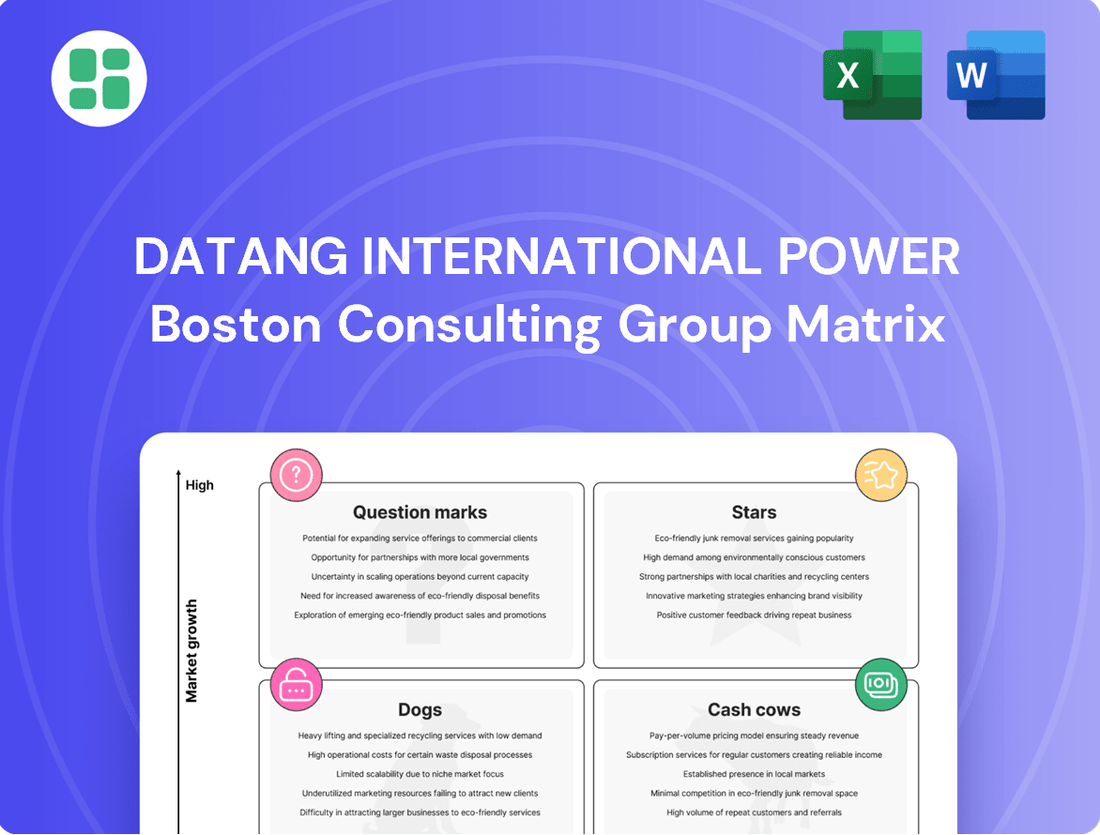

Datang International Power Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Datang International Power Bundle

Curious about Datang International Power's market standing? This glimpse into their BCG Matrix highlights their strategic positioning, but the real power lies in the full report. Discover which of their ventures are fueling growth and which require a closer look.

Unlock the complete Datang International Power BCG Matrix to gain a comprehensive understanding of their product portfolio's performance. This detailed analysis will equip you with the insights needed to make informed decisions about resource allocation and future investments. Purchase the full report for a strategic roadmap to capitalize on opportunities and mitigate risks.

Stars

Datang International has seen a remarkable surge in renewable energy, with its parent company, China Datang, adding over 20 GW of new capacity in 2024. This impressive expansion is reflected in Datang International's own cumulative installed capacity, which grew by 22.23% during the same year. This aggressive development is a direct response to China's ambitious energy transition, aiming for wind and solar installations to surpass 500 GW by 2025.

Datang International's wind power segment is experiencing robust expansion. In April 2025, wind power generation surged by 16.68% year-over-year, demonstrating strong momentum. This growth is a key driver of the company's renewable energy strategy.

The company's commitment to expanding its renewable capacity is evident. A significant development is the 2 GW wind-solar-thermal-storage multi-energy complementary base that became operational in 2024. This project enhances the company's ability to leverage diverse energy sources.

Datang International Power Generation is experiencing a robust expansion in its photovoltaic (solar) energy sector. In April 2025, the company's solar power generation saw a significant increase of 6.52%, highlighting its growing dominance in this rapidly expanding market.

This growth is further supported by substantial investments. Datang International Power Generation has committed to procuring 22.5 GW of advanced solar photovoltaic modules for the 2025-2026 period, signaling a strong belief in the future of solar power.

Strategic Investments in New Energy Projects

Datang International Power is strategically positioning its new energy projects as Stars within the BCG Matrix. The company significantly ramped up its development pipeline, acquiring construction targets for 8,098.80 MW in 2024, a substantial 126.22% increase from the previous year.

This aggressive expansion is heavily concentrated in wind and photovoltaic (PV) power generation. In the first half of 2025, Datang International saw its approved capacity for wind and PV projects surpass 4,000 MW, underscoring its commitment to capturing market share in these rapidly growing renewable energy segments.

- Acquired construction targets: 8,098.80 MW in 2024 (126.22% YoY increase).

- Focus areas: Wind and photovoltaic projects.

- Approved capacity (H1 2025): Exceeded 4,000 MW for wind and PV.

- Strategic implication: High growth, high market share potential in renewables.

Leading Position in China's Energy Transition

Datang International Power Generation Co., Ltd. is solidifying its leading position within China's rapidly evolving energy landscape. As the nation pushes towards its carbon peak goals and aggressively expands its new energy sector, Datang's consistent investment and operational expansion in renewable energy sources are crucial. This strategic focus places the company at the forefront of a high-growth market, capitalizing on national energy transition initiatives.

The company's commitment to clean energy is evident in its growing installed capacity. By the close of 2023, Datang International reported that its clean and renewable energy installed capacity proportion had climbed to 37.75%. This significant increase underscores its dedication to decarbonization and its role in powering China's sustainable development.

- Market Leadership: Datang International is a prominent player in China's energy transition, driven by national decarbonization targets.

- Renewable Growth: The company is actively investing in and expanding its renewable energy operations to meet increasing demand.

- Capacity Increase: As of the end of 2023, clean and renewable energy accounted for 37.75% of Datang International's installed capacity.

- Strategic Alignment: Datang's strategy aligns with China's goals for carbon peaking and the rapid development of the new energy industry.

Datang International's renewable energy ventures, particularly in wind and solar, are positioned as Stars in the BCG Matrix due to their high growth and market share potential. The company aggressively expanded its development pipeline, acquiring construction targets for 8,098.80 MW in 2024, a significant 126.22% year-over-year increase. This expansion is concentrated in wind and photovoltaic projects, with approved capacity for these segments exceeding 4,000 MW in the first half of 2025.

| Segment | Growth Rate (YoY) | Market Share Potential | Strategic Positioning |

|---|---|---|---|

| Wind Power | 16.68% (April 2025 generation) | High | Star |

| Photovoltaic (Solar) Power | 6.52% (April 2025 generation) | High | Star |

| New Energy Project Acquisition | 126.22% (2024 construction targets) | High | Star |

What is included in the product

Strategic overview of Datang International Power's portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

Datang International Power's BCG Matrix offers a clear, one-page overview, simplifying complex portfolio analysis for executives.

Cash Cows

Datang International's dominant established coal-fired fleet represents a significant portion of its operational assets, historically serving as the backbone of its power generation capacity. These plants are crucial for providing a stable and high-volume supply of electricity, which translates into consistent and substantial cash flow for the company.

In 2023, Datang International's coal-fired power generation capacity remained a key component of its overall portfolio. While specific figures for the exact contribution to total generation in 2024 are still emerging, the company's strategic reliance on this segment underscores its role as a primary cash generator. This established infrastructure ensures a predictable revenue stream, even as the energy landscape evolves.

Datang International Power's traditional generation, primarily coal-fired, functions as a cash cow within its BCG matrix. Despite China's ongoing energy transition, coal continues to be the backbone of its power supply, guaranteeing a steady demand for Datang's extensive thermal power infrastructure.

This segment is a significant contributor to the company's financial health. For instance, Datang International Power reported its net profit doubled in the first half of 2025. A notable factor driving this surge was the decrease in fuel prices, which directly boosted the profitability of its coal-fired power generation business, underscoring its cash-generating capabilities.

Datang International's integrated coal mining operations are a classic example of a Cash Cow within its business portfolio. In 2024, the company achieved a significant milestone, exceeding 30 million tonnes in annual coal production. This robust output ensures a consistent and cost-effective fuel source for its thermal power generation segment.

This vertical integration is a key strategic advantage, directly mitigating the impact of fluctuating fuel prices on the company's bottom line. By controlling its coal supply, Datang International enhances both the profitability and the operational reliability of its thermal power plants, solidifying its position in the energy market.

High Market Share in Mature Power Segments

Datang International's thermal power assets represent significant Cash Cows. These operations benefit from a high market share in China's mature electricity segments, meaning they generate substantial, stable cash flows with minimal need for aggressive marketing or expansion efforts. For instance, as of the end of 2023, Datang International operated a vast portfolio of thermal power capacity, contributing a significant portion to its overall generation mix.

These mature segments are characterized by predictable demand and established infrastructure, allowing Datang to leverage its scale for cost efficiencies. The company's focus on optimizing these existing, high-performing assets ensures consistent profitability. In 2024, the company continued to emphasize operational excellence in its thermal power fleet, aiming to maintain high utilization rates and cost control.

- High Market Share: Datang International is a dominant player in China's thermal power generation sector.

- Mature Markets: Operations are in established electricity markets with stable demand.

- Low Investment Needs: Existing infrastructure and market position reduce the need for high promotional or placement spending.

- Stable Cash Flow Generation: These assets are the primary source of consistent, predictable earnings for the company.

Consistent Cash Flow for Reinvestment

Datang International Power's established coal-fired power stations are true cash cows. They consistently churn out substantial cash, which is vital for keeping the company running smoothly. This reliable income stream covers everything from day-to-day administration and crucial research and development efforts to managing debt obligations and rewarding shareholders with dividends.

This robust cash generation is the bedrock for Datang's strategic growth. It provides the necessary financial muscle to invest in promising, high-growth areas of the business, often categorized as 'Question Marks' or 'Stars' in strategic analysis frameworks. For instance, in 2023, Datang's coal power segment continued to be a primary contributor to its overall revenue, enabling continued exploration of renewable energy projects.

- Consistent Revenue: Datang's mature coal plants provide a steady and predictable revenue stream.

- Funding Operations: This cash flow underpins administrative expenses, R&D, and debt servicing.

- Dividend Support: It allows for the continued payment of dividends to shareholders.

- Investment Capital: Crucially, it fuels investment in new growth opportunities, particularly in renewable energy sectors.

Datang International's coal-fired power generation business, including its integrated coal mining operations, functions as a robust Cash Cow. These segments benefit from a high market share in China's established electricity markets, ensuring stable demand and consistent, substantial cash flows with minimal need for aggressive expansion or marketing. For example, in 2024, the company's coal production exceeded 30 million tonnes, securing a cost-effective fuel source for its thermal fleet.

This reliable revenue stream is critical, covering operational expenses, funding research and development, and supporting dividend payouts. The financial strength derived from these mature assets, such as the reported doubling of net profit in the first half of 2025 partly due to lower fuel costs, provides the capital necessary to invest in emerging growth areas, like renewable energy projects, which Datang actively pursued in 2023.

| Segment | BCG Category | Key Characteristics | 2024/2025 Data Point |

| Thermal Power Generation | Cash Cow | High market share, mature market, stable demand, low investment needs | Net profit doubled in H1 2025; significant portion of generation mix end of 2023 |

| Integrated Coal Mining | Cash Cow | Vertical integration, cost control, fuel security | Exceeded 30 million tonnes annual coal production in 2024 |

Delivered as Shown

Datang International Power BCG Matrix

The Datang International Power BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises; you get the complete, professionally designed strategic analysis ready for immediate use.

Rest assured, the BCG Matrix report you are currently examining is the exact final version that will be delivered to you upon completing your purchase. It has been meticulously crafted with insightful market analysis and is prepared for direct application in your business strategy, ensuring you receive a high-quality, ready-to-use asset.

What you see here is the actual, unadulterated Datang International Power BCG Matrix file that will be yours once you buy. Upon purchase, you will gain instant access to the complete, editable report, enabling you to seamlessly integrate its strategic insights into your planning and presentations without any delay.

Dogs

Datang International Power's older, less efficient thermal units are likely positioned as Dogs in the BCG Matrix. These assets face mounting pressure from stricter environmental regulations, which can increase operating costs and limit their market viability.

In 2024, China's commitment to carbon neutrality continues to drive a shift towards cleaner energy. This trend directly impacts older coal-fired plants, potentially leading to reduced operating hours and lower revenue streams for these inefficient units.

Marginal hydropower assets within Datang International Power's portfolio, while contributing to the company's overall renewable energy capacity, may represent a "Marginal" category in a BCG Matrix analysis. These could be older, smaller-scale, or less efficiently located facilities that face challenges in terms of growth potential and market dominance compared to Datang's larger, more advanced hydropower projects.

These marginal assets might not command the same level of investment or generate the same returns as the company's flagship renewable energy initiatives. For instance, while Datang's total installed hydropower capacity reached approximately 39.1 GW by the end of 2023, a portion of this could be comprised of these less impactful sites, potentially seeing slower revenue growth.

Datang International Power's older thermal power assets might be struggling in areas with too much electricity or where they're forced to reduce output. This means they're not running as much, cutting into their earnings and making them less valuable.

For instance, in 2024, regions with significant renewable energy integration often face oversupply challenges during peak generation times. This can lead to curtailment of thermal power plants, directly impacting their operational hours and revenue streams for companies like Datang International Power.

Non-Core, Underperforming Ancillary Businesses

Datang International Power's portfolio likely includes non-core, underperforming ancillary businesses that fall into the Dogs category of the BCG Matrix. These are typically smaller energy-related ventures or legacy assets that no longer align with the company's primary focus on power generation and integrated energy supply chains. Such businesses often exhibit low market share and minimal growth prospects, consuming valuable resources without generating significant returns.

For instance, Datang might have divested or is considering divesting smaller, less efficient coal-fired power plants that are not strategically aligned with their transition towards cleaner energy sources. In 2023, Datang International Power's revenue was approximately RMB 180.5 billion, with net profit attributable to parent company shareholders around RMB 10.6 billion. Businesses within the Dogs quadrant would contribute a disproportionately small fraction of this revenue and profit, while potentially requiring substantial capital expenditure for upgrades or maintenance.

- Low Profitability: These ancillary businesses often operate with thin profit margins or may even incur losses, dragging down overall company performance.

- Resource Drain: They can tie up management attention, capital, and operational resources that could be better deployed in the company's star or cash cow segments.

- Strategic Mismatch: Their operations or market focus may diverge from Datang's core competencies and long-term strategic objectives, such as expanding renewable energy capacity.

- Divestment Potential: Identifying and divesting these underperforming assets is a common strategy to streamline operations and improve financial efficiency.

Legacy Technology with High Maintenance Costs

Legacy technology power generation units with high maintenance costs and significant capital expenditure requirements for upgrades, offering little return on investment, fall into the Dogs category of the BCG Matrix. These assets often face challenges in remaining competitive within the dynamic energy sector.

Datang International Power's older generation units, particularly those relying on subcritical technology, represent this challenge. For instance, many of these plants require continuous investment in repairs and modernization to meet increasingly stringent environmental regulations and operational efficiency standards. In 2024, the company continued to assess the economic viability of these older assets, balancing the cost of continued operation against the potential for phased retirement or replacement.

- High Operating Expenses: Older plants often have higher fuel consumption and more frequent breakdowns, leading to increased operational costs compared to newer, more efficient facilities.

- Limited Growth Potential: Due to outdated technology, these units are unlikely to see significant increases in output or efficiency, limiting their market share growth.

- Capital Intensive Upgrades: Modernizing these legacy assets to meet current environmental standards or improve performance can require substantial capital without guaranteeing a competitive advantage.

- Risk of Obsolescence: As the energy industry shifts towards renewables and advanced technologies, these older units face a growing risk of becoming economically obsolete.

Datang International Power's older, less efficient thermal units, particularly those with subcritical technology, are firmly positioned as Dogs in the BCG Matrix. These assets are characterized by low market share in a growing market and low growth prospects, often facing high operating costs and the risk of obsolescence as the energy sector transitions. In 2024, the company continued to evaluate the economic viability of these legacy plants, balancing ongoing maintenance costs against potential retirement or replacement strategies.

These "Dog" assets, such as older coal-fired plants, contribute minimally to Datang's overall revenue and profit, which stood at approximately RMB 180.5 billion and RMB 10.6 billion respectively in 2023. Their limited growth potential and high capital expenditure requirements for upgrades make them prime candidates for divestment or phased retirement, freeing up resources for more promising ventures.

Datang's portfolio may also include underperforming ancillary businesses that fall into the Dogs category. These ventures, often smaller and not aligned with the company's core focus on power generation and clean energy expansion, exhibit low market share and minimal growth prospects, consuming resources without generating significant returns.

The company's strategy often involves identifying and divesting these underperforming assets to streamline operations and improve financial efficiency. For instance, while Datang's total installed hydropower capacity reached about 39.1 GW by the end of 2023, some smaller or less efficiently located hydropower sites might also be considered marginal "Dogs" if their growth potential is severely limited.

Question Marks

Datang International is making significant strides in emerging energy storage, notably with its 100 MW/200 MWh sodium-ion battery storage power station, operational since 2024. This project represents a major step in the commercialization of sodium-ion technology, positioning Datang at the forefront of this rapidly developing field. While the potential for growth in energy storage is substantial, Datang's current market share in this new sector is relatively small, reflecting its early-stage involvement.

Datang International Power is actively investing in green hydrogen production, exemplified by its involvement in the Duolun 150MW Wind and Solar Hydrogen Production Integration Demonstration Project. This initiative positions the company within the burgeoning green hydrogen sector, a critical component of future energy strategies.

While these projects signify a forward-looking approach, they are in their nascent stages. The market share for green hydrogen production is still being defined, meaning Datang International Power's position within this emerging market is yet to be solidified.

Datang International Power is actively investing in pilot smart grid and digital energy solutions, signaling a strategic move into high-growth sectors. These initiatives are crucial for optimizing operational efficiency and facilitating the integration of renewable energy sources, a key trend in the global energy landscape.

While these digital energy solutions represent a promising frontier, Datang's current market share and established presence in these specialized service areas are still developing. This positions these ventures within the question mark category of the BCG Matrix, indicating potential for significant growth but also requiring substantial investment and strategic focus to mature.

Overseas Renewable Energy Ventures

Datang International Power's overseas renewable energy ventures, while aligned with China's global energy transition strategy, represent a nascent but promising area. Despite China's commitment to cease overseas coal financing and boost renewable support, Datang's current market share in these international renewable projects is likely modest.

These ventures are characterized by substantial growth potential in emerging markets, but they necessitate significant initial capital outlay and are exposed to various inherent risks. For instance, the global renewable energy sector saw substantial investment in 2024, with figures indicating continued expansion, yet the specific allocation to Chinese companies like Datang in these international ventures remains a developing aspect.

- Market Entry: Datang's international renewable projects are in their early stages, aiming to capture nascent market share.

- Growth Potential: These ventures tap into high-growth opportunities in new geographical markets for renewable energy.

- Investment & Risk: Significant upfront capital is required, coupled with the inherent risks associated with international project development and execution.

- Strategic Alignment: Datang's overseas renewable focus aligns with China's broader policy shifts away from coal financing abroad.

Advanced Hydropower Technologies

Datang International Power is investing in advanced hydropower technologies, like its 500 MW high-head impulse turbine demonstration project, to push the boundaries of innovation in the sector.

While traditional hydropower is a mature technology, these cutting-edge developments represent high-growth areas where Datang is actively building expertise and aiming to secure future market leadership.

- Innovation Focus: Datang's commitment to advanced hydropower technologies signifies a strategic move to differentiate and grow within the energy sector.

- High-Growth Potential: Projects like the 500 MW impulse turbine are positioned in segments with significant future market potential.

- Expertise Development: These initiatives are crucial for Datang to cultivate specialized knowledge and capabilities in next-generation hydro solutions.

Datang International's ventures into emerging energy storage, such as its 100 MW/200 MWh sodium-ion battery project operational since 2024, and green hydrogen production, as seen in the Duolun project, represent significant investments in high-growth potential areas. These sectors are still defining their market share, placing Datang's current position as a developing player within the question mark category. The company's strategic focus on pilot smart grid and digital energy solutions also falls into this category, requiring substantial investment to mature and capture market share.

Datang's overseas renewable energy projects and its focus on advanced hydropower technologies, like the 500 MW high-head impulse turbine, are also positioned as question marks. While these areas offer substantial growth potential and align with global energy transition trends, Datang's market share is currently modest. These initiatives necessitate significant capital and carry inherent risks, but they are crucial for building expertise and securing future market leadership in these evolving segments.

| Business Unit | Market Growth | Relative Market Share | BCG Classification |

|---|---|---|---|

| Emerging Energy Storage (Sodium-ion) | High | Low | Question Mark |

| Green Hydrogen Production | High | Low | Question Mark |

| Smart Grid & Digital Energy Solutions | High | Low | Question Mark |

| Overseas Renewable Energy Ventures | High | Low | Question Mark |

| Advanced Hydropower Technologies | High | Low | Question Mark |

BCG Matrix Data Sources

Our Datang International Power BCG Matrix is constructed using a blend of financial disclosures, market research reports, and industry growth forecasts to provide a comprehensive view of their business units.