Datang International Power Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Datang International Power Bundle

Datang International Power faces significant competitive pressures, with the threat of new entrants and the bargaining power of buyers being key considerations in its market. Understanding these dynamics is crucial for navigating the evolving energy landscape.

Ready to move beyond the basics? Get a full strategic breakdown of Datang International Power’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

The bargaining power of coal suppliers for Datang International Power is considerable, largely due to the concentration of major state-owned coal mining companies in China. These large entities often dictate terms, especially given the significant reliance of thermal power plants on coal.

While Datang has some internal coal production, it still procures a substantial portion of its fuel externally. This external reliance means suppliers can exert influence, particularly as around 80% of coal power generators in China operate on long-term contracts, a structure that solidifies supplier leverage.

Government interventions aimed at stabilizing coal prices and ensuring supply do temper this power, but market volatility and the contractual nature of coal procurement mean suppliers retain significant sway over Datang's operational costs and fuel security.

Datang International Power's shift towards renewables like hydro, wind, and solar significantly lessens its reliance on coal suppliers. This diversification means coal producers have less leverage over Datang, as the company can switch to alternative energy sources if coal prices become unfavorable. For instance, in 2024, Datang's renewable energy capacity continued to expand, contributing a larger percentage to its overall generation mix.

Conversely, suppliers of specialized equipment for these renewable projects, such as advanced wind turbines or high-efficiency solar panels, can command greater bargaining power. This is often due to proprietary technology and intellectual property, making direct substitutes scarce. While the renewable component market is growing, a few key technology providers may still hold considerable sway, impacting project costs and timelines for Datang.

Datang International Power faces considerable supplier bargaining power due to high switching costs for critical components like large-scale power generation equipment and long-term fuel supply agreements. Establishing new supplier relationships and integrating unfamiliar technologies can demand substantial capital and extended timelines, impacting operational continuity.

Threat of Forward Integration by Suppliers

While the power generation sector is heavily regulated, large state-owned coal mining entities in China could theoretically integrate forward into power production. This move, though not widespread, could enhance their bargaining leverage. For instance, in 2024, China's coal output reached approximately 4.7 billion tonnes, highlighting the scale of potential upstream players.

However, the existing dominance of major state-owned power generators like Datang International Power Generation Co., Ltd. (Datang) makes this forward integration a less immediate concern. The Chinese power industry's structure, with established generation giants, acts as a deterrent to new entrants from the supply side. Instead, supplier influence is more often exerted through policy alignments that connect coal production and consumption, rather than direct operational integration.

- Forward Integration Potential: Large coal mining groups could enter power generation, increasing their influence.

- Industry Structure Barrier: Dominant state-owned power companies like Datang limit this threat.

- Policy Influence: Supplier power is more often channeled through government policies linking coal supply and power demand.

- 2024 Coal Output: China produced around 4.7 billion tonnes of coal, indicating the scale of potential upstream players.

Impact of Government Policies on Supply

Chinese government policies significantly shape the supply landscape for Datang International Power. Directives on coal production quotas, for example, directly impact the availability and cost of fuel for thermal power plants. In 2023, China's coal output reached approximately 4.7 billion tonnes, a testament to the government's role in managing this critical resource.

Environmental regulations, such as stricter emissions standards and carbon pricing mechanisms, also influence supplier behavior and costs. These policies can incentivize a shift towards cleaner fuels and technologies, potentially altering the bargaining power of traditional fossil fuel suppliers versus those in the renewable energy sector. China's commitment to achieving carbon neutrality by 2060 is a driving force behind these regulatory changes.

- Government intervention in coal production quotas directly affects fuel availability and pricing for thermal power generation.

- Stricter environmental regulations and carbon policies can empower renewable energy suppliers while constraining traditional fuel providers.

- Policies promoting domestic manufacturing of renewable energy components aim to reduce reliance on foreign suppliers, potentially shifting bargaining power.

Datang International Power's reliance on coal means suppliers, particularly large state-owned mining companies, hold significant leverage, especially given China's 2024 coal output of approximately 4.7 billion tonnes. While government policies aim to stabilize prices, the contractual nature of fuel procurement and high switching costs for essential equipment empower suppliers. Datang's increasing investment in renewables in 2024, however, dilutes the bargaining power of coal suppliers while potentially increasing it for specialized renewable component providers due to proprietary technology.

| Factor | Impact on Datang | Supplier Leverage |

|---|---|---|

| Coal Supply Concentration | High reliance on a few large state-owned entities. | Considerable |

| Switching Costs (Equipment) | Significant capital and time required for new technology integration. | High |

| Renewable Energy Growth | Reduced dependence on coal, shifting power dynamics. | Decreasing for coal, increasing for specialized renewables |

| Government Policy | Influences coal availability, pricing, and environmental standards. | Moderate (mitigating supplier power) |

What is included in the product

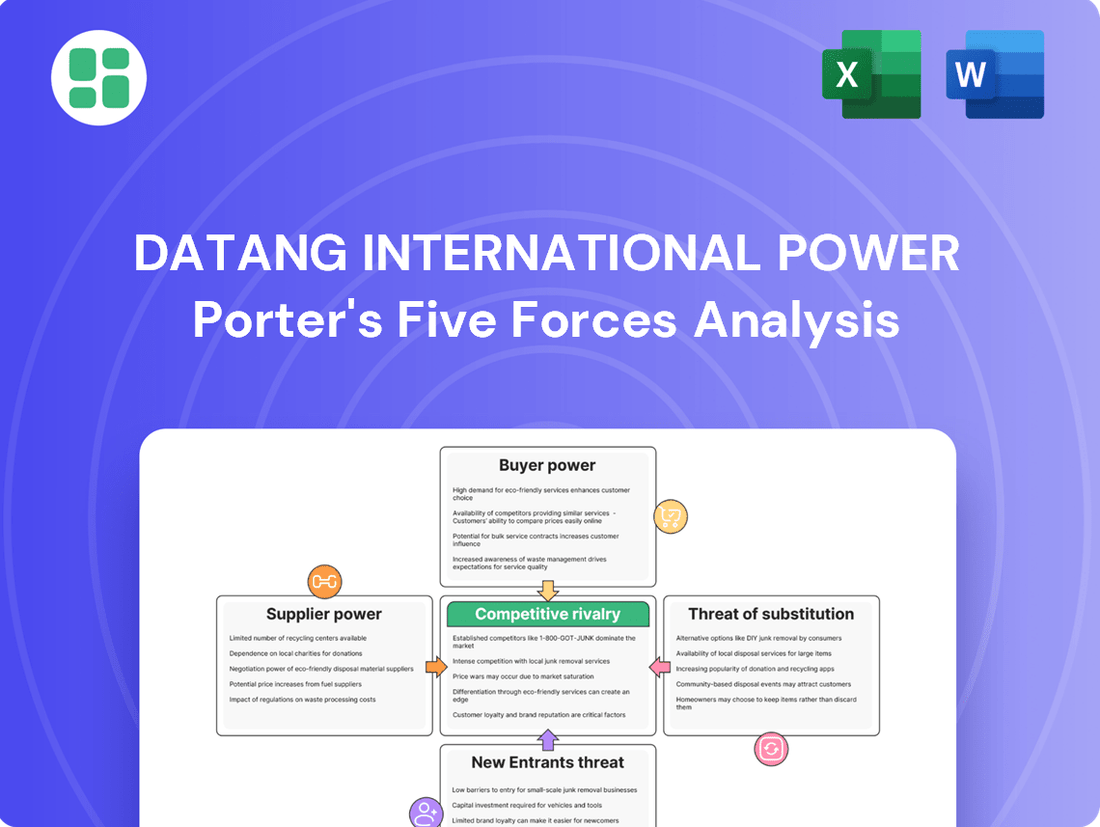

This analysis uncovers the key competitive forces influencing Datang International Power, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the power generation industry.

Instantly understand strategic pressure with a powerful spider/radar chart, visualizing Datang International Power's competitive landscape to pinpoint key pain points.

Customers Bargaining Power

Datang International Power's primary customers, such as provincial grid companies and major industrial users, are large and consolidated entities. This concentration means these buyers hold substantial sway due to their significant contribution to Datang's overall revenue. For instance, in 2023, Datang's revenue was approximately RMB 160 billion, with a substantial portion coming from these large industrial and grid customers.

The ongoing market reforms in China are also tilting the scales in favor of these customers. The push towards electricity spot markets and direct power purchase agreements (PPAs) gives these large buyers more options and negotiation leverage. This shift allows them to secure more favorable pricing and terms, directly impacting Datang's profitability and pricing power.

Customers, particularly industrial and commercial users, are becoming more sensitive to electricity prices as the market increasingly dictates costs. This trend directly impacts Datang International Power by potentially reducing their pricing flexibility.

While residential customers might not wield as much direct bargaining power, the overall demand for electricity is significant. Projections indicate a robust 6.3% compound annual growth rate (CAGR) for electricity consumption between 2024 and 2030, suggesting a strong underlying market for power generation.

However, an anticipated easing of supply-demand constraints, driven by the addition of new renewable energy capacity, could intensify competition among power generators. This heightened competition is likely to exert downward pressure on electricity prices, further amplifying customer bargaining power.

Customers are gaining more leverage as alternative power sources become readily available. This includes the rise of distributed generation, like rooftop solar photovoltaic (PV) systems, and improvements in energy efficiency, both of which lessen dependence on traditional grid electricity.

While new residential rooftop PV installations saw a dip in 2024, the broader expansion of distributed generation continues to offer consumers more choices. This trend is particularly noticeable in coastal provinces where electricity demand is high, directly impacting Datang International Power's pricing power.

Switching Costs for Customers

For many residential and small business customers, the process of switching electricity providers remains complex due to the deeply integrated nature of the power grid and existing regulatory structures. These factors often create a de facto barrier, making it inconvenient or even prohibitive for customers to change suppliers easily.

However, ongoing market liberalization efforts are poised to alter this landscape. The introduction of new energy projects into market transactions, expected from June 2025, signifies a potential shift. This development could empower customers with greater choice regarding their electricity suppliers and the pricing models they engage with.

As these reforms take hold, we anticipate a reduction in the effective switching costs for customers. This increased flexibility will likely translate into a stronger bargaining position for consumers, as they gain more leverage in negotiating terms or selecting providers that better suit their needs. For instance, in markets where retail competition has been introduced, customer switching rates have shown an upward trend, indicating the impact of reduced barriers.

- Integrated Grid System: Creates inherent difficulties for customers to switch electricity providers.

- Regulatory Frameworks: Existing regulations often reinforce the complexity of switching.

- Market Reforms (from June 2025): Introduction of new energy projects into market transactions is expected to increase customer choice.

- Impact on Bargaining Power: Lowered switching costs are anticipated to enhance the bargaining power of customers.

Regulatory Influence on Customer Power

The Chinese government's push for power market reforms directly enhances customer bargaining power. These reforms aim to inject market principles and competition, which typically translate to more favorable and clearer pricing for electricity consumers. For instance, the introduction of spot markets and direct sales channels between power producers like Datang International and large industrial users significantly shifts leverage towards the buyer.

The 'Basic Rules for Power Market Operation,' implemented in July 2024, further solidifies this trend. By clearly outlining market participants and standardizing transaction processes, these rules create a more predictable and competitive environment. This regulatory framework empowers customers by giving them more options and a clearer understanding of the market, thereby increasing their ability to negotiate better terms.

- Increased Competition: Reforms encourage more players, giving customers more choices for electricity supply.

- Price Transparency: Market mechanisms and standardized rules lead to clearer and potentially lower electricity costs.

- Direct Transactions: Policies enabling direct deals between generators and large consumers bypass intermediaries, boosting customer leverage.

- Regulatory Framework: The July 2024 'Basic Rules for Power Market Operation' provides a structured environment for these enhanced customer rights.

Datang International Power faces increasing customer bargaining power due to market reforms and evolving consumer behavior. Large industrial and grid customers, who represent a significant portion of Datang's revenue, are benefiting from the shift towards electricity spot markets and direct purchase agreements, allowing them to negotiate better pricing. This trend is further amplified by the government's push for market liberalization, which is expected to introduce more energy projects into market transactions from June 2025, thereby increasing customer choice and reducing switching costs.

| Factor | Impact on Bargaining Power | Supporting Data/Trend |

|---|---|---|

| Customer Concentration | High | Large provincial grid companies and industrial users contribute significantly to Datang's revenue (approx. RMB 160 billion in 2023). |

| Market Reforms | Increasing | Introduction of spot markets and direct PPAs from 2024 onwards. New energy projects entering market transactions from June 2025. |

| Price Sensitivity | Increasing | Industrial and commercial users are more responsive to electricity price fluctuations. |

| Availability of Alternatives | Increasing | Growth in distributed generation (e.g., rooftop solar PV). |

| Switching Costs | Decreasing (expected) | Market reforms aim to lower barriers to switching providers. |

Full Version Awaits

Datang International Power Porter's Five Forces Analysis

This preview showcases the exact Datang International Power Porter's Five Forces Analysis you will receive upon purchase, providing a comprehensive examination of competitive forces within the power generation sector. You'll gain detailed insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing firms. This document is fully formatted and ready for immediate use, offering a complete and professionally written analysis.

Rivalry Among Competitors

The Chinese power generation landscape is fiercely competitive, dominated by a handful of massive state-owned enterprises. Datang International Power stands as one of these key players, often grouped with others like China Huaneng Group, collectively known as the 'Five Bigs'.

These behemoths vie for market share across diverse generation technologies and geographical areas. By the close of 2024, Datang reported an impressive installed capacity of 18,846.32 MW, highlighting its significant presence in this concentrated market.

While China's electricity demand is projected to grow at a healthy 6.3% CAGR from 2024 to 2030, the sheer volume of new renewable energy capacity added in 2024, surpassing 300 GW, is creating a surplus. This surge in supply, especially evident in the spot market, is forcing power generators like Datang International to compete more fiercely for customers.

Electricity is inherently a commodity, making it tough for companies like Datang International Power to stand out based on product alone. However, Datang's broad mix of generation sources, including coal, hydro, wind, and solar, offers a degree of differentiation. This diversification allows them to offer varying levels of reliability and environmental credentials, such as green power certificates.

As China's electricity market evolves with ancillary services and spot markets, Datang's capacity to provide flexible and low-carbon power generation is becoming a key differentiator. For instance, in 2023, renewable energy sources accounted for a significant portion of China's new installed capacity, pushing companies to innovate in grid responsiveness and sustainability to attract customers and meet regulatory demands.

High Fixed Costs and Exit Barriers

The power generation sector, including companies like Datang International Power, is defined by substantial upfront investments in infrastructure. Building a new power plant, for instance, can cost billions of dollars, creating a high fixed cost structure. This capital intensity means that once these assets are in place, companies have a strong incentive to operate them as much as possible to recoup their investment.

These high fixed costs, combined with the strategic nature of energy supply and often significant government involvement in the sector, erect formidable exit barriers. Companies find it difficult and financially punishing to simply shut down or divest their power generation assets. Consequently, even when market demand is weak or there's an oversupply of electricity, existing players are compelled to continue operating, leading to intensified competition as they strive to cover their ongoing operational and capital costs.

- High Capital Intensity: The construction of power plants involves enormous capital expenditure, often running into billions of dollars per facility.

- Strategic Importance and Government Ownership: Many power generation assets are considered critical national infrastructure, and government ownership or heavy regulation can further complicate exiting the market.

- Aggressive Competition in Oversupply: The inability to easily exit forces companies to compete fiercely for market share to ensure their expensive assets remain utilized, even if it means lower profit margins.

Regulatory Environment and Market Reforms

China's ongoing power market reforms are a significant driver of competitive rivalry. The transition to market-based pricing for renewable energy sources, coupled with the expansion of spot markets, intensifies direct competition among power generators like Datang International Power.

These reforms, aiming for a unified national power market, compel companies to become more efficient and responsive. The shift away from historically fixed tariffs means that profitability is increasingly tied to operational excellence and the ability to navigate fluctuating market prices.

- Market-Based Pricing: Reforms are moving renewables away from fixed feed-in tariffs towards market-determined prices, increasing price competition.

- Spot Market Expansion: The growth of short-term electricity markets allows for more dynamic price discovery and direct competition based on real-time supply and demand.

- National Unified Market: Efforts to create a single, integrated national power market are expected to further level the playing field and heighten rivalry across regions.

- Increased Agility Needed: Companies must adapt to price volatility and optimize generation to remain competitive in this evolving landscape.

The competitive rivalry for Datang International Power is intense, driven by the presence of large state-owned enterprises and a rapidly expanding renewable energy sector. The sheer volume of new capacity added in 2024, exceeding 300 GW, has created an oversupply situation, forcing generators to compete aggressively for customers in a commodity market. Datang's installed capacity of 18,846.32 MW as of the end of 2024 underscores its significant position within this highly concentrated industry.

High capital intensity and substantial exit barriers mean that existing players must operate their assets, intensifying competition even during periods of lower demand. China's power market reforms, including the move towards market-based pricing and the expansion of spot markets, further amplify this rivalry by linking profitability directly to operational efficiency and market responsiveness.

| Metric | Value (End of 2024) | Significance |

|---|---|---|

| Datang Installed Capacity | 18,846.32 MW | Demonstrates Datang's substantial market presence. |

| New Renewable Capacity (2024) | > 300 GW | Indicates significant supply growth, increasing competitive pressure. |

| Electricity Demand Growth (2024-2030 CAGR) | 6.3% | Suggests continued demand, but oversupply can still drive rivalry. |

SSubstitutes Threaten

Advancements in energy efficiency and demand-side management are a significant threat to Datang International Power. These technologies reduce the overall need for electricity, directly impacting demand. For instance, the International Energy Agency reported in 2024 that global energy intensity improvements continued, meaning less energy is required per unit of economic output.

Policies encouraging energy conservation and the electrification of industries with more efficient solutions further exacerbate this threat. This trend suggests that future electricity demand growth for traditional power generators like Datang might be slower than in the past, as more output can be achieved with less power consumption.

The rise of distributed generation technologies presents a significant threat of substitutes for traditional utility power. Rooftop solar photovoltaic (PV) systems, for instance, empower homes and businesses to produce their own electricity, directly diminishing demand for power from centralized plants. Despite some grid integration challenges and return on investment concerns for residential solar in 2024, the sector saw substantial capacity growth, with supportive policies further bolstering its appeal.

The threat of substitutes for Datang International Power's heat generation business is a significant consideration. Alternatives like geothermal heat pumps and advanced, non-traditional district heating systems can siphon off demand from centralized power producers. For instance, the global geothermal heat pump market was valued at approximately $7.5 billion in 2023 and is projected to grow, indicating increasing adoption of these localized, efficient solutions.

Technological Advancements in Energy Storage

Technological advancements in energy storage present a significant threat to traditional power providers like Datang International Power. Innovations in battery technology, particularly for grid-scale and commercial/industrial applications, are making energy storage more accessible and cost-effective. This allows consumers to store electricity purchased during off-peak hours or generated from their own renewable sources, thereby reducing their dependence on utility companies during peak demand periods.

The declining costs of battery storage are a key driver of this threat. For instance, the global average cost of lithium-ion battery packs for energy storage systems saw a substantial decrease, falling by over 90% from 2010 to 2023, according to BloombergNEF data. This trend is projected to continue, making stored energy a more competitive alternative to grid-supplied power. Such a shift empowers consumers and businesses to manage their energy consumption more flexibly, potentially impacting the revenue streams of established power generation companies.

- Falling Battery Costs: Lithium-ion battery pack costs for energy storage dropped by over 90% between 2010 and 2023, making stored energy increasingly competitive.

- Grid Independence: Advances enable consumers to store cheaper off-peak electricity or self-generated renewable power, reducing reliance on traditional supply.

- Demand Flexibility: Large-scale and commercial battery systems offer greater control over energy usage, potentially shifting demand away from peak utility pricing.

- Renewable Integration: Enhanced storage solutions facilitate greater integration of intermittent renewable sources, further challenging the market position of fossil fuel-based power generation.

Direct Renewable Energy Sourcing by Large Consumers

Large industrial and commercial customers are increasingly bypassing traditional utility models by directly sourcing renewable energy. This trend significantly strengthens the threat of substitutes for companies like Datang International Power. These major energy consumers can now enter into Power Purchase Agreements (PPAs) directly with renewable energy developers or even invest in their own on-site generation facilities.

This direct sourcing allows businesses to secure renewable energy independently, effectively substituting the power they would otherwise purchase from the grid. For instance, in 2024, the corporate PPA market saw substantial growth, with companies signing agreements for gigawatts of renewable capacity, demonstrating a clear shift away from reliance on traditional power providers.

- Direct Sourcing via PPAs: Businesses secure renewable energy directly from developers, bypassing utilities.

- On-site Generation: Companies invest in their own solar or wind installations.

- Market Shift: Significant growth in corporate PPA commitments in 2024 indicates a growing trend.

- Impact on Utilities: This directly substitutes traditional grid power purchases for large consumers.

The threat of substitutes for Datang International Power is multifaceted, encompassing energy efficiency, distributed generation, and alternative heating solutions. These substitutes directly reduce the demand for traditional electricity and heat supplied by centralized power plants.

Advancements in energy efficiency continue to lower overall electricity consumption per unit of economic output. For example, the International Energy Agency reported in 2024 that global energy intensity improvements persisted, meaning less power is needed for the same level of economic activity.

Distributed generation, such as rooftop solar, allows consumers to generate their own power, directly substituting utility-provided electricity. Despite some challenges, the solar sector saw substantial capacity growth in 2024, supported by favorable policies.

Alternative heating methods like geothermal heat pumps also pose a threat to Datang's heat generation business. The global geothermal heat pump market, valued around $7.5 billion in 2023, is projected to grow, indicating increasing adoption of these localized, efficient alternatives.

| Substitute Category | Key Technologies | 2023/2024 Data Point | Impact on Datang |

|---|---|---|---|

| Energy Efficiency | Demand-side management, efficient appliances | Global energy intensity improvements continued (IEA, 2024) | Reduced overall electricity demand |

| Distributed Generation | Rooftop solar PV | Substantial capacity growth in 2024 | Directly substitutes grid electricity for consumers |

| Alternative Heating | Geothermal heat pumps | Market valued at ~$7.5 billion (2023), projected growth | Reduces demand for centralized heat generation |

| Energy Storage | Lithium-ion batteries | Cost drop >90% (2010-2023) | Enables greater grid independence and use of stored/renewable energy |

Entrants Threaten

The power generation industry, particularly for large-scale operations like those Datang International Power engages in, demands substantial upfront capital. Building power plants, establishing transmission networks, and acquiring advanced technology all require massive financial outlays.

This high capital requirement serves as a significant hurdle, deterring many potential new entrants from entering the market. For instance, Datang International Power's installed capacity stood at an impressive 18,846.32 MW by the close of 2024, illustrating the sheer scale of investment necessary to compete effectively.

The Chinese power sector operates under a highly regulated environment, featuring strict licensing requirements, rigorous environmental impact assessments, and demanding operational standards. These intricate regulatory processes, including obtaining essential permits and securing access to the national grid, create a substantial barrier for any potential new companies looking to enter the market.

While reforms in recent years have aimed to introduce more market-based mechanisms, the overall regulatory oversight within China's power industry remains robust. For instance, by the end of 2023, China's installed renewable energy capacity reached 1.5 billion kilowatts, with significant grid integration challenges still managed by state-controlled entities, underscoring the continued importance of regulatory approval for new capacity additions.

Datang International Power, like other established players, benefits from its existing, deeply integrated access to China's vast national and provincial transmission and distribution networks. This established infrastructure is a significant barrier for potential new entrants. Securing reliable and cost-effective grid connections, crucial for delivering electricity to consumers, presents a substantial hurdle for newcomers attempting to enter the market.

While China continues to invest in grid expansion, with significant government backing for renewable energy integration, new power generation capacity still faces integration complexities. These challenges can translate into higher upfront costs and longer timelines for new entrants compared to incumbents who already have established grid access points and relationships.

Economies of Scale and Experience Curve

Datang International Power, established in 1994, leverages substantial economies of scale in generation, fuel sourcing, and operational management. This scale translates into lower per-unit costs, making it challenging for newcomers to compete on price. For instance, as of the first half of 2024, Datang's total installed capacity reached 182.9 GW, demonstrating its vast operational footprint.

The company's extensive experience curve, accumulated over decades, also creates a significant barrier. Datang has refined its processes for managing complex power generation facilities and navigating diverse energy markets, leading to greater efficiency and cost-effectiveness. This deep-seated expertise is not easily acquired by new entrants, who would face a steep learning curve and higher initial operational costs.

- Economies of Scale: Datang's massive installed capacity of 182.9 GW (H1 2024) allows for bulk purchasing of fuel and efficient resource allocation, driving down costs per megawatt-hour.

- Experience Curve Advantage: Decades of operational experience since 1994 have enabled Datang to optimize plant performance and reduce maintenance expenses, creating a cost differential against less experienced competitors.

- Capital Intensity: Building new, large-scale power generation facilities requires immense capital investment, which new entrants may struggle to secure compared to established players like Datang.

Government Ownership and Policy Support for Incumbents

As a significant state-owned enterprise, Datang International Power enjoys substantial government backing, including favorable policies and alignment with national energy objectives. This inherent advantage, even with market liberalization efforts, creates a substantial hurdle for new, privately-owned or foreign competitors seeking to enter the market.

The entrenched position and strategic importance of state-owned power generators, like Datang, act as a powerful deterrent to potential new entrants. For instance, in 2024, state-owned enterprises continued to dominate China's power generation sector, accounting for a significant majority of installed capacity, thereby limiting the available market share for newcomers.

- Government Support: Datang's status as a major state-owned enterprise translates into implicit and explicit government backing, crucial for securing capital and navigating regulatory landscapes.

- Policy Alignment: Strategic alignment with national energy development plans, such as those promoting clean energy transitions, provides Datang with preferential treatment and access to resources.

- Market Dominance: In 2024, state-owned power generators held a commanding share of China's electricity production, making it exceedingly difficult for new, non-state-backed entities to gain a foothold.

- Barriers to Entry: The combination of government support and existing market dominance by incumbents like Datang creates significant barriers for purely private or foreign new entrants.

The threat of new entrants for Datang International Power is considerably low due to immense capital requirements and stringent regulatory frameworks in China's power sector. Building and operating power plants demands vast financial investment, with Datang's installed capacity reaching 18,846.32 MW by the end of 2024, highlighting the scale of investment needed. Additionally, complex licensing and environmental assessments create significant hurdles for newcomers.

Established players like Datang benefit from decades of operational experience and economies of scale, with total installed capacity at 182.9 GW in H1 2024, allowing for cost efficiencies that new entrants struggle to match. Furthermore, Datang's status as a major state-owned enterprise ensures significant government support and alignment with national energy policies, a distinct advantage over private or foreign competitors seeking market entry.

| Factor | Impact on New Entrants | Datang International Power's Position |

|---|---|---|

| Capital Intensity | Very High Barrier | Established infrastructure and scale |

| Regulatory Hurdles | High Barrier | Experienced in navigating regulations |

| Economies of Scale | Significant Barrier | 182.9 GW installed capacity (H1 2024) |

| Government Support | High Barrier | Major state-owned enterprise |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Datang International Power leverages comprehensive data from annual reports, regulatory filings (like those with the China Securities Regulatory Commission), and industry-specific market research reports to assess competitive dynamics.