Chevron Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chevron Bundle

Chevron's marketing prowess is built on a strategic foundation, meticulously aligning its Product, Price, Place, and Promotion. Understanding how this energy giant crafts its offerings, sets competitive prices, distributes its fuels, and communicates its value is key to grasping its market dominance.

Dive deeper into Chevron's comprehensive 4Ps analysis to uncover the intricate details of their product portfolio, pricing strategies, extensive distribution network, and impactful promotional campaigns. This ready-to-use, editable report provides actionable insights for business professionals, students, and consultants seeking to benchmark and strategize.

Product

Chevron's product strategy is built on a diverse energy portfolio, encompassing traditional fossil fuels like crude oil and natural gas, alongside a growing array of lower-carbon alternatives. This breadth ensures they can serve a wide customer base, from everyday drivers to major industrial partners needing significant energy volumes.

In 2024, Chevron continued to invest heavily in both its traditional and new energy segments. For instance, their upstream segment, focused on oil and gas production, saw significant capital allocation, reflecting ongoing demand. Simultaneously, investments in renewable fuels and hydrogen technologies are expanding, signaling a commitment to evolving energy needs.

This dual approach allows Chevron to meet immediate energy requirements through established products while strategically positioning itself for the future energy landscape. Their refined products, such as gasoline and diesel, remain a core offering, complemented by investments in areas like carbon capture and storage, aiming to reduce the environmental impact of their operations.

Chevron's refined petroleum products, including gasoline, diesel, jet fuel, lubricants, and asphalt, are fundamental to global transportation, industry, and energy. These offerings, marketed under trusted brands such as Chevron and Texaco, are engineered for superior quality, performance, and unwavering reliability. In 2023, Chevron's downstream segment, which includes refining and marketing, generated approximately $24.8 billion in earnings, underscoring the critical role of these refined products in the company's financial success.

Chevron's petrochemical segment is a significant contributor, transforming oil and natural gas into essential building blocks for countless products. These derivatives, like ethylene and propylene, are vital for industries ranging from automotive manufacturing to packaging. In 2024, Chevron continued to emphasize operational efficiency and product quality within its petrochemical division, aiming to meet growing global demand for these fundamental materials.

Upstream Oil and Gas

Chevron's upstream segment is built upon the extraction of crude oil and natural gas, the company's core products. These operations span exploration and production across the globe, forming the bedrock of its energy business. The emphasis is on conducting these activities efficiently and responsibly, ensuring sustainable resource management.

In 2024, Chevron's upstream segment continued to be a major revenue driver. For instance, the company reported significant production volumes, with an average of 3.2 million barrels of oil equivalent per day in the first quarter of 2024. This highlights the scale of their operations in bringing essential energy resources to market.

- Crude Oil and Natural Gas: The fundamental raw materials Chevron extracts and processes.

- Global Exploration and Production: Operations are geographically diverse, securing a broad resource base.

- Efficiency and Responsibility: A commitment to optimizing extraction processes while adhering to environmental standards.

- Production Volumes: Averaging 3.2 million barrels of oil equivalent per day in Q1 2024, showcasing operational capacity.

Lower Carbon Solutions

Chevron's commitment to lower-carbon solutions is a significant evolution in its product strategy, addressing the global energy transition and increasing demand for sustainable options. This includes investments in biofuels, hydrogen, and carbon capture technologies, aiming to diversify its energy portfolio beyond traditional fossil fuels.

This strategic pivot is supported by tangible investments and targets. For instance, Chevron aims to invest $10 billion in lower-carbon initiatives through 2028, with a focus on areas like renewable natural gas, hydrogen, and carbon capture, utilization, and storage (CCUS). The company is also actively pursuing projects such as the development of renewable fuels facilities and exploring hydrogen production hubs.

- Biofuels: Chevron is expanding its renewable fuels capacity, with plans to increase production of renewable diesel and sustainable aviation fuel.

- Hydrogen: The company is investing in hydrogen production and infrastructure, recognizing its potential as a clean energy carrier.

- Carbon Capture: Chevron is developing and deploying carbon capture, utilization, and storage (CCUS) technologies to reduce emissions from its operations and for third parties.

- Offsets: The company utilizes carbon offsets as part of its strategy to manage its carbon footprint and offer lower-carbon solutions to customers.

Chevron's product offering is a dynamic mix of traditional energy sources and emerging lower-carbon solutions. Their core business remains the production and refining of crude oil and natural gas, which are transformed into essential fuels, lubricants, and petrochemicals. This robust portfolio is crucial for global transportation and industry, as evidenced by the $24.8 billion in earnings from their downstream segment in 2023.

The company is actively expanding into lower-carbon areas like renewable natural gas, hydrogen, and carbon capture. For example, Chevron aims to invest $10 billion in these initiatives through 2028, demonstrating a clear commitment to diversifying its energy solutions. This dual strategy ensures they meet current energy demands while preparing for a future with evolving environmental considerations.

Chevron's upstream segment, a significant revenue driver, reported an average production of 3.2 million barrels of oil equivalent per day in Q1 2024. Their petrochemical division converts hydrocarbons into vital materials for manufacturing and packaging, underscoring the broad utility of their product range.

| Product Category | Key Offerings | 2023 Segment Earnings (Approx.) | 2024 Production (Q1 Avg.) | Strategic Focus |

|---|---|---|---|---|

| Upstream (Oil & Gas) | Crude Oil, Natural Gas | N/A (Integrated) | 3.2 million boe/day | Efficient extraction, resource management |

| Downstream (Refining & Marketing) | Gasoline, Diesel, Jet Fuel, Lubricants, Asphalt | $24.8 billion | N/A | Quality, performance, reliability |

| Petrochemicals | Ethylene, Propylene, etc. | N/A (Integrated) | N/A | Operational efficiency, product quality |

| Lower-Carbon Solutions | Renewable Fuels, Hydrogen, CCUS | N/A | N/A | Investment in transition, sustainability |

What is included in the product

This analysis delves into Chevron's marketing mix, examining their product offerings, pricing strategies, distribution channels (place), and promotional activities. It provides a comprehensive understanding of how Chevron positions itself in the competitive energy market.

This Chevron 4P's analysis cuts through marketing complexity, offering a clear roadmap to address customer needs and competitive pressures.

Place

Chevron operates a vast global distribution network, utilizing pipelines, marine vessels, rail, and trucks to move its energy products efficiently. This extensive infrastructure is crucial for transporting crude oil, natural gas, and refined products from production sites to markets across the globe, ensuring a reliable international supply chain.

Chevron's extensive network of branded retail fueling stations, encompassing both Chevron and Texaco locations, represents a critical 'place' element in its marketing mix. These stations serve as the primary touchpoint for consumers seeking gasoline, diesel, and a range of convenience store products. As of late 2024, Chevron operates tens of thousands of these retail outlets globally, strategically positioned in high-traffic areas to ensure accessibility and brand presence.

The strategic placement of these stations is paramount, aiming to capture market share by offering unparalleled convenience to a broad customer base. This physical presence is not just about product distribution; it's about direct consumer engagement and reinforcing brand loyalty through consistent service and offerings. The retail footprint directly influences sales volume and brand perception in the competitive fuel market.

Chevron's Industrial and Commercial Sales segment is a cornerstone of its business, directly supplying substantial volumes of refined products, lubricants, and petrochemicals to a global clientele encompassing industrial, commercial, and government entities. This B2B channel is expertly managed through dedicated sales teams and sophisticated, customized logistics to precisely cater to the unique requirements of large-scale operations.

This direct sales approach is vital for securing high-volume transactions and establishing enduring, long-term contracts, forming a critical part of Chevron's overall market strategy. For instance, in 2024, Chevron’s lubricants business alone reported significant revenue contributions from its industrial sector, underscoring the importance of these B2B relationships.

Terminals and Storage Facilities

Chevron operates an extensive network of terminals, refineries, and storage facilities, critical for managing inventory and ensuring efficient product distribution across its global operations. These strategically located assets are the backbone of its supply chain, enabling seamless product flow and market responsiveness.

The company's investment in these infrastructure nodes directly impacts its ability to meet demand and optimize logistics. For instance, in 2023, Chevron continued to invest in its downstream infrastructure, including upgrades to storage and distribution capabilities, to enhance operational efficiency and reduce costs.

- Strategic Location: Facilities are positioned to minimize transportation expenses and maximize market access.

- Inventory Management: Storage capacity allows for buffering against supply disruptions and managing product availability.

- Efficiency Gains: Integrated operations at these sites facilitate product blending and efficient distribution networks, contributing to a competitive cost structure.

Digital and Strategic Partnerships

Chevron leverages digital platforms extensively to streamline business-to-business transactions and manage its complex supply chain. This digital focus enhances efficiency and provides greater accessibility for its partners and significant clientele. For instance, Chevron's digital solutions aim to simplify ordering, tracking, and payment processes, reducing administrative burdens and improving partner relationships.

Strategic alliances and joint ventures are cornerstones of Chevron's market expansion strategy. These collaborations enable the company to enter new geographic regions or tap into specialized markets where direct entry might be challenging or less efficient. Such partnerships are crucial for achieving deeper market penetration and optimizing resource utilization across its global operations.

- Digital Efficiency: Chevron's investment in digital platforms for B2B operations is designed to reduce transaction times and costs, with many industry peers reporting efficiency gains of 10-15% through similar digital transformations.

- Market Reach Expansion: Strategic partnerships, including joint ventures in areas like renewable energy or advanced materials, allow Chevron to access markets and technologies that complement its existing portfolio, contributing to revenue diversification.

- Supply Chain Optimization: Digitalization of the supply chain provides real-time visibility and control, a critical factor in managing fuel and lubricant distribution, especially in volatile market conditions experienced throughout 2024.

- Resource Pooling: Joint ventures enable Chevron to share the significant capital investment required for large-scale projects, thereby optimizing resource allocation and mitigating financial risk in its expansion efforts.

Chevron's 'Place' strategy is deeply rooted in its extensive physical and digital infrastructure, ensuring product availability and accessibility across diverse markets. This includes a vast network of retail stations, industrial supply channels, and strategically located operational facilities.

The company's global reach is amplified by its sophisticated distribution network, utilizing pipelines, marine vessels, rail, and trucks to move products efficiently. As of 2024, Chevron's retail presence includes tens of thousands of branded stations worldwide, a testament to its commitment to consumer accessibility and brand visibility.

Furthermore, Chevron's B2B segment relies on direct sales and tailored logistics, supported by robust infrastructure like terminals and refineries, which are continuously upgraded to enhance efficiency. Digital platforms and strategic alliances also play a key role in optimizing market access and transaction processes.

| Channel | Description | Key Feature | 2024 Data Point |

|---|---|---|---|

| Retail Fueling Stations | Branded Chevron and Texaco locations | High-traffic, consumer accessibility | Tens of thousands globally |

| Industrial & Commercial Sales | Direct supply to businesses | Customized logistics, long-term contracts | Significant revenue contribution from lubricants segment |

| Infrastructure Network | Terminals, refineries, storage facilities | Inventory management, efficient distribution | Continued investment in upgrades for efficiency |

| Digital Platforms | B2B transaction and supply chain management | Streamlined ordering, tracking, payment | Aimed at reducing administrative burdens |

What You See Is What You Get

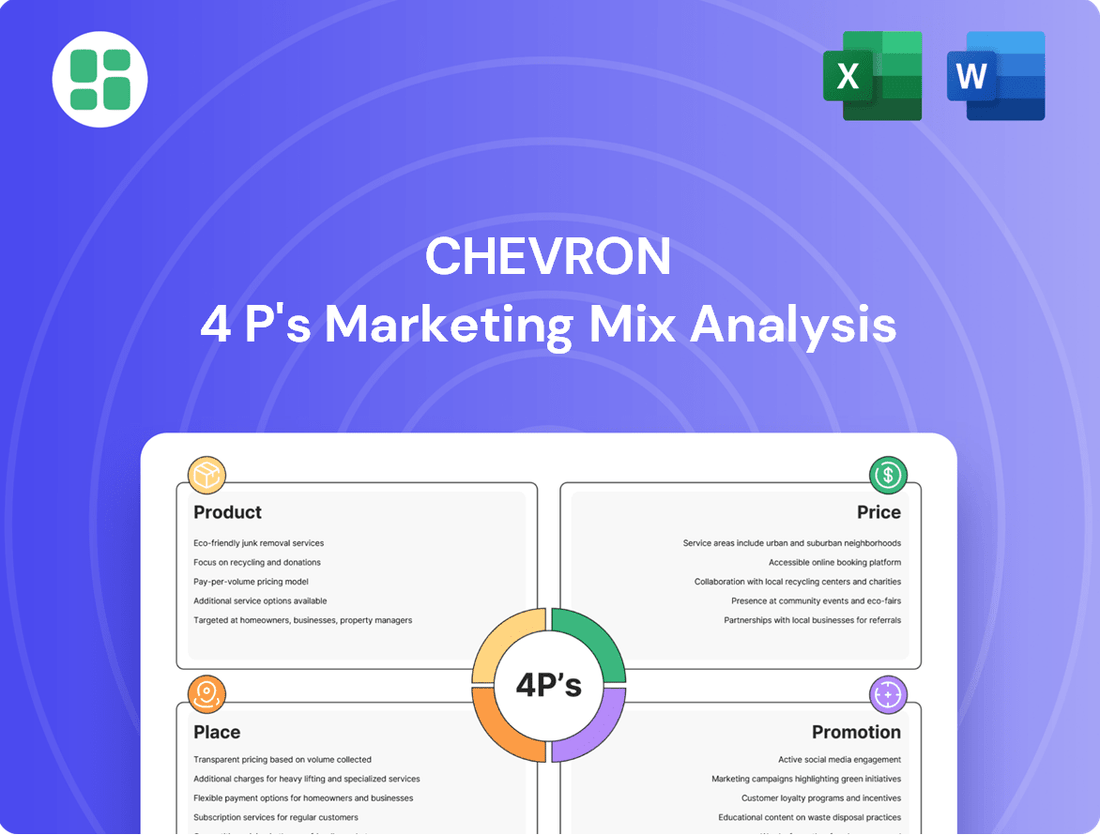

Chevron 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Chevron's 4P's Marketing Mix is fully prepared for your immediate use. You are viewing the exact version of the analysis you'll receive, ready to be applied to your strategic thinking.

Promotion

Chevron's corporate branding and advertising efforts are extensive, utilizing diverse media to solidify its image as a forward-thinking energy company. In 2024, Chevron continued to invest in campaigns emphasizing its role in providing reliable energy while highlighting advancements in lower carbon solutions. For instance, advertising often showcases technological innovation and operational excellence, reinforcing its position as a leader in the energy sector.

These initiatives are crucial for building and maintaining trust with stakeholders, including investors, consumers, and communities. Chevron's messaging consistently underscores its dedication to safety and environmental responsibility, aiming to shape perceptions of the company as a responsible corporate citizen. This focus on sustainability and innovation is a key element in its 2024-2025 marketing strategy.

Chevron actively communicates its sustainability and ESG efforts through dedicated reports and digital channels. In 2023, the company reported a 15% reduction in its Scope 1 and 2 greenhouse gas emission intensity compared to a 2019 baseline. This transparency aims to address stakeholder concerns and highlight investments in lower-carbon technologies, such as its $2 billion investment in renewable natural gas projects by 2025.

Chevron actively uses its corporate website and social media platforms, like LinkedIn and X (formerly Twitter), to connect with investors, customers, and prospective employees. In 2023, Chevron’s investor relations website saw consistent traffic, highlighting its role in communicating financial performance and strategic updates to a key audience.

Digital content marketing, including blog posts and videos showcasing projects and sustainability efforts, helps Chevron manage its public image and reach a wide, digitally connected demographic. The company's social media channels are crucial for real-time communication and fostering dialogue, especially concerning energy transition initiatives.

Investor Relations Communications

Chevron actively engages the financial community through investor relations communications, a key promotional element. This includes detailed investor presentations, quarterly earnings calls, and comprehensive financial reports. For instance, in the first quarter of 2024, Chevron reported earnings of $5.5 billion, demonstrating its financial health and providing a basis for investor discussions.

These efforts are designed to clearly articulate the company's financial performance, strategic objectives, and outlook for future growth to existing shareholders and prospective investors. Maintaining transparency and consistency in these communications is paramount for fostering and sustaining investor confidence.

- Financial Performance: Detailed reporting on earnings, revenue, and operational efficiency.

- Strategic Direction: Outlining long-term plans, capital allocation, and growth initiatives.

- Future Prospects: Communicating market outlook, project pipelines, and sustainability efforts.

- Investor Confidence: Building trust through transparent and regular engagement.

Community and Partnership Programs

Chevron actively invests in community and partnership programs, recognizing their importance in building goodwill and securing its social license to operate. These initiatives are designed to foster local development and showcase the company's positive contributions.

In 2024, Chevron continued its commitment to community engagement, with significant investments in areas such as education and environmental stewardship. For instance, their support for STEM education programs reached over 50,000 students across various regions, demonstrating a tangible impact on future workforce development.

Key partnership programs in 2024-2025 include collaborations with non-profit organizations focused on disaster relief and economic empowerment. These partnerships aim to address critical societal needs and create sustainable local benefits. Chevron's sponsorships also extend to cultural events and local sports leagues, further embedding the company within the community fabric.

- Community Investment: Chevron's global community investments in 2023 totaled $41 million, with a significant portion allocated to programs that enhance social and economic well-being.

- Partnership Impact: In 2024, partnerships with environmental groups led to the restoration of over 10,000 acres of natural habitat.

- Employee Engagement: Over 15,000 Chevron employees participated in volunteer activities in 2023, contributing over 50,000 volunteer hours to community projects.

- Social License: These outreach efforts are crucial for maintaining a positive public image and fostering trust, which is vital for long-term operational success.

Chevron's promotional strategy encompasses broad corporate branding, targeted investor relations, and significant community engagement. These efforts aim to build a reputation for reliability, innovation, and corporate responsibility. The company actively communicates its financial performance, strategic direction, and sustainability initiatives to a diverse stakeholder base.

In 2024, Chevron continued to highlight its role in providing essential energy while investing in lower-carbon solutions, with a focus on technological advancements and operational excellence. Its 2023 community investments totaled $41 million, supporting programs in education and environmental stewardship, with over 15,000 employees volunteering 50,000 hours.

The company's digital presence on platforms like LinkedIn and its investor relations website are key for disseminating financial results, such as the $5.5 billion earnings reported in Q1 2024, and fostering investor confidence.

| Promotional Area | Key Activities | 2023/2024 Data Points |

|---|---|---|

| Corporate Branding | Advertising, Public Relations | Emphasis on reliable energy & lower-carbon solutions |

| Investor Relations | Earnings Calls, Financial Reports | Q1 2024 Earnings: $5.5 billion |

| Community Engagement | Local Programs, Partnerships | $41 million invested in 2023; 50,000+ student reach in STEM |

| Digital Marketing | Social Media, Website Content | Active presence on LinkedIn, X; investor website traffic |

Price

Chevron's primary products, crude oil and natural gas, are priced based on volatile global commodity markets. These markets are swayed by supply and demand, geopolitical shifts, and economic health, leading to daily price fluctuations that directly impact Chevron's revenue. For instance, West Texas Intermediate (WTI) crude oil prices traded around $80 per barrel in early 2024, a significant factor in Chevron's financial performance.

To navigate this inherent price volatility, Chevron employs sophisticated hedging strategies, locking in prices for future sales and purchases to mitigate risk. Alongside hedging, the company focuses on operational efficiency, optimizing production costs to maintain profitability even when market prices are unfavorable. This dual approach is crucial for sustaining predictable earnings in a dynamic energy landscape.

Chevron actively manages its retail fuel prices to remain competitive, factoring in local market dynamics, competitor pricing, and regional demand. For instance, in early 2024, average gasoline prices across the US hovered around $3.50 per gallon, with significant regional variations that Chevron's pricing strategy must address. This approach is designed to draw in and keep customers while maintaining healthy profit margins.

Chevron frequently employs contractual B2B pricing for its industrial, commercial, and wholesale customers, especially for substantial volume transactions. These agreements often feature tailored price structures, incorporating elements like volume discounts or pricing formulas linked to prevailing market benchmarks, fostering predictable revenue streams and stable operational costs for both parties.

Refined Product Margins

Chevron's refined product margins are influenced by a complex interplay of factors, including the cost of crude oil, refining expenses, and distribution costs. These margins are not static; they fluctuate based on regional supply and demand dynamics. For instance, in Q1 2024, Chevron reported a refining margin of $7.48 per barrel, reflecting robust market conditions and efficient operations.

The company actively works to enhance these margins by focusing on operational efficiency within its refineries and strategically allocating its refined products to markets where demand is strongest and pricing is most favorable. This strategic approach helps to capture value across its downstream segment.

Market conditions are paramount in determining the final pricing and, consequently, the profit margins. Factors such as geopolitical events impacting crude supply, seasonal demand shifts for products like gasoline and jet fuel, and the competitive landscape all play a significant role. In 2024, the global refining sector saw varied performance, with some regions experiencing tighter supply due to refinery outages, which generally supported higher margins.

- Crude Oil Costs: A primary driver of refined product pricing, directly impacting the cost base.

- Refining Expenses: Operational costs associated with transforming crude oil into usable products.

- Transportation & Distribution: Costs incurred to move refined products to market.

- Market Demand & Supply: Regional balances significantly influence achievable margins, as seen with Chevron's Q1 2024 refining margin of $7.48 per barrel.

Investment-Based Pricing for New Energies

Chevron's pricing for new energy solutions like biofuels and carbon capture services is influenced by significant upfront development costs and the evolving regulatory landscape. For instance, the cost of producing sustainable aviation fuel (SAF) can be substantially higher than traditional jet fuel, reflecting the investment in new feedstocks and processing technologies. In 2024, the U.S. government's Biofuel Producer Program offered tax credits, impacting the effective price point for these cleaner alternatives.

The nascent nature of these markets also means pricing must account for a developing willingness to pay from customers seeking sustainable options. This can be seen in early adoption premiums for carbon capture utilization and storage (CCUS) projects, where the value proposition includes emissions reduction and potential future carbon market benefits. As these technologies scale and become more efficient, Chevron anticipates a shift in pricing strategies to reflect greater market maturity and broader adoption.

- Development Costs: High initial capital expenditure for new energy technologies.

- Regulatory Incentives: Tax credits and subsidies play a crucial role in making prices competitive.

- Market Willingness to Pay: Early adopters may pay a premium for sustainable solutions.

- Market Maturation: Pricing strategies will adapt as demand and supply chains strengthen.

Chevron's pricing strategy for its core products, crude oil and natural gas, is intrinsically tied to global commodity markets, which experienced significant volatility. For example, WTI crude oil prices fluctuated, trading around $80 per barrel in early 2024, directly impacting Chevron's revenue streams.

To manage this, Chevron employs hedging and focuses on operational efficiency to maintain profitability. In its retail operations, competitive pricing is key, with average US gasoline prices around $3.50 per gallon in early 2024, necessitating regional adjustments.

For B2B clients, Chevron utilizes contractual pricing, often with volume discounts. The company's refined product margins, exemplified by a Q1 2024 refining margin of $7.48 per barrel, are influenced by crude costs, refining expenses, and market dynamics.

New energy solutions like biofuels face pricing challenges due to high development costs and regulatory impacts, though incentives like U.S. tax credits in 2024 aim to make them more competitive.

| Product Segment | Pricing Driver | 2024 Data Point | Impact |

|---|---|---|---|

| Crude Oil & Natural Gas | Global Commodity Markets | WTI ~$80/barrel (Early 2024) | Direct revenue impact, necessitates hedging |

| Refined Products (Retail) | Local Market Competition & Demand | US Avg. Gasoline ~$3.50/gallon (Early 2024) | Requires regional pricing strategies |

| Refined Products (Margins) | Crude Costs, Refining Expenses, Market Balance | Chevron Refining Margin $7.48/barrel (Q1 2024) | Influenced by operational efficiency and market conditions |

| New Energy Solutions (e.g., Biofuels) | Development Costs, Regulation, Willingness to Pay | US Biofuel Producer Program Tax Credits (2024) | Affects competitiveness and adoption |

4P's Marketing Mix Analysis Data Sources

Our Chevron 4P's Marketing Mix Analysis is grounded in a comprehensive review of official company disclosures, including SEC filings and investor presentations, alongside detailed industry reports and competitive intelligence. This ensures our insights into product offerings, pricing strategies, distribution networks, and promotional activities are robust and current.