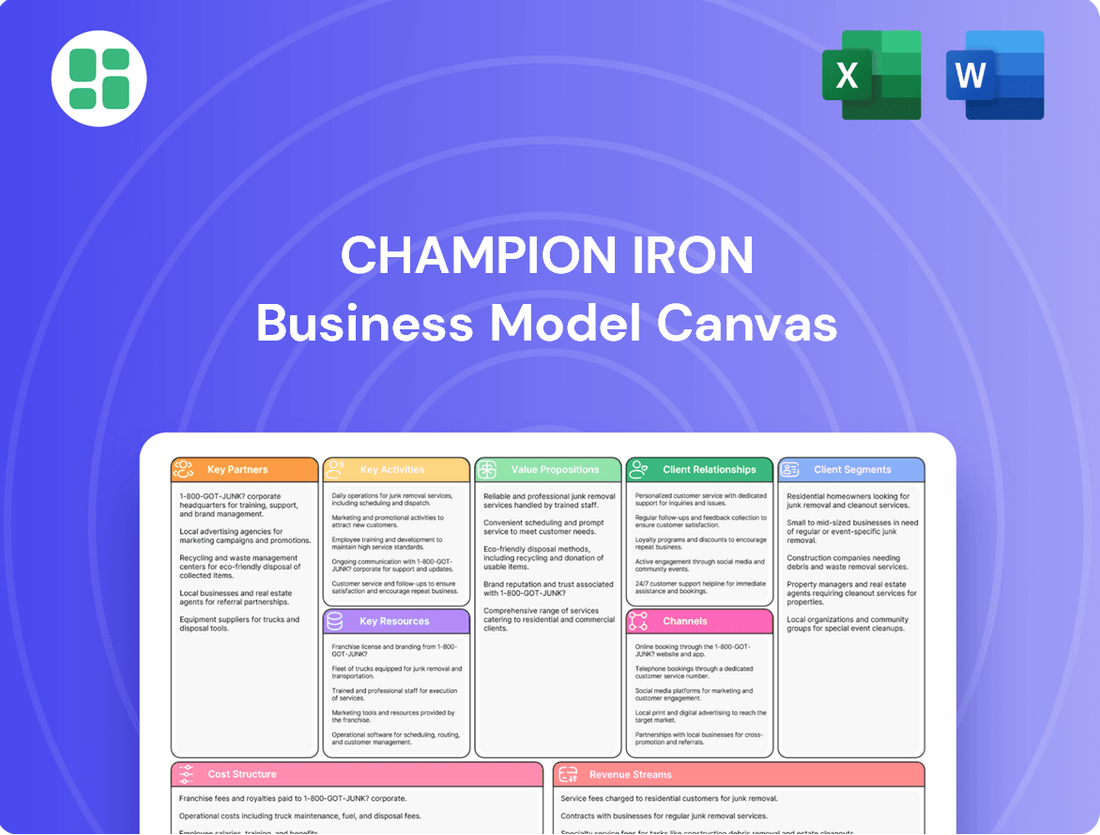

Champion Iron Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Champion Iron Bundle

Unlock the full strategic blueprint behind Champion Iron's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Champion Iron has forged significant strategic alliances to propel its project development. Binding agreements with global leaders such as Nippon Steel Corporation and Sojitz Corporation are in place to explore and advance the Kami project.

These collaborations are crucial for moving forward with the definitive feasibility study for Kami. The aim is to ensure a future supply of high-grade iron ore, underscoring the strategic importance of these partnerships in Champion Iron's operational roadmap.

Champion Iron actively partners with government bodies like the Government of Canada and the provinces of Québec and Newfoundland and Labrador. These collaborations are vital for securing resources, such as additional hydroelectric power from Hydro-Québec, which is essential for their operations.

Furthermore, these governmental relationships are key to gaining recognition for their high-purity iron ore as a critical mineral. This designation can unlock further support and investment opportunities, bolstering the company's strategic growth initiatives.

Champion Iron's business model hinges on robust partnerships with key logistics and transportation providers. These relationships are vital for moving its iron ore concentrate from the Bloom Lake mine to global customers.

Critical to this network are rail operators, who ensure the efficient haulage of ore, and port authorities, facilitating its shipment overseas. For instance, in the fiscal year ending March 31, 2024, Champion Iron reported shipping 13.1 million tonnes of iron ore concentrate, underscoring the sheer volume these partners manage.

Maintaining reliable haulage is paramount for managing mine stockpiles and consistently meeting sales targets. Despite facing occasional logistical challenges, these partnerships are fundamental to Champion Iron's operational success and its ability to deliver product to market.

Local Communities and First Nations

Champion Iron places significant importance on fostering robust relationships with local communities and First Nations partners. This commitment is built on recognizing and valuing their ongoing trust and support, which are fundamental to the company's sustained operations.

These partnerships are crucial for maintaining social license to operate and ensuring operational stability. By aligning business practices with the interests and well-being of these communities, Champion Iron aims to create shared value and long-term mutual benefit.

- Community Engagement: Champion Iron invested over $10 million in community initiatives and sponsorships in Quebec during the 2023 fiscal year, demonstrating a tangible commitment to local development.

- First Nations Agreements: The company has established comprehensive Impact and Benefit Agreements (IBAs) with key First Nations groups, such as the Innu of Matimekosh and Lac-Rapide, ensuring their participation and economic benefits from mining operations.

- Employment and Training: Champion Iron prioritizes local hiring and training programs, contributing to economic growth and skill development within the communities where it operates. For example, in FY2023, over 25% of its Quebec workforce resided in the Fermont region.

Equipment and Service Suppliers

Champion Iron's operational backbone relies heavily on its relationships with key equipment and service suppliers. These partnerships are crucial for securing the specialized machinery needed for mining and processing, as well as for ensuring ongoing maintenance and support. For instance, in fiscal year 2024, the company continued to focus on optimizing its supply chain for critical components and services to support its production targets.

The acquisition and availability of additional mining and processing equipment directly impact Champion Iron's ability to expand its production capacity. By maintaining strong ties with suppliers, the company can ensure timely delivery and integration of new assets, which is vital for meeting increased output demands. This strategic approach to supplier management underpins the company's growth trajectory.

- Supplier Relationships: Maintaining robust relationships with providers of mining, processing, and maintenance equipment is essential for operational continuity and growth.

- Equipment Acquisition: Securing necessary equipment through these partnerships directly supports increased mine production and processing capabilities.

- Operational Efficiency: Reliable service providers ensure that equipment is maintained, minimizing downtime and maximizing operational efficiency.

Champion Iron's success is significantly amplified by its strategic alliances with major industrial players like Nippon Steel Corporation and Sojitz Corporation, crucial for advancing the Kami project. These partnerships are instrumental in securing future high-grade iron ore supply, vital for the company's long-term growth strategy.

Furthermore, Champion Iron collaborates closely with governmental bodies, including the Government of Canada and the provinces of Québec and Newfoundland and Labrador, to secure essential resources like hydroelectric power from Hydro-Québec. These relationships also aid in gaining recognition for its iron ore as a critical mineral, unlocking further investment and support.

The company's operational efficiency is heavily reliant on key logistics and transportation partners, ensuring the movement of iron ore concentrate from its Bloom Lake mine to global markets. In the fiscal year ending March 31, 2024, Champion Iron shipped 13.1 million tonnes of iron ore concentrate, highlighting the scale of these vital logistical operations.

Champion Iron also prioritizes strong relationships with local communities and First Nations, evidenced by over $10 million invested in community initiatives in Quebec during FY2023 and comprehensive Impact and Benefit Agreements with groups like the Innu of Matimekosh and Lac-Rapide. These collaborations are fundamental for maintaining social license and operational stability.

Critical supplier relationships are also a cornerstone, providing essential mining, processing, and maintenance equipment. This ensures operational continuity and supports capacity expansion, directly impacting the company's ability to meet increased output demands and maintain operational efficiency.

| Key Partnership Type | Key Partners | Strategic Importance | Recent Data/Impact |

| Project Development | Nippon Steel Corporation, Sojitz Corporation | Advancing Kami project, securing future iron ore supply | Binding agreements in place for Kami project feasibility study. |

| Governmental & Resource | Government of Canada, Québec, Newfoundland and Labrador, Hydro-Québec | Securing hydroelectric power, critical mineral designation | Essential for operations; facilitates recognition as a critical mineral. |

| Logistics & Transportation | Rail operators, Port authorities | Efficient movement of iron ore concentrate to global customers | Managed shipment of 13.1 million tonnes in FY2024. |

| Community & First Nations | Local communities, Innu of Matimekosh and Lac-Rapide | Social license to operate, operational stability, shared value | Over $10 million invested in Quebec community initiatives (FY2023); IBAs established. |

| Suppliers | Equipment and service providers | Securing mining/processing equipment, maintenance, operational continuity | Focus on optimizing supply chain for critical components in FY2024. |

What is included in the product

This Business Model Canvas details Champion Iron's strategy for producing and selling high-quality iron ore, focusing on its integrated operations, cost-efficiency, and key customer relationships in the global steel market.

Champion Iron's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their operations, enabling quick identification of inefficiencies and strategic alignment.

Activities

Champion Iron's core activity is the open-pit mining of iron ore at its Bloom Lake complex, transforming it into high-grade iron ore concentrate. This process requires meticulous management of mined and hauled materials to maintain efficient operations.

Optimizing mill availabilities and enhancing metallurgical recovery rates are crucial for ensuring consistent, high-quality production. For the fiscal year ended March 31, 2024, Champion Iron reported record annual production of 13.4 million wet metric tons (WMT) of iron ore concentrate, with a grade of 62.1% Fe.

Champion Iron's key activity involves the development and commissioning of its Direct Reduction Pellet Feed (DRPF) project. This initiative is designed to upgrade half of the Bloom Lake mine's output to produce direct reduction quality pellet feed iron ore.

This strategic move is directly aligned with the growing global demand for green steel, a critical component in decarbonizing the steel industry. The project is anticipated to reach completion in late 2025.

Champion Iron's global sales and distribution network is central to its operations, focusing on delivering high-quality iron ore concentrate to steel producers worldwide. The company manages a complex logistics chain, ensuring efficient transport from its Quebec mines to international customers.

In the fiscal year ending March 31, 2024, Champion Iron reported total revenue of approximately $2.1 billion CAD, reflecting strong demand and successful distribution efforts. The company's primary markets include China, Japan, South Korea, and Europe, where its iron ore is a key input for steel manufacturing.

The distribution process involves extensive rail transportation to the port of Sept-Îles, Quebec, followed by bulk ocean freight. This integrated approach allows Champion Iron to maintain control over its supply chain and meet the delivery schedules of its global clientele, contributing to its market position.

Exploration and Growth Project Evaluation

Champion Iron actively pursues exploration and evaluation of future growth opportunities, with the Kami project being a significant focus. This involves undertaking definitive feasibility studies to assess the viability and potential of expanding its high-grade iron ore production capacity.

The company's strategic vision extends beyond its current operational footprint, aiming to secure long-term growth through the development of new projects. These efforts are crucial for maintaining and enhancing its position in the global iron ore market.

- Kami Project Development: Champion Iron is advancing the Kami project, a key component of its future growth strategy.

- Feasibility Studies: Definitive feasibility studies are underway to thoroughly evaluate the technical and economic aspects of potential expansions.

- Capacity Enhancement: The objective is to significantly increase high-grade iron ore production capacity, bolstering the company's market supply.

- Strategic Future Planning: These activities underscore Champion Iron's commitment to long-term sustainability and market leadership through proactive project evaluation.

Sustainability and Decarbonization Initiatives

Champion Iron is actively pursuing sustainability and decarbonization, aiming to be a key player in the green steel supply chain. A significant part of this involves a commitment to reducing greenhouse gas (GHG) emissions.

The company has set an ambitious target to cut its GHG emissions by 40% by the year 2030. This is a substantial undertaking that will require strategic investments and operational changes.

A core element of their decarbonization strategy is the extensive use of renewable hydroelectric power. This clean energy source is crucial for powering their operations and minimizing their carbon footprint.

Furthermore, Champion Iron's focus on producing high-purity iron ore directly supports the steel industry's own decarbonization efforts. High-purity ore requires less energy to process into steel, leading to lower emissions downstream.

- GHG Emission Reduction Target: Aiming for a 40% reduction by 2030.

- Renewable Energy Adoption: Extensive use of hydroelectric power for operations.

- Product Focus: Production of high-purity iron ore to facilitate steel industry decarbonization.

Champion Iron's key activities revolve around the efficient extraction and processing of high-grade iron ore concentrate from its Bloom Lake mine. This involves optimizing mining operations and metallurgical recovery to ensure consistent output. The company is also strategically developing its Direct Reduction Pellet Feed (DRPF) project, which will upgrade a portion of its production for the growing green steel market, with completion anticipated in late 2025.

Furthermore, Champion Iron actively manages its global sales and distribution network, ensuring timely delivery of its product to international steel manufacturers. This logistical undertaking, from mine to port and then by sea, underpins its revenue generation. The company is also focused on future growth through exploration and evaluation, notably the Kami project, with definitive feasibility studies underway to assess expansion potential.

Champion Iron is committed to sustainability, targeting a 40% reduction in greenhouse gas emissions by 2030, largely through the use of renewable hydroelectric power. Its production of high-purity iron ore also aids the steel industry's decarbonization efforts.

| Key Activity | Description | Fiscal Year 2024 Data/Targets |

|---|---|---|

| Iron Ore Mining & Processing | Open-pit mining and production of high-grade iron ore concentrate. | 13.4 million WMT produced; 62.1% Fe grade. |

| DRPF Project Development | Upgrading half of Bloom Lake's output to direct reduction quality pellet feed. | Project completion expected late 2025. |

| Global Sales & Distribution | Managing logistics and sales to international steel producers. | Total revenue of $2.1 billion CAD; primary markets include China, Japan, South Korea, and Europe. |

| Exploration & Future Growth | Evaluating new projects like Kami for capacity expansion. | Definitive feasibility studies for Kami project are in progress. |

| Sustainability & Decarbonization | Reducing GHG emissions and utilizing renewable energy. | Targeting a 40% GHG emission reduction by 2030; extensive use of hydroelectric power. |

Full Version Awaits

Business Model Canvas

The Champion Iron Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You'll gain immediate access to this complete, ready-to-use Business Model Canvas, allowing you to seamlessly integrate it into your strategic planning.

Resources

The Bloom Lake Mining Complex, Champion Iron's flagship asset, is a crucial key resource. This open-pit mine in Quebec, Canada, is the bedrock of the company's production, featuring two concentration plants and substantial proven and probable mineral reserves.

In the fiscal year ending March 31, 2024, Bloom Lake achieved a record ore production of 16.1 million tonnes, demonstrating its operational strength and capacity. This output directly fuels Champion Iron's revenue streams, underscoring its importance in the business model.

Champion Iron's business model hinges on its substantial, high-purity iron ore deposits located in Quebec's Labrador Trough, a region recognized for its vast, high-quality iron ore reserves globally. These assets are the bedrock of the company's production capabilities, ensuring a consistent supply of premium iron ore.

The Kami project and the Cluster II properties are prime examples of these key resources. They are instrumental in Champion Iron's ability to extract and process iron ore with exceptionally low contaminant levels and high iron content, meeting the stringent demands of the global steel industry.

As of early 2024, Champion Iron's operations in the Labrador Trough are central to its strategy, with the company focusing on maximizing the value of these high-grade deposits. The quality of this iron ore is a significant competitive advantage, allowing for more efficient steel production and a reduced environmental footprint for its customers.

Champion Iron's access to abundant and renewable hydroelectric power from Hydro-Québec is a cornerstone of its business model. This vital resource fuels the Bloom Lake operations, directly contributing to a lower carbon footprint in iron ore production.

In 2024, Hydro-Québec continued to be a primary electricity provider for Quebec's industrial sector, including mining. The reliance on this green energy source for Bloom Lake operations is a significant differentiator, aligning with increasing investor and customer demand for sustainable mining practices.

Advanced Mining and Processing Equipment

Champion Iron's operations rely heavily on a significant investment in advanced mining and processing equipment. This substantial fleet is not static; the company prioritizes continuous updates and expansion to maintain operational efficiency and competitive advantage. For instance, in fiscal year 2024, significant capital expenditures were allocated towards enhancing their mining fleet and processing capabilities, ensuring they can handle increasing production volumes and maintain high-quality output.

The efficiency of ore extraction, hauling, and the subsequent production of high-grade iron ore concentrate are directly tied to the quality and modernity of this machinery. Coupled with advanced recovery circuits, this equipment is fundamental to Champion Iron's ability to transform raw ore into a valuable commodity. The company's commitment to utilizing state-of-the-art technology in this area underpins its cost-competitiveness and the consistent quality of its product, which is crucial for meeting market demands.

- Fleet Modernization: Champion Iron maintains a modern and continuously updated fleet of mining and processing equipment, crucial for efficient operations.

- Efficiency Gains: Advanced recovery circuits and up-to-date machinery are key drivers for efficient ore extraction, hauling, and the production of high-grade iron ore concentrate.

- Capital Allocation (FY24): Significant capital was deployed in fiscal year 2024 towards upgrading and expanding the mining and processing equipment base, reflecting a strategic focus on operational enhancement.

Skilled Workforce and Management Expertise

Champion Iron's operational success hinges on its highly skilled workforce. This includes specialized engineers, experienced mine operators, and a robust management team possessing deep knowledge in mine development and ongoing operations. Their collective expertise is fundamental to maintaining efficiency and executing strategic plans effectively.

The company's management team, in particular, brings a wealth of experience directly relevant to the iron ore sector. This seasoned leadership guides project execution and ensures that operations align with industry best practices and strategic objectives. For instance, in fiscal year 2024, Champion Iron reported significant operational milestones, underscoring the impact of this experienced human capital.

- Skilled Workforce: Engineers and operators with specialized mining and processing knowledge.

- Management Expertise: A seasoned leadership team with proven track records in mine development and operations.

- Operational Efficiency: The expertise directly contributes to optimizing production and cost management.

- Strategic Execution: Crucial for successful project planning, expansion, and navigating market dynamics.

Champion Iron's intellectual property, particularly its proprietary processing technologies and operational methodologies, represents a significant intangible asset. These innovations contribute to the high-grade concentrate produced and the efficiency of their operations.

The company’s strategic agreements and partnerships, especially those related to offtake and logistics, are also key resources. These arrangements ensure market access and efficient delivery of their iron ore product, solidifying their position in the global market.

| Key Resource | Description | FY2024 Relevance |

|---|---|---|

| Proprietary Processing Technologies | Innovations in iron ore beneficiation and concentration. | Enhances product quality and operational efficiency. |

| Offtake Agreements | Contracts for the sale of iron ore concentrate. | Secures market demand and revenue streams. |

| Logistics Infrastructure Access | Agreements for rail and port services. | Ensures timely and cost-effective delivery to customers. |

Value Propositions

Champion Iron’s core value proposition centers on its production of exceptionally high-purity iron ore concentrate, currently averaging 66.2% iron content. This high grade is a significant differentiator in the market.

The company is actively working to further enhance this purity, with plans to reach 69% iron content. This focus on purity is driven by increasing demand for cleaner steelmaking inputs.

This high-purity iron ore is particularly sought after for its low contaminant profile, making it ideal for advanced steelmaking methods like direct reduction. In 2024, Champion Iron continued to solidify its position as a key supplier of premium iron ore for these evolving industrial needs.

Champion Iron's high-purity iron ore is a crucial component for direct reduction (DR) and electric arc furnace (EAF) steelmaking, technologies at the forefront of the industry's decarbonization. This makes the company a vital enabler of greener steel production.

By supplying this essential raw material, Champion Iron directly supports the global steel industry's push to lower greenhouse gas emissions. In 2024, the demand for low-carbon steelmaking inputs is projected to continue its upward trajectory, underscoring the strategic importance of Champion Iron's offering.

Champion Iron commands a premium for its high-grade, low-contaminant iron ore, often exceeding benchmarks like the Platts IODEX 62% Fe. This pricing advantage is a cornerstone of their value proposition, reflecting the superior quality of their product.

The company’s continued investment in projects like the DRPF (Dry-Stack Tailings Facility) is designed to further solidify this premium. By producing even higher-grade iron ore, Champion Iron aims to capture a more specialized and potentially captive market segment.

Reliable and Sustainable Supply

Champion Iron's operations in Quebec, Canada, position it as a reliable supplier within a stable and favorable mining jurisdiction. This geographical advantage contributes significantly to the consistency and predictability of its iron ore output.

The company’s strategic decision to power its operations with renewable hydroelectricity underscores a commitment to sustainability. This not only reduces its environmental footprint but also appeals to a global market increasingly prioritizing ESG (Environmental, Social, and Governance) factors in their supply chains.

In 2024, Champion Iron's commitment to sustainable practices is particularly noteworthy. For instance, its Bloom Lake mine, a flagship operation, leverages Quebec's abundant hydroelectric power, aligning with global decarbonization trends and offering a distinct value proposition to environmentally conscious buyers.

- Stable Jurisdiction: Operating in Quebec provides regulatory certainty and access to established infrastructure.

- Renewable Energy: Utilization of hydroelectric power enhances sustainability credentials.

- Consistent Output: Favorable operating conditions support reliable iron ore production.

- Market Appeal: Sustainability focus attracts buyers seeking responsible sourcing.

Long-Term Growth and Supply Security

Champion Iron's DRPF project and the prospective Kami development are pivotal for securing long-term, high-grade iron ore supply. This strategy directly addresses customer needs for consistent raw material access, fostering confidence in their future operational stability.

By focusing on these growth avenues, Champion Iron aims to solidify its position as a reliable supplier. For instance, in the fiscal year ending March 31, 2024, Champion Iron reported record iron ore production of 13.1 million tonnes, underscoring their capacity to meet demand.

This commitment to expanding high-grade iron ore output is crucial for industries reliant on this essential commodity. It translates into tangible benefits for customers:

- Enhanced Supply Chain Reliability: Customers can depend on a more stable and predictable flow of iron ore.

- Future Operational Planning: Long-term supply security allows businesses to plan their production and expansion with greater certainty.

- Support for Industrial Demand: Meeting the ongoing demand for high-grade iron ore is fundamental for sectors like steel manufacturing.

Champion Iron's value proposition is built on delivering exceptionally high-purity iron ore concentrate, averaging 66.2% iron content in 2024, with plans to reach 69%. This premium quality is essential for modern, greener steelmaking processes like direct reduction and electric arc furnaces, directly supporting the industry's decarbonization efforts.

The company's operations in Quebec, powered by renewable hydroelectricity, offer a stable and sustainable supply chain advantage. This commitment to ESG principles, exemplified by the Bloom Lake mine's energy sourcing, attracts environmentally conscious buyers and allows Champion Iron to command pricing premiums over benchmark indices.

Champion Iron's strategic investments, including the DRPF project and the potential Kami development, ensure a consistent, long-term supply of high-grade iron ore. This focus on future capacity, demonstrated by a record 13.1 million tonnes produced in the fiscal year ending March 31, 2024, provides customers with enhanced supply chain reliability and supports their own operational planning.

| Metric | Value (as of latest reporting) | Significance |

|---|---|---|

| Average Iron Content | 66.2% | Premium quality for advanced steelmaking |

| Target Iron Content | 69% | Further enhancement for cleaner steel |

| Fiscal Year 2024 Production | 13.1 million tonnes | Record output demonstrating capacity |

| Power Source | Renewable Hydroelectricity | Sustainability and reduced environmental footprint |

Customer Relationships

Champion Iron cultivates direct relationships with its global steel industry clientele, enabling personalized sales interactions and providing crucial technical support for its high-purity iron ore concentrate. This direct approach ensures tailored solutions and fosters a responsive environment to meet evolving customer demands.

Champion Iron actively pursues long-term supply agreements and off-take arrangements with its core clientele. This approach is designed to lock in consistent demand for its iron ore products, creating a predictable revenue stream.

These enduring partnerships offer significant advantages, providing both Champion Iron and its customers with greater certainty regarding future supply and pricing. For example, in fiscal year 2023, the company reported that a substantial portion of its sales were secured through these types of arrangements, underscoring their importance to its business model.

Champion Iron cultivates robust investor relations by consistently providing detailed financial reports, hosting conference calls, and conducting webcasts. This dedication to openness ensures shareholders, including institutional investors who held approximately 75% of its shares as of its latest filings, remain informed about operational progress and strategic initiatives.

Active Engagement for New Products

Champion Iron actively engages with potential buyers when developing new offerings, such as its Direct Reduction Pellet Feed. This dialogue helps the company tailor its products to market demands and secure commitments.

For instance, in the fiscal year ending March 31, 2024, Champion Iron reported significant progress in its pellet feed initiatives, aiming to capture a growing segment of the steelmaking market. This forward-looking engagement is crucial for validating product development and de-risking future sales.

- Market Validation: Direct customer feedback ensures new products like Direct Reduction Pellet Feed meet specific industry requirements.

- Securing Future Demand: Proactive engagement aims to establish future supply agreements, guaranteeing market uptake for evolving products.

- Strategic Partnerships: Building relationships with prospective customers fosters collaboration and aligns product development with market needs.

Community and Stakeholder Engagement

Champion Iron actively cultivates strong ties with the communities where it operates, recognizing that this is fundamental to its long-term success. This engagement extends to building and nurturing positive relationships with local populations, including important partnerships with First Nations groups. It’s an ongoing commitment that requires consistent effort and open dialogue.

The company prioritizes transparent communication, making sure to listen to and address community concerns promptly and effectively. This proactive approach fosters trust and ensures that operations proceed smoothly and harmoniously. Champion Iron also invests in local economic development, understanding that shared prosperity benefits everyone involved.

- Community Investment: In fiscal year 2023, Champion Iron contributed $1.6 million to community initiatives and sponsorships, demonstrating a tangible commitment to local development.

- First Nations Partnerships: The company has established formal agreements with local First Nations communities, ensuring their participation and benefit from mining operations.

- Employment and Procurement: Champion Iron aims to maximize local employment and procurement opportunities, with a significant portion of its workforce and supplier base drawn from the Quebec regions.

- Social License: Maintaining social acceptance is paramount, achieved through continuous dialogue, addressing environmental stewardship, and contributing positively to the social fabric of the operating regions.

Champion Iron prioritizes direct engagement with its global steel clients, offering personalized sales and technical support for its high-purity iron ore concentrate. This direct approach allows for tailored solutions and responsive adaptation to evolving customer needs, fostering strong, long-term supply agreements and off-take arrangements that ensure predictable demand and revenue streams.

The company also maintains robust investor relations through consistent financial reporting and communication, keeping shareholders informed about operational progress. Furthermore, Champion Iron actively involves potential buyers in new product development, like its Direct Reduction Pellet Feed, to ensure market alignment and secure future sales commitments.

Champion Iron's commitment extends to its operating communities, building positive relationships with local populations and First Nations groups through transparent communication and investment in local economic development. This focus on social license is crucial for smooth operations and shared prosperity.

| Customer Relationship Aspect | Description | Key Data/Initiative (FY23/FY24) |

|---|---|---|

| Direct Client Engagement | Personalized sales and technical support for iron ore concentrate. | Securing long-term supply agreements and off-take arrangements. |

| Investor Relations | Transparent financial reporting, conference calls, and webcasts. | Institutional investors held approximately 75% of shares (latest filings). |

| New Product Development Engagement | Involving potential buyers in product development (e.g., Direct Reduction Pellet Feed). | Significant progress in pellet feed initiatives reported for FY24. |

| Community Relations | Building positive relationships with local populations and First Nations. | $1.6 million contributed to community initiatives and sponsorships in FY23. |

Channels

Champion Iron's global direct sales channel is crucial for its business model, enabling direct engagement with major steel manufacturers worldwide. This approach bypasses intermediaries, fostering stronger client relationships and allowing for tailored supply agreements.

In 2024, Champion Iron's direct sales strategy continued to be a cornerstone of its operations, facilitating significant transaction volumes. The company's commitment to direct customer interaction allows for a deeper understanding of market needs, driving customized solutions and securing long-term supply contracts with key global players in the steel industry.

Champion Iron's business model heavily leverages a dedicated rail transportation network, a crucial domestic logistics channel for moving substantial volumes of iron ore concentrate. This network is essential for transporting product from the Bloom Lake mine directly to the port of Sept-Îles, Québec.

In the fiscal year 2024, Champion Iron reported shipping 13.2 million tonnes of iron ore concentrate. The efficiency and reliability of their rail operations are paramount to achieving these production and delivery targets, directly impacting their cost structure and market competitiveness.

Champion Iron relies heavily on international ocean freight, primarily from Sept-Îles, to move its iron ore concentrate to a global customer base. This channel is crucial for reaching key markets including China, Japan, the Middle East, Europe, South Korea, India, and domestic Canadian clients.

In 2023, global seaborne iron ore trade volume was estimated to be around 1.5 billion tonnes, highlighting the scale of operations for companies like Champion Iron. The company's strategic use of ocean freight ensures its product reaches diverse international demand centers, forming the backbone of its global distribution strategy.

Company Website and Digital Platforms

The company website is the primary hub for all official corporate communications, offering a direct line to investors, analysts, and the public. It's the go-to place for the latest news, financial filings, and detailed operational updates, ensuring transparency and accessibility. For instance, as of their latest reporting, Champion Iron's website prominently features their quarterly and annual reports, providing crucial data points for valuation models like Discounted Cash Flow (DCF).

These digital platforms are critical for disseminating timely information, including press releases and investor presentations, which are vital for understanding the company's strategic direction and performance. The ease of access to these documents on the website empowers stakeholders to conduct thorough research and make informed decisions. In 2024, Champion Iron continued to leverage its website to highlight key production figures and market outlooks.

- Centralized Information Source: The company website acts as a comprehensive repository for corporate news, investor relations materials, and financial reports.

- Stakeholder Engagement: It facilitates direct communication and information sharing with investors, analysts, and the wider public.

- Accessibility of Data: Provides easy access to up-to-date financial statements and operational data, essential for financial analysis.

- Digital Presence: Reinforces the company's digital footprint, offering a professional and informative online presence.

Industry Conferences and Investor Events

Champion Iron actively engages with the financial world through participation in key industry conferences and investor events. This direct interaction allows them to effectively communicate their strategic vision, recent performance, and exciting growth initiatives to a broad audience.

These engagements are crucial for building relationships and fostering transparency with investors, analysts, and potential strategic partners. For instance, in 2024, Champion Iron participated in several prominent mining and investment forums, including the BMO Capital Markets Global Metals, Mining & Critical Minerals Conference and the CIBC Eastern Canada Conference, where they presented updates on their operations and expansion plans.

The company also hosts its own investor days and roadshows, providing a platform for deeper dives into their operations and financial outlook. This proactive approach ensures that the financial community has a clear understanding of Champion Iron's value proposition and future potential.

- Industry Conferences: Participation in events like PDAC (Prospectors & Developers Association of Canada) convention provides visibility and networking opportunities.

- Investor Roadshows: Direct engagement with institutional investors and analysts to discuss financial results and strategic objectives.

- Host Investor Events: Company-organized events to showcase operational progress and future development plans, fostering direct communication.

- Financial Community Engagement: Crucial for disseminating information on production levels, cost management, and exploration success, such as their 2024 production guidance updates.

Champion Iron's direct sales channel is a primary method for reaching major steel manufacturers globally, fostering robust client relationships and enabling customized supply agreements.

In 2024, this direct engagement allowed for significant transaction volumes, with the company focusing on understanding market needs to secure long-term contracts.

The company also utilizes a dedicated rail network for domestic logistics, moving iron ore concentrate from its Bloom Lake mine to the port of Sept-Îles, Québec.

This rail efficiency was critical in fiscal year 2024, supporting the shipment of 13.2 million tonnes of iron ore concentrate.

| Channel | Description | Key Activities/Data (2023-2024) |

|---|---|---|

| Global Direct Sales | Direct engagement with steel manufacturers worldwide. | Securing long-term supply contracts; facilitating significant transaction volumes in 2024. |

| Domestic Rail Network | Transporting concentrate from mine to port. | Shipped 13.2 million tonnes of iron ore concentrate in FY2024 via rail. |

| International Ocean Freight | Reaching global customer base from Sept-Îles. | Serving markets including China, Japan, Europe; global seaborne trade was ~1.5 billion tonnes in 2023. |

| Company Website | Primary hub for corporate communications and data. | Provides access to financial reports and operational updates; highlighted 2024 production figures. |

| Industry Conferences & Events | Direct interaction with financial community. | Participated in BMO and CIBC conferences in 2024; hosts investor days and roadshows. |

Customer Segments

Champion Iron's core customer base comprises global steel manufacturers. These companies are the primary consumers of iron ore, relying on a consistent supply of high-quality material to fuel their steel production processes across diverse geographical regions.

In 2024, the global steel industry's demand for iron ore remained robust. Major steelmaking nations, including China, India, and those in the European Union, continued to be significant buyers, driving the market for producers like Champion Iron.

Champion Iron's focus on producing high-grade iron ore directly addresses the needs of these large-scale steel producers who prioritize material quality for efficient and high-performance steel output.

Champion Iron is seeing increased interest from steel producers who are transitioning to Direct Reduction (DR) and Electric Arc Furnace (EAF) technologies. These forward-thinking steelmakers are actively looking for high-purity iron ore to bolster their decarbonization strategies and produce cleaner steel. This segment represents a significant growth opportunity.

In 2024, the global steel industry is heavily focused on sustainability, with DR/EAF production methods gaining considerable traction as a pathway to reduce carbon emissions. Companies adopting these cleaner technologies require iron ore with minimal impurities to optimize their processes. Champion Iron's high-grade product aligns perfectly with this evolving demand, positioning them to capture a larger share of this strategic market.

Champion Iron's customer base is heavily concentrated in key Asian markets, with China and Japan historically being the largest consumers of its iron ore. These nations represent significant demand centers for the commodity, driving a substantial portion of the company's sales volume.

In the fiscal year 2024, Champion Iron's sales were predominantly directed towards these major Asian economies. For instance, China accounted for a significant percentage of its sales, reflecting its status as the world's largest steel producer and thus a primary importer of iron ore.

While Asia remains a critical market, Champion Iron is actively working to diversify its geographic sales concentration. The introduction of new products is a strategic move to broaden its customer appeal and reduce reliance on any single region, aiming for more resilient revenue streams.

European and Middle Eastern Steel Industry

Champion Iron is strategically focusing on the European and Middle Eastern steel industries due to a rising demand for high-purity iron ore, a key component in green steel production. This pivot is driven by the increasing global emphasis on decarbonization within the steel sector, making Champion Iron's product offerings particularly attractive.

This expansion into Europe and the Middle East offers significant logistical advantages, potentially reducing shipping costs and lead times for customers in these regions. Furthermore, it diversifies Champion Iron's market base, mitigating risks associated with over-reliance on any single geographic area.

- Growing Green Steel Demand: European Union targets aim to reduce steel sector emissions by 30% by 2030, creating a substantial market for low-carbon inputs.

- Market Diversification: Expanding into these regions reduces reliance on traditional markets, enhancing overall business resilience.

- Logistical Efficiencies: Proximity to European and Middle Eastern steel producers can lead to lower transportation expenses and improved supply chain management.

- Product Alignment: Champion Iron's high-purity iron ore directly meets the evolving quality requirements for advanced steel manufacturing processes.

Financial and Investment Community

The financial and investment community, while not directly consuming Champion Iron's products, is a vital customer segment. This group, encompassing individual investors, financial analysts, portfolio managers, and academic researchers, relies on detailed company performance data and market analysis to inform their investment decisions regarding Champion Iron.

In 2024, Champion Iron's market capitalization fluctuated, reflecting investor sentiment and commodity prices. For instance, by mid-2024, the company's stock performance was closely watched, with analysts focusing on production levels and future expansion plans. Key financial metrics such as revenue, earnings per share, and cash flow from operations are critical for this segment in assessing the company's valuation and investment potential.

- Investor Relations: Champion Iron actively engages with this segment through regular financial reporting, investor calls, and presentations to provide transparency on operations and strategy.

- Valuation Tools: Financial professionals utilize discounted cash flow (DCF) models and other valuation methods, incorporating Champion Iron's production forecasts and cost structures.

- Market Analysis: Academic stakeholders and business strategists study Champion Iron's position within the global iron ore market, considering factors like supply-demand dynamics and geopolitical influences.

- Data Requirements: This segment demands comprehensive data, including operational efficiency, reserve estimates, and environmental, social, and governance (ESG) performance, to conduct thorough due diligence.

Champion Iron's primary customers are global steel manufacturers, who require a steady supply of high-quality iron ore for their production needs. In 2024, demand from major steelmaking nations like China and India remained strong, underscoring the importance of these markets.

A growing segment of Champion Iron's customer base consists of steel producers adopting Direct Reduction (DR) and Electric Arc Furnace (EAF) technologies. These forward-thinking companies are specifically seeking high-purity iron ore to support their decarbonization efforts and produce greener steel, a trend that gained significant momentum in 2024.

Champion Iron's customer concentration has historically been in Asia, particularly China and Japan, which are major consumers of iron ore. However, the company is actively diversifying its sales to include European and Middle Eastern markets, driven by the increasing demand for low-carbon steel inputs in those regions.

The financial and investment community, including analysts and investors, is another key customer segment. They rely on Champion Iron's performance data and market analysis to make informed investment decisions. In 2024, this segment closely monitored the company's production, expansion plans, and financial metrics.

| Customer Segment | Key Characteristics | 2024 Market Dynamics | Champion Iron's Value Proposition |

|---|---|---|---|

| Global Steel Manufacturers | Require consistent, high-quality iron ore supply. | Robust demand from China, India, EU. | High-grade iron ore meeting stringent quality requirements. |

| Green Steel Producers (DR/EAF) | Seeking high-purity iron ore for decarbonization. | Increasing adoption of cleaner steel technologies. | Product purity aligns with evolving sustainability goals. |

| Geographic Markets (Asia, Europe, Middle East) | Concentrated demand in key steelmaking regions. | Asia remains dominant; growing interest in Europe/Middle East. | Strategic expansion for market diversification and logistical benefits. |

| Financial & Investment Community | Analyzes company performance for investment decisions. | Focus on production, expansion, and financial metrics. | Transparency through regular reporting and data provision. |

Cost Structure

Mining and processing operating costs are the direct expenses tied to extracting and concentrating iron ore. These include labor, energy, equipment upkeep, and necessary consumables. For Champion Iron, these costs are a significant component of their overall expenditure.

Despite Champion Iron's commitment to renewable energy, electricity costs are still a factor. For instance, in the fiscal year ending March 31, 2024, the company incurred substantial operating expenses related to mining and processing activities at its operations.

Champion Iron dedicates significant capital to major growth projects, such as the Direct Reduction Pellet Feed (DRPF) project and the potential Kami project. These substantial investments are crucial for expanding production capacity and enhancing product quality.

In fiscal year 2024, Champion Iron reported capital expenditures of approximately C$347 million, with a notable portion directed towards these expansion and development efforts. This demonstrates a clear commitment to future growth and market positioning.

Champion Iron's cost structure is heavily influenced by logistics and transportation. This includes the significant expense of moving its iron ore concentrate from its mines in Quebec to the port, primarily through rail haulage. For instance, in the fiscal year ending March 31, 2024, Champion Iron reported substantial transportation costs associated with its operations.

Further adding to these costs is the ocean freight required to ship the iron ore concentrate to global markets. Fluctuations in freight rates, driven by global demand and supply dynamics, can directly impact the company's profitability. The company's reliance on these transportation networks means that any logistical disruptions or increases in shipping costs can have a material effect on its overall cost of goods sold.

Sustaining Capital and Tailings Management

Champion Iron's cost structure includes significant ongoing capital expenditures necessary for sustaining its mining operations. This includes essential investments in managing tailings and rebuilding mining equipment to ensure operational efficiency and adherence to stringent environmental regulations. These expenditures are crucial for executing the company's long-term mine plan.

- Sustaining Capital: Ongoing investments are made to maintain and upgrade mining infrastructure and equipment.

- Tailings Management: Costs are incurred for the safe and compliant management of mine tailings.

- Equipment Rebuilding: Capital is allocated to refurbish or replace critical mining machinery.

- Environmental Compliance: Expenditures are necessary to meet environmental standards and regulations.

For the fiscal year ending March 31, 2024, Champion Iron reported capital expenditures of approximately C$246.7 million. A significant portion of this was directed towards sustaining capital projects, including the expansion of the Bloom Lake mine and ongoing tailings management activities at its facilities.

General and Administrative (G&A) and Financing Costs

General and Administrative (G&A) and Financing Costs encompass the essential corporate overheads and the expenses tied to managing the company's capital structure. These include salaries for administrative staff, office rent, and other operational support functions that keep the business running smoothly.

Financing costs are particularly significant, especially interest payments on debt. For Champion Iron, a key component here is the interest on its senior notes. These costs are crucial for understanding the company's overall profitability and financial health.

- Corporate Overheads: These are the fixed and variable costs associated with running the central operations of the company, including executive salaries, legal fees, and accounting services.

- Administrative Expenses: This category covers day-to-day operational costs not directly tied to production, such as IT support, office supplies, and travel.

- Financing Costs: Primarily includes interest paid on outstanding debt. For Champion Iron, a substantial portion of this is the interest on their senior notes, which are due in 2025 and 2027, representing a fixed financial obligation.

- Impact on Profitability: Both G&A and financing costs directly reduce net income, making efficient management of these expenses vital for maximizing shareholder returns.

Champion Iron's cost structure is dominated by mining and processing operational expenses, which encompass labor, energy, and equipment maintenance. The company also faces significant logistics and transportation costs, including rail haulage and ocean freight, to get its product to market. Furthermore, ongoing capital expenditures for sustaining operations and growth projects, alongside general administrative and financing costs like interest on debt, are key components.

| Cost Component | Description | FY2024 Impact (Approx.) |

| Mining & Processing Operating Costs | Direct costs of extraction and concentration (labor, energy, consumables) | Significant portion of total expenses |

| Logistics & Transportation | Rail haulage to port, ocean freight to global markets | Substantial reported costs |

| Sustaining Capital Expenditures | Maintaining operations, tailings management, equipment upkeep | C$246.7 million (FY2024) |

| Growth Capital Expenditures | DRPF project, Kami project, Bloom Lake expansion | C$347 million total Capex (FY2024), with portion for growth |

| General & Administrative (G&A) | Corporate overheads, salaries, office expenses | Directly impacts profitability |

| Financing Costs | Interest on debt, notably senior notes | Crucial for financial health |

Revenue Streams

Champion Iron's main income comes from selling its high-grade iron ore concentrate to steel manufacturers worldwide. This is the core of their business model.

The amount of money they make depends on how much they sell, the current price of iron ore, and how much demand there is for pure iron ore. For the fiscal year ending March 31, 2024, Champion Iron reported total revenue of $2.1 billion, with sales of iron ore concentrate being the dominant contributor.

Champion Iron is positioning itself to capture higher prices by producing direct reduction grade pellet feed, with a target purity of 69% Fe. This strategic move taps into a growing market demand for materials essential for environmentally friendlier steel production methods. For instance, in their fiscal year 2024, the company reported significant progress in advancing their direct reduction projects, indicating a clear pathway to realizing these premium pricing opportunities.

Champion Iron's revenue can be affected by provisional pricing adjustments. These happen when the final settlement price for iron ore differs from the initial price set at invoicing, due to market volatility.

For instance, during the fiscal year ending March 31, 2024, Champion Iron reported that its realized average selling price for iron ore was influenced by these adjustments. While the company achieved a strong average selling price of $128.30 per dry metric ton (dmt) for its fines product, the provisional pricing mechanism means actual revenue can fluctuate based on iron ore index price movements between sale and final payment.

Potential Future Revenue from Kami Project

The Kami project represents a significant long-term growth opportunity for Champion Iron, poised to unlock a substantial new revenue stream. This development is anticipated to bolster the company's production capacity with high-quality direct reduction iron ore, a valuable commodity in the evolving steelmaking landscape.

In the long term, the potential development and subsequent production from the Kami project could introduce a significant new revenue stream. This project is expected to add substantial volumes of direct reduction quality iron ore to Champion Iron's portfolio.

- Kami Project Potential: Expected to contribute significantly to future revenue.

- Product Quality: Focus on direct reduction quality iron ore.

- Volume Addition: Anticipated to add substantial volumes to the iron ore portfolio.

Diversified Market Sales

Champion Iron is actively broadening its customer reach beyond its primary market in China. By targeting regions like Europe, the Middle East, and North Africa, the company is building a more geographically diverse sales base. This strategic expansion is designed to reduce the company's vulnerability to fluctuations in any single market, thereby strengthening its overall revenue stability.

This diversification is crucial for long-term resilience. For instance, in the fiscal year ending March 31, 2024, Champion Iron reported total revenue of $2.1 billion CAD. Expanding into new territories helps ensure that a downturn in one region does not disproportionately impact overall sales performance.

The benefits of this approach include:

- Reduced Market Dependency: Lessens reliance on China for sales.

- Enhanced Revenue Stability: A wider customer base provides a buffer against regional economic shifts.

- New Growth Opportunities: Access to previously untapped markets for iron ore demand.

- Improved Negotiating Power: A broader market presence can strengthen pricing and contract terms.

Champion Iron's primary revenue stream originates from the sale of high-grade iron ore concentrate to steel manufacturers globally. This core business is supplemented by efforts to capture premium pricing for direct reduction grade pellet feed, targeting a purity of 69% Fe, essential for greener steel production methods.

The company's financial performance is closely tied to iron ore prices and sales volumes. For the fiscal year ending March 31, 2024, Champion Iron generated $2.1 billion in revenue, with sales of iron ore concentrate forming the bulk of this figure. The average realized selling price for their fines product was $128.30 per dry metric ton (dmt) for the same period, though provisional pricing adjustments can impact final revenue recognition.

Strategic initiatives like the Kami project are designed to introduce substantial new revenue by adding significant volumes of direct reduction quality iron ore to their portfolio. Furthermore, Champion Iron is actively diversifying its customer base beyond China, targeting markets in Europe, the Middle East, and North Africa to enhance revenue stability and reduce market dependency.

| Revenue Source | Key Driver | Fiscal Year 2024 Impact |

| Iron Ore Concentrate Sales | Volume & Market Price | Dominant contributor to $2.1 billion total revenue |

| Direct Reduction Grade Pellet Feed | Premium Pricing & Demand | Advancing projects for future premium realization |

| Geographic Diversification | Market Access & Stability | Expanding beyond China to Europe, Middle East, North Africa |

Business Model Canvas Data Sources

The Champion Iron Business Model Canvas is built upon a foundation of robust financial disclosures, detailed market research reports, and comprehensive operational data. These sources ensure each component of the canvas accurately reflects the company's strategy and market position.