China Jinmao PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Jinmao Bundle

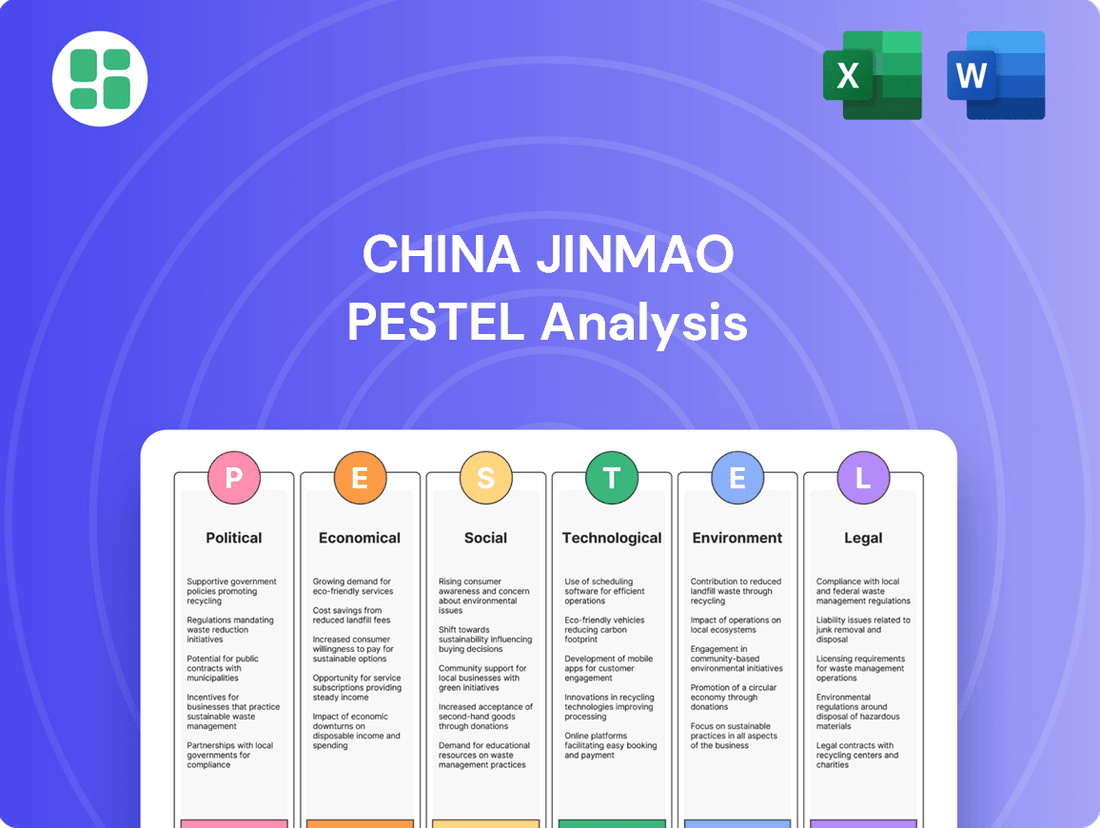

Uncover the intricate web of political, economic, social, technological, legal, and environmental factors shaping China Jinmao's trajectory. Our PESTLE analysis provides a critical lens into these external forces, offering actionable intelligence for strategic decision-making. Don't get left behind; download the full version now to gain a competitive edge.

Political factors

The Chinese government's ongoing efforts to stabilize the real estate market are a significant political factor impacting China Jinmao. These policies, designed to deleverage developers and curb speculation, include stricter financing rules for developers and purchase limitations for homebuyers. For instance, in 2024, authorities continued to enforce measures like the "three red lines" policy, which restricts developer borrowing capacity, aiming to reduce systemic financial risk.

These regulatory actions directly influence China Jinmao's operational landscape, affecting its ability to secure funding for new projects and manage sales volumes. The emphasis on market stability over unchecked expansion means that the pace and nature of new developments are carefully managed. This regulatory environment necessitates a strategic approach from companies like China Jinmao to navigate the evolving market dynamics and ensure financial resilience.

China's national strategies actively promote urbanization and the growth of city clusters, like the Greater Bay Area and the Beijing-Tianjin-Hebei region. These initiatives create significant strategic avenues for China Jinmao, as the company's core business revolves around developing integrated urban complexes. This focus directly aligns with government efforts to concentrate development and infrastructure spending in vital metropolitan hubs.

The government's push for concentrated urban development fuels demand for high-quality residential, commercial, and hospitality properties. For instance, by the end of 2023, the Greater Bay Area's GDP reached approximately $1.3 trillion, showcasing the economic vitality and investment potential within these key regions. China Jinmao's business model is well-positioned to capitalize on this trend, supporting the need for sophisticated urban living and commercial spaces.

China's government is strongly backing green and smart urban development, which presents both chances and obligations for property developers like China Jinmao. This policy direction means that companies need to align their projects with national sustainability goals.

Regulations encouraging higher green building standards and the adoption of smart technologies directly shape how China Jinmao designs and constructs its properties. For instance, the Ministry of Housing and Urban-Rural Development has been actively promoting stricter energy efficiency codes for new buildings, aiming to reduce carbon emissions significantly by 2030.

Meeting these increasingly stringent environmental and technological benchmarks can make China Jinmao's projects more attractive to buyers and investors, boosting their market standing. Conversely, failing to keep pace with these evolving requirements could result in administrative hurdles or financial penalties, impacting project timelines and profitability.

Geopolitical Tensions and Economic Stability

Broader geopolitical tensions, such as ongoing trade disputes and regional security concerns, can indirectly impact China's economic stability, thereby influencing its real estate and hospitality sectors. For instance, shifts in global trade relations, evidenced by the US-China trade war's continued evolution, can affect investor sentiment and foreign direct investment into China's property market.

Any significant geopolitical shifts or domestic political stability concerns can dampen investor confidence and reduce consumer spending power. This directly impacts demand for real estate and hospitality services, key areas for China Jinmao. For example, the International Monetary Fund (IMF) in its April 2024 World Economic Outlook projected global growth to moderate, highlighting the sensitivity of economies to geopolitical shocks.

- Geopolitical Impact: Heightened global tensions can lead to capital flight and reduced foreign investment in China's property sector.

- Trade Relations: Changes in trade policies and tariffs can affect the profitability of Chinese businesses, including those in real estate development and hospitality.

- Investor Confidence: Political stability is crucial for maintaining investor confidence, which directly influences capital flows into China Jinmao's projects.

- Consumer Spending: Economic uncertainty stemming from geopolitical events can curb consumer spending on discretionary items like travel and new housing.

State-Owned Enterprise (SOE) Reform and Support

As a significant player in China's real estate sector, China Jinmao, being a partially state-owned enterprise (SOE), may leverage continued government backing. This support is particularly crucial during economic downturns, offering a buffer against market volatility. For instance, in 2023, SOEs generally maintained stronger financial performance compared to private counterparts, often benefiting from preferential lending and policy support.

Ongoing SOE reforms, such as those focused on improving operational efficiency and market-driven decision-making, could reshape China Jinmao's structure and access to capital. These reforms aim to create more competitive and financially sound enterprises. The government's commitment to supporting SOEs in strategic sectors, like real estate development, directly influences the competitive dynamics within the industry.

- Government Support: China Jinmao's SOE status can provide access to favorable financing and policy advantages, particularly beneficial in navigating market uncertainties.

- SOE Reform Impact: Reforms targeting efficiency and market competitiveness could lead to structural changes and enhanced access to funding for China Jinmao.

- Competitive Landscape: The government's strategic decisions regarding SOE support in real estate directly shape the competitive environment for companies like China Jinmao.

The Chinese government's continued focus on stabilizing the real estate market, through measures like the "three red lines" policy, directly impacts China Jinmao's financing and sales strategies. Simultaneously, national urbanization plans, such as the development of city clusters like the Greater Bay Area, create significant opportunities for the company's integrated urban development projects.

Government backing for green and smart urban development mandates that China Jinmao align its projects with sustainability goals, influencing construction standards and potentially boosting market appeal. Geopolitical tensions and trade disputes can indirectly affect investor sentiment and consumer spending, impacting the property and hospitality sectors where China Jinmao operates.

As a state-owned enterprise (SOE), China Jinmao benefits from potential government support, which is crucial during economic fluctuations, though ongoing SOE reforms may alter its operational structure and capital access.

| Policy Area | Impact on China Jinmao | Example/Data (2023-2024) |

|---|---|---|

| Real Estate Stabilization | Constrained financing, managed sales pace | Continued enforcement of "three red lines" policy |

| Urbanization Initiatives | Opportunities in key metropolitan hubs | Greater Bay Area GDP ~ $1.3 trillion (end of 2023) |

| Green Development | Need to meet stricter environmental codes | Ministry of Housing promoting higher energy efficiency standards |

| Geopolitical Factors | Potential impact on investor confidence and spending | IMF projects moderate global growth, sensitive to shocks (April 2024) |

| SOE Status | Access to preferential financing and policy support | SOEs generally outperformed private peers in 2023 |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting China Jinmao, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions. It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within the company's operating landscape.

A PESTLE analysis of China Jinmao provides a clear framework to navigate complex market dynamics, offering actionable insights to mitigate risks and capitalize on opportunities.

Economic factors

China's real estate sector continues to navigate a significant downturn, marked by falling property sales and price adjustments in various cities. For China Jinmao, this translates to a more challenging sales environment, impacting revenue streams from its core development business. For instance, new home sales in major Chinese cities saw a notable decrease in early 2024 compared to the previous year, creating headwinds for developers.

The pace of recovery in the real estate market is a critical factor for China Jinmao's future performance. While the government has implemented various support measures, including easing some purchase restrictions and providing liquidity assistance to developers, the market's rebound is expected to be gradual. Analysts project a slow but steady stabilization, with the high-end segment potentially showing more resilience than mass-market housing.

China's monetary policy, including interest rate adjustments, significantly impacts China Jinmao's financing costs. For instance, the People's Bank of China (PBOC) has maintained a relatively accommodative stance, with the Loan Prime Rate (LPR) for 5-year loans, a benchmark for mortgages, standing at 3.95% as of early 2024, down from 4.20% in mid-2023. This reduction in borrowing costs is beneficial for China Jinmao's extensive development projects.

Lower interest rates generally translate to reduced financial burdens for China Jinmao, making it more affordable to finance its ambitious urban complex developments and other investment initiatives. This environment can also stimulate buyer demand in the property market, as mortgage costs become more manageable for consumers, indirectly supporting sales volumes for the company.

Conversely, any future increases in interest rates by the PBOC would directly raise China Jinmao's borrowing expenses. Higher financing costs could potentially dampen investor and buyer sentiment, impacting the pace of project execution and sales performance, especially given the company's reliance on debt for its capital-intensive operations.

China Jinmao's performance hinges on the spending power of its affluent and middle-class consumers. In 2024, a key indicator will be how economic stability and job security influence their willingness to invest in luxury real estate and premium hospitality. Consumer confidence surveys will be crucial to track, as a dip could directly impact demand for China Jinmao's high-end offerings.

Inflationary Pressures and Construction Costs

China Jinmao faces significant economic headwinds from rising inflation, particularly impacting raw materials, labor, and energy. For instance, China's Producer Price Index (PPI) saw a notable increase in early 2024, with specific sectors like construction materials experiencing higher cost pressures. This trend directly translates to increased construction expenses for Jinmao's property development ventures, posing a challenge to maintaining profitability.

Managing these escalating input costs is a critical economic hurdle for China Jinmao. The company must balance the need to absorb some of these higher costs to remain competitive in the property market against the imperative to protect its profit margins. This delicate balancing act requires astute financial management and strategic pricing decisions.

To navigate these inflationary pressures, efficient supply chain management and strategic procurement are paramount for China Jinmao. By securing favorable terms for materials and labor and optimizing logistics, the company can better mitigate the impact of rising costs on its project profitability. For example, securing long-term supply contracts for key materials before significant price hikes can lock in more favorable rates.

- Rising Input Costs: China's PPI for construction materials like steel and cement experienced upward trends in early 2024, directly increasing project expenses.

- Profit Margin Squeeze: Companies like China Jinmao must manage higher construction costs while maintaining competitive sales prices, potentially squeezing profit margins.

- Strategic Procurement: Proactive sourcing and securing of raw materials and labor contracts are essential to offset inflationary impacts on project profitability.

Investment in Urban Infrastructure and Development

Government and private sector investment in China's urban infrastructure, including transportation and public amenities, directly fuels opportunities for China Jinmao's integrated urban complex developments. These initiatives boost project value by enhancing connectivity and livability.

For instance, China's fixed-asset investment in infrastructure reached approximately 3.9 trillion USD in 2023, a significant portion directed towards urban renewal and transportation networks. This sustained investment trend is a key economic indicator for China Jinmao's strategic planning, signaling continued demand for well-connected and amenity-rich urban living spaces.

- Government commitment to urban development: Continued large-scale infrastructure spending supports the viability and growth potential of China Jinmao's large-scale urban projects.

- Enhanced project value: Improved transportation and public amenities directly increase the attractiveness and market value of China Jinmao's integrated urban complexes.

- Economic indicators for planning: The scale and direction of infrastructure investment provide crucial data for China Jinmao's long-term development strategies and land acquisition.

- Growth opportunities: Investments in new city districts and smart city initiatives create direct avenues for China Jinmao to expand its development portfolio.

China's economic landscape presents a mixed bag for China Jinmao. While the real estate market is undergoing a correction, government efforts to stabilize it, including interest rate adjustments, offer some relief. For example, the People's Bank of China's reduction of the 5-year Loan Prime Rate to 3.95% in early 2024 lowers borrowing costs for developers like Jinmao.

However, rising inflation, particularly in construction materials, is a significant concern, potentially squeezing profit margins. Companies must strategically manage procurement to mitigate these cost increases. Furthermore, the overall economic stability and consumer confidence will directly influence demand for Jinmao's premium properties.

Government investment in infrastructure remains a strong positive, enhancing the value and appeal of Jinmao's urban complex developments. China's substantial fixed-asset investment in infrastructure, around 3.9 trillion USD in 2023, underscores this supportive economic factor.

| Economic Factor | Impact on China Jinmao | Key Data/Trend (2024/2025) |

|---|---|---|

| Real Estate Market Correction | Challenging sales environment, potential revenue impact | New home sales in major cities saw a decrease in early 2024. |

| Monetary Policy (Interest Rates) | Lower financing costs beneficial; potential for increased borrowing expenses if rates rise. | PBOC's 5-year LPR at 3.95% (early 2024) reduces borrowing costs. |

| Inflation (Input Costs) | Increased construction expenses, potential profit margin squeeze. | Producer Price Index (PPI) for construction materials showed upward trends in early 2024. |

| Infrastructure Investment | Enhanced project value and demand for urban developments. | China's fixed-asset investment in infrastructure was approx. 3.9 trillion USD in 2023. |

Preview Before You Purchase

China Jinmao PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive China Jinmao PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting China Jinmao.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights for strategic planning.

Sociological factors

China's urban population, now exceeding 930 million in 2024, shows a clear shift towards integrated living. This demographic is increasingly seeking mixed-use developments that blend housing, shopping, entertainment, and cultural amenities, reflecting a desire for convenience and enhanced quality of life. China Jinmao's strategic emphasis on urban complexes directly aligns with this evolving preference, positioning them to capitalize on this significant market trend.

Following the global pandemic, Chinese society has placed a significantly higher value on health, wellness, and environmentally conscious living. This shift directly influences consumer preferences, particularly in real estate, leading to a growing demand for properties that offer extensive green spaces, sophisticated air purification technologies, on-site fitness centers, and convenient access to outdoor recreational activities.

China Jinmao is well-positioned to leverage this evolving consumer sentiment. By proactively incorporating these sought-after health and wellness amenities into its premium residential and commercial developments, the company can significantly boost the marketability and perceived value of its properties. For instance, a focus on biophilic design and smart home technology that supports well-being could resonate strongly with affluent buyers in 2024 and 2025.

China's demographic landscape is undergoing significant transformations, notably an aging population and declining birth rates. By the end of 2023, China's population had fallen for the second consecutive year, with the birth rate dropping to 6.39 per 1,000 people, a new low. This shift directly impacts housing demand, potentially increasing the need for smaller, more manageable living spaces suitable for an aging demographic and a rise in single-person households.

Evolving household structures, with a trend towards smaller family units and an increase in single-person households, are reshaping the property market. This suggests a growing demand for compact, well-appointed apartments in urban areas, catering to a more independent lifestyle. China Jinmao must strategically adjust its property development portfolio to align with these changing consumer preferences and ensure its offerings resonate with the evolving needs of Chinese households.

Cultural Significance of Home Ownership

Home ownership remains a cornerstone of Chinese culture, deeply intertwined with social standing and financial stability. This enduring aspiration fuels consistent demand for housing, acting as a buffer against market volatility. For instance, in 2024, surveys indicated that over 90% of Chinese urban households aspire to own their homes, a figure that has remained remarkably stable.

China Jinmao's strategic focus on premium residential projects aligns perfectly with this cultural imperative. By delivering high-quality, aspirational living spaces, the company taps into the profound desire for homeownership as a symbol of success and security. This cultural resonance is a significant driver for China Jinmao's brand appeal in the competitive property market.

- Cultural Imperative: Homeownership is a primary goal for most Chinese families, signifying stability and social achievement.

- Market Driver: This deep-seated value ensures sustained demand for residential real estate, even during economic slowdowns.

- Brand Alignment: China Jinmao's luxury segment directly appeals to this cultural aspiration, enhancing its market position.

Impact of Digitalization on Consumer Behavior

The pervasive digitalization of Chinese society profoundly reshapes consumer engagement with real estate and hospitality. By mid-2024, over 1.1 billion people in China were active internet users, with mobile penetration reaching approximately 85%. This digital immersion means consumers expect seamless online research, virtual property viewings, and integrated smart home functionalities as baseline offerings.

China Jinmao's strategic imperative lies in fully embracing this digital shift. This involves not only enhancing its online marketing and sales channels but also integrating digital solutions into property management to cater to a sophisticated, digitally-native clientele. For instance, by Q1 2025, the company aims to have 75% of its customer service interactions managed through digital platforms.

- Digital Adoption: 85% mobile penetration in China as of mid-2024 fuels online research and purchasing.

- Consumer Expectations: Demand for virtual tours and smart home features is rising across property segments.

- Digital Transformation: China Jinmao is prioritizing digital channels for marketing, sales, and customer service.

- Service Integration: Plans are in place to manage 75% of customer service digitally by early 2025.

China's rapidly urbanizing population, projected to reach over 930 million by the end of 2024, demonstrates a strong preference for integrated living environments. This demographic actively seeks mixed-use developments that combine residential, commercial, and leisure facilities, highlighting a growing demand for convenience and enhanced urban lifestyles.

The increasing emphasis on health and wellness post-pandemic is a significant sociological trend influencing real estate choices. Consumers, particularly in urban centers, are prioritizing properties with ample green spaces, advanced air purification, and access to recreational amenities, driving demand for health-conscious developments.

China's aging population and declining birth rates, with a second consecutive year of population decline reported by late 2023 and a new low birth rate of 6.39 per 1,000 people, are reshaping housing needs. This demographic shift is expected to increase demand for smaller, more manageable living spaces and cater to a growing number of single-person households.

Homeownership remains a deeply ingrained cultural aspiration in China, symbolizing financial security and social status. This enduring value ensures consistent demand for residential properties, with surveys in 2024 indicating over 90% of urban households aspire to own a home, providing market stability.

Technological factors

The increasing adoption of smart building and Internet of Things (IoT) technologies is fundamentally reshaping property management in China. China Jinmao can harness these advancements to bolster security, optimize energy consumption, and implement predictive maintenance across its portfolio. For instance, by 2024, the smart home market in China was projected to reach over $30 billion, highlighting a significant consumer demand for integrated living experiences.

Leveraging IoT for personalized resident services and efficient building management presents a key competitive advantage. By 2025, it's estimated that over 80% of new commercial buildings in major Chinese cities will incorporate some level of smart technology. This trend necessitates that China Jinmao actively integrates intelligent building management platforms to maintain its market position and enhance resident satisfaction.

Innovations like Building Information Modeling (BIM) and prefabrication are transforming China's construction sector. These advanced techniques are projected to boost efficiency and shorten project timelines significantly. For instance, the adoption of BIM in China is expected to grow, with a significant percentage of large-scale projects utilizing it by 2025, leading to an estimated 10-20% reduction in project costs.

The integration of sustainable and advanced materials is also a key technological driver. These materials not only enhance building performance and energy efficiency but also contribute to improved environmental ratings, a growing concern in China's urban development. China Jinmao can leverage these advancements to build more cost-effective and environmentally friendly properties, securing a competitive advantage in the market.

The Property Technology (PropTech) wave is significantly reshaping property management in China. Digital platforms are streamlining leasing, tenant services, and maintenance, with predictive analytics and AI optimizing commercial spaces. For instance, by mid-2024, a significant portion of new commercial developments are expected to integrate smart building technologies, enhancing operational efficiency and tenant experience.

China Jinmao can leverage these PropTech advancements to bolster its property management capabilities. Investing in digital solutions for tenant engagement and predictive maintenance, for example, could lead to improved asset performance and reduced operational costs. The company's commitment to digital transformation, evident in its 2024 strategy, positions it to capitalize on these trends.

Big Data Analytics for Market Insights

China Jinmao leverages big data analytics to dissect market trends, consumer behavior, and potential investment avenues. This allows for more strategic decisions concerning property development, from selecting optimal locations to fine-tuning pricing and marketing campaigns.

By processing extensive datasets encompassing property sales, demographic shifts, and economic indicators, the company can refine its project planning. For instance, in 2024, real estate data analytics platforms are increasingly vital for identifying undersupplied urban areas or predicting demand for specific housing types.

- Enhanced Market Understanding: Big data provides granular insights into property market dynamics, enabling more accurate forecasting.

- Optimized Project Development: Analytics inform decisions on project scale, design features, and pricing strategies to meet specific consumer needs.

- Targeted Marketing: Understanding consumer preferences through data allows for more effective and personalized marketing efforts, boosting sales conversion rates.

- Risk Mitigation: Identifying potential market saturation or economic downturns through data analysis helps in mitigating investment risks.

Digitalization of Hospitality Services

The hospitality sector in China is rapidly embracing digitalization, transforming how guests interact with services. Online booking platforms and mobile check-in/check-out are becoming standard, streamlining the guest journey. For instance, by the end of 2023, over 70% of hotel bookings in China were made through online channels, highlighting a significant shift towards digital engagement.

China Jinmao's hotel division can leverage these technological trends to enhance guest experiences and operational efficiency. AI-powered personalization, offering tailored recommendations and services based on guest data, is a key area for growth. This digital transformation also supports more sophisticated revenue management strategies, optimizing pricing and occupancy rates. In 2024, many Chinese hotel groups reported a 15-20% increase in revenue per available room (RevPAR) after implementing advanced digital tools.

Key technological advancements impacting China Jinmao's hospitality segment include:

- AI-driven personalization: Utilizing data analytics to offer customized guest experiences, from room preferences to dining suggestions.

- Mobile integration: Enhancing guest convenience through mobile check-in/out, digital room keys, and in-app service requests.

- Smart hotel technology: Implementing IoT devices for automated room controls (lighting, temperature) and improved operational monitoring.

- Big data analytics: Leveraging guest data to refine marketing strategies, improve service delivery, and forecast demand more accurately.

The increasing integration of smart building technologies and the Internet of Things (IoT) is a significant technological factor for China Jinmao. By 2025, it's projected that over 80% of new commercial buildings in major Chinese cities will feature smart technology, driving demand for integrated management platforms. China Jinmao can leverage these advancements to enhance property management, improve energy efficiency, and offer personalized resident services, thereby gaining a competitive edge.

Legal factors

China Jinmao's operations are intrinsically tied to the nation's intricate property laws, especially those dictating land use rights. These regulations govern everything from acquiring land to its transfer and the lease terms, which commonly extend to 70 years for residential properties. In 2024, the government continued to navigate evolving housing market policies, with a focus on stabilizing development and addressing regional imbalances, directly impacting the cost and availability of land for developers like China Jinmao.

China's real estate sector has seen significant regulatory shifts, directly affecting developers like China Jinmao. The 'three red lines' policy, introduced in August 2020, imposed strict limits on developer borrowing, aiming to curb excessive leverage. For instance, by the end of 2023, many developers struggled to meet these criteria, impacting their ability to secure new financing.

These financing regulations extend to mortgage lending as well, influencing buyer demand and, consequently, sales volumes for companies like China Jinmao. Stricter mortgage approval processes and potential caps on loan-to-value ratios can dampen market activity, requiring developers to adjust their sales strategies and financial planning.

Navigating this evolving regulatory landscape is paramount for China Jinmao's financial health and expansion plans. The company must ensure robust compliance with all financing rules to maintain access to capital, manage its debt levels effectively, and continue its project development pipeline in a sustainable manner.

China's construction and building codes are notably strict and frequently updated, focusing on safety, quality, and structural soundness. China Jinmao must meticulously follow these detailed regulations at every stage, from initial design through construction and final inspection. For instance, in 2024, the Ministry of Housing and Urban-Rural Development continued to emphasize stricter enforcement of seismic design standards and fire safety measures across new developments.

Failure to comply with these evolving codes can result in substantial project delays, hefty fines, and severe damage to China Jinmao's reputation. In the most extreme cases, non-compliance could even lead to project cancellations, directly impacting the company's financial performance and profitability. Adherence is therefore not just a legal necessity but a critical component of risk management for China Jinmao.

Environmental Protection Laws and Compliance

China Jinmao faces increasingly stringent environmental protection laws, impacting its construction and operational phases. Regulations focus on emissions, waste management, and resource efficiency, creating significant compliance obligations for developers. For instance, in 2023, China intensified enforcement of its Environmental Protection Law, with a notable increase in penalties for non-compliant businesses.

To navigate this, China Jinmao must embed sustainable practices and secure essential environmental permits for its developments. This includes investing in green building technologies and robust waste reduction strategies. The company's commitment to environmental, social, and governance (ESG) principles is crucial for long-term viability.

Failure to adhere to these regulations can lead to substantial legal penalties and damage to its public image. For example, in early 2024, several real estate firms faced fines for environmental violations, highlighting the heightened scrutiny. China Jinmao's proactive approach to environmental compliance is therefore a critical risk management strategy.

Key compliance areas for China Jinmao include:

- Emissions Control: Meeting stricter air and water quality standards for construction sites and operational facilities.

- Waste Management: Implementing comprehensive strategies for construction waste recycling and reduction, as well as operational waste disposal.

- Resource Efficiency: Optimizing water and energy consumption throughout project lifecycles.

- Permitting and Reporting: Obtaining and maintaining all necessary environmental permits and transparently reporting environmental performance.

Contract Law and Dispute Resolution

China Jinmao's operations are deeply intertwined with contract law, impacting everything from supplier agreements to tenant leases. Navigating China's evolving legal landscape, including its contract enforcement mechanisms, is paramount for risk mitigation. For instance, in 2023, the Supreme People's Court of China reported handling over 3.5 million first-instance civil and commercial cases, highlighting the volume and importance of contract-related disputes.

Effective dispute resolution is a key legal factor for China Jinmao. The company must be adept at utilizing mechanisms like arbitration and court litigation to protect its interests and ensure contractual compliance. A robust understanding of these processes can significantly reduce potential financial and operational disruptions stemming from disagreements.

- Contractual Clarity: Ensuring all agreements with suppliers, contractors, buyers, and tenants are meticulously drafted and legally sound is crucial for preventing future disputes.

- Dispute Resolution Expertise: Developing in-house or external capabilities to effectively manage and resolve legal conflicts through arbitration or litigation is essential for safeguarding company assets and reputation.

- Regulatory Compliance: Staying abreast of changes in Chinese contract law and related regulations ensures that all business dealings remain compliant and legally defensible.

China Jinmao must navigate a complex web of legal frameworks governing property development and sales. The nation's evolving housing policies, including those aimed at stabilizing the market and addressing regional disparities, directly influence land acquisition costs and availability. For example, in 2024, continued policy adjustments by the Ministry of Housing and Urban-Rural Development underscored the dynamic legal environment developers must adapt to.

Environmental factors

Climate change is intensifying extreme weather in China, with more frequent heavy rainfall, heatwaves, and floods. These events present direct physical risks to China Jinmao's real estate developments, potentially damaging properties and disrupting operations. For instance, in 2023, China experienced significant rainfall and flooding in various regions, impacting infrastructure and urban areas.

Adapting to these climatic shifts necessitates designing climate-resilient buildings and urban complexes. This proactive approach is crucial for safeguarding China Jinmao's assets and ensuring their long-term sustainability and value. Such resilience measures also influence the company's insurance premiums and overall risk management strategies, as insurers increasingly factor in climate-related vulnerabilities.

Growing environmental consciousness among Chinese consumers and investors is significantly boosting the demand for green and sustainable buildings. This trend is further supported by government policies and incentives aimed at promoting eco-friendly construction. China Jinmao can leverage this by integrating sustainable practices, energy-efficient technologies, and environmentally sound materials into its developments, thereby increasing their appeal and aligning with Environmental, Social, and Governance (ESG) investment criteria.

The market for green buildings in China is experiencing robust growth. By 2024, it's estimated that over 2 billion square meters of green building space will be operational nationwide. Achieving certifications such as LEED or the China Green Building Label can substantially enhance a project's market value and attract a wider pool of environmentally conscious buyers and investors.

China Jinmao faces significant hurdles due to the scarcity of vital natural resources, particularly water and energy, which are increasingly constrained within the nation. Coupled with this, increasingly strict regulations governing construction waste management are directly impacting operational costs and demanding innovative solutions for material handling and disposal.

To navigate these challenges and capitalize on emerging opportunities, China Jinmao must prioritize the implementation of highly efficient resource utilization strategies across all its projects. This includes adopting robust waste reduction and recycling practices, which are crucial for both mitigating escalating costs and ensuring full compliance with evolving environmental standards.

The commitment to sustainable resource management is not merely a compliance issue but a fundamental pillar for China Jinmao's long-term business viability and competitive advantage. For instance, in 2023, China's Ministry of Ecology and Environment reported a 15% increase in construction waste generation, highlighting the urgency for companies like Jinmao to invest in circular economy principles.

Pollution Control and Air Quality Concerns

Urban air pollution remains a significant challenge in China, impacting public health and shaping consumer demand for healthier living and working environments. For instance, in 2023, cities like Beijing and Shanghai continued to experience periods of elevated PM2.5 levels, although overall improvements were noted compared to previous years due to stricter environmental regulations.

China Jinmao, especially with its focus on premium residential and commercial developments, needs to proactively integrate solutions addressing these environmental concerns. This includes incorporating advanced air filtration systems, increasing green spaces within projects, and designing structures that limit residents' exposure to external pollutants. Such features directly enhance the appeal and marketability of their properties.

- Air Quality Initiatives: China's Ministry of Ecology and Environment reported a 4.5% decrease in average PM2.5 concentrations across 339 cities in 2023 compared to 2022.

- Green Building Standards: The adoption of stricter green building certifications, like LEED and China's own Three Star system, is becoming more prevalent, encouraging developers to invest in sustainable technologies.

- Consumer Demand: Surveys indicate a growing consumer preference for properties in areas with better air quality and developers who demonstrate a commitment to environmental sustainability.

Corporate Social Responsibility (CSR) and ESG Pressure

China Jinmao faces growing expectations from investors, regulators, and the public to showcase robust Environmental, Social, and Governance (ESG) practices. This pressure is increasingly shaping investment decisions and corporate strategy.

To thrive, China Jinmao must embed environmental sustainability into its core operations, provide clear disclosures on its environmental footprint, and secure relevant certifications. These steps are vital for attracting socially responsible capital and upholding a favorable public image.

ESG performance is emerging as a significant competitive advantage. For instance, as of early 2024, global ESG assets under management were projected to reach $50 trillion by 2025, highlighting the financial imperative for strong ESG credentials.

- Investor Scrutiny: A significant portion of institutional investors now integrate ESG factors into their due diligence, with many divesting from companies with poor environmental records.

- Regulatory Landscape: China's own push for green development and carbon neutrality goals, aiming for peak carbon emissions before 2030, directly influences real estate developers like China Jinmao.

- Market Demand: Consumers and business partners are increasingly favoring companies with demonstrable commitments to sustainability, influencing purchasing power and partnership opportunities.

China Jinmao must navigate increasing environmental scrutiny, with climate change posing risks like extreme weather events that can damage properties, as seen with 2023 flooding impacts across China. Growing consumer and investor demand for green buildings, supported by government incentives, presents an opportunity for Jinmao to enhance property value by integrating sustainable practices and achieving certifications like LEED, especially as the green building market is projected for significant expansion.

Resource scarcity, particularly water and energy, coupled with stricter construction waste management regulations, directly impacts operational costs for China Jinmao, necessitating efficient resource utilization and robust waste reduction strategies to ensure compliance and cost control.

Addressing urban air pollution is critical, as consumers increasingly seek healthier living environments, prompting developers like Jinmao to integrate advanced air filtration and increased green spaces into their projects to boost marketability, aligning with China's reported 4.5% decrease in average PM2.5 concentrations in 2023.

| Environmental Factor | Impact on China Jinmao | Mitigation/Opportunity | Relevant Data (2023-2025) |

|---|---|---|---|

| Climate Change & Extreme Weather | Physical risks to properties, operational disruptions | Develop climate-resilient buildings, enhance risk management | Increased frequency of heavy rainfall and heatwaves in China |

| Green Building Demand | Opportunity for enhanced property value and market appeal | Integrate sustainable practices, energy efficiency, eco-friendly materials | Over 2 billion sq meters of green building space projected operational by 2024 |

| Resource Scarcity (Water, Energy) | Increased operational costs, regulatory compliance challenges | Implement efficient resource utilization, waste reduction, and recycling | 15% increase in construction waste generation reported in 2023 |

| Air Quality Concerns | Consumer demand for healthier living environments | Incorporate advanced air filtration, increase green spaces, limit pollutant exposure | 4.5% decrease in average PM2.5 concentrations across 339 cities in 2023 |

PESTLE Analysis Data Sources

Our China Jinmao PESTLE Analysis is built upon a comprehensive review of official Chinese government publications, economic reports from international organizations like the World Bank and IMF, and reputable industry-specific market research. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.