Chevron PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chevron Bundle

Chevron operates within a dynamic global landscape, significantly influenced by political stability, economic fluctuations, and evolving social attitudes towards energy. Understanding these external forces is crucial for navigating the company's future. Our comprehensive PESTLE analysis delves deep into these factors, offering actionable intelligence. Gain a competitive edge by downloading the full report now and unlock strategic insights tailored for Chevron.

Political factors

Chevron's global operations are heavily influenced by government policies and regulations, particularly concerning carbon emissions and the energy transition. For instance, the U.S. Inflation Reduction Act of 2022, with its significant tax credits for clean energy, could shape Chevron's future investments in lower-carbon technologies, though the company's primary focus remains on traditional oil and gas.

Local content requirements in countries like Nigeria or Angola can mandate that a certain percentage of Chevron's workforce or procurement comes from local sources, impacting operational costs and supply chain management. These regulations are often tied to the stability and political priorities of host governments, meaning shifts in administration can directly alter the operating landscape for Chevron.

Geopolitical stability in regions where Chevron operates, such as the Middle East and West Africa, is crucial. For instance, in 2024, ongoing tensions in the Red Sea have impacted shipping routes, potentially affecting global oil and gas logistics and pricing, which directly influences Chevron's operational costs and revenue streams.

Political instability or conflicts can disrupt Chevron's production activities, as seen in past instances where civil unrest in certain African nations led to temporary shutdowns. Such events increase operational risks and can necessitate significant investments in security, impacting the company's bottom line.

Navigating international relations is a constant challenge for Chevron. The company must manage its operations in countries with varying political systems and be prepared for potential sanctions, which could restrict market access or impact its financial transactions, as demonstrated by past sanctions regimes affecting energy companies.

Chevron's global operations are significantly shaped by international trade policies, including tariffs and trade agreements. These policies directly influence the cost of both importing essential equipment and exporting refined petroleum products. For instance, changes in tariffs on specialized drilling equipment could increase capital expenditures for Chevron's exploration projects.

Protectionist measures or escalating trade disputes can create substantial headwinds for Chevron. These can lead to higher operational costs through increased duties and potentially restrict access to key international markets where Chevron seeks to sell its energy products, thereby impacting its overall competitiveness in the dynamic global energy landscape.

Energy Security Agendas

Many countries are heavily focused on energy security, a trend that directly impacts companies like Chevron. This focus often translates into government policies designed to bolster domestic oil and gas output or encourage a broader mix of energy sources. For Chevron, this can mean opportunities when policies favor stable energy supplies, but it also presents a challenge to adapt to national objectives for energy transitions, requiring a careful balance between established fossil fuel operations and growing investments in less carbon-intensive alternatives.

For instance, in 2024, the International Energy Agency highlighted that despite global efforts towards renewables, many nations are still increasing their investments in oil and gas infrastructure to ensure immediate energy availability. This dual approach creates a complex operating environment for Chevron. The company must navigate varying national priorities, from supporting traditional energy production to meeting climate targets.

- Energy Security Focus: Governments globally are prioritizing reliable energy access, influencing policy towards domestic production and diversification.

- Chevron's Dual Role: The company benefits from policies supporting stable energy supply but also faces pressure to invest in lower-carbon solutions to meet national transition goals.

- 2024/2025 Trends: Continued investment in traditional energy alongside renewable initiatives reflects the ongoing tension between immediate security needs and long-term climate objectives.

Regulatory Deference Shift

The U.S. Supreme Court's June 2024 decision to overturn Chevron deference marks a significant political shift, potentially altering how federal agencies, including those overseeing environmental and energy sectors, enforce regulations. This ruling means courts will no longer automatically defer to an agency's interpretation of ambiguous laws, a change that could lead to more challenges against existing and future regulations.

For Chevron, this translates into a more complex and potentially litigious operating environment. The energy giant may face increased scrutiny and legal battles over its compliance with environmental standards, as the interpretation of these rules becomes more subject to judicial review rather than agency expertise.

This regulatory uncertainty could impact Chevron's long-term strategic planning and investment decisions, particularly concerning projects subject to evolving environmental interpretations. The company will need to adapt its legal and compliance strategies to this new landscape.

- Increased Litigation Risk: The overturning of Chevron deference could spur more lawsuits challenging environmental regulations affecting the energy sector.

- Regulatory Uncertainty: Agencies' interpretations of statutes may face greater judicial skepticism, creating a less predictable compliance framework.

- Strategic Adaptation Required: Chevron must adjust its legal and policy engagement to navigate a landscape where agency interpretations hold less weight in court.

Government policies on climate change and energy transition are pivotal. For instance, the U.S. Inflation Reduction Act of 2022, offering substantial clean energy tax credits, could influence Chevron's investment in lower-carbon technologies, though its core business remains oil and gas. Geopolitical stability in regions like the Middle East and West Africa directly impacts Chevron's operations, with events such as the 2024 Red Sea tensions affecting logistics and pricing.

Local content requirements in countries like Nigeria mandate local sourcing, increasing operational costs. Political instability can disrupt production, as seen with past shutdowns in African nations due to civil unrest, necessitating security investments. Navigating international relations requires managing varying political systems and preparing for potential sanctions that could restrict market access.

The June 2024 U.S. Supreme Court decision to overturn Chevron deference means courts will scrutinize agency interpretations of laws more closely. This could lead to increased litigation risk and regulatory uncertainty for Chevron, impacting strategic planning and investment decisions, particularly concerning environmental compliance.

| Political Factor | Impact on Chevron | Example/Data Point |

|---|---|---|

| Regulatory Interpretation | Increased litigation risk and compliance complexity | Overturning of Chevron deference (June 2024) |

| Energy Security Policies | Opportunities and challenges in balancing fossil fuels with transition | Global focus on stable energy access influencing national investments |

| Geopolitical Stability | Logistical disruptions and price volatility | 2024 Red Sea tensions impacting shipping routes |

| Local Content Requirements | Higher operational costs and supply chain adjustments | Mandates in countries like Nigeria and Angola |

What is included in the product

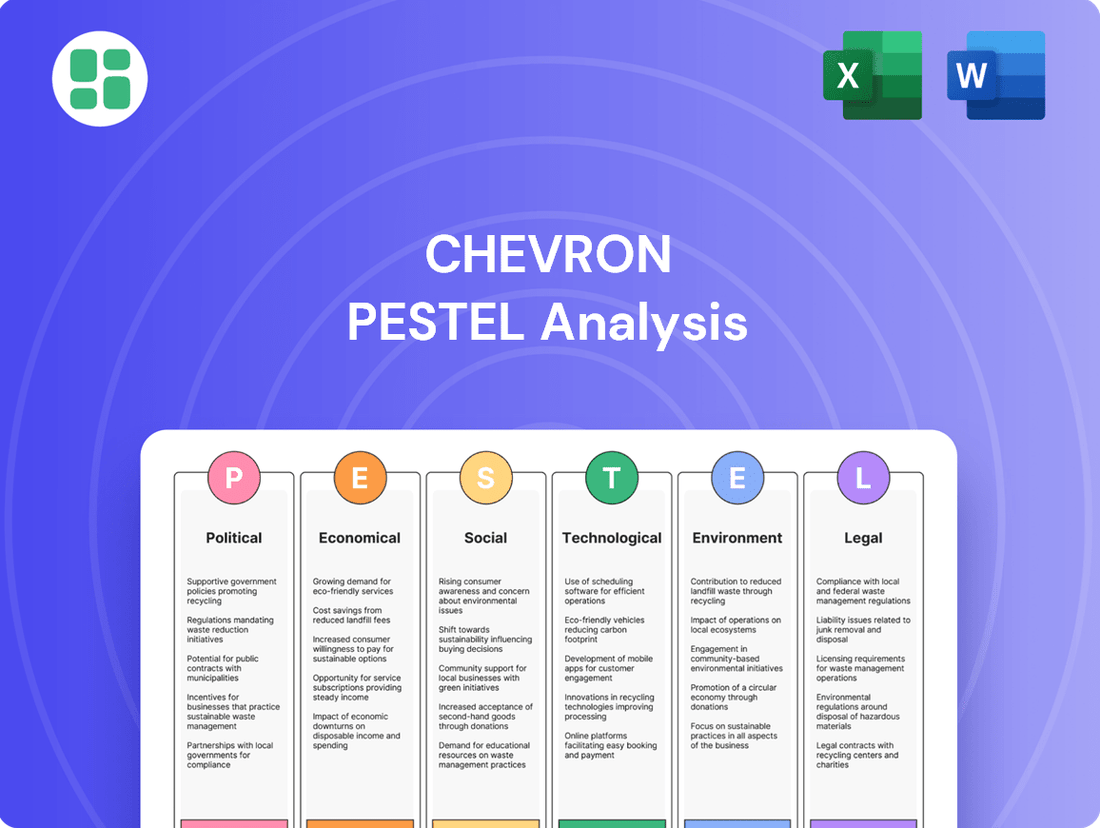

This PESTLE analysis examines the external macro-environmental factors influencing Chevron, detailing impacts across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for strategic decision-making.

Economic factors

Global oil and gas prices are the bedrock of Chevron's economic environment. Fluctuations here directly dictate the company's revenue and profitability. For instance, in early 2024, Brent crude oil prices hovered around $80 per barrel, a level that generally supports robust earnings for integrated energy companies like Chevron. Conversely, a significant drop, such as the mid-2020 lows when prices briefly dipped below $20, would severely impact cash flow and investment decisions.

The impact extends to Chevron's strategic choices regarding exploration and production. Higher prices incentivize investment in new projects and the expansion of existing ones, boosting future production capacity. Conversely, sustained low prices can lead to project deferrals or cancellations, potentially limiting long-term growth. For example, if prices were to consistently fall below Chevron's break-even costs for certain operations, those projects would likely be re-evaluated.

Global economic growth is a primary driver for energy demand, directly impacting Chevron's sales volumes across its petroleum and petrochemical segments. A stronger global economy translates to increased consumption of transportation fuels and essential industrial materials, which is a positive signal for Chevron's revenue streams.

For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a rate that supports sustained demand for oil and gas products. This growth underpins Chevron's ability to maintain and potentially increase its sales volumes, contributing to its financial performance.

Global investment in renewable energy is accelerating, with projections indicating trillions of dollars will be deployed by 2030. For Chevron, this surge represents a critical strategic pivot, demanding substantial capital allocation towards lower-carbon ventures like renewable fuels and carbon capture technologies.

The company's 2024 capital expenditure plan, for instance, includes significant investments in these areas, aiming to balance its traditional oil and gas business with emerging energy solutions. The speed of this energy transition directly impacts the long-term value of Chevron's existing fossil fuel assets, making adaptability paramount for sustained profitability.

Capital Expenditure and Free Cash Flow

Chevron's financial strategy hinges on carefully managing its capital expenditures (CapEx) and consistently producing robust free cash flow. This disciplined approach ensures the company can fund its operations and invest in growth opportunities while also rewarding its shareholders. For instance, in the first quarter of 2024, Chevron reported capital and exploratory expenditures of $3.4 billion, demonstrating a commitment to strategic investments.

The company's ability to efficiently allocate capital to projects with high expected returns, such as its significant operations in the Permian Basin, is a cornerstone of its financial stability. This strategic deployment of resources not only fuels ongoing production but also creates a strong foundation for shareholder returns. In 2023, Chevron returned $26.3 billion to shareholders, a testament to its robust free cash flow generation and commitment to capital discipline.

- Disciplined CapEx: Chevron aims for efficient capital allocation, prioritizing projects with strong returns.

- Strong Free Cash Flow: The company focuses on generating substantial free cash flow to support operations and shareholder returns.

- Permian Basin Investments: Strategic investments in areas like the Permian Basin are key drivers of financial performance.

- Shareholder Returns: Robust free cash flow enables significant returns to shareholders through dividends and share repurchases.

Inflation and Cost Management

Inflationary pressures directly impact Chevron's operational expenses. Rising costs for labor, raw materials like steel and chemicals, and essential services can significantly squeeze profit margins. For instance, in 2023, global inflation remained a persistent challenge, with energy and material costs seeing notable increases, directly affecting the oil and gas sector.

Effective cost management is therefore paramount for Chevron to maintain profitability. The company's focus on efficiency improvements, exemplified by its streamlined operations in the Permian Basin, is a key strategy. These efforts aim to mitigate the impact of escalating input costs and preserve financial health amidst economic uncertainties.

- Increased Operational Costs: Global inflation in 2023 led to higher expenses for labor, materials, and services across the energy sector.

- Margin Pressure: Rising input costs directly challenge Chevron's ability to maintain healthy profit margins.

- Efficiency as a Mitigator: Chevron's strategic focus on operational efficiencies, particularly in key production areas like the Permian Basin, is vital for cost control.

- Profitability Maintenance: Successful cost management is crucial for sustaining profitability in an environment of persistent inflationary pressures.

Global economic growth directly fuels energy demand, impacting Chevron's sales volumes. The International Monetary Fund projected global growth at 3.2% for 2024, supporting sustained oil and gas consumption. This positive economic outlook bolsters Chevron's revenue potential across its diverse operations.

Inflationary pressures continue to impact Chevron's operational expenses, increasing costs for labor and materials. For instance, the persistent inflation seen in 2023 directly affected input costs for the energy sector. Effective cost management and operational efficiencies are therefore critical for maintaining profitability.

Chevron's financial strategy emphasizes disciplined capital expenditure and strong free cash flow generation. In Q1 2024, CapEx was $3.4 billion, supporting investments like those in the Permian Basin. The company returned $26.3 billion to shareholders in 2023, showcasing its commitment to capital discipline and shareholder value.

| Economic Factor | 2024 Projection/Data | Impact on Chevron | Key Metric/Example |

| Global Economic Growth | IMF projects 3.2% (2024) | Increases energy demand and sales volumes | Supports revenue streams |

| Inflation | Persistent challenge (2023) | Increases operational costs, pressures margins | Higher expenses for labor, materials |

| Capital Expenditure | $3.4 billion (Q1 2024) | Funds operations and growth opportunities | Permian Basin investments |

| Shareholder Returns | $26.3 billion (2023) | Demonstrates financial strength and capital discipline | Dividends and share repurchases |

Preview the Actual Deliverable

Chevron PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Chevron PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a detailed strategic overview for informed decision-making.

Sociological factors

Public perception of the oil and gas sector, especially regarding environmental impact and climate change, directly affects Chevron's ability to operate. Surveys in 2024 indicated a growing public concern, with a significant majority of respondents globally expressing worry about the industry's contribution to global warming. This sentiment underscores the critical need for Chevron to actively manage its reputation.

Building and maintaining public trust hinges on transparent communication about operations, a steadfast commitment to safety, and visible efforts in environmental protection and community support. In 2025, Chevron's investments in renewable energy projects and its detailed reporting on emissions reduction targets are key strategies aimed at addressing these societal expectations and bolstering its social license to operate.

The energy sector, including Chevron, grapples with an aging workforce, with a significant portion of experienced professionals nearing retirement. This demographic shift necessitates a proactive approach to knowledge transfer and the recruitment of new talent. For instance, in 2024, the U.S. Bureau of Labor Statistics projected that while overall employment would grow, specific sectors like oil and gas extraction might see slower growth, highlighting the need for strategic workforce planning.

Chevron must actively address the evolving skill demands, particularly in areas like digital transformation, data analytics, and renewable energy technologies. A 2024 report by Deloitte indicated that companies prioritizing digital upskilling saw a 15% increase in employee productivity. Therefore, investing in robust talent development programs, fostering diversity and inclusion, and cultivating an attractive employer brand are crucial for Chevron to secure a skilled workforce capable of navigating both traditional and emerging energy landscapes.

Consumers are increasingly prioritizing sustainable energy, influencing demand for traditional fuels and pushing companies like Chevron to invest in renewables. For instance, a 2024 survey indicated that over 60% of global consumers consider a company's environmental impact when making purchasing decisions.

This shift directly impacts Chevron's product mix, necessitating a strategic pivot towards lower-carbon alternatives and electric vehicle infrastructure. By 2025, projections suggest the renewable energy sector will see significant growth, making adaptation essential for sustained market presence and profitability.

Community Engagement and Social Responsibility

Chevron's extensive operations necessitate deep engagement with the local communities where it operates, making robust community relations and social investment paramount. In 2023, Chevron invested over $200 million in community engagement initiatives globally, focusing on education, health, and economic development. These efforts are crucial for fostering goodwill and securing social license to operate, thereby reducing the risk of operational disruptions and aiding in project approvals.

Chevron actively supports educational programs, understanding their long-term impact on community well-being and future workforce development. For instance, their STEM education initiatives reached over 500,000 students in 2023. By investing in local talent and infrastructure, Chevron aims to build trust and ensure that its presence is viewed as a positive contributor to societal progress, aligning with growing expectations for corporate social responsibility.

- Community Investment: Chevron's global community engagement spending exceeded $200 million in 2023.

- Educational Reach: STEM programs impacted over 500,000 students in 2023.

- Risk Mitigation: Strong community relations are vital for operational continuity and project approvals.

- Social License: Investments in local development aim to foster trust and positive societal impact.

Health and Safety Standards

Chevron's commitment to robust health and safety standards is a critical societal expectation, directly influencing its operational license and public trust. Failure to uphold these standards can result in significant reputational damage, hefty regulatory fines, and disruptions to business operations. For instance, in 2023, the energy sector globally saw a notable focus on safety protocols following several high-profile incidents, underscoring the increasing scrutiny on companies like Chevron.

Maintaining exemplary safety performance is not just a regulatory requirement but a fundamental aspect of corporate social responsibility. This includes safeguarding employees, contractors, and the communities where Chevron operates. The company's investments in safety training and technology are therefore paramount. Chevron reported a Total Recordable Injury Rate (TRIR) of 0.39 for its employees and contractors in 2023, a figure that reflects ongoing efforts to minimize workplace incidents and meet societal demands for a secure operating environment.

- Societal Pressure: Growing public and governmental demand for zero-harm workplaces influences Chevron's operational strategies and investment in safety.

- Reputational Risk: Safety incidents directly impact Chevron's brand image, potentially deterring investors and customers.

- Regulatory Compliance: Adherence to stringent health and safety regulations is essential to avoid penalties and maintain operational permits.

- Operational Continuity: A strong safety record ensures uninterrupted operations, preventing costly shutdowns and delays.

Societal expectations regarding environmental stewardship and climate action are paramount for Chevron, directly influencing its social license to operate. Public concern over climate change, evident in 2024 surveys showing a majority of global respondents worried about the oil and gas sector's impact, necessitates transparent communication and tangible environmental efforts from Chevron.

Chevron's proactive engagement with communities through significant investments, such as over $200 million in global community initiatives in 2023, is crucial for building trust and mitigating operational risks. These investments, including STEM education programs that reached over 500,000 students in 2023, demonstrate a commitment to positive societal impact and workforce development.

The company's unwavering focus on health and safety, reflected in a 2023 Total Recordable Injury Rate (TRIR) of 0.39, is a key societal expectation that safeguards its reputation and ensures operational continuity. Adherence to stringent safety standards is vital to avoid regulatory penalties and maintain public trust in a sector facing increasing scrutiny.

| Sociological Factor | Description | 2023/2024/2025 Data/Projections |

| Public Perception & Climate Change | Growing concern over the environmental impact of fossil fuels. | Majority of global respondents in 2024 surveys expressed worry about the sector's contribution to global warming. |

| Community Relations & Social Investment | Importance of local engagement and corporate social responsibility. | Chevron invested over $200 million in community engagement initiatives globally in 2023. STEM programs reached over 500,000 students. |

| Health & Safety Standards | Societal demand for zero-harm workplaces and operational safety. | Chevron's 2023 TRIR was 0.39. Increased focus on safety protocols globally following high-profile incidents. |

| Workforce Demographics & Skills | Addressing an aging workforce and evolving skill demands. | Projected slower growth in oil and gas extraction employment by the U.S. Bureau of Labor Statistics in 2024. Deloitte report indicated a 15% productivity increase from digital upskilling. |

| Consumer Preferences for Sustainability | Shift towards sustainable energy options influencing demand. | Over 60% of global consumers in a 2024 survey considered environmental impact in purchasing decisions. Projections for significant renewable energy sector growth by 2025. |

Technological factors

Chevron actively employs advanced exploration and production technologies to unlock value from complex geological formations. For instance, in the Permian Basin, the company utilizes sophisticated seismic imaging and horizontal drilling techniques. These methods are crucial for efficiently extracting oil and gas from unconventional reservoirs.

These technological advancements directly translate into improved operational efficiency and cost reductions. Enhanced oil recovery (EOR) methods, for example, can boost production from mature fields. In 2023, Chevron reported significant production growth, partly attributable to the successful deployment of these cutting-edge technologies across its global portfolio.

Chevron's embrace of digitalization, machine learning, and artificial intelligence is a significant technological driver, boosting operational efficiency and predictive capabilities. For instance, AI-powered tools are optimizing cargo routes and refining processes, leading to substantial cost reductions.

In 2024, Chevron reported that its AI initiatives in supply chain forecasting alone contributed to millions in savings by improving inventory management and reducing waste. This integration allows for more informed, data-driven decisions across the company's vast energy operations.

Chevron is significantly investing in Carbon Capture, Utilization, and Storage (CCUS) technologies as a core element of its strategy to reduce the carbon footprint of its operations and the products it offers. This focus acknowledges CCUS as a vital tool for mitigating emissions from industrial processes, positioning it as indispensable for achieving a lower-carbon future.

The company's commitment is underscored by its participation in projects like the Gorgon CCUS facility in Australia, which, despite facing initial operational challenges, represents a substantial investment in large-scale carbon abatement. Chevron's 2023 earnings report highlighted ongoing capital expenditures in lower-carbon initiatives, including CCUS, signaling a tangible financial commitment to these technological advancements.

Renewable Fuels and Bioenergy Technologies

Chevron is actively investing in renewable fuels, such as renewable diesel and sustainable aviation fuel. This expansion includes building new biorefineries and advancing catalytic technologies to process lower-carbon feedstocks. The company is leveraging its existing infrastructure to scale up production.

In 2023, Chevron announced plans to increase its renewable diesel production capacity. By 2025, the company aims to have a significant presence in the renewable fuels market, with investments projected to reach billions of dollars. This strategic move aligns with global efforts to decarbonize transportation sectors.

- Chevron's 2023 investments in renewable fuels are substantial, focusing on biorefinery expansion and new technology development.

- The company aims to be a major producer of renewable diesel and sustainable aviation fuel by 2025.

- Leveraging existing infrastructure is key to their production scaling strategy.

- These initiatives are driven by the growing demand for lower-carbon energy solutions in the transportation industry.

Energy Storage and Grid Modernization

Advancements in energy storage and grid modernization are reshaping the energy sector, directly impacting companies like Chevron. The increasing integration of renewable energy sources necessitates more robust and flexible grid infrastructure, driving demand for innovative storage solutions. This trend is crucial as the global energy storage market is projected to reach over $250 billion by 2030, according to some industry forecasts.

Chevron's strategic focus on natural gas, including powering data centers, showcases an adaptation to evolving energy demands. This approach acknowledges the need for reliable, on-demand power sources that can complement intermittent renewables. For instance, the company's investments in natural gas infrastructure aim to provide stable energy for critical operations, such as the growing demand from cloud computing and AI, which are energy-intensive.

- Growing Demand for Reliable Power: Data centers, a key area for Chevron's natural gas ventures, are experiencing exponential growth, requiring consistent and high-capacity energy supply.

- Grid Modernization Investments: Global investments in smart grid technologies and energy storage are expected to exceed trillions of dollars in the coming decade, creating opportunities and challenges for traditional energy providers.

- Energy Storage Market Expansion: The market for battery storage, a critical component of grid modernization, is expanding rapidly, with significant growth anticipated in utility-scale and behind-the-meter applications.

- Chevron's Strategic Positioning: Chevron's natural gas strategy positions it to potentially leverage its existing infrastructure to support the transition, offering a bridge fuel for a modernized grid.

Chevron's technological edge is evident in its sophisticated exploration and production techniques, particularly in complex formations like the Permian Basin. The company leverages advanced seismic imaging and horizontal drilling, crucial for extracting resources from unconventional reservoirs. These innovations directly boost operational efficiency and reduce costs, as seen in their 2023 production growth, partly fueled by these technologies.

Digitalization, AI, and machine learning are key drivers for Chevron, enhancing operational efficiency and predictive capabilities. AI tools optimize logistics and refining processes, leading to significant cost savings; for example, AI in supply chain forecasting alone yielded millions in savings in 2024 by improving inventory management.

Chevron is heavily investing in Carbon Capture, Utilization, and Storage (CCUS) technologies to reduce its operational carbon footprint. This commitment is demonstrated through participation in large-scale projects like the Gorgon CCUS facility, with ongoing capital expenditures in lower-carbon initiatives highlighted in their 2023 earnings.

The company is also expanding into renewable fuels, such as renewable diesel and sustainable aviation fuel, by building new biorefineries and advancing catalytic technologies. Chevron aims for a significant market presence in renewable fuels by 2025, with projected investments reaching billions of dollars.

| Technology Area | Chevron's Focus/Investment | Impact/Goal | Relevant Data Point (2023-2025) |

|---|---|---|---|

| Exploration & Production | Seismic imaging, horizontal drilling, EOR | Improved efficiency, cost reduction, production growth | Contributed to production growth in 2023 |

| Digitalization & AI | AI for supply chain, machine learning | Optimized operations, cost savings | Millions saved in 2024 from AI supply chain initiatives |

| Carbon Capture (CCUS) | Investment in CCUS projects | Reduced carbon footprint | Ongoing capital expenditures in lower-carbon initiatives (2023) |

| Renewable Fuels | Biorefinery expansion, new fuel technologies | Increased renewable diesel & SAF production | Aiming for significant market presence by 2025; billions in projected investment |

Legal factors

Chevron faces rigorous environmental rules, including the EPA's new methane emission standards and state laws like California's SB 1137, which aims to curb oil and gas production. These regulations necessitate substantial capital outlays for advanced monitoring and leak-detection technologies to minimize emissions.

Compliance with these evolving environmental mandates, particularly those targeting greenhouse gases, directly influences Chevron's operational expenditures and long-term strategic planning. For instance, the U.S. Environmental Protection Agency (EPA) proposed new rules in late 2023 that could require oil and gas facilities to reduce methane emissions by 75% by 2030 compared to 2019 levels, a significant undertaking for companies like Chevron.

Antitrust and competition laws are a significant legal consideration for Chevron. As a dominant force in the global energy sector, its strategic moves, including major acquisitions like the proposed $53 billion deal for Hess in late 2023, face intense scrutiny from regulators worldwide. These bodies, such as the U.S. Federal Trade Commission (FTC) and the European Commission, are tasked with preventing anti-competitive practices and ensuring a level playing field for all market participants.

These regulations directly impact Chevron's ability to pursue growth through mergers and acquisitions. For instance, the Hess acquisition, which aims to bolster Chevron's presence in Guyana's lucrative offshore oil fields, is undergoing rigorous review to assess its potential impact on market concentration and consumer prices. Failure to gain antitrust approval in key jurisdictions could force Chevron to divest certain assets or abandon the deal entirely, significantly altering its expansion plans.

Chevron's extensive global reach means it must navigate a complex web of international trade laws and sanctions. These regulations, enacted by governments and international organizations like the United Nations, dictate how companies can buy and sell goods and services across borders. Failure to comply can result in severe financial penalties and reputational damage.

For instance, in 2023, the United States continued to enforce sanctions against countries like Iran and Venezuela, impacting oil and gas operations. Chevron's adherence to these sanctions is paramount, ensuring it avoids fines and maintains its ability to operate in or source from various regions. The company's compliance programs are therefore a critical component of its risk management strategy, safeguarding its access to global markets and essential resources.

Health, Safety, and Labor Laws

Chevron navigates a complex web of health, safety, and labor regulations across its global operations. These laws dictate everything from ensuring safe working conditions in oil fields and refineries to upholding employee rights regarding fair wages, working hours, and non-discrimination. Failure to adhere to these mandates can result in significant penalties.

For instance, in 2023, the Occupational Safety and Health Administration (OSHA) in the United States issued citations and fines totaling over $200 million for workplace safety violations. Chevron, like other major energy companies, faces similar scrutiny worldwide. Non-compliance can trigger costly lawsuits, government investigations, and severe reputational damage, impacting investor confidence and public trust.

Key areas of compliance include:

- Workplace Safety Standards: Adherence to regulations designed to prevent accidents and injuries in hazardous environments.

- Employee Rights and Fair Labor Practices: Compliance with laws concerning minimum wage, overtime, anti-harassment, and freedom of association.

- Environmental Health and Safety (EHS): Meeting standards for the safe handling of materials and the prevention of environmental contamination affecting worker health.

- Reporting and Record-Keeping: Maintaining accurate records of incidents, injuries, and safety training as required by regulatory bodies.

Permitting and Licensing Requirements

Chevron's operations, from exploration to transportation, are subject to a complex and ongoing web of permitting and licensing requirements. These legal hurdles are not static; they evolve with regulatory changes and public policy shifts, directly influencing project feasibility and expenditure. For instance, the potential impact of the overturning of 'Chevron deference' by the U.S. Supreme Court in 2024 could lead to greater uncertainty in regulatory interpretations, potentially affecting the speed and cost of obtaining necessary approvals for new projects or expansions.

The continuous need to obtain and maintain these permits and licenses represents a significant operational and financial commitment for Chevron. Any increased scrutiny or changes in the permitting processes, especially in light of evolving environmental and safety standards, can introduce delays and inflate project costs. For example, in 2023, the U.S. Environmental Protection Agency (EPA) continued to refine its permitting processes for oil and gas operations, a trend expected to persist into 2024 and 2025, demanding meticulous compliance from companies like Chevron.

- Regulatory Compliance: Chevron must navigate a dynamic legal landscape to secure and maintain permits for all stages of its business, including exploration, production, refining, and distribution.

- Impact of Legal Precedents: The potential overturning of 'Chevron deference' in 2024 could introduce greater variability in how environmental and operational regulations are interpreted and enforced, impacting project timelines and capital allocation.

- Operational Costs and Timelines: Increased regulatory scrutiny or shifts in permitting procedures can lead to extended project development cycles and higher compliance costs, directly affecting Chevron's profitability and strategic planning.

Chevron's legal landscape is shaped by stringent environmental regulations, including proposed EPA rules in late 2023 aiming for a 75% methane emission reduction by 2030, impacting operational costs. Antitrust laws heavily scrutinize its growth strategies, as seen with the proposed $53 billion Hess acquisition in late 2023, requiring approval from bodies like the FTC and European Commission to prevent market concentration.

Navigating international trade laws and sanctions, such as U.S. sanctions on Iran and Venezuela in 2023, is critical for global operations and avoiding penalties. Furthermore, health, safety, and labor laws, exemplified by OSHA's over $200 million in workplace safety fines in 2023, necessitate robust compliance programs to prevent lawsuits and reputational damage.

Permitting and licensing requirements are a constant legal challenge, with potential shifts in regulatory interpretation following the U.S. Supreme Court's consideration of 'Chevron deference' in 2024, which could affect project timelines and costs. The EPA's ongoing refinement of permitting processes in 2023 and anticipated through 2024-2025 demands meticulous adherence from Chevron.

| Legal Factor | Impact on Chevron | Relevant Data/Examples (2023-2025) |

|---|---|---|

| Environmental Regulations | Increased compliance costs, operational adjustments | Proposed EPA methane emission reduction rules (late 2023); California's SB 1137 |

| Antitrust & Competition Law | Scrutiny of M&A, potential divestitures | Proposed $53 billion Hess acquisition (late 2023) review by FTC, European Commission |

| International Trade & Sanctions | Risk of penalties, market access limitations | U.S. sanctions on Iran and Venezuela (2023) |

| Health, Safety & Labor Law | Potential fines, lawsuits, reputational damage | OSHA fines exceeding $200 million for safety violations (2023) |

| Permitting & Licensing | Project delays, increased costs, regulatory uncertainty | Potential impact of 'Chevron deference' overturn (2024); EPA permitting process refinements (2023-2025) |

Environmental factors

Global and national climate change policies, such as carbon pricing mechanisms and stringent emissions reduction targets, directly shape Chevron's strategic direction. For instance, the European Union's Emissions Trading System (ETS) and the United States' Inflation Reduction Act (IRA) are influencing investment decisions and operational adjustments.

Chevron faces mounting pressure to decarbonize its operations and product portfolio, compelling significant investments in lower-carbon energy solutions. In 2023, the company announced plans to invest approximately $8 billion in lower-carbon projects through 2028, reflecting this shift.

Net-zero commitments by various nations and international bodies are accelerating the transition away from fossil fuels, posing both challenges and opportunities for Chevron. The company's own target to achieve net-zero operational emissions by 2050 requires substantial technological innovation and capital reallocation.

Chevron is actively working to lower methane emissions from its oil and gas activities, recognizing methane's significant impact as a potent greenhouse gas. This focus is driven by increasing regulatory pressure and the company's own commitment to sustainability targets.

To achieve these reductions, Chevron is adopting advanced technologies and operational improvements. Examples include replacing high-bleed pneumatic devices with low-bleed or zero-bleed alternatives and electrifying compression stations, which can substantially cut direct methane releases.

These initiatives are crucial for compliance with evolving environmental regulations, such as those from the EPA, and contribute to Chevron's broader climate strategy. For instance, the company has set goals to reduce its methane intensity across its operations.

Chevron actively manages its water resources, recognizing the critical nature of water scarcity in many of its operational areas. The company's strategy involves responsible sourcing, efficient usage, and robust wastewater treatment to lessen its environmental impact.

In 2023, Chevron reported a reduction in freshwater withdrawals by 7% compared to its 2019 baseline, a testament to its ongoing efforts in water conservation. Furthermore, the company is increasingly focused on reusing produced water, which is water extracted during oil and gas production, thereby decreasing its reliance on freshwater sources.

Biodiversity and Ecosystem Protection

Chevron's extensive global operations, particularly in areas like the Niger Delta and offshore California, necessitate stringent measures for biodiversity and ecosystem protection. The company's asset lifecycle, from exploration and production to decommissioning, must be managed to minimize disruption to local flora and fauna. For instance, in 2024, Chevron reported investing in habitat restoration projects adjacent to its operations in Texas, aiming to offset ecological impacts.

Protecting biodiversity involves careful planning and execution to avoid habitat fragmentation and safeguard endangered species. This commitment extends to responsible water management, as operations can impact aquatic ecosystems. Chevron's 2023 sustainability report highlighted a 15% reduction in freshwater withdrawal intensity compared to 2019, a move that indirectly supports ecosystem health.

- Habitat Preservation Initiatives: Chevron actively engages in projects aimed at preserving and restoring natural habitats in areas surrounding its operational sites, such as mangrove restoration in Southeast Asia.

- Endangered Species Management: The company implements specific protocols to protect endangered species, including marine mammals during offshore seismic surveys and terrestrial wildlife near onshore facilities.

- Water Resource Management: Efforts to reduce water usage and ensure responsible discharge practices are critical for maintaining the health of aquatic ecosystems and the biodiversity they support.

- Biodiversity Impact Assessments: Prior to new project development, comprehensive assessments are conducted to identify potential impacts on biodiversity, informing mitigation strategies and operational adjustments.

Waste Management and Circularity

Chevron is navigating increasing environmental expectations around waste management, particularly concerning plastic waste reduction and the adoption of circular economy principles within its petrochemical operations. This focus is critical as global regulatory bodies and consumer groups push for more sustainable product lifecycles.

Chevron Phillips Chemical, a joint venture, is actively engaged in initiatives to address these concerns. Their commitment is demonstrated through efforts to divert plastic waste from landfills and oceans, alongside a strong emphasis on achieving zero plastic pellet loss throughout their supply chain. These actions are crucial for maintaining social license to operate and meeting evolving industry standards.

- Plastic Waste Reduction: Global plastic waste generation reached an estimated 275 million metric tons in 2023, underscoring the urgency for companies like Chevron to implement effective reduction strategies.

- Circularity Initiatives: The petrochemical industry is increasingly exploring chemical recycling and advanced recycling technologies to create closed-loop systems for plastics, aiming to transform waste into valuable feedstock.

- Pellet Loss Prevention: Programs like Operation Clean Sweep, which Chevron Phillips Chemical participates in, aim to prevent resin pellet loss, a significant contributor to microplastic pollution, with industry-wide participation growing.

Chevron's environmental performance is increasingly scrutinized, with a significant focus on reducing greenhouse gas emissions and transitioning to lower-carbon energy sources. The company is investing in technologies to lower methane emissions, a potent greenhouse gas, and is committed to achieving net-zero operational emissions by 2050.

Water resource management is another key environmental factor, with Chevron implementing strategies for responsible water sourcing and efficient usage. In 2023, the company reported a 7% reduction in freshwater withdrawals compared to its 2019 baseline, demonstrating progress in water conservation efforts.

Biodiversity and ecosystem protection are critical, especially in areas with sensitive environments. Chevron is actively involved in habitat restoration projects and implements protocols to protect endangered species, aiming to minimize its operational footprint.

Waste management, particularly concerning plastic waste, is also a growing concern. Chevron Phillips Chemical, a joint venture, is working to reduce plastic waste and prevent pellet loss throughout its supply chain, aligning with circular economy principles.

| Environmental Factor | Chevron's Actions/Commitments | Relevant Data/Targets |

|---|---|---|

| Greenhouse Gas Emissions | Investing in lower-carbon energy, reducing methane emissions | Net-zero operational emissions by 2050 |

| Water Management | Responsible sourcing, efficient usage, reuse of produced water | 7% reduction in freshwater withdrawals (2023 vs. 2019 baseline) |

| Biodiversity | Habitat restoration, endangered species protection protocols | Investment in habitat restoration projects (2024) |

| Waste Management | Plastic waste reduction, pellet loss prevention | Participation in Operation Clean Sweep |

PESTLE Analysis Data Sources

Our Chevron PESTLE Analysis draws upon a comprehensive blend of data, including reports from international energy agencies, government regulatory bodies, and leading economic forecasting firms. This ensures a robust understanding of political stability, economic trends, and environmental policies impacting the energy sector.