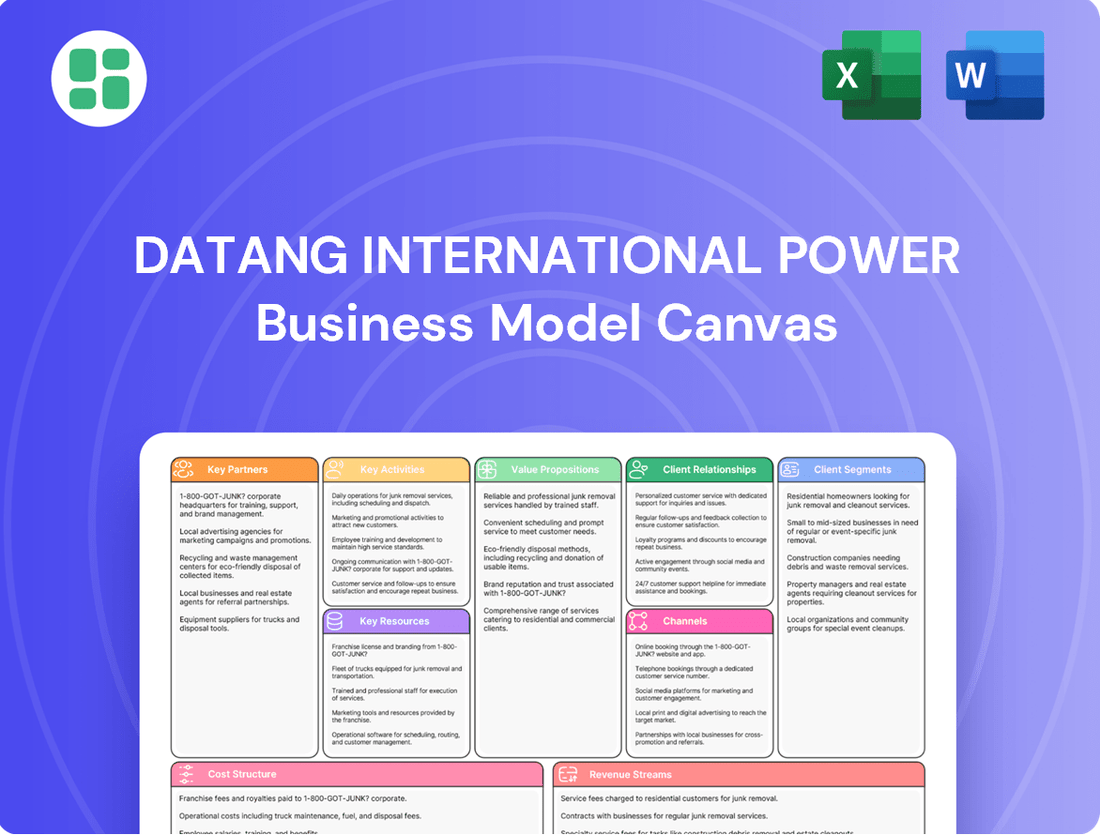

Datang International Power Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Datang International Power Bundle

Unlock the strategic blueprint of Datang International Power's business model. This comprehensive canvas details their customer segments, value propositions, and revenue streams, offering a clear view of their market dominance. Perfect for anyone seeking to understand how this energy giant operates and thrives.

Partnerships

Datang International Power Generation Co., Ltd. relies heavily on its relationships with Chinese government agencies and regulators. These partnerships are essential for obtaining licenses and permits, ensuring compliance with national energy policies, and aligning with environmental standards. For instance, in 2023, Datang continued to focus on developing clean energy projects, a key priority for the Chinese government's energy transition strategy.

Datang International Power's extensive network of coal-fired power plants necessitates robust partnerships with coal suppliers and mining companies. These collaborations are crucial for securing a consistent and cost-effective supply of coal, directly influencing the company's operational efficiency and profitability. For instance, in 2023, Datang's coal consumption was a significant factor in its operating expenses, making these supplier relationships vital for cost management.

Maintaining strong ties with major coal mining firms and traders allows Datang to navigate the volatility of coal prices more effectively. This strategic alignment helps in hedging against price fluctuations, thereby bolstering the company's financial stability and predictability. The ability to negotiate favorable terms with these partners is a key determinant of Datang's competitive edge in the energy market.

Datang International Power's key partnerships with equipment manufacturers and technology providers are crucial for its operational advancement. These collaborations ensure access to cutting-edge power generation technologies, from traditional thermal and hydro to renewable wind and solar solutions. For instance, in 2023, the company continued to integrate advanced turbine technologies, contributing to improved energy conversion efficiency across its diverse portfolio.

These strategic alliances are fundamental to Datang's green transformation. By partnering with innovators, the company can adopt next-generation solutions, such as high-head impulse turbines for hydropower and emerging sodium-ion energy storage systems. These partnerships directly support the company's 2024 objectives to enhance operational efficiency and significantly reduce its carbon footprint, aligning with national energy transition goals.

Grid Operators and Transmission Companies

Datang International Power Generation's relationship with grid operators and transmission companies is foundational to its business model. These entities are responsible for the physical delivery of electricity and heat from Datang's generation facilities to consumers, making them indispensable partners. In 2024, the efficiency and reliability of China's vast transmission network, managed by State Grid Corporation of China and China Southern Power Grid, directly impact Datang's revenue and operational stability.

These partnerships are crucial for maintaining grid stability and ensuring the efficient dispatch of power. Datang's ability to integrate its diverse power generation portfolio, including significant thermal and growing renewable assets, relies on seamless coordination with grid infrastructure. For instance, the integration of new wind and solar farms in remote areas necessitates robust transmission planning and upgrades, often undertaken in collaboration with these grid entities.

- Grid Connectivity: Ensuring access to the national grid for power transmission.

- Dispatch and Load Balancing: Coordinating power generation with grid demand requirements.

- Infrastructure Development: Collaborating on transmission upgrades and new line construction to accommodate generation capacity.

- Renewable Integration: Facilitating the smooth integration of Datang's expanding renewable energy sources into the grid.

International Energy Corporations and Investors

Datang International Power Generation is strategically broadening its network by forging alliances with major international energy firms and investment entities. This initiative is particularly focused on expanding its footprint along the Belt and Road Initiative, aiming to co-develop overseas energy projects and foster technological advancements.

These partnerships are crucial for Datang's global growth strategy, enabling access to new markets and capital. For instance, the company has engaged in collaborations such as a Memorandum of Understanding with ZESCO Limited in Zambia, and joint ventures with SIUT and Datang Buka New Energy in Uzbekistan. These alliances are instrumental in driving market expansion and facilitating the transfer of cutting-edge green energy technologies.

- Global Reach Expansion: Datang International Power Generation actively cultivates relationships with international energy corporations and investors to facilitate overseas project development.

- Belt and Road Initiative Focus: Partnerships are strategically aligned with the Belt and Road Initiative to unlock new opportunities in emerging markets.

- Technological Exchange: Collaborations aim to foster the transfer of advanced technologies, particularly in the green energy sector, enhancing operational efficiency and innovation.

- Access to Capital: These key partnerships provide essential access to new capital, enabling the financing of significant green energy projects and supporting sustainable development goals.

Datang International Power Generation's key partnerships with financial institutions and investors are vital for securing the substantial capital required for its extensive infrastructure projects. These relationships, including those with major Chinese banks and international investment funds, provide the necessary funding for both existing operations and new ventures, particularly in renewable energy development.

In 2023, Datang International Power Generation successfully secured significant financing through various channels, underscoring the importance of these financial partnerships. For example, the company issued corporate bonds and leveraged syndicated loans to fund its ongoing construction and upgrade projects, demonstrating a strong reliance on these relationships to maintain financial health and pursue growth objectives.

These financial alliances are crucial for Datang's strategic expansion, especially its commitment to green energy. By partnering with entities that understand and support sustainable development, the company can access favorable financing terms, facilitating its transition towards a lower-carbon energy portfolio and meeting its 2024 targets for renewable energy capacity growth.

| Type of Partner | Role in Business Model | Example of Collaboration | Impact on Datang |

| Financial Institutions (Banks, Investment Funds) | Capital provision for projects, financing operations | Syndicated loans, corporate bond issuance, equity investments | Enables large-scale project development, supports financial stability, facilitates green energy transition |

| Government Agencies & Regulators | Licensing, policy alignment, regulatory compliance | Obtaining permits for new power plants, adhering to national energy policies | Ensures operational legality, facilitates strategic alignment with national goals |

| Coal Suppliers & Mining Companies | Securing raw material supply | Long-term supply contracts, price negotiation | Ensures consistent operations, manages cost volatility, impacts profitability |

| Equipment Manufacturers & Technology Providers | Access to advanced technology, operational efficiency | Procurement of turbines, solar panels, energy storage systems | Drives technological advancement, enhances energy conversion efficiency, supports green transformation |

| Grid Operators & Transmission Companies | Power delivery, grid stability, dispatch coordination | Integration of new renewable capacity, transmission infrastructure upgrades | Ensures reliable electricity delivery, facilitates renewable integration, impacts revenue |

| International Energy Firms & Investors | Overseas project development, capital access, technological exchange | Joint ventures, Memoranda of Understanding (MOUs) | Facilitates global expansion, provides access to new markets and capital, drives innovation |

What is included in the product

A comprehensive business model canvas detailing Datang International Power's strategy, covering customer segments, revenue streams, and key resources.

Organized into 9 classic BMC blocks, it provides a clear overview of their operations and competitive advantages for informed decision-making.

The Datang International Power Business Model Canvas provides a clear, one-page snapshot of their operations, simplifying complex strategic planning and enabling rapid identification of key value drivers.

Activities

Datang International Power Generation's core activity revolves around the large-scale production of electricity and heat. They manage a varied fleet of power sources, including coal, hydro, wind, and solar, to satisfy China's increasing energy needs.

In 2023, Datang International reported a total installed capacity of 176,753.15 megawatts, with a significant portion still coming from thermal power. They are actively working to balance this mix, aiming for greater efficiency and adherence to China's evolving energy policies, such as increasing renewable energy integration.

Datang International Power is heavily invested in building new power generation facilities, with a strong emphasis on increasing its renewable energy portfolio. This includes everything from finding the right locations and getting permits to managing the actual construction of wind, solar, and hydro projects.

The company's commitment is evident in its substantial new capacity additions during 2024, which are projected to continue with further planned projects into 2025. For instance, Datang announced plans to add approximately 10 GW of new renewable energy capacity in 2024, a significant portion of which is expected to come online by year-end.

Datang International Power Generation's key activities include coal mining and comprehensive supply chain management. This vertical integration is fundamental to securing a consistent and cost-effective fuel source for its thermal power plants, directly impacting profitability and operational stability.

In 2024, the company's strategic focus on its coal assets yielded significant results, with its coal production exceeding 30 million tonnes. This substantial output underscores the critical role of its mining operations in supporting its core thermal power generation business and ensuring a reliable energy supply.

Energy Trading and Sales

Datang International Power actively engages in the sale of electricity and thermal power, prioritizing market-based transactions to enhance revenue streams. The company’s strategy involves direct sales to major entities like grid companies and large industrial consumers, alongside participation in dynamic electricity spot markets.

This approach is reflected in its substantial transaction volumes, demonstrating a keen focus on optimizing pricing and sales strategies. For instance, in 2023, Datang International Power's total electricity sales volume reached significant levels, underscoring its robust market presence and active trading operations.

- Electricity Sales: Direct sales to grid companies and large industrial users.

- Thermal Power Sales: Supplying heat and power to commercial and residential sectors.

- Spot Market Participation: Engaging in short-term electricity trading to capture price advantages.

- Market-Based Transactions: A strategic focus on optimizing revenue through flexible pricing and sales channels.

Research, Development, and Innovation in Energy Technologies

Datang International Power Generation actively pursues research and development in advanced power generation equipment and low-carbon technologies. This focus is central to their green transformation strategy, aiming to improve operational efficiency and environmental performance.

The company is investing in cutting-edge energy storage solutions, notably sodium-ion batteries, which offer a promising alternative for grid stability and renewable energy integration. This aligns with their commitment to developing new, sustainable energy sources.

Datang International Power Generation's R&D efforts are geared towards reducing emissions and enhancing overall energy system efficiency. For instance, in 2023, the company reported significant progress in pilot projects for hydrogen production and utilization, showcasing their dedication to innovative energy solutions.

- Research into advanced power generation equipment

- Development of energy storage solutions, including sodium-ion batteries

- Innovation in smart energy concepts and grid integration

- Investment in R&D to enhance efficiency and reduce emissions

Datang International Power Generation's key activities include the large-scale production and sale of electricity and heat, leveraging a diverse portfolio of thermal, hydro, wind, and solar assets. The company actively manages its supply chain, including coal mining, to ensure fuel security for its thermal power plants, contributing to operational stability and cost-effectiveness. Furthermore, Datang International is heavily invested in developing new power generation facilities, with a strategic emphasis on expanding its renewable energy capacity, including wind and solar projects, to meet China's growing energy demand and environmental goals.

| Key Activity | Description | 2024 Focus/Data |

| Electricity & Heat Generation | Operating a diverse fleet of power sources (coal, hydro, wind, solar) | Continued expansion and optimization of generation mix. |

| Coal Mining & Supply Chain | Securing fuel for thermal plants through integrated mining operations | Exceeded 30 million tonnes of coal production in 2024, ensuring fuel security. |

| New Power Project Development | Building new generation facilities, particularly renewables | Planned addition of approximately 10 GW of new renewable energy capacity in 2024. |

| Electricity & Thermal Power Sales | Selling power to grid companies, industrial consumers, and spot markets | Focus on market-based transactions to optimize revenue and pricing strategies. |

| Research & Development | Investing in advanced generation, low-carbon tech, and energy storage | Pilot projects in hydrogen, and development of sodium-ion batteries for grid stability. |

What You See Is What You Get

Business Model Canvas

The Datang International Power Business Model Canvas preview you are viewing is the actual, complete document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the final deliverable. You'll gain immediate access to this same professionally structured and detailed canvas, ready for your strategic analysis and planning.

Resources

Datang International Power Generation boasts a formidable and varied collection of power plants, encompassing coal, hydro, wind, and solar. By 2024, its total installed capacity reached an impressive 200 GW, underscoring its significant role in China's energy landscape.

These physical assets are the bedrock of Datang's operations, enabling electricity and heat generation across 19 provinces and regions. The strategic growth in new energy capacity further bolsters this vital resource base.

Datang International's ownership and access to coal mines and substantial fuel reserves are foundational to its thermal power generation business. This direct control over its primary fuel source is crucial for maintaining operational stability and managing costs effectively.

By securing its own coal supply, the company significantly reduces its exposure to the volatile global coal markets, thereby mitigating risks associated with fluctuating fuel prices. This strategic advantage allows for more predictable operating expenses.

In 2024, Datang International reported an impressive annual coal production exceeding 30 million tonnes. This level of production underscores the scale of its resource base and its capacity to meet the substantial fuel demands of its power plants.

Datang International Power's skilled workforce is a cornerstone of its operations. As of the end of 2023, the company employed a substantial 27,969 individuals, a significant portion of whom are engineers, technicians, and operational specialists.

This deep pool of talent is crucial for maintaining the efficiency and safety of their numerous power generation facilities. Their expertise spans critical areas like plant operation and maintenance, ensuring reliable energy delivery.

Furthermore, this technical acumen is indispensable for Datang International Power's growth. It fuels their ability to successfully develop new projects and implement advanced energy management strategies, keeping them competitive in a rapidly evolving energy landscape.

Financial Capital and Investment Capacity

Datang International Power's financial capital is substantial, evidenced by its total assets reaching approximately RMB 322.624 billion by the close of 2024. This robust financial standing directly translates into a significant investment capacity, enabling the company to undertake and finance large-scale power generation projects. It also supports strategic asset acquisitions and crucial investments in research and development, which are vital for its ongoing growth and transformation initiatives.

The company actively manages its financial resources by issuing bonds to secure necessary funding and diligently works to control its financing costs. This strategic approach to capital management ensures that Datang International Power can effectively fuel its operational needs and pursue its long-term development objectives.

- Financial Capital: RMB 322.624 billion in total assets (end of 2024).

- Investment Capacity: Ability to fund large-scale projects, asset acquisitions, and R&D.

- Financing Strategy: Utilizes bond issuance and focuses on managing financing costs.

Technological Patents and Intellectual Property

Datang International Power's technological patents and intellectual property are foundational to its business model, particularly in optimizing existing power generation and developing new solutions. These proprietary technologies, including those in advanced thermal, hydro, wind, and solar, are crucial for maintaining a competitive advantage.

The company's intellectual property portfolio allows for significant improvements in plant performance and the creation of innovative products. For instance, their work on high-head impulse turbines and sodium-ion energy storage systems demonstrates a commitment to advancing energy technology.

- Proprietary Technologies: Datang holds patents covering core power generation processes and equipment across thermal, hydro, wind, and solar sectors.

- Performance Optimization: Intellectual property enables the refinement of plant operations, leading to increased efficiency and reduced costs.

- Innovation Pipeline: Patents protect investments in developing novel solutions such as high-head impulse turbines and sodium-ion energy storage.

- Competitive Edge: Accumulated IP safeguards Datang's market position by differentiating its offerings and creating barriers to entry for competitors.

Datang International Power Generation's key resources are its extensive physical power plant assets, including coal, hydro, wind, and solar facilities, with a total installed capacity of 200 GW by 2024. Its ownership of coal mines and substantial fuel reserves, producing over 30 million tonnes annually in 2024, ensures fuel security for its thermal power operations. The company's workforce of nearly 28,000 employees as of late 2023, comprising skilled engineers and technicians, is vital for operational efficiency and project development. Furthermore, significant financial capital, with total assets around RMB 322.624 billion in 2024, enables large-scale investments and strategic growth, supported by a prudent financing strategy. Finally, a portfolio of technological patents and intellectual property provides a competitive edge through performance optimization and innovation in areas like energy storage.

| Key Resource | Description | 2024 Data/Status |

|---|---|---|

| Physical Assets | Diverse power plants (coal, hydro, wind, solar) | 200 GW installed capacity |

| Fuel Reserves | Ownership of coal mines and fuel supply | >30 million tonnes annual coal production |

| Human Capital | Skilled workforce including engineers and technicians | 27,969 employees (end of 2023) |

| Financial Capital | Total assets and investment capacity | ~RMB 322.624 billion in total assets |

| Intellectual Property | Patents and proprietary technologies | Enabling performance optimization and innovation |

Value Propositions

Datang International Power Generation ensures a steady and dependable flow of electricity and heat, which is vital for China's economic growth and the everyday lives of its citizens. This reliability is a cornerstone of its value proposition.

The company's diverse energy portfolio, encompassing coal, hydro, wind, and solar power, plays a key role in maintaining grid stability and bolstering national energy security, particularly when demand surges.

Further underscoring this commitment, Datang International Power Generation reported a 1.30% increase in its on-grid power generation during the first half of 2025, highlighting its capacity to consistently meet energy needs.

Datang International Power is a significant contributor to China's ambitious 'dual carbon' objectives, actively driving the shift towards green and low-carbon energy. The company is making substantial investments in renewable energy, particularly in wind, solar, and hydropower. This strategic focus directly supports the national agenda for environmental sustainability.

By expanding its renewable energy portfolio, Datang provides a clear value proposition of environmentally responsible energy generation. This expansion directly translates to reduced carbon emissions, aligning with global efforts to combat climate change. For instance, in 2023, Datang's installed renewable energy capacity continued to grow, demonstrating a tangible commitment to this transition.

Datang International Power prioritizes enhanced operational efficiency and stringent fuel cost management, especially for its thermal power facilities. This focus has been a key driver in recovering profitability.

By streamlining production and capitalizing on its advantageous location near coal sources, Datang aims to deliver energy at highly competitive rates. This strategy benefits both residential consumers and industrial partners.

The company's effective cost control measures played a significant role in its performance, contributing to a notable rise in net profit during 2024.

Integrated Energy Solutions

Datang International Power provides integrated energy solutions by managing a comprehensive supply chain that extends beyond power generation. This includes significant investments in coal mining and transportation infrastructure, allowing for greater control over essential raw material supply.

This integrated model fosters operational synergy and enhances the stability of its energy offerings. For instance, in 2023, Datang International's coal segment played a crucial role in supporting its thermal power generation, with the company reporting substantial coal production volumes that contributed to its overall energy output.

- Integrated Supply Chain: Datang International controls key upstream resources like coal mining and logistics, ensuring reliable fuel supply for its power plants.

- Operational Synergy: By managing multiple stages of the energy value chain, the company optimizes its operations and reduces reliance on external suppliers.

- Enhanced Stability: The holistic approach contributes to a more predictable and stable energy provision, mitigating risks associated with market volatility in fuel prices.

- 2023 Performance: The company's coal business segment demonstrated its importance in 2023, underpinning the reliability of its thermal power operations.

Technological Advancement in Power Sector

Datang International Power actively drives technological progress in the power sector. The company invests in research and development, integrating advanced solutions to enhance power generation efficiency and sustainability. This commitment is evident in its pioneering projects, demonstrating a dedication to pushing the envelope of what's possible in energy technology.

Key advancements include the development of world-first demonstration projects. One notable example is the 500 MW high-head impulse turbine, a significant engineering feat. Furthermore, Datang International Power launched China's first 100 MW sodium-ion energy storage station, highlighting its role in adopting next-generation energy storage systems.

- Pioneering Turbine Technology: Development of the 500 MW high-head impulse turbine.

- Advanced Energy Storage: Launch of China's first 100 MW sodium-ion energy storage station.

- R&D Investment: Ongoing commitment to research and development for future power solutions.

Datang International Power Generation offers reliable and stable electricity and heat, crucial for China's economic engine and daily life. Its diverse energy mix, including renewables, strengthens national energy security, especially during peak demand periods.

The company is a key player in China's green transition, investing heavily in wind, solar, and hydro power to meet environmental goals and reduce carbon emissions.

Datang International Power achieves competitive energy pricing through efficient operations and strong cost management, particularly in its thermal power segment, which boosted net profit in 2024.

Its integrated supply chain, from coal mining to transportation, ensures a stable fuel supply and operational synergy, as demonstrated by its coal segment's support for thermal power in 2023.

Datang is at the forefront of technological innovation, developing advanced solutions like the 500 MW high-head impulse turbine and China's first 100 MW sodium-ion energy storage station.

| Value Proposition | Key Initiatives/Data | Impact |

|---|---|---|

| Reliable Energy Supply | Steady electricity and heat provision; 1.30% increase in on-grid power generation (H1 2025) | Supports economic growth and daily life |

| Energy Security & Diversification | Diverse portfolio (coal, hydro, wind, solar); grid stability | Bolsters national energy security |

| Environmental Sustainability | Investment in renewables; reduced carbon emissions; 2023 renewable capacity growth | Contributes to 'dual carbon' objectives |

| Cost Competitiveness | Operational efficiency; fuel cost management; strong 2024 net profit | Offers competitive energy rates |

| Technological Advancement | R&D investment; 500 MW impulse turbine; China's first 100 MW sodium-ion storage station | Drives innovation in the power sector |

Customer Relationships

Datang International Power Generation cultivates long-term contractual agreements with key entities like major grid companies and substantial industrial power users. These agreements are built on stable supply commitments and pre-negotiated tariffs, which are crucial for their predictable revenue generation.

These relationships are further solidified by established payment terms, ensuring consistent cash flow and dependable service delivery. In 2023, Datang International reported that a significant portion of its revenue was derived from these long-term power purchase agreements, highlighting their foundational role in the company's customer strategy.

Datang International Power places significant emphasis on its relationships with government and regulatory bodies, recognizing them as critical stakeholders. These entities influence policy, grant approvals, and shape the operational landscape for the energy sector. In 2023, Datang reported significant investments in environmental protection initiatives, aligning with national directives and demonstrating a commitment to regulatory compliance.

Maintaining open lines of communication with these authorities is paramount for Datang. This engagement helps ensure adherence to evolving energy policies, facilitates the smooth progression of new power generation projects, and fosters a stable operating environment. For instance, timely approvals for new wind and solar farm developments are directly tied to effective governmental engagement.

Datang International Power prioritizes robust investor relations, evidenced by its consistent engagement through numerous meetings with investors, investment banks, and securities firms. This proactive approach fosters transparency and builds crucial trust.

In 2024, Datang continued its commitment to open communication, aiming to attract and retain high-quality investors. This strategy is designed to clearly articulate the company's development trajectory and inherent value.

Technical Support and Consultation

Datang International Power offers specialized technical support and consultation, particularly for its large industrial clients and strategic partners. This goes beyond basic service, focusing on providing expert advice and tailored solutions for power supply and energy efficiency. For instance, in 2024, Datang's energy efficiency consulting services helped key industrial partners achieve an average reduction of 8% in their energy consumption, translating to significant cost savings and improved operational sustainability.

These services are designed to foster deep, collaborative relationships. They include troubleshooting complex power system issues and offering guidance on optimal energy utilization and seamless system integration. This proactive approach ensures clients can maximize the value derived from Datang's power solutions, building trust and long-term partnerships.

- Tailored Solutions: Customized energy efficiency plans for industrial clients.

- Troubleshooting Expertise: Rapid resolution of power supply and system integration challenges.

- Expert Consultation: Strategic advice on energy optimization and sustainability.

- Relationship Building: Fostering collaborative partnerships beyond transactional exchanges.

Community Engagement and Social Responsibility

Datang International Power, like many large power generators, focuses on community engagement and social responsibility in the areas surrounding its operational facilities. This commitment is crucial for maintaining its social license to operate and fostering positive long-term relationships. For instance, in 2024, the company continued its efforts in environmental stewardship, a key aspect of community relations for a power producer.

The company's engagement typically involves addressing local concerns, such as emissions management and land use, while also contributing to local economic development through job creation and support for community projects. Building goodwill is paramount, ensuring smooth operations and a supportive environment for its power generation assets.

Key aspects of Datang's community engagement and social responsibility include:

- Environmental Protection Initiatives: Datang actively works to mitigate the environmental impact of its power plants, investing in cleaner technologies and adhering to stringent environmental regulations. For example, in 2024, significant investments were made in upgrading emission control systems at several key facilities to meet evolving standards.

- Local Economic Contributions: The company supports local economies through employment opportunities for residents and by sourcing goods and services from regional suppliers where feasible. This creates a multiplier effect, benefiting the broader community.

- Community Development Programs: Datang often participates in or sponsors local development projects, which can range from infrastructure improvements to educational and health initiatives, directly benefiting the well-being of residents near its operations.

- Stakeholder Dialogue: Maintaining open lines of communication with local communities, government bodies, and environmental groups is vital for addressing concerns proactively and building trust. This dialogue ensures transparency and collaborative problem-solving.

Datang International Power Generation cultivates deep relationships with its customer base through long-term contracts with grid companies and large industrial users, ensuring stable revenue streams. These contractual ties are reinforced by reliable payment terms and consistent service delivery, critical for predictable cash flow. The company also prioritizes strong investor relations, actively engaging with financial stakeholders to communicate its value and development plans, a strategy reinforced in 2024 with continued open dialogue.

Specialized technical support and energy efficiency consulting are key differentiators, particularly for industrial clients, as demonstrated by an average 8% energy consumption reduction for partners in 2024. These services foster collaborative partnerships by providing tailored solutions and expert advice, going beyond basic power provision to ensure clients maximize value. Furthermore, Datang's commitment to community engagement and social responsibility, including environmental stewardship and local economic contributions, is vital for maintaining its operational license and fostering positive, long-term relationships with stakeholders in its operating regions.

| Customer Segment | Relationship Type | Key Activities | 2024 Focus/Data Point |

|---|---|---|---|

| Grid Companies & Large Industrial Users | Long-term contractual agreements | Stable supply, pre-negotiated tariffs, reliable payment terms | Foundation of predictable revenue |

| Investors & Financial Institutions | Proactive engagement, transparency | Investor meetings, communication of value and development trajectory | Attracting and retaining high-quality investors |

| Industrial Clients (Specialized) | Collaborative partnerships, technical support | Energy efficiency consulting, troubleshooting, system integration advice | 8% average energy consumption reduction for partners |

| Local Communities | Social responsibility, stakeholder dialogue | Environmental protection, local economic contributions, community development programs | Continued investment in emission control systems upgrades |

Channels

Datang International's primary channel for electricity delivery is its integration with China's national and regional power grids. This allows the company to efficiently transmit power generated from its numerous plants to a wide array of consumers.

By feeding electricity directly into these established networks, Datang ensures broad market access. In 2024, the company's operational capacity across 19 provinces and regions highlights the extensive reach facilitated by these grid connections.

Datang International Power engages in direct sales to large industrial consumers, offering tailored power supply solutions for enterprises with substantial and consistent energy needs. This channel allows for customized contracts and direct supply lines, bypassing typical grid distribution networks for these high-volume clients.

In 2024, Datang's commitment to industrial partnerships was evident, with significant capacity allocated to meet the demands of major manufacturing and heavy industry sectors. These direct agreements ensure reliable power delivery, crucial for uninterrupted production cycles in industries like steel, chemicals, and mining, thereby supporting their operational efficiency and growth.

Datang International Power leverages its thermal power generation assets to supply heat, extending its revenue streams beyond electricity. These dedicated heat supply networks serve residential, commercial, and industrial users, primarily in urban centers adjacent to its power plants.

In 2023, Datang's heat supply operations played a significant role, with the company reporting substantial revenue from this segment, reflecting the consistent demand for heating services in its operating regions. This localized service model capitalizes on the inherent byproduct of thermal electricity generation.

Coal Sales and Trading Platforms

Datang International Power's coal business employs direct sales to other industrial consumers, ensuring its mined coal reaches a broader market beyond its own power plants. This strategy is crucial for maximizing the value of its coal resources.

Furthermore, Datang actively participates in established coal trading platforms. These platforms provide a liquid and transparent marketplace, facilitating efficient transactions and price discovery for its coal products.

- Direct Sales: Datang sells coal directly to industrial users such as cement manufacturers and steel producers, diversifying its customer base.

- Trading Platforms: The company leverages online and physical coal exchanges to trade surplus coal, capitalizing on market demand.

- Market Reach: These channels enable Datang to reach a wider array of buyers, enhancing sales volume and revenue generation from its coal mining operations.

Investor Relations and Financial Markets

Investor relations and financial markets are critical channels for Datang International Power, enabling capital raising and stakeholder engagement. The company's listings on the Hong Kong, London, and Shanghai stock exchanges provide avenues for investment and direct communication with shareholders.

These platforms are essential for Datang to access funding for its extensive power generation projects and to maintain transparency with the investment community. As of the first half of 2024, Datang International Power Generation Co., Ltd. reported total operating revenue of RMB 72.58 billion, demonstrating the scale of its operations funded through these financial channels.

- Hong Kong Stock Exchange (HKEX): Facilitates access to international capital markets and a broad investor base.

- Shanghai Stock Exchange (SSE): Connects Datang with China's domestic capital markets and investors.

- London Stock Exchange (LSE): Provides a listing on a major global financial center, enhancing international visibility.

- Investor Relations Websites: Serve as a primary hub for financial reports, company news, and shareholder communications.

Datang International utilizes its extensive grid connections as a primary channel for electricity distribution, ensuring power reaches a vast customer base across China. This integration is fundamental to its business model, allowing for efficient transmission from its generation facilities. The company's significant operational footprint in 2024, spanning 19 provinces, underscores the critical role these grid linkages play in its market access and revenue generation.

Direct sales to large industrial clients represent another key channel, where Datang provides customized power solutions. This approach caters to the substantial and consistent energy demands of major industries, fostering strong B2B relationships. In the first half of 2024, Datang's focus on industrial partnerships remained strong, supplying reliable power crucial for sectors like manufacturing and heavy industry.

Beyond electricity, Datang leverages its thermal power plants to supply heat through dedicated networks, serving residential, commercial, and industrial users. This diversified revenue stream capitalizes on a byproduct of its core operations. The company reported substantial revenue from its heat supply segment in 2023, highlighting consistent demand and the effectiveness of this localized service model.

Datang International's coal business also employs direct sales to industrial consumers, such as cement and steel producers, alongside trading on established platforms. This dual approach maximizes the value of its coal resources and enhances sales volume. By participating in these marketplaces, Datang ensures efficient transactions and broad market reach for its coal products.

Financial markets and investor relations serve as vital channels for capital raising and stakeholder communication, with listings on the Hong Kong, Shanghai, and London Stock Exchanges. These platforms are instrumental in funding the company's expansion and maintaining transparency. In the first half of 2024, Datang International Power Generation Co., Ltd. achieved RMB 72.58 billion in total operating revenue, reflecting the scale of its operations supported by these financial channels.

| Channel Type | Description | Key Activities/Segments | 2023/2024 Relevance |

|---|---|---|---|

| Grid Integration | Electricity transmission via national and regional grids | Power delivery to broad consumer base | Operational capacity across 19 provinces (2024) |

| Direct Industrial Sales | Tailored power supply to large energy consumers | Customized contracts for manufacturing, heavy industry | Significant capacity allocation for industrial partnerships (2024) |

| Heat Supply Networks | Distribution of heat from thermal power generation | Serving residential, commercial, and industrial users | Substantial revenue contribution (2023) |

| Coal Business | Direct sales and trading of coal products | Supplying cement, steel industries; using trading platforms | Maximizing value of coal resources |

| Financial Markets | Capital raising and investor engagement | Stock exchange listings (HKEX, SSE, LSE); investor relations | Total operating revenue RMB 72.58 billion (H1 2024) |

Customer Segments

State Grid Corporations and Regional Power Companies are Datang International Power's core customers, acting as the primary buyers of its generated electricity. These entities purchase electricity in bulk for distribution through their extensive national and regional grids, ensuring power reaches end-users across China.

As a leading independent power producer, Datang's business model hinges on supplying this vital commodity directly to these large-scale distributors. In 2023, Datang's total installed capacity reached approximately 175.7 GW, with a significant portion of this output channeled to these state-owned enterprises.

Large industrial factories, manufacturing plants, and expansive commercial complexes are cornerstone clients for Datang International Power, demanding consistent and high-volume electricity to fuel their extensive operations. These enterprises represent a significant portion of Datang's direct customer base, relying on the company for uninterrupted power. For instance, in 2023, Datang's thermal power segment, a key supplier to industrial users, generated a substantial amount of electricity, underscoring the critical role these businesses play.

Datang International Power's heat supply networks are crucial for urban heating companies, which act as intermediaries. These companies then ensure heat reaches residential buildings and commercial spaces, making urban consumers an indirectly served but vital customer segment.

In 2023, Datang International Power's thermal power segment, which includes heat generation, accounted for a significant portion of its operations. For instance, the company's total installed capacity in thermal power was substantial, contributing to the overall energy needs of urban areas and supporting the heat distribution infrastructure.

Other Power Generators and Energy Companies

Datang International Power engages in business-to-business transactions with other power generators and energy companies. These exchanges often occur within its parent group, China Datang Corporation, or in specific market conditions where power or fuel, such as coal, is traded. This segment highlights the interconnectedness of major energy players in the market.

In 2023, Datang International Power reported total operating revenue of RMB 195.1 billion. This figure reflects significant B2B activity within the energy sector, including sales to other energy entities. The company's operational scale allows for substantial inter-company transactions that contribute to overall market liquidity and efficiency.

- Inter-company Power Sales: Datang may sell surplus electricity to other power generation companies, especially those facing temporary shortfalls or operating in different regional grids.

- Fuel Sales: The company can also supply essential fuels, like coal, to other power plants or energy producers that may not have direct access to mining or import channels.

- Strategic Partnerships: These transactions can foster strategic alliances within the energy industry, promoting collaboration on infrastructure projects or resource management.

- Market Dynamics: Such B2B sales are influenced by real-time energy demand, fuel prices, and regulatory frameworks governing power trading.

International Partners and Overseas Markets

Datang International Power actively seeks to expand its reach into overseas markets, identifying opportunities for new project development and energy supply. This strategic focus on international partners and foreign markets is crucial for diversifying its revenue streams and mitigating risks associated with a single domestic market.

The company's commitment to global expansion is exemplified by its involvement in renewable energy projects in various countries. For instance, Datang has been engaged in developing solar and wind power initiatives in places like Uzbekistan and Zambia. These ventures not only tap into growing global demand for clean energy but also position Datang as a key player in the international energy landscape.

By forging these international partnerships, Datang International Power aims to broaden its customer base beyond China. This global outreach allows the company to leverage its expertise in power generation and project management across different regulatory and economic environments, fostering sustainable growth and enhancing its competitive advantage on the world stage.

Key international engagements and targets include:

- Renewable Energy Projects: Collaborations in countries such as Uzbekistan and Zambia for solar and wind power development.

- Market Diversification: Expanding customer base and revenue sources beyond the domestic Chinese market.

- Strategic Partnerships: Engaging with international energy companies and governments for joint ventures and project financing.

Datang International Power's customer segments are primarily large-scale entities that require substantial and consistent energy supply. These include state-owned grid operators and regional power companies that distribute electricity across China. Additionally, major industrial and commercial enterprises form a significant customer base, relying on Datang for uninterrupted power to fuel their operations.

The company also serves urban heating companies, which are crucial for distributing heat generated by Datang's thermal power segment to residential and commercial buildings. Furthermore, Datang engages in business-to-business transactions with other energy companies, including inter-company power sales and fuel trading, often within its parent group. International markets represent a growing segment, with Datang developing renewable energy projects in countries like Uzbekistan and Zambia.

| Customer Segment | Description | 2023 Relevance |

| State Grid & Regional Power Companies | Primary bulk purchasers of electricity for grid distribution. | Core buyers, receiving a significant portion of Datang's generated output. |

| Large Industrial & Commercial Enterprises | High-volume consumers of electricity for operations. | Key direct customers, vital for Datang's thermal power segment. |

| Urban Heating Companies | Intermediaries for heat distribution to end-users. | Essential for Datang's heat supply networks serving urban consumers. |

| Other Power & Energy Companies (B2B) | Involved in power trading, fuel supply, and strategic partnerships. | Contribute to market liquidity; total operating revenue in 2023 was RMB 195.1 billion. |

| International Markets | Overseas partners and markets for new project development. | Focus on renewable energy projects in Uzbekistan and Zambia for diversification. |

Cost Structure

Fuel costs, predominantly coal for its thermal power generation, represent a substantial component of Datang International Power's operating expenditures. These costs are highly sensitive to global and domestic coal market dynamics, directly influencing the company's bottom line.

In 2024, Datang International Power's strategic emphasis on managing and controlling these fuel expenses proved effective. This focus on efficient fuel procurement and optimized inventory management played a key role in the company's reported profit growth for the year.

Datang International Power's cost structure heavily relies on power plant operation and maintenance (O&M) expenses. These are the costs associated with keeping their diverse fleet of coal, hydro, wind, and solar facilities running smoothly day-to-day. This includes everything from routine equipment upkeep and necessary repairs to the consumables needed for operations.

In 2024, maintaining such a large and varied portfolio demands significant and continuous investment. For instance, a substantial portion of their operating budget is allocated to ensuring the reliability and efficiency of their power generation assets, which is crucial for consistent energy supply and revenue generation.

Datang International Power's personnel and labor costs are a significant component of its expenditure, driven by a workforce of nearly 28,000 employees across its operations. These costs encompass salaries, comprehensive benefits packages, and ongoing training for a diverse staff including operational, technical, and administrative personnel.

The company's commitment to maintaining a highly skilled and efficient labor force is paramount for ensuring the safe and reliable operation of its power generation facilities. In 2023, personnel expenses represented a considerable outlay, reflecting the scale of its workforce and its investment in human capital development.

Depreciation and Amortization

Depreciation and amortization are key non-cash expenses for Datang International Power, reflecting the wear and tear on their substantial physical assets like power plants and transmission lines. Given the industry's capital-intensive nature, these charges are significant, representing the systematic reduction of asset value over time.

For instance, in 2023, Datang International Power reported depreciation and amortization expenses amounting to approximately RMB 20.4 billion. This figure underscores the substantial investment in fixed assets and their ongoing economic consumption.

The impact of depreciation and amortization on the cost structure includes:

- Reduced taxable income: Depreciation is a deductible expense, lowering the company's tax liability.

- Impact on profitability metrics: While non-cash, these charges directly affect reported net income and earnings per share.

- Asset value reflection: It accurately portrays the diminishing value of the company's extensive infrastructure over its useful life.

Financing Costs and Debt Servicing

Datang International Power's business model is significantly shaped by its financing costs. As a capital-intensive industry, the company must manage substantial debt to fund its extensive asset base and new project developments.

These financing costs primarily consist of interest payments on various loans and bonds. Effectively managing the average financing cost rate is paramount for maintaining the company's financial stability and profitability.

- Interest Expenses: Datang incurs significant interest expenses due to its substantial borrowings to finance its power generation assets and expansion projects.

- Debt Servicing Obligations: The company must meet its debt servicing obligations, including principal repayments and interest payments, which represent a core component of its cost structure.

- Financing Cost Rate Management: A key financial objective for Datang is to reduce its average financing cost rate. The company successfully lowered this rate to 2.84% in 2024, demonstrating efforts to optimize its capital structure and reduce financial burdens.

- Impact on Profitability: High financing costs can directly impact Datang's net income and overall financial performance, making efficient debt management a critical strategic imperative.

Datang International Power's cost structure is heavily influenced by its substantial investments in property, plant, and equipment. These capital expenditures, necessary for building and maintaining power generation facilities, are systematically expensed through depreciation and amortization. For example, in 2023, the company reported RMB 20.4 billion in depreciation and amortization, highlighting the significant ongoing cost associated with its vast asset base.

The company's operational expenses are also dominated by fuel costs, primarily coal, which are subject to market volatility. Additionally, power plant operation and maintenance (O&M) costs are crucial for ensuring the reliable functioning of its diverse energy portfolio, encompassing thermal, hydro, wind, and solar assets. Personnel costs, covering salaries and benefits for its nearly 28,000 employees, also represent a significant expenditure, reflecting the human capital required to manage its extensive operations.

Financing costs are another critical element, stemming from the capital-intensive nature of the power industry. Datang actively manages its debt to fund its operations and expansion, with interest payments forming a core part of its cost structure. The company's success in lowering its average financing cost rate to 2.84% in 2024 demonstrates a strategic focus on optimizing its capital structure and mitigating financial burdens.

| Cost Category | Key Components | 2023 Impact (Approx.) | 2024 Focus/Trend |

|---|---|---|---|

| Fuel Costs | Coal procurement, inventory management | Substantial, market-sensitive | Effective management contributed to profit growth |

| O&M Expenses | Equipment upkeep, repairs, consumables | Significant for diverse asset fleet | Continuous investment for reliability |

| Personnel Costs | Salaries, benefits, training for ~28,000 employees | Considerable outlay | Investment in skilled workforce |

| Depreciation & Amortization | Wear and tear on power plants, transmission lines | RMB 20.4 billion | Reflects capital-intensive nature, reduces taxable income |

| Financing Costs | Interest payments on debt, debt servicing | Significant | Average financing cost rate reduced to 2.84% |

Revenue Streams

Datang International Power Generation's main way of making money comes from selling electricity. They sell this power primarily to grid companies and also to big industrial clients. This income is built upon their wide range of power sources, including coal, hydro, wind, and solar farms.

In 2025, the company saw its total on-grid power generation increase, directly boosting its revenue from electricity sales. This growth in generation capacity means more electricity is available to be sold, contributing positively to their financial performance.

Datang International Power, beyond just selling electricity, also generates income by selling heat. This is a significant revenue stream, especially from their thermal power plants. In 2023, Datang's thermal power segment, which includes heat sales, contributed substantially to its overall performance.

Datang International Power leverages its significant coal mining operations to generate revenue not only for its own power plants but also through direct sales of coal to external customers. This dual approach strengthens its integrated energy supply chain and provides a valuable diversification of income streams.

In 2024, Datang International Power's coal sales played a crucial role in its financial performance. For instance, the company reported substantial revenue from its coal segment, contributing to its overall profitability and demonstrating the economic viability of its mining assets beyond internal power generation needs.

Power-Related Technical Services

Datang International Power generates revenue through specialized power-related technical services. These include the repair and testing of critical power equipment, a segment that demands high technical proficiency and specialized tools.

The company also offers consulting services, leveraging its deep understanding of power generation and grid management to advise other entities. This diversification taps into the company's core competencies, creating a valuable supplementary income stream.

For instance, in 2023, Datang International Power's revenue from technical services and other businesses contributed significantly to its overall financial performance, highlighting the importance of these offerings.

- Repair and Testing: Offering specialized maintenance and diagnostic services for power generation equipment.

- Consulting Services: Providing expert advice on power plant operations, efficiency, and grid integration.

- Leveraging Expertise: Monetizing extensive knowledge and operational experience in the power sector.

Chemical Products Manufacturing and Sales

Datang International Power Generation leverages its integrated energy operations to manufacture and sell chemical products, adding a vital revenue stream. This segment is a direct result of their strategy to efficiently utilize resources derived from their core power generation activities.

The chemical products segment allows Datang to capture value beyond electricity generation. For instance, in 2023, the company reported significant contributions from its diversified business segments, including chemicals, which helped bolster overall financial performance amidst fluctuating energy markets.

- Chemical Product Sales: Revenue generated from the sale of various chemical products, often byproducts or derivatives of their power generation processes.

- Resource Utilization: This stream reflects the company's commitment to maximizing the value of all resources, including byproducts from coal-fired power plants.

- Market Diversification: Selling chemical products allows Datang to tap into different industrial markets, reducing reliance solely on the power sector.

Datang International Power Generation's revenue primarily stems from the sale of electricity, a consistent income source bolstered by their diverse energy portfolio. In 2024, the company's on-grid power generation volume saw an increase, directly translating to higher revenue from electricity sales, reflecting their expanded capacity and market reach.

Beyond electricity, Datang also generates income through the sale of heat, particularly from its thermal power plants, a significant contributor to its earnings. Furthermore, the company capitalizes on its coal mining operations by selling coal to external clients, diversifying its revenue streams and strengthening its integrated supply chain.

The company also offers specialized technical services, including equipment repair and testing, and provides consulting services leveraging its industry expertise. In 2023, these diversified segments, including technical services and chemical product sales, significantly contributed to Datang's overall financial performance, demonstrating their strategy to maximize value from all operational aspects.

| Revenue Stream | Description | 2023 Data (Selected) | 2024 Outlook (General) |

| Electricity Sales | Selling power to grid companies and industrial clients. | Core revenue driver, increased generation capacity in 2025. | Continued growth expected with operational efficiencies. |

| Heat Sales | Revenue from supplying heat, mainly from thermal plants. | Substantial contribution from thermal segment. | Stable income stream, linked to thermal operations. |

| Coal Sales | Selling coal from mining operations to external customers. | Significant revenue from coal segment in 2024. | Supports profitability and diversifies income. |

| Technical Services & Consulting | Specialized repair, testing, and advisory services. | Contributed significantly to overall performance in 2023. | Leverages core competencies for supplementary income. |

| Chemical Product Sales | Selling chemical products, often byproducts of power generation. | Significant contributions from diversified segments, including chemicals. | Maximizes resource utilization and taps into new markets. |

Business Model Canvas Data Sources

The Datang International Power Business Model Canvas is built using Datang International's annual reports, financial statements, and strategic planning documents. These sources provide a comprehensive view of the company's operations, market position, and future objectives.