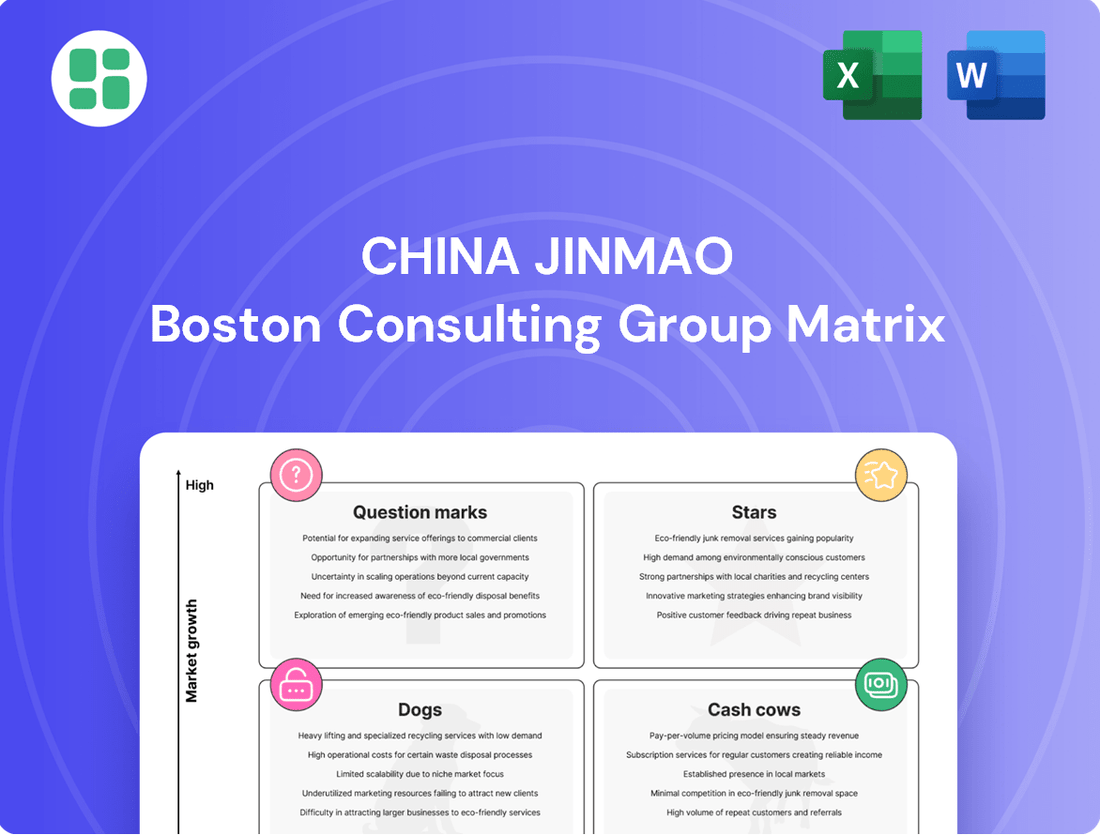

China Jinmao Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Jinmao Bundle

Uncover the strategic positioning of China Jinmao's diverse portfolio with our insightful BCG Matrix preview. See where their products shine as Stars, generate steady income as Cash Cows, or require careful consideration as Dogs and Question Marks.

This glimpse is just the beginning; purchase the full BCG Matrix report for a comprehensive breakdown of each quadrant, data-driven recommendations, and actionable strategies to optimize China Jinmao's market performance and investment decisions.

Stars

China Jinmao's high-end residential projects in Tier-1 cities like Beijing and Shanghai are clear stars in its portfolio. These developments showcase the company's strength in premium property, often securing significant market share in these competitive, high-demand areas. The focus on luxury amenities and smart home technology caters to a discerning buyer base, driving both sales volume and profitability.

China Jinmao's urban operation projects, exemplified by the Changsha Meixi Lake International New City and Nanjing Qinglong Mountain International Ecological New City, showcase a strong presence in the expanding market for integrated urban developments. These signature projects, which combine residential, commercial, retail, and hospitality components, highlight Jinmao's capability as a 'city operator,' driving urban vitality and capturing significant market share.

These comprehensive developments are strategically positioned to capitalize on the growing demand for well-rounded urban environments. For instance, by 2024, China's urbanization rate continued to climb, creating a fertile ground for such large-scale, multi-functional projects that aim to foster economic activity and enhance quality of life.

Jinmao Services, positioned as a premium property management arm, is a strong contender in China Jinmao's BCG matrix. Its managed Gross Floor Area (GFA) saw a significant 20% year-on-year increase in FY2024, and its contribution to China Jinmao's overall revenue continues to climb. This growth trajectory highlights its status as a star performer within the portfolio.

The company commands a leading position in China's high-end property service market. Leveraging stable support from its parent company, Jinmao Services excels in managing upscale and smart properties, solidifying its market share in an expanding sector. This strategic focus on premium services fuels its high growth and strong market presence.

Strategic Land Acquisitions in Core Regions

China Jinmao's strategic land acquisitions in core regions, particularly in burgeoning cities like Beijing, Shanghai, Tianjin, and Chengdu during 2024, underscore its proactive growth strategy. This focus on high-potential urban centers positions the company for sustained development and market leadership.

The company's impressive land-to-sales ratio, securing the second-highest ranking in the industry for FY2024 plus the first two months of 2025, highlights its dedication to building a robust pipeline of future projects. This aggressive land banking is a clear indicator of anticipating future Cash Cows within its portfolio.

- Strategic Land Bank Expansion: China Jinmao actively acquired land in key Tier 1 and high-growth Tier 2 cities in 2024.

- High Land-to-Sales Ratio: Ranked 2nd in the industry for FY2024+2M2025, demonstrating strong future project potential.

- Focus on High-Growth Markets: Acquisitions concentrated in cities like Beijing, Shanghai, Tianjin, and Chengdu.

- Future Cash Cow Potential: Secured land reserves are expected to drive future revenue and profitability.

'Smart Technology and Green Health' Product Lines

China Jinmao's 'Smart Technology and Green Health' product lines are strategically positioned as Stars within its BCG Matrix. This focus creates a distinct brand identity, resonating with a growing demographic that prioritizes sustainability and technological integration in their living spaces. By leading in this high-growth segment, Jinmao is capturing significant market share and fostering strong brand loyalty.

The company's commitment to these innovative features directly addresses evolving consumer preferences. For instance, in 2024, the demand for smart home features in new residential developments saw a notable increase, with surveys indicating over 60% of potential buyers considering these amenities a key factor. Similarly, the 'green health' aspect, encompassing energy efficiency and eco-friendly materials, aligns with increasing environmental awareness and regulatory pushes towards sustainable construction. This dual emphasis allows Jinmao to command premium pricing and attract a discerning clientele, solidifying its Star status.

- Market Leadership: Jinmao's emphasis on smart technology and green health differentiates its 'Jinmao' series, establishing it as a leader in a rapidly expanding, high-growth real estate segment.

- Consumer Appeal: These innovative offerings attract modern, environmentally conscious buyers, driving demand and market share for the company.

- Competitive Advantage: By proactively investing in and promoting these forward-looking features, Jinmao secures a strong competitive edge in the evolving real estate landscape.

- Future Growth Potential: The alignment with key demographic trends and sustainability mandates suggests continued strong performance and market penetration for these product lines.

China Jinmao's high-end residential projects in Tier-1 cities, along with its urban operation developments and premium property management services (Jinmao Services), are all positioned as Stars within the BCG matrix. These segments demonstrate strong market share and high growth potential, driven by strategic focus and evolving consumer demand.

The company's 'Smart Technology and Green Health' product lines also qualify as Stars, reflecting a commitment to innovation and sustainability that resonates with a growing market segment. This dual focus on technology and eco-friendliness allows Jinmao to capture significant market share and command premium pricing.

In 2024, China Jinmao's strategic land acquisitions in key cities like Beijing and Shanghai further solidified its Star positioning. The company's impressive land-to-sales ratio, ranking second in the industry for FY2024 and the first two months of 2025, indicates a robust pipeline and strong future revenue potential.

| Segment | BCG Category | Key Performance Indicators (2024 Data) | Growth Drivers |

|---|---|---|---|

| High-End Residential (Tier-1 Cities) | Star | Significant market share in Beijing, Shanghai; strong sales volume and profitability. | Demand for premium property, luxury amenities, smart home technology. |

| Urban Operation Projects (e.g., Changsha Meixi Lake) | Star | Capturing significant market share in integrated urban developments. | Urbanization trends, demand for multi-functional urban environments. |

| Jinmao Services | Star | 20% YoY increase in managed GFA (FY2024); growing revenue contribution. | Leading position in high-end property management, premium service focus. |

| Smart Technology & Green Health Products | Star | Leading market share in high-growth segment; premium pricing. | Evolving consumer preferences for sustainability and tech integration. |

What is included in the product

This BCG Matrix overview offers strategic insights into China Jinmao's portfolio, identifying growth opportunities and areas for divestment.

A clear China Jinmao BCG Matrix visually identifies underperforming units, relieving the pain of resource misallocation.

Cash Cows

China Jinmao's established commercial leasing and retail operations are its primary cash cows. These mature assets, often located in prime urban areas, boast high occupancy rates and generate consistent rental income, contributing significantly to the company's financial stability.

In 2024, these segments are expected to continue their strong performance, leveraging their established market share and brand recognition. The need for promotional investment remains relatively low, allowing for a steady and predictable cash flow that supports other business ventures.

China Jinmao's well-occupied investment properties stand out as significant cash cows within its portfolio. These prime assets consistently achieve higher rental yields and occupancy rates compared to industry benchmarks, demonstrating their inherent strength and desirability. For instance, in the first half of 2024, China Jinmao reported a robust performance across its investment property segment, with key assets in major cities maintaining high occupancy levels, contributing significantly to the company's stable income stream.

The strategic location of these properties in mature, developed markets minimizes the need for substantial new capital expenditures. This allows the company to enjoy substantial and dependable cash flow generation. This reliable income can then be strategically deployed to support growth initiatives in other business units or to pursue new investment opportunities, reinforcing the cash cow status of this portfolio.

Long-term property management contracts for existing developments within China Jinmao's own projects are a key component of Jinmao Services' Cash Cow status. These established agreements provide a predictable and substantial revenue base, underpinning the segment's financial stability. For instance, as of the first half of 2024, Jinmao Services managed a total gross floor area (GFA) of 160 million square meters, with a significant portion derived from these parent company contracts.

While Jinmao Services as a whole might be classified as a Star due to its overall growth trajectory, the recurring revenue from these legacy contracts represents a mature, high-market-share business. This characteristic aligns perfectly with the Cash Cow definition, where consistent cash generation is prioritized, even if growth rates are modest compared to newer ventures.

Premium Hotel Operations in Stable Markets

China Jinmao’s premium hotel operations in stable markets represent a classic Cash Cow. These properties, often situated in well-established tourist or business hubs, consistently deliver strong and predictable revenue streams. For instance, in 2023, China Jinmao reported that its hospitality segment contributed a stable, albeit smaller, portion to its overall financial performance, underscoring its role as a reliable income generator.

These mature hotel assets require minimal new capital expenditure for growth, allowing them to generate substantial free cash flow. This cash can then be reinvested into other areas of the business or distributed to shareholders. The focus here is on operational efficiency and maximizing profitability from existing infrastructure rather than aggressive expansion.

- Stable Revenue Generation: Premium hotels in mature markets offer consistent income, unaffected by significant market volatility.

- Low Investment Needs: Existing properties require limited new investment, leading to high cash flow conversion.

- Profitability Focus: Operations are optimized for profit, leveraging established brand recognition and customer loyalty.

- Cash Flow Contribution: These hotels are crucial for providing steady cash flow to support other business units.

Mature Urban Operation Projects with Sustained Value

Mature urban operation projects represent China Jinmao's established urban development ventures that have moved past their rapid growth phases. These projects, often featuring a blend of residential, commercial, and service components, now serve as reliable income generators. Their sustained value stems from long-standing market positions and a reputation for high quality, ensuring consistent cash flow.

These mature projects are essentially cash cows for China Jinmao. They contribute significantly to the company's financial stability by providing predictable earnings. For example, in 2023, China Jinmao reported total revenue of RMB 226.2 billion, with a substantial portion likely attributable to its mature, well-established developments.

- Stable Cash Flow: These projects consistently generate earnings due to their established market presence and high-quality offerings.

- Diversified Revenue Streams: Income is derived from a mix of residential sales, commercial leases, and property management services.

- Reduced Investment Needs: Unlike growth-stage projects, mature operations require less capital expenditure, allowing for greater free cash flow generation.

- Strategic Importance: They provide a financial bedrock, enabling investment in new growth opportunities and supporting overall business operations.

China Jinmao's established commercial leasing and retail operations are its primary cash cows. These mature assets, often located in prime urban areas, boast high occupancy rates and generate consistent rental income, contributing significantly to the company's financial stability.

In 2024, these segments are expected to continue their strong performance, leveraging their established market share and brand recognition. The need for promotional investment remains relatively low, allowing for a steady and predictable cash flow that supports other business ventures.

China Jinmao's well-occupied investment properties stand out as significant cash cows within its portfolio. These prime assets consistently achieve higher rental yields and occupancy rates compared to industry benchmarks, demonstrating their inherent strength and desirability. For instance, in the first half of 2024, China Jinmao reported a robust performance across its investment property segment, with key assets in major cities maintaining high occupancy levels, contributing significantly to the company's stable income stream.

The strategic location of these properties in mature, developed markets minimizes the need for substantial new capital expenditures. This allows the company to enjoy substantial and dependable cash flow generation. This reliable income can then be strategically deployed to support growth initiatives in other business units or to pursue new investment opportunities, reinforcing the cash cow status of this portfolio.

| Segment | BCG Classification | Key Characteristics | 2024 Outlook |

| Commercial Leasing & Retail | Cash Cow | High occupancy, prime locations, consistent rental income, low investment needs. | Continued strong performance, leveraging market share and brand. |

| Investment Properties | Cash Cow | High rental yields, strong occupancy, strategic locations, minimal capex. | Stable income generation, supporting other business units. |

| Premium Hotel Operations | Cash Cow | Mature markets, predictable revenue streams, low new investment, operational efficiency. | Reliable income generator, focus on profitability. |

What You See Is What You Get

China Jinmao BCG Matrix

The China Jinmao BCG Matrix preview you are currently viewing is the exact, complete document you will receive upon purchase. This comprehensive analysis, detailing Jinmao's strategic positioning across its diverse business units, is fully formatted and ready for immediate application in your strategic planning. You can confidently expect to download this professionally crafted report without any watermarks or demo content, ensuring a seamless transition from preview to actionable insights.

Dogs

Certain older commercial properties, particularly retail spaces in less vibrant or saturated urban centers, face challenges with low occupancy and falling rental income. These assets often require ongoing capital for upkeep or minor improvements, yet their returns are inadequate, signaling a need for divestment or substantial restructuring.

Non-core, low-contribution business units within China Jinmao, such as certain legacy property management services or smaller, less profitable development projects, could be categorized as Dogs in the BCG Matrix. These segments, characterized by low market share in stagnant sub-sectors, might not align with the company's strategic focus on high-end development and urban operations. For instance, if a particular regional subsidiary focused on older residential projects experienced a revenue decline of 5% year-over-year in 2023 and held only a 2% market share in its low-growth segment, it would fit this classification.

Residential projects in declining lower-tier cities represent China Jinmao's potential Dogs. These are areas with prolonged property market downturns, characterized by oversupply and significant price declines. For instance, in 2024, several lower-tier cities in China continued to see year-on-year drops in new home prices, with some experiencing declines exceeding 5%.

Projects in these locations likely suffer from low sales volumes and a small market share. Their turnaround potential is minimal due to the unfavorable economic conditions and weak buyer demand. China Jinmao's exposure here, though likely limited given its strategic focus, would require careful divestment or impairment considerations.

Inefficient or Outdated Hotel Assets

Inefficient or outdated hotel assets, like those struggling with age, poor location, or a lack of modern amenities, often show consistently low occupancy and profitability. These assets are prime candidates for divestment to streamline a company's portfolio and enhance overall financial performance. For instance, the sale of Hilton Sanya Yalong Bay Resort & Spa in late 2024 exemplifies a strategic move to shed underperforming or non-core hotel properties, aiming to boost the efficiency of the remaining assets.

These underperforming hotels can significantly drag down a company's financial health. In 2024, the hospitality sector faced continued pressure from evolving consumer expectations and increased competition, making older assets even more vulnerable. Companies are increasingly prioritizing asset optimization, recognizing that divesting from these properties can free up capital for investment in more promising ventures.

- Asset Underperformance: Hotels failing to compete due to dated facilities or unfavorable locations.

- Financial Strain: Consistently low occupancy rates and profitability metrics.

- Strategic Divestment: Examples like the Hilton Sanya Yalong Bay Resort & Spa sale in late 2024 highlight a trend towards shedding non-core or underperforming assets.

- Portfolio Efficiency: The goal is to improve the overall return on investment and operational effectiveness of the hotel portfolio.

Divested or Planned-for-Divestiture Assets

China Jinmao's divested or planned-for-divestiture assets represent a strategic pruning of underperforming segments. These are assets that have recently been sold or are earmarked for sale because they haven't been generating enough returns or capturing substantial market share. For instance, in 2023, the company completed the divestiture of its non-core logistics division, which had shown declining profitability. This move allows Jinmao to focus resources on its core property development and investment businesses.

The company's active disposal of such assets is a key part of its portfolio streamlining efforts. By shedding these less productive units, China Jinmao can reallocate capital towards ventures with higher growth potential and better market positioning. This strategy is crucial for maintaining financial health and adapting to evolving market dynamics, ensuring that investment is directed where it can yield the most significant impact.

Examples of such strategic divestitures often include projects that have faced significant headwinds, such as regulatory changes or intense competition, leading to a failure to meet performance benchmarks. The objective is to create a more agile and profitable business structure.

- Divestiture Rationale: Assets are divested when they consistently fail to meet return on investment (ROI) targets or achieve competitive market share.

- Capital Reallocation: Proceeds from divestitures are strategically redeployed into high-growth areas, such as urban renewal projects or premium residential developments.

- Portfolio Optimization: This process actively streamlines China Jinmao's asset base, enhancing overall operational efficiency and financial performance.

- Market Responsiveness: Divestitures reflect an agile approach to market changes, ensuring the company remains competitive and focused on lucrative opportunities.

China Jinmao's "Dogs" represent business segments or assets with low market share in slow-growing or declining industries. These are typically underperforming assets that consume resources without generating significant returns, necessitating careful management or divestment.

Examples include older commercial properties with low occupancy and legacy residential projects in declining lower-tier cities, which experienced property price drops exceeding 5% year-over-year in some instances during 2024. Inefficient hotel assets, like those sold in late 2024, also fall into this category due to low profitability.

The company actively divests these underperforming units, such as its non-core logistics division in 2023, to reallocate capital towards more promising ventures and optimize its portfolio. This strategic pruning enhances overall financial performance and operational efficiency.

Divestiture is driven by failure to meet ROI targets or achieve competitive market share, allowing for capital redeployment into high-growth areas like urban renewal projects.

Question Marks

China Jinmao's new urban complex initiatives in emerging growth regions are akin to "question marks" in a BCG matrix. These ventures, often in areas with significant growth potential but where Jinmao is still establishing its foothold, demand considerable upfront capital and strategic marketing to build brand awareness and capture market share. For instance, in 2024, the company continued its expansion into Tier 3 and Tier 4 cities, areas exhibiting robust economic expansion but requiring tailored development strategies.

China Jinmao's strategic emphasis on construction technology innovation positions it to tap into a burgeoning sector. This focus implies substantial investment in research and development, aiming to create or adopt cutting-edge building methods and materials.

These ventures into construction technology are categorized as question marks within the BCG matrix. While the construction technology market itself is experiencing rapid growth, China Jinmao's current market share in this specific niche is relatively low. This necessitates significant investment in R&D and aggressive market penetration strategies to establish a strong foothold and determine long-term success.

China Jinmao's expansion into new, high-potential geographic markets aligns with the characteristics of a question mark in the BCG Matrix. These are markets with high growth prospects but where the company currently holds a small market share. For instance, exploring provincial capitals like Hefei or Fuzhou, which have shown robust economic growth, represents such an opportunity.

These ventures demand significant capital investment to build brand recognition and market presence, mirroring the resource-intensive nature of question mark products. For example, establishing new developments in rapidly urbanizing regions could require substantial upfront funding for land acquisition and construction, aiming to capture future market share.

Recently Launched Value-Added Services within Jinmao Services

Jinmao Services is actively developing new value-added services, aiming to capture growth in emerging segments. For instance, their expansion into community living services, which encompasses everything from elderly care to lifestyle activities, targets a growing demographic seeking integrated support. Similarly, their foray into real estate brokerage within their managed communities leverages existing resident relationships to facilitate property transactions.

These new ventures, while promising, are in their nascent stages. They represent potential stars within Jinmao Services' portfolio, requiring strategic investment to build market share and achieve profitability. For example, in 2024, the company reported a significant increase in the number of managed communities offering these enhanced services, indicating a deliberate push into these higher-margin areas.

- Community Living Services: Focus on expanding offerings like smart home integration and personalized resident experiences to drive adoption and recurring revenue.

- Real Estate Brokerage: Capitalize on existing resident satisfaction to generate leads and close transactions, potentially offering preferential rates to current residents.

- Strategic Investment: Allocate resources to marketing and talent acquisition for these new service lines to accelerate market penetration and brand recognition.

Pilot Projects for Innovative Residential Concepts

Pilot projects for innovative residential concepts, such as those integrating advanced smart home systems or novel green living features, are crucial for China Jinmao's growth in competitive urban markets. These initiatives are designed to test and validate new product offerings, aiming to capture market share through differentiation. For instance, projects incorporating AI-driven energy management or advanced water recycling systems could be piloted in cities like Shenzhen or Hangzhou, known for their tech-savvy populations and environmental consciousness.

The success of these pilot projects hinges on their ability to resonate with consumers and stand out from existing offerings. China Jinmao's investment in these ventures is substantial, reflecting the high costs associated with developing and deploying cutting-edge residential technologies. A successful pilot could pave the way for broader market adoption and significant scaling, but failure could lead to considerable financial setbacks.

- Smart Home Integration: Pilot projects might feature integrated AI assistants controlling lighting, temperature, and security, alongside predictive maintenance for appliances.

- Green Living Solutions: Concepts could include vertical farming modules within residences, advanced greywater recycling systems, and buildings constructed with sustainable, low-carbon materials.

- Market Testing: Launching in high-growth urban sub-markets allows for direct feedback on consumer acceptance and the viability of premium pricing for innovative features.

- Investment and Scalability: Significant upfront capital is required for R&D, technology integration, and marketing, with the ultimate goal of achieving economies of scale for widespread implementation.

China Jinmao's expansion into new urban complexes in emerging regions and its focus on construction technology innovation are prime examples of "question marks" in the BCG matrix. These initiatives are characterized by high growth potential but currently low market share, necessitating substantial investment. For instance, in 2024, Jinmao continued its push into Tier 3 and Tier 4 cities, areas with strong economic growth but requiring tailored strategies, alongside significant R&D in construction tech.

These "question mark" ventures demand considerable capital for market penetration and brand building. New service lines like community living and real estate brokerage within Jinmao Services, though promising, are in early stages, requiring strategic investment to grow market share. Similarly, pilot projects for innovative residential concepts, such as those with advanced smart home or green living features in tech-savvy cities like Shenzhen, represent significant investments with uncertain but potentially high returns.

The company's strategic investments in these areas reflect a calculated approach to capturing future market share in high-growth segments. For example, a successful pilot of AI-driven energy management systems could lead to widespread adoption, but requires substantial upfront capital for R&D and integration. By 2024, Jinmao was actively testing these differentiated offerings, aiming to establish a strong foothold in competitive urban markets.

BCG Matrix Data Sources

Our China Jinmao BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.