Chevron Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chevron Bundle

Chevron operates in a highly competitive energy landscape, where intense rivalry among existing players significantly shapes market dynamics. Understanding the nuances of bargaining power held by both suppliers and buyers is crucial for navigating this complex industry.

The threat of new entrants and the availability of substitutes present constant challenges that Chevron must strategically address to maintain its market position. This brief overview only scratches the surface of these critical forces.

Unlock the full Porter's Five Forces Analysis to explore Chevron’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Chevron's reliance on a global network for specialized equipment, like advanced drilling rigs and refinery components, means concentrated suppliers of proprietary technology can wield significant power. For instance, in 2024, the energy sector saw increased demand for highly specialized subsea equipment, with a few key manufacturers controlling a substantial portion of the market, potentially driving up costs for major oil companies.

Chevron faces significant switching costs when dealing with suppliers for critical infrastructure and long-term service contracts. These costs can include substantial investments in re-tooling facilities, retraining specialized personnel, and the potential for considerable operational disruptions during a transition. For instance, changing providers for specialized offshore drilling equipment or long-term pipeline maintenance could easily run into millions of dollars in upfront expenses and lost production time.

While some of Chevron's inputs are highly specialized, a significant portion of its needs, particularly for commodities and standard services, are met by a vast and diverse global supplier base. This broad availability of alternative sources directly diminishes the bargaining power of any single supplier. For instance, in 2024, the global market for oil and gas exploration equipment, while competitive, offers numerous manufacturers, preventing any one from dictating terms.

Threat of Forward Integration by Suppliers

Suppliers to Chevron generally possess limited ability to integrate forward into the oil and gas value chain. This is due to the immense capital requirements, specialized technical knowledge, and extensive regulatory hurdles inherent in exploration, production, and refining. For instance, the upfront investment for a single offshore oil platform can easily run into billions of dollars, a scale most suppliers cannot readily absorb.

This low threat of forward integration means suppliers have less leverage to dictate terms or disrupt Chevron's operations. They are unlikely to become direct competitors by acquiring or developing their own upstream or downstream assets. This dynamic preserves Chevron's control over its core business activities and market positioning.

- Limited Supplier Capacity: Most suppliers to Chevron, such as equipment manufacturers or service providers, lack the substantial financial resources needed to undertake large-scale exploration or refining projects.

- Expertise Gap: The technical expertise required for complex operations like deepwater drilling or advanced petrochemical refining is highly specialized and not typically held by suppliers in these industries.

- Strategic Disincentives: For many suppliers, the core business focus remains on their existing product or service offerings, making forward integration a significant strategic deviation with uncertain returns.

- Reduced Supplier Leverage: The inability of suppliers to effectively integrate forward limits their bargaining power, as they cannot credibly threaten to enter Chevron's market and compete directly.

Importance of Supplier's Input to Chevron's Cost Structure

The cost of raw materials, especially crude oil and natural gas, represents a substantial portion of Chevron's expenses. In 2023, the cost of goods sold for Chevron reached approximately $146 billion, highlighting the significant impact of input prices.

Specialized services, such as drilling and exploration, also contribute heavily to Chevron's operational costs. These inputs are essential for maintaining production levels and exploring new reserves, directly influencing the company's bottom line.

- Input Costs: Crude oil and natural gas are the primary raw materials, forming a large segment of Chevron's cost of goods sold.

- Service Dependency: Specialized services are crucial for exploration, extraction, and refining operations.

- Profitability Impact: Fluctuations in input prices, driven by supplier power or market volatility, directly affect Chevron's profitability.

- Cost Management: Effective management of supplier relationships and input costs is critical for maintaining competitive margins.

Suppliers of highly specialized equipment and proprietary technology can exert significant bargaining power over Chevron, particularly when few alternatives exist. For example, in 2024, the demand for advanced subsea drilling components saw a few key manufacturers controlling a substantial market share, potentially leading to increased costs for major energy firms.

Chevron faces substantial switching costs for critical infrastructure and long-term service contracts, including re-tooling and potential operational disruptions. The upfront investment for a single offshore oil platform, for instance, can easily reach billions of dollars, a scale most suppliers cannot readily absorb, thereby limiting their ability to integrate forward into Chevron's business.

While Chevron relies on specialized inputs, a broad global supplier base for commodities and standard services mitigates individual supplier power. The cost of raw materials, like crude oil, represented a significant portion of Chevron's expenses, with its cost of goods sold reaching approximately $146 billion in 2023, underscoring the impact of input prices.

| Factor | Impact on Chevron | 2023 Data (USD Billions) |

|---|---|---|

| Specialized Equipment Suppliers | High bargaining power due to proprietary tech and few alternatives | N/A (Specific data not publicly available for individual supplier categories) |

| Switching Costs | High for critical infrastructure and long-term contracts | N/A (Difficult to quantify across all contracts) |

| Commodity/Standard Service Suppliers | Low bargaining power due to broad availability | Cost of Goods Sold: ~146 |

| Supplier Forward Integration Threat | Low due to capital and expertise requirements | N/A (Industry-wide characteristic) |

What is included in the product

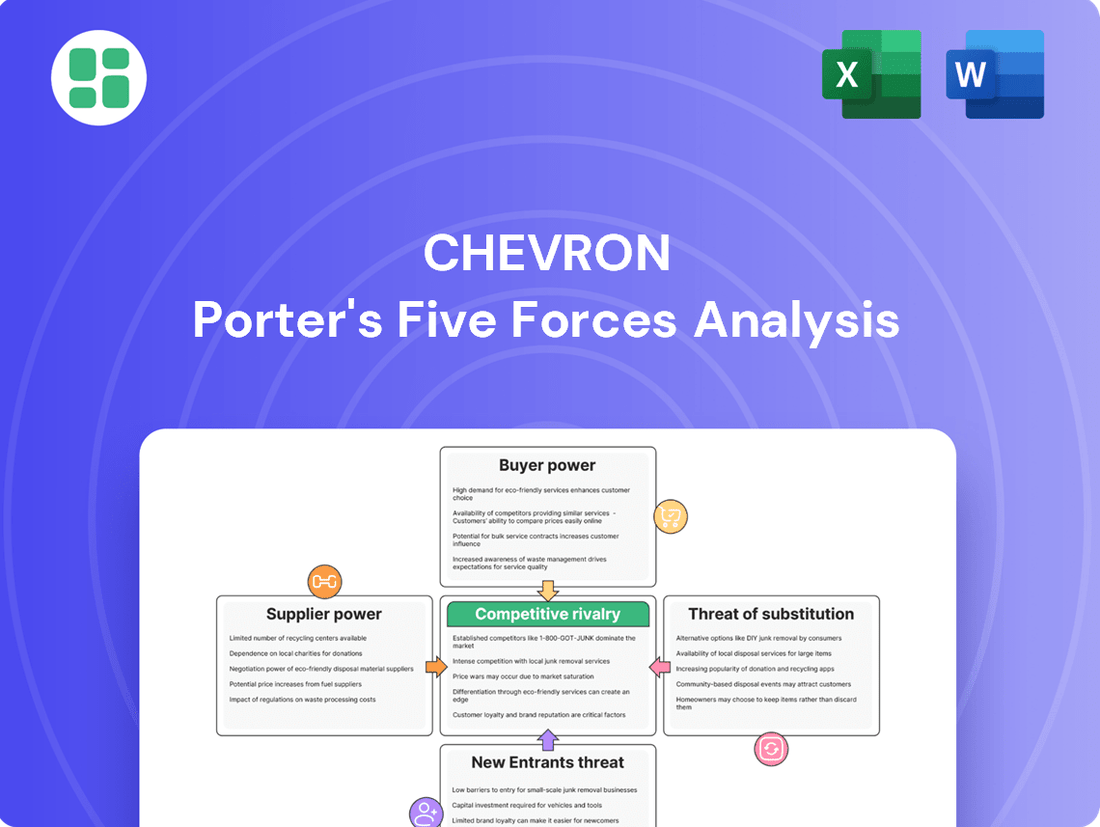

A comprehensive examination of the competitive forces impacting Chevron, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly visualize competitive pressures with a dynamic Porter's Five Forces model, allowing for rapid identification of strategic vulnerabilities and opportunities.

Customers Bargaining Power

Chevron's customers, from everyday drivers to large industrial buyers of petrochemicals, are quite sensitive to price. This is because refined petroleum products are often seen as commodities, meaning there isn't a huge difference in quality between suppliers.

Even small price changes can make a big difference in who a customer chooses to buy from. For example, in 2024, the average price of gasoline fluctuated significantly, and consumers often switched brands based on even a few cents per gallon difference. This price sensitivity gives customers considerable bargaining power, especially when there are many suppliers in the market.

Chevron's large industrial customers, airlines, and bulk distributors are significant purchasers of its products, a factor that grants them substantial bargaining power. These major buyers can negotiate for better pricing, discounts, or even tailored product offerings because of the sheer volume they commit to, representing a considerable portion of Chevron's revenue stream.

The rise of electric vehicles (EVs) and renewable energy sources directly impacts Chevron's customer base by providing viable alternatives to gasoline and diesel. For instance, by the end of 2023, global EV sales surpassed 13.5 million units, a significant jump from previous years. This growing adoption means consumers have more choices beyond traditional internal combustion engine vehicles, directly affecting demand for Chevron's core products.

Customer Information and Transparency

Customers in the energy sector, especially for standardized products like gasoline, benefit from significant price transparency. This access to market data empowers them to easily compare offerings across different suppliers. For instance, in 2024, readily available online price comparison tools for gasoline in major markets allowed consumers to identify the lowest prices within a few clicks, directly impacting their purchasing decisions and negotiation leverage.

This transparency effectively reduces information asymmetry, a key factor in the bargaining power of customers. When customers are well-informed about prevailing market rates and competitor pricing, they are in a stronger position to negotiate better terms or switch to more cost-effective providers. This dynamic is particularly pronounced in the retail fuel market, where price fluctuations are frequent and easily observable.

- Price Transparency: Consumers can easily access and compare fuel prices online, reducing information gaps.

- Market Data Availability: Widespread access to real-time market data for commodities like natural gas enhances customer knowledge.

- Negotiation Leverage: Informed customers can more effectively negotiate prices or switch suppliers, increasing their bargaining power.

- Reduced Switching Costs: For many energy products, the cost or effort to switch providers is relatively low, further empowering customers.

Threat of Backward Integration by Customers

The threat of backward integration by customers, while generally low for Chevron, can manifest with very large industrial clients or utility providers. These entities might explore producing their own energy or refining crude oil if the economics become compelling enough, though the substantial capital investment and regulatory complexities typically deter such moves. For instance, a major airline might consider hedging strategies that mimic backward integration rather than building its own refinery, given the astronomical costs involved.

While rare, the potential for significant customers to vertically integrate into energy production or refining represents a theoretical bargaining chip. This leverage is amplified if a customer's demand is substantial enough to justify the immense upfront costs and operational expertise required.

- Low Likelihood: The immense capital expenditure, estimated in billions of dollars for a refinery, and complex regulatory approvals make backward integration by customers a seldom-seen threat in the oil and gas sector.

- Theoretical Leverage: For exceptionally large buyers of Chevron's products, the mere possibility of exploring backward integration provides a degree of negotiation power, especially during periods of high energy prices.

- Focus on Alternatives: Instead of full integration, large customers often pursue alternative strategies like long-term supply contracts, hedging, or investing in energy efficiency to mitigate their reliance on suppliers like Chevron.

Chevron's customers, particularly those purchasing refined products like gasoline, exhibit significant price sensitivity. This sensitivity is amplified by the commodity nature of many energy products, leading to a strong inclination to switch suppliers based on minor price differences. For example, in 2024, readily available online price comparison tools for gasoline in major markets allowed consumers to identify the lowest prices within a few clicks, directly impacting their purchasing decisions and negotiation leverage.

Large industrial customers and distributors hold considerable bargaining power due to the sheer volume of their purchases, which can represent a substantial portion of Chevron's revenue. These buyers can negotiate for better pricing and tailored offerings. The growing availability of alternatives, such as electric vehicles, also bolsters customer power by providing viable substitutes for traditional fuels, as evidenced by the more than 13.5 million global EV sales by the end of 2023.

| Factor | Impact on Bargaining Power | Example/Data (2024 unless specified) |

|---|---|---|

| Price Sensitivity | High | Consumers switching brands based on a few cents per gallon difference in gasoline prices. |

| Availability of Alternatives | Increasing | Global EV sales surpassed 13.5 million units by end of 2023, offering alternatives to gasoline. |

| Volume of Purchase | High for Major Customers | Large industrial clients can negotiate significant discounts due to bulk purchasing. |

| Price Transparency | High | Online price comparison tools for fuel allow easy identification of lowest prices. |

Preview Before You Purchase

Chevron Porter's Five Forces Analysis

This preview shows the exact Chevron Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive breakdown of competitive pressures within the oil and gas industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. This detailed report is professionally formatted and ready for your immediate use and strategic planning.

Rivalry Among Competitors

Chevron faces intense competition from a multitude of global energy giants. Major supermajors like ExxonMobil, Shell, BP, and TotalEnergies, along with state-owned behemoths such as Saudi Aramco and ADNOC, are all significant players. This crowded landscape means constant pressure on market share and resource acquisition.

While global energy demand is projected to increase, the traditional oil and gas sector is experiencing a decelerating growth rate. This slowdown is largely driven by the accelerating energy transition towards renewables and ongoing improvements in energy efficiency. For instance, the International Energy Agency (IEA) forecast for 2024 suggests a modest increase in oil demand, but the long-term trajectory points towards peak oil demand in the coming years.

A slower industry growth rate inherently intensifies competitive rivalry among existing players. When the overall market pie is growing less rapidly, companies are compelled to fight harder for a larger slice of that more stagnant or even shrinking segment. This dynamic forces companies like Chevron to focus on operational efficiency, cost control, and strategic market positioning to maintain or grow their market share.

Petroleum products like gasoline and diesel are largely seen as commodities, making it difficult for companies such as Chevron to stand out based on product features alone. This means competition often boils down to price, operational efficiency, and the strength of the brand. In 2023, Chevron's average refined product sales volume was 5.4 million barrels per day, highlighting the sheer scale of operations needed to compete.

High Fixed Costs and Exit Barriers

The oil and gas sector, where Chevron operates, is defined by colossal fixed costs. Think about the billions of dollars needed for exploration, drilling, refining facilities, and the vast pipeline networks. These aren't costs you can easily shed.

These substantial upfront investments create significant exit barriers. Decommissioning aging platforms, fulfilling long-term supply contracts, and environmental remediation obligations all make it incredibly difficult and expensive for companies to simply walk away from their operations. This locks companies into the industry, even when market conditions are tough.

Consequently, companies like Chevron are compelled to keep producing and selling, even during periods of low oil prices, to try and recoup those massive fixed costs. This persistent operational pressure naturally fuels intense competition among industry players, as everyone strives to maintain market share and cover their substantial investments.

- High Capital Expenditure: In 2023, Chevron reported capital and exploratory expenditures of $11.5 billion, underscoring the significant ongoing investment required to maintain and expand operations.

- Asset Decommissioning: The cost of safely shutting down and restoring sites after production ceases can run into hundreds of millions, even billions, for large-scale operations.

- Long-Term Contracts: Many oil and gas companies are bound by long-term agreements for supply, transportation, and processing, which necessitate continued operation regardless of short-term market fluctuations.

- Industry Consolidation: While competition remains, the high costs can also drive consolidation, with larger players acquiring smaller ones to achieve economies of scale and better manage fixed assets.

Strategic Stakes and Diversification Efforts

Major energy players like Chevron are actively diversifying into renewable energy and lower-carbon technologies. This strategic pivot intensifies competition, as companies now vie for market share in both established fossil fuel sectors and nascent clean energy markets.

For instance, in 2023, Chevron announced significant investments in renewable natural gas projects and carbon capture technologies, aiming to bolster its low-carbon portfolio. This move directly challenges competitors who are also pursuing similar diversification strategies, creating a more complex competitive landscape.

- Renewable Energy Investments: Chevron's 2023 capital expenditure for low-carbon initiatives, including renewables and hydrogen, reached $2 billion, a notable increase from previous years.

- Carbon Capture and Storage (CCS): The company is involved in several large-scale CCS projects, such as the proposed project in the San Joaquin Valley, California, which aims to store millions of tons of CO2 annually.

- Competitive Response: Competitors like ExxonMobil and Shell have also announced substantial investments in low-carbon solutions, indicating a broad industry trend and heightened rivalry in these emerging areas.

Chevron operates in a highly competitive environment with numerous global energy giants and state-owned enterprises vying for market share. The industry's decelerating growth, driven by the energy transition, intensifies rivalry as companies fight for a larger portion of a slower-growing market. This necessitates a focus on efficiency and cost control.

The commoditized nature of petroleum products means competition largely centers on price and operational excellence, with companies like Chevron needing vast scale, as evidenced by their 5.4 million barrels per day refined product sales volume in 2023.

High capital expenditures and significant exit barriers, including decommissioning costs and long-term contracts, compel companies to maintain operations even in challenging markets, further fueling intense competition.

Chevron's diversification into renewables and lower-carbon technologies, with $2 billion invested in such initiatives in 2023, creates new competitive fronts against rivals also pursuing similar strategies.

| Competitor | 2023 Revenue (approx. USD bn) | 2023 Capital Expenditure (approx. USD bn) | Low-Carbon Investment (2023, approx. USD bn) |

| ExxonMobil | 344.6 | 23.0 | 1.0-2.0 (estimated) |

| Shell | 327.0 | 23.0 | 3.0-4.0 (estimated) |

| BP | 213.0 | 17.0 | 3.0-4.0 (estimated) |

| TotalEnergies | 214.0 | 16.0 | 2.0-3.0 (estimated) |

SSubstitutes Threaten

Renewable energy sources, such as solar and wind power, are rapidly becoming more affordable and accessible. This trend presents a substantial long-term challenge to traditional fossil fuel businesses like Chevron, especially in the power generation sector.

By 2025, global investment in clean energy is projected to be twice the amount directed towards fossil fuels. This significant shift in capital allocation underscores the growing viability and competitive threat posed by renewables.

Rapid advancements in electric vehicle (EV) technology are a significant threat of substitution for traditional gasoline and diesel. As EV performance improves and charging infrastructure expands, consumer demand for internal combustion engine vehicles is likely to decline.

Global EV sales are projected to reach over 30 million units in 2024, a substantial increase from previous years, directly impacting the demand for refined petroleum products. This growing adoption rate suggests a tangible shift in transportation energy sources.

The increasing development and commercialization of alternative fuels like biofuels, hydrogen, and renewable natural gas (RNG) directly challenge the demand for traditional oil and gas products. These alternatives offer viable substitutes across various sectors, from transportation to industrial processes.

While still in their nascent stages for widespread adoption, these cleaner energy sources are experiencing growing momentum. This growth is significantly bolstered by supportive government policies, such as tax credits and mandates, and continuous technological advancements that improve efficiency and cost-effectiveness. For instance, in 2024, global investment in clean energy technologies, including alternative fuels, continued to climb, indicating a strong market signal towards decarbonization.

Government Policies and Regulations Promoting Clean Energy

Governments worldwide are increasingly implementing policies that favor clean energy, directly challenging fossil fuel reliance. For instance, the United States' Inflation Reduction Act of 2022, with its substantial clean energy tax credits, is a prime example of how legislative action accelerates the adoption of alternatives. This trend puts pressure on traditional energy companies like Chevron by making substitute technologies more economically viable and attractive.

These government initiatives, including mandates for renewable energy portfolios and carbon pricing mechanisms, effectively raise the cost of doing business for fossil fuel producers while simultaneously lowering the cost of their competitors. By 2024, many nations have set ambitious targets for renewable energy integration, further solidifying the competitive landscape against hydrocarbons.

- Accelerated Adoption: Government subsidies and mandates directly boost the competitiveness of renewable energy sources, such as solar and wind power, making them more attractive alternatives to traditional fuels.

- Regulatory Headwinds: Increasing environmental regulations and carbon pricing policies can raise operational costs for fossil fuel companies, enhancing the relative attractiveness of cleaner substitutes.

- Market Shift: Global policy trends indicate a sustained shift towards decarbonization, signaling a long-term threat to the market share of fossil fuels in the energy mix.

Public Awareness and Environmental Concerns

Growing public awareness of climate change is a significant threat of substitutes for Chevron. Consumers are increasingly seeking greener alternatives, pushing demand away from traditional fossil fuels.

This societal pressure directly influences investment trends, with capital flowing towards renewable energy sources rather than oil and gas. For instance, global investment in clean energy technologies reached an estimated $1.7 trillion in 2023, a substantial increase that signals a clear shift.

- Rising consumer demand for electric vehicles (EVs) directly reduces gasoline consumption. By the end of 2023, global EV sales surpassed 13 million units, a 35% increase from the previous year.

- Increased adoption of renewable energy sources like solar and wind power for electricity generation displaces the need for natural gas and oil in power plants. In 2023, renewable energy sources accounted for approximately 30% of global electricity generation.

- Government policies and regulations aimed at reducing carbon emissions further incentivize the use of substitutes. Many countries are setting ambitious targets for renewable energy integration and phasing out internal combustion engine vehicles.

The threat of substitutes for Chevron remains a significant challenge, driven by the accelerating adoption of cleaner energy alternatives across various sectors. These substitutes directly impact the demand for Chevron's core products, from gasoline to natural gas.

The energy transition is gaining considerable momentum, with investments and policy support heavily favoring renewable sources. This shift is not just a future prospect but a present reality reshaping the energy landscape.

Technological advancements and supportive government policies are making substitutes like electric vehicles and renewable power generation increasingly cost-competitive and accessible, directly eroding the traditional market share of fossil fuels.

| Substitute | Impact on Demand | 2024 Data/Projections |

|---|---|---|

| Electric Vehicles (EVs) | Reduces demand for gasoline and diesel | Global EV sales projected to exceed 30 million units in 2024. |

| Renewable Energy (Solar/Wind) | Displaces natural gas and oil in power generation | Renewable energy sources accounted for approximately 30% of global electricity generation in 2023. |

| Alternative Fuels (Hydrogen, Biofuels) | Offers substitutes in transportation and industry | Global investment in clean energy technologies, including alternative fuels, continued to climb in 2024. |

Entrants Threaten

The oil and gas sector, where Chevron operates, demands staggering capital outlays. Think billions for exploration, drilling, and building pipelines or refineries. For instance, a single offshore platform can cost upwards of $1 billion, and a new refinery project can easily exceed $10 billion. These massive upfront costs create a significant hurdle, effectively shutting out many aspiring companies before they even begin.

New entrants in the oil and gas sector confront a formidable array of regulatory challenges. These include rigorous environmental impact assessments, adherence to stringent safety standards, and the necessity of obtaining numerous permits for every stage of operation, from exploration to transportation. For instance, in 2024, the average time to secure all necessary permits for a new offshore drilling project could extend over two years, with costs easily reaching millions of dollars.

The sheer complexity and cost associated with navigating these extensive regulatory hurdles act as a significant deterrent. This time-consuming and capital-intensive process effectively limits the number of new companies that can realistically enter the market, thereby reducing the threat of new entrants for established players like Chevron.

Established energy giants like Chevron have spent decades building and integrating extensive distribution networks. This includes a vast array of pipelines, sophisticated refineries, and a widespread presence of retail service stations. For instance, in 2023, Chevron operated approximately 7,700 retail stations globally, a testament to its entrenched market access.

New entrants face a formidable challenge in replicating such an established infrastructure. The sheer capital investment and time required to build comparable logistics and retail footprints are immense. This difficulty in efficiently transporting and marketing products creates a significant barrier to entry, protecting incumbent players.

Economies of Scale and Experience Curve

Chevron's vast operational scale, encompassing massive upstream exploration and downstream refining, creates substantial economies of scale. This means Chevron can produce oil and gas at a lower cost per barrel than smaller competitors. For instance, in 2023, Chevron's average production cost per barrel of oil equivalent (BOE) was reported to be around $29.40, a figure that includes significant investments in infrastructure and technology that new entrants would struggle to replicate.

The experience curve further solidifies Chevron's competitive advantage. Years of operational experience have allowed Chevron to optimize processes, improve efficiency, and reduce waste, leading to further cost reductions. This accumulated knowledge in areas like deepwater drilling and complex refining operations is not easily transferable or replicable by newcomers. Without this established experience, new entrants face higher initial costs and a steeper learning curve, making it challenging to achieve cost parity.

- Economies of Scale: Chevron's integrated operations, from exploration to refining, allow for significant cost efficiencies, lowering per-unit production costs.

- Experience Curve: Decades of operational expertise enable Chevron to optimize processes and reduce costs, a benefit not available to new market entrants.

- Cost Disadvantage: New entrants would face a considerable cost disadvantage due to the lack of scale and accumulated experience, hindering their ability to compete on price.

- Capital Intensity: The high capital requirements for establishing the necessary infrastructure and technology create a substantial barrier for potential new competitors.

Brand Loyalty and Established Relationships

While petroleum products are largely seen as commodities, established brands like Chevron have cultivated decades of brand recognition and customer loyalty. This deep-seated trust, built over many years, makes it difficult for new entrants to gain market acceptance. For instance, in 2024, Chevron's brand value was estimated to be in the billions, a significant barrier for any newcomer.

Furthermore, Chevron has nurtured long-standing relationships with industrial clients and government entities. These established partnerships often involve complex contracts and proven reliability, creating a formidable hurdle for new competitors seeking to displace them. Breaking into these established networks requires more than just competitive pricing; it demands a proven track record and deep-seated trust.

- Brand Recognition: Decades of advertising and consistent service have solidified Chevron's brand in consumers' minds.

- Customer Loyalty: Repeat business from both individual consumers and large industrial clients demonstrates strong loyalty.

- Established Client Base: Long-term contracts with key industrial sectors and government bodies provide a stable revenue stream.

- Trust and Reliability: A history of dependable supply and product quality builds trust that new entrants must work hard to replicate.

The threat of new entrants for Chevron is significantly low due to extremely high capital requirements. Establishing operations in the oil and gas sector demands billions for exploration, infrastructure, and technology. For example, a new refinery can cost over $10 billion, a barrier few can overcome.

Navigating the complex and lengthy regulatory landscape, which includes environmental assessments and safety standards, further deters new players. In 2024, obtaining permits for a new offshore project could take over two years and cost millions. This regulatory burden protects established companies like Chevron.

New entrants also face the challenge of replicating Chevron's extensive distribution networks, including pipelines and thousands of retail stations. Building such a logistical footprint is both capital-intensive and time-consuming, making it difficult to compete with established market access.

Chevron benefits from significant economies of scale and an experience curve advantage. In 2023, their production cost per barrel was around $29.40, a level difficult for newcomers to match without similar operational scale and optimized processes gained over decades.

| Barrier Type | Description | Example Data (2023/2024) |

|---|---|---|

| Capital Requirements | Staggering upfront investment for exploration, drilling, and infrastructure. | New refinery cost: >$10 billion; Offshore platform cost: >$1 billion |

| Regulatory Hurdles | Extensive environmental, safety, and permitting processes. | Permit acquisition time: >2 years (2024); Permit costs: Millions of dollars |

| Distribution Networks | Established pipelines, refineries, and retail stations. | Chevron retail stations globally: ~7,700 (2023) |

| Economies of Scale & Experience | Lower per-unit costs due to large-scale operations and optimized processes. | Chevron production cost per BOE: ~$29.40 (2023) |

Porter's Five Forces Analysis Data Sources

Our Chevron Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Chevron's annual reports and SEC filings, as well as industry-specific market research from firms like Wood Mackenzie and IHS Markit. We also incorporate macroeconomic data from sources such as the EIA and OPEC to understand broader market influences.