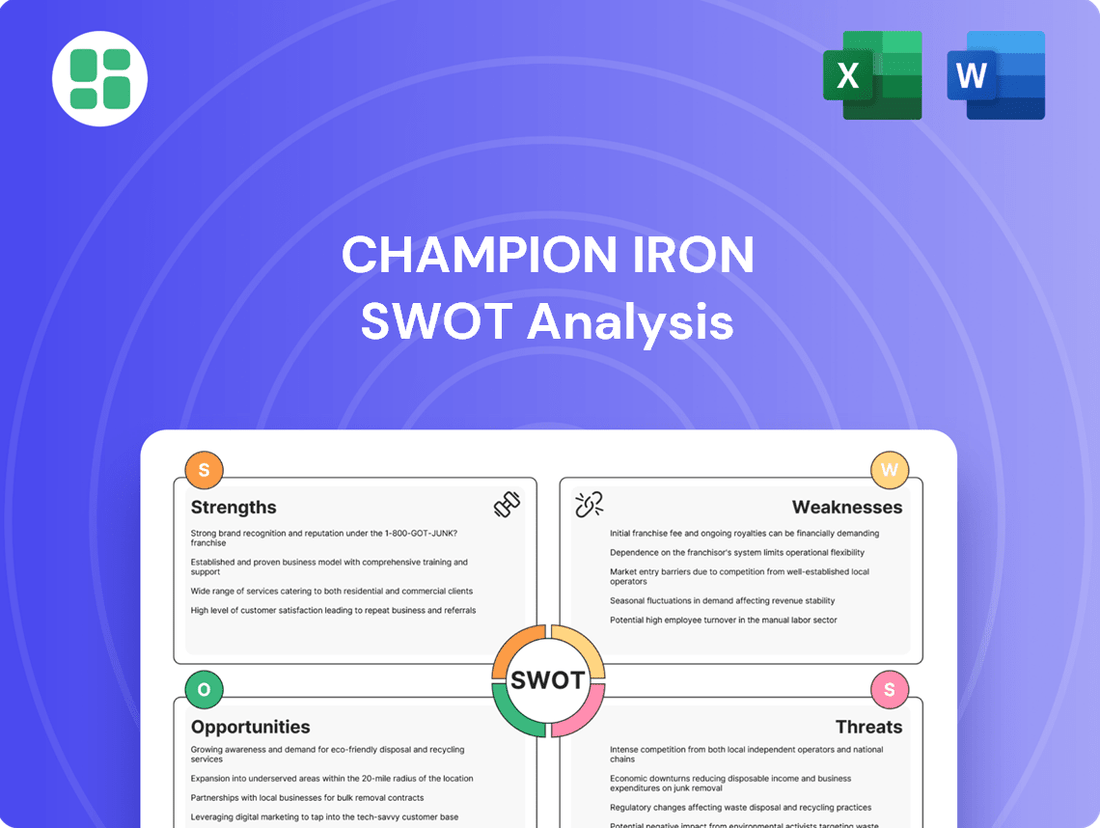

Champion Iron SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Champion Iron Bundle

Champion Iron boasts significant strengths in its high-quality iron ore reserves and efficient production capabilities, but faces opportunities in expanding its market reach. However, understanding the full picture of its potential threats and weaknesses is crucial for strategic decision-making.

Discover the complete picture behind Champion Iron’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors looking to capitalize on its potential.

Strengths

Champion Iron's Bloom Lake Mine is a standout asset, consistently producing a high-purity iron ore concentrate. This premium product, with an iron content often reaching up to 69% Fe, is highly sought after for direct reduction (DR) steelmaking, a cleaner production method. Its low contaminant levels translate directly into market premiums, especially as the steel industry increasingly prioritizes decarbonization.

Champion Iron's strategic location in Quebec, Canada, offers a significant advantage by situating operations within a stable and well-regulated mining jurisdiction. This minimizes exposure to the geopolitical uncertainties that can impact mining ventures in other parts of the world, providing a foundation for operational reliability and long-term security.

The company leverages Quebec's access to abundant and cost-effective renewable hydroelectric power from Hydro-Québec. This not only supports sustainable mining practices and a reduced carbon footprint, a growing factor for environmentally conscious investors and buyers, but also contributes to operational cost efficiency.

Champion Iron boasts a proven operational track record, highlighted by the successful, on-time and on-budget recommissioning of Bloom Lake and its subsequent Phase II expansion, which effectively doubled its nameplate capacity to 15 million tonnes per annum (Mtpa). This demonstrates a strong ability to execute complex projects efficiently.

The company is not resting on its laurels, actively pursuing debottlenecking initiatives to push production beyond the current 15 Mtpa capacity. This forward-looking approach signals a commitment to continuous improvement and maximizing asset potential.

Further underscoring its expansion capabilities, Champion Iron is on track for the commissioning of its Direct Reduction Pellet Feed (DRPF) project in the latter half of 2025. This project will upgrade half of Bloom Lake's output to DR quality, a significant step in enhancing product value and market reach.

Alignment with Green Steel Demand

Champion Iron is well-positioned to benefit from the increasing global demand for green steel. Its high-purity iron ore is a key ingredient for low-carbon steelmaking methods like Electric Arc Furnaces (EAFs) and Direct Reduced Iron (DRI). This aligns perfectly with the steel industry's push to decarbonize.

The company's focus on producing Direct Reduced Iron (DR)-grade ore directly supports this critical industry-wide trend. As steel manufacturers invest in cleaner technologies, the need for premium quality inputs like Champion's product is set to rise significantly.

- Growing Green Steel Market: The global green steel market is projected to grow substantially, driven by environmental regulations and consumer demand for sustainable products.

- Premium Ore Quality: Champion Iron's high-purity iron ore is essential for EAF and DRI processes, which are central to green steel production.

- Industry Decarbonization: The steel sector's commitment to reducing its carbon footprint directly translates into increased demand for Champion's DR-grade ore.

Strong Financial Position and Liquidity

Champion Iron boasts a strong financial position, underpinned by substantial cash reserves and readily available liquidity. This financial resilience allows the company to confidently pursue its expansion plans, including the DRPF and Kami projects, while also providing a buffer against market volatility and operational hurdles.

The company's commitment to financial stability is further evidenced by recent strategic maneuvers. For instance, a US$500 million Senior Unsecured Notes offering in late 2023 significantly bolstered its balance sheet. This move not only enhances its capacity to fund growth but also fortifies its long-term financial health, positioning it well for future opportunities and challenges.

- Robust Cash Position: Champion Iron consistently maintains strong cash and cash equivalents, providing immediate operational and investment flexibility.

- Ample Liquidity: Significant available credit facilities and cash reserves ensure the company can meet its financial obligations and pursue strategic growth.

- Debt Management: Successful refinancing, such as the US$500 million Senior Unsecured Notes, demonstrates prudent debt management and improved financial stability.

- Funding Capacity: The company's financial strength enables it to self-fund key development projects and navigate market downturns effectively.

Champion Iron's primary strength lies in its high-quality iron ore concentrate, frequently achieving up to 69% iron content. This premium product is highly valued for direct reduction steelmaking, a cleaner process, and commands market premiums due to its low impurities. The company's strategic location in Quebec offers stability and access to cost-effective renewable hydroelectric power, supporting both operational efficiency and sustainability goals.

The company has a proven track record of successful project execution, notably the recommissioning and Phase II expansion of the Bloom Lake Mine, which doubled its capacity to 15 million tonnes per annum. Ongoing debottlenecking initiatives aim to further increase production beyond this capacity. Additionally, the upcoming Direct Reduction Pellet Feed (DRPF) project, slated for the latter half of 2025, will upgrade half of Bloom Lake's output to DR quality, enhancing product value and market appeal.

Champion Iron is financially robust, supported by significant cash reserves and liquidity, enabling it to pursue expansion projects like DRPF and Kami. A US$500 million Senior Unsecured Notes offering in late 2023 further strengthened its balance sheet, demonstrating prudent financial management and positioning the company for future growth and market challenges.

| Metric | Value (as of latest reported) | Commentary |

|---|---|---|

| Bloom Lake Capacity | 15 Mtpa (nameplate) | Phase II expansion successfully completed. |

| Iron Ore Purity | Up to 69% Fe | Premium quality for DR steelmaking. |

| Hydro-Québec Power Cost | Cost-effective | Supports operational cost efficiency and sustainability. |

| Cash and Equivalents | Significant | Provides financial flexibility for growth and stability. |

| Senior Unsecured Notes | US$500 million (issued late 2023) | Strengthened balance sheet and funding capacity. |

What is included in the product

This analysis maps out Champion Iron’s market strengths, operational gaps, and external risks.

Offers a clear, structured framework to identify and address Champion Iron's market vulnerabilities and competitive challenges.

Weaknesses

Champion Iron's significant reliance on its Bloom Lake Mine presents a notable weakness. This concentration means that any operational hiccups, unexpected geological issues, or localized regulatory shifts at Bloom Lake could have a disproportionately severe impact on the company's total output and financial health. For instance, in the fiscal year ending March 31, 2024, Bloom Lake accounted for the vast majority of Champion Iron's iron ore production.

Champion Iron's primary weakness lies in its direct exposure to the unpredictable swings in global iron ore prices. As a commodity producer, its financial performance is inextricably linked to these market fluctuations.

Looking ahead to 2025, market analysts anticipate potential downward pressure on iron ore prices. This is largely attributed to anticipated oversupply in the market and a potentially tempered demand from major consumers like China, which could impact Champion Iron's revenue streams.

These price volatilities create significant challenges for Champion Iron, leading to unpredictable variations in its financial results and complicating the accuracy of revenue forecasting for investors and management alike.

Champion Iron faces ongoing logistical hurdles, notably with rail transport from its Bloom Lake Mine. This has resulted in substantial stockpiles of iron ore concentrate, impacting its ability to efficiently deliver product to global markets.

The company's reliance on third-party rail operators creates a dependency that can affect shipment volumes and increase operational costs, as seen in the ongoing efforts to optimize these services throughout 2024 and into 2025.

Operational Cost Pressures and Ore Characteristics

Champion Iron has navigated increased operational costs, particularly in the 2024 fiscal year, driven by essential plant maintenance and strategic shifts in ore blending. These operational adjustments, coupled with the inherent hardness of ore at the Bloom Lake mine, have presented ongoing challenges. The harder ore necessitates more intensive grinding, directly impacting energy consumption and processing efficiency, thereby elevating per-tonne production expenses.

These ore characteristics require constant adaptation in mining and processing techniques to maintain optimal throughput. For instance, the company has noted the need for continuous operational adjustments to manage these variable ore qualities effectively. This can lead to fluctuations in efficiency and contribute to higher unit operating costs, a key area of focus for cost management strategies.

- Elevated Unit Operating Costs: Faced increased per-tonne expenses in recent periods.

- Bloom Lake Ore Hardness: Encountered harder ore at Bloom Lake, impacting grinding efficiency.

- Operational Adjustments: Required ongoing changes due to ore blending and maintenance schedules.

- Throughput Challenges: Harder ore can affect overall production volume and increase per-tonne costs.

Fluctuating Earnings and Market Sentiment

Champion Iron's financial performance can be quite unpredictable, with recent quarterly earnings and net income showing significant fluctuations. This volatility is often tied to provisional pricing adjustments, which are common in the iron ore industry, and the overall health of the global market. For instance, in the fiscal third quarter of 2024, the company reported a net income of $164.5 million, a notable decrease from the $328.9 million recorded in the same period of the previous year, highlighting this sensitivity.

Investor sentiment and the company's valuation are also susceptible to shifts in market perception and immediate financial results. While analyst ratings tend to be favorable, there have been instances of price target reductions, reflecting a cautious approach from some market participants. The stock's performance has, at times, lagged behind broader market indices and industry peers, underscoring how sensitive its valuation can be to short-term financial reports and prevailing market moods.

- Quarterly Earnings Volatility: Net income saw a significant drop from $328.9 million in Q3 FY23 to $164.5 million in Q3 FY24.

- Market Sentiment Impact: Stock performance has occasionally underperformed the market and industry due to sensitivity to financial results.

- Analyst Revisions: While generally positive, some analysts have issued price target reductions, indicating cautious sentiment.

Champion Iron's significant reliance on its Bloom Lake Mine is a key weakness. This concentration means operational issues or localized regulatory changes at Bloom Lake can disproportionately impact the company's total output and financial health. For instance, in the fiscal year ending March 31, 2024, Bloom Lake accounted for the vast majority of Champion Iron's iron ore production, underscoring this dependency.

The company faces ongoing logistical challenges, particularly with rail transport from its Bloom Lake Mine, leading to substantial stockpiles of iron ore concentrate and impacting efficient global delivery. This reliance on third-party rail operators can affect shipment volumes and increase operational costs, as evidenced by ongoing efforts to optimize these services throughout 2024 and into 2025.

Champion Iron's financial performance is subject to considerable volatility, with recent quarterly earnings showing significant fluctuations. This is often tied to provisional pricing adjustments common in the iron ore industry and the overall health of the global market. For example, in the fiscal third quarter of 2024, net income was $164.5 million, a notable decrease from $328.9 million in the same period of the prior year.

| Metric | Q3 FY24 | Q3 FY23 |

|---|---|---|

| Net Income (USD millions) | 164.5 | 328.9 |

| Iron Ore Production (Mt) | 3.1 | 3.0 |

| Average Selling Price (USD/tonne) | 116.7 | 135.1 |

Full Version Awaits

Champion Iron SWOT Analysis

The preview below is taken directly from the full Champion Iron SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive understanding of the company's strategic position.

This is a real excerpt from the complete Champion Iron SWOT analysis. Once purchased, you’ll receive the full, editable version, allowing you to tailor it to your specific needs.

You’re viewing a live preview of the actual Champion Iron SWOT analysis file. The complete version becomes available after checkout, providing all the detailed insights you need.

Opportunities

The global steel industry's push for decarbonization is fueling a substantial rise in demand for high-purity iron ore, especially Direct Reduction (DR) grade pellets. This trend directly benefits Champion Iron, as its product is ideal for these environmentally friendlier steelmaking methods.

Champion Iron is positioned to capitalize on a premium pricing structure and gain market share as steel manufacturers increasingly prioritize emissions reduction. This shift is a key opportunity for the company in the evolving steel market.

Champion Iron is actively pursuing opportunities to boost production at its Bloom Lake Mine, aiming to surpass the current 15 million tonnes per annum (Mtpa) capacity through debottlenecking and targeted investments. This expansion strategy is designed to unlock greater operational efficiency and output.

A key initiative is the DRPF project, slated for commissioning in late 2025. This project will strategically convert half of Bloom Lake's existing capacity to produce higher-value Direct Reduction Grade (DRG) pellet feed, thereby maximizing both the mine's overall output and the market value of its products.

The Kami Project represents a substantial growth opportunity for Champion Iron, poised to contribute approximately 9 million tons of DR grade iron ore annually, significantly bolstering production capacity.

A key development is the definitive framework agreement granting Nippon Steel Corporation and Sojitz Corporation a 49% stake in Kami, which is expected to close in early 2025. This partnership is crucial for de-risking the project's financial burden and paving the way for its successful advancement.

This strategic alliance not only secures vital funding but also leverages the expertise of established global players, creating a clear and actionable roadmap for unlocking Kami's considerable future growth potential.

Strategic Partnerships and Customer Diversification

Champion Iron's strategic partnerships are crucial for de-risking large capital expenditures and securing stable revenue streams. A prime example is the recent agreement for the Kami Project, which aims to solidify long-term off-take arrangements, offering a predictable income flow. This approach is vital in the capital-intensive mining sector.

The company's diversified global customer base, spanning Asia, Europe, and North America, presents significant opportunities for deeper market penetration. By cultivating these relationships, Champion Iron can reduce its dependence on any single market or customer, enhancing financial resilience. For instance, in the fiscal year ending March 31, 2024, Champion Iron's sales were distributed across multiple regions, with Asia representing a substantial portion.

- Strategic Alliances: Agreements like the Kami Project partnership reduce capital investment risks and secure long-term sales contracts, ensuring revenue stability.

- Global Reach: Existing customers across Asia, Europe, and North America provide a foundation for expanding market share and diversifying revenue sources.

- Market Penetration: Further engagement with current clients in key geographies can lead to increased sales volumes and a stronger competitive position.

- Reduced Reliance: Diversifying its customer portfolio mitigates the impact of regional economic downturns or shifts in demand from individual buyers.

Leveraging Green Steel Technologies

The ongoing technological evolution in steelmaking, particularly the emergence of hydrogen-based Direct Reduced Iron (H2-DRI) and Electric Arc Furnaces (EAFs), creates a strong tailwind for Champion Iron. These technologies are integral to low-carbon steel production and require premium iron ore inputs. As these innovations gain wider adoption globally, Champion Iron's high-grade product will become even more integral to the supply chain.

The global steel industry is actively pursuing decarbonization, with significant investments in green steel technologies. For instance, by 2024, the European Union aims to have at least 30% of its steel production utilizing low-carbon methods. Champion Iron’s high-quality iron ore, with its low impurity profile, is ideally suited for these emerging H2-DRI and EAF processes, which demand superior raw materials to achieve their environmental and performance goals.

This shift positions Champion Iron favorably, as the demand for high-grade iron ore is expected to rise. By 2025, projections suggest that the market share of green steel produced via DRI/EAF routes could increase by 15-20% in key markets. This presents a substantial opportunity for Champion Iron to capitalize on its existing production capabilities and secure premium pricing for its product.

- Technological Shift: Growing adoption of H2-DRI and EAF technologies in steelmaking.

- Input Requirements: These green steel methods necessitate high-grade iron ore.

- Market Advantage: Champion Iron's premium product aligns perfectly with these evolving industry needs.

- Demand Growth: Increased demand for low-carbon steel production will drive the need for high-quality iron ore inputs.

Champion Iron is well-positioned to benefit from the global steel industry's decarbonization efforts, which are increasing demand for high-purity iron ore suitable for Direct Reduction (DR) grade pellets. The company's Bloom Lake Mine expansion and the development of the Kami Project, which aims to produce 9 million tons of DR grade iron ore annually, are key growth drivers. Strategic partnerships, like the one with Nippon Steel Corporation and Sojitz Corporation for Kami, are crucial for de-risking capital expenditures and securing long-term revenue streams.

The company's diversified global customer base across Asia, Europe, and North America offers significant opportunities for market penetration and revenue diversification. Furthermore, the increasing adoption of green steelmaking technologies, such as hydrogen-based Direct Reduced Iron (H2-DRI) and Electric Arc Furnaces (EAFs), creates a strong tailwind for Champion Iron's premium, low-impurity iron ore product. By 2025, projections indicate a 15-20% potential increase in green steel production via DRI/EAF routes in key markets, directly benefiting suppliers of high-quality inputs.

| Opportunity | Description | Impact | Key Data/Projections |

|---|---|---|---|

| Decarbonization Demand | Rising demand for DR-grade iron ore for low-carbon steelmaking. | Premium pricing, increased market share. | EU aiming for 30% low-carbon steel production by 2024. |

| Bloom Lake Expansion | Increasing production capacity beyond 15 Mtpa through debottlenecking. | Enhanced operational efficiency and output. | Targeting increased capacity post-2024. |

| DRPF Project | Converting half of Bloom Lake's capacity to DR-grade pellet feed. | Maximizing product value and output. | Commissioning slated for late 2025. |

| Kami Project | Developing a new mine to produce 9 million tons of DR grade iron ore annually. | Significant production capacity boost. | Partnership with Nippon Steel and Sojitz expected to close early 2025. |

| Global Market Diversification | Leveraging existing customers in Asia, Europe, and North America. | Reduced reliance on single markets, enhanced financial resilience. | FY24 sales distributed across multiple regions. |

| Green Steel Technology Adoption | Alignment with H2-DRI and EAF technologies. | Integral role in the low-carbon steel supply chain. | Potential 15-20% market share increase for green steel by 2025. |

Threats

The iron ore market is bracing for continued price pressure and volatility through 2025. This stems from anticipated oversupply and a potential softening in global demand, even for high-grade ore. For Champion Iron, this broad market trend means its realized selling prices and profit margins could be significantly impacted, irrespective of its product quality.

China's persistent real estate sector struggles present a substantial threat to Champion Iron, as it remains the world's dominant iron ore consumer. A continued slump in Chinese construction activity directly translates to weaker demand for steel, consequently dampening iron ore import volumes and potentially pressuring prices.

The iron ore market faces a significant threat from projected oversupply in 2025, driven by new project developments and expanded output from established producers. This influx of supply could pressure prices and make it harder for companies like Champion Iron to maintain their premium for high-grade ore.

Furthermore, a shift in demand towards lower-cost, mid-grade iron ore by some steel mills exacerbates this competitive pressure. This trend could diminish the pricing advantage Champion Iron has historically enjoyed for its premium product, impacting its revenue streams.

Stricter Environmental Regulations and Compliance Costs

Champion Iron faces growing environmental scrutiny in Canada, with federal and provincial governments implementing stricter rules. These include new anti-greenwashing legislation and more rigorous environmental impact assessments, alongside enhanced waste management protocols. For instance, Quebec’s proposed Bill 102, aiming to strengthen environmental protection, could introduce additional compliance burdens for mining operations within the province.

Adhering to these evolving environmental standards can lead to significant capital investments and increased operating expenses. Failure to comply can result in substantial fines and damage to the company's reputation. For example, the Canadian mining sector, as a whole, saw compliance costs rise in 2024 due to updated emissions reporting and biodiversity protection mandates.

- Increased Capital Expenditures: Investments may be required for advanced pollution control technologies and habitat restoration projects.

- Higher Operational Costs: Ongoing expenses for monitoring, reporting, and waste disposal are likely to escalate.

- Reputational Risk: Non-compliance can lead to negative publicity and investor backlash, impacting market perception.

Geopolitical Risks and Trade Tensions

Geopolitical risks and escalating trade tensions pose a significant threat to Champion Iron. The global iron ore market is inherently sensitive to international relations, with conflicts and policy shifts capable of disrupting established supply chains and injecting considerable market uncertainty. For instance, ongoing trade disputes between major economies could lead to the implementation of new tariffs or trade barriers, directly impacting cross-border flows of commodities like iron ore.

These policy changes can swiftly alter demand dynamics or pricing for Champion Iron's products in crucial export markets. As of early 2024, the potential for increased protectionist measures in key steel-producing regions remains a persistent concern, directly affecting the accessibility and profitability of Champion Iron's output. This volatility necessitates careful monitoring of international political and economic landscapes.

- Trade disputes: Ongoing trade friction between major economic blocs could result in tariffs on steel and iron ore, impacting Champion Iron's export revenue.

- Supply chain disruptions: Geopolitical instability in regions supplying essential inputs or shipping routes could impede production and delivery.

- Policy shifts: Sudden changes in national trade policies or sanctions can create abrupt market access issues for Champion Iron's products.

- Market uncertainty: Heightened geopolitical tensions contribute to overall market volatility, making long-term planning more challenging for commodity producers.

The iron ore market faces a significant threat from projected oversupply in 2025, driven by new project developments and expanded output from established producers. This influx of supply could pressure prices and make it harder for companies like Champion Iron to maintain their premium for high-grade ore.

China's persistent real estate sector struggles present a substantial threat to Champion Iron, as it remains the world's dominant iron ore consumer. A continued slump in Chinese construction activity directly translates to weaker demand for steel, consequently dampening iron ore import volumes and potentially pressuring prices.

Geopolitical risks and escalating trade tensions pose a significant threat to Champion Iron. The global iron ore market is inherently sensitive to international relations, with conflicts and policy shifts capable of disrupting established supply chains and injecting considerable market uncertainty.

SWOT Analysis Data Sources

This Champion Iron SWOT analysis is built upon comprehensive data from official company financial filings, detailed market research reports, and insights from industry experts and reputable news sources, ensuring a robust and informed perspective.