Champion Iron Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Champion Iron Bundle

Champion Iron operates in a dynamic market shaped by significant buyer power and intense rivalry. Understanding these forces is crucial for navigating the iron ore landscape. The full analysis reveals the real forces shaping Champion Iron’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Champion Iron's dependence on specialized mining equipment and advanced technology, such as sophisticated concentrator plants and material handling systems, grants significant bargaining power to its suppliers. The global mining equipment market, projected to reach approximately $200 billion by 2024, is increasingly dominated by players investing heavily in automation and AI, further concentrating leverage with providers of these cutting-edge solutions.

Champion Iron's Bloom Lake mine benefits from a stable energy supply through renewable hydroelectric power, a significant advantage in mitigating the impact of volatile fossil fuel prices. This reliance on hydroelectricity, primarily from Hydro-Québec, does, however, concentrate bargaining power with this single major supplier.

Champion Iron's reliance on rail and port services is a significant factor in its supply chain. These providers are crucial for moving iron ore concentrate from the Bloom Lake mine to international customers. The company has established specific agreements for access, highlighting the essential role these logistics partners play.

The bargaining power of these logistics and infrastructure providers can be substantial, particularly if alternative transportation options are scarce in the region. This limited availability of other operators or infrastructure could give these specialized suppliers considerable leverage in negotiations, impacting Champion Iron's operational costs and efficiency.

Skilled Labor and Specialized Services

The mining sector, including iron ore operations like Champion Iron, frequently grapples with a scarcity of skilled workers. This shortage directly translates into higher wage expectations and increased operational expenses. For instance, in 2023, the Australian mining industry reported significant skill gaps, particularly in engineering and trades, leading to wage inflation in these critical areas.

Furthermore, specialized services essential for mining, such as advanced geological analysis, mine engineering, and environmental impact assessments, are often provided by a select group of highly qualified experts. This limited availability of specialized knowledge empowers these service providers, allowing them to command higher fees. In 2024, the demand for specialized environmental consulting services in mining projects saw a notable increase, with project costs for these services rising by an average of 8-10% year-over-year.

- Skilled Labor Shortages: In 2023, the Australian mining sector experienced a notable shortage of skilled tradespeople and engineers, impacting operational costs.

- Specialized Service Providers: A limited pool of experts in areas like geological surveys and mine engineering can increase supplier bargaining power.

- Wage Inflation: The demand for skilled labor in mining contributed to wage increases, with some specialized roles seeing double-digit percentage hikes in 2023.

- Consulting Costs: Specialized consulting services for mining projects saw an estimated 8-10% cost increase in 2024 due to high demand.

Maintenance and Spare Parts

Champion Iron's Bloom Lake mine complex, a substantial asset requiring constant upkeep, makes it dependent on suppliers for essential maintenance and spare parts. This reliance can translate into supplier leverage, particularly when specialized components are involved.

For proprietary or highly specialized equipment crucial to Bloom Lake's continuous operation, the original equipment manufacturers (OEMs) often hold significant bargaining power. This is due to the limited availability of alternative suppliers for these unique parts, meaning Champion Iron may have less room to negotiate pricing or terms.

- Supplier Dependence: Champion Iron's operational continuity at Bloom Lake is directly tied to the timely availability of maintenance and spare parts, creating a degree of supplier dependence.

- OEM Power: For specialized components, OEMs can command higher prices and stricter terms due to their unique offerings and the lack of readily available substitutes.

- Risk Mitigation: Champion Iron likely mitigates this by establishing strong supplier relationships, potentially entering into long-term supply agreements, or maintaining strategic spare part inventories.

Champion Iron's reliance on specialized mining equipment and advanced technology, like sophisticated concentrator plants, grants significant bargaining power to its suppliers. The global mining equipment market, projected to reach approximately $200 billion by 2024, is increasingly dominated by players investing heavily in automation and AI, further concentrating leverage with providers of these cutting-edge solutions.

Champion Iron's dependence on hydroelectricity from Hydro-Québec concentrates bargaining power with this single major supplier for its Bloom Lake mine. Furthermore, the company's reliance on rail and port services for transporting iron ore concentrate means these logistics providers, especially where alternatives are scarce, hold considerable leverage in negotiations, impacting operational costs.

The mining sector's persistent scarcity of skilled workers, as seen with significant skill gaps in Australian mining in 2023, translates to higher wage expectations and increased operational expenses for companies like Champion Iron. This extends to specialized services such as advanced geological analysis and mine engineering, where a limited pool of experts allows providers to command higher fees, with consulting costs rising by an estimated 8-10% in 2024.

Champion Iron's need for maintenance and spare parts for its Bloom Lake mine complex creates dependence on suppliers. Original equipment manufacturers (OEMs) for proprietary or highly specialized components hold significant bargaining power due to the lack of readily available substitutes, potentially leading to higher prices and stricter terms for Champion Iron.

| Supplier Category | Impact on Champion Iron | Key Factors Contributing to Bargaining Power | Market Data/Trends (2023-2024) |

|---|---|---|---|

| Mining Equipment & Technology | Increased costs for specialized machinery and automation solutions. | High R&D investment by suppliers, market concentration in AI/automation. | Global mining equipment market ~$200 billion by 2024. |

| Energy (Hydroelectric) | Potential for price increases or supply conditions dictated by the provider. | Single-source reliance for Bloom Lake mine. | N/A (Specific to Hydro-Québec agreement). |

| Logistics & Infrastructure (Rail/Port) | Higher transportation costs and potential operational constraints if alternatives are limited. | Essential for market access, scarcity of alternative routes/operators. | N/A (Specific to regional infrastructure). |

| Skilled Labor & Specialized Services | Elevated wage costs and higher fees for essential expertise. | Shortage of skilled trades, engineers, geologists, and environmental consultants. | Australian mining skill gaps (2023); Consulting costs up 8-10% (2024). |

| Maintenance & Spare Parts (OEMs) | Higher prices and less favorable terms for proprietary components. | Limited availability of substitutes for specialized equipment. | N/A (Specific to OEM agreements). |

What is included in the product

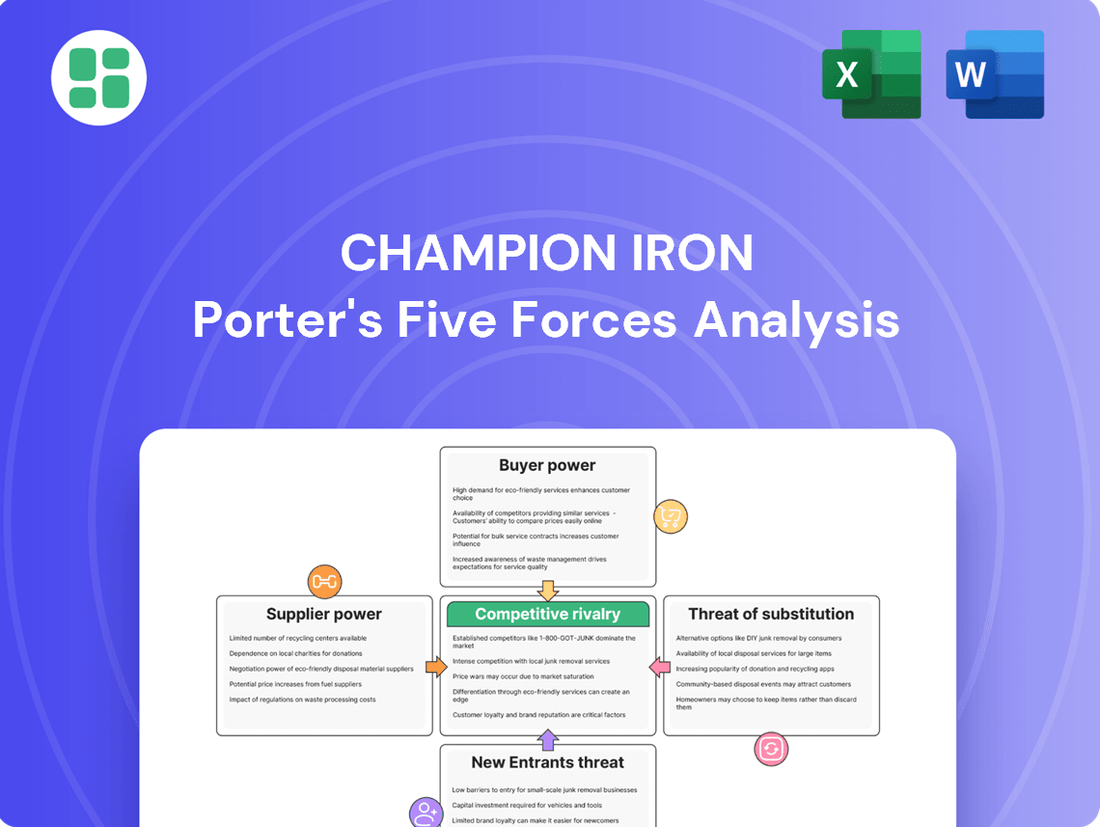

This analysis examines the competitive landscape for Champion Iron by dissecting the five forces: threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitutes, and industry rivalry.

Visualize competitive intensity with a dynamic Porter's Five Forces dashboard, allowing for rapid identification of strategic leverage points.

Customers Bargaining Power

Champion Iron's customers, primarily in the global steel industry, are increasingly demanding high-grade iron ore for decarbonization efforts. This shift means customers have more leverage if Champion Iron cannot meet these specific quality requirements.

While global steel demand is expected to recover by 2025, with India being a significant growth market, fluctuating economic conditions and regional disparities can impact purchasing power. Customers facing economic pressures may seek more favorable pricing or terms.

Champion Iron's strategic emphasis on high-purity iron ore, specifically for direct reduction (DR) steelmaking, directly addresses the growing demand from steel manufacturers seeking to lower their carbon footprint. This focus on a premium product inherently strengthens the company's position, as customers requiring this specialized ore have fewer alternative suppliers.

The premium pricing associated with high-purity iron ore provides Champion Iron with greater pricing power, thereby diminishing the bargaining leverage of its customers. For instance, as of early 2024, the price differential between high-grade and lower-grade iron ore has widened, reflecting this demand dynamic.

Champion Iron is actively enhancing its ore quality, with plans to reach a 69% Fe (iron content) grade. This upgrade is specifically designed to cater to the requirements of electric arc furnace (EAF) steelmaking, a sector increasingly favored for its lower emissions, further solidifying the company's value proposition and customer relationships.

While Champion Iron serves a global market, the steel industry is characterized by a relatively concentrated group of major producers. This concentration means that large buyers, who represent a significant portion of Champion Iron's sales volume, can wield considerable bargaining power, potentially influencing pricing and contract terms. For instance, in 2023, Champion Iron's sales were primarily to China, South Korea, Japan, and India, highlighting the importance of these key steel-producing regions.

However, the specialized nature and consistent quality of Bloom Lake's iron ore concentrate may mitigate some of this customer leverage. Buyers seeking high-grade, low-impurity concentrate, particularly those with ambitious green steel initiatives, may find it challenging to substitute Champion Iron's product without potentially impacting their own production efficiency or environmental targets. This differentiation can provide Champion Iron with a degree of pricing power, even with large customers.

Sensitivity to Iron Ore Prices and Steel Margins

The bargaining power of Champion Iron's customers, primarily steelmakers, is significantly tied to their own profitability and the cost of raw materials. When steelmakers face squeezed margins, often exacerbated by fluctuating iron ore prices, they become more sensitive to input costs.

In periods like parts of 2024 and expected early 2025, a softening iron ore market combined with challenging steelmaking conditions can empower customers. This environment allows them to exert greater pressure for price concessions, even for premium, high-grade iron ore products, as they seek to protect their own bottom lines.

- Customer Margin Sensitivity: Steelmakers' profitability directly impacts their willingness and ability to absorb higher iron ore costs.

- Iron Ore Market Dynamics: A buyer's market for iron ore, characterized by ample supply, increases customer leverage.

- Demand for Discounts: In 2024, some steel producers reported tighter margins, leading to increased negotiation for lower raw material prices.

- Product Quality vs. Price: Even high-grade iron ore may face pricing pressure if customers are under significant cost constraints.

Availability of Alternative Iron Ore Grades

The availability of alternative iron ore grades presents a nuanced aspect of customer bargaining power for Champion Iron. While the market increasingly favors high-purity ore for green steel production, customers theoretically possess the option to switch to lower-grade iron ore or blend different grades if it proves more economical. This could, in principle, introduce some pricing pressure on Champion Iron's offerings.

However, this theoretical leverage is significantly tempered by prevailing market trends. The long-term trajectory clearly points towards higher-grade iron ore inputs due to their inherent efficiency advantages and crucial role in meeting environmental mandates for greener steelmaking. Consequently, the attractiveness of lower-grade substitutes is progressively diminishing, thereby limiting the practical bargaining power of customers in this regard.

- Shifting Demand: The global steel industry's move towards decarbonization and enhanced efficiency is driving a strong preference for high-grade iron ore, often exceeding 65% Fe content.

- Cost-Benefit Analysis: While lower-grade ores might offer a lower per-tonne price, the increased processing costs and lower yield can negate these savings, making high-grade ore more cost-effective in the long run for many users.

- Champion Iron's Position: Champion Iron's focus on producing high-grade Direct Shipping Ore (DSO) with high iron content (typically around 66% Fe) positions it favorably in this evolving market, reducing the impact of customers seeking lower-grade alternatives.

- Environmental Regulations: Increasingly stringent environmental regulations worldwide further incentivize the use of higher-grade ores, as they require less energy and generate fewer emissions during the steelmaking process.

Champion Iron's customers, primarily large steel producers, possess significant bargaining power due to the concentrated nature of the steel industry and their substantial purchasing volumes. However, the increasing global demand for high-grade iron ore, essential for green steel production, mitigates this power as fewer suppliers can meet these stringent quality requirements. Champion Iron's strategic focus on producing premium, high-purity iron ore, aiming for grades around 69% Fe by 2025, positions it favorably, reducing customer ability to substitute or demand steep discounts.

| Customer Factor | Impact on Champion Iron | Supporting Data/Trend (as of early 2024/2025) |

|---|---|---|

| Concentrated Customer Base | High leverage for large buyers | Sales primarily to key steel-producing regions like China, South Korea, Japan, and India. |

| Demand for High-Grade Ore | Reduced leverage for customers seeking premium product | Growing preference for 65%+ Fe content for decarbonization efforts. |

| Price Sensitivity | Potential for price pressure during market downturns | Some steel producers reported tighter margins in 2024, increasing negotiation for lower raw material costs. |

| Availability of Alternatives | Limited practical leverage due to diminishing value of lower-grade ores | Increased processing costs and lower yield from lower-grade ores make high-grade ore more cost-effective long-term. |

Preview Before You Purchase

Champion Iron Porter's Five Forces Analysis

This preview displays the comprehensive Champion Iron Porter's Five Forces Analysis you will receive immediately after purchase, offering a detailed examination of the competitive landscape. You're looking at the actual document, ensuring no surprises, as it covers the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. Once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your strategic planning needs.

Rivalry Among Competitors

The global high-grade iron ore market is characterized by intense rivalry among a few major multinational producers, including giants like Vale, Rio Tinto, and BHP. These established players possess significant scale and market influence, setting a high bar for new entrants.

Champion Iron focuses on the high-grade segment, a strategically important niche driven by the steel industry's push for decarbonization, as higher-grade ore requires less energy to process. This focus, however, means Champion Iron faces increasing competition as new, large-scale high-grade projects, such as the Simandou project in Guinea, are progressing towards production, potentially altering the competitive landscape.

Champion Iron distinguishes itself by producing high-purity, low-contaminant iron ore concentrate. This superior quality is highly sought after for direct reduction steelmaking, allowing the company to command premium pricing and sidestep direct competition from lower-grade ore producers. For instance, in the fiscal year ending March 31, 2024, Champion Iron reported an average realized selling price for its iron ore concentrate of $129 per dry metric ton, significantly above the benchmark prices for standard grades.

Competitive rivalry in the iron ore sector is significantly influenced by cost structure and operational efficiency. Champion Iron's success hinges on optimizing its Bloom Lake operations, focusing on improving recovery rates and diligently managing C1 cash costs. This focus is essential to compete effectively against larger, often more cost-advantaged global producers.

Logistical efficiency further bolsters cost competitiveness. Champion Iron's reliance on rail and port services means that the cost and reliability of these transportation networks directly impact its overall cost structure, making efficient logistics a critical factor in its competitive standing.

Production Capacity and Expansion Plans

The iron ore market is characterized by significant capacity expansions among major players, a move that directly fuels competitive rivalry by increasing the overall supply available. This heightened competition puts pressure on pricing and market share for all participants.

Champion Iron is actively pursuing strategic expansions to bolster its competitive standing. The company is evaluating increasing its production capacity at Bloom Lake beyond the current 15 million tonnes per year. Furthermore, the development of the Kami project represents another key initiative aimed at enhancing its market position and catering to anticipated future demand for iron ore.

- Bloom Lake Expansion: Champion Iron is exploring options to increase output beyond 15 million tonnes per year.

- Kami Project Development: This strategic project aims to further expand the company's production capabilities.

- Market Impact: Such expansions can intensify competition, potentially affecting pricing and market share dynamics within the iron ore sector.

Geographical Market Focus

Champion Iron's competitive rivalry is significantly shaped by its geographical market focus. While the company exports globally, its core customer base resides within the steel industries of key regions including China, Japan, the Middle East, Europe, South Korea, India, and Canada.

The intensity of competition naturally fluctuates across these diverse markets. Factors such as prevailing local steel production volumes, the specifics of import tariffs and policies, and the proximity and capabilities of other high-grade iron ore suppliers all play a crucial role in defining the competitive landscape for Champion Iron in each area.

- Key Export Markets: China, Japan, Middle East, Europe, South Korea, India, Canada.

- Competitive Factors: Local steel demand, import regulations, presence of alternative suppliers.

- Regional Intensity: Competition varies significantly by geographic focus.

Champion Iron operates in a market dominated by a few large players, but its focus on high-grade ore creates a distinct competitive space. The ongoing development of new high-grade projects, such as Simandou, directly increases competitive pressure. Champion Iron's strategy to differentiate through product quality, evidenced by its premium pricing, is crucial for navigating this rivalry.

The company's ability to manage costs through operational efficiency at Bloom Lake and secure reliable logistics is paramount. Capacity expansions by major competitors further intensify rivalry, impacting pricing and market share. Champion Iron's own expansion plans, including the Kami project, aim to strengthen its position amidst this dynamic competitive environment.

| Metric | Champion Iron (FY24) | Industry Context |

|---|---|---|

| Average Realized Price (per dmt) | $129 | Premium over standard grades |

| Bloom Lake Capacity | 15 million tonnes per year (target) | Potential for expansion |

| Key Markets | China, Japan, Europe, etc. | Varies by local demand and regulations |

SSubstitutes Threaten

Steel scrap represents the most significant substitute for virgin iron ore, particularly for electric arc furnaces (EAFs) that are gaining traction in steel production due to their lower carbon footprint. As EAFs become more prevalent globally, the demand for new iron ore could see a reduction.

Even with the increasing use of electric arc furnaces (EAFs), the global supply of high-quality steel scrap remains constrained, unable to fully satisfy worldwide steel production requirements. In 2023, global crude steel production reached approximately 1.89 billion tonnes, with EAFs accounting for a significant portion, yet the demand for scrap continues to outpace its availability.

The inherent long lifespan of steel products means that scrap generated from retired items enters the supply chain with a considerable delay. This lag effect ensures that the steel industry will continue to depend on primary raw materials like iron ore to meet immediate production needs, underpinning the demand for iron ore producers.

While lower-grade iron ores can technically serve as substitutes, particularly when steelmakers face thin margins and can leverage discounts on these materials, the evolving landscape of steel production presents a counteracting force.

The global drive towards decarbonization and the adoption of more efficient green steelmaking technologies significantly elevates the demand for high-purity, low-contaminant iron ore. This trend directly benefits producers like Champion Iron, whose products align with these emerging industry requirements.

For instance, in 2024, the average spot price for 62% Fe fines, a common benchmark, saw fluctuations, but the premium for higher-grade ores, such as those above 65% Fe, remained substantial, reflecting the market's preference for quality inputs in advanced steelmaking processes.

Hydrogen-Based Direct Reduced Iron (H-DRI)

Emerging steelmaking technologies like hydrogen-based direct reduced iron (H-DRI) are gaining traction as greener alternatives. These processes, however, don't eliminate the need for iron ore; rather, they shift the demand towards higher-grade iron ore or specialized direct reduction pellets. This means that while the *method* of steelmaking changes, the fundamental requirement for iron ore as a raw material persists, impacting the *type* of ore in demand.

The threat of substitutes for Champion Iron, in the context of H-DRI, is therefore not about replacing iron ore itself, but about potentially altering the specifications of the iron ore required.

- H-DRI processes require high-grade iron ore or DR pellets.

- This shifts demand to specific ore qualities, not a complete substitution of ore.

- The fundamental need for iron ore in steelmaking remains.

Material Substitution in End-Use Industries

While steel's dominance is strong, the threat of material substitution, particularly in sectors like automotive and construction, is a long-term consideration. Materials such as aluminum, advanced composites, and high-performance plastics are increasingly viable alternatives in specific applications where weight reduction or enhanced properties are paramount.

For instance, in the automotive industry, aluminum is already widely used in body panels and engine components to improve fuel efficiency. By 2024, the global automotive aluminum market was projected to reach approximately USD 70 billion, showcasing the growing adoption of this substitute. This trend could indirectly dampen overall demand for steel and, by extension, iron ore.

- Automotive: Aluminum and composites offer weight savings, improving fuel economy and electric vehicle range.

- Construction: Advanced plastics and composites can provide corrosion resistance and easier installation in certain building elements.

- Infrastructure: While less common, composite materials are being explored for bridges and other structures where longevity and low maintenance are key.

However, steel's inherent advantages, including its exceptional strength-to-weight ratio, cost-effectiveness, and widespread recyclability, present significant hurdles for widespread substitution. The established infrastructure and familiarity with steel further solidify its position across numerous industries.

Steel scrap is the primary substitute for virgin iron ore, especially for electric arc furnaces (EAFs) which are becoming more common due to their lower emissions. Despite the rise of EAFs, the global supply of high-quality scrap is insufficient to meet all steel production needs. In 2023, global steel output was around 1.89 billion tonnes, with EAFs playing a significant role, yet scrap availability still lags behind demand.

New steelmaking technologies like hydrogen-based direct reduced iron (H-DRI) are emerging, but they don't eliminate the need for iron ore; instead, they increase the demand for higher-grade ore or specialized pellets. This means the type of iron ore required is changing, not that iron ore is being replaced entirely.

Materials like aluminum, composites, and advanced plastics pose a longer-term threat, particularly in sectors such as automotive and construction where weight reduction is critical. For example, the global automotive aluminum market was valued at approximately USD 70 billion in 2024, highlighting its growing use. However, steel's strength, cost-effectiveness, and established infrastructure make widespread substitution challenging.

Entrants Threaten

The iron ore mining sector demands substantial upfront capital, often running into billions of dollars for everything from initial exploration and mine development to the necessary infrastructure. For example, Champion Iron's Bloom Lake operation alone has attracted over US$4.5 billion in investment. This immense financial commitment acts as a significant deterrent, creating a high barrier to entry for prospective new competitors.

The significant lead times for developing new iron ore projects present a formidable barrier to entry. It can take many years, even decades, from initial exploration and feasibility studies through permitting and construction to bring a new mine online. This lengthy process, often exacerbated by complex regulatory frameworks and the need for extensive environmental approvals, deters potential new competitors.

The availability of economically viable, high-quality iron ore deposits is a significant barrier for new entrants. Many of the most promising reserves are already under the control of established mining giants, making it difficult for newcomers to secure the raw materials needed for production. For instance, the discovery and development of a new, large-scale deposit like Champion Iron's Bloom Lake project represents a substantial hurdle that aspiring competitors must overcome.

Infrastructure Development and Access

The threat of new entrants in the iron ore sector, particularly for companies like Champion Iron, is significantly mitigated by the substantial infrastructure requirements. New players must secure access to vital transportation networks, including rail lines and port facilities, to move their product efficiently. For instance, Champion Iron's operations rely heavily on the Quebec North Shore and Labrador Railway and the Sept-Îles port, highlighting the critical nature of this infrastructure. Developing these assets from scratch is prohibitively expensive and time-consuming, creating a formidable barrier.

Furthermore, gaining access to existing infrastructure can be a major hurdle. Capacity constraints are common, and established operators often have long-term agreements in place, making it difficult for newcomers to secure the necessary transport links. This limited access to essential logistical channels effectively deters many potential entrants from challenging established players in the market.

- Infrastructure Costs: Building new rail lines and port facilities can cost billions of dollars, a significant deterrent for new entrants.

- Access Challenges: Securing capacity on existing rail and port infrastructure is often difficult due to high demand and existing contracts.

- Logistical Complexity: The sheer scale and complexity of managing iron ore logistics require specialized expertise and significant capital investment.

Regulatory and Environmental Hurdles

The mining sector faces significant regulatory and environmental hurdles, acting as a substantial barrier to new entrants. Stringent environmental protection laws, coupled with evolving social licensing demands, require new companies to invest heavily in compliance and community engagement from the outset. For instance, in 2024, the cost of environmental impact assessments and permitting processes for new mining projects in Canada, a key jurisdiction for iron ore, continued to escalate, often running into tens of millions of dollars.

These complexities mean that potential new competitors must not only secure capital for exploration and extraction but also navigate a labyrinth of regulations governing emissions, waste management, and land reclamation. Failure to meet these standards can result in substantial fines, project delays, or outright cancellation, making the path to market exceptionally challenging and costly.

- Increased Capital Requirements: New entrants must allocate significant capital towards environmental mitigation and compliance technologies.

- Extended Project Timelines: Regulatory approval processes can add years to project development schedules, delaying revenue generation.

- Community Relations Management: Building and maintaining positive relationships with local communities is crucial for obtaining and retaining operating permits, adding an ongoing cost and management burden.

- Reputational Risk: Environmental or social missteps can severely damage a new company's reputation, impacting access to capital and markets.

The threat of new entrants in the iron ore sector is considerably low due to the immense capital required for mine development and infrastructure. For example, Champion Iron's Bloom Lake project alone represents over US$4.5 billion in investment, a figure that deters most potential competitors. Additionally, the lengthy development timelines, often spanning years due to complex regulations and environmental approvals, further discourage new players from entering the market.

| Barrier | Description | Impact on New Entrants | Example (Champion Iron) |

|---|---|---|---|

| Capital Requirements | Billions of USD needed for exploration, development, and infrastructure. | Extremely high barrier, limiting the pool of potential competitors. | Bloom Lake: > US$4.5 billion invested. |

| Infrastructure Needs | Access to rail, ports, and processing facilities is critical and costly. | New entrants must build or secure expensive, often capacity-limited, infrastructure. | Reliance on Quebec North Shore and Labrador Railway and Sept-Îles port. |

| Regulatory & Environmental Hurdles | Complex permitting, environmental impact assessments, and social license. | Adds significant cost and time to project development, increasing risk. | 2024 Canadian mining project assessments can cost tens of millions USD. |

Porter's Five Forces Analysis Data Sources

Our Champion Iron Porter's Five Forces analysis is built upon a foundation of data from annual reports, investor presentations, and industry-specific market research reports. We also incorporate information from regulatory filings and news releases to capture the dynamic competitive landscape.