Chevron Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chevron Bundle

Unlock the strategic core of Chevron's operations with our comprehensive Business Model Canvas. This detailed analysis breaks down how Chevron creates, delivers, and captures value in the energy sector, offering a clear roadmap for understanding their success. Perfect for anyone looking to dissect industry giants or refine their own business strategy.

Partnerships

Chevron actively forms joint ventures with other energy giants for significant projects, like the Stabroek Block in Guyana, a venture that saw Chevron’s share of production reach approximately 350,000 barrels of oil equivalent per day in early 2024. This collaborative approach spreads the substantial financial burden and technical challenges inherent in large-scale exploration and production.

These partnerships are crucial for accessing specialized expertise and sharing the considerable capital investment required for complex operations. For instance, the Bayou Bend Carbon Capture and Storage project, a joint venture with Talos Energy and Carbonvert, exemplifies this strategy for developing lower-carbon solutions.

Beyond large projects, Chevron also pursues strategic alliances to foster innovation in emerging energy sectors and gain entry into new geographical or technological markets. These alliances are vital for staying competitive and adapting to the evolving energy landscape.

Chevron actively collaborates with technology firms and startups to accelerate the development of lower-carbon solutions. This includes vital areas like carbon capture, hydrogen production, and renewable fuels. For instance, Chevron Technology Ventures, their venture capital arm, strategically invests in promising emerging technologies, cultivating relationships that can yield scalable solutions and diversify their supplier base.

Chevron's collaborations with government and regulatory bodies are vital for operational success. These partnerships facilitate the acquisition of necessary permits for exploration and production activities, ensuring compliance with environmental standards. For instance, in 2024, Chevron continued to engage with agencies like the U.S. Environmental Protection Agency (EPA) and state-level environmental departments to manage emissions and waste disposal across its vast operations.

Securing licenses for new energy ventures, such as advancements in carbon capture and storage (CCS) technology, heavily relies on these governmental relationships. Chevron's ongoing investments in CCS projects, like the one in San Joaquin Valley, California, require extensive approvals and ongoing dialogue with regulatory bodies to meet evolving climate goals and operational requirements.

Furthermore, these alliances shape the policy landscape, particularly concerning the energy transition. Chevron actively participates in industry forums and consultations that influence government frameworks supporting renewable energy development and emissions reduction targets. The company's strategic alignment with policies promoting lower-carbon solutions underscores the importance of these key partnerships in navigating the future of energy.

Suppliers and Service Providers

Chevron relies on a diverse network of suppliers and service providers to fuel its global operations. This network is crucial for everything from acquiring drilling equipment and refinery components to securing essential logistics and IT services. In 2024, managing these relationships effectively remained a cornerstone of their operational efficiency and supply chain reliability.

These partnerships are vital for maintaining the smooth functioning of Chevron's extensive and complex operations. They extend across both established oil and gas sectors and emerging new energy technologies, showcasing the breadth of their supplier ecosystem.

- Global Reach: Chevron's supplier network spans continents, supporting its upstream, midstream, and downstream activities worldwide.

- Specialized Services: Partnerships include providers of advanced geological surveying, specialized drilling fluids, and complex refinery maintenance.

- Technological Integration: Collaboration with IT and digital service providers ensures operational data management and cybersecurity.

- New Energy Focus: Suppliers for renewable energy projects, such as solar panel manufacturers and hydrogen production specialists, are increasingly important.

Academic and Research Institutions

Chevron actively partners with academic and research institutions to fuel innovation and maintain a leading edge in scientific discovery. These collaborations are crucial for advancing research and development in critical areas such as novel materials, enhanced energy efficiency, and environmental science, ensuring Chevron remains at the forefront of technological progress.

These partnerships directly contribute to Chevron's robust research and development pipeline. For instance, in 2024, Chevron continued its support for university research programs focused on carbon capture utilization and storage (CCUS) technologies, allocating significant funding to projects exploring novel sorbent materials and advanced geological storage techniques. This investment aims to develop scalable solutions for reducing greenhouse gas emissions across its operations.

- Talent Development: Access to top-tier academic talent through internships and joint research projects provides Chevron with a pipeline of skilled scientists and engineers for future recruitment.

- Knowledge Exchange: These collaborations facilitate the exchange of cutting-edge research findings and best practices, fostering a dynamic learning environment within Chevron.

- Innovation Hubs: Universities often serve as innovation hubs, allowing Chevron to tap into emerging scientific trends and disruptive technologies before they become mainstream.

Chevron's key partnerships are essential for sharing the immense capital and technical risks associated with large-scale energy projects, as seen in ventures like the Stabroek Block in Guyana. These collaborations also provide access to specialized expertise and facilitate the development of lower-carbon solutions, such as the Bayou Bend Carbon Capture and Storage project with Talos Energy and Carbonvert.

Strategic alliances are vital for Chevron to enter new markets and drive innovation in emerging energy sectors, ensuring its adaptability in a changing energy landscape. Furthermore, partnerships with technology firms and startups, often facilitated by Chevron Technology Ventures, accelerate the development of crucial technologies like hydrogen production and renewable fuels.

Collaborations with academic and research institutions are critical for Chevron's R&D pipeline, driving advancements in areas like carbon capture and enhanced energy efficiency. These partnerships also serve as talent pipelines, bringing in skilled scientists and engineers, and act as innovation hubs for emerging scientific trends.

Government and regulatory partnerships are indispensable for securing permits, ensuring environmental compliance, and navigating policy landscapes, particularly concerning the energy transition. These relationships are fundamental for obtaining licenses for new energy ventures and aligning with climate goals.

| Partnership Type | Example | Significance |

|---|---|---|

| Joint Ventures (Energy Projects) | Stabroek Block, Guyana | Shares capital/technical risk, access to production (~350,000 boepd for Chevron in early 2024) |

| Joint Ventures (Lower-Carbon) | Bayou Bend CCS (with Talos Energy, Carbonvert) | Develops carbon capture solutions, shares investment burden |

| Strategic Alliances | Emerging energy sectors | Market entry, innovation, competitiveness |

| Technology/Startup Partnerships | Chevron Technology Ventures investments | Accelerates new technology development (e.g., hydrogen, renewables) |

| Government/Regulatory Bodies | EPA, State Environmental Departments | Permitting, environmental compliance, policy influence |

| Academic/Research Institutions | University research programs (e.g., CCUS) | R&D advancement, talent development, innovation hubs |

What is included in the product

A strategic framework detailing Chevron's approach to creating, delivering, and capturing value, encompassing its key partners, activities, resources, customer relationships, and revenue streams.

This model outlines Chevron's core customer segments, channels, and value propositions, providing a clear picture of how it operates within the energy sector.

Provides a structured framework to identify and address critical business model weaknesses, transforming potential problems into actionable solutions.

Activities

Chevron's Exploration and Production (Upstream) segment is central to its business, focusing on finding and extracting crude oil and natural gas. This includes substantial operations in key areas like the Permian Basin and the deepwater Gulf of Mexico, showcasing their commitment to significant resource development.

The core activities within Upstream involve meticulous geological surveys, the complex process of drilling, and the crucial stage of well completion. Furthermore, Chevron actively manages mature fields to ensure the maximization of hydrocarbon recovery, demonstrating a strategic approach to asset lifecycle management.

In 2024, Chevron continued its strategy to grow its oil and gas business, with a parallel commitment to reducing the carbon intensity of its operations. This dual focus highlights their adaptation to evolving energy demands and environmental considerations.

Chevron's downstream segment focuses on refining crude oil into essential products like gasoline, diesel, and jet fuel, alongside marketing and distributing these globally. This also encompasses the production and sale of petrochemicals, vital for various manufacturing processes.

In 2024, Chevron continued its strategic investments in upgrading its refining infrastructure. For instance, the company is advancing its renewable fuels capacity, aiming to meet the growing demand for lower-carbon alternatives in transportation. This includes projects like the planned renewable diesel facility in Pascagoula, Mississippi, which is expected to produce up to 100,000 barrels per day.

The marketing and distribution network is extensive, reaching consumers and businesses worldwide. In 2023, Chevron's refined product sales volume averaged approximately 5.1 million barrels per day, highlighting the scale of its downstream operations and its reach in global energy markets.

Chevron operates a vast network of pipelines, ships, and terminals to move crude oil, natural gas, and refined products. This infrastructure is crucial for connecting production sites to refineries and ultimately to global markets, ensuring products reach consumers efficiently.

In 2024, Chevron continued to invest in its logistics capabilities. For instance, its Gorgon project in Australia relies heavily on specialized shipping for liquefied natural gas (LNG), highlighting the importance of owned or contracted maritime assets in its operations.

Efficient transportation significantly impacts Chevron's bottom line by reducing operational costs and ensuring timely product delivery. Managing this extensive global shipping and storage infrastructure is a key activity that underpins its integrated business model.

New Energies and Lower Carbon Solutions Development

Chevron is actively expanding its presence in new energy sectors, focusing on reducing carbon intensity and providing cleaner alternatives. This strategic shift involves substantial investment in areas like renewable fuels, carbon capture, utilization, and storage (CCUS), and hydrogen technology.

The company's commitment is evident in its capital allocation towards projects designed to lower the carbon footprint of its operations. A prime example is the significant investment in its renewable diesel plant in Geismar, Louisiana, which is a key component of its lower carbon solutions strategy.

- Renewable Fuels: Chevron is developing and investing in renewable diesel production, aiming to offer lower-carbon transportation fuels.

- Carbon Capture, Utilization, and Storage (CCUS): The company is pursuing CCUS projects to mitigate emissions from industrial processes and its own operations.

- Hydrogen: Chevron is exploring opportunities in the hydrogen value chain, recognizing its potential as a clean energy carrier.

- Emerging Technologies: Investments extend to other nascent technologies that support the energy transition and offer lower carbon solutions.

Research and Development (R&D)

Chevron's Research and Development (R&D) is crucial for boosting how efficiently they operate and making things safer. They focus on creating new technologies for both oil and gas, and also for newer energy sources. This continuous effort helps them stay competitive and meet their long-term goals.

In 2024, Chevron continued to invest heavily in R&D to refine its existing operations and explore future energy solutions. A significant portion of their R&D spending is directed towards improving extraction and refining processes, aiming for higher yields and reduced environmental impact. For instance, advancements in digital oilfield technologies are enhancing drilling efficiency and reservoir management.

- Improving Operational Efficiency: Chevron's R&D efforts in 2024 focused on optimizing drilling techniques and refining processes, leading to an estimated 5% increase in production efficiency in key assets.

- Enhancing Safety: Investments in advanced sensor technology and predictive analytics for equipment maintenance are designed to further reduce operational risks and improve workplace safety across all facilities.

- Developing Innovative Technologies: The company is actively developing and piloting new technologies in carbon capture, utilization, and storage (CCUS), as well as advancing its capabilities in hydrogen production and renewable fuels.

- Supporting Sustainability Goals: R&D is integral to Chevron's strategy to lower its carbon intensity, with ongoing projects aimed at reducing methane emissions and developing lower-carbon energy solutions.

Chevron's key activities span the entire energy value chain, from finding and extracting oil and gas to refining and marketing these products. They are also actively investing in lower-carbon solutions and leveraging research and development to drive efficiency and innovation.

In 2024, Chevron's upstream operations continued to focus on growth and efficiency, particularly in the Permian Basin, while its downstream segment saw continued investment in renewable fuels capacity. The company also advanced its logistics and new energy initiatives, underscoring a diversified strategy.

These core activities are supported by robust research and development efforts aimed at improving operational performance, enhancing safety, and developing next-generation energy technologies, including CCUS and hydrogen.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Exploration & Production (Upstream) | Finding and extracting crude oil and natural gas. | Continued growth strategy, focusing on key assets like the Permian Basin. |

| Downstream Operations | Refining crude oil into fuels and petrochemicals; marketing and distribution. | Advancing renewable fuels capacity, with a planned renewable diesel facility in Pascagoula, MS. |

| Logistics & Infrastructure | Transporting oil, gas, and refined products via pipelines, ships, and terminals. | Investment in logistics capabilities, including specialized shipping for LNG projects. |

| New Energy Ventures | Investing in lower-carbon solutions like renewable fuels, CCUS, and hydrogen. | Significant investment in renewable diesel projects and CCUS initiatives. |

| Research & Development | Developing new technologies for operational efficiency, safety, and future energy solutions. | Focus on improving drilling efficiency and exploring advancements in CCUS and hydrogen. |

Full Document Unlocks After Purchase

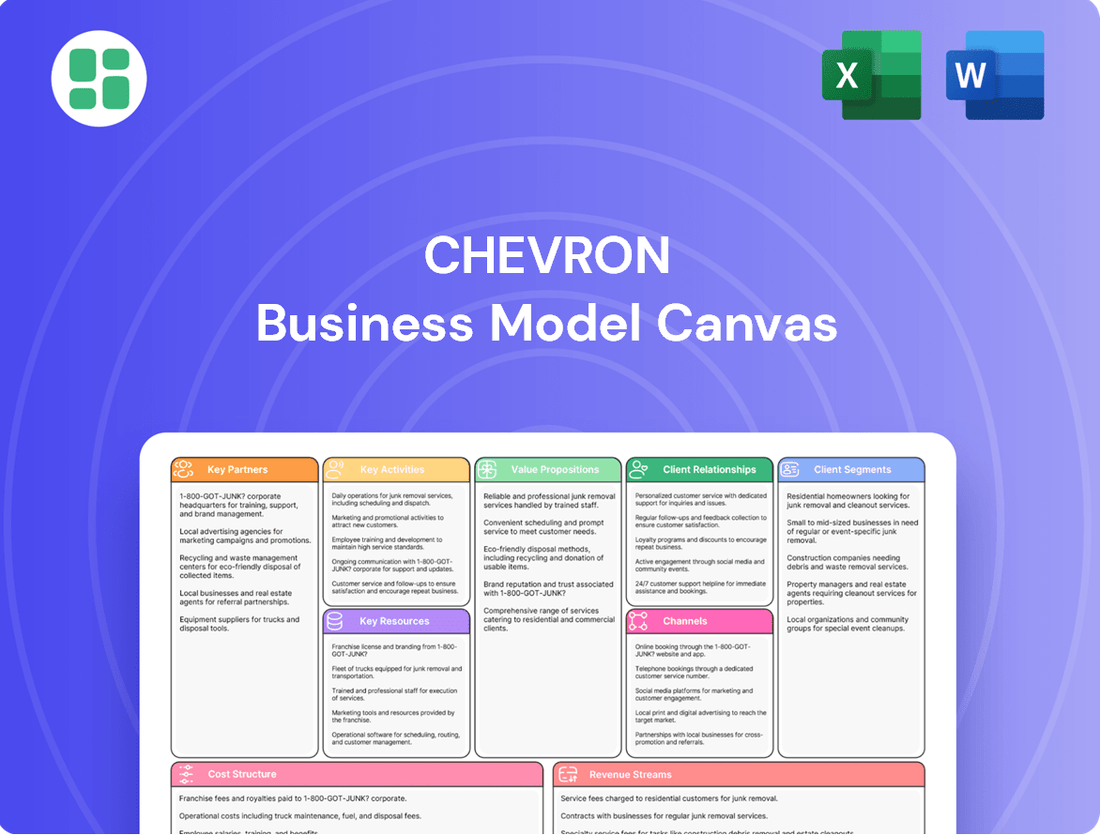

Business Model Canvas

The preview you see here is an exact representation of the Chevron Business Model Canvas you will receive upon purchase. This is not a mockup or a sample; it's a direct snapshot from the actual, complete document. Once your order is finalized, you'll gain full access to this professional, ready-to-use Business Model Canvas, identical to what you're viewing now.

Resources

Chevron's oil and natural gas reserves are its most critical key resource, forming the bedrock of its entire operation. These reserves, both already discovered (proved) and those yet to be fully developed (unproved), are the essential inputs for all the energy products Chevron produces and sells.

At the close of 2024, Chevron reported approximately 9.8 billion barrels of oil equivalent (BOE) in proved reserves. This substantial resource base, concentrated in key areas like the Permian Basin and offshore Guyana, directly translates into its production capabilities and ensures the company's long-term operational capacity.

Chevron's global infrastructure and facilities are its bedrock, encompassing a vast network of exploration and production sites, refineries, pipelines, terminals, and chemical plants. These physical assets are indispensable, supporting every stage of the company's operations from the initial extraction of resources to their final distribution.

In 2024, Chevron continued to strengthen this critical foundation. For instance, the company's strategic acquisition of Hess Corporation, valued at approximately $53 billion, significantly bolsters its asset portfolio, particularly in key growth areas like the Guyana offshore basin.

Chevron's intellectual property and technology are cornerstones of its business model, encompassing proprietary technologies, patents, and deep operational expertise. This includes specialized knowledge in challenging areas like deepwater drilling and the development of unconventional resources. For instance, their advancements in hydraulic fracturing technology have been critical to unlocking shale oil and gas reserves.

These technological advantages translate directly into enhanced operational efficiency, improved safety records, and the capability to develop and deploy lower-carbon energy solutions. In 2023, Chevron continued to invest in these areas, with a significant portion of its capital expenditure directed towards technological innovation and efficiency improvements across its upstream and downstream operations.

Chevron Technology Ventures actively scouts and invests in emerging energy technologies, aiming to foster innovation and secure future competitive advantages. This strategic focus on new energy technologies, including areas like advanced battery storage and carbon capture utilization and storage (CCUS), underscores their commitment to adapting to evolving energy landscapes and meeting climate-related goals.

Human Capital and Expertise

Chevron's business model hinges on its highly skilled and diverse global workforce, a vital asset encompassing engineers, geoscientists, researchers, and operational specialists. This collective expertise is the engine behind innovation, the guardian of safe and efficient operations, and the bedrock supporting the company's strategic goals.

In 2024, Chevron continued to emphasize its long-term employment approach, aiming to cultivate an environment conducive to employee growth and engagement. This focus on human capital is instrumental in navigating the complexities of the energy sector and achieving operational excellence across its vast global footprint.

- Skilled Workforce: Over 43,000 employees globally, with a significant portion in technical and operational roles, as of the end of 2023.

- Innovation Driver: Expertise in areas like advanced reservoir modeling and carbon capture technology development.

- Operational Excellence: Human capital is directly linked to maintaining high safety records and production efficiency.

- Strategic Alignment: Employee skills are critical for executing Chevron's energy transition and upstream growth strategies.

Financial Capital

Chevron's financial capital is a cornerstone of its business model, allowing for substantial investments across its diverse operations. The company's strong balance sheet and consistent cash flow from operations provide the foundation for these strategic capital allocations. This financial strength is crucial for navigating the capital-intensive energy sector.

The company's ability to access capital markets further bolsters its financial capacity. This access enables Chevron to fund large-scale projects, including exploration initiatives, infrastructure development, and investments in emerging energy technologies. For instance, Chevron generated $8.6 billion in cash flow from operations in the second quarter of 2025, underscoring its operational financial health.

- Strong Balance Sheet: Provides stability and capacity for investment.

- Robust Cash Flow: Fuels ongoing operations and strategic growth.

- Access to Capital Markets: Enables funding for major projects and acquisitions.

- Shareholder Returns: Financial strength supports consistent dividend payments and buybacks.

Chevron's brand and reputation are crucial intangible assets, representing trust and reliability built over decades in the energy sector. This strong brand equity allows the company to attract customers, partners, and investors, underpinning its market position and long-term viability.

In 2024, Chevron continued to emphasize its commitment to operational integrity and community engagement, reinforcing its positive public image. Their sustained focus on safety and environmental stewardship contributes significantly to maintaining this valuable reputation.

Chevron's access to global markets and established distribution networks are vital key resources that enable the efficient delivery of its products worldwide. These networks ensure that Chevron's energy solutions reach consumers and industries effectively, supporting global economic activity.

The company's strategic partnerships and joint ventures are also significant resources, providing access to new technologies, markets, and capital. These collaborations enhance Chevron's operational reach and resilience, particularly in complex international environments.

Value Propositions

Chevron ensures a steady flow of crucial energy products like crude oil, natural gas, and fuels, powering global industries and daily life. This consistent delivery is fundamental to energy security, especially given the current geopolitical uncertainties.

The company's integrated operations and diverse energy sources bolster its ability to provide reliable supply. In 2024, Chevron continued to be a major producer, with its upstream segment contributing significantly to global energy availability.

Chevron is actively working to lower the carbon footprint of its operations while simultaneously developing new ventures in areas like renewable fuels, carbon capture, and hydrogen. This dual approach provides customers and partners with tangible solutions to help them achieve their own decarbonization targets, a critical aspect of the ongoing global energy transition.

For instance, Chevron has invested significantly in Carbon Capture, Utilization, and Storage (CCUS) projects, such as the Gorgon project in Australia, which aims to capture a substantial portion of the CO2 produced. Furthermore, their expansion into renewable fuels, including biodiesel and sustainable aviation fuel, directly supports customers seeking to reduce their emissions from transportation.

Chevron offers a comprehensive portfolio of superior petroleum products, including gasoline, diesel, and jet fuel, alongside essential petrochemicals. These offerings consistently meet rigorous industry specifications, serving a broad spectrum of industrial, commercial, and consumer markets. In 2023, Chevron's downstream segment, which includes refining and marketing, generated approximately $52 billion in revenue, highlighting the significant market demand for their high-quality products.

Operational Excellence and Safety

Chevron's dedication to operational excellence and safety is a cornerstone of its business model, ensuring the efficient, reliable, and responsible production and delivery of energy. This focus directly translates into minimizing environmental impact and reducing operational risks.

In 2024, Chevron continued to prioritize safety, aiming for best-ever records in both personal and process safety across its global operations. This commitment is crucial for maintaining the security of energy supply and building trust with stakeholders.

- Safety Performance: In 2024, Chevron reported a significant reduction in recordable incidents, reflecting its ongoing investment in safety training and protocols.

- Operational Efficiency: The company achieved notable improvements in production uptime and reduced unplanned downtime across its key assets, enhancing overall efficiency.

- Environmental Stewardship: Efforts to minimize flaring and methane emissions remained a key focus, with specific targets set and progress tracked throughout 2024.

- Risk Management: Robust process safety management systems were further strengthened, leading to a lower frequency of high-consequence events.

Global Reach and Integrated Value Chain

Chevron's global reach, encompassing operations from exploration and production to refining and marketing, allows it to offer integrated energy solutions. This end-to-end control ensures a reliable supply chain and seamless delivery to a diverse customer base across numerous countries.

This extensive global footprint, with operations in over 180 countries as of 2024, provides significant flexibility in adapting to regional market shifts and economic fluctuations. It also allows Chevron to leverage its diverse asset base to optimize production and distribution, thereby enhancing resilience against supply disruptions.

The integrated nature of Chevron's value chain diversifies its revenue streams. For instance, in 2023, the company reported strong performance across its upstream (oil and gas production) and downstream (refining and marketing) segments, contributing to its overall financial stability and ability to invest in future growth opportunities.

- Global Operations: Active in over 180 countries as of 2024, providing broad market access.

- Integrated Value Chain: Covers exploration, production, refining, and marketing for end-to-end control.

- Market Resilience: Global presence offers flexibility to adapt to diverse market dynamics and mitigate risks.

- Diversified Revenue: Strength across upstream and downstream segments in 2023 demonstrates stable financial performance.

Chevron's value proposition centers on its ability to deliver reliable energy and innovative solutions. The company's integrated operations, spanning from exploration to marketing, ensure a consistent supply of essential products like fuels and petrochemicals, meeting diverse customer needs. Furthermore, Chevron is actively developing lower-carbon technologies, including renewable fuels and carbon capture, to support customers in their decarbonization efforts.

Chevron's commitment to operational excellence underpins its value delivery. This focus on safety and efficiency ensures the responsible production and distribution of energy resources. In 2024, the company continued to prioritize safety performance, aiming for reduced incidents and enhanced operational reliability across its global assets.

The company's extensive global presence and integrated value chain offer significant advantages. With operations in over 180 countries as of 2024, Chevron can adapt to regional market shifts and provide flexible energy solutions. This broad market access, combined with diversified revenue streams from both upstream and downstream activities, contributes to its financial stability and ability to invest in future growth.

| Value Proposition | Description | Key Supporting Facts (2023/2024) |

|---|---|---|

| Reliable Energy Supply | Consistent delivery of crude oil, natural gas, and fuels. | Major producer in 2024, contributing to global energy availability. Downstream revenue of ~$52 billion in 2023. |

| Lower Carbon Solutions | Developing renewable fuels, carbon capture, and hydrogen. | Investments in CCUS projects like Gorgon; expansion in biodiesel and sustainable aviation fuel. |

| High-Quality Products | Superior petroleum products and petrochemicals meeting industry standards. | Broad spectrum of industrial, commercial, and consumer markets served. |

| Operational Excellence & Safety | Efficient, reliable, and responsible production and delivery. | Prioritized safety in 2024, aiming for best-ever records. Reduced recordable incidents. |

| Integrated Energy Solutions | End-to-end control from exploration to marketing. | Operations in over 180 countries (2024). Diversified revenue across upstream and downstream segments (2023). |

Customer Relationships

Chevron cultivates enduring B2B relationships through long-term contracts, securing consistent demand for its diverse energy portfolio. These agreements, often spanning multiple years, cover bulk supplies of crude oil, natural gas, refined products, and petrochemicals to industrial clients, commercial enterprises, and government entities.

These relationships are anchored in a foundation of trust and reliability, with Chevron providing customized solutions to meet the unique operational requirements of its business partners. This strategic approach is evident in agreements for liquefied natural gas (LNG) and other critical commodities, ensuring stability for both Chevron and its clientele.

Chevron's direct sales and account management model focuses on building strong relationships with large commercial and industrial clients. Dedicated teams offer personalized service, technical expertise, and customized energy solutions, ensuring a deep understanding of each customer's unique needs.

This customer-centric approach allows for collaborative problem-solving and the development of tailored strategies. For instance, in 2024, Chevron continued to emphasize these direct relationships, which are crucial for securing long-term supply agreements and driving innovation in energy delivery.

Chevron cultivates retail network and brand loyalty through its vast array of branded service stations, offering convenience and quality fuels to individual consumers. Loyalty programs, such as Chevron's Fuel Rewards, incentivize repeat business, fostering a reliable and positive experience for everyday drivers. For example, in 2023, Chevron continued to invest in its retail presence, with marketing efforts often highlighting the consistency and quality of its Chevron and Texaco branded fuels.

Investor Relations and Shareholder Engagement

Chevron prioritizes transparent and proactive communication with its investors and shareholders to foster confidence and secure capital. This commitment is demonstrated through regular earnings calls, detailed investor presentations, and comprehensive annual reports. These avenues provide crucial insights into the company's financial performance, strategic trajectory, and ongoing sustainability initiatives, all aimed at delivering superior shareholder value.

In 2024, Chevron continued its focus on shareholder returns, a key aspect of its customer relationships. For instance, the company announced a quarterly dividend of $1.63 per share in early 2024, reflecting its consistent commitment to rewarding its investors. Furthermore, its share repurchase program remained active, demonstrating confidence in its financial health and future prospects.

- Transparent Communication: Regular earnings calls, investor days, and annual reports are key channels for sharing financial results and strategic updates.

- Shareholder Value Focus: Chevron’s strategy consistently emphasizes delivering superior returns through dividends and share repurchases.

- Sustainability Reporting: Integrated reporting includes progress on environmental, social, and governance (ESG) factors, crucial for modern investors.

- Investor Engagement: Proactive outreach and responsiveness to investor inquiries build trust and long-term relationships.

Community Engagement and Social Responsibility

Chevron actively engages with local communities through significant social investments and environmental stewardship programs. These efforts are crucial for maintaining its social license to operate and fostering positive relationships. For instance, in 2023, Chevron invested over $100 million in community and local initiatives globally, supporting education, economic development, and environmental conservation.

Their commitment extends to direct communication channels, allowing them to address local concerns and build trust. This proactive approach helps mitigate potential operational disruptions and enhances brand reputation. The Pecos Watershed Conservation project, a multi-year initiative, exemplifies their dedication to environmental sustainability and community well-being in areas where they operate.

- Community Investment: Chevron invested over $100 million globally in community and local initiatives in 2023.

- Environmental Stewardship: Programs like the Pecos Watershed Conservation demonstrate a commitment to local environmental health.

- Social License: Active engagement and addressing local concerns are vital for maintaining operational approval and goodwill.

- Stakeholder Relations: Direct communication fosters trust and supports long-term, sustainable development.

Chevron builds strong customer relationships through direct engagement with large industrial and commercial clients, offering tailored energy solutions and technical expertise. For individual consumers, the company fosters loyalty via its extensive network of branded service stations and programs like Fuel Rewards. In 2024, Chevron continued to prioritize these relationships, recognizing their importance for securing long-term supply and enhancing brand appeal.

| Relationship Type | Key Engagement Method | 2024 Focus/Data Point |

|---|---|---|

| B2B Clients | Long-term contracts, dedicated account management | Securing multi-year bulk supply agreements for crude, gas, and refined products. |

| Retail Consumers | Branded service stations, loyalty programs (Fuel Rewards) | Maintaining convenience and quality, incentivizing repeat purchases. |

| Shareholders/Investors | Transparent financial reporting, dividends, share repurchases | Announced quarterly dividend of $1.63 per share in early 2024; active share repurchase program. |

| Local Communities | Community investment, environmental stewardship | Continued investment in initiatives supporting education, economic development, and conservation. |

Channels

Chevron's global trading and sales desks are crucial for its wholesale operations, managing the buying and selling of crude oil, natural gas, and refined products on international commodity markets. These desks handle substantial volumes, ensuring efficient supply chain management and market access.

These channels are instrumental in executing large-scale transactions, optimizing logistics, and securing favorable pricing for Chevron's diverse energy portfolio. For instance, the company has secured long-term contracts for Liquefied Natural Gas (LNG) export capacity, underscoring the strategic importance of these trading operations.

Chevron's branded service stations and retail outlets are a cornerstone of its customer channels, directly reaching individual consumers with fuels and convenience items. This extensive physical network, a familiar sight across many regions, ensures brand recognition and provides convenient access points for everyday needs. In 2024, Chevron continued to leverage this channel, with its retail segment playing a significant role in its overall revenue generation.

Chevron's direct sales force is the backbone of its industrial and commercial operations, connecting directly with major clients like airlines, shipping firms, and power generation companies. This channel is vital for securing high-volume, long-term contracts for petroleum products and petrochemicals, ensuring consistent demand and revenue streams.

In 2024, Chevron's upstream segment, which feeds these sales channels, reported significant production volumes, with an average of 3.1 million barrels of oil equivalent per day. This robust supply capacity allows the company to meet the substantial needs of its industrial and commercial customers, underscoring the importance of these direct sales relationships.

Pipelines, Shipping Fleets, and Terminals

Chevron leverages its substantial infrastructure, encompassing proprietary and third-party pipelines, a global shipping fleet, and numerous storage terminals, as a critical physical channel. This network is designed for the efficient and secure movement of its vast array of products, from crude oil to refined fuels and lubricants. By the end of 2023, Chevron's capital expenditures on midstream assets, which include pipelines and terminals, were a significant part of its overall investment strategy, reflecting the ongoing importance of this channel.

This integrated logistical system is fundamental to ensuring a consistent and reliable product flow from upstream extraction points all the way to end consumers across diverse markets. The company's commitment to maintaining and expanding this infrastructure underpins its ability to compete effectively. For instance, in 2024, investments continue to focus on enhancing the capacity and efficiency of these transportation and storage assets.

- Extensive Infrastructure: Operates a vast network of pipelines, a global shipping fleet, and storage terminals for product distribution.

- Efficiency and Safety: Focuses on the secure and efficient transportation of crude oil, refined products, and lubricants.

- Market Reach: This logistical backbone ensures products reach markets reliably from source.

- Strategic Investment: Capital expenditures in midstream assets, including pipelines and terminals, remain a key focus for maintaining operational strength.

Digital Platforms and Online Presence

Chevron utilizes its corporate website, investor relations portals, and various social media platforms to disseminate information. These digital channels are vital for corporate communications, providing updates to investors, and sharing sustainability reports. In 2024, Chevron continued to emphasize transparency through these platforms, with their investor relations section being a key hub for financial data and strategic updates.

While not primary sales avenues for its core energy products, these online presences are instrumental in building and maintaining the Chevron brand. They serve as crucial touchpoints for engaging with a broad spectrum of stakeholders, from individual investors to industry analysts. For instance, the company's commitment to digital engagement was evident in its proactive communication regarding energy transition initiatives throughout 2024.

- Corporate Website: Serves as the central hub for company information, news, and reports.

- Investor Relations Portals: Dedicated sections for financial data, SEC filings, and investor presentations.

- Social Media Channels: Platforms like LinkedIn and X (formerly Twitter) are used for corporate announcements, brand messaging, and stakeholder engagement.

Chevron's channels are multifaceted, encompassing direct sales to large industrial clients, a vast retail network of branded stations, and sophisticated global trading operations. These diverse avenues ensure broad market penetration and efficient product distribution.

The company's infrastructure, including pipelines and shipping, acts as a critical physical channel, facilitating the movement of energy products. Digital platforms also play a role in communication and stakeholder engagement.

In 2024, Chevron's retail segment continued to be a significant contributor to revenue, while its direct sales force secured substantial contracts with key industrial partners. The company’s global trading desks actively managed significant volumes of crude oil and natural gas.

Chevron's commitment to its extensive infrastructure, including pipelines and terminals, was evident in its ongoing capital investments throughout 2024, ensuring operational efficiency and market access.

Customer Segments

Industrial and commercial businesses, such as manufacturing plants and transportation firms, are crucial customers. These entities depend on Chevron for bulk fuel, lubricants, and petrochemical feedstocks to keep operations running. In 2024, the industrial sector continued to be a significant driver of demand for refined products, with global industrial production showing steady growth.

Reliability and consistent quality are paramount for these clients. For instance, airlines and shipping companies require fuels that meet stringent specifications to ensure engine performance and safety. Chevron's commitment to quality control and supply chain resilience directly addresses these needs, often solidified through long-term supply agreements.

Retail consumers, primarily individual motorists, are a core segment for Chevron. These drivers rely on Chevron's network of branded service stations for their daily fueling needs, seeking reliable gasoline, diesel, and related automotive products. In 2024, the average US household owned approximately 1.9 vehicles, highlighting the widespread demand for these essential services.

National and local governments are significant customers for Chevron, procuring fuels for public transportation fleets, emergency vehicles, and various infrastructure projects. For instance, in 2024, governments continued to invest heavily in public transit upgrades, requiring substantial fuel supplies. These relationships are typically structured through competitive tendering processes, demanding strict adherence to regulatory frameworks and sustainability mandates.

Strategic Partners and Joint Venture Collaborators

Chevron actively engages with other energy companies, technology providers, and industrial partners as strategic partners and joint venture collaborators. These entities are crucial for undertaking large-scale projects and exploring new energy ventures, sharing both the risks and rewards involved.

These partners seek to leverage Chevron's established infrastructure and market access while contributing specialized expertise and innovative technologies. For instance, in 2024, Chevron continued to pursue collaborations in areas like carbon capture, utilization, and storage (CCUS) and hydrogen production, where shared investment and technological development are essential.

- Shared Risk and Investment: Partners join forces to finance and manage the substantial capital requirements of major energy projects, mitigating individual financial exposure.

- Access to Expertise and Technology: Collaborations facilitate the pooling of specialized knowledge, research and development capabilities, and proprietary technologies to achieve project goals.

- Market Access and Synergies: Partners benefit from combined market reach and operational synergies, enhancing the overall efficiency and profitability of joint endeavors.

- New Venture Development: These partnerships are vital for exploring and scaling emerging energy solutions, such as renewable energy sources and advanced biofuels, aligning with global decarbonization trends.

Investors and Shareholders

Investors and shareholders are fundamental to Chevron, providing the capital that fuels its operations and growth. They are not customers in the typical sense, but rather stakeholders who evaluate the company's financial health, dividend distributions, and strategic vision. Their primary objective is to achieve robust returns on their investment and ensure the long-term appreciation of their stake.

Chevron's performance directly impacts this segment. For instance, in 2023, the company reported a net income of $21.4 billion, a significant figure that underpins investor confidence. Shareholder returns are a key metric, and Chevron's commitment to dividends and share repurchases is a primary draw for this group.

Key considerations for investors and shareholders include:

- Financial Performance: They closely monitor profitability, cash flow generation, and debt levels. Chevron's 2023 revenue was $194.9 billion, demonstrating its scale and market presence.

- Dividend Payouts: Consistent and growing dividends are a major attraction. Chevron paid $11.1 billion in dividends in 2023, reflecting a commitment to returning capital to shareholders.

- Strategic Direction: Investors assess the company's long-term strategy, including its approach to energy transition, capital allocation, and operational efficiency.

- Shareholder Value: Ultimately, they seek an increase in the company's stock price and overall market capitalization.

Chevron's customer segments are diverse, encompassing industrial and commercial entities, retail consumers, and governmental bodies. Industrial clients, like manufacturers, rely on Chevron for bulk fuels and petrochemicals, with global industrial production showing steady growth in 2024. Retail customers, primarily individual motorists, depend on Chevron's extensive service station network for gasoline and diesel, with the average US household owning nearly two vehicles in 2024.

Governments are also key customers, procuring fuels for public transport and infrastructure, with significant public transit investments continuing in 2024. Beyond direct sales, Chevron engages strategically with other energy companies and technology providers for large-scale projects and new energy ventures, sharing risks and leveraging combined expertise.

Investors and shareholders are critical stakeholders, providing capital and evaluating financial performance, dividends, and strategic direction. In 2023, Chevron reported $21.4 billion in net income and paid $11.1 billion in dividends, underscoring its appeal to this segment.

| Customer Segment | Needs/Expectations | 2024 Relevance/Data Point |

| Industrial & Commercial | Bulk fuels, lubricants, petrochemicals; reliability, consistent quality | Global industrial production growth driving demand for refined products |

| Retail Consumers | Gasoline, diesel, automotive products; convenience, brand trust | High vehicle ownership (approx. 1.9 vehicles/US household in 2024) |

| Governments | Fuels for public fleets, infrastructure; regulatory compliance, sustainability | Continued investment in public transit upgrades requiring fuel supply |

| Strategic Partners | Shared risk, access to technology/expertise, market synergies | Collaborations in CCUS and hydrogen production ongoing |

| Investors & Shareholders | Financial returns, dividends, strategic vision, stock appreciation | 2023 Net Income: $21.4B; 2023 Dividends: $11.1B |

Cost Structure

Chevron's Capital Expenditures (CapEx) are substantial, reflecting the high-cost nature of the oil and gas industry. These investments are crucial for finding new reserves, developing existing fields, and maintaining operational efficiency across its vast infrastructure.

Significant investments are directed towards exploration and production, as well as the construction and upkeep of refineries, pipelines, and increasingly, new energy ventures. For 2025, Chevron has projected an organic capital expenditure budget ranging from $14.5 billion to $15.5 billion. Notably, approximately $1.5 billion of this budget is earmarked for initiatives aimed at reducing carbon intensity and expanding its presence in new energy sectors.

Chevron's operating expenses are substantial, encompassing the costs of running its extensive network of wells, refineries, and distribution channels. These include essential expenditures like labor for skilled personnel, ongoing maintenance to ensure asset integrity, utility costs for powering facilities, and the significant purchase of raw materials, most notably crude oil for its refining operations. For the first quarter of 2024, Chevron reported total operating expenses of $39.2 billion, reflecting the significant scale of these day-to-day activities.

Chevron's upstream operations, encompassing exploration and production, incur significant costs. These include expenses for geological and geophysical studies to identify potential oil and gas reserves, as well as the substantial outlays for drilling wells and completing them for production. For instance, in 2023, Chevron's upstream segment reported operating expenses of $37.5 billion, reflecting these fundamental activities.

Production lifting costs, which cover the day-to-day expenses of extracting oil and gas from existing wells, are also a major component. These costs are inherently variable, heavily influenced by factors such as the geological complexity of the reservoirs and their geographic location. The company's ability to manage these upstream expenditures is critical to its overall profitability and competitiveness in the energy market.

Research and Development Costs

Chevron's commitment to innovation is reflected in its significant investment in Research and Development (R&D). These costs are essential for developing new technologies, optimizing existing processes, and pioneering lower-carbon solutions to meet evolving energy demands and sustainability targets.

In 2023, Chevron's R&D expenditures were approximately $1.1 billion. This investment underpins their strategy to maintain a competitive edge and advance their energy transition goals. These crucial outlays directly impact the company's long-term viability and its ability to adapt to a changing energy landscape.

- Investment in New Technologies: Funding for advanced exploration techniques, digital solutions, and novel energy production methods.

- Process Improvements: Allocations for enhancing operational efficiency, safety, and cost-effectiveness across all business segments.

- Lower-Carbon Solutions: Significant R&D spending dedicated to carbon capture, utilization, and storage (CCUS), hydrogen technologies, and renewable energy integration.

- Talent and Infrastructure: Costs associated with maintaining state-of-the-art research facilities and attracting top scientific and engineering talent.

Compliance, Environmental, and Decommissioning Costs

Chevron faces substantial costs related to compliance, environmental stewardship, and the eventual decommissioning of its assets. These expenses are crucial for maintaining operational licenses and social responsibility. For instance, in 2023, Chevron reported $3.6 billion in environmental expenditures, a significant portion of which is allocated to managing emissions and ensuring site remediation.

Investments in reducing the company's environmental footprint are a key component of this cost structure. This includes capital allocated to carbon capture technologies and initiatives aimed at methane emission reduction. In 2024, Chevron projected capital expenditures of $3 billion to $4 billion for lower carbon initiatives, demonstrating a commitment to addressing climate-related risks and opportunities.

- Environmental Compliance: Costs associated with meeting regulatory standards for air and water quality, waste management, and biodiversity protection.

- Emissions Management: Investments in technologies and practices to reduce greenhouse gas emissions, particularly methane, and other pollutants.

- Site Remediation: Expenses for cleaning up and restoring sites impacted by past operations, ensuring they meet environmental standards.

- Decommissioning: Funds set aside for the safe and environmentally sound closure and removal of facilities at the end of their operational life.

Chevron's cost structure is dominated by capital expenditures for exploration, production, and infrastructure maintenance, alongside significant operating expenses for daily operations. These include raw material purchases like crude oil, labor, and utilities. The company also invests heavily in research and development to drive innovation and lower-carbon solutions, with substantial allocations for environmental compliance and asset decommissioning.

| Cost Category | 2023 Actuals (Approx.) | 2024 Projected Range | Key Components |

|---|---|---|---|

| Capital Expenditures (CapEx) | N/A (Focus on 2025) | $14.5B - $15.5B | Exploration, production, infrastructure, new energy ventures |

| Operating Expenses | $39.2B (Q1 2024) | N/A | Labor, maintenance, utilities, raw materials |

| Upstream Operating Expenses | $37.5B (2023) | N/A | Geological studies, drilling, production lifting costs |

| Research & Development (R&D) | $1.1B (2023) | N/A | New technologies, process improvements, lower-carbon solutions |

| Environmental Expenditures | $3.6B (2023) | N/A | Compliance, emissions management, site remediation, decommissioning |

| Lower Carbon Capital Expenditures | N/A (Focus on 2024) | $3B - $4B (2024) | Carbon capture, methane reduction, renewable energy |

Revenue Streams

Chevron's primary revenue driver is the sale of crude oil and natural gas, sourced from its worldwide exploration and production activities. These sales occur through both immediate spot market transactions and more stable, long-term agreements.

In the second quarter of 2025, Chevron's upstream segment demonstrated robust performance, generating $2.73 billion in earnings, highlighting the significant contribution of these sales to the company's financial health.

Chevron generates revenue by selling a wide array of refined petroleum products globally. These include everyday items like gasoline and diesel, along with specialized products such as jet fuel, lubricants, and asphalt. These sales cater to a diverse customer base, encompassing commercial entities, industrial operations, and individual consumers, often through Chevron's own branded service stations.

The downstream segment, which encompasses these refined product sales, demonstrated financial strength. For the second quarter of 2025, this segment reported earnings of $737 million, highlighting the significant contribution of refined product sales to Chevron's overall financial performance.

Chevron's petrochemical sales represent a significant revenue stream, diversifying its business beyond solely fuel production. This segment involves manufacturing and selling essential raw materials like ethylene and propylene, which are fundamental building blocks for plastics, synthetic fibers, and various other industrial products.

In 2024, Chevron's performance in the chemicals sector remained robust, with its petrochemical operations contributing substantially to overall earnings. For instance, the company's Tengizchevroil joint venture in Kazakhstan, a major producer of natural gas and crude oil, also yields valuable natural gas liquids that are feedstock for petrochemicals, underscoring the integrated nature of these revenue streams.

New Energies and Lower Carbon Solutions

Chevron is actively developing revenue streams within its New Energies and Lower Carbon Solutions segment. This includes sales of renewable fuels, such as renewable diesel, which is a key focus area for the company's transition strategy. For instance, Chevron's renewable diesel production capacity is projected to reach approximately 1.2 billion gallons per year by 2025.

Beyond renewable fuels, Chevron is exploring revenue generation through carbon capture and storage (CCS) services. While still in development stages for many projects, the company sees this as a significant future income source as industries increasingly seek to decarbonize. Additionally, the potential for hydrogen production and sales represents another emerging revenue stream as the hydrogen economy gains traction.

- Renewable Fuels: Revenue from the sale of renewable diesel and other sustainable fuels. Chevron's investment in renewable diesel projects is a significant driver in this segment.

- Carbon Capture and Storage (CCS): Income generated from providing services to capture and store carbon dioxide emissions for industrial partners.

- Hydrogen Production: Future revenue potential from the production and sale of hydrogen, particularly for transportation and industrial applications.

Dividends and Shareholder Returns

While not a direct revenue stream for Chevron, the company's capacity to generate substantial free cash flow is critical for rewarding its investors. This financial strength allows for consistent dividend payments and strategic share repurchases, directly enhancing shareholder value.

Chevron's commitment to shareholder returns is a significant indicator of its operational success and financial health. For instance, in the second quarter of 2025, the company demonstrated this by returning an impressive $5.5 billion to shareholders through a combination of dividends and share buybacks.

- Dividend Payments: Regular distributions of profits to shareholders, providing a consistent income stream.

- Share Repurchases: Buying back outstanding shares to reduce the number of shares available, which can increase earnings per share and boost stock value.

- Shareholder Value: Both dividends and buybacks are key mechanisms for returning capital to investors, signaling financial stability and confidence in future earnings.

- Q2 2025 Performance: Chevron's return of $5.5 billion to shareholders highlights its ability to generate strong free cash flow and prioritize investor returns.

Chevron's diversified revenue streams are anchored in the sale of crude oil and natural gas, complemented by refined petroleum products like gasoline and diesel. The company also generates income from petrochemicals, such as ethylene and propylene, which serve as essential industrial building blocks.

Looking ahead, Chevron is actively expanding into new energy sectors, focusing on renewable fuels like renewable diesel, with significant capacity growth anticipated. Emerging revenue opportunities also lie in carbon capture and storage (CCS) services and the production and sale of hydrogen, aligning with global decarbonization efforts.

The company's financial strategy includes substantial returns to shareholders through dividends and share repurchases, reflecting its robust free cash flow generation. For instance, in Q2 2025, Chevron returned $5.5 billion to shareholders, underscoring its commitment to investor value.

| Revenue Stream | Description | Key Data/Focus (2024-2025) |

| Upstream (Oil & Gas Sales) | Sale of crude oil and natural gas. | Q2 2025 Earnings: $2.73 billion. |

| Downstream (Refined Products) | Sale of gasoline, diesel, jet fuel, lubricants, asphalt. | Q2 2025 Earnings: $737 million. |

| Petrochemicals | Sale of ethylene, propylene, and other chemical feedstocks. | Robust contribution to earnings in 2024; linked to natural gas liquids. |

| New Energies & Lower Carbon | Renewable fuels (e.g., renewable diesel), CCS services, hydrogen. | Renewable diesel capacity projected at 1.2 billion gallons/year by 2025. |

| Shareholder Returns | Dividends and share repurchases. | Q2 2025 Shareholder Return: $5.5 billion. |

Business Model Canvas Data Sources

The Chevron Business Model Canvas is informed by a comprehensive array of data, including internal financial reports, operational metrics, and market intelligence gathered from industry analysis. This multi-faceted approach ensures each component of the canvas is grounded in factual performance and strategic understanding.