Champion Iron Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Champion Iron Bundle

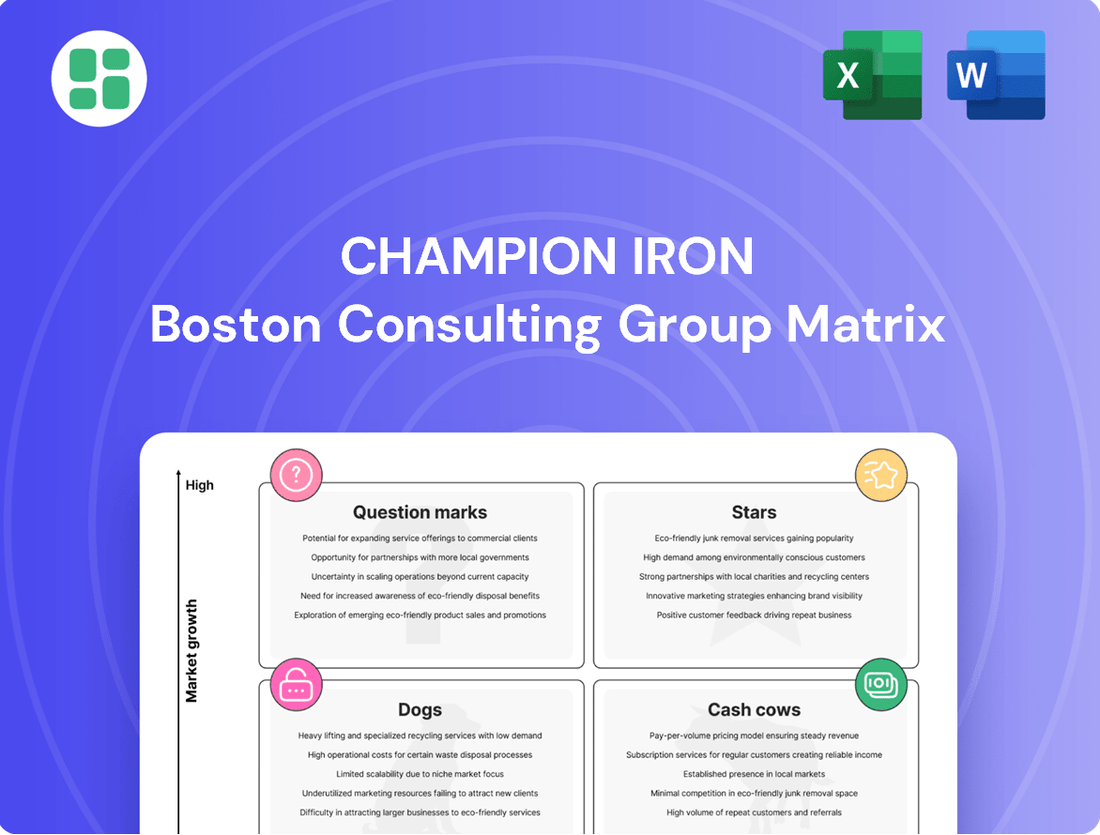

Champion Iron's BCG Matrix offers a powerful snapshot of its product portfolio, revealing which assets are driving growth and which require careful consideration. Understanding this strategic framework is crucial for navigating the competitive landscape.

This preview highlights the core of Champion Iron's market positioning, but the full BCG Matrix unlocks a comprehensive view of its Stars, Cash Cows, Dogs, and Question Marks. Purchase the complete report for detailed quadrant analysis and actionable insights that will empower your investment and resource allocation decisions.

Stars

Champion Iron's high-purity iron ore, especially its direct reduction (DR) quality product, is a star performer. This is driven by the massive global push for green steel, a cleaner way to produce the metal.

The company's DRPF project, expected to start operations in December 2025, will boost its capacity for 69% Fe pellet feed. This makes Champion Iron a crucial supplier for electric arc furnace (EAF) steelmaking, a method that significantly cuts carbon emissions.

The market for direct reduced iron (DRI), essential for green steel, is booming. Projections show it growing at a compound annual growth rate of 9.2% from 2024 to 2032, highlighting the strong demand for Champion Iron's products.

The Direct Reduction Pellet Feed (DRPF) project, a significant C$470.7 million capital investment at Champion Iron's Bloom Lake mine, is progressing towards its commissioning in December 2025, with commercial shipments anticipated by mid-2026.

This initiative is a key growth engine for Champion Iron, designed to upgrade half of Bloom Lake's production capacity to higher-purity iron ore. This upgraded product is projected to achieve a notable 10-15% price premium compared to standard benchmark iron ore prices.

The DRPF project strategically positions Champion Iron to capitalize on the global steel industry's transition towards decarbonization, ensuring a robust and valuable revenue stream for the future.

Champion Iron's strategic alliances are crucial for its growth, especially concerning the Kami project. Their partnership with Nippon Steel Corporation and Sojitz Corporation is a prime example, bringing in C$245 million for a 49% stake in the project.

This collaboration is more than just financial; it diversifies Champion Iron's supply chain and reduces risk. It also firmly embeds Champion Iron with significant global steel manufacturers, guaranteeing future sales of its high-grade iron ore.

Bloom Lake Mine Expansion Potential

Champion Iron is exploring ways to increase Bloom Lake's production capacity beyond its current 15 million tonnes per year. This expansion potential is a key factor in its BCG Matrix positioning.

Debottlenecking initiatives are a primary focus, with the aim of boosting annual output to an estimated 17-18 million tonnes. This strategy leverages existing infrastructure for growth, representing a significant upside without the need for new mine construction.

- Bloom Lake's current nameplate capacity: 15 million tonnes per year.

- Potential debottlenecking target: 17-18 million tonnes per year.

- Strategic advantage: Capacity increase through existing asset optimization.

Inclusion on Canada's Critical Minerals List

Champion Iron's high-purity iron ore being added to Canada's Critical Minerals List in 2024 is a significant development. This inclusion elevates the company's strategic position within Canada's resource sector. It also signals potential benefits from government programs and financial assistance aimed at bolstering critical mineral production.

This designation highlights Champion Iron's crucial contribution to both national resource strategies and the global shift towards cleaner energy. The classification is expected to foster a more supportive regulatory framework and attract favorable investment opportunities for the company.

- Strategic Importance: Inclusion on the critical minerals list validates the importance of Champion Iron's high-purity iron ore for national economic and security interests.

- Government Support: This status can unlock access to government grants, loans, and tax incentives designed to accelerate the development of critical mineral projects. For instance, Canada's Critical Minerals Strategy aims to mobilize significant private sector investment.

- Global Energy Transition: High-purity iron ore is essential for advanced manufacturing, including components for renewable energy technologies like wind turbines and electric vehicles, positioning Champion Iron as a key player in the energy transition.

- Investment Climate: The critical mineral designation is likely to improve investor confidence and attract capital, potentially lowering the cost of capital for Champion Iron's expansion plans.

Champion Iron's high-purity iron ore, particularly its direct reduction (DR) grade product, is a clear star in its portfolio. This is largely due to the global surge in demand for green steel, a more environmentally friendly method of steel production. The company's DRPF project, set to begin operations in December 2025, will significantly increase its capacity for 69% Fe pellet feed, making it a vital supplier for electric arc furnace (EAF) steelmaking, which drastically reduces carbon emissions.

The market for direct reduced iron (DRI), a key component in green steel, is experiencing robust growth, projected to expand at a compound annual growth rate of 9.2% between 2024 and 2032. This strong demand underscores the value of Champion Iron's offerings. The DRPF project, representing a C$470.7 million investment at the Bloom Lake mine, aims to upgrade half of its production to higher-purity iron ore, expected to command a 10-15% price premium over standard iron ore. This strategic move positions Champion Iron to benefit from the steel industry's decarbonization efforts.

Champion Iron's inclusion of its high-purity iron ore on Canada's Critical Minerals List in 2024 further solidifies its strategic importance. This designation can unlock government support and investment, aligning with Canada's Critical Minerals Strategy. Furthermore, the company is exploring capacity expansions at Bloom Lake through debottlenecking initiatives, targeting an increase from 15 million tonnes per year to an estimated 17-18 million tonnes, leveraging existing infrastructure for growth.

| Project/Initiative | Status/Target | Key Metric | Strategic Impact | Financial Implication |

|---|---|---|---|---|

| Bloom Lake DRPF | Commissioning Dec 2025 | 69% Fe pellet feed capacity | Supplies green steel market | C$470.7M investment |

| Bloom Lake Debottlenecking | Target 17-18 Mtpa | Increased output via existing assets | Leverages infrastructure | Optimized capital expenditure |

| Kami Project Partnership | Strategic Alliance | 49% stake for C$245M | Secures future sales | Diversifies supply chain |

| Critical Minerals List | Added in 2024 | High-purity iron ore | National strategic importance | Potential government support |

What is included in the product

Strategic assessment of Champion Iron's assets, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

Provides a clear, visual representation of Champion Iron's portfolio, simplifying strategic decision-making.

Cash Cows

The Bloom Lake Mine is Champion Iron's cornerstone, currently producing around 15 million tonnes annually of high-grade iron ore. This consistent output makes it the company's primary cash cow, generating significant and reliable cash flow.

Even with market volatility, Bloom Lake's established operations ensure substantial cash generation. This financial strength is crucial for funding new development projects, such as the DRPF, and for providing returns to shareholders via dividends.

Champion Iron's Bloom Lake mine exemplifies a classic cash cow, consistently delivering high production and sales volumes. This operational steadiness in a mature market segment is a key indicator of its strong position. In Q4 FY2025, the company reported record sales volumes, surpassing production levels and actively reducing existing inventory. This performance highlights the robust demand for its product and the effectiveness of its logistical operations.

Champion Iron boasts a solid financial standing, evidenced by its net cash position. This financial strength allows the company to consistently reward shareholders with semi-annual dividends, underscoring its commitment to capital returns.

Despite encountering some operational hurdles that led to recent earnings shortfalls, Champion Iron's capacity to maintain its dividend payouts and liquidity speaks volumes about the underlying cash-generating power of its core mining activities.

Premium Pricing for High-Grade Ore

Champion Iron's strategic focus on high-grade iron ore allows it to achieve premium pricing, even when overall market prices for iron ore are experiencing declines or volatility. This premium is a direct result of the ore's superior quality, making it highly sought after for specific steelmaking processes.

The company's high-purity iron ore is particularly well-suited for direct reduction steelmaking, a method that is becoming increasingly important for producing "green steel" with a lower carbon footprint. This demand for cleaner production methods further solidifies Champion Iron's pricing power. For instance, in the first quarter of fiscal year 2024, Champion Iron reported an average realized selling price of $134 per dry metric ton (dmt) for its iron ore, significantly above the benchmark prices for lower-grade material during the same period.

- Superior Quality: Champion Iron's ore boasts low levels of impurities, enhancing its value.

- Direct Reduction Suitability: The ore's characteristics are ideal for modern, lower-emission steelmaking.

- Pricing Advantage: This specialization allows for premium pricing over standard iron ore benchmarks.

- Fiscal Year 2024 Performance: The company achieved an average realized selling price of $134/dmt in Q1 FY24, demonstrating its pricing strength.

Operational Cost Management

Champion Iron’s focus on operational cost management is crucial for its position as a Cash Cow. Despite facing hurdles like ore hardness and complex logistics, the company has actively worked to keep its expenses in check.

This dedication to cost control is reflected in its financial performance. For the fiscal year ending March 31, 2024, Champion Iron reported a C1 cash cost of approximately $50-$55 per tonne, a figure that remained competitive within the industry. Even with fluctuating iron ore prices, this cost efficiency allowed the company to maintain robust cash operating margins.

The company’s All-in Sustaining Costs (AISC) also remained a key indicator of its operational efficiency. For the fiscal year 2024, AISC was reported in the range of $80-$85 per tonne, demonstrating effective management of all costs associated with maintaining production levels.

- Competitive C1 Cash Cost: Champion Iron’s C1 cash cost for FY2024 was around $50-$55 per tonne, highlighting efficient production.

- Controlled AISC: All-in Sustaining Costs for FY2024 were approximately $80-$85 per tonne, indicating effective management of ongoing operational expenses.

- Healthy Margins: These cost efficiencies enable the company to achieve healthy cash operating margins, even amidst market price volatility.

- Logistical and Ore Hardness Management: The company continues to implement strategies to mitigate the impact of inherent challenges like ore hardness and logistical complexities.

Champion Iron's Bloom Lake mine is the company's primary cash cow, consistently generating substantial revenue. Its high-grade iron ore commands premium pricing, as seen with an average realized selling price of $134 per dry metric ton in Q1 FY2024. This strong financial performance allows for consistent dividend payouts to shareholders, demonstrating the mine's reliable cash-generating capabilities.

| Metric | FY2024 (approx.) | Significance |

|---|---|---|

| Bloom Lake Production | ~15 million tonnes annually | Core operational output |

| Average Realized Price (Q1 FY24) | $134/dmt | Demonstrates premium pricing power |

| C1 Cash Cost | $50-$55/tonne | Indicates efficient production costs |

| All-in Sustaining Costs (AISC) | $80-$85/tonne | Shows effective management of ongoing expenses |

What You See Is What You Get

Champion Iron BCG Matrix

The Champion Iron BCG Matrix preview you see is the complete, unwatermarked document you will receive immediately after purchase. This means the strategic insights and market positioning analysis presented here are exactly what you'll be working with, ready for immediate integration into your business planning. You can confidently use this preview as a direct representation of the high-quality, professionally formatted report that will be yours to edit, present, and leverage for Champion Iron's strategic advantage.

Dogs

Persistent logistical hurdles, especially with rail transport, have historically hampered Champion Iron's shipments, causing substantial stockpiles of iron ore concentrate at Bloom Lake. For instance, in the fiscal year ending March 31, 2023, the company reported that logistical constraints impacted its ability to move product, leading to higher inventory levels.

These ongoing issues have previously limited sales volumes and dented profitability, acting as a drag on overall operational efficiency. Although Champion Iron is actively working to mitigate these problems by securing additional railcars and enhancing services, the impact of these bottlenecks remains a key consideration for the company's performance.

The global iron ore market experienced considerable price fluctuations throughout 2024. For instance, benchmark 62% Fe fines CFR North China prices saw a notable peak in early 2024, reaching over $130 per tonne, before declining to below $100 per tonne by mid-year, reflecting shifts in Chinese steel demand and global supply dynamics.

Champion Iron, known for its high-grade iron ore concentrate, benefits from a premium over the benchmark price. However, even with this advantage, the company's profitability is inherently tied to the overall health of the iron ore market. A sustained downturn in global iron ore prices, such as the observed dips in 2024, directly compresses Champion Iron's cash operating margins, impacting its financial performance.

Recent geological sequences at Champion Iron's Bloom Lake mine have introduced harder ore, which has directly impacted milling capacity and recovery rates. This presents a significant operational challenge.

While Champion Iron is actively optimizing its recovery circuits and adapting its strategies to mitigate these effects, the harder ore can lead to temporary dips in production efficiency. Furthermore, these geological hurdles are likely to increase processing costs as the company works to extract the mineral content more effectively.

Reliance on Chinese Demand

Champion Iron's significant reliance on Chinese demand places it firmly in the question mark category of the BCG matrix. Despite efforts to diversify, over half of its iron ore production, approximately 54% in the fiscal year 2023, is still directed towards China. This makes the company highly sensitive to the economic performance and steel consumption trends within the Chinese market.

Any downturn in China's construction or real estate sectors, or changes in its steel production policies, can directly affect the demand for Champion Iron's products. For instance, a slowdown in Chinese infrastructure projects, a key driver of steel demand, could reduce the need for iron ore.

- Customer Concentration: Approximately 54% of Champion Iron's sales in FY2023 were to China.

- Market Sensitivity: Vulnerable to fluctuations in China's construction and real estate markets.

- Policy Impact: Susceptible to changes in Chinese steel production and trade policies.

- Risk Factor: High dependence on a single, large market presents a significant risk.

Temporary Production Impacts from Maintenance/External Factors

Champion Iron, like many in the mining sector, navigates temporary production dips due to scheduled maintenance and unforeseen external events. These can affect quarterly performance.

For instance, semi-annual plant maintenance shutdowns, essential for operational integrity, inherently reduce output during those periods. In 2024, such planned downtimes are factored into production forecasts, aiming to minimize long-term disruption.

External factors also play a role. Forest fires, which have impacted Quebec in recent years, can lead to operational pauses for safety reasons. Similarly, temporary utility interruptions, such as those that might affect Hydro-Quebec's supply, can halt operations. For example, in Q1 2024, Champion Iron reported lower shipments partly due to these types of operational adjustments, though specific figures related to maintenance or external factors are often detailed in their quarterly financial reports.

- Scheduled Maintenance: Essential for asset upkeep, leading to predictable, short-term output reductions.

- External Disruptions: Unforeseen events like forest fires or power outages can cause unplanned operational stoppages.

- Impact on Results: These interruptions directly affect quarterly production volumes and financial reporting.

- 2024 Context: Production plans for 2024 incorporate allowances for these inevitable operational variances.

Champion Iron's significant exposure to the Chinese market, with approximately 54% of its sales in fiscal year 2023 directed there, places it squarely in the question mark category of the BCG matrix. This high dependence makes the company vulnerable to shifts in China's economic policies, construction activity, and steel demand. Any slowdown in these areas directly impacts the demand for Champion Iron's products, highlighting a key risk factor.

The company's reliance on China means its performance is closely tied to the economic health and policy decisions within that single, large market. Fluctuations in China's real estate sector or changes in its steel production strategies can create considerable volatility for Champion Iron. This customer concentration is a critical element when assessing its strategic position.

Champion Iron's position as a question mark is further reinforced by its operational challenges, such as logistical bottlenecks and the impact of harder ore on milling efficiency. These factors, combined with market sensitivity, create a dynamic where investment is needed to maintain or improve its market position and operational output.

| BCG Category | Champion Iron's Position | Key Characteristics | Strategic Implication |

|---|---|---|---|

| Question Mark | High Market Dependence (China) | 54% of FY2023 sales to China; sensitive to Chinese economic policies and construction trends. | Requires careful investment to grow market share or divest if growth prospects are weak. |

| Operational Challenges | Logistical Hurdles & Ore Hardness | Rail transport issues causing stockpiles; harder ore impacting milling capacity and recovery rates. | Needs operational improvements and investment to boost efficiency and reduce costs. |

| Market Dynamics | Iron Ore Price Volatility | Affected by global steel demand; 2024 saw prices fluctuate significantly, impacting margins. | Benefits from premium pricing but remains susceptible to overall market downturns. |

Question Marks

The Kami Project, a significant iron ore asset near Champion Iron's Bloom Lake operation, is currently undergoing a feasibility study. This project targets the production of 9 million tonnes annually of direct reduction quality iron ore, a crucial component for green steel manufacturing.

With partners Nippon Steel and Sojitz, Kami represents a substantial long-term growth opportunity for Champion Iron. Its development aligns with the increasing global demand for steel produced with lower carbon emissions.

However, the Kami Project is considered a speculative investment at this stage. It requires considerable capital expenditure and successful execution of the development plan before it can generate any positive cash flow for the company.

Champion Iron's Cluster II properties represent its exploration portfolio, a collection of early-stage assets primarily located in the Labrador Trough. These projects are characterized by their significant growth potential, contingent on successful exploration and development outcomes.

Currently, these properties hold no market share, reflecting their developmental stage. They demand substantial capital investment for exploration activities, with the ultimate returns remaining highly uncertain, placing them firmly in the question mark category of the BCG matrix.

Champion Iron is strategically targeting North Africa and the Middle East for its Direct Reduced Iron Pellet Feed (DRPF) product, viewing these regions as key growth areas for green steel. This expansion aims to diversify its customer base beyond its traditional stronghold in China.

While these emerging markets present significant opportunities, Champion Iron currently holds a minimal market share. For instance, in 2024, the company's presence in these regions was nascent, with minimal reported sales compared to established markets.

To capitalize on this potential, substantial investment in marketing, sales infrastructure, and robust logistics networks will be crucial. This will enable Champion Iron to effectively compete and build brand recognition in these new territories.

Hydrogen-Based DRI Steelmaking Transition

The transition to hydrogen-based Direct Reduced Iron (DRI) steelmaking presents a significant, albeit uncertain, growth avenue for Champion Iron. Its high-purity ore is well-suited for this emerging technology, which aims to decarbonize steel production. However, the commercial viability and widespread adoption timeline for hydrogen DRI remain key questions, impacting the immediate market share potential.

While the global steel industry is under pressure to reduce emissions, with a projected CAGR of 3.5% for green steel technologies through 2030, the exact pace of hydrogen DRI integration is still developing. Champion Iron's strategic positioning with its high-quality ore is a strong foundation, but the market's actual uptake will dictate the speed of this opportunity.

- Market Potential: The global green steel market is anticipated to reach $150 billion by 2030, with hydrogen DRI playing a crucial role.

- Technological Uncertainty: While pilot projects are underway, widespread commercial deployment of hydrogen DRI is still in its nascent stages.

- Champion Iron's Advantage: The company's high-purity iron ore is a critical input for efficient hydrogen DRI production.

- Strategic Alignment: Champion Iron is positioning itself to benefit from this long-term shift, though the precise timing and scale of market penetration are still unclear.

Future Debottlenecking Beyond Current Plans

While Champion Iron is focused on increasing Bloom Lake's capacity to 17-18 million tonnes per year, any expansion beyond this level would be a significant undertaking, moving into the realm of question marks for their long-term strategic growth.

These potential future debottlenecking projects, which could unlock substantial additional output, are currently unproven and would necessitate extensive feasibility studies and considerable capital investment, introducing a higher degree of risk compared to their current, more defined plans.

For instance, a hypothetical expansion beyond 18 million tonnes at Bloom Lake, or developing new projects, would likely require a multi-year timeline and substantial funding, potentially in the hundreds of millions of dollars, depending on the scale and complexity.

The company's 2024 performance, demonstrating their ability to operate efficiently within existing parameters, provides a foundation, but these larger, future capacity increases represent a different strategic challenge.

- Future Capacity Increases: Beyond the 17-18 million tonnes per year target for Bloom Lake, further structural capacity enhancements are unproven initiatives.

- Growth Potential vs. Risk: These potential expansions offer high growth prospects but demand new studies, significant capital, and carry inherent risks.

- Strategic Uncertainty: Such initiatives represent question marks in the company's long-term strategy due to their unproven nature and associated investment requirements.

- Investment Horizon: Any move beyond current plans would likely involve substantial capital outlays and a longer development timeline, impacting future financial projections.

Champion Iron's early-stage exploration projects, like those in Cluster II, are prime examples of question marks. These assets have significant potential but currently hold no market share and require substantial capital for exploration, with uncertain future returns.

The company's foray into new markets like North Africa and the Middle East for its DRPF product also fits the question mark category. While these regions offer growth, Champion Iron's market share in 2024 was minimal, necessitating considerable investment in sales and logistics to gain traction.

Similarly, the potential of hydrogen-based DRI steelmaking is a question mark. Champion Iron's high-purity ore is advantageous, but the commercial viability and adoption timeline for this green steel technology remain uncertain, impacting immediate market penetration.

Future capacity expansions at Bloom Lake beyond the 17-18 million tonnes per year target also represent question marks. These are unproven initiatives requiring extensive studies and significant capital, carrying higher risks than current, more defined plans.

| Project/Initiative | BCG Category | Current Status | Market Share (2024 Est.) | Key Uncertainties |

|---|---|---|---|---|

| Cluster II Exploration | Question Mark | Early Stage Exploration | 0% | Exploration success, development feasibility, capital requirements |

| North Africa/Middle East Expansion | Question Mark | Nascent Market Entry | Minimal | Market adoption, sales infrastructure development, logistics |

| Hydrogen DRI Integration | Question Mark | Emerging Technology | N/A (market developing) | Commercial viability, widespread adoption timeline, technological maturity |

| Bloom Lake Capacity Beyond 18 Mtpa | Question Mark | Hypothetical Expansion | N/A (not yet planned) | Feasibility studies, capital investment, multi-year development timeline |

BCG Matrix Data Sources

Our Champion Iron BCG Matrix is built on robust data, leveraging annual reports, market share analysis, and commodity price trends to accurately position its assets.