Datang International Power SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Datang International Power Bundle

Datang International Power demonstrates significant strengths in its established market presence and extensive operational capacity. However, understanding the nuances of its competitive landscape and potential regulatory shifts is crucial for informed decision-making.

Want the full story behind Datang International Power's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Datang International Power Generation boasts a robust and diversified energy portfolio, encompassing coal-fired, hydro, wind, and solar power plants. This strategic mix significantly reduces the company's vulnerability to fluctuations in any single energy source, allowing for greater operational resilience and adaptability to evolving market conditions and environmental policies.

The company's commitment to clean energy is evident in its substantial growth in renewable capacity. By the end of 2024, Datang International reported a considerable increase in both wind and solar photovoltaic installations, highlighting a successful pivot towards more sustainable energy generation and a stronger position in the green energy sector.

Datang International Power's integrated energy supply chain is a significant strength, encompassing not only power generation but also upstream activities like coal mining. This vertical integration, evidenced by their substantial coal reserves, provides a more secure and potentially cost-controlled fuel source for their thermal power fleet. For instance, in 2023, Datang International reported coal production capacity that directly supports its thermal power generation needs, mitigating risks associated with fluctuating coal prices and availability.

Datang International Power holds a commanding position as one of China's preeminent independent power generators. Its installed capacity reached a significant 73.29 GW by the close of 2023, and this figure expanded to an impressive 79.11 GW by the first quarter of 2025.

This substantial operational scale translates directly into considerable economies of scale, bolstering its market presence and providing a robust platform for continued growth within China's dynamic power industry. The parent entity, China Datang, achieved a remarkable milestone, surpassing 200 GW in total installed capacity during 2024.

Strong Financial Performance and Improving Profitability

Datang International Power showcased impressive financial strength in 2024, reporting a total profit of RMB 3.118 billion. The company anticipates its net profit to more than double, representing its strongest performance since its initial public offering. This upward trajectory persisted into the first quarter of 2025, with substantial growth in net profit.

This profitability surge is largely attributed to strategic cost management, specifically a reduction in fuel expenses. Furthermore, improvements in operational efficiency across its power generation facilities have significantly contributed to the enhanced financial results.

- 2024 Total Profit: RMB 3.118 billion

- Projected Net Profit Growth: More than doubling

- Q1 2025 Performance: Significant net profit increase

- Key Drivers: Reduced fuel costs and improved operational efficiency

Commitment to Green Transformation and New Energy Expansion

Datang International Power is making significant strides in its green transformation, with clean and renewable energy sources comprising 37.75% of its total installed capacity by the close of 2023. This commitment is further underscored by the company's record-high construction targets for new energy projects in 2024, which include substantial additions to its wind and photovoltaic power generation capacity. This aggressive expansion in renewables clearly signals Datang's dedication to sustainable development and its alignment with China's broader energy transition objectives.

The company's strategic focus on new energy is a powerful strength, positioning it favorably within a market increasingly prioritizing decarbonization.

- Renewable Energy Dominance: Clean and renewable energy represented 37.75% of Datang's installed capacity as of year-end 2023.

- Aggressive 2024 Expansion: Achieved record-high construction targets for new energy development in 2024.

- Wind and Solar Growth: Significant additions to wind and photovoltaic capacity are a key component of the 2024 strategy.

- Alignment with National Goals: The company's green transformation directly supports national energy transition and low-carbon development policies.

Datang International Power holds a commanding position as one of China's largest independent power generators, boasting an installed capacity of 79.11 GW by Q1 2025, up from 73.29 GW in 2023. This scale provides significant economies of scale and a strong market presence. The company also demonstrated robust financial health in 2024, reporting RMB 3.118 billion in total profit and anticipating its net profit to more than double, driven by cost management and operational efficiencies.

| Metric | 2023 | 2024 | Q1 2025 |

|---|---|---|---|

| Total Installed Capacity (GW) | 73.29 | N/A | 79.11 |

| Total Profit (RMB billion) | N/A | 3.118 | N/A |

| Projected Net Profit Growth | N/A | > 100% | N/A |

What is included in the product

Analyzes Datang International Power’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Datang International Power's strategic challenges and capitalize on opportunities.

Weaknesses

Datang International Power's significant dependence on coal-fired thermal power remains a key vulnerability. As of the first quarter of 2025, thermal power represented a substantial 47.17 GW of its total installed capacity, which stood at 79.11 GW. This concentration means the company is particularly susceptible to the increasing environmental regulations and the broader decarbonization push within China.

While Datang International Power benefited from declining coal prices in 2024, which positively impacted its bottom line, the company remains exposed to the inherent volatility of thermal coal prices. This fluctuation poses a significant risk to its financial performance.

Future increases in coal prices could substantially reduce profitability, particularly given the company's substantial reliance on its large fleet of coal-fired power plants. For instance, if coal prices were to rise by 10% in 2025, it could directly impact the operating costs of these facilities.

Datang International Power's asset-liability ratio presents a notable weakness. As of the close of 2024, this ratio was recorded at 67.48%, and it saw a slight increase to 69.63% by the first quarter of 2025. This elevated level of debt signifies a significant reliance on borrowed funds.

This substantial debt burden can constrain the company's financial maneuverability. It may lead to higher interest expenses, impacting profitability, and could make it more challenging to secure additional financing at favorable terms, a critical factor in the capital-intensive power generation sector.

Furthermore, a high asset-liability ratio exposes Datang International to greater interest rate volatility. Should interest rates rise, the cost of servicing its existing debt will increase, potentially eroding earnings and affecting its overall financial stability.

Intensifying Competition in the Power Market

Datang International Power faces intensified competition as China's power market reforms steer towards a more market-driven approach. This shift, particularly evident in the spot market, creates pricing pressures and can squeeze profit margins. For instance, declining green power and GEC prices observed in 2024 directly illustrate this challenge.

The increasing competitiveness can lead to:

- Price Volatility: Market-oriented reforms often introduce greater price fluctuations, making revenue forecasting more challenging.

- Margin Erosion: As more players enter and compete on price, especially for renewable energy sources, margins can shrink.

- Operational Efficiency Demands: Companies like Datang must constantly improve efficiency to remain competitive in a market where cost is a key differentiator.

Regulatory and Policy Risks Related to Coal

Datang International Power faces significant regulatory and policy risks stemming from China's commitment to its 'dual carbon' goals. The new Energy Law, effective January 2025, is expected to usher in more stringent environmental regulations and operational limitations for coal-fired power plants, directly impacting Datang's core business.

The ongoing approval of new coal capacity in China, despite these ambitious climate targets, presents a further challenge. This trend risks creating an oversupply of electricity generation, potentially leading to stranded assets and a devaluation of Datang's existing coal power infrastructure. For instance, in 2023, China approved a record amount of new coal power capacity, raising concerns about the long-term viability of such investments.

- Stricter Environmental Regulations: The 2025 Energy Law could impose higher costs for emissions and operational requirements on coal plants.

- Risk of Stranded Assets: Continued new coal approvals may lead to excess capacity, diminishing the value of Datang's coal fleet.

- Policy Uncertainty: Evolving climate policies create an unpredictable operating environment for coal-dependent utilities.

Datang International Power's substantial reliance on coal-fired thermal power, accounting for 47.17 GW of its 79.11 GW installed capacity as of Q1 2025, makes it highly vulnerable to China's escalating environmental regulations and decarbonization efforts. This concentration exposes the company to significant policy shifts and the growing pressure to transition away from fossil fuels. The company’s asset-liability ratio, standing at 69.63% in Q1 2025, up from 67.48% at the end of 2024, indicates a considerable dependence on debt financing, which could lead to higher interest expenses and reduced financial flexibility, especially in a rising interest rate environment.

| Weakness | Description | Impact |

|---|---|---|

| Coal Dependence | 47.17 GW of 79.11 GW installed capacity (Q1 2025) is coal-fired. | Vulnerability to environmental regulations and decarbonization push. |

| High Asset-Liability Ratio | 69.63% (Q1 2025), up from 67.48% (End of 2024). | Increased financial risk, higher interest expenses, and reduced maneuverability. |

| Market Competition | Price pressures from market-driven reforms and declining green power prices (2024). | Potential for margin erosion and challenges in revenue forecasting. |

Preview Before You Purchase

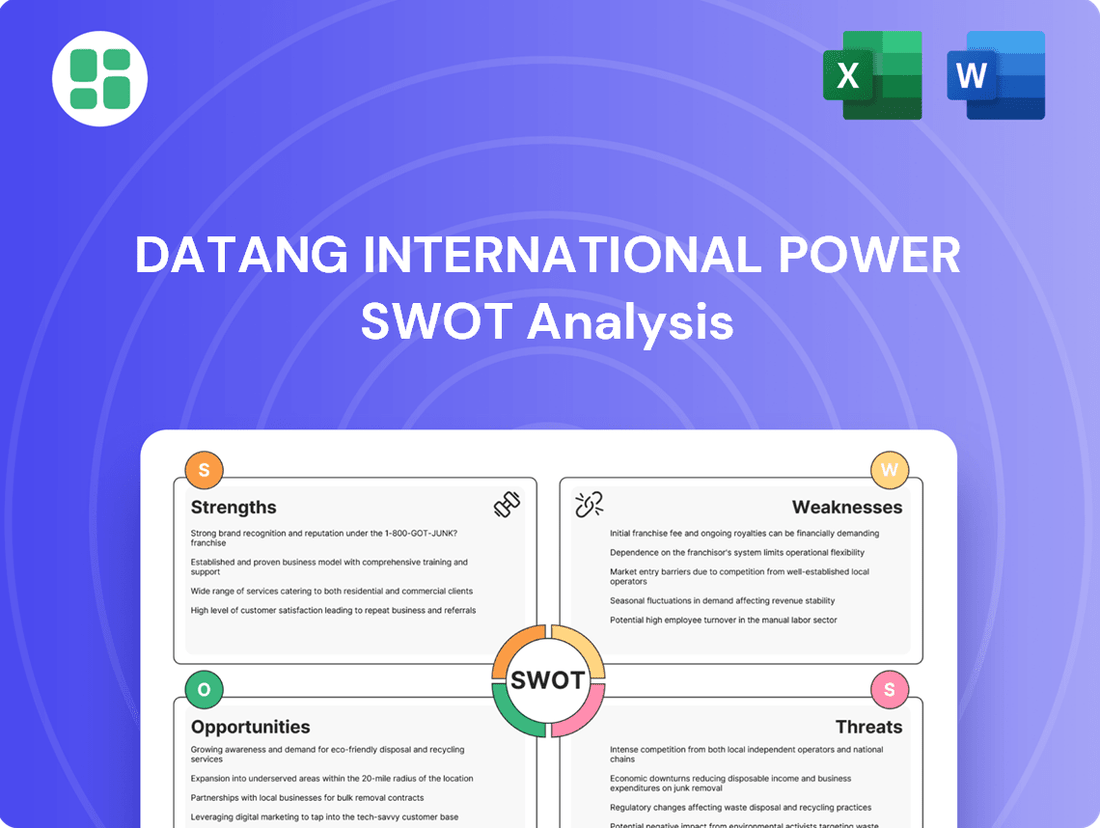

Datang International Power SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get, detailing Datang International Power's strengths, weaknesses, opportunities, and threats. This is the actual document you’ll receive upon purchase—no surprises, just professional quality analysis. Purchase unlocks the entire in-depth version, providing comprehensive insights into the company's strategic position.

Opportunities

China's new Energy Law, taking effect in January 2025, mandates accelerated renewable energy development to achieve its carbon goals. This policy shift offers a significant advantage for Datang International Power, encouraging further expansion of its wind, solar, and hydropower capacities. This strategic alignment with national objectives positions Datang favorably for growth in the clean energy sector.

China's electricity consumption is projected to see robust growth, with an estimated increase of around 6.5% in 2024. This sustained demand creates a substantial and expanding market for Datang International Power's generation capacity, bolstering both its existing power assets and its investments in new energy sources.

China's power sector reforms, particularly the growth of spot markets and green power trading, present significant opportunities for Datang International Power. These changes allow for more dynamic pricing and the integration of renewable energy sources, potentially boosting revenue. For instance, by 2023, the cumulative transaction volume in China's electricity spot market exceeded 1 trillion kWh, indicating substantial growth and potential for companies like Datang to optimize their market participation.

Datang can capitalize on these reforms by refining its dispatch strategies to better respond to market signals and fluctuating demand. The expansion of green power trading platforms, which saw a 20% year-on-year increase in trading volume in 2023, offers a direct channel to monetize its renewable energy assets more effectively. This strategic alignment with market-oriented reforms can enhance operational efficiency and profitability.

Advancements in Energy Storage Technologies

Datang International Power is strategically positioning itself to capitalize on the evolving energy landscape through significant investments in advanced energy storage technologies. A prime example is their pioneering work with the world's first large-scale commercial sodium-ion energy storage project, successfully deployed in Hubei during 2024. This initiative underscores their commitment to innovation in this critical sector.

Further development and widespread adoption of energy storage solutions present substantial opportunities for Datang. These advancements are crucial for bolstering grid stability, which is essential as renewable energy sources become more integrated into the power mix. Moreover, these technological leaps can unlock new revenue streams and business models, enhancing the company's overall competitive advantage.

- Enhanced Grid Stability: Energy storage systems help manage the intermittency of renewables, ensuring a more reliable power supply.

- Improved Renewable Integration: Facilitates greater penetration of solar and wind power by smoothing out supply fluctuations.

- New Business Ventures: Opens avenues for services like frequency regulation, peak shaving, and ancillary services in the electricity market.

- Technological Leadership: Datang's investment in projects like the Hubei sodium-ion storage facility positions them as a leader in next-generation energy solutions.

Potential for International Expansion

Datang International can leverage its parent company, China Datang's, expanding global presence, particularly through the Belt and Road Initiative. This initiative is already facilitating new energy projects in regions like Africa, with Zambia slated for new developments in 2024. This strategic alignment presents a significant opportunity for Datang International to actively pursue international projects.

Such expansion allows for crucial diversification of revenue streams, moving beyond a sole reliance on the Chinese domestic market. This geographical diversification can mitigate risks associated with market fluctuations or policy changes within a single country. By engaging in overseas ventures, Datang International can tap into new growth markets and secure long-term, stable revenue sources.

- Global Reach Expansion: China Datang's involvement in the Belt and Road Initiative provides a framework for Datang International to explore international markets.

- Diversification Benefits: Pursuing projects in countries like Zambia in 2024 offers a chance to diversify revenue and reduce dependency on the domestic market.

- New Market Opportunities: International expansion can unlock access to emerging economies with growing energy demands, creating new avenues for growth.

- Risk Mitigation: Spreading operations across different geographies can buffer against country-specific economic or regulatory risks.

China's commitment to renewable energy, driven by its 2025 carbon goals and a new Energy Law, provides a fertile ground for Datang International Power's expansion in wind, solar, and hydropower. The projected 6.5% growth in China's electricity consumption for 2024 further solidifies a strong domestic market, while ongoing power sector reforms, including the expansion of spot and green power markets, offer avenues for revenue optimization. Datang's strategic investments in advanced energy storage, exemplified by its 2024 sodium-ion project in Hubei, are crucial for grid stability and unlocking new revenue streams.

| Opportunity Area | Description | Key Data/Fact |

|---|---|---|

| Renewable Energy Push | Alignment with China's carbon goals and new Energy Law (Jan 2025). | Mandated accelerated renewable energy development. |

| Growing Electricity Demand | Robust increase in China's electricity consumption. | Projected 6.5% increase in 2024. |

| Power Sector Reforms | Growth of spot markets and green power trading. | Spot market cumulative volume exceeded 1 trillion kWh by 2023; green power trading volume up 20% year-on-year in 2023. |

| Energy Storage Innovation | Investment in advanced storage technologies. | Deployment of world's first large-scale commercial sodium-ion energy storage project (Hubei, 2024). |

| International Expansion | Leveraging parent company's global presence (Belt and Road Initiative). | New energy projects in Africa, including Zambia in 2024. |

Threats

China's ambitious 'dual carbon' targets, aiming for carbon peak by 2030 and carbon neutrality by 2060, alongside a new Energy Law, are accelerating the transition to low-carbon power sources. This regulatory push is likely to impose stricter environmental standards on power producers.

These evolving regulations could translate into increased compliance costs for Datang International Power, particularly due to its substantial reliance on thermal power assets. Furthermore, there's a growing possibility of accelerated phasing out of coal-fired power plants, directly impacting the company's existing operational base.

China's aggressive expansion of wind and solar power, with installed capacity reaching approximately 1.6 billion kilowatts by the end of 2023, is creating a significant challenge. This rapid growth, often exceeding the grid's ability to absorb the power, leads to curtailment, meaning renewable energy is intentionally shut off. In 2023, China's wind curtailment rate was around 2%, and solar curtailment was about 1%, representing a substantial amount of wasted clean energy.

This oversupply and curtailment directly impacts the profitability of companies like Datang International Power, which are heavily investing in renewable energy. When their clean energy assets are curtailed, it reduces their effective generation output and, consequently, their revenue and profit margins. This situation could dampen the financial returns on Datang's substantial clean energy investments.

Datang International Power faces significant competition in China's power generation sector, a landscape populated by numerous large state-owned enterprises and increasingly active private entities. This crowded market often translates into considerable pricing pressure, especially as market reforms continue to reshape how electricity is bought and sold.

For instance, in 2023, the average on-grid electricity price for coal-fired power in China saw fluctuations, with some regions experiencing downward adjustments due to oversupply and policy changes. This environment directly challenges Datang's ability to maintain robust profit margins across its various generation assets, from coal to renewables.

The ongoing push for market-based pricing mechanisms means that Datang, like its peers, must constantly adapt to competitive forces that can impact revenue streams and overall profitability. Successfully navigating these competitive threats requires strategic efficiency improvements and a keen focus on cost management.

Market Price Volatility and Negative Electricity Prices

The shift towards market-based electricity trading, especially in provincial spot markets, has intensified price volatility for generators like Datang. This volatility is further exacerbated by the occurrence of negative electricity prices, a phenomenon observed during times of low demand coupled with high renewable energy output. For instance, in some European markets in 2023, wholesale electricity prices dipped below zero for extended periods, directly impacting revenue streams.

These market dynamics pose a significant threat to Datang International Power's revenue stability and overall profitability. The unpredictability of electricity prices makes long-term financial planning challenging and can erode margins, particularly for baseload generation assets. This trend is expected to continue as renewable energy penetration increases.

- Increased Market Volatility: Greater reliance on spot markets leads to unpredictable revenue.

- Negative Pricing Events: Periods of oversupply can result in zero or negative revenue for generated electricity.

- Impact on Profitability: Volatility and negative pricing directly squeeze profit margins for power producers.

- Renewable Energy Influence: Rising renewable generation contributes to price swings and negative price occurrences.

Challenges in Integrating Coal and Renewables

Integrating coal and renewables presents a significant hurdle, even with supportive policies. The core issue lies in aligning dispatch principles and market mechanisms effectively. This coordination is crucial for ensuring that coal power’s role as a support for renewables doesn’t inadvertently create bottlenecks.

The continued reliance on coal plants for baseload power, rather than their intended flexible standby role, directly impedes the grid's capacity to absorb renewable energy. This operational reality limits the available grid space for wind and solar, thereby slowing down the energy transition. For companies like Datang International Power, this dynamic poses both operational and strategic challenges, impacting their ability to maximize renewable integration.

- Coordination Gap: Policy aims to use coal for renewable support, but practical coordination of dispatch and market rules remains a challenge.

- Baseload vs. Flexibility: Coal plants often operate as baseload, reducing grid flexibility needed for renewables.

- Limited Renewable Space: The inflexible operation of coal plants restricts the grid's ability to accommodate more wind and solar power.

- Strategic Impact: This situation creates operational and strategic difficulties for power generators like Datang in achieving a balanced energy mix.

Datang International Power faces significant threats from China's evolving energy policies and market dynamics. The country's ambitious 'dual carbon' targets are driving a rapid transition to low-carbon sources, potentially increasing compliance costs for Datang's thermal assets and risking accelerated phase-outs of coal-fired plants.

Intensifying competition and market-based pricing mechanisms are leading to greater electricity price volatility, with instances of negative pricing observed in some markets. This unpredictability directly impacts revenue stability and profit margins, especially for baseload generation.

Furthermore, challenges in coordinating coal and renewable energy dispatch can limit the grid's capacity to absorb clean energy, hindering the overall energy transition and impacting Datang's renewable investments.

China's installed renewable capacity reached approximately 1.6 billion kilowatts by the end of 2023, with curtailment rates around 2% for wind and 1% for solar in 2023, illustrating the potential for wasted clean energy revenue.

SWOT Analysis Data Sources

This analysis is built upon a foundation of robust data, including Datang International Power's official financial reports, comprehensive market research from industry analysts, and insights from expert commentary on the energy sector.