Datang International Power PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Datang International Power Bundle

Navigate the complex global landscape impacting Datang International Power with our comprehensive PESTLE analysis. Understand how political shifts, economic volatilities, and technological advancements are creating both challenges and opportunities for the company. Equip yourself with actionable intelligence to refine your strategies and gain a competitive edge. Download the full PESTLE analysis now to unlock critical insights.

Political factors

The Chinese government's commitment to its 'dual carbon' objectives, aiming for carbon emissions to peak before 2030 and achieve carbon neutrality by 2060, profoundly influences Datang International's strategic direction. This overarching policy framework is a primary driver for the company's investment decisions and operational adjustments.

Policies actively promoting renewable energy development are central to this political landscape. For instance, national targets for new renewable energy capacity additions and provincial consumption benchmarks directly encourage companies like Datang to expand their clean energy portfolios, impacting their capital allocation and project pipelines.

This strong political imperative is accelerating Datang International's transition away from its reliance on traditional coal-fired power generation. The government's stance mandates a significant shift towards a cleaner energy mix, pushing the company to prioritize investments in wind, solar, and other renewable sources to align with national environmental and energy security goals.

As a significant state-owned enterprise (SOE) under China Datang Corporation Ltd., Datang International Power is directly impacted by evolving SOE reforms. These initiatives are designed to boost efficiency, enhance market responsiveness, and strengthen corporate governance across state-controlled entities.

These reforms can significantly shape Datang International's operational freedom, its strategic investment choices, and its overall financial strategy. For instance, reforms in 2024 and 2025 are expected to further encourage market-based principles, potentially opening avenues for greater private sector involvement in China's dynamic energy landscape.

China's push for a unified national power market by 2029, alongside accelerated integration of new energy sources, presents a significant shift. This reform moves away from predictable fixed tariffs towards a competitive bidding and market-based pricing model for renewables.

This transition directly impacts Datang International Power's revenue streams, necessitating adaptation to new trading mechanisms and potentially affecting the stability of its earnings as it navigates a more dynamic pricing environment.

Geopolitical Stability and Energy Security

China's heightened focus on energy security, intertwined with geopolitical dynamics, significantly shapes the nation's energy mix. This strategic imperative balances the push for renewable energy sources with a pragmatic, ongoing reliance on coal. The government views coal as a crucial supplementary resource, particularly for ensuring grid stability during periods of high demand or economic pressure, a crucial consideration for companies like Datang International Power.

This dual strategy directly impacts Datang International's operational and investment decisions. While the company is actively expanding its renewable capacity, it must also manage its substantial coal-fired power generation assets. For instance, in 2024, China continued to approve new coal power projects to meet energy demand, even as it pursued ambitious renewable energy targets. This presents a complex operating environment where the company navigates both decarbonization goals and the immediate need for reliable power.

- Renewable Energy Growth: China aims for renewables to constitute over 45% of its total installed power capacity by 2025, a target that influences Datang's investment in wind and solar.

- Coal's Continued Role: Despite the green push, coal power still accounted for approximately 55% of China's electricity generation in 2023, highlighting its importance for baseload power and energy security.

- Geopolitical Influences: International energy market volatility and supply chain concerns reinforce China's commitment to domestic energy sources, including coal, as a strategic buffer.

International Collaboration and Belt and Road Initiative

China's Belt and Road Initiative (BRI) actively promotes international energy cooperation, presenting Datang International with significant avenues for overseas project development and the exchange of advanced technologies. This strategic alignment could bolster the company's global footprint and operational capabilities.

Datang International has proactively cultivated partnerships along the BRI, extending its 'Circle of Friends' to include key projects in regions like Africa. This demonstrates a clear strategic intent to forge global alliances and pursue international expansion, leveraging the BRI framework for growth.

- BRI-driven Opportunities: The BRI's focus on infrastructure development, particularly in energy, creates a conducive environment for Datang International to secure new international projects, potentially increasing its overseas revenue streams.

- Technological Advancement: Collaborations fostered by the BRI can facilitate access to cutting-edge energy technologies and best practices, enhancing Datang International's efficiency and competitiveness in the global market.

- Geographic Diversification: Projects in Africa, for instance, indicate Datang International's commitment to diversifying its asset base and reducing reliance on domestic markets, thereby mitigating country-specific risks.

China's commitment to its dual carbon goals, aiming for carbon neutrality by 2060, drives Datang International's strategic shift towards renewables, influencing investment and operations. National targets for renewable energy capacity, like the aim for renewables to exceed 45% of total installed power capacity by 2025, directly encourage Datang's clean energy expansion.

The ongoing SOE reforms are designed to enhance efficiency and market responsiveness, impacting Datang's operational freedom and financial strategy, with further market-based principles expected in 2024-2025.

China's energy security focus, balancing renewables with coal's role for grid stability, means Datang must manage its coal assets while expanding clean energy, a strategy evidenced by continued coal project approvals in 2024 alongside renewable targets.

The Belt and Road Initiative offers Datang International opportunities for international energy cooperation and technology exchange, fostering global partnerships and diversification, as seen in projects in Africa.

What is included in the product

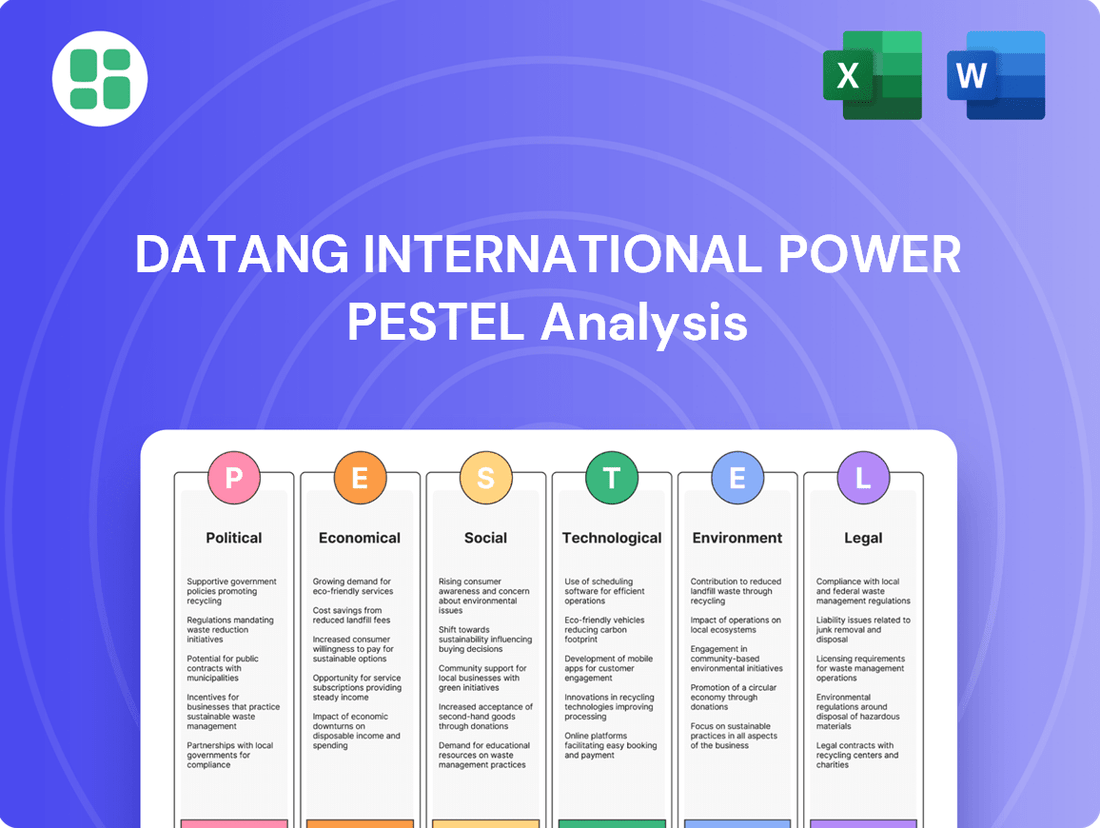

This PESTLE analysis of Datang International Power offers a comprehensive examination of the political, economic, social, technological, environmental, and legal forces impacting the company's operations and strategic decisions.

It provides a data-driven overview of how these external factors create both significant challenges and promising opportunities for Datang International Power within its operating landscape.

A clear, actionable PESTLE analysis for Datang International Power that highlights key external factors, enabling proactive strategy development and mitigating potential risks.

This analysis provides a structured framework to understand the political, economic, social, technological, environmental, and legal landscape impacting Datang International Power, thereby simplifying complex market dynamics for strategic decision-making.

Economic factors

China's electricity consumption saw a 6.7% increase in 2023, reaching 9.5 trillion kilowatt-hours, indicating continued robust demand. Datang International's profitability is closely linked to this trend, particularly the industrial sector, which accounted for over 50% of total electricity usage in 2023.

However, periods of slower industrial output, such as the 2.1% year-on-year contraction in industrial production in February 2024, can temper the demand for thermal power. This directly impacts Datang's coal-fired power generation segment, a core part of its asset base.

Datang International is navigating a significant shift in electricity pricing as markets move towards greater orientation, especially for renewables. This transition presents a dual-edged sword: while competitive bidding for new solar and wind projects, as seen in recent Chinese tenders, can drive down tariffs, it also creates revenue streams that are less predictable than the older fixed-offtake agreements. For instance, some renewable projects secured in 2023 auctions saw tariff reductions of 10-15% compared to previous years, impacting revenue stability.

The company must strategically adapt to these evolving pricing mechanisms to ensure sustained profitability. This involves not only securing competitive bids but also exploring strategies to mitigate revenue volatility, such as long-term power purchase agreements (PPAs) where possible or diversifying their energy portfolio. The ability to manage fluctuating tariffs will be a key determinant of Datang International's financial performance in the coming years.

Coal prices remain a critical factor for Datang International Power, even as the company diversifies into renewables. In 2024, Datang's annual coal production exceeded 30 million tonnes, highlighting the continued reliance on this fuel source for its thermal power generation. Any volatility in coal prices directly affects the profitability of these operations.

The company's ability to maintain stable operations and profitability within its coal production segment is essential for securing a consistent fuel supply for its thermal power assets. This internal fuel security helps mitigate some of the risks associated with external market price fluctuations for coal.

Investment in Green Energy and Infrastructure

China’s commitment to green energy is accelerating, with substantial investments pouring into renewable sources, grid modernization, and energy storage. This national drive directly impacts major energy producers like Datang International. The company is strategically allocating significant capital to expand its renewable energy portfolio, enhance its smart grid capabilities, and develop advanced energy storage solutions, aligning with China's ambitious decarbonization goals.

Datang International's investment strategy reflects the broader economic trend. For instance, China's renewable energy capacity saw a remarkable surge, with solar power installations alone adding over 216 gigawatts in 2023, a new global record. This expansion necessitates robust grid infrastructure and storage to manage the intermittent nature of renewables. Datang's capital expenditures in these areas are crucial for integrating this new capacity and ensuring grid stability. The company's focus is on building a resilient and efficient power system for the future.

- Record Renewable Investment: China's investment in clean energy reached new heights, with the National Energy Administration reporting over $89 billion USD invested in the sector in the first half of 2024.

- Grid Modernization Focus: Datang International is actively upgrading its transmission and distribution networks to accommodate a higher percentage of renewable energy, aiming for a more integrated and intelligent power system.

- Energy Storage Expansion: The company is investing in battery storage and other energy storage technologies, recognizing their critical role in balancing supply and demand as renewable penetration increases.

- Strategic Alignment: These investments are directly tied to China's 14th Five-Year Plan targets for renewable energy development and carbon emissions reduction.

Macroeconomic Conditions and Deflationary Risks

China's macroeconomic landscape presents significant headwinds for Datang International Power. The nation's GDP growth targets, while ambitious, face challenges from persistently weak domestic consumption. This directly impacts energy demand, a key driver for power generation companies like Datang.

Deflationary risks are a growing concern, potentially squeezing profit margins and impacting the company's ability to raise capital. For instance, the producer price index (PPI) in China has shown periods of contraction, indicating falling prices for industrial goods, which can translate to lower revenue for power producers.

- GDP Growth: China's official GDP growth target for 2024 was set at around 5%, but actual performance is closely watched amid domestic demand weakness.

- Consumption: Retail sales growth has been uneven, highlighting cautious consumer spending habits that dampen electricity demand.

- Deflationary Pressures: The Consumer Price Index (CPI) and Producer Price Index (PPI) have both exhibited low inflation or outright deflation in certain months during 2023 and early 2024, impacting revenue realization.

These macroeconomic conditions directly influence Datang International's financial health, affecting its capacity to secure favorable financing terms and manage the rising costs associated with operations and potential new investments in a challenging economic climate.

China's economic policies are increasingly focused on energy transition and sustainability, directly influencing Datang International's strategic direction. The government's emphasis on reducing carbon intensity and promoting renewable energy sources necessitates significant capital reallocation towards cleaner technologies.

While China's GDP growth for 2024 is targeted around 5%, actual performance is subject to domestic consumption patterns. Weak consumer spending can temper electricity demand, impacting Datang's revenue, particularly from industrial sources which accounted for over 50% of electricity consumption in 2023.

Deflationary pressures, evidenced by low inflation or negative PPI figures in late 2023 and early 2024, pose a risk to Datang's profitability and its ability to secure favorable financing for its extensive capital expenditure plans in renewable energy and grid modernization.

| Economic Factor | 2023/2024 Data Point | Impact on Datang International |

|---|---|---|

| Electricity Consumption Growth | 6.7% in 2023 | Indicates sustained demand for power generation. |

| Industrial Production Growth | -2.1% YoY (Feb 2024) | Can temper demand for thermal power, affecting Datang's coal segment. |

| Renewable Energy Tariffs | 10-15% reduction in 2023 auctions | Presents revenue volatility for new renewable projects. |

| Coal Production (Datang) | Over 30 million tonnes (2024 estimate) | Highlights continued reliance on coal, making coal prices critical. |

| Renewable Energy Investment (China) | Over $89 billion USD (H1 2024) | Supports Datang's strategic shift towards renewables. |

| GDP Growth Target (China) | ~5% for 2024 | Overall economic health influences energy demand. |

| Consumer Price Index (CPI) | Low inflation/deflation in parts of 2023-2024 | Suggests cautious consumer spending, potentially impacting demand. |

| Producer Price Index (PPI) | Periods of contraction in 2023-2024 | Indicates falling industrial goods prices, potentially squeezing revenue. |

What You See Is What You Get

Datang International Power PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. It details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Datang International Power.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a comprehensive understanding of the external forces shaping Datang International Power's strategic landscape.

The content and structure shown in the preview is the same document you’ll download after payment. This PESTLE analysis provides actionable insights for strategic decision-making.

Sociological factors

Public concern over air quality and climate change is a significant driver in China, influencing energy choices. Datang International, like other power giants, faces increasing pressure to transition towards cleaner energy to meet societal expectations and maintain its operating permits.

This societal shift is reflected in policy, with China aiming for carbon neutrality by 2060. In 2023, renewable energy sources accounted for over 50% of China's newly installed power generation capacity, a trend Datang International must align with to remain competitive and socially responsible.

China's ongoing urbanization, with an estimated 65% of its population expected to live in cities by 2025, directly fuels shifting energy consumption. This trend signifies a substantial rise in demand from residential and commercial sectors, requiring Datang International to strategically adjust its power generation and distribution approaches to meet these growing urban energy requirements.

To effectively serve these evolving urban energy needs, Datang International is likely exploring investments in distributed energy solutions and advanced smart grid technologies. For instance, by 2024, China's smart grid investment was projected to reach over $100 billion, indicating a national push towards more efficient and responsive energy infrastructure that Datang can leverage.

The global shift towards cleaner energy sources significantly impacts employment in sectors reliant on traditional fossil fuels. For companies like Datang International Power, this means a substantial need to retrain and reallocate workers from coal-fired power generation to emerging renewable energy projects and advanced technology roles.

In 2024, China, a key market for Datang, continued its aggressive renewable energy expansion. The country added approximately 300 GW of renewable capacity in 2023, a record-breaking year, indicating a strong demand for skilled labor in solar, wind, and other green technologies. This transition presents both a challenge in managing existing coal-sector employment and a significant opportunity to build a future-ready workforce for Datang's expanding green portfolio.

Corporate Social Responsibility (CSR)

As a significant state-owned enterprise (SOE), Datang International Power faces considerable societal expectations to uphold robust corporate social responsibility (CSR). This includes not only ensuring a stable and reliable power supply for the nation but also actively contributing to the economic development of the regions where it operates and maintaining stringent ethical labor practices. These commitments are crucial for maintaining its reputation and fostering positive relationships with all stakeholders.

Datang International's commitment to CSR is often detailed in its annual social responsibility reports. For instance, in 2023, the company reported investing ¥1.2 billion in community development projects, focusing on education and environmental protection. These reports serve as a transparent account of their efforts, directly impacting how the public and investors perceive the company's broader societal role and its commitment to sustainable operations.

- Stable Power Supply: Datang International is a key player in China's energy security, with its operations directly impacting millions of households and businesses.

- Community Engagement: The company's CSR initiatives in 2023 included supporting 50 rural electrification projects and providing job training for over 10,000 individuals in underserved areas.

- Ethical Labor Practices: Datang International emphasizes fair wages and safe working conditions, with a reported 99.8% compliance rate with national labor laws in its 2023 employee surveys.

- Reputation Management: Positive CSR performance, as evidenced by its 2023 CSR report achieving a 92% stakeholder satisfaction score, enhances brand image and investor confidence.

Community Engagement and Impact

Datang International's large-scale power projects, particularly its renewable energy ventures in less populated regions, necessitate robust engagement with the local populations. Successfully integrating these projects hinges on addressing the social ramifications, such as land acquisition and the distribution of economic advantages to nearby residents.

Effective community relations are crucial for Datang International to navigate potential social disruptions and foster local buy-in. For instance, in 2023, Datang International reported significant community investment programs alongside its wind farm developments, aiming to create shared value and mitigate localized impacts.

- Community Acceptance: Ensuring local populations benefit from projects, such as through employment or infrastructure improvements, is key to smooth implementation.

- Social Impact Management: Datang International actively monitors and manages the social footprint of its operations, from land use changes to environmental effects on local livelihoods.

- Benefit Sharing: Programs designed to share the economic benefits of energy projects with local communities are vital for long-term project sustainability and positive stakeholder relationships.

Societal expectations in China increasingly prioritize environmental sustainability and a cleaner energy future, directly influencing Datang International Power's strategic direction. The company must balance its role as a major energy provider with growing public demand for reduced emissions and a transition to renewable sources. This societal pressure is a key driver for Datang's investments in green technologies and its commitment to corporate social responsibility.

China's rapid urbanization, with an estimated 65% of its population expected to reside in cities by 2025, is a significant sociological factor driving energy demand. This demographic shift necessitates that Datang International Power adapt its infrastructure and supply strategies to meet the concentrated energy needs of urban centers. The company's ability to provide reliable and increasingly cleaner energy to these burgeoning populations is paramount for its continued relevance and operational success.

Datang International Power, as a prominent state-owned enterprise, faces substantial societal expectations regarding its corporate social responsibility (CSR). This includes ensuring energy security while also contributing to regional economic development and upholding ethical labor standards. In 2023, the company's CSR report highlighted investments of ¥1.2 billion in community projects and a 99.8% compliance rate with labor laws, underscoring its commitment to these societal obligations.

The company's large-scale renewable energy projects, particularly in less populated areas, require careful community engagement to ensure local acceptance and benefit sharing. Datang International actively manages the social impacts of its operations, aiming to create shared value and mitigate localized disruptions. For instance, in 2023, its wind farm developments were accompanied by significant community investment programs to foster positive relationships and ensure project sustainability.

| Sociological Factor | Impact on Datang International Power | Key Data/Initiatives (2023-2024) |

| Environmental Awareness & Climate Change Concern | Increased pressure for cleaner energy transition; adoption of renewable technologies. | China's 2060 carbon neutrality goal; over 50% of new capacity in 2023 was renewable. |

| Urbanization & Shifting Energy Consumption | Growing demand from residential and commercial sectors; need for smart grid solutions. | 65% urban population expected by 2025; over $100 billion projected for China's smart grid investment in 2024. |

| Corporate Social Responsibility (CSR) Expectations | Need for stable power, regional economic contribution, and ethical labor practices. | ¥1.2 billion invested in community projects (2023); 99.8% labor law compliance (2023). |

| Community Relations & Local Impact | Requirement for engagement, benefit sharing, and social impact management for projects. | Support for 50 rural electrification projects; job training for 10,000+ individuals (2023). |

Technological factors

Rapid advancements in wind and solar power technology are significantly boosting efficiency and driving down costs, forming a core element of Datang International's expansion plans. The company is strategically increasing its wind and photovoltaic generation capacity, reflecting a commitment to these evolving technologies.

Datang International is actively investing in and deploying these improved technologies to align with national renewable energy goals. For instance, by the end of 2023, the company had achieved substantial growth in its wind power installed capacity, a testament to its adoption of these technological leaps.

The inherent intermittency of renewable energy sources like solar and wind power makes advanced energy storage solutions crucial for grid stability and reliability. Datang International is actively addressing this challenge.

In 2024, Datang International commissioned China's first 100 MW sodium-ion energy storage project, a landmark achievement in the commercial deployment of next-generation storage technologies. This project signifies a major advancement in Datang's strategy to integrate and stabilize renewable energy generation.

Datang International is actively involved in China's push towards a modernized power system, emphasizing smart grid development and digitalization. This strategic focus is vital for incorporating more renewable energy sources and ensuring the grid's stability. The company's efforts are geared towards expanding transmission capabilities and leveraging digital intelligence for better operational coordination.

In 2023, China's investment in smart grid construction reached approximately 500 billion yuan, highlighting the national commitment to this technological advancement. Datang International's participation in this trend positions it to benefit from improved efficiency and greater integration of clean energy, aligning with national energy transition goals.

Clean Coal Technologies

Datang International Power continues to invest in clean coal technologies, recognizing the ongoing role of coal in China's energy mix. The company is actively deploying ultra-supercritical (USC) coal-fired units, which operate at higher temperatures and pressures to improve efficiency and reduce emissions compared to older technologies. For instance, by the end of 2023, Datang had a significant portion of its thermal power capacity equipped with advanced USC technology.

These investments are coupled with the implementation of advanced emission control systems, such as flue gas desulfurization (FGD) and selective catalytic reduction (SCR), to minimize pollutants like sulfur dioxide and nitrogen oxides. This focus on the clean and efficient use of coal aims to mitigate the environmental impact of its thermal power generation assets, ensuring they remain a viable part of the company's diversified energy portfolio while adhering to stricter environmental regulations.

- Ultra-supercritical (USC) technology: Datang International has been a leader in adopting USC technology for its new coal-fired power plants, significantly enhancing thermal efficiency.

- Emission reduction: Investments in FGD and SCR systems allow Datang's coal plants to meet stringent environmental standards, reducing SO2 and NOx emissions.

- Energy mix support: By improving the environmental performance of its coal assets, Datang supports a balanced energy transition, integrating cleaner coal power with growing renewable capacity.

Hydro and Other Advanced Generation Technologies

Datang International is actively pursuing advancements in hydropower, exemplified by its 500 MW high-head impulse turbine demonstration project. This initiative highlights significant progress in the independent development of critical power generation equipment, signaling a strategic move to diversify its energy portfolio beyond renewable sources like wind and solar.

This commitment to advanced generation technologies is crucial for Datang International's long-term strategy. By pushing the boundaries in hydropower, the company is not only enhancing its operational efficiency but also solidifying its position as a leader in innovative energy solutions. The successful implementation of such projects is expected to contribute to a more stable and resilient power supply.

- Hydropower Innovation: Datang International's 500 MW high-head impulse turbine project demonstrates a focus on advanced hydropower technology.

- Independent Equipment Development: This project signifies breakthroughs in the company's ability to develop key power generation equipment independently.

- Diversification Strategy: The move into advanced hydropower underscores a broader strategy to leverage diverse generation technologies, moving beyond a sole reliance on wind and solar.

Datang International is embracing technological advancements in renewable energy, particularly in wind and solar power, to boost efficiency and reduce costs. The company's strategic expansion into these areas is supported by significant investments in improved technologies, as evidenced by its growing wind power installed capacity by the end of 2023.

To address the intermittency of renewables, Datang is investing in advanced energy storage. A key milestone was the commissioning of China's first 100 MW sodium-ion energy storage project in 2024, showcasing a commitment to next-generation storage solutions for grid stability.

The company is also a key player in China's smart grid development, investing in digitalization and transmission capabilities to better integrate clean energy. This aligns with national efforts, as China's smart grid investment reached approximately 500 billion yuan in 2023.

Datang continues to enhance its clean coal operations through ultra-supercritical (USC) technology, improving efficiency and reducing emissions. By the close of 2023, a substantial portion of its thermal power capacity utilized USC technology, complemented by advanced emission control systems.

| Technology Area | Datang's Focus/Investment | Key Data/Achievement | Year |

|---|---|---|---|

| Wind Power | Increasing installed capacity | Significant growth in wind power capacity | End of 2023 |

| Solar Power | Increasing photovoltaic generation capacity | Strategic expansion | Ongoing |

| Energy Storage | Sodium-ion battery technology | Commissioned China's first 100 MW project | 2024 |

| Smart Grid | Digitalization, transmission enhancement | Aligning with national investment of ~500 billion yuan | 2023 |

| Clean Coal | Ultra-supercritical (USC) units | Significant portion of thermal capacity equipped | End of 2023 |

Legal factors

China's increasingly stringent environmental protection laws, covering emissions, water usage, and noise pollution, directly impact Datang International's power generation activities. For instance, the nation’s commitment to carbon neutrality by 2060 necessitates significant investment in cleaner technologies and operational adjustments.

Datang International must adhere to these evolving regulations, which often include specific targets for reducing sulfur dioxide and nitrogen oxide emissions. Failure to comply can result in substantial fines and operational disruptions, underscoring the need for robust environmental management systems.

The company's proactive approach to strengthening environmental risk control is crucial for sustainable operations and maintaining its social license to operate. This includes investing in advanced pollution control equipment and exploring renewable energy sources to align with national environmental goals.

China's commitment to peak carbon emissions before 2030 and achieve carbon neutrality by 2060 is solidifying into robust legal frameworks. These include the ongoing development and expansion of national and regional carbon trading schemes, designed to put a price on carbon emissions and incentivize reductions.

As a major player in the power generation sector, Datang International Power is directly impacted by these evolving regulations. The company faces growing legal mandates to lower its carbon intensity, which will likely translate to increased operational costs related to compliance and a significant push for investments in cleaner energy technologies and carbon capture solutions.

China's evolving energy laws, particularly the updated renewable energy consumption quotas, mandate specific percentages for provincial renewable energy sourcing. This legal scaffolding directly shapes Datang International's renewable energy development objectives and guides its strategic project placements across various Chinese provinces.

For instance, the 2023 National Development and Reform Commission (NDRC) directive outlined ambitious renewable energy targets, pushing for a significant increase in the proportion of non-fossil fuel energy consumption. This legal push means Datang International must align its investment and operational plans to meet these increasingly stringent provincial benchmarks, impacting where and how quickly it can deploy new renewable capacity.

Land Use and Project Permitting Regulations

Datang International Power faces significant legal hurdles in developing new power plants, particularly large-scale wind and solar farms. Navigating complex land use and project permitting regulations is paramount for successful project execution.

Legal compliance across site selection, thorough environmental impact assessments (EIAs), and securing all necessary governmental approvals are critical. For instance, China's environmental protection laws, including those related to land use and EIA procedures, are continually evolving, demanding proactive engagement from Datang.

- Land Use Zoning: Compliance with national and local zoning laws dictates where power generation facilities, especially renewable energy projects, can be sited.

- Environmental Impact Assessments (EIAs): Datang must conduct rigorous EIAs to identify and mitigate potential environmental impacts, a process often involving public consultation and regulatory review.

- Permitting Processes: Obtaining permits for construction and operation involves multiple government agencies, with timelines often extending over several years. For example, the approval process for major renewable projects in 2024 has seen increased scrutiny on grid connection and land sustainability.

Corporate Governance and Compliance

Datang International Power, as a publicly listed entity and a State-Owned Enterprise (SOE), navigates a complex web of corporate governance and compliance. This necessitates strict adherence to regulations from its listing venues, including the Hong Kong Stock Exchange (HKEX), London Stock Exchange (LSE), and Shanghai Stock Exchange (SSE).

Key compliance areas include ensuring transparent financial reporting, meticulous documentation of board resolutions, and fulfilling legal obligations concerning debt financing. The company also faces responsibilities related to director liability, underscoring the importance of robust internal controls and ethical conduct.

For instance, in 2023, Datang International reported total assets of approximately RMB 639.6 billion, with total liabilities standing at around RMB 440.8 billion, highlighting the significant financial commitments and regulatory scrutiny associated with its scale of operations and debt management.

- Regulatory Adherence: Compliance with HKEX, LSE, and SSE listing rules is paramount for maintaining market access and investor confidence.

- Financial Transparency: Publicly disclosed financial statements, audited by independent firms, must meet international accounting standards.

- Board Oversight: Corporate governance frameworks mandate independent board members and clear procedures for decision-making and accountability.

- Debt and Liability Management: Stringent regulations govern the issuance of debt and the fiduciary duties of directors to protect stakeholders.

Datang International Power operates within a dynamic legal landscape in China, particularly concerning environmental protection and carbon emissions. The nation's commitment to carbon neutrality by 2060 and peaking emissions before 2030 translates into increasingly stringent regulations, including carbon trading schemes and renewable energy quotas.

Compliance with these evolving laws, such as the updated renewable energy consumption quotas and environmental impact assessment procedures, is critical for Datang's project development and operational strategies. Failure to adhere to these legal mandates can result in substantial penalties and operational hindrances.

Furthermore, as a publicly listed entity on multiple exchanges, Datang International is subject to rigorous corporate governance and financial reporting standards. This includes maintaining transparency, robust board oversight, and diligent management of its significant debt obligations, as evidenced by its substantial total liabilities of approximately RMB 440.8 billion reported in 2023.

Environmental factors

China's ambitious targets to peak carbon emissions before 2030 and achieve carbon neutrality by 2060 are fundamentally reshaping the energy landscape, directly influencing Datang International Power. This national commitment necessitates a significant pivot in the company's operational strategy, pushing it towards greener energy sources and lower carbon intensity.

Datang International is responding by actively phasing out coal-fired power generation and increasing its investment in renewable energy. By the end of 2023, the company had already achieved a substantial portion of its renewable energy capacity, with wind and solar power making up a growing share of its total installed capacity, demonstrating a tangible commitment to this transition.

Datang International is actively addressing China's focus on reducing air pollutants from coal-fired power plants. The company is investing in advanced ultra-low emission technologies for its thermal power units. This strategic move ensures compliance with increasingly strict air quality standards, aiming to improve air quality across the regions it serves.

Datang International Power's operations, especially its thermal and hydropower plants, are heavily reliant on water. In 2023, China faced significant regional water stress, impacting areas where Datang has substantial generation capacity. This necessitates robust water management to ensure continued operations and meet environmental regulations.

The company is investing in advanced water-saving technologies, such as closed-loop cooling systems for thermal plants, to mitigate the effects of water scarcity. For instance, by the end of 2024, Datang aims to reduce its water consumption intensity by 5% compared to 2020 levels across its thermal fleet.

Biodiversity Protection and Land Use Impact

Datang International's significant investments in renewable energy, such as wind and solar farms, raise concerns about their impact on local ecosystems and biodiversity. For instance, the construction of large-scale solar projects can lead to habitat fragmentation and disruption of wildlife corridors. The company needs to proactively incorporate robust biodiversity protection strategies into its site selection, design, and operational phases, especially when developing in areas known for their ecological sensitivity.

To address these environmental factors, Datang International should consider the following:

- Conducting thorough Environmental Impact Assessments (EIAs) that specifically address biodiversity and land use for all new renewable energy projects.

- Implementing habitat restoration and offsetting programs to compensate for any unavoidable ecological disturbances.

- Engaging with local conservation groups and communities to ensure project development aligns with regional biodiversity goals, potentially drawing from best practices seen in projects that have successfully minimized their footprint.

- Monitoring and reporting on biodiversity metrics post-construction to track the effectiveness of mitigation measures and adapt strategies as needed.

Renewable Energy Integration and Grid Curtailment

China's ambitious renewable energy goals, while commendable, present integration hurdles. Insufficient transmission capacity in certain regions leads to grid curtailment, meaning renewable energy generated cannot be transmitted and is essentially wasted. This directly impacts the profitability of companies like Datang International Power, as their renewable assets may not operate at full potential.

For Datang International, these curtailment issues mean that a portion of their renewable energy output, particularly from wind and solar farms, goes unused. For instance, in 2023, while China's total renewable energy capacity surged, some provinces experienced significant curtailment. This situation necessitates strategic investments in grid modernization and smart grid technologies to better absorb and manage the intermittent nature of renewables.

- Grid Curtailment Impact: Datang International's renewable energy segment revenue is directly affected by the amount of energy curtailed, reducing operational efficiency and profitability.

- Transmission Bottlenecks: Inadequate transmission infrastructure is a primary driver of curtailment, highlighting the need for enhanced grid connectivity.

- Investment in Smart Grids: To mitigate curtailment, Datang International must consider increased capital expenditure on grid upgrades and advanced grid management systems.

- Policy and Regulatory Support: Government initiatives aimed at improving grid flexibility and transmission capacity are crucial for Datang International to maximize its renewable energy investments.

Datang International Power faces significant environmental regulatory pressures driven by China's commitment to carbon reduction. The company is actively investing in ultra-low emission technologies for its coal-fired plants and expanding its renewable energy portfolio, with wind and solar capacity showing notable growth by the close of 2023.

Water scarcity is a growing concern, particularly in regions where Datang operates. The company is implementing water-saving technologies, aiming for a 5% reduction in water consumption intensity for its thermal fleet by the end of 2024 compared to 2020 levels.

The expansion of renewable projects necessitates careful management of biodiversity impacts. Datang must integrate robust protection strategies into project development and consider habitat restoration programs.

Grid curtailment due to transmission bottlenecks is impacting the utilization of renewable energy. Datang International's profitability is affected, underscoring the need for investments in grid modernization and smart grid technologies to better manage intermittent renewable sources.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Datang International Power is grounded in data from official Chinese government ministries, reputable financial news outlets, and leading energy industry research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.