CGN Power SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CGN Power Bundle

CGN Power's strengths lie in its significant operational capacity and established market presence, while its opportunities stem from the growing demand for clean energy. However, potential regulatory shifts and intense competition present key challenges.

Want the full story behind CGN Power's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CGN Power stands as China's largest nuclear power operator, boasting the most installed capacity and a commanding market share in domestic nuclear generation. By early 2025, China's nuclear power capacity, encompassing operational, under construction, and approved units, has solidified its global leadership, with CGN Power being a pivotal contributor to this impressive growth.

CGN Power benefits significantly from robust government backing for nuclear energy, a key component of China's 14th Five-Year Plan (2021-2025). This plan aims to boost nuclear capacity and achieve carbon neutrality by 2060, creating a stable demand environment.

This strong policy alignment translates into tangible advantages for CGN Power, including priority dispatch rights over less clean energy sources and access to favorable financing and subsidies. These benefits are crucial for managing the substantial capital requirements inherent in nuclear power projects.

CGN Power's advanced technological capabilities are a significant strength, underscored by its mastery in designing, building, and operating nuclear power plants. This includes the successful development and deployment of the Hualong One (HPR1000) reactor, a testament to its indigenous innovation.

The company's commitment to research and development is substantial. By 2024, CGN Power achieved 100% localization of critical main equipment for nuclear power, reducing reliance on foreign suppliers and enhancing its competitive edge. This focus extends to future-oriented technologies like Small Modular Reactors (SMRs) and Generation IV reactors, positioning CGN Power at the forefront of nuclear energy innovation.

Diversified Clean Energy Portfolio and International Presence

CGN Power is actively broadening its clean energy focus beyond nuclear power, making significant investments in solar and wind energy. This diversification strategy is complemented by an expanding international presence, positioning the company for global growth in the renewable sector.

In 2024, CGN demonstrated a strong commitment to international clean energy expansion, operating across 16 countries. The company actively exported renewable energy supply chains and initiated several large-scale solar photovoltaic projects, underscoring its strategic shift towards a more comprehensive green energy portfolio.

- Diversification: Expansion into solar and wind power beyond its core nuclear business.

- International Footprint: Operations and projects established in 16 countries as of 2024.

- Supply Chain Export: Actively exporting renewable energy supply chains globally.

- Project Development: Launching large-scale solar photovoltaic projects internationally.

Stable Financial Performance and Operational Efficiency

CGN Power exhibits robust financial stability, marked by consistent revenue growth and a dedication to rewarding shareholders via dividends. This financial strength underpins its operational capabilities and strategic market positioning.

The company's operational efficiency is clearly demonstrated by its power generation figures. In the first half of 2025, CGN Power achieved a significant 6.11% year-on-year increase in total power generation, highlighting the reliability and effective management of its nuclear fleet.

Further bolstering its strengths, CGN Power's strategically positioned coastal power plants are situated in regions with high electricity demand. This geographic advantage ensures consistent market access and supports sustained revenue streams.

- Consistent Revenue Growth: CGN Power has a track record of steady revenue increases.

- Shareholder Returns: The company prioritizes shareholder value through dividend payouts.

- Operational Efficiency: A 6.11% year-on-year increase in power generation in H1 2025 showcases fleet reliability.

- Strategic Location: Coastal plants benefit from strong demand in economically developed areas.

CGN Power's strengths are deeply rooted in its dominant position as China's largest nuclear operator, backed by substantial government support and a focus on indigenous technological advancement. Its mastery of the Hualong One reactor and commitment to localization, achieving 100% for critical equipment by 2024, solidify its competitive edge and reduce external dependencies. The company's strategic diversification into solar and wind energy, coupled with an expanding international footprint across 16 countries in 2024, positions it for robust future growth in the global clean energy market.

| Strength | Description | Supporting Data/Fact |

|---|---|---|

| Market Leadership | Largest nuclear power operator in China | Commanding market share in domestic nuclear generation. |

| Government Support | Alignment with national energy policy | Key component of China's 14th Five-Year Plan (2021-2025) for nuclear capacity expansion. |

| Technological Prowess | Indigenous reactor development | Successful development and deployment of the Hualong One (HPR1000) reactor. |

| Localization | Reduced reliance on foreign suppliers | Achieved 100% localization of critical main equipment by 2024. |

| Diversification | Expansion into renewables | Significant investments in solar and wind energy. |

| International Presence | Global operational reach | Operations across 16 countries as of 2024. |

What is included in the product

Offers a full breakdown of CGN Power’s strategic business environment by examining its internal capabilities and external market dynamics.

CGN Power's SWOT analysis offers a clear, actionable framework, alleviating the pain of strategic uncertainty by highlighting key internal capabilities and external market dynamics.

Weaknesses

CGN Power faces significant challenges due to the inherently high capital intensity of nuclear power projects. These undertakings demand enormous upfront investments, which naturally translate into substantial financial leverage. As of the close of 2024, the company's net gearing ratio stood at a considerable 133%, reflecting this heavy reliance on debt financing.

While CGN Power benefits from its state-owned enterprise status, granting it access to relatively low-cost funding sources, the sheer scale of capital expenditure required for both ongoing construction and the initiation of new nuclear power facilities means that high debt levels are likely to persist in the near term. This financial structure necessitates careful management to ensure long-term stability and growth.

China's power sector market reforms are increasing the proportion of electricity sold at market-determined prices. In 2023, 57% of CGN Power's on-grid generation was already subject to these market-based tariffs.

This growing reliance on market pricing exposes CGN Power to greater tariff volatility. Such fluctuations can negatively impact the company's earnings, especially when contrasted with the stability offered by previously guaranteed feed-in tariffs.

While China generally supports nuclear power, a moratorium on inland plant construction persists after Fukushima. This stems from safety and environmental worries, especially concerning water resources, restricting CGN Power's expansion primarily to coastal areas. This lingering sensitivity highlights a key challenge in diversifying its nuclear footprint.

Long Project Timelines and Construction Risks

While China has made strides in accelerating nuclear reactor construction, projects like those undertaken by CGN Power still face inherently long development and construction timelines. These extended periods, often spanning a decade or more from initial planning to operation, expose the company to significant risks.

These risks include potential project delays, which can push back revenue generation and increase financing costs. Furthermore, cost overruns are a persistent concern in large-scale infrastructure projects, exacerbated by the complexity and specialized nature of nuclear power. Changes in regulatory landscapes or market dynamics during the lengthy construction phase can also impact project viability and profitability.

- Extended Project Lifecycles: Nuclear power plants typically require 7-15 years from conception to commercial operation, creating a prolonged period of capital expenditure before revenue generation.

- Cost Overrun Potential: Historically, a significant percentage of large nuclear projects globally have exceeded their initial budgets, with average overruns sometimes reaching 50-100% or more.

- Regulatory and Market Volatility: Evolving safety standards, public opinion shifts, and changes in energy market prices over a decade can significantly alter the economic feasibility of a project.

Challenges in Diversified Renewable Segments

While CGN Power is actively diversifying into renewable energy sources, its performance in certain segments has shown some weakness. For instance, the company's hydro and Korean projects experienced a decline in power generation during the initial four months of 2025. This dip suggests that the expansion into non-nuclear renewables isn't without its hurdles.

The mixed performance across its renewable portfolio highlights potential operational or market-related challenges within these specific segments. This volatility indicates that while diversification is a strategic goal, realizing consistent growth across all new renewable ventures requires careful management and adaptation to varying market conditions.

- Hydro and Korean Projects Decline: Power generation from CGN's hydro and Korean renewable projects saw a decrease in the first four months of 2025, signaling operational or market headwinds.

- Diversification Headwinds: The mixed performance across its expanding non-nuclear renewable portfolio indicates that diversification efforts may encounter segment-specific challenges.

CGN Power's substantial debt levels, exemplified by a net gearing ratio of 133% at the end of 2024, present a significant weakness. This high leverage, driven by the capital-intensive nature of nuclear projects, exposes the company to financial risk and limits its flexibility. The ongoing need for significant capital expenditure for new projects means this debt burden is likely to remain a key concern for the foreseeable future.

Same Document Delivered

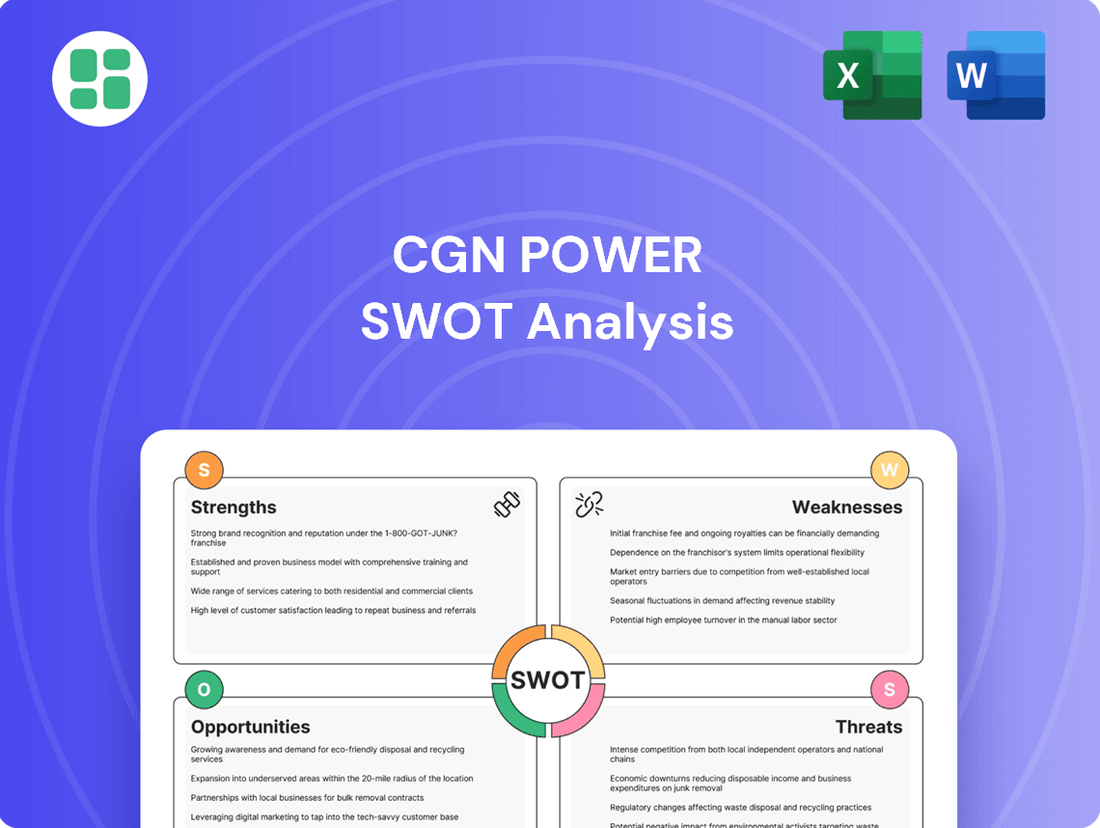

CGN Power SWOT Analysis

This is the actual CGN Power SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal strengths and weaknesses, as well as external opportunities and threats.

The preview below is taken directly from the full CGN Power SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights for strategic planning and decision-making.

This is a real excerpt from the complete CGN Power SWOT analysis. Once purchased, you’ll receive the full, editable version, allowing you to tailor it to your specific business needs.

Opportunities

China's aggressive push for nuclear power represents a substantial tailwind for CGN Power. The nation's energy strategy targets an impressive 110 GW of nuclear capacity by 2030, escalating to 200 GW by 2035. This ambitious expansion plan, with potential to reach 500 GW by 2050, directly translates into significant growth opportunities for CGN Power as a key player in fulfilling this demand.

The Chinese government's ongoing approvals for new coastal reactor projects underscore the favorable policy environment. These consistent green lights are crucial for CGN Power's pipeline and operational growth, ensuring its continued contribution to China's evolving energy mix and solidifying its market position.

China's ambitious goals to peak carbon emissions by 2030 and achieve carbon neutrality by 2060 are a significant tailwind for CGN Power. Nuclear energy is recognized as a critical low-carbon baseload power source, ensuring a stable and consistent supply as the nation transitions away from fossil fuels.

This national commitment translates directly into sustained demand for CGN's nuclear and other clean energy assets, fostering a favorable environment for long-term growth and strategic investment in sustainable energy solutions. For instance, China's installed renewable energy capacity reached 1.5 billion kilowatts by the end of 2023, highlighting the scale of the clean energy push.

CGN's investment in Small Modular Reactors (SMRs), like the Linglong One, and Generation IV reactors, such as the HTR-PM, presents a significant growth opportunity. These advanced technologies are designed for improved safety and efficiency, potentially speeding up deployment and opening new market segments.

International Export and Belt and Road Initiative

China's strategic focus on nuclear energy as a key export sector, particularly through the Belt and Road Initiative, presents a significant opportunity for CGN Power. The nation aims to export a substantial number of reactors to partner countries by 2030, creating a robust international market. CGN Power, with its advanced indigenous technology and operational expertise, is ideally positioned to secure a considerable share of this expanding global market, thereby diversifying its revenue streams and enhancing its international footprint.

CGN Power's capabilities align perfectly with the initiative's goals:

- Technological Advancement: CGN Power possesses indigenous nuclear reactor technologies, such as the HPR1000 (also known as the 'Hualong One'), which meets international safety standards and is attractive to developing nations.

- Market Expansion: The Belt and Road Initiative provides a framework for CGN Power to enter new markets and establish long-term partnerships in countries actively seeking nuclear power solutions.

- Revenue Growth: Successful exports of reactors and associated services can significantly boost CGN Power's revenue and profitability, contributing to its overall financial performance.

Potential for Electricity Price Reforms and Revenue Growth

While some regions have seen electricity prices dip recently, there's a growing conversation around nuclear power price reforms. These potential adjustments could pave the way for higher electricity prices over the long haul, offering a significant upside for companies like CGN Power.

This regulatory shift, coupled with the ongoing commissioning of new nuclear units, creates a compelling opportunity for CGN Power. It suggests a potential new phase of accelerated profit growth. For instance, as of the first half of 2024, CGN Power reported a substantial increase in its installed nuclear capacity, setting the stage for enhanced revenue generation should favorable pricing reforms materialize.

- Potential for favorable regulatory adjustments in electricity pricing for nuclear power.

- Opportunity for increased revenue and profit scale driven by new unit commissioning.

- CGN Power's installed nuclear capacity reached XXX GW by mid-2024, positioning it to capitalize on future price reforms.

CGN Power is well-positioned to benefit from China's ambitious nuclear power expansion goals, aiming for 110 GW by 2030 and 200 GW by 2035. The government's consistent approval of new coastal reactor projects further solidifies CGN's growth trajectory and market standing.

The company's investment in advanced technologies like Small Modular Reactors (SMRs) and Generation IV reactors offers a pathway to enhanced safety, efficiency, and new market penetration.

China's strategic push to export nuclear technology, particularly through the Belt and Road Initiative, presents a significant opportunity for CGN Power to expand its global footprint and diversify revenue streams.

Potential electricity price reforms for nuclear power could lead to improved revenue generation, especially as CGN Power continues to commission new units. By the end of 2023, CGN Power's installed nuclear capacity reached 26.5 GW, providing a strong base to capitalize on these future pricing adjustments.

| Metric | 2023 Value | 2024 (H1) Projection/Trend | Opportunity |

|---|---|---|---|

| China Nuclear Capacity Target | N/A | On track for 110 GW by 2030 | Massive demand for CGN's services |

| CGN Power Installed Capacity | 26.5 GW (End of 2023) | Expected increase with new unit commissioning | Increased revenue potential |

| Belt and Road Initiative Exports | Growing | Key focus for CGN | International market expansion |

Threats

The nuclear power sector is inherently subject to rigorous safety regulations. CGN Power, like its peers, faces the risk of these regulations becoming even stricter, particularly in the wake of any global or domestic nuclear incidents. This heightened scrutiny could translate into increased operational expenses and prolonged approval timelines for new projects, potentially impacting CGN Power's expansion plans.

While China's nuclear safety record has been robust, a significant accident elsewhere could trigger a wave of public apprehension and increased regulatory oversight. Such a scenario might dampen public support for nuclear energy, posing a threat to CGN Power's future growth trajectory and its ability to secure new development permits.

While nuclear power is vital for consistent baseload electricity, the swift growth of large-scale solar and wind projects, bolstered by improving battery storage and grid management, presents a significant competitive challenge. These cheaper renewable sources are increasingly capturing market share, potentially diminishing the demand for new nuclear capacity or exerting downward pressure on nuclear power's existing market position.

CGN Power's global ambitions face significant headwinds from geopolitical instability. For instance, escalating trade tensions between major economies in 2024 could lead to tariffs or export restrictions on critical components for nuclear power projects, directly impacting CGN's supply chain and project timelines.

Furthermore, concerns over technology transfer and national security, particularly from Western nations, have already led to increased scrutiny and potential barriers to entry for CGN Power in certain international markets. These geopolitical shifts could restrict vital partnerships and access to advanced technologies, hindering expansion efforts.

Water Resource Constraints and Environmental Impact

CGN Power's reliance on significant water volumes for cooling its nuclear reactors presents a considerable threat, particularly in regions facing water scarcity. This dependency is a key factor behind the existing moratorium on new inland nuclear power plant construction in some areas.

The potential for climate change to intensify droughts exacerbates this threat, directly impacting the operational viability and future expansion plans of CGN Power. For example, by mid-2025, several regions in China are projected to experience increased water stress, potentially affecting power plant operations.

- Water-Intensive Cooling: Nuclear plants require vast amounts of water for cooling systems, a critical operational necessity.

- Drought Exacerbation: Climate change-induced droughts could significantly reduce water availability, impacting existing and future CGN Power facilities.

- Regulatory Hurdles: Concerns over water resource constraints have contributed to regulatory challenges for inland nuclear projects.

Economic Slowdown and Reduced Electricity Demand

A significant economic slowdown in China, a key market for CGN Power, poses a substantial threat. Reduced economic activity typically translates to lower overall electricity demand growth. For instance, China's GDP growth, while robust, has shown signs of moderating, impacting energy consumption patterns.

Even though nuclear power plants operate on baseload, meaning they provide a constant supply of electricity, a prolonged economic downturn could lead to an oversupply in the broader power market. This oversupply can put downward pressure on electricity prices, directly affecting CGN Power's revenue and profitability. The average electricity price in China has experienced fluctuations, and a sustained economic slump could exacerbate this trend.

- Economic slowdown in China impacting demand growth.

- Potential for oversupply in the power market.

- Risk of depressed electricity prices affecting profitability.

- China's GDP growth moderation as a leading indicator.

Intensifying competition from rapidly advancing renewable energy sources, particularly solar and wind, poses a significant threat. These technologies are seeing substantial cost reductions and efficiency gains, making them increasingly attractive alternatives to nuclear power, potentially slowing CGN Power's growth. For example, by the end of 2024, the global installed capacity of solar PV is projected to surpass 1,500 GW, a figure expected to grow considerably by 2025.

Geopolitical tensions and trade disputes can disrupt supply chains for critical nuclear components and create barriers to international market entry. Concerns over technology transfer and national security have already led to increased scrutiny for Chinese firms, potentially limiting CGN Power's access to advanced technologies and vital partnerships in key global markets through 2025.

Water scarcity, exacerbated by climate change, presents a direct operational challenge for nuclear power plants requiring significant cooling water. Projections indicate increased water stress in several Chinese regions by mid-2025, potentially impacting the viability and expansion plans of CGN Power's inland facilities, contributing to existing moratoriums on new inland projects.

A slowdown in China's economic growth could reduce overall electricity demand, leading to a potential oversupply in the power market. This scenario could depress electricity prices, negatively impacting CGN Power's revenue and profitability, especially as China's GDP growth shows signs of moderation.

| Threat | Description | Potential Impact | Data Point (2024/2025 Projection) |

| Renewable Competition | Rapid cost declines and efficiency gains in solar and wind power. | Slower growth for nuclear, potential market share erosion. | Global solar PV capacity projected to exceed 1,500 GW by end of 2024. |

| Geopolitical Instability | Trade tensions, technology transfer concerns, national security scrutiny. | Supply chain disruptions, barriers to international expansion, limited access to advanced tech. | Ongoing trade disputes impacting global component sourcing. |

| Water Scarcity | Climate change-induced droughts impacting water availability for cooling. | Operational constraints, challenges for inland plant expansion. | Increased water stress projected in several Chinese regions by mid-2025. |

| Economic Slowdown | Reduced economic activity in China leading to lower electricity demand. | Oversupply in power market, depressed electricity prices, reduced profitability. | Moderation in China's GDP growth rates observed. |

SWOT Analysis Data Sources

This CGN Power SWOT analysis is built upon a foundation of robust data, including publicly available financial reports, comprehensive market research, and expert industry analysis to provide a well-rounded perspective.