall portfolio performance. Their inability to leverage scale means higher operational costs relative to revenue. For example, a small, independent propane distributor operating in a declining industrial area might see its customer base shrink year over year, further eroding its profitability. This lack of growth and market penetration positions them as potential candidates for divestment as part of a broader portfolio optimization strategy.

- Limited Economies of Scale: Small, localized distribution points often lack the volume to negotiate favorable terms with suppliers or spread fixed infrastructure costs efficiently.

- Intense Local Competition: Even in niche markets, a few dominant players or numerous small competitors can drive down margins.

- Low Market Share and Growth Prospects: These factors combined make such operations unattractive for further investment and signal potential divestment.

Recalled or Problematic Feed Product Lines

The recall of 'Payback Champion Lamb Feed' in July 2025 due to health risks is a clear indicator of a problematic product line. This situation, if unresolved, could position the feed as a low-growth, low-market share 'Dog' in the BCG Matrix, consuming resources without generating substantial returns.

Such recalls often lead to decreased consumer confidence and potentially higher operational costs associated with managing the fallout. For instance, a significant recall could impact future sales projections by an estimated 10-15% in the immediate aftermath, based on industry trends following similar incidents.

- Product Recall Impact: 'Payback Champion Lamb Feed' recall in July 2025 due to health concerns.

- BCG Matrix Classification: Likely categorized as a 'Dog' due to low market share and low growth prospects post-recall.

- Financial Implications: Potential for increased operational costs and a projected 10-15% drop in immediate sales.

- Reputational Damage: Risk of lasting negative impact on brand perception and future product adoption.

Products or business units classified as Dogs in the BCG Matrix are characterized by low market share and low market growth. These segments often require significant resources for maintenance but generate minimal returns, acting as cash drains rather than contributors.

For CHS, these could include older grain handling facilities or underperforming regional agronomy centers that struggle with modernization or local market shifts. In 2024, agricultural hubs facing water scarcity or acreage contraction directly impacted the performance of these legacy operations.

Divesting or restructuring these 'Dog' assets is often a strategic imperative to free up capital and focus on more promising areas of the business. The decision hinges on whether the cost of revitalization outweighs the potential future returns.

The following table illustrates potential 'Dog' segments within a diversified agricultural cooperative like CHS, highlighting their typical characteristics and strategic considerations.

| Business Segment Example | BCG Classification | Key Characteristics | Strategic Consideration |

|---|---|---|---|

| Legacy Grain Handling Facilities | Dog | Low market share in region, outdated infrastructure, inefficient operations | Modernization investment or divestiture |

| Underperforming Agronomy Centers | Dog | Low market share, declining local agricultural activity, high competition | Restructuring, divestiture, or targeted revitalization |

| Niche/Unprofitable Energy Distribution Points | Dog | Limited geographic scope, small operational scale, high cost per unit | Divestment or integration into larger networks |

| Legacy Food Ingredient Lines | Dog | Declining consumer demand for older processing methods, shift to natural alternatives | Product line rationalization or reformulation |

Question Marks

CHS is actively venturing into emerging biofuel and sustainable energy sectors, particularly focusing on areas like sustainable aviation fuel. This strategic move taps into the robust growth trajectory of renewable energy, a market projected to see significant expansion in the coming years. For instance, the global sustainable aviation fuel market alone was valued at approximately $1.9 billion in 2023 and is anticipated to reach over $15 billion by 2030, demonstrating a compound annual growth rate of around 35%.

Despite this promising outlook, CHS's current market share within these specialized and still-developing biofuel markets is likely modest. These ventures are characterized by nascent technologies and evolving market dynamics, meaning CHS is positioned as a player in a high-potential, but currently niche, segment of the broader energy landscape. Their investment here signifies a bet on future market leadership rather than dominance in established segments.

Developing proprietary digital agriculture platforms represents a significant investment for CHS, fitting into the question mark category of the BCG matrix. These platforms, designed for farm management, data analytics, and supply chain optimization, require substantial upfront capital to build and market effectively. While the potential for high growth exists, initial market adoption can be slow as farmers integrate new technologies into their operations.

Expansion into untapped international agricultural markets represents a classic 'Question Mark' opportunity within the CHS BCG Matrix. These markets, often characterized by emerging economies or less developed agricultural infrastructures, offer substantial growth potential but currently hold a very low market share for CHS. For instance, exploring opportunities in parts of Sub-Saharan Africa or Southeast Asia, where agricultural output is growing but often faces logistical and technological challenges, fits this profile.

Such ventures demand significant capital investment for infrastructure development, market penetration, and navigating complex regulatory environments. CHS would need to deploy substantial resources to establish a foothold, build relationships with local stakeholders, and adapt its offerings to diverse local needs.

The potential upside is considerable, as these markets could become future growth engines. However, the inherent risks, including political instability, currency fluctuations, and unpredictable market demand, mean that success is far from guaranteed, necessitating careful strategic planning and risk management.

High-Tech Crop Protection and Soil Health Innovations (Early Stage)

Innovations like Velora™ for residue management and Anoculare™ for soybean inoculation represent significant advancements in agricultural technology. These early-stage products target critical areas of crop protection and soil health, aligning with the increasing demand for sustainable farming practices. Their novelty suggests a high potential for growth as the agricultural sector increasingly adopts biological solutions.

Despite their innovative nature, these products are likely to occupy a low market share initially. This is typical for new entrants in the ag-tech space, requiring considerable investment in market education, distribution, and farmer adoption. The competitive landscape, while evolving, still sees established chemical solutions dominating, presenting a challenge for market penetration.

- High Growth Potential: Products address growing needs for sustainable agriculture and biological solutions.

- Low Market Share: As new entrants, initial market penetration is expected to be limited.

- Investment Needs: Substantial marketing and adoption efforts are required for success.

- Market Validation: The agricultural sector is increasingly receptive to science-backed biologicals, with the global biopesticides market projected to reach $10.4 billion by 2025, growing at a CAGR of 13.5%.

Advanced Financial Products for Emerging Agricultural Risks

Developing highly specialized financial products to manage emerging agricultural risks, such as climate risk hedging or new commodity derivatives, presents a significant opportunity. These bespoke solutions, while currently having low market penetration, require substantial investment in development and client education. For instance, the global agricultural derivatives market, while growing, still offers ample room for innovation in managing climate-related volatility.

- Climate Risk Hedging: Products like weather derivatives or parametric insurance can protect farmers from unpredictable weather events, a growing concern with climate change impacting yields.

- New Commodity Derivatives: The emergence of new bio-based commodities or shifts in global food demand could spur the creation of novel derivative contracts to manage price volatility.

- Market Penetration Challenges: Early adoption of these advanced products will likely be concentrated among larger agricultural enterprises or cooperatives due to the need for sophisticated risk management capabilities.

- Investment Needs: Significant capital is required not only for product creation but also for building the necessary infrastructure and educational outreach to foster market understanding and adoption.

Question Marks represent areas where CHS is investing in high-growth potential markets but currently holds a small market share. These ventures require significant capital and strategic focus to convert into Stars. Success is not guaranteed, making them a critical area for careful evaluation and resource allocation.

CHS's foray into sustainable aviation fuel and proprietary digital agriculture platforms are prime examples of Question Marks. These sectors, while showing immense promise, demand substantial upfront investment and face the challenge of building market adoption against established players or nascent technologies.

Expanding into underdeveloped international agricultural markets and developing specialized financial risk products also fall into this category. These initiatives offer the allure of future market leadership but come with inherent risks and the need for extensive market development and client education.

The success of these Question Marks hinges on CHS's ability to effectively navigate evolving market dynamics, secure necessary funding, and drive product or service adoption, transforming them into future revenue drivers.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, growth rates, and competitive analyses, alongside industry expert opinions to provide a robust strategic overview.