China Jinmao Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Jinmao Bundle

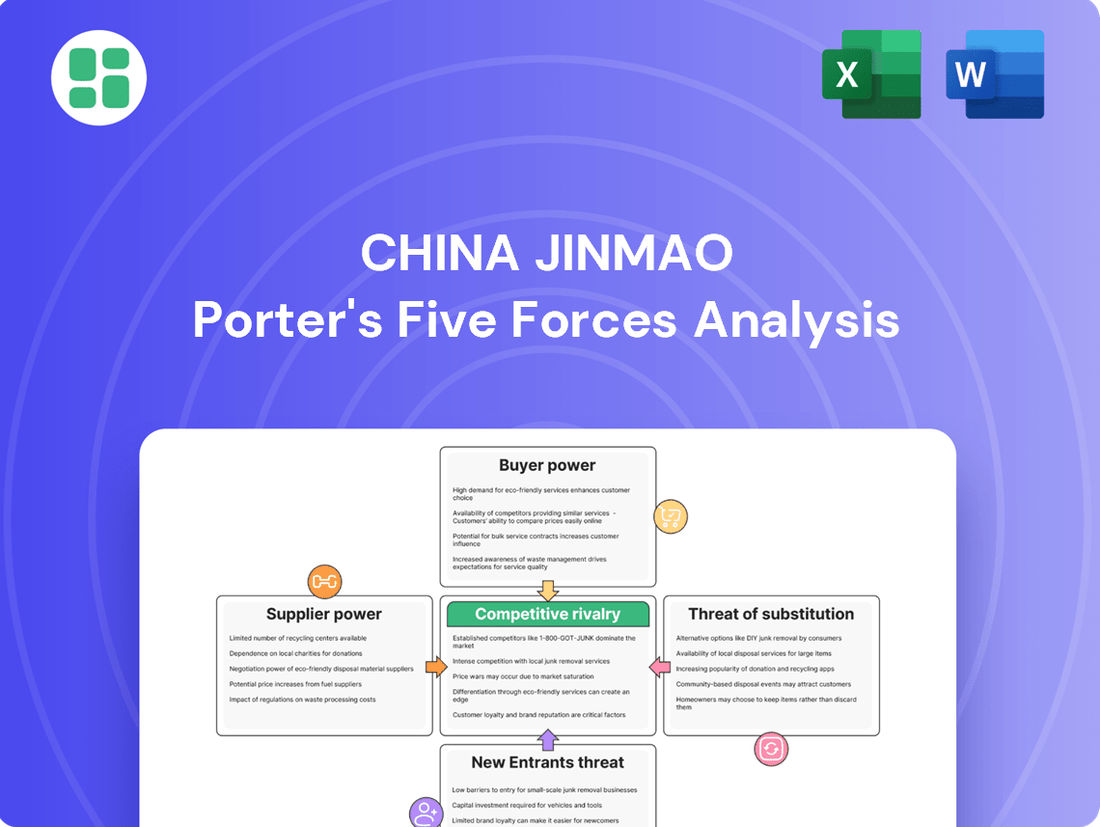

China Jinmao operates within a dynamic real estate market, facing significant competitive pressures from rivals and a constant threat from new entrants seeking to capture market share. Understanding the intensity of these forces is crucial for strategic planning.

The full Porter's Five Forces Analysis reveals the real forces shaping China Jinmao’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Land suppliers, predominantly local governments in China, wield significant bargaining power. This stems from their exclusive control over land availability, a critical input for developers like China Jinmao. The essential nature of land for any property venture solidifies this leverage.

While recent government initiatives aimed at stabilizing the real estate market might offer some negotiation room, the core monopolistic position of these land suppliers remains largely intact. China Jinmao, like its peers, must contend with intricate land acquisition procedures and intense competition for desirable development sites.

The bargaining power of construction material suppliers for China Jinmao is influenced by the specific materials needed. For commodity items like basic concrete or steel, suppliers generally have lower power due to widespread availability and many competing producers. However, when China Jinmao requires specialized, high-end finishes or imported materials for its premium developments, the bargaining power of those select suppliers increases significantly.

China Jinmao's strategic focus on high-end residential and commercial properties naturally leads to a demand for superior quality and often unique materials. This means that suppliers offering these specialized products, which may be less commoditized and have fewer alternatives, can command more favorable terms. For example, in 2024, the global supply chain for certain advanced composite materials or bespoke architectural elements remained tight, allowing those producers to exert greater influence over pricing and delivery schedules.

The bargaining power of labor suppliers in China's construction and hospitality sectors is a key consideration for companies like China Jinmao. The sheer size of China's labor force generally limits individual worker power, but specialized skills can shift this dynamic. For instance, demand for experienced project managers in large-scale construction or highly trained hospitality staff for luxury hotels can grant these skilled workers more leverage.

Rising labor costs directly impact operational expenses. In 2023, average wages in China continued to trend upwards, particularly in major urban centers and for skilled trades. This increase puts pressure on development budgets and ongoing operational costs for businesses like China Jinmao, potentially affecting profitability and pricing strategies.

Financial Service Providers

Financial institutions, acting as crucial suppliers of capital, wield considerable bargaining power over real estate developers like China Jinmao. This is particularly true in the current economic climate, where challenges within China's property market are intensifying. Developers rely heavily on these institutions for loans to secure land and fund ongoing projects.

Banks and other lenders have adopted a more risk-averse stance, prioritizing the containment of potential losses. This cautious approach directly translates into increased leverage for financial institutions, allowing them to dictate terms more effectively to developers. For instance, in early 2024, the People's Bank of China maintained its benchmark lending rates, but the secondary market for property debt saw increased scrutiny, impacting financing availability and cost for developers.

- Increased Lending Scrutiny: Banks are more selective in approving loans for real estate projects, demanding stronger collateral and more robust repayment plans.

- Higher Financing Costs: Developers may face higher interest rates or unfavorable loan covenants due to the perceived risk in the sector.

- Impact on Project Viability: Restricted access to capital or unfavorable financing terms can directly impact the feasibility and profitability of development projects.

Specialized Service Providers

Suppliers of specialized services, like architectural design, engineering, and advanced technology for smart buildings, can exert moderate to high bargaining power. China Jinmao's focus on premium, integrated urban developments means these sophisticated providers are essential. Their unique skills and knowledge often mean there aren't many alternatives, giving them leverage.

For instance, the demand for cutting-edge smart building technology, which integrates AI and IoT solutions, is rapidly growing. In 2024, the global smart building market was projected to reach over $100 billion, indicating significant reliance on specialized tech providers. Companies like China Jinmao, aiming for market leadership, must secure these capabilities, strengthening the suppliers' position.

- High demand for specialized expertise: China Jinmao's projects require advanced architectural and engineering talent.

- Limited substitute providers: The niche nature of smart building technology limits readily available alternatives.

- Strategic importance of suppliers: Strong relationships with these providers are critical for project success and innovation.

Land suppliers, primarily local governments in China, hold substantial bargaining power due to their exclusive control over land availability, a critical input for China Jinmao. This monopolistic position, despite government efforts to stabilize the market, means developers face intense competition for desirable sites.

The bargaining power of specialized material and service suppliers, such as those providing advanced smart building technology, is considerable. China Jinmao's focus on premium developments necessitates these unique capabilities, limiting alternatives and strengthening supplier leverage. For example, the global smart building market was projected to exceed $100 billion in 2024, highlighting the strategic importance of these providers.

| Supplier Type | Bargaining Power Level | Key Factors |

|---|---|---|

| Land (Local Governments) | High | Exclusive control over land supply, essential input for development. |

| Specialized Materials/Services | Moderate to High | Unique skills, limited alternatives, strategic importance for premium projects. |

| Commodity Materials | Low | Widespread availability, numerous competing producers. |

What is included in the product

This analysis dissects the competitive forces impacting China Jinmao, examining industry rivalry, buyer and supplier power, new entrant threats, and the impact of substitutes.

Quickly identify and neutralize competitive threats with a visually intuitive breakdown of China Jinmao's market pressures.

Customers Bargaining Power

High-end residential buyers in China wield considerable bargaining power, especially given the market's current landscape. An oversupply of properties means buyers have a wider selection, making them more discerning about price, the quality of construction, and crucially, the assurance of project completion. This leverage is further amplified by cautious consumer sentiment, where buyers prioritize security and value over speculative purchases.

In 2023, China's property market experienced a notable slowdown, with new home prices in 70 major cities declining on average. This trend directly translates to increased buyer power, as developers are more inclined to negotiate on terms and pricing to secure sales. For instance, reports indicated that some developers were offering significant discounts or enhanced payment plans to attract this segment of buyers.

Commercial property tenants in China, particularly those seeking office, retail, and urban complex spaces, are experiencing a significant increase in their bargaining power. This trend is largely driven by rising vacancy rates observed across numerous Chinese cities. For instance, by the end of 2023, the office vacancy rate in Tier 1 cities like Beijing and Shanghai hovered around 15-20%, creating a tenant-favorable market.

This heightened bargaining power allows tenants to more effectively negotiate for favorable terms, including reduced rental prices, more flexible lease agreements, and customized space configurations to meet their evolving operational needs. Property developers and owners, such as China Jinmao, must therefore focus on differentiating their offerings.

To attract and retain these discerning tenants, property owners are compelled to enhance their competitive edge. This involves securing prime locations, investing in state-of-the-art facilities, and developing comprehensive service packages that go beyond basic property management, aiming to create a more holistic and attractive environment for businesses.

Hotel guests, particularly those frequenting high-end establishments, wield significant bargaining power. This is largely due to the abundant choices available, fueled by intense competition among hotels and the ease of comparing prices through numerous online travel agencies and booking platforms.

While China's domestic tourism sector has shown robust recovery, with outbound travel expected to rebound significantly by 2024, guests are becoming more sophisticated. They are not just looking for a room; they demand exceptional value, memorable experiences, and superior service, pressuring hotel brands to innovate and offer more attractive packages and loyalty programs.

Property Management Clients

Clients of property management services, particularly those dealing with premium residential and commercial real estate, generally possess moderate bargaining power. This is because China Jinmao, while managing its own developed properties, faces competition from other property management firms. If clients perceive a decline in service quality or find the costs unsatisfactory, they have the option to seek out alternative service providers. Therefore, consistently delivering superior service and prompt responses is crucial for client retention.

For instance, in 2024, the property management sector in major Chinese cities saw an increase in competition, with new entrants offering specialized services. This intensified competition directly influences the bargaining power of clients, especially those managing large portfolios of high-value assets. Companies like China Jinmao must therefore focus on differentiation through service excellence to maintain client loyalty.

- Client Retention Focus: Maintaining high service standards and responsiveness is paramount for retaining property management clients.

- Competitive Landscape: The presence of alternative property management providers grants clients the ability to switch if dissatisfied with service or cost.

- Market Dynamics (2024): Increased competition in China's property management sector in 2024 has amplified client bargaining power, particularly for high-end properties.

- Strategic Imperative: Differentiation through service excellence is key for China Jinmao to secure and retain its property management client base amidst growing market competition.

Urban Complex Users/Visitors

The bargaining power of urban complex users and visitors, encompassing shoppers, office workers, and residents, is substantial, albeit indirect. Their collective preferences and spending habits directly shape the appeal and profitability of mixed-use developments. For instance, a shift in consumer trends towards online shopping can reduce foot traffic, impacting retail tenants and, consequently, the overall valuation of the complex. In 2024, major urban complexes in China are increasingly focusing on experiential retail and integrated lifestyle services to retain and attract these diverse customer segments, recognizing that sustained demand is crucial for rental income and property values.

These users wield influence through their decisions on where to spend their time and money. A complex that fails to offer desirable amenities, convenient access, or a vibrant atmosphere risks losing its customer base to competitors. This can lead to decreased occupancy rates for retail and office spaces, putting pressure on landlords to offer concessions or lower rents. The collective sentiment and purchasing power of these integrated users are a critical factor in the long-term success of urban developments.

Key aspects influencing their bargaining power include:

- Choice and Mobility: Urban dwellers have numerous options for retail, dining, and workspace, allowing them to easily shift their patronage if a complex underperforms.

- Demand for Experience: Modern consumers prioritize experience over mere transactions, giving them leverage to demand unique offerings and high-quality amenities.

- Impact on Property Value: Low foot traffic and tenant dissatisfaction directly translate to reduced rental income and lower property valuations, giving users indirect but significant leverage.

The bargaining power of customers in China's property market, particularly for high-end residential buyers, remains significant. With an oversupply in many cities, buyers can be more selective, demanding better pricing and assurances of project completion, a sentiment reinforced by cautious consumer behavior. By the end of 2023, new home prices in 70 major Chinese cities saw a general decline, underscoring the leverage buyers hold.

Commercial property tenants also benefit from increased bargaining power due to rising vacancy rates. In 2023, office vacancy rates in Tier 1 cities like Beijing and Shanghai were around 15-20%, prompting landlords to offer more flexible lease terms and competitive pricing. This market dynamic necessitates that developers like China Jinmao focus on differentiating their properties through location and enhanced facilities to attract and retain tenants.

Hotel guests, especially in the luxury segment, possess considerable bargaining power, driven by the abundance of choice and easy price comparison. While China's tourism sector recovered robustly, guests in 2024 are seeking superior experiences and value, compelling hotels to innovate with attractive packages and loyalty programs.

Property management clients, particularly for premium real estate, have moderate bargaining power. With increased competition in China's property management sector in 2024, clients can switch providers if dissatisfied with service or cost. China Jinmao must therefore prioritize service excellence to maintain client loyalty.

Urban complex users, including shoppers and office workers, exert substantial indirect bargaining power. Their preferences influence the appeal and profitability of mixed-use developments. In 2024, complexes are focusing on experiential retail and lifestyle services to maintain foot traffic and rental income, recognizing that customer satisfaction is key to property value.

| Customer Segment | Bargaining Power Driver | Market Condition (2023-2024) | Impact on Developers |

|---|---|---|---|

| High-end Residential Buyers | Oversupply, cautious sentiment | Price declines in major cities | Need for competitive pricing and completion assurance |

| Commercial Tenants (Office/Retail) | Rising vacancy rates | 15-20% vacancy in Tier 1 cities (2023) | Negotiable rents, flexible leases, demand for amenities |

| Hotel Guests (High-end) | Abundant choice, price transparency | Robust tourism recovery, demand for experiences | Pressure for value-added services and loyalty programs |

| Property Management Clients | Availability of alternative providers | Increased sector competition (2024) | Emphasis on service quality and differentiation |

| Urban Complex Users | Preference shifts, mobility | Focus on experiential retail and lifestyle services | Need to attract and retain diverse user base for sustained demand |

Same Document Delivered

China Jinmao Porter's Five Forces Analysis

This preview offers a complete, ready-to-use China Jinmao Porter's Five Forces Analysis, detailing the competitive landscape and strategic implications for the company. What you're viewing is precisely the same professionally formatted document you'll receive instantly upon purchase, enabling immediate strategic planning and decision-making.

Rivalry Among Competitors

China's real estate market presents a complex competitive landscape for China Jinmao. While the overall market is vast and includes numerous smaller developers, the premium segments where China Jinmao focuses, such as urban complexes, are characterized by intense competition among a more concentrated group of major players. This means that while there are many companies, the key rivals are well-established and formidable.

This intense rivalry is particularly evident among state-owned enterprises (SOEs) and large private developers. These entities actively compete for prime land parcels, aiming to capture significant market share and attract top talent within the industry. For instance, in 2023, major developers like Vanke and Country Garden continued to be significant forces, alongside SOEs such as China Overseas Land & Investment, all vying for the most lucrative development opportunities.

China's property market downturn is fueling fierce competition among developers. With sales slumping and inventory high, companies are aggressively cutting prices to move units and reduce debt. This deleveraging push means developers are competing intensely for dwindling buyer confidence, impacting overall profitability.

In the premium property market, success hinges on distinguishing products and building a strong brand. China Jinmao, by concentrating on upscale residential and commercial spaces, alongside integrated urban developments, competes through superior design, enhanced amenities, exceptional service, and holistic lifestyle experiences.

A robust brand image, cultivated through consistent delivery of high-quality projects, serves as a significant competitive edge. For instance, in 2024, China Jinmao reported a significant portion of its revenue derived from its premium property segment, underscoring the importance of this differentiation strategy in attracting discerning buyers and investors.

Geographic Concentration of Competition

Competitive rivalry is particularly intense in China's major urban centers, where China Jinmao has a significant footprint. This includes first-tier cities like Beijing, Shanghai, and Guangzhou, as well as rapidly developing emerging first-tier cities. These prime locations are highly sought after by numerous large-scale developers, creating a highly competitive environment.

The intense competition in these key markets translates into aggressive bidding for land parcels, driving up acquisition costs for developers. Furthermore, companies like China Jinmao must invest heavily in marketing and sales efforts to capture the attention of affluent customers in these saturated markets. For instance, in 2023, the land auction prices in Shanghai saw significant increases, with some prime plots fetching premiums of over 50% above the reserve price, reflecting the fierce competition among developers.

- Intense rivalry in first-tier and emerging first-tier cities where China Jinmao operates.

- High competition for prime land and affluent customer segments.

- Aggressive bidding for land and substantial marketing expenditures are common.

- Example: Shanghai land auctions in 2023 saw premiums exceeding 50% due to developer competition.

Government Policy and SOE Advantage

Government policies designed to bolster the real estate market can significantly shape competition, often benefiting state-owned enterprises (SOEs) like China Jinmao. As a subsidiary of Sinochem Group, Jinmao may experience preferential treatment, including more accessible financing and land acquisition opportunities.

This government backing can create an uneven playing field, granting SOEs like China Jinmao a distinct advantage in overcoming market hurdles and securing essential resources compared to privately held firms.

- Government Support for SOEs: Policies favoring SOEs can lead to easier access to capital and land, as seen with China Jinmao's backing from Sinochem Group.

- Uneven Competitive Landscape: This preferential treatment creates an advantage for SOEs, potentially impacting market share and profitability for private developers.

- Stabilization Efforts: Government interventions aimed at stabilizing the real estate sector in 2024, such as adjustments to mortgage rates and property purchase restrictions, illustrate these policy influences.

Competitive rivalry is a defining characteristic of China Jinmao's operating environment, particularly in its focus on premium urban developments. The company faces intense competition from other major developers, including state-owned enterprises and large private firms, all vying for prime land and affluent customers in key urban centers.

This rivalry manifests in aggressive land acquisition, as evidenced by Shanghai land auctions in 2023 where premiums exceeded 50%. Developers also invest heavily in marketing to differentiate their offerings, a strategy China Jinmao employs by emphasizing superior design and lifestyle experiences in its projects.

The property market's downturn in 2023 and 2024 has further intensified this competition, with companies cutting prices to boost sales and manage debt. China Jinmao's position as an SOE, backed by Sinochem Group, provides a degree of advantage in accessing capital and land, potentially influencing the competitive dynamics.

| Key Competitor Type | Competitive Tactics | Impact on China Jinmao |

|---|---|---|

| Major SOEs | Prime land acquisition, government support | Increased land costs, need for strong government relations |

| Large Private Developers | Aggressive pricing, brand building, innovation | Pressure on margins, need for differentiation |

| Smaller Developers | Niche market focus, regional strength | Fragmented competition in specific segments |

SSubstitutes Threaten

The rental market presents a considerable substitute threat to residential property sales, particularly during periods of economic volatility and falling property prices. Many individuals, especially younger demographics or those with more modest income projections, may find renting a more appealing option than purchasing a home, thereby dampening demand for new property acquisitions.

In China, the rental market has seen significant growth. For instance, by the end of 2023, the rental housing market in major Chinese cities was valued at over 1.2 trillion yuan, indicating a substantial alternative for consumers.

The presence of readily available and affordable rental accommodations, including government-backed initiatives designed to increase the supply of subsidized housing, further bolsters the attractiveness of renting as a substitute for homeownership.

The threat of substitutes for traditional commercial spaces like those offered by China Jinmao is significant. Co-working spaces and flexible office solutions provide businesses with agility and often lower upfront costs. For instance, the global flexible office market was valued at approximately $55 billion in 2023 and is projected to grow substantially, indicating a strong shift away from long-term, fixed leases.

Furthermore, the enduring trend of remote and hybrid work models directly impacts demand for physical office footprints. Many companies are re-evaluating their real estate needs, opting to downsize or eliminate traditional office spaces altogether. This can lead to increased vacancy rates in commercial properties, putting downward pressure on rental prices and impacting revenue for companies like China Jinmao.

In the broader hospitality sector, alternatives to traditional hotels are plentiful. These include the rapidly growing short-term rental platforms, serviced apartments offering longer-term stays with hotel-like amenities, and various budget accommodation options. For instance, in 2024, the global short-term rental market was projected to reach over $100 billion, demonstrating significant consumer adoption outside of traditional hotel bookings.

While China Jinmao primarily targets the luxury segment, these substitutes can still siphon off demand. Travelers seeking more localized experiences or extended stays might opt for a serviced apartment or a unique Airbnb, even if they would typically choose a high-end hotel for shorter trips. This diversion, though perhaps smaller for the premium segment, still represents a competitive pressure that impacts overall market share.

Investing in Other Asset Classes

For investors eyeing China Jinmao's real estate ventures, the threat of substitutes is significant. Other asset classes, like equities and fixed income, offer alternative avenues for capital deployment. In 2024, global equity markets, for instance, showed resilience, with major indices like the S&P 500 posting substantial gains, potentially drawing investor attention away from real estate.

When the property market faces headwinds, such as the slowdown observed in certain segments of China's real estate sector in late 2023 and early 2024, investors naturally seek out opportunities offering better risk-adjusted returns or perceived lower risk profiles. This shift can directly impact capital availability for property development and acquisition.

- Alternative Investments: Stocks, bonds, and direct investments in sectors like technology or manufacturing present viable substitutes for real estate.

- Market Conditions: Challenging property markets can incentivize investors to explore higher-return or lower-risk alternatives.

- Capital Flow Impact: A pivot to substitute assets can reduce the capital available for real estate development and purchases.

- 2024 Market Dynamics: The performance of global equity markets in 2024, with significant positive returns in benchmarks like the S&P 500, highlights the competitive landscape for investor capital.

Lifestyle Changes and Urban Planning

Broader lifestyle shifts, like the growing desire for compact living or eco-friendly communities, can present indirect substitutes to traditional real estate offerings. For instance, the rise of co-living spaces or the increasing popularity of remote work, reducing the need for extensive office footprints, are examples of these evolving preferences.

Urban planning plays a significant role too. Initiatives that enhance public transportation, create vibrant public spaces, and develop community amenities can diminish the demand for large, privately developed commercial or residential projects. In 2023, many Chinese cities continued to invest heavily in public infrastructure, with significant budget allocations towards expanding metro systems and developing green urban spaces, potentially altering the demand for traditional property developments.

- Urban Redevelopment: Cities are prioritizing mixed-use developments that integrate residential, commercial, and recreational facilities, reducing reliance on single-purpose large complexes.

- Shared Economy Growth: The increasing adoption of shared services, from co-working spaces to ride-sharing, offers alternatives that can substitute the need for individual ownership of certain assets or services traditionally provided by large developments.

- Digitalization of Leisure: A greater emphasis on digital entertainment and virtual experiences can reduce the demand for physical leisure spaces, impacting the commercial real estate sector.

The threat of substitutes for China Jinmao's offerings is multifaceted, impacting residential, commercial, and hospitality sectors. For residential property, the growing rental market, valued at over 1.2 trillion yuan in major Chinese cities by end-2023, provides a significant alternative to ownership, especially for younger demographics. In commercial real estate, co-working spaces and flexible office solutions, part of a global market estimated around $55 billion in 2023, offer agility and cost savings, directly competing with traditional leases. The hospitality sector sees substitutes like short-term rentals, projected to exceed $100 billion globally in 2024, diverting demand from conventional hotels, even within the luxury segment.

| Substitute Type | Market Size/Growth | Impact on China Jinmao |

| Rental Housing (Residential) | Over 1.2 trillion yuan (China, end-2023) | Reduces demand for property sales, impacting residential revenue. |

| Flexible Office Spaces (Commercial) | Approx. $55 billion (Global, 2023) | Challenges long-term leases, potentially lowering commercial rental yields. |

| Short-Term Rentals (Hospitality) | Projected >$100 billion (Global, 2024) | Siphons demand from traditional hotels, affecting occupancy and rates. |

| Alternative Investments (Financial) | S&P 500 gains (2024) | Draws capital away from real estate, impacting funding for development. |

Entrants Threaten

The real estate development and urban complex sectors demand significant capital for land acquisition, construction, and marketing. For instance, in 2024, major Chinese developers continued to face substantial upfront costs, with land bids often exceeding billions of yuan. This high capital requirement acts as a formidable barrier, making it difficult for new companies to enter the market without substantial backing.

Securing large-scale financing presents a considerable challenge for potential entrants, particularly given the tightened credit environment in China as of 2024. Lenders are more cautious, demanding stronger collateral and proven track records, which emerging players typically lack, thus limiting their ability to compete with established entities.

The threat of new entrants in China Jinmao's sector is significantly mitigated by extensive regulatory hurdles and evolving government policies. Navigating China's real estate market demands a deep understanding of complex permitting, zoning, and environmental regulations, which often prove time-consuming and expensive for newcomers. For instance, the ongoing efforts to stabilize the market and implement a new development model, as emphasized by government directives throughout 2023 and into 2024, introduce substantial uncertainties and compliance burdens that deter potential new players.

Established developers like China Jinmao benefit from strong brand recognition and customer loyalty, particularly in the high-end property market. Their proven track record of successful project delivery instills confidence, a significant barrier for newcomers. For instance, in 2024, China Jinmao reported a robust sales performance, demonstrating the strength of its brand in attracting buyers even amidst market fluctuations.

Access to Prime Land and Resources

Gaining access to prime land parcels in desirable urban locations presents a significant barrier for new entrants in China's real estate market. Limited supply, coupled with intense competition from established, often state-owned enterprises, drives up acquisition costs. For instance, in 2024, major tier-1 cities continued to see record-high land prices, making it difficult for newcomers to secure competitive deals.

New entrants may struggle to acquire land at prices that allow for profitable development. The sheer scale of operations required for large-scale projects necessitates substantial capital and robust resource management, areas where incumbent players often have a distinct advantage. Securing necessary partnerships and navigating complex regulatory environments further exacerbate these challenges.

- Limited Land Supply: Prime urban land in China's top-tier cities remains scarce, with annual land sales often concentrated among a few major developers.

- Intense Competition: State-owned enterprises (SOEs) and large private developers frequently outbid smaller or new entrants for desirable plots.

- Rising Land Costs: In 2024, average land prices in cities like Shanghai and Beijing continued their upward trend, demanding significant upfront capital from any new player.

- Resource Acquisition Challenges: New entrants face hurdles in securing not only land but also the necessary construction materials, financing, and skilled labor, often at less favorable terms than established firms.

Economies of Scale and Experience

Existing large-scale developers in China's property market, including companies like China Jinmao, significantly benefit from economies of scale. This allows them to secure better pricing on materials and labor through bulk purchasing, and to spread fixed costs across a larger number of projects, leading to lower per-unit costs. For instance, in 2023, China Jinmao reported a revenue of ¥146.7 billion, underscoring its substantial operational footprint.

New entrants face a considerable hurdle in matching these efficiencies. They typically lack the established supply chain relationships and the operational experience that seasoned developers have accumulated over years of market participation. This experience is crucial for navigating China's complex regulatory environment and executing large-scale projects effectively, making it difficult for newcomers to compete on price or speed.

- Economies of Scale: Large developers achieve lower per-unit costs through bulk purchasing and fixed cost absorption.

- Procurement Advantages: Established players secure better terms with suppliers due to higher volume commitments.

- Operational Efficiency: Experienced firms optimize construction and management processes, reducing waste and time.

- Market Navigation: Accumulated knowledge of market cycles and regulatory frameworks provides a competitive edge.

The threat of new entrants for China Jinmao is relatively low due to substantial capital requirements, with land acquisition and construction costs often running into billions of yuan in 2024. Access to prime urban land is also limited, driving up acquisition prices, particularly in major cities where established players, including state-owned enterprises, frequently dominate bidding. Newcomers also face significant regulatory hurdles and the challenge of building brand recognition and customer loyalty, which are crucial for success in China's competitive real estate market.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for China Jinmao is built upon a foundation of publicly available financial reports, industry-specific market research from reputable firms, and government economic data. This blend ensures a comprehensive understanding of the competitive landscape.