Chevron Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chevron Bundle

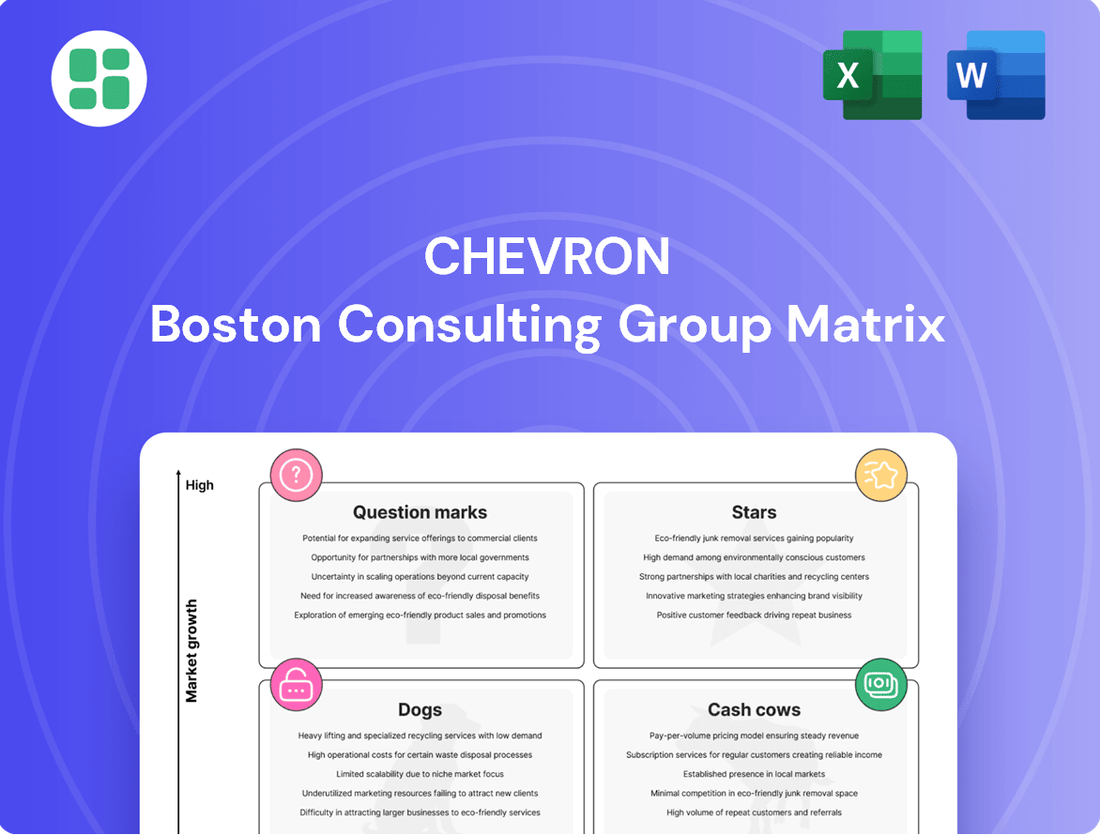

The Chevron BCG Matrix provides a powerful framework for understanding a company's product portfolio, categorizing them as Stars, Cash Cows, Dogs, or Question Marks based on market growth and share. This initial glimpse highlights key areas of opportunity and potential challenges within Chevron's diverse operations.

To truly leverage this strategic tool, dive into the full BCG Matrix report. It offers a comprehensive breakdown of each product's quadrant placement, providing data-driven insights and actionable recommendations for optimizing resource allocation and future investments.

Purchase the complete BCG Matrix today to gain a clear roadmap for strategic decision-making, ensuring you can confidently navigate market dynamics and drive sustainable growth for Chevron.

Stars

Chevron's Permian Basin operations are a significant contributor to its overall production, with output surpassing 1 million barrels of oil equivalent per day (boe/d) in the second quarter of 2025. This robust performance highlights the asset's maturity and ongoing expansion capabilities.

The company is prioritizing capital efficiency within the Permian, aiming to enhance free cash flow generation even as it manages growth rates. This strategic focus underscores the Permian's position as a highly profitable and mature asset within Chevron's portfolio.

Benefiting from an extensive acreage position and notably low breakeven costs, Chevron's Permian Basin assets are recognized as a premier asset, demonstrating strong competitive advantages in the energy market.

The Tengiz Future Growth Project (FGP), in which Chevron has a 50% interest, reached a significant milestone with first oil production in January 2025. This project is poised to be a major contributor to Chevron's growth trajectory.

Upon reaching full capacity, the FGP is expected to boost crude oil output by an additional 260,000 barrels per day. This substantial increase will significantly enhance Chevron's total production figures and bolster its free cash flow generation.

As a long-term investment with the potential for high returns, the FGP solidifies Tengiz's position as a crucial and consistent cash-generating asset for Chevron in the coming years.

Chevron is significantly boosting its deepwater operations in the U.S. Gulf of Mexico. Several key projects are anticipated to reach a combined production of 300,000 barrels of oil equivalent per day (boe/d) by 2026.

These deepwater assets are instrumental in driving record U.S. production figures and are considered prime candidates for high returns. The company's strategy involves utilizing cutting-edge technology to pinpoint and extract resources from this expansive region.

Liquefied Natural Gas (LNG) Expansion

Chevron is making significant moves in the Liquefied Natural Gas (LNG) sector, a key growth area. The company has secured long-term contracts for 7 million tonnes per year of U.S. Gulf Coast LNG export capacity. This expansion underscores Chevron's confidence in the rising global demand for natural gas.

This strategic expansion positions Chevron to play a crucial role in meeting long-term energy security requirements, especially for markets in Europe and Asia. By increasing its offtake from projects like Energy Transfer's proposed Lake Charles LNG terminal, Chevron is demonstrating a bullish outlook on the future of natural gas.

- Global LNG Demand Growth: Projections indicate continued robust demand for LNG, driven by the transition to cleaner energy sources and increasing industrialization in developing nations.

- U.S. Export Capacity Expansion: The U.S. is a major player in global LNG exports, with new terminals and expansions coming online to meet international demand.

- Chevron's Strategic Investments: Chevron's investments in LNG infrastructure and offtake agreements are designed to capitalize on these market trends and secure long-term revenue streams.

Carbon Capture, Utilization, and Storage (CCUS)

Chevron is positioning Carbon Capture, Utilization, and Storage (CCUS) as a significant growth area, likely classifying it as a 'Star' in its BCG Matrix. The company is backing this with substantial financial commitments, earmarking $1.5 billion for 2025 to support lower carbon intensity projects, with CCUS being a core focus. This strategic investment underscores the perceived high-growth potential and market leadership Chevron aims to achieve in this evolving sector.

The company's commitment is further evidenced by its active development of key CCUS projects. These include the Pascagoula CCS and Bayou Bend CCS initiatives, alongside pilot programs exploring innovative technologies like Svante's carbon capture solutions. These tangible projects demonstrate Chevron's dedication to scaling CCUS capabilities and capturing market share in a segment critical for achieving global decarbonization targets.

- Chevron's 2025 CCUS Investment: $1.5 billion allocated to lower carbon intensity projects, including carbon capture.

- Key CCUS Projects Under Development: Pascagoula CCS, Bayou Bend CCS.

- Technology Pilots: Actively testing Svante carbon capture technology.

- Strategic Importance: CCUS is seen as a high-growth sector crucial for meeting decarbonization goals.

Chevron's Carbon Capture, Utilization, and Storage (CCUS) initiatives are positioned as a high-growth area, aligning with the 'Star' category in the BCG Matrix. The company is demonstrating this by allocating $1.5 billion in 2025 specifically for lower carbon intensity projects, with CCUS being a primary focus. This significant investment signals Chevron's ambition to lead in a sector vital for global decarbonization efforts.

Chevron is actively advancing several CCUS projects, including Pascagoula CCS and Bayou Bend CCS, alongside piloting technologies like Svante's carbon capture. These concrete developments showcase Chevron's commitment to scaling its CCUS capabilities and securing a strong market position.

The strategic importance of CCUS for Chevron lies in its potential to address climate change while creating new revenue streams. This sector is expected to see substantial growth as industries worldwide seek to reduce their carbon footprints.

Chevron's investment in CCUS reflects a forward-looking strategy to capitalize on the growing demand for decarbonization solutions, positioning these assets as future growth drivers.

| Initiative | Status/Focus | Strategic Significance |

|---|---|---|

| CCUS Investment (2025) | $1.5 billion allocated for lower carbon intensity projects | High growth potential, market leadership ambition |

| Key Projects | Pascagoula CCS, Bayou Bend CCS | Tangible development, scaling capabilities |

| Technology Pilots | Svante carbon capture solutions | Innovation, efficiency enhancement |

What is included in the product

The Chevron BCG Matrix analyzes Chevron's business units based on market share and growth, guiding investment and divestment strategies.

Quickly identify underperforming "Dogs" and reallocate resources from "Cash Cows" to promising "Stars".

Cash Cows

Chevron's mature conventional oil and gas fields are the bedrock of its cash generation. These are the large, established assets, often in areas like the Gulf of Mexico or offshore West Africa, that have been producing for years. They are characterized by stable, predictable output and lower maintenance costs compared to the more volatile shale plays.

In 2023, Chevron's upstream segment, which heavily features these conventional assets, reported a significant contribution to its overall financial performance. For instance, the company's Tengiz field in Kazakhstan, a prime example of a mature, large-scale conventional asset, continued to be a major producer, underpinning substantial cash flow for the company.

These fields require less aggressive capital investment to sustain production levels, meaning a larger portion of the revenue they generate flows directly to the bottom line. This consistent cash flow is crucial for funding Chevron's investments in growth areas and returning capital to shareholders.

Chevron's global refining operations, particularly in the U.S. and Asia, are strong cash cows. These integrated facilities, like the Pascagoula refinery, process crude oil into essential products such as gasoline and jet fuel, benefiting from consistent demand. In 2023, Chevron's refining segment reported an impressive earnings of $5.7 billion, underscoring its role as a major profit generator.

Chevron's extensive global marketing and retail network, featuring branded service stations, is a significant cash cow. This network consistently generates cash from sales of gasoline, diesel, lubricants, and various other products, underscoring its role as a reliable revenue generator.

The strength of this segment lies in its robust brand recognition and expansive distribution footprint. This allows Chevron to secure dependable income streams, even within established and mature markets, demonstrating its resilience.

In 2023, Chevron's downstream segment, which includes marketing and retail, reported an impressive earnings of $7.4 billion. This segment requires comparatively modest investment for promotion and placement relative to the substantial cash it generates, highlighting its efficiency.

Chevron Phillips Chemical Company LLC (CPChem)

Chevron Phillips Chemical Company LLC (CPChem), a significant joint venture for Chevron, is a powerhouse in petrochemicals and additives, consistently bolstering Chevron's earnings.

Operating within a mature market, CPChem commands a strong market share across numerous chemical products, translating into robust and stable cash flow generation for the parent company.

Investments in this segment are strategically directed towards enhancing operational efficiency and expanding its core product offerings, ensuring continued profitability.

For instance, in 2024, CPChem's performance remained a key contributor to Chevron's overall financial health, with reported segments showing resilience.

- Market Position: High market share in mature petrochemical markets.

- Cash Flow Generation: Substantial and consistent cash flow from operations.

- Investment Focus: Efficiency improvements and expansion of key product lines.

- 2024 Contribution: Remained a vital earnings driver for Chevron.

Lubricants Business

Chevron's global lubricants business, featuring well-known brands like Havoline and Delo, operates within a mature market where it holds a significant market share. This segment is a consistent generator of substantial profit margins and dependable cash flow, largely due to established brand loyalty and an extensive distribution network. The mature, low-growth nature of this market also means reduced requirements for aggressive promotional spending, which in turn supports sustained profitability.

In 2023, Chevron's lubricants segment reported impressive financial performance. For instance, the company's base oils and marketing segment, which heavily includes lubricants, saw earnings before interest and taxes (EBIT) of approximately $3.3 billion. This highlights the segment's role as a stable cash generator for the broader company, even in a market with modest expansion prospects.

- Strong Brand Recognition: Brands like Havoline and Delo benefit from decades of consumer trust and performance recognition.

- Mature Market Stability: The lubricants market, while not experiencing rapid growth, offers predictable demand and consistent revenue streams.

- Efficient Operations: A well-established distribution network and economies of scale contribute to high profit margins.

- Cash Flow Generation: The segment reliably converts profits into cash, providing financial flexibility for Chevron's other ventures.

Chevron's mature conventional oil and gas fields act as significant cash cows, providing a stable and predictable revenue stream. These established assets, often in regions like the Gulf of Mexico, require less capital for maintenance, allowing a larger portion of their earnings to flow directly to the company's bottom line.

The company's global refining operations, including facilities like the Pascagoula refinery, are also strong cash cows. These operations process crude oil into essential fuels, benefiting from consistent demand. In 2023, Chevron's refining segment reported earnings of $5.7 billion, demonstrating its substantial profit-generating capability.

Chevron's marketing and retail network, featuring branded service stations, consistently generates cash from sales of fuels and lubricants. This segment benefits from strong brand recognition and an extensive distribution footprint, ensuring dependable income streams.

The petrochemicals business, particularly through its joint venture Chevron Phillips Chemical Company LLC (CPChem), is another key cash cow. CPChem maintains a strong market share in mature petrochemical markets, translating into robust and stable cash flow for Chevron, with its performance remaining a vital earnings driver in 2024.

| Segment | 2023 Earnings (approx.) | Key Characteristics |

|---|---|---|

| Upstream (Conventional Oil & Gas) | Significant contributor to overall performance | Stable, predictable output, lower maintenance costs |

| Refining | $5.7 billion | Consistent demand for refined products, integrated facilities |

| Marketing & Retail | Part of $7.4 billion downstream earnings | Strong brand recognition, extensive distribution |

| Petrochemicals (CPChem) | Key contributor to overall financial health | High market share in mature markets, stable cash flow |

| Lubricants | $3.3 billion EBIT (Base Oils & Marketing) | Established brand loyalty, extensive distribution, efficient operations |

What You See Is What You Get

Chevron BCG Matrix

The preview you are seeing is the exact Chevron BCG Matrix document you will receive upon purchase, offering a complete and unwatermarked strategic tool. This comprehensive analysis, ready for immediate application, will be delivered to you without any demo content or hidden surprises. You can confidently use this preview as a direct representation of the fully formatted and editable BCG Matrix report you'll download. It's designed for professional use, providing clear insights into your business portfolio's strategic positioning.

Dogs

Chevron is strategically divesting non-core and higher-cost assets, aiming to offload $10 billion to $15 billion worth by 2028. This includes assets in Canada, Congo, and Alaska that were either underperforming or not strategically aligned with its long-term goals.

These divested assets, such as its Canadian operations including the Kaybob Duvernay shale and Athabasca Oil Sands interest, are classified as Dogs in the BCG Matrix. They exhibit low growth prospects and a diminished market share within Chevron's broader portfolio, often demanding significant investment for modest returns.

Legacy high-cost, declining production fields, often referred to as Dogs in the BCG matrix, represent older oil and gas assets where output is naturally decreasing and operational expenses are rising. These fields, though historically significant, now provide limited growth and cash flow compared to their upkeep costs.

Chevron's strategy for these assets focuses on either improving their efficiency through optimization efforts or divesting them entirely to reallocate capital more effectively. For instance, in 2023, Chevron's capital expenditures on mature assets were carefully managed to ensure they met profitability hurdles, with a strong emphasis on cost control.

Underperforming refining or chemical units are those specific assets within Chevron that are less competitive due to factors like outdated technology, elevated operating expenses, or challenging market dynamics. These units often find it difficult to generate substantial profit margins.

Such underperforming units might be considered for strategic restructuring or even divestiture as Chevron prioritizes efficiency and investments in high-return projects. The company’s commitment to optimizing its portfolio means a constant assessment of these less productive segments.

Marginal Exploration Acreage

Marginal Exploration Acreage represents areas within Chevron's portfolio that are characterized by their presence in frontier or unproven basins. Initial drilling outcomes in these regions have often been less than stellar, or the projected development costs are so substantial that future profitability remains a significant question mark.

These holdings are capital intensive, demanding investment without delivering commensurate gains in market share or growth for Chevron. Consequently, they fall into a category where the company might consider divesting or relinquishing these assets to reallocate resources more effectively.

- Low Success Rate: Exploration in these areas often yields disappointing initial drilling results.

- High Development Costs: Significant capital is required for further development, casting doubt on profitability.

- Limited Market Share Growth: These assets do not contribute substantially to increasing Chevron's market presence.

- Potential Divestment: Chevron may choose to sell or relinquish these marginal exploration areas.

Obsolete Infrastructure

Obsolete infrastructure represents a significant challenge, often characterized by aging pipelines or processing facilities that demand substantial capital for upkeep or modernization. These assets may support increasingly less productive operations, potentially becoming cash traps if their running expenses exceed the value of the resources they handle.

Chevron's strategic initiatives, including its ongoing restructuring, are designed to mitigate these structural costs. For instance, in 2024, the company continued its focus on optimizing its asset base, which includes divesting or retiring older, less efficient facilities to improve overall operational efficiency and reduce capital intensity.

- Aging Assets: Infrastructure like older refineries or pipelines may require extensive, costly upgrades to meet current environmental standards or operational demands.

- Capital Drain: Continued investment in obsolete infrastructure can divert capital from more promising growth opportunities, impacting overall profitability.

- Operational Inefficiency: Older facilities often have lower energy efficiency and higher maintenance costs compared to modern counterparts.

- Strategic Divestment: Companies like Chevron may strategically exit or sell off segments of their business that rely on outdated infrastructure to streamline operations and focus on core, high-return assets.

Dogs in Chevron's portfolio, like its Canadian operations and certain legacy fields, represent assets with low growth and market share. These segments often require significant investment for minimal returns, prompting strategic divestment or efficiency improvements.

Chevron's divestment of $10 billion to $15 billion in non-core assets by 2028, including those in Canada and Congo, highlights its focus on shedding underperforming Dog assets. These assets are characterized by declining production, rising operational costs, and limited future growth potential.

The company's approach involves optimizing these assets or selling them to reallocate capital towards more profitable ventures. For instance, in 2023, Chevron carefully managed capital expenditures on mature assets, prioritizing cost control and profitability hurdles.

Chevron's strategy for managing Dog assets, such as underperforming refining units or marginal exploration acreage, involves either restructuring or divestiture. This ensures capital is directed towards high-return projects and enhances overall operational efficiency.

| Asset Type (Dog) | Characteristics | Chevron's Strategy | Example |

|---|---|---|---|

| Legacy Oil & Gas Fields | Declining production, high operating costs | Optimization or divestment | Certain mature fields in the Permian Basin |

| Underperforming Refining Units | Outdated technology, low profit margins | Restructuring or divestment | Specific units facing competitive pressures |

| Marginal Exploration Acreage | Low success rate, high development costs | Divestment or relinquishment | Frontier basin acreage with disappointing initial results |

| Obsolete Infrastructure | Aging pipelines, high maintenance costs | Retirement or sale | Older processing facilities requiring significant upgrades |

Question Marks

Chevron's early-stage hydrogen projects, like its planned solar-to-hydrogen facility in California slated for 2025 production, position it within the "Question Marks" quadrant of the BCG Matrix. This classification reflects the high growth potential of the hydrogen market, a sector where Chevron currently holds a minor share.

The substantial capital expenditure required for these nascent ventures, aimed at scaling operations and building market presence, further solidifies their "Question Mark" status. Success hinges on Chevron's ability to navigate the evolving regulatory landscape and technological advancements in the clean energy sector.

Chevron's recent foray into lithium extraction, particularly its acquisitions in Texas and Arkansas, positions its ventures as potential question marks within the BCG matrix. This is a nascent stage for Chevron in a high-growth sector, characterized by substantial future investment needs and currently minimal market share in the burgeoning electric vehicle battery supply chain.

Chevron's strategic push into renewable fuels, exemplified by its Geismar renewable diesel plant expansion, positions advanced biofuel technologies as potential Stars or Question Marks in its BCG matrix. The global renewable fuels market is projected for significant growth, with some analysts forecasting it to reach over $200 billion by 2030, driven by strong decarbonization mandates.

While Chevron is actively investing, many advanced biofuel technologies, such as those utilizing cellulosic biomass or algae, are still in relatively nascent stages of commercialization. This suggests they represent high-growth potential but currently possess low market share, fitting the profile of Question Marks, requiring further investment and development to determine their future success.

Geothermal Energy Ventures

Chevron's geothermal energy ventures are positioned as question marks within its broader energy portfolio. While the company is actively exploring and investing in this renewable sector, its current market share and operational scale in geothermal are still nascent. This aligns with the BCG matrix's classification of question marks, indicating high growth potential but also significant uncertainty and the need for substantial investment to mature.

Geothermal energy offers long-term growth prospects due to its consistent and renewable nature. However, these ventures require considerable capital and technological development to reach a significant scale. For instance, in 2024, global geothermal power generation capacity was projected to continue its steady climb, with new projects coming online, underscoring the market's potential, yet Chevron's specific contribution remains a developing aspect.

- Geothermal Potential: Geothermal energy is a reliable, baseload renewable source, offering continuous power generation unlike intermittent sources like solar or wind.

- Chevron's Investment: Chevron is strategically investing in geothermal projects as part of its New Energies division, aiming to diversify its renewable energy offerings.

- Market Position: Despite growing interest, Chevron's current market share and operational footprint in geothermal are relatively small, reflecting its status as an emerging area for the company.

- Future Outlook: These ventures represent high-potential opportunities that will require sustained investment and development to transition from question marks to more established positions in Chevron's portfolio.

Direct Air Capture (DAC) and Emerging Carbon Removal Technologies

Chevron Technology Ventures is actively exploring and investing in nascent decarbonization technologies, including Direct Air Capture (DAC). These innovative solutions, while showing significant long-term potential within a developing carbon circular economy, are currently in very early stages. Chevron's market share in these specific emerging sectors is virtually nonexistent, necessitating considerable investment in research, development, and commercialization to establish a foothold.

The DAC market, for instance, is projected for substantial growth. For example, by 2030, the global DAC market could reach approximately $1.5 billion, with projections suggesting it could expand to over $100 billion by 2050, according to some industry analyses. Chevron's involvement signifies a strategic move to position itself in future carbon management solutions.

- Investment Focus: Chevron Technology Ventures is backing emerging carbon removal technologies like DAC.

- Market Position: Current market share in these nascent areas is negligible, highlighting the early-stage nature.

- Growth Potential: These technologies are seen as having immense long-term growth prospects in the carbon circular economy.

- Development Needs: Significant R&D and commercialization efforts are required for market entry and growth.

Chevron's investments in areas like advanced biofuels and geothermal energy are classified as Question Marks within the BCG matrix. These ventures are characterized by high market growth potential but currently low market share for Chevron. Substantial capital is required to scale these operations and navigate evolving technologies and regulations.

| Venture Area | Market Growth Potential | Chevron's Market Share | Investment Needs | BCG Classification |

| Hydrogen Production | High | Low | High | Question Mark |

| Lithium Extraction | High | Low | High | Question Mark |

| Advanced Biofuels | High (projected >$200B by 2030) | Low | High | Question Mark |

| Geothermal Energy | High (steady global capacity climb in 2024) | Low | High | Question Mark |

| Direct Air Capture (DAC) | High (projected $1.5B by 2030, >$100B by 2050) | Negligible | High | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, and industry growth projections, to accurately position each business unit.