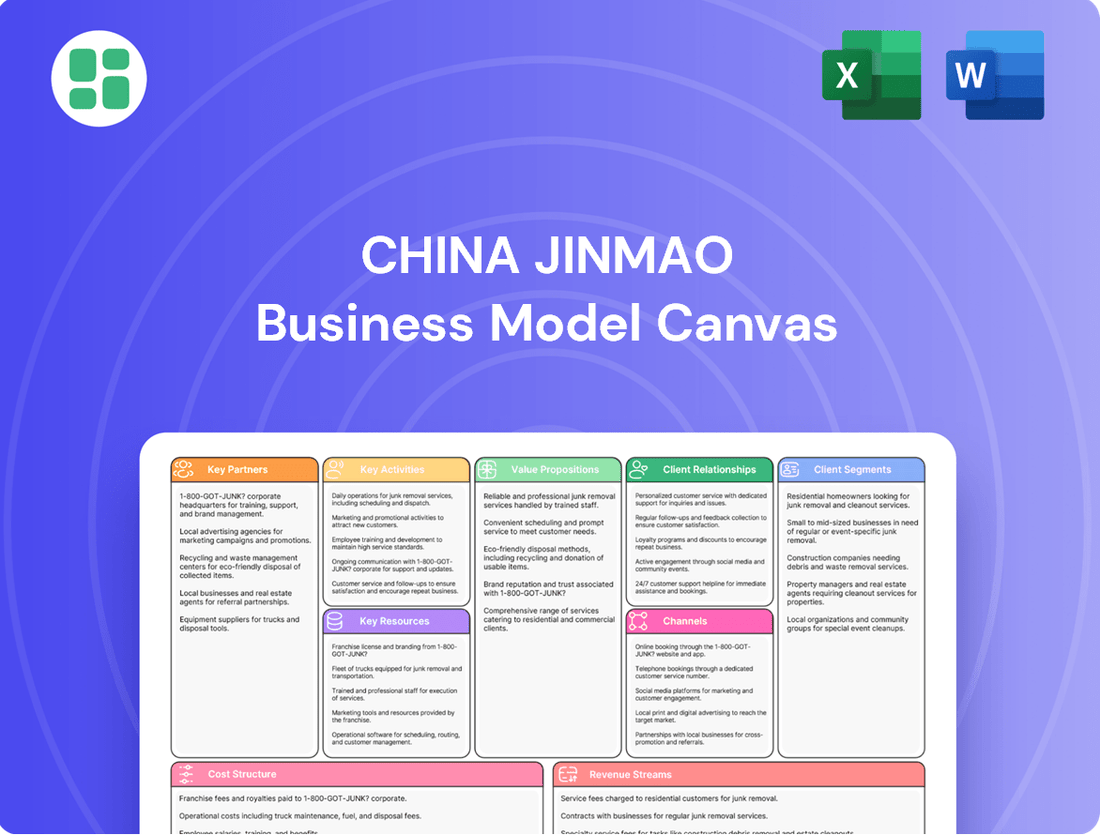

China Jinmao Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Jinmao Bundle

Unlock the strategic DNA of China Jinmao's success with our comprehensive Business Model Canvas. This in-depth analysis reveals their core customer segments, value propositions, and revenue streams, offering a clear roadmap for market penetration. Perfect for anyone seeking to understand how China Jinmao thrives, this downloadable resource provides actionable insights for your own ventures.

Partnerships

China Jinmao's relationship with government entities is foundational, enabling access to prime land for development through direct acquisition and participation in urban planning initiatives. These collaborations are vital for navigating China's complex regulatory environment and securing approvals for large-scale projects.

As a state-affiliated entity, China Jinmao benefits from the backing of its parent, Sinochem Holdings, a major state-owned enterprise. This affiliation streamlines strategic partnerships and allows for the leveraging of significant state support, which is critical for large urban development endeavors.

In 2023, China Jinmao continued to secure land through government channels, with its total land bank remaining a key asset. For instance, the company's strategic land acquisition in key cities underscores the importance of these government relationships for its growth pipeline.

China Jinmao actively collaborates with financial institutions, including major banks, to secure crucial project financing for its diverse property developments and urban complex initiatives. This includes managing its debt portfolio and facilitating capital for ongoing operations.

The company also cultivates relationships with a broad range of investors to support capital increases and explore innovative financing structures. For instance, its involvement in the Huaxia Jinmao Commercial REIT pilot program demonstrates a strategic move to attract diverse investment and ensure a consistent capital stream for its ambitious development pipeline.

China Jinmao collaborates with a diverse range of construction and engineering firms to bring its premium residential, commercial, and mixed-use developments to life. These alliances are critical for maintaining high standards of quality, operational efficiency, and adherence to project timelines for its substantial developments.

The company's commitment to integrating 'smart technology' and 'green health' features into its projects necessitates strategic partnerships with specialized technology providers and green building solution experts.

Luxury Brands and Hospitality Partners

China Jinmao strategically partners with renowned luxury brands and respected hospitality operators to elevate its commercial properties and hotel ventures. These alliances are crucial for boosting the attractiveness and perceived value of its integrated urban developments. For instance, in 2024, Jinmao continued to leverage its relationships with top-tier international hotel management companies to ensure premium service standards across its portfolio.

These collaborations extend to the leasing of retail spaces within its complexes, bringing sought-after luxury brands to its developments. This approach helps solidify Jinmao's premium market positioning. By associating with established names, Jinmao ensures its properties are seen as high-quality destinations, attracting both discerning customers and high-caliber tenants.

- Luxury Brand Integration: Jinmao secures partnerships with globally recognized luxury retailers to occupy prime locations in its commercial developments, thereby enhancing the overall prestige and shopping experience.

- Hospitality Management Excellence: Collaborations with leading international hotel groups ensure that Jinmao's hotel assets are managed to the highest standards, attracting a premium clientele and driving occupancy rates.

- Value Proposition Enhancement: These key partnerships directly contribute to a stronger value proposition for Jinmao's properties, making them more appealing to both end-users and investors.

Property Management Service Providers

China Jinmao leverages its in-house property management arm, Jinmao Services, but also strategically partners with external property management providers. This approach allows for the expansion of its managed gross floor area (GFA) by tapping into a wider network of properties. In 2024, this strategy continued to be crucial for increasing recurring revenue streams and market penetration.

These collaborations are vital for Jinmao Services to grow beyond projects developed by the parent company. By engaging with third-party developers and property owners, Jinmao Services can significantly broaden its service offerings and client base, thereby enhancing its overall market position and revenue generation capabilities.

- Strategic Alliances: Jinmao Services actively seeks partnerships to manage properties not directly developed by China Jinmao, aiming to boost its managed GFA.

- Market Expansion: Collaborations with external property management firms enable Jinmao Services to enter new geographical markets and property segments.

- Revenue Diversification: By managing a wider portfolio, including third-party properties, Jinmao Services diversifies its income streams beyond its parent company's development pipeline.

- Operational Synergies: Partnerships can lead to shared best practices and operational efficiencies, benefiting both Jinmao Services and its collaborators.

China Jinmao's key partnerships are crucial for its operational success and market expansion. The company relies on strong relationships with government entities for land acquisition and approvals, and with financial institutions for project funding. Strategic alliances with construction firms ensure development quality, while collaborations with luxury brands and hospitality operators enhance property value.

In 2023, China Jinmao's land bank remained a testament to its government partnerships. The company's financial strategies, including its involvement in the Huaxia Jinmao Commercial REIT pilot program, highlight its reliance on diverse investor relationships for capital. Furthermore, Jinmao Services' expansion in 2024 was driven by its strategy to partner with external property managers, increasing its managed GFA.

| Partner Type | Strategic Importance | Example/2024 Focus |

|---|---|---|

| Government Entities | Land acquisition, regulatory navigation | Continued land acquisition in key cities |

| Financial Institutions | Project financing, capital management | Securing project financing for diverse developments |

| Luxury Brands & Hospitality | Property value enhancement, tenant attraction | Leveraging partnerships with international hotel management companies |

| Jinmao Services (External) | Managed GFA growth, revenue diversification | Expanding service offerings to third-party developers |

What is included in the product

A detailed Business Model Canvas for China Jinmao, outlining its core strategies, customer focus, and operational framework.

This model highlights China Jinmao's key resources, activities, and partnerships to deliver value and achieve sustainable growth.

The China Jinmao Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of complex business operations, simplifying strategic discussions and decision-making.

It alleviates the pain of information overload by condensing intricate strategies into a single, easily understandable page, fostering alignment and efficiency within the organization.

Activities

China Jinmao's core activity is the development of high-end residential and commercial properties. This encompasses the entire process from securing land and initial planning through to construction, marketing, sales, and the final handover of premium real estate. They focus on prime locations within China's major urban centers.

The company has been strategically growing its land bank, a crucial element for future development. For instance, in the first half of 2024, China Jinmao actively acquired new land parcels, strengthening its pipeline for upcoming projects. This proactive land acquisition is essential for maintaining its position in the competitive high-end property market.

China Jinmao's key activity revolves around investing in and actively managing large-scale urban complexes. These developments are designed as integrated hubs, seamlessly blending retail spaces, modern offices, and residential units to create a holistic urban living and working experience.

This strategic approach positions Jinmao as a 'city operator,' focusing on enhancing regional functionalities and injecting vitality into urban areas. By strategically integrating high-quality resources, the company aims to foster vibrant communities and sophisticated environments for both living and working.

In 2024, China Jinmao continued to prioritize the development and operation of these mixed-use complexes. For instance, their portfolio includes significant projects in major Chinese cities, contributing to urban regeneration and economic growth in those regions.

China Jinmao actively operates and manages a diverse portfolio of hotels, providing a full spectrum of hospitality services. This strategic focus targets high-end niche markets, underscoring their commitment to premium guest experiences.

The company's dedication to brand development is evident in its proprietary hotel brands, 'Jinmao Puxiu' and 'Jinmao Jiayue.' These brands are integral to their strategy of capturing specific market segments and enhancing brand recognition.

Beyond its own brands, China Jinmao also leverages its expertise to manage established hotel brands, further diversifying its hospitality offerings and revenue streams. This dual approach allows them to cater to a broader range of clientele and market demands.

Property Management Services

China Jinmao, through its subsidiary Jinmao Services, offers comprehensive property management services. These are primarily for its own developed properties, but the company is actively working to grow its management contracts with third-party clients. The focus is on delivering high-quality, efficient services, incorporating smart community technologies to enhance resident experience.

Jinmao Services aims to be a leading provider in the property management sector, leveraging its expertise. In 2023, Jinmao Services managed a significant portfolio, with revenue from property management services reaching RMB 6.5 billion, a notable increase from previous years. This growth reflects their strategy to expand beyond their own developments.

- Core Offerings: Comprehensive management for residential and commercial properties, including maintenance, security, and customer service.

- Smart Community Solutions: Integration of technology for enhanced living experiences, such as intelligent access systems and community apps.

- Third-Party Expansion: Strategic efforts to increase the proportion of revenue generated from managing properties not developed by China Jinmao.

- Market Position: Aiming for leadership through quality service and technological innovation in a competitive market.

Strategic Investment and Financing

China Jinmao's strategic investment and financing activities are crucial for its development. In 2024, the company continued to leverage various financial instruments to bolster its operations and expand its market presence.

Key financing actions included the issuance of corporate bonds, aiming to secure long-term capital for project development and debt refinancing. These issuances are vital for managing liquidity and supporting growth initiatives.

The company also pursued capital increases and strategic asset dispositions. These moves are designed to optimize its asset portfolio, enhance financial flexibility, and ensure a healthy balance sheet, reflecting a proactive approach to financial management.

- Bond Issuances: In 2024, China Jinmao raised significant capital through corporate bond issuances, providing stable funding for its development pipeline.

- Capital Increases and Dispositions: The company actively managed its capital structure through strategic capital injections and the selective sale of non-core assets to improve financial efficiency.

- Cost Control and Lean Management: A persistent focus on cost optimization and lean operational practices underpins these financial strategies, ensuring sustainable profitability.

China Jinmao's key activities extend to strategic investments and financing to fuel its growth. The company actively issues corporate bonds to secure long-term capital for its extensive development projects and to manage its existing debt. In 2024, these financing efforts were crucial for maintaining liquidity and supporting ongoing expansion initiatives.

Furthermore, China Jinmao engages in capital increases and strategic asset dispositions to optimize its portfolio and enhance financial flexibility. This proactive financial management ensures a robust balance sheet, underpinning its ambitious development plans.

A consistent focus on cost control and lean management practices is integrated into these financial strategies, aiming to ensure sustained profitability and operational efficiency across all its ventures.

| Activity | Description | 2024 Focus/Data |

| Property Development | High-end residential and commercial real estate | Continued land acquisition to bolster future projects |

| Urban Complex Management | Integrated mixed-use developments | Focus on enhancing regional functionalities and urban vitality |

| Hotel Operations | Premium hospitality services | Development and management of proprietary brands like Jinmao Puxiu |

| Property Management | Services for own and third-party properties | Expansion of third-party contracts, aiming for market leadership |

| Investment & Financing | Securing capital for development | Corporate bond issuances and strategic asset management |

What You See Is What You Get

Business Model Canvas

The China Jinmao Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you'll gain immediate access to the complete, professionally structured canvas, mirroring precisely what you see here. There are no altered samples or mockups; what you preview is precisely what you'll download, ready for your strategic analysis and implementation.

Resources

China Jinmao's extensive land bank and property portfolio are its bedrock. This vast collection of high-end residential, commercial, and urban complex properties, strategically located in major Chinese cities, fuels its development pipeline and ensures consistent revenue streams. As of the first half of 2024, the company reported a robust land reserve, a testament to its ongoing strategic expansion efforts.

China Jinmao's access to substantial financial capital, encompassing equity, debt, and investment funds, is a cornerstone for its ambitious property development and urban management projects. This strong financial foundation allows for the execution of large-scale initiatives that are critical to its business model.

The company's state-backed affiliation significantly bolsters its ability to secure favorable financing terms. This backing provides a crucial advantage in the competitive real estate market, enabling Jinmao to undertake projects that might be beyond the reach of purely private entities.

Demonstrating a notable turnaround in profitability, China Jinmao reported a net profit attributable to owners of RMB 7.3 billion for the first half of 2024, a substantial increase from RMB 2.1 billion in the same period of 2023. This financial resurgence directly enhances investor confidence, making it easier to attract further capital and solidify its funding access.

China Jinmao's recognized brand reputation is a cornerstone of its business model, particularly in the high-end real estate sector. The Jinmao brand is synonymous with premium quality, innovative green technology, and intelligent living concepts, fostering strong customer loyalty and market differentiation across its various operations.

This established brand equity directly translates into reduced customer acquisition costs and a stronger market position. For instance, in 2023, China Jinmao reported a significant increase in its property sales, partly attributable to the trust and recognition associated with its brand name, demonstrating its tangible impact on revenue generation.

Beyond brand recognition, the company is actively cultivating a robust intellectual property (IP) portfolio. This strategic focus on technological IP creates a competitive moat, safeguarding its innovations and providing a sustainable advantage in an increasingly technology-driven real estate market.

Skilled Human Capital and Management Expertise

China Jinmao's success hinges on its skilled human capital and experienced management. This includes development teams adept at executing large-scale urban regeneration projects and hospitality professionals ensuring premium service delivery in their high-end properties. The company's commitment to lean management principles underscores the critical role of its workforce in driving operational efficiency.

The company's investment in talent is evident in its strategic focus on human resource development. For instance, in 2024, China Jinmao continued to emphasize training and upskilling its employees, particularly in areas like sustainable development practices and digital transformation within the real estate sector. This focus ensures they can effectively manage complex projects and adapt to evolving market demands.

- Talented Workforce: Development teams, management, and hospitality staff are essential for complex urban projects and premium service delivery.

- Management Expertise: Experienced leadership is vital for strategic execution and operational efficiency.

- Lean Management Focus: The company prioritizes efficiency improvements, highlighting the value of its human capital.

- 2024 Emphasis: Continued investment in employee training for sustainable development and digital transformation.

Advanced Technology and Green Building Systems

China Jinmao strategically leverages advanced technology and green building systems as a cornerstone of its business model, focusing on 'smart technology and green health' as key product differentiators. This commitment translates into substantial investments in research and development, aimed at pioneering innovative building technologies, sustainable design principles, and integrated smart community solutions. These efforts are designed to cultivate a distinct competitive advantage and build valuable intellectual property within the real estate sector.

The company's dedication to technological advancement is evident in its pursuit of smart home integration and energy-efficient construction methods. For instance, in 2024, China Jinmao continued to expand its smart community initiatives, integrating features like intelligent security systems, environmental monitoring, and personalized resident services across its developments. This focus on green building not only aligns with global sustainability trends but also appeals to a growing segment of environmentally conscious consumers, enhancing property value and market appeal.

- R&D Investment: China Jinmao consistently allocates resources to research and development, focusing on smart home technologies and sustainable construction materials.

- Green Building Certification: The company prioritizes achieving high standards in green building certifications, such as LEED or equivalent national standards, for its projects.

- Smart Community Features: Developments incorporate advanced features like integrated IoT platforms for building management, smart energy grids, and resident-centric digital services.

- Intellectual Property: Investments in proprietary technologies and design methodologies contribute to a unique intellectual property portfolio, strengthening its market position.

China Jinmao's extensive land bank and property portfolio are its bedrock, fueling its development pipeline and ensuring consistent revenue streams. As of the first half of 2024, the company reported a robust land reserve, a testament to its ongoing strategic expansion efforts.

Access to substantial financial capital, encompassing equity, debt, and investment funds, is a cornerstone for its ambitious property development and urban management projects. This strong financial foundation allows for the execution of large-scale initiatives critical to its business model.

The company's state-backed affiliation significantly bolsters its ability to secure favorable financing terms, providing a crucial advantage in the competitive real estate market. This enables Jinmao to undertake projects beyond the reach of purely private entities.

Demonstrating a notable turnaround in profitability, China Jinmao reported a net profit attributable to owners of RMB 7.3 billion for the first half of 2024, a substantial increase from RMB 2.1 billion in the same period of 2023, enhancing investor confidence and capital attraction.

China Jinmao's recognized brand reputation, synonymous with premium quality and innovative concepts, fosters strong customer loyalty and market differentiation. This established brand equity translates into reduced customer acquisition costs and a stronger market position, as evidenced by increased property sales in 2023 partly due to brand trust.

Beyond brand recognition, the company actively cultivates a robust intellectual property (IP) portfolio, creating a competitive moat and safeguarding its innovations in a technology-driven real estate market.

China Jinmao's success hinges on its skilled human capital and experienced management, including development teams adept at urban regeneration and hospitality professionals ensuring premium service delivery. The company's commitment to lean management principles underscores the critical role of its workforce in driving operational efficiency.

The company's investment in talent is evident in its strategic focus on human resource development, with continued emphasis in 2024 on training and upskilling employees in sustainable development and digital transformation.

China Jinmao strategically leverages advanced technology and green building systems, focusing on 'smart technology and green health' as key differentiators. This commitment translates into substantial R&D investments aimed at pioneering innovative building technologies and sustainable design principles.

The company's dedication to technological advancement is evident in its pursuit of smart home integration and energy-efficient construction methods, with continued expansion of smart community initiatives in 2024.

| Key Resource | Description | 2024 Data/Impact |

|---|---|---|

| Land Bank & Property Portfolio | Extensive, high-end residential, commercial, and urban complex properties in major Chinese cities. | Robust land reserve reported in H1 2024, fueling development pipeline. |

| Financial Capital Access | Equity, debt, and investment funds for large-scale projects. | Strong foundation enabling ambitious property development and urban management. |

| State-Backed Affiliation | Government support providing favorable financing terms. | Crucial advantage in securing competitive financing for projects. |

| Profitability & Financial Performance | Net profit attributable to owners. | RMB 7.3 billion in H1 2024 (up from RMB 2.1 billion in H1 2023), boosting investor confidence. |

| Brand Reputation | Synonymous with premium quality, green technology, and intelligent living. | Drives customer loyalty, reduces acquisition costs, and enhances market position. |

| Intellectual Property (IP) | Focus on technological IP and proprietary design methodologies. | Creates a competitive moat and sustainable advantage in the real estate sector. |

| Human Capital & Management | Skilled workforce, experienced leadership, and lean management focus. | Essential for complex project execution, premium service, and operational efficiency. |

| Technology & Green Building | Smart technology, green building systems, R&D investment. | Key product differentiators; continued expansion of smart community initiatives in 2024. |

Value Propositions

China Jinmao distinguishes itself by delivering premium residential properties and creating integrated urban living experiences tailored for affluent clientele. This commitment to high-end living focuses on providing superior quality and aspirational lifestyles.

The company's strategic emphasis on 'green health' and 'smart technology' is a key differentiator, actively shaping the future of luxury residences. These elements redefine high-end living by offering a more sustainable and technologically advanced lifestyle. For instance, in 2024, China Jinmao continued to invest in smart home integration and eco-friendly building materials across its developments, enhancing the overall living experience.

China Jinmao's 'city operator' model delivers integrated urban solutions, blending residential, commercial, retail, and hospitality. This holistic approach aims to boost regional functions and urban vitality.

This strategy enhances city life for residents and fosters a thriving environment for businesses. For instance, in 2024, China Jinmao's projects focused on creating vibrant community hubs that saw increased foot traffic and local economic activity.

China Jinmao offers premium luxury hospitality, both through its proprietary brands and by managing other properties. This commitment translates into high customer satisfaction, with a particular emphasis on catering to discerning travelers in high-end niche markets.

In 2024, China Jinmao's hotel portfolio continued to focus on delivering exceptional guest experiences, aiming for high satisfaction scores that reflect their dedication to quality. The strategy targets specific segments of the travel market, ensuring that both business and leisure guests receive a truly distinguished stay.

Professional and Comprehensive Property Management

China Jinmao's value proposition in property management, delivered through Jinmao Services, focuses on providing professional, refined, and highly customized solutions. This commitment ensures residents and tenants experience living and working environments that are not only comfortable and secure but also meticulously maintained. This approach directly contributes to enhancing the overall value of the properties managed and fostering greater customer satisfaction.

The company's dedication to excellence in property management is evident in its operational philosophy. For instance, in 2024, Jinmao Services managed a portfolio of properties across key Chinese cities, aiming to elevate the living standards for its clientele. Their service model is designed to address the specific needs of diverse property types, from residential complexes to commercial spaces.

- Professionalism: Adherence to high industry standards and best practices in all management aspects.

- Refinement: Offering sophisticated and detailed service delivery, anticipating resident needs.

- Customization: Tailoring management strategies to suit the unique characteristics of each property and its occupants.

- Asset Enhancement: Proactively working to maintain and improve property value over time.

Strategic Locations and Sustainable Development Focus

China Jinmao strategically places its developments in the heart of major cities and burgeoning economic zones, ensuring accessibility and future appreciation. This prime positioning is a significant draw for both residents and businesses seeking growth opportunities.

The company's dedication to sustainable development and environmental, social, and governance (ESG) principles resonates strongly with a growing segment of customers and investors. By prioritizing resilience and eco-friendly practices, China Jinmao enhances its appeal in the market.

For instance, in 2024, China Jinmao continued to emphasize its commitment to green building certifications, with a significant portion of its new projects aiming for LEED or similar accreditations. This focus on sustainability is not just an ethical choice but a strategic advantage, attracting environmentally conscious capital and fostering long-term value.

The value proposition is further strengthened by China Jinmao's proactive approach to urban renewal and community integration, creating living and working environments that are both functional and forward-thinking.

China Jinmao offers premium residential properties and integrated urban living experiences, focusing on high-quality, aspirational lifestyles for affluent clients. Their commitment to 'green health' and 'smart technology' in 2024 developments further distinguishes their offerings, creating sustainable and technologically advanced living spaces.

The 'city operator' model provides comprehensive urban solutions, blending residential, commercial, and hospitality elements to enhance regional vitality and resident experience. This approach fosters thriving community hubs, as seen in 2024 projects that saw increased local economic activity.

Furthermore, China Jinmao delivers exceptional luxury hospitality and refined property management services through Jinmao Services, emphasizing professionalism, customization, and asset enhancement to ensure high customer satisfaction and property value.

| Value Proposition | Key Features | 2024 Focus/Impact |

|---|---|---|

| Premium Residential & Urban Living | High-quality, aspirational lifestyles; 'green health' & 'smart technology' integration | Continued investment in smart home tech and eco-friendly materials; enhanced living experience. |

| Integrated City Operations | Blending residential, commercial, retail, hospitality; boosting urban vitality | Projects focused on creating vibrant community hubs with increased foot traffic and local economic activity. |

| Luxury Hospitality & Property Management | Proprietary brands, high customer satisfaction, refined services via Jinmao Services | Portfolio managed across key cities, aiming to elevate living standards; focus on exceptional guest experiences in hotels. |

Customer Relationships

China Jinmao leverages dedicated sales and customer service teams to foster strong connections with its clientele. These teams are instrumental in guiding potential buyers through the purchasing process and providing ongoing support to residents, aiming for a seamless and positive experience. This direct engagement is key to building lasting relationships and ensuring customer satisfaction, a crucial element in the competitive real estate market.

China Jinmao actively cultivates community engagement for its residential and urban complex developments, aiming to forge lasting connections with residents. This commitment is demonstrated through various initiatives designed to foster a sense of belonging and enhance resident satisfaction.

The company organizes community events, such as seasonal celebrations and local interest gatherings, to encourage interaction among residents and build a vibrant neighborhood atmosphere. These events are crucial for strengthening the social fabric of their developments.

Furthermore, China Jinmao provides comprehensive resident services, including property management, concierge services, and access to shared amenities, all aimed at improving the quality of life for its customers. For instance, in 2023, projects like the Jinmao Mansion in Shanghai saw high resident satisfaction scores, partly attributed to these services.

Loyalty programs are also a key component, rewarding long-term residents and repeat customers with exclusive benefits and discounts, thereby boosting retention rates. This strategy is vital in a competitive real estate market, ensuring continued customer loyalty and positive word-of-mouth referrals.

China Jinmao distinguishes itself by offering highly personalized and exclusive services tailored to the unique requirements of its high-net-worth clientele. This bespoke approach ensures that every aspect of the client's experience, from property selection to post-purchase support, aligns with their individual preferences and expectations.

This commitment to individualized attention reinforces the premium positioning of China Jinmao's properties. For instance, in 2024, the company continued to invest in dedicated client relationship managers who provide one-on-one consultations, property previews, and even lifestyle integration services, fostering strong loyalty among its discerning customer base.

Digital Platforms and Online Engagement

China Jinmao actively leverages digital platforms and online channels to foster customer relationships, manage sales inquiries, and deliver services. This strategic online presence significantly boosts accessibility and convenience for a wide array of customers, from prospective property buyers to existing property owners and even potential investors.

The company's digital engagement is designed to streamline interactions, offering efficient avenues for information gathering and support. This approach is crucial in today's market, where digital convenience often dictates customer preference and loyalty.

- Online Presence: China Jinmao maintains a robust digital footprint through its official website and social media channels, facilitating direct customer interaction and information dissemination.

- Digital Sales & Service: Online platforms are utilized for property viewings, sales inquiries, and customer service requests, enhancing convenience and reach.

- Investor Relations: Digital channels are key for communicating with investors, providing access to financial reports, company news, and investment opportunities.

- Customer Feedback: Online engagement allows for the collection of valuable customer feedback, informing service improvements and future development strategies.

Feedback Mechanisms and Continuous Improvement

China Jinmao actively solicits customer feedback through various channels. These likely include post-purchase surveys, customer service interactions, and potentially online review platforms to gauge satisfaction with their properties and services.

The company utilizes this gathered feedback to drive continuous improvement. For instance, insights from buyer satisfaction surveys might inform design modifications in future developments or enhancements to property management services, ensuring alignment with evolving customer expectations.

- Customer Feedback Channels: Surveys, direct communication, service interactions.

- Improvement Focus: Product quality, service delivery, and overall customer experience.

- Data Utilization: Feedback informs design, management, and future project planning.

China Jinmao prioritizes personalized customer relationships, especially for its high-net-worth clients, offering tailored services and dedicated managers. The company also fosters community through events and comprehensive resident services, aiming for high satisfaction. Digital platforms are crucial for sales, service, and investor communication, with feedback actively sought to drive improvements.

Channels

China Jinmao leverages direct sales offices and showrooms at its project locations to provide potential buyers with a tangible experience of its residential and commercial properties. These physical touchpoints are crucial for customers to assess the quality, design, and overall appeal of the developments firsthand.

In 2024, China Jinmao continued to emphasize these direct channels, recognizing their effectiveness in converting interest into sales. For instance, during the first half of 2024, the company reported a significant portion of its sales originating from these on-site customer interactions, underscoring the value of a physical presence in the property market.

China Jinmao actively collaborates with a wide array of real estate agencies and broker networks. This strategic partnership is crucial for extending their market presence and effectively managing property transactions, both for sales and rentals.

These collaborations grant China Jinmao access to a larger customer base and leverage specialized sales knowledge that might not be available internally. For instance, by Q3 2024, the company reported a significant increase in sales volume attributed to expanded distribution channels, including these agency partnerships.

China Jinmao's official website acts as a central hub for showcasing its diverse property portfolio, offering detailed project information, and sharing corporate news. This digital storefront is crucial for reaching potential buyers and investors across China and beyond.

Leveraging prominent online property portals is essential for extending market reach. These platforms allow China Jinmao to list its developments, attract a broad audience actively searching for real estate, and generate valuable leads for its sales teams.

In 2024, China Jinmao continued to invest in its digital presence, with its official website reporting millions of unique visitors monthly. Property portal listings consistently drove a significant portion of website traffic, underscoring the effectiveness of these channels in property discovery and initial engagement.

Hotel Booking Platforms and Hospitality Networks

China Jinmao leverages a multi-channel approach for its hotel bookings, integrating with major Online Travel Agencies (OTAs) like Ctrip, Booking.com, and Expedia to capture a broad spectrum of travelers. In 2024, OTAs continued to be a dominant force in travel bookings, with many reporting significant year-over-year growth in gross booking value, reflecting their essential role in reaching international and domestic customers for China Jinmao's properties.

Beyond OTAs, direct booking platforms on China Jinmao's own website and loyalty program channels are crucial for fostering customer relationships and potentially improving profit margins. These direct channels allow for personalized offers and a more controlled brand experience. The company also actively participates in global hospitality networks and alliances, enhancing its visibility and offering bundled services that appeal to a wider audience.

- OTA Integration: Partnerships with platforms like Ctrip and Booking.com are vital for broad market access.

- Direct Bookings: Emphasizing proprietary channels to build loyalty and capture higher margins.

- Hospitality Networks: Collaborating with industry alliances to expand reach and service offerings.

Marketing and Advertising Campaigns

China Jinmao invests heavily in comprehensive marketing and advertising to reach its diverse customer base. These campaigns span digital platforms, traditional print media, and prominent outdoor advertising spaces, effectively showcasing the company's brand and individual project offerings.

The company's strategy focuses on building strong brand recognition and directly influencing purchasing decisions. For instance, in 2023, China Jinmao's marketing efforts contributed to a significant portion of its sales pipeline, with digital channels showing particularly high engagement rates.

- Brand Awareness: Campaigns aim to establish China Jinmao as a leading developer in its target markets.

- Project Promotion: Specific advertising highlights the unique features and value propositions of each development.

- Customer Engagement: Digital marketing initiatives are designed to foster interaction and drive leads.

- Sales Conversion: Ultimately, these efforts are geared towards converting interest into actual sales.

China Jinmao utilizes a multi-pronged channel strategy, encompassing direct sales offices, real estate agency partnerships, and a robust digital presence including its official website and online property portals. For its hospitality segment, the company integrates with major Online Travel Agencies (OTAs) while also promoting direct bookings and participating in global hospitality networks.

| Channel Type | Key Platforms/Methods | 2024 Focus/Impact |

|---|---|---|

| Direct Sales | On-site sales offices, showrooms | Crucial for tangible property experience; significant sales contribution in H1 2024. |

| Agency Partnerships | Real estate agencies, broker networks | Expands market reach and sales volume; notable increase by Q3 2024. |

| Digital Presence | Official website, online property portals | Showcases portfolio, generates leads; website saw millions of monthly visitors in 2024. |

| Hospitality Bookings | OTAs (Ctrip, Booking.com), Direct bookings, Loyalty programs | Broad customer access via OTAs; direct channels build loyalty and margins. |

Customer Segments

Affluent individuals and high-net-worth families represent a key customer segment for China Jinmao, prioritizing luxury residential properties and sophisticated living experiences. These clients actively seek out developments that offer superior quality, integrated smart home technology, and environmentally conscious green building features. Their investment decisions are often influenced by strategic locations within China's major first-tier cities and other areas experiencing robust economic growth.

Businesses and corporations are crucial customers for China Jinmao, particularly for its commercial real estate offerings. These clients are interested in leasing office spaces and retail units situated within Jinmao's well-developed urban complexes. They prioritize locations that offer excellent connectivity and prestige, coupled with contemporary facilities designed to support productivity and business operations.

These corporate clients value the integrated business environments that Jinmao's properties provide, which often include amenities like advanced technology infrastructure, ample parking, and access to supporting services. For instance, in 2024, China Jinmao continued to focus on enhancing the appeal of its commercial portfolios to attract and retain high-caliber business tenants, aiming for occupancy rates that reflect the demand for quality commercial space in key Chinese cities.

Luxury travelers and business tourists represent a key customer segment for China Jinmao, seeking premium accommodations and comprehensive hospitality services for both leisure and corporate needs. This group values high-quality amenities, personalized service, and convenient locations for their trips and events. For instance, in 2024, the luxury travel market continued its robust recovery, with spending expected to significantly outpace pre-pandemic levels, indicating strong demand for China Jinmao's offerings.

These clients often engage with China Jinmao for a variety of purposes, including high-end vacations, important business meetings, and significant corporate events. They are drawn to properties that offer an elevated experience, from sophisticated dining options to well-appointed meeting facilities and exclusive leisure activities. The demand for such integrated luxury experiences remained a driving force in the hospitality sector throughout 2024.

Institutional Investors and Property Funds

Institutional investors and property funds are key customers for China Jinmao, viewing its diverse property portfolio and urban complexes as attractive investment opportunities. They are primarily driven by the potential for solid returns, long-term asset appreciation, and the company's demonstrated financial stability. In 2024, China Jinmao continued to focus on deleveraging and optimizing its asset structure, making it a more appealing prospect for these sophisticated investors seeking predictable income streams and capital growth.

These investors are particularly interested in China Jinmao's strategy of developing integrated urban complexes, which offer a blend of residential, commercial, and retail spaces, creating diversified revenue streams. The company's potential foray into Real Estate Investment Trusts (REITs) also presents a compelling avenue for these funds to gain exposure to high-quality, income-generating assets. As of the first half of 2024, China Jinmao reported a significant reduction in its net gearing ratio, a key metric for institutional confidence.

The decision-making process for these customer segments is heavily influenced by:

- Financial Performance: Consistent revenue growth, profitability, and a healthy balance sheet are paramount.

- Asset Quality and Location: The desirability and potential for appreciation of China Jinmao's property assets, particularly in prime urban locations, are critical factors.

- Strategic Vision and Execution: Investors assess the company's long-term development plans, its ability to execute on these plans, and its commitment to sustainable growth.

Government and Public Sector Entities

As a key player in urban development, China Jinmao directly engages with government and public sector entities. These collaborations are central to its role as a 'city operator,' particularly through large-scale urban renewal projects and broader city development initiatives. For instance, in 2023, the company continued to pursue strategic partnerships for integrated urban planning and infrastructure enhancement across various Chinese cities.

These engagements often involve significant public-private partnerships, where Jinmao contributes its expertise in master planning, infrastructure construction, and property development. The company’s involvement in city-level projects underscores its commitment to improving urban living environments and fostering sustainable city growth. Such projects are crucial for realizing national urban development goals.

- Urban Renewal Projects: China Jinmao undertakes extensive urban renewal, transforming older city districts into modern, functional spaces. This includes redeveloping brownfield sites and upgrading existing infrastructure.

- City Development Initiatives: The company participates in government-led initiatives aimed at improving city-wide infrastructure, public services, and economic zones.

- Large-Scale Collaborations: These partnerships involve significant capital investment and long-term commitment, often spanning multiple years and requiring close coordination with municipal governments.

- Strategic Planning: Jinmao works with public sector entities on strategic urban planning, ensuring that development aligns with economic, social, and environmental objectives.

China Jinmao's customer base is diverse, encompassing affluent individuals seeking luxury residences and businesses requiring prime commercial spaces. These segments prioritize quality, location, and integrated amenities. Institutional investors are also key, attracted by the company's portfolio and financial stability. The company's strategy in 2024 focused on optimizing assets to appeal to these sophisticated investors.

| Customer Segment | Key Motivations | 2024 Focus/Activity |

|---|---|---|

| Affluent Individuals | Luxury, quality, smart tech, green features, prime locations | Continued development of high-end residential properties |

| Businesses/Corporations | Prestige, connectivity, modern facilities, business environment | Enhancing commercial portfolio appeal for quality tenants |

| Institutional Investors | Returns, asset appreciation, financial stability, diversified revenue | Deleveraging, asset structure optimization, reduced net gearing ratio (H1 2024) |

Cost Structure

China Jinmao's cost structure heavily features land acquisition costs, representing a substantial investment for its real estate development ventures. These expenses are dynamic, influenced by factors like the specific location of the land, prevailing market trends, and the intensity of competition, especially for highly sought-after urban sites.

For instance, in 2024, the company continued to navigate a competitive land market. While specific figures for individual land acquisitions are often proprietary, industry analysis indicates that prime land parcels in major Chinese cities can command prices equivalent to a significant percentage of the total project development cost, sometimes exceeding 40%.

Construction and development expenses are a significant component of China Jinmao's cost structure. These costs encompass the building of residential properties, mixed-use commercial centers, and hospitality facilities, reflecting the company's diverse real estate portfolio.

Key expenditures within this category include the procurement of building materials, wages for skilled and unskilled labor, fees paid to external contractors, and the operational costs of project management teams. These elements are crucial for bringing Jinmao's development projects to fruition.

For instance, in 2023, China Jinmao reported significant investment in its development projects. While specific breakdowns for construction and development expenses are embedded within broader cost of sales and development expenditures, the company's capital expenditure on property development remained a substantial outlay, underscoring the capital-intensive nature of its business.

Ongoing operational costs for China Jinmao's properties and hotels are a significant component of its cost structure. These include essential expenses like utilities, regular maintenance and repairs to ensure property quality, and staffing across various departments from management to service personnel.

Administrative overhead, encompassing areas like marketing, sales, and corporate functions supporting these assets, also adds to the overall operating expenses. For instance, in 2023, China Jinmao reported significant investment in property management and development, with operating expenses reflecting the continuous effort to maintain and enhance its portfolio of commercial properties and hotels.

Sales, Marketing, and Administrative Expenses

China Jinmao's Sales, Marketing, and Administrative Expenses are crucial for its business model. These costs encompass expenditures tied to promoting properties, brand building, and the day-to-day operations of the company. A significant portion of these expenses is dedicated to advertising campaigns and sales commissions aimed at driving property sales.

The company actively works to optimize these costs to enhance its overall profitability. For instance, in 2024, China Jinmao reported that its sales and marketing expenses represented a specific percentage of its revenue, demonstrating a focused effort on cost management. This strategic approach helps ensure that marketing investments translate efficiently into sales.

- Sales and Marketing Expenditures: Costs associated with advertising, promotions, and sales commissions for property development projects.

- Brand Promotion: Investments in enhancing brand recognition and market presence within the real estate sector.

- Administrative Functions: General operating expenses, including salaries for management and support staff, office overhead, and legal fees.

- Cost Control Initiatives: Ongoing efforts to streamline operations and reduce overheads to improve profit margins.

Financing Costs and Debt Servicing

Financing costs, primarily interest expenses on loans, bonds, and other debt instruments, represent a substantial component of China Jinmao's cost structure. This is directly attributable to the inherently capital-intensive nature of real estate development projects, which often require significant upfront investment and ongoing funding.

Effective debt management is therefore paramount for China Jinmao to control its overall expenses and maintain financial stability. The company's ability to secure favorable interest rates and manage its debt obligations efficiently directly impacts its profitability and operational capacity.

- Interest Expenses: In 2023, China Jinmao reported finance costs of RMB 11.02 billion, a notable increase from RMB 9.78 billion in 2022, highlighting the growing impact of borrowing costs.

- Debt Servicing Burden: The company's substantial reliance on debt financing means that a significant portion of its revenue is allocated to servicing these obligations, influencing cash flow and investment capacity.

- Impact on Profitability: Higher interest rates or an increased debt load can directly reduce net profit margins, making efficient treasury management a critical factor for the company's financial health.

- Strategic Financing: China Jinmao's strategy often involves a mix of bank loans, corporate bonds, and other financing vehicles, each with varying interest rates and maturity profiles that need careful management.

China Jinmao's cost structure is heavily influenced by land acquisition, construction, and financing. In 2023, finance costs alone reached RMB 11.02 billion, reflecting the capital-intensive nature of its real estate development. These significant outlays are balanced by strategic sales and marketing investments, with the company actively managing operational overheads to maintain profitability.

| Cost Component | Key Drivers | 2023 Impact (Illustrative) |

|---|---|---|

| Land Acquisition | Location, Market Trends, Competition | Substantial upfront investment, often >40% of project cost for prime sites |

| Construction & Development | Materials, Labor, Contractors, Project Management | Significant capital expenditure, integral to cost of sales |

| Operations & Administration | Utilities, Maintenance, Staffing, Marketing, Sales | Ongoing expenses to maintain portfolio quality and drive sales |

| Financing Costs | Interest on Loans & Bonds | RMB 11.02 billion in finance costs (2023), impacting profitability |

Revenue Streams

China Jinmao's main income source is the sale of premium residential and commercial properties it develops. This revenue comes from both properties sold before they are finished and those that are already built.

In 2024, the property sales segment is expected to remain a significant contributor to Jinmao's financial performance, reflecting ongoing demand in China's real estate market for quality developments.

Revenue streams for China Jinmao are significantly bolstered by rental income derived from its diverse portfolio of commercial properties. This includes leasing office spaces, retail units, and other commercial assets situated within its urban development complexes.

This consistent rental income provides China Jinmao with a stable and predictable recurring revenue stream, which is crucial for financial planning and operational stability. For instance, in 2023, the company reported significant contributions from its property leasing segment, underscoring its importance to overall financial performance.

Income from hotel operations, encompassing room revenue, food and beverage sales, and various hospitality services, represents a substantial revenue contributor. China Jinmao strategically targets high-end niche markets within this segment, aiming for premium pricing and customer loyalty.

Property Management Fees

China Jinmao's property management fees represent a significant and growing revenue stream, generated by providing comprehensive services to property owners and tenants. These fees are crucial for the company's financial health and are becoming increasingly diversified.

In 2023, China Jinmao Services reported a substantial increase in its revenue from property management, reflecting its expanding market presence and service offerings. The company's commitment to enhancing service quality and broadening its scope of management capabilities directly contributes to this growth.

- Growing Revenue Base: Property management fees are a core component of Jinmao Services' income, bolstered by an expanding portfolio of managed properties.

- Diversification of Services: The company is actively diversifying its fee structure by offering a wider array of value-added services beyond basic property upkeep.

- Market Performance: In the first half of 2024, China Jinmao Services saw its revenue from property management and value-added services reach approximately RMB 6.9 billion, marking a year-on-year increase of 16.2%. This highlights the consistent upward trajectory of this revenue stream.

Returns from Urban Complex Investments

Revenue streams from urban complex investments for China Jinmao are multifaceted, encompassing profits generated through development, ongoing asset appreciation, and potential service income. This model leverages the company's expertise in creating and managing large-scale urban developments.

In 2024, China Jinmao continued to focus on its core strategy of developing high-quality urban complexes. The company's ability to secure prime locations and execute complex development projects is key to realizing substantial returns. For instance, the successful completion and sale of residential or commercial units within these complexes contribute directly to development profits.

- Development Profits: Realized upon the sale of properties within the urban complex, reflecting the difference between sale prices and development costs.

- Asset Appreciation: Long-term growth in the value of the developed urban complex, driven by market conditions and ongoing management.

- Urban Operation Services: Potential income from providing services such as property management, retail leasing, or community services within the complex.

China Jinmao's revenue streams are primarily driven by property sales, rental income from commercial properties, hotel operations, and property management fees. The company also generates income from its urban complex investments.

In the first half of 2024, China Jinmao Services reported property management and value-added services revenue of approximately RMB 6.9 billion, a 16.2% year-on-year increase.

| Revenue Stream | Description | 2023/2024 Data Point |

|---|---|---|

| Property Sales | Development and sale of residential and commercial properties. | Significant contributor, ongoing demand for quality developments in 2024. |

| Rental Income | Leasing of office spaces, retail units, and commercial assets. | Provided stable and predictable recurring revenue in 2023. |

| Hotel Operations | Room revenue, F&B sales, and hospitality services. | Substantial contributor, targeting high-end niche markets. |

| Property Management Fees | Services provided to property owners and tenants. | RMB 6.9 billion (H1 2024) for Jinmao Services, up 16.2% YoY. |

| Urban Complex Investments | Profits from development, asset appreciation, and services. | Focus on high-quality complexes, with development profits from sales. |

Business Model Canvas Data Sources

The China Jinmao Business Model Canvas is informed by a blend of internal financial disclosures, real estate market research reports, and analyses of government housing policies. These sources provide a comprehensive view of the company's operations and the broader economic landscape.