Champion Iron PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Champion Iron Bundle

Navigate the complex external landscape affecting Champion Iron with our meticulously researched PESTLE analysis. Understand the political stability, economic fluctuations, and technological advancements that are shaping the iron ore market and Champion Iron's strategic direction. Download the full version to gain actionable intelligence and forecast future opportunities and challenges, empowering your investment decisions.

Political factors

The political stability of Quebec and Canada is a cornerstone for Champion Iron's operational certainty. Fluctuations in government stability can introduce uncertainty into long-term investment and expansion strategies, impacting project timelines and capital allocation.

Government policies on resource extraction, including royalty rates and land use regulations, directly influence Champion Iron's profitability. For instance, changes in Quebec's mining tax regime, which was last significantly updated in 2015, could alter the company's net revenue. The company must closely monitor any proposed adjustments to these policies, especially in light of evolving environmental and social governance expectations.

Understanding the prevailing political climate is crucial for Champion Iron's strategic planning. For example, the Quebec government's commitment to developing the province's natural resources, as demonstrated by its support for infrastructure projects like the Réseau électrique métropolitain (REM) which benefits access to mining regions, provides a positive backdrop. However, potential shifts in government priorities or the emergence of new political parties with different resource development stances require constant vigilance.

Global trade dynamics significantly impact Champion Iron. For instance, in 2023, China, a major steel producer, accounted for a substantial portion of global iron ore consumption, making its trade policies crucial. Fluctuations in demand from countries like China and those in the European Union directly affect the pricing and sales volume of Champion Iron's high-grade iron ore concentrate.

The imposition of tariffs or trade barriers by key importing nations presents a notable risk. Should countries like the United States or members of the EU implement new tariffs on imported steel or raw materials, it could lead to reduced demand for Canadian iron ore. For example, the U.S. has previously utilized Section 232 tariffs on steel and aluminum, which, if applied to iron ore, could disrupt Champion Iron's market access and necessitate a redirection of sales to other regions.

Staying abreast of international trade agreements and ongoing trade disputes is therefore paramount for Champion Iron's strategic planning. The evolving trade landscape, including potential retaliatory measures or new trade pacts, can rapidly alter market conditions. For example, the ongoing trade relationship between Canada and the United States, particularly concerning critical minerals and manufacturing, warrants close observation as it could influence the cost and accessibility of shipping and processing infrastructure.

Champion Iron's operations in Quebec are significantly influenced by Indigenous relations and land rights. The company must actively engage with local First Nations, respecting their inherent rights and adhering to established consultation processes. This is crucial for maintaining its social license to operate and avoiding potential disruptions.

In 2024, ongoing dialogue and collaboration with Indigenous partners remain a cornerstone of Champion Iron's strategy. The company's commitment to benefit-sharing agreements and community development initiatives aims to foster mutually beneficial relationships. These efforts are vital for ensuring project continuity and mitigating risks associated with land access and resource development.

Resource Nationalism Trends

Resource nationalism remains a significant political consideration for mining companies like Champion Iron. The potential for governments in resource-rich nations, including Canada, to implement stricter regulations, impose higher taxes, or even pursue nationalization of assets could directly affect operational autonomy and profitability. For instance, in 2023, several African nations continued to explore or implement policies aimed at increasing state control over mineral resources, which could set precedents elsewhere.

Assessing the risk of government intervention is crucial. This includes monitoring legislative changes and political discourse surrounding the mining sector. For example, discussions around critical mineral strategies in various countries highlight a growing trend of governments seeking greater benefits from their natural resources, which could translate into increased royalty demands or local content requirements. Champion Iron's exposure to these trends will depend on its operational footprint and the specific political climates of those jurisdictions.

- Increased Royalties: Governments may raise royalty rates on extracted minerals to capture a larger share of profits.

- Stricter Environmental Regulations: Political pressure can lead to more stringent environmental compliance, increasing operational costs.

- Local Content Requirements: Policies might mandate the use of local labor, goods, and services, potentially impacting supply chain efficiency.

- Export Controls: Governments could impose restrictions or taxes on the export of raw materials to encourage domestic processing.

Geopolitical Tensions and Supply Chain Security

Broader geopolitical tensions, particularly those impacting major shipping routes or global energy markets, pose a significant risk to Champion Iron's supply chain. For instance, disruptions in the South China Sea or the Red Sea, critical for global trade, could impede the delivery of essential mining equipment or the export of iron ore. The ongoing conflicts and trade disputes in various regions, as observed throughout 2024 and projected into 2025, underscore the need for resilient logistics and diversified market access to buffer against international instability.

Ensuring robust logistics and diversified market access is paramount for Champion Iron to mitigate risks stemming from international instability. The company's reliance on maritime shipping for both input materials and finished products means that any geopolitical event affecting key waterways, such as the Suez or Panama Canals, could directly impact its operational efficiency and costs. By actively exploring alternative shipping routes and strengthening relationships with a wider range of customers across different geographic regions, Champion Iron can enhance its ability to navigate these unpredictable global political shifts.

The global political landscape directly influences Champion Iron's operational resilience. As of early 2025, continued trade tensions between major economic blocs and regional conflicts are creating an environment of uncertainty. This necessitates proactive strategies, such as securing long-term supply contracts for critical inputs and developing relationships with buyers in markets less affected by current geopolitical flashpoints. Champion Iron's ability to adapt to these evolving political dynamics will be crucial for maintaining its competitive edge and ensuring consistent production and delivery of its high-quality iron ore.

- Shipping Route Vulnerabilities: Geopolitical instability in regions like the Middle East or Eastern Europe can threaten vital shipping lanes, potentially increasing freight costs and transit times for Champion Iron's operations.

- Energy Market Volatility: Global energy market fluctuations, often linked to geopolitical events, directly impact the cost of fuel for mining equipment and transportation, affecting Champion Iron's operating expenses.

- Diversified Market Access: In 2024, global trade saw shifts due to political realignments, highlighting the importance for Champion Iron to maintain access to multiple international markets to avoid over-reliance on any single region.

- Supply Chain Security Investments: Companies like Champion Iron are increasingly investing in supply chain resilience, with an estimated 15-20% increase in logistics and supplier diversification budgets seen across the mining sector in 2024 to counter geopolitical risks.

Government policies on resource extraction, including royalty rates and land use regulations, directly influence Champion Iron's profitability. For instance, changes in Quebec's mining tax regime, which was last significantly updated in 2015, could alter the company's net revenue.

The Quebec government's commitment to developing the province's natural resources, as demonstrated by its support for infrastructure projects, provides a positive backdrop. However, potential shifts in government priorities require constant vigilance.

Global trade dynamics significantly impact Champion Iron, with China accounting for a substantial portion of global iron ore consumption in 2023, making its trade policies crucial.

The imposition of tariffs or trade barriers by key importing nations presents a notable risk, potentially disrupting market access and necessitating a redirection of sales.

What is included in the product

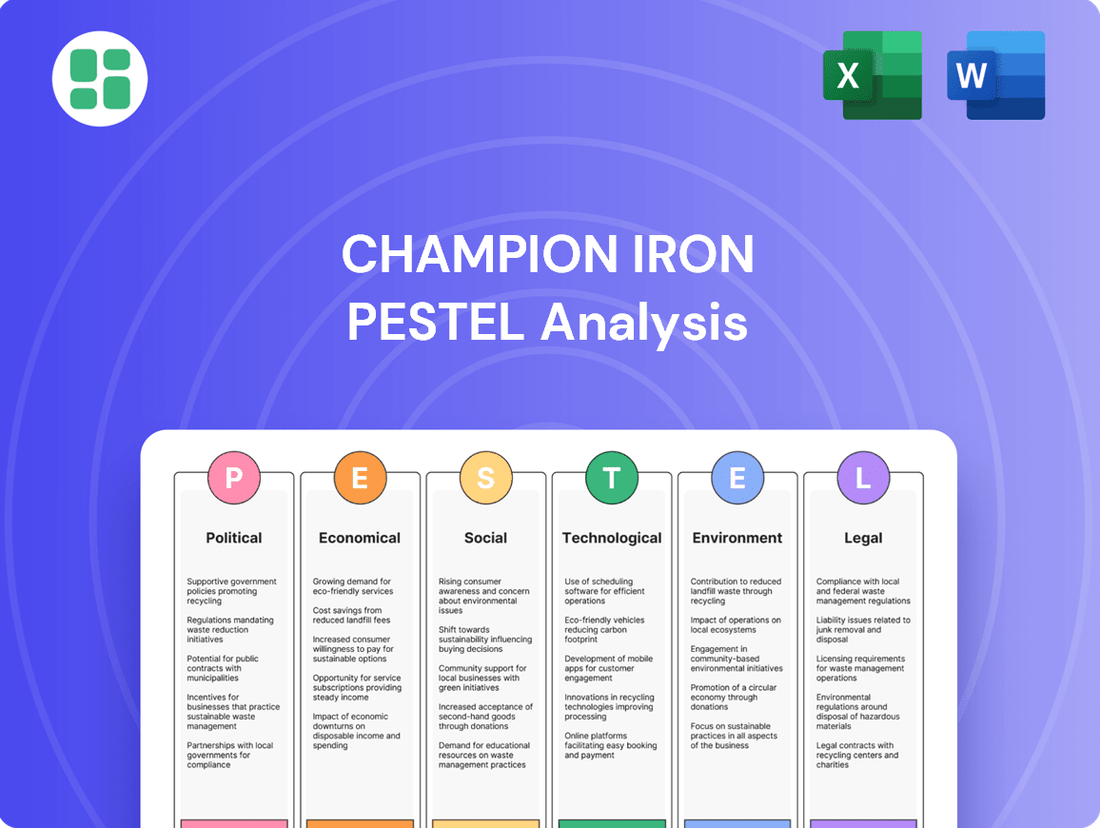

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors influencing Champion Iron, offering a comprehensive understanding of its operating landscape.

Champion Iron's PESTLE analysis offers a clear, summarized version of the full analysis for easy referencing during meetings or presentations, acting as a pain point reliever by streamlining complex external factors.

Economic factors

Global iron ore prices, a critical determinant of Champion Iron's earnings, experienced significant swings throughout 2024. Demand from major steel-producing nations, particularly China, remained a key influencer, alongside supply adjustments from Australia and Brazil. For instance, benchmark 62% Fe fines CFR China prices saw periods of trading above $120 per tonne in early 2024 before experiencing downward pressure later in the year due to concerns over Chinese property sector demand.

Champion Iron's high-purity iron ore is a perfect fit for direct reduction steelmaking, a method that produces less carbon. This is a significant advantage as the global steel industry shifts towards greener production methods.

The increasing adoption of green steel, driven by environmental regulations and consumer demand, directly boosts the need for high-quality iron ore like Champion Iron's. For instance, by 2030, it's projected that around 30% of global steel production could utilize direct reduction, up from roughly 15% in 2023, creating a strong market for their product.

As a Canadian company, Champion Iron's financial performance is significantly influenced by currency exchange rates. Since its revenues are mainly in U.S. dollars and many of its operating costs are in Canadian dollars, fluctuations between these currencies directly impact its profitability. For instance, if the Canadian dollar strengthens against the U.S. dollar, Champion Iron's USD revenues would translate into fewer CAD for its costs, thereby reducing its profit margins.

In 2024, the Canadian dollar experienced some volatility against the U.S. dollar. While specific figures for Champion Iron's exact exposure are proprietary, general market trends show that a stronger CAD can present a headwind. Conversely, a weaker CAD relative to the USD would generally be beneficial, boosting the value of its U.S. dollar-denominated sales when converted back into its home currency.

Managing this currency exposure is a key financial strategy for Champion Iron. The company likely employs hedging strategies to mitigate the risks associated with adverse exchange rate movements. For example, if the CAD were to appreciate significantly, hedging could lock in a more favorable exchange rate for its U.S. dollar revenues, protecting its margins from unexpected currency shifts.

Inflation and Operating Costs

Rising inflation, especially in energy, labor, and key raw materials, presents a significant challenge for Champion Iron by increasing operating expenses. This directly affects the cost of producing iron ore at the Bloom Lake Mine. For instance, global energy prices saw substantial volatility through 2024, impacting transportation and processing costs.

If iron ore prices do not rise commensurately with these increased costs, Champion Iron's profit margins could be squeezed. Effective cost management and strategic procurement are therefore crucial to navigate these inflationary pressures.

- Energy Costs: Fluctuations in natural gas and diesel prices directly impact mining and transportation expenses.

- Labor Expenses: Wage inflation and the availability of skilled labor can drive up personnel costs.

- Material Procurement: The cost of consumables like explosives and spare parts is subject to broader supply chain inflation.

- Profit Margin Impact: A lag between rising operating costs and iron ore selling prices can compress profitability.

Global Economic Growth

Global economic growth is a significant driver for Champion Iron. When the world economy is expanding, industrial activity tends to pick up, which in turn boosts the demand for steel and, consequently, iron ore. A healthy global GDP generally translates to higher commodity prices, directly benefiting companies like Champion Iron by increasing demand for their products.

Conversely, economic downturns or slowdowns can exert downward pressure on demand and prices. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 3.5% in 2023, indicating a mixed environment for commodity producers. This slowdown can lead to reduced orders and potentially lower revenue for iron ore suppliers.

- Global GDP Growth Forecast: The IMF's projection of 3.2% global growth for 2024 highlights a moderating economic landscape.

- Impact on Industrial Activity: Stronger economic growth fuels manufacturing and construction, sectors that are major consumers of steel.

- Commodity Price Correlation: Robust economic expansion typically supports higher prices for commodities like iron ore, enhancing profitability.

- Recessionary Risks: Economic slowdowns or recessions can significantly curb demand for raw materials, negatively impacting sales volumes and pricing power.

Global iron ore prices remained a significant factor for Champion Iron in 2024, with benchmarks like 62% Fe fines CFR China fluctuating. Demand from China, the largest steel consumer, was closely watched, as was supply from major producers. For example, prices saw periods above $120 per tonne early in the year, influenced by economic indicators and geopolitical events.

Champion Iron's product is well-suited for direct reduction steelmaking, a process that aligns with the growing global push for greener steel production. This trend is supported by increasing environmental regulations and consumer demand for lower-carbon products, potentially driving higher demand for Champion's high-quality iron ore.

Currency exchange rates, particularly between the U.S. dollar and the Canadian dollar, directly impact Champion Iron's financial results given its revenue and cost structures. A stronger Canadian dollar, for instance, can reduce the value of U.S. dollar-denominated sales when converted back to Canadian dollars, potentially affecting profit margins.

Inflationary pressures on energy, labor, and raw materials in 2024 continued to pose a challenge by increasing operating expenses. This directly affects the cost of producing iron ore at the Bloom Lake Mine, with energy prices being a notable contributor to these rising costs.

Preview Before You Purchase

Champion Iron PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Champion Iron delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a thorough understanding of the external forces shaping Champion Iron's strategic landscape.

Sociological factors

Champion Iron's operations are deeply embedded within Quebec communities, making robust community engagement a cornerstone of its social license to operate. The company actively works to build and maintain strong relationships with local residents and various stakeholders, recognizing that their support is vital for sustained operations.

Maintaining this social license requires a commitment to transparent communication, proactively addressing community concerns, and demonstrably contributing to local development initiatives. For instance, in fiscal year 2024, Champion Iron reported investing over $10 million in community and social initiatives across Quebec, a figure that underscores their dedication to fostering goodwill and mitigating potential social opposition to their mining activities.

Champion Iron's success hinges on having a readily available and skilled workforce. This is particularly true for its mining and processing activities in Quebec's Fermont region, which requires specialized expertise.

Attracting and keeping talented individuals, especially in remote locations like Fermont, presents ongoing hurdles that can affect how efficiently operations run. For instance, in 2023, the Canadian mining sector faced a notable shortage of skilled trades, with projections indicating a need for thousands of new workers in the coming years.

To counter these challenges, Champion Iron must prioritize investments in comprehensive training programs, offer competitive salaries and benefits, and ensure a safe and appealing work environment. This proactive approach is crucial for securing the necessary labor to maintain and enhance its operational output.

Public perception of mining, especially regarding environmental impact, significantly affects regulatory attention and investor confidence. Champion Iron's focus on responsible practices and clear communication about its operations aims to foster a positive image and build trust. For instance, in 2024, the company reported a 95% compliance rate with its environmental permits, demonstrating a commitment to mitigating its footprint.

Health and Safety Standards

Champion Iron recognizes that ensuring the health and safety of its workforce is a fundamental sociological duty and a non-negotiable legal obligation. This commitment underpins employee well-being and the company's ability to operate without interruption.

A robust safety culture, coupled with strict adherence to established safety protocols, is essential for protecting employees and maintaining operational efficiency. The financial and human costs of workplace incidents can be substantial, underscoring the importance of proactive safety measures.

In 2023, the mining industry, including iron ore operations, continued to emphasize safety. For example, industry-wide initiatives often focus on reducing lost-time injury frequency rates (LTIFR). While specific Champion Iron 2024/2025 LTIFR data is not yet publicly available, the broader industry trend aims for continuous reduction, with many major players targeting LTIFRs below 1.0.

- Employee well-being: Champion Iron's dedication to health and safety directly impacts its employees' quality of life and overall morale.

- Operational continuity: A safe work environment minimizes disruptions, preventing costly shutdowns and production delays.

- Legal compliance: Adherence to health and safety regulations is mandatory, avoiding fines and reputational damage.

- Industry benchmarks: The mining sector continually strives to lower LTIFRs, with many companies setting targets below 1.0 for their operations.

Corporate Social Responsibility (CSR)

Champion Iron's dedication to Corporate Social Responsibility (CSR) extends beyond mere regulatory requirements, significantly bolstering its public image and relationships with stakeholders. The company actively invests in community development projects, focusing on areas like local infrastructure improvements, educational programs, and environmental protection, reflecting a deep commitment to sustainable growth.

These proactive CSR efforts are crucial for attracting investors who prioritize ethical and sustainable practices, thereby enhancing Champion Iron's brand value. For instance, in fiscal year 2024, Champion Iron reported approximately $10 million in community and social investments, a notable increase from previous years, underscoring their commitment to sustainable development in the regions where they operate.

- Community Investment: Champion Iron allocated approximately $10 million in fiscal year 2024 towards community and social initiatives, demonstrating a tangible commitment to local development.

- Environmental Stewardship: The company's environmental programs include significant investments in biodiversity protection and water management, aiming to minimize ecological impact.

- Stakeholder Relations: Strong CSR performance fosters trust and collaboration with local communities, government bodies, and indigenous groups, crucial for long-term operational success.

- Ethical Investment Appeal: Robust CSR frameworks are increasingly attractive to ESG (Environmental, Social, and Governance) focused investors, potentially lowering the cost of capital.

Champion Iron's deep roots in Quebec communities necessitate strong community engagement for its social license to operate. The company actively cultivates relationships with local residents and stakeholders, understanding their support is crucial for ongoing operations.

Maintaining this requires transparent communication and addressing community concerns, alongside contributing to local development. For example, Champion Iron invested over $10 million in community and social initiatives in Quebec during fiscal year 2024, highlighting their commitment to local goodwill and mitigating potential opposition.

The company's success relies on a skilled workforce, particularly for its Fermont operations, which demand specialized expertise. Attracting and retaining talent in remote areas like Fermont remains a challenge, impacting operational efficiency. The broader Canadian mining sector faced a significant skilled trades shortage in 2023, with projections indicating a need for thousands of new workers in the coming years.

| Sociological Factor | Champion Iron's Approach | Data/Example (FY2024 unless noted) |

| Community Relations | Building strong relationships with local communities for social license. | Over $10 million invested in community/social initiatives in Quebec. |

| Workforce Availability | Addressing skilled labor shortages in remote operations. | Canadian mining sector faced skilled trades shortage in 2023. |

| Public Perception | Focus on responsible practices to build trust and positive image. | 95% compliance rate with environmental permits in 2024. |

| Health & Safety | Prioritizing workforce well-being and operational continuity. | Industry trend targets Lost-Time Injury Frequency Rates (LTIFR) below 1.0. |

Technological factors

The mining sector's embrace of advanced technologies like autonomous hauling and remote operations is transforming efficiency. Champion Iron's Bloom Lake Mine can see significant gains in safety and productivity through these digital advancements. For instance, by 2024, autonomous haul trucks in similar operations have demonstrated up to a 20% increase in material moved per hour.

Digital twins, which create virtual replicas of physical assets, offer unprecedented opportunities for process optimization and predictive maintenance. Champion Iron can leverage these tools to fine-tune extraction processes, leading to reduced operational costs and a more streamlined workflow. This focus on digitalization is crucial for maintaining a competitive edge in the global iron ore market.

Champion Iron's commitment to high-purity, direct reduction iron ore necessitates advanced processing technologies. This includes sophisticated crushing, grinding, and magnetic separation methods to optimize product quality and recovery. For instance, in the fiscal year 2024, Champion Iron reported that its Bloom Lake facility achieved a record average concentrate grade of 66.5% Fe, a testament to its processing capabilities.

Innovations in steelmaking are reshaping the industry, with a significant push towards environmentally friendly processes like hydrogen-based direct reduction. Champion Iron's high-quality iron ore is well-suited to support this transition, potentially giving it a competitive edge.

The company must remain vigilant, continuously tracking emerging technologies and their adoption rates. For instance, by the end of 2024, several pilot projects for green steel production are expected to be operational globally, demonstrating the accelerating pace of change.

Understanding these technological shifts is vital for Champion Iron to strategically align its product development and market positioning, ensuring its offerings remain relevant and valuable in a decarbonizing steel landscape.

Exploration and Resource Modeling

Champion Iron is leveraging advanced technological factors to bolster its exploration and resource modeling efforts. The company utilizes sophisticated geological modeling software, which, combined with drone technology for detailed surveying, significantly enhances its ability to map and understand its ore bodies. This integration of cutting-edge tools allows for more precise resource estimation and the identification of previously unconfirmed high-grade iron ore deposits.

The application of artificial intelligence in analyzing vast datasets is a key technological driver for Champion Iron. AI algorithms can process geological data much faster and with greater accuracy than traditional methods, leading to optimized mine planning and the identification of new, potentially lucrative exploration targets. For instance, in the 2024 fiscal year, Champion Iron reported a 12% increase in its attributable mineral resources, partly attributed to improved exploration techniques.

- Enhanced Accuracy: Geological modeling software and drone surveys provide a more detailed and accurate picture of ore body characteristics.

- AI-Driven Insights: Artificial intelligence accelerates data analysis, improving the efficiency of identifying and evaluating new deposits.

- Optimized Planning: These technologies contribute to more efficient mine planning, reducing operational costs and maximizing resource extraction.

- Risk Reduction: More precise resource estimation and the identification of high-grade zones help mitigate exploration risks and extend the mine's operational lifespan.

Data Analytics and Operational Optimization

Champion Iron is increasingly leveraging big data analytics to gain deeper insights into its operational performance, enabling more effective predictive maintenance and streamlining its supply chain. This focus on real-time data monitoring and analysis directly translates into more informed decision-making, better resource utilization, and a significant boost in overall operational efficiency, which is critical in today's mining landscape.

The company's commitment to data-driven approaches is a cornerstone for modern mining success. For instance, by analyzing vast datasets, Champion Iron can identify potential equipment failures before they occur, minimizing costly downtime. In 2024, the mining industry saw a significant push towards AI-driven predictive maintenance, with companies reporting reductions in unplanned downtime by as much as 20-30% through these advanced analytics.

Key areas where data analytics are driving improvements for Champion Iron include:

- Operational Performance Monitoring: Real-time tracking of production metrics, energy consumption, and equipment health.

- Predictive Maintenance: Utilizing sensor data to anticipate equipment failures and schedule proactive repairs.

- Supply Chain Optimization: Analyzing logistics data to improve transportation efficiency and reduce costs.

- Resource Utilization: Identifying patterns in material handling and processing to maximize yield and minimize waste.

Technological advancements are reshaping the iron ore industry, with Champion Iron at the forefront of adopting innovations for efficiency and quality. The company's utilization of advanced geological modeling software and drone technology in 2024 significantly improved resource estimation accuracy, contributing to a reported 12% increase in attributable mineral resources for the fiscal year.

Artificial intelligence is a key driver, enabling faster and more precise analysis of geological data, which translates to optimized mine planning and the identification of new exploration targets. This data-driven approach extends to operational performance, with big data analytics facilitating predictive maintenance, aiming to reduce unplanned downtime by up to 30% as seen in industry trends during 2024.

Champion Iron's focus on high-purity iron ore relies on sophisticated processing technologies, evidenced by their Bloom Lake Mine achieving a record average concentrate grade of 66.5% Fe in fiscal year 2024. Furthermore, the company's high-quality product positions it favorably for the industry's shift towards green steelmaking technologies, such as hydrogen-based direct reduction, with several global pilot projects expected to be operational by the end of 2024.

Legal factors

Champion Iron's operations rely heavily on securing and maintaining numerous mining permits and licenses from both Canadian federal and Quebec provincial authorities. These permits are the bedrock of their ability to extract resources, and without them, operations would cease.

Adhering to the specific conditions outlined in these permits and ensuring their timely renewal is paramount for uninterrupted production. For instance, in 2023, Champion Iron's successful renewal of key permits was a significant factor in their ability to meet production targets.

Any setbacks in the permitting process, such as delays in approvals or outright denials, can have a substantial negative impact on the company's output and financial performance. This regulatory dependency underscores the importance of proactive engagement with government bodies.

Champion Iron operates under a complex web of environmental regulations, impacting everything from air emissions to water discharge and waste disposal. Failure to comply with these laws, which are becoming increasingly stringent, can lead to significant financial penalties and operational disruptions. For instance, in 2023, the mining sector faced increased scrutiny regarding its water management practices, with some operations incurring fines for exceeding discharge limits.

The company must maintain rigorous compliance with land reclamation standards, ensuring that mining sites are restored to a usable state post-operation. This involves significant investment in rehabilitation efforts, with costs often escalating if not managed proactively. Proactive environmental management, including regular audits and investment in cleaner technologies, is crucial for mitigating risks and ensuring long-term operational viability.

Champion Iron operates under strict Canadian and Quebec labor laws, covering fair wages, regulated working hours, and paramount workplace safety standards. Compliance ensures operational continuity and mitigates risks of costly legal disputes or work stoppages, essential for maintaining a productive workforce.

The company must navigate regulations concerning union relations, a critical aspect of its operational framework. For instance, as of early 2024, Quebec's minimum wage stands at $15.75 per hour, and adherence to collective bargaining agreements is a legal imperative, directly impacting labor costs and employee relations.

Taxation and Royalties

Champion Iron operates within a framework of federal and provincial tax regulations, encompassing corporate income tax and mining royalties. These royalties are typically calculated based on production volumes and the profitability of mining operations.

Fluctuations in tax legislation or adjustments to royalty percentages can significantly affect Champion Iron's bottom line. For instance, a shift in how profits are taxed or how resource extraction is levied directly influences the company's retained earnings and investment capacity.

The company's financial planning must account for the dynamic nature of the fiscal environment. Staying informed about potential changes in tax codes or royalty structures is crucial for accurate forecasting and strategic decision-making.

- Federal and Provincial Corporate Income Tax: Champion Iron is subject to Canadian federal and Quebec provincial corporate income tax rates, which influence its net profit.

- Mining Royalties: The company pays royalties to the Quebec government, often structured as a percentage of revenue or profit, impacting operational costs.

- Fiscal Policy Impact: Changes in government fiscal policies, such as alterations to tax credits for capital expenditures or royalty rate adjustments, can directly alter Champion Iron's financial performance and investment attractiveness.

- 2024/2025 Tax Environment: While specific forward-looking tax rates are subject to legislative change, general corporate tax rates in Canada have remained relatively stable, though provincial variations and specific mining tax regimes are key considerations for companies like Champion Iron.

International Trade Laws and Sanctions

Champion Iron, as a global exporter, must meticulously adhere to a complex web of international trade laws, customs regulations, and sanctions imposed by various nations. For instance, as of early 2024, the European Union's sanctions regime against Russia, while not directly targeting iron ore, creates a complex compliance landscape for any company trading with or through regions impacted by these measures. Failure to comply can result in significant financial penalties, operational disruptions, and damage to the company's reputation.

Navigating these intricate global trade regulations is a critical legal consideration for Champion Iron. The company's ability to export its products hinges on understanding and implementing these diverse legal frameworks. For example, the World Trade Organization (WTO) agreements provide a foundational structure, but individual country-specific import requirements, quotas, and tariffs, such as those encountered in Asian markets, demand constant vigilance.

- Compliance Burden: Champion Iron faces ongoing legal obligations to track and comply with evolving international trade laws and sanctions, which can impact market access and operational costs.

- Risk of Penalties: Non-compliance with trade regulations, including sanctions, can lead to substantial fines and legal action, as seen with various companies facing penalties for trade violations in recent years.

- Market Access: Adherence to customs and trade laws is paramount for maintaining access to key export markets, particularly in regions with stringent import controls.

- Reputational Impact: Violations of international trade laws can severely damage Champion Iron's reputation, affecting stakeholder trust and future business opportunities.

Champion Iron's operations are intrinsically linked to the legal framework governing mining rights and resource extraction in Canada, particularly Quebec. The company must secure and maintain numerous permits and licenses, with their renewal being critical for uninterrupted production. Any delays or denials in this process directly impact output and financial performance, highlighting the necessity of proactive engagement with regulatory bodies.

The company operates under stringent environmental regulations concerning emissions, water discharge, and waste management, facing potential penalties for non-compliance. Furthermore, adherence to land reclamation standards is a legal requirement, necessitating significant investment in site restoration post-operation. As of early 2024, Quebec's minimum wage is $15.75 per hour, and compliance with labor laws, including collective bargaining agreements, is essential for maintaining a productive workforce and avoiding legal disputes.

Champion Iron must also navigate federal and provincial tax regulations, including corporate income tax and mining royalties, which directly influence its profitability and investment capacity. Changes in fiscal policy, such as adjustments to tax credits or royalty rates, can significantly alter the company's financial outlook.

As a global exporter, Champion Iron is subject to international trade laws, customs regulations, and sanctions. Compliance is crucial for market access and avoiding substantial penalties, with evolving global trade landscapes demanding constant vigilance and strategic adaptation.

Environmental factors

Champion Iron, operating in Canada, faces increasing pressure from climate change policies and carbon pricing. Canada has set ambitious emission reduction targets, aiming for a 40-45% reduction below 2005 levels by 2030 and net-zero by 2050.

These policies directly impact Champion Iron's operational costs through carbon taxes or the need to acquire allowances in cap-and-trade systems. For instance, federal carbon pricing is projected to increase annually, impacting industries with significant emissions.

The company must invest in strategies to mitigate its carbon footprint, potentially including energy efficiency upgrades or exploring lower-emission mining technologies, which can affect capital expenditure plans and long-term profitability.

Champion Iron's mining operations, particularly the processing of iron ore, are inherently water-intensive. The company must therefore focus on responsible water management, adhering to strict discharge quality standards and actively implementing conservation strategies across its facilities.

Water scarcity or contamination incidents could trigger increased regulatory oversight, potentially lead to community resistance, and pose significant operational hurdles. For instance, in 2024, several mining regions globally faced heightened scrutiny over water usage, impacting project timelines and operational costs.

Adopting sustainable water practices is not just an environmental imperative but a critical business strategy for Champion Iron, ensuring long-term operational viability and social license to operate. This includes exploring advanced water recycling technologies and optimizing water use in all stages of production.

The Bloom Lake Mine is situated within an ecosystem that demands meticulous management to reduce its impact on local plant and animal life. Champion Iron is tasked with implementing robust biodiversity protection strategies and detailed land reclamation plans once mining operations conclude.

For instance, as of their 2023 sustainability report, Champion Iron detailed ongoing efforts in progressive reclamation at Bloom Lake, covering approximately 15 hectares. These environmental commitments are vital for ensuring regulatory adherence and upholding a favorable environmental reputation, especially given the increasing scrutiny on mining operations in sensitive regions.

Waste Management and Tailings Safety

Champion Iron operates under stringent environmental regulations governing the safe disposal and management of mining waste, especially tailings. The company's commitment to tailings safety is paramount, requiring robust engineering and continuous oversight of its storage facilities to prevent any environmental harm. In 2024, Champion Iron continued its focus on maintaining the integrity of its tailings management systems, investing in technologies that ensure long-term stability and minimize environmental risks.

Adherence to these regulations is not just a compliance issue but a core operational necessity. The company's approach involves ongoing monitoring and the adoption of industry-leading practices to safeguard against potential contamination. For instance, Champion Iron's operational reports for the fiscal year ending March 31, 2025, detail significant capital expenditures allocated to enhancing its tailings management infrastructure, reflecting a proactive stance on environmental stewardship.

- Regulatory Compliance: Champion Iron must meet evolving national and provincial environmental standards for tailings storage facilities.

- Environmental Protection: Preventing water and soil contamination from tailings is a key focus, with ongoing investments in containment and monitoring technologies.

- Operational Costs: Maintaining high standards in waste management represents a significant operational cost, impacting profitability.

- Community Relations: Demonstrating responsible tailings management is crucial for maintaining social license to operate and positive community relations.

Energy Consumption and Renewable Energy Adoption

Mining is inherently energy-hungry, and if that energy comes from fossil fuels, it means more greenhouse gases. Champion Iron is actively working to use less energy and is looking into renewable options for its mines. This focus on cleaner energy helps their environmental standing and shields them from rising carbon taxes.

Sustainable energy is no longer just a nice-to-have; it's a critical part of business strategy. For example, in 2023, the mining sector's energy consumption globally was substantial, with a growing push towards electrification and renewables. Champion Iron's commitment to these trends is key to its long-term environmental responsibility and financial resilience.

- Energy Intensity: Mining operations require significant energy input, impacting operational costs and environmental footprint.

- Renewable Adoption: Champion Iron's exploration of renewable energy sources aims to lower emissions and reduce reliance on volatile fossil fuel markets.

- Carbon Costs: Investing in sustainable energy strategies mitigates the financial risk associated with carbon pricing mechanisms.

- Industry Trend: The global mining industry is increasingly prioritizing decarbonization and renewable energy integration to meet sustainability goals.

Champion Iron faces significant environmental pressures, including Canada's ambitious emission reduction targets and the increasing cost of carbon pricing. The company must invest in cleaner technologies and energy efficiency to mitigate these rising operational costs and maintain profitability. Furthermore, responsible water management is crucial due to the water-intensive nature of iron ore processing, with strict discharge standards and potential operational disruptions from scarcity or contamination incidents.

The company is also tasked with protecting local ecosystems around its Bloom Lake Mine, implementing biodiversity strategies and land reclamation plans, as evidenced by their progressive reclamation efforts covering approximately 15 hectares as of their 2023 report. Tailings management remains a critical focus, with ongoing investments in infrastructure and technology to ensure safety and prevent environmental harm, as detailed in their fiscal year ending March 31, 2025, capital expenditure reports.

Champion Iron's commitment to sustainable energy is vital, as mining operations are energy-intensive. By exploring renewable options, the company aims to reduce its environmental footprint and hedge against volatile fossil fuel prices and carbon taxes, aligning with a global mining industry trend towards decarbonization.

| Environmental Factor | Impact on Champion Iron | Key Actions/Considerations | Relevant Data/Context (2023-2025) |

|---|---|---|---|

| Climate Change Policies & Carbon Pricing | Increased operational costs, need for emission reduction strategies | Invest in energy efficiency, explore lower-emission technologies, acquire carbon allowances | Canada's 2030 emission reduction target: 40-45% below 2005 levels. Federal carbon pricing increases annually. |

| Water Management | Operational risks from scarcity/contamination, regulatory scrutiny | Implement water conservation, recycling technologies, adhere to strict discharge standards | Global mining regions faced heightened scrutiny on water usage in 2024. |

| Biodiversity & Land Reclamation | Need for robust protection and reclamation plans | Implement biodiversity strategies, detailed reclamation plans, progressive reclamation | Bloom Lake Mine: ~15 hectares under progressive reclamation (2023 report). |

| Tailings Management | Regulatory compliance, operational necessity, community relations | Invest in tailings safety infrastructure, continuous oversight, monitoring | Fiscal year ending March 31, 2025: Significant capital expenditure on tailings management infrastructure. |

| Energy Consumption & Renewables | Operational costs, environmental footprint, carbon tax exposure | Reduce energy intensity, explore renewable energy sources, electrification | Mining sector's substantial energy consumption in 2023; growing push for electrification and renewables. |

PESTLE Analysis Data Sources

Our Champion Iron PESTLE analysis is built on comprehensive data from government mining regulations, global commodity market reports, and economic forecasts. We also incorporate insights from environmental impact assessments and technological advancements in the mining sector.