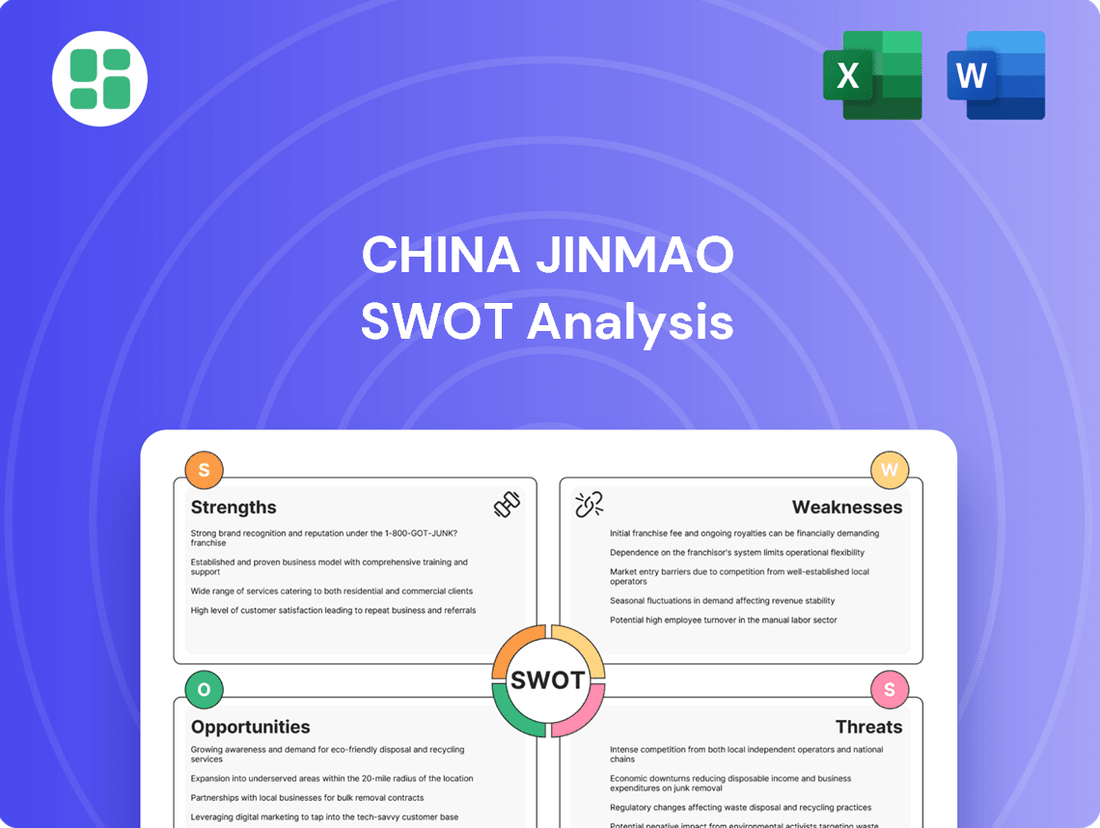

China Jinmao SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Jinmao Bundle

China Jinmao's robust brand recognition and extensive property portfolio present significant strengths in a dynamic real estate market. However, navigating evolving regulatory landscapes and potential economic headwinds poses notable challenges.

Want the full story behind China Jinmao's competitive advantages, market vulnerabilities, and strategic opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your investment decisions and strategic planning.

Strengths

China Jinmao's diversified and integrated business model is a significant strength, encompassing high-end residential and commercial property development, hotel operations, urban complex management, and property management services. This broad portfolio generates multiple revenue streams, contributing to overall business resilience. For instance, in the first half of 2024, the company reported a 13.6% year-on-year increase in revenue, demonstrating the effectiveness of its integrated approach.

China Jinmao's strategic emphasis on high-end properties and premium services is a significant advantage, setting it apart in China's crowded real estate sector. This specialization typically leads to better profit margins and enhances its image as a provider of quality and luxury. For instance, in the first half of 2024, the company reported a robust growth in its high-end segment, contributing significantly to its overall revenue.

As a key platform enterprise under Sinochem Holdings Corporation Ltd., a prominent state-owned entity, China Jinmao enjoys substantial backing and access to considerable resources. This affiliation offers a significant advantage, fostering stability, facilitating capital acquisition, and providing a competitive edge in securing prime land and navigating complex regulatory environments.

The robust financial performance and active land acquisition strategies of its parent company, Sinochem Holdings, directly translate into strong support for China Jinmao Property Services' expansion initiatives. For instance, Sinochem Holdings reported a net profit of RMB 33.4 billion in 2023, demonstrating its financial strength which underpins Jinmao's strategic growth.

Extensive National Presence in Core Cities

China Jinmao boasts an extensive national presence, strategically anchored in China's most dynamic economic hubs. This includes significant footprints in the Beijing-Tianjin-Hebei Metropolitan Region, the Yangtze River Delta, and the Pearl River Delta, areas known for robust growth and high population density.

The company's portfolio features projects in key Tier 1 cities such as Beijing, Shanghai, Guangzhou, and Tianjin. These locations offer consistent demand and strong economic fundamentals, providing a stable base for operations and future expansion. As of late 2024, China Jinmao continued to leverage these core city advantages, with these regions representing a substantial portion of its total asset value and revenue streams.

- Strategic Geographic Focus: Operations concentrated in China's primary economic zones.

- Tier 1 City Penetration: Projects located in major metropolitan areas with high market demand.

- Economic Resilience: Presence in regions with strong underlying economic drivers.

Commitment to Quality and Innovation in City Operations

China Jinmao's dedication to quality and innovation is a significant strength, underpinning its vision of 'Unleashing Future Vitality of the City'. By positioning itself as a city operator, the company integrates premium resources and thoughtful urban planning, setting it apart in the real estate sector.

The focus on 'smart technology and green health' as distinct product attributes directly addresses evolving consumer preferences for sustainable and technologically advanced living spaces. This commitment is not just aspirational; it translates into tangible competitive advantages, attracting a discerning customer base increasingly valuing these integrated solutions.

For instance, in 2024, China Jinmao continued to emphasize its smart city initiatives, with projects incorporating advanced building management systems and eco-friendly design principles. This strategic differentiation helps the company command premium pricing and build stronger brand loyalty in a competitive market.

Key aspects of this strength include:

- Visionary City Operator Model: Integrating resources for holistic urban development.

- Smart Technology Integration: Enhancing living experiences through advanced tech.

- Green Health Focus: Prioritizing sustainable and well-being aspects in projects.

- Premium Product Attributes: Differentiating offerings to attract discerning customers.

China Jinmao's diversified business model, spanning property development, hotels, and urban complexes, creates multiple revenue streams and enhances resilience. This integrated approach was evident in the first half of 2024, with revenue climbing 13.6% year-on-year. The company's strategic focus on high-end properties further bolsters its market position, leading to improved profit margins and a strong brand image, as demonstrated by robust growth in its premium segment during the same period.

As a key enterprise under Sinochem Holdings, China Jinmao benefits from significant state backing, ensuring stability and facilitating capital access. This affiliation provides a competitive edge in land acquisition and regulatory navigation. Sinochem Holdings' strong financial performance, including a 2023 net profit of RMB 33.4 billion, directly supports Jinmao's expansion strategies.

China Jinmao's commitment to quality and innovation, particularly its 'smart technology and green health' initiatives, differentiates it in the market. These efforts align with evolving consumer preferences for sustainable and advanced living spaces, enabling premium pricing and fostering customer loyalty. Projects in 2024 showcased these advancements, integrating modern building systems and eco-friendly designs.

| Metric | H1 2024 | 2023 |

|---|---|---|

| Revenue Growth (YoY) | 13.6% | N/A |

| Sinochem Holdings Net Profit | N/A | RMB 33.4 billion |

What is included in the product

Analyzes China Jinmao’s competitive position through key internal and external factors, highlighting its strengths in property development and brand recognition while also identifying potential weaknesses in debt management and market opportunities in urban renewal.

Highlights key competitive advantages and market vulnerabilities for China Jinmao, enabling targeted strategy development and risk mitigation.

Weaknesses

China Jinmao's focus on high-end properties doesn't shield it from the wider turbulence in China's property sector. A downturn in new home sales, coupled with unsold inventory and a generally cautious market mood, could directly affect the company's revenue from development projects and the valuation of its existing properties.

The impact is already visible, as sales for China's top 100 developers saw a decline in the initial months of 2025, indicating a challenging environment that could pressure Jinmao's financial performance.

China Jinmao's core businesses in real estate development and urban complex management demand significant capital for land acquisition and construction. This inherent capital intensity can strain financial resources, particularly when market conditions become challenging.

While state backing is a strength, the company's financial health can be vulnerable to high debt-to-equity ratios or elevated financing costs. For instance, as of the first half of 2024, China Jinmao reported a gearing ratio of approximately 1.1 times, indicating a considerable reliance on debt financing which can amplify financial risks during periods of economic slowdown or rising interest rates.

China Jinmao, like other developers, faces significant headwinds from stringent government regulations in the real estate sector. Policies such as the 'three red lines,' introduced to curb developer debt, directly impact their financial flexibility, potentially leading to liquidity issues and hindering access to capital for new projects or expansion. This regulatory environment, while designed for market stability, introduces considerable uncertainty and can stifle growth.

Competition in the High-End Market

China Jinmao's focus on high-end properties, while strategic, exposes it to fierce competition. Major domestic and international developers are also vying for a share of this lucrative segment, intensifying the battle for market dominance. This rivalry necessitates constant innovation in design, amenities, and customer experience to stand out.

The pressure to differentiate in the luxury market is significant. Developers must offer unique value propositions to attract discerning buyers, which can lead to increased marketing and development costs. For instance, in 2024, the luxury property market saw a surge in demand for smart home features and sustainable building practices, pushing developers to invest more in these areas.

This competitive landscape can impact pricing power and market share. Developers like China Jinmao need to carefully manage their pricing strategies to remain competitive while maintaining profitability. Brand reputation and a proven track record become crucial differentiators in attracting buyers who prioritize trust and quality in their high-value investments.

- Intense Competition: China Jinmao faces strong rivalry from established luxury developers in key Chinese cities.

- Pricing Pressure: Competition can force developers to adjust pricing, potentially impacting profit margins.

- Differentiation Challenges: Standing out in the luxury segment requires continuous innovation in product offerings and branding.

- Market Share Impact: Fierce competition can limit market share gains if differentiation strategies are not effective.

Dependency on Domestic Economic Conditions

China Jinmao's reliance on the domestic economy presents a significant weakness. The company's performance, especially in its premium residential, commercial, and hospitality sectors, is directly influenced by China's economic trajectory and consumer sentiment. A downturn in economic growth or a dip in consumer spending on discretionary items like luxury real estate and hotel services can directly curtail its revenue streams and profitability.

For instance, during periods of economic uncertainty in China, such as the property market adjustments seen in 2023 and early 2024, companies heavily invested in the domestic real estate sector, like China Jinmao, often experience pressure on sales volumes and pricing power. This sensitivity means that any slowdown in China's GDP growth or a decrease in household disposable income can disproportionately affect Jinmao's financial results.

- Economic Sensitivity: Performance is closely linked to China's GDP growth and consumer confidence.

- Impact on High-End Segments: Luxury residential, commercial, and hotel operations are particularly vulnerable to economic slowdowns.

- Reduced Consumer Spending: A decline in discretionary spending directly affects revenue and profitability.

China Jinmao's substantial debt load is a significant vulnerability. The company's gearing ratio, reported at approximately 1.1 times in the first half of 2024, highlights a considerable reliance on borrowed funds. This high leverage amplifies financial risk, especially during economic downturns or periods of rising interest rates, potentially impacting liquidity and access to capital.

The company's capital-intensive business model, centered on real estate development and urban complex management, necessitates continuous investment in land acquisition and construction. This inherent need for capital can strain financial resources, particularly when market conditions are unfavorable, as seen in the broader Chinese property sector's challenges in early 2025.

Stringent government regulations, such as the 'three red lines' policy aimed at curbing developer debt, directly limit China Jinmao's financial flexibility. These policies can lead to liquidity challenges and hinder the company's ability to secure funding for new projects, thereby impacting its growth potential.

China Jinmao faces intense competition within the high-end property market. Rivalry from both domestic and international developers necessitates significant investment in differentiation through design and amenities, potentially increasing costs and impacting pricing power and market share if strategies are not effectively executed.

| Metric | Value (H1 2024) | Implication |

|---|---|---|

| Gearing Ratio | ~1.1 times | High reliance on debt, increasing financial risk. |

| Capital Intensity | High | Requires continuous funding for land and construction. |

| Regulatory Environment | Challenging ('three red lines') | Limits financial flexibility and access to capital. |

| Competitive Landscape | Intense (High-end segment) | Pressures pricing, necessitates higher investment in differentiation. |

Full Version Awaits

China Jinmao SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing an actual excerpt from the China Jinmao SWOT analysis, ensuring you know exactly what you're getting. Purchase unlocks the complete, in-depth report.

Opportunities

China's commitment to urbanization and urban renewal is a major tailwind for China Jinmao. The government's goal to renovate old urban residential areas by 2025 is a direct driver for the company's integrated urban development and property management services.

China's domestic tourism sector is experiencing a significant upswing, with projections indicating continued growth through 2025. This surge, fueled by rising disposable incomes and targeted government initiatives, presents a prime opportunity for China Jinmao's hotel and commercial leasing businesses. For instance, the luxury hotel segment alone saw a notable increase in occupancy rates and average daily rates in late 2024, reflecting strong consumer confidence in high-end hospitality experiences.

China Jinmao can capitalize on opportunities by strategically expanding into new tier-one and tier-two cities that exhibit robust economic growth and a clear demand for its integrated development model. Despite broader market headwinds, the company has been actively building its land reserves, evidenced by its land acquisition activities throughout 2024, which position it for future development in these promising urban centers.

Leveraging Smart Technology and Green Building Trends

China Jinmao's strategic focus on smart technology and green building principles directly taps into a burgeoning market demand. This approach resonates with increasing consumer interest in eco-friendly and technologically advanced living spaces, a trend strongly supported by Chinese government policies promoting sustainable urban development. For instance, by 2023, green building certifications had expanded significantly, with over 3.5 billion square meters of certified green buildings across China, indicating a robust market for Jinmao's offerings.

Further investment in these 'smart and green' initiatives presents a clear opportunity for China Jinmao to differentiate its product portfolio and capture a larger market share. This can translate into enhanced product competitiveness, potentially commanding premium pricing, and opening avenues for new revenue streams through integrated smart home services or advanced energy-efficient solutions. The company's commitment to these trends positions it favorably for future growth in a rapidly evolving real estate landscape.

Key opportunities arising from this focus include:

- Enhanced Brand Reputation: Aligning with 'smart and green' trends bolsters Jinmao's image as a forward-thinking and responsible developer.

- Market Differentiation: Offering advanced smart home features and sustainable designs sets Jinmao apart from competitors.

- New Revenue Streams: Opportunities exist in developing and monetizing smart home ecosystems and energy management services.

- Policy Alignment: Capitalizing on government incentives and regulations favoring green and intelligent construction.

Potential for Market Stabilization and Policy Support

The Chinese government is actively working to stabilize the real estate market. Measures like reducing mortgage rates and providing financial support for purchasing unsold properties aim to boost developer confidence and consumer sentiment. This policy environment could foster a more predictable market, creating opportunities for established players.

China Jinmao, being a state-backed enterprise, is strategically positioned to leverage these stabilization efforts. Its access to capital and potential preferential treatment under supportive policies could allow it to navigate the market downturn more effectively than private developers. For instance, by the end of 2023, the People's Bank of China had announced a significant cut in the mortgage rate for first-time homebuyers, a move designed to stimulate demand.

- Government Stimulus: Policy interventions are aimed at preventing a sharp decline and encouraging a gradual market recovery.

- State Backing Advantage: China Jinmao's status could translate into better access to funding and regulatory support.

- Improved Sentiment: Efforts to stabilize the market are expected to gradually improve buyer confidence.

China Jinmao is well-positioned to benefit from the nation's ongoing urbanization and urban renewal initiatives, with government targets for renovating old residential areas by 2025 directly supporting its integrated development services. The company's focus on smart and green building principles aligns with increasing consumer demand and government policies promoting sustainable urban development, a trend evidenced by the significant growth in certified green buildings across China, exceeding 3.5 billion square meters by 2023.

The burgeoning domestic tourism sector, projected for continued growth through 2025, presents a strong opportunity for Jinmao's hospitality and commercial leasing segments, with the luxury hotel market showing robust recovery in late 2024. Furthermore, strategic expansion into high-growth tier-one and tier-two cities, supported by Jinmao's active land acquisition throughout 2024, positions the company to capitalize on future urban development needs.

| Opportunity Area | Description | Supporting Data/Trend |

|---|---|---|

| Urbanization & Renewal | Leveraging government-driven urban development projects. | Target for old urban residential area renovation by 2025. |

| Smart & Green Buildings | Meeting demand for eco-friendly and technologically advanced properties. | Over 3.5 billion sq. meters of certified green buildings by 2023. |

| Domestic Tourism Growth | Capitalizing on increased travel and hospitality spending. | Luxury hotel segment occupancy and ADR increased in late 2024. |

| Strategic City Expansion | Expanding land reserves in economically vibrant urban centers. | Active land acquisition throughout 2024 in tier-one/two cities. |

Threats

A major threat for China Jinmao is the persistent weakness in China's real estate sector. This downturn is marked by declining property sales, reduced investment, and a significant overhang of unsold inventory. Fitch Ratings anticipates a further drop in new home sales throughout 2025, signaling a difficult operating landscape for developers like China Jinmao.

China Jinmao faces significant threats from a tightening regulatory environment. The government's ongoing efforts to curb excessive debt and speculative real estate investment, exemplified by the 'three red lines' policy, continue to pose a risk. This policy, introduced in 2020, has already led to considerable liquidity challenges for many developers, and further tightening could severely restrict Jinmao's ability to finance its operations and expansion plans.

The potential for new or more stringent regulations targeting the property sector, particularly concerning leverage and sales practices, remains a key concern. For example, in early 2024, discussions around potential adjustments to property transaction taxes or stricter rules on pre-sale funds could emerge, directly impacting cash flow and profitability. Such policy shifts could disproportionately affect developers like Jinmao, limiting their growth trajectory and potentially leading to increased financial strain.

A prolonged economic slowdown in China, potentially exacerbated by global economic headwinds, poses a significant threat. This slowdown, coupled with a less certain job market, could directly dampen consumer confidence. Consequently, individuals might scale back on discretionary spending, including investments in premium real estate and luxury hospitality, which are core to China Jinmao's business model.

Intensifying Competition and Market Fragmentation

China Jinmao faces a significant threat from intensifying competition within China's vast real estate and property management sectors. The market is crowded with many companies, both state-owned and private, all competing for a slice of the pie.

This fierce competition can force price wars, which inevitably squeeze profit margins and make it harder for Jinmao to win lucrative development projects. For instance, by the end of 2023, the top 100 developers in China saw their collective sales decline, highlighting the pressure on all players in the market.

The fragmentation of the market means that Jinmao must constantly innovate and offer compelling value propositions to stand out. Well-capitalized competitors can also leverage their financial strength to outbid others for prime land and projects, further complicating Jinmao's strategic positioning.

- High Market Saturation: Numerous domestic and international developers are active in China, leading to oversupply in certain segments.

- Price Sensitivity: Buyers and tenants are increasingly price-conscious, especially in a moderating economic environment, forcing developers to offer discounts.

- Emergence of Niche Players: Specialized property management firms and boutique developers are gaining traction by focusing on specific market needs, fragmenting market share further.

Rising Financing Costs and Liquidity Challenges

Rising interest rates present a significant hurdle for China Jinmao. If borrowing costs increase, the expense of funding its extensive development projects will climb, impacting profitability. For instance, in early 2024, benchmark lending rates remained elevated, reflecting ongoing monetary policy adjustments.

Furthermore, broader liquidity challenges within China's property sector, even for state-backed entities like Jinmao, could create difficulties. This tightening environment might make it harder to secure new funding or manage existing debt obligations efficiently, potentially affecting project timelines and financial flexibility.

- Increased Debt Servicing Costs: Higher interest rates directly inflate the cost of servicing China Jinmao's substantial debt load.

- Reduced Access to Capital: A general tightening of credit conditions in the property market could limit Jinmao's ability to raise capital for new ventures or refinancing.

- Impact on Project Viability: Elevated financing costs can make previously feasible projects less attractive, potentially leading to delays or cancellations.

The ongoing contraction in China's property market remains a primary threat, with Fitch Ratings projecting a further 5% to 10% decline in new home sales for 2025, impacting sales volumes and revenue for developers like China Jinmao.

Stricter regulatory oversight, particularly concerning developer leverage and capital controls, continues to pose a significant risk, potentially limiting Jinmao's financial flexibility and access to funding for new projects.

Intensifying competition within the real estate sector, evidenced by the continued sales decline of top developers in 2023, pressures profit margins and necessitates constant innovation to secure profitable projects.

Rising interest rates, with benchmark lending rates remaining elevated in early 2024, directly increase debt servicing costs for China Jinmao and could impact the viability of new developments.

SWOT Analysis Data Sources

This China Jinmao SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial statements, comprehensive market research reports, and insightful industry expert commentary. This multi-faceted approach ensures a thorough understanding of both internal capabilities and external market dynamics.