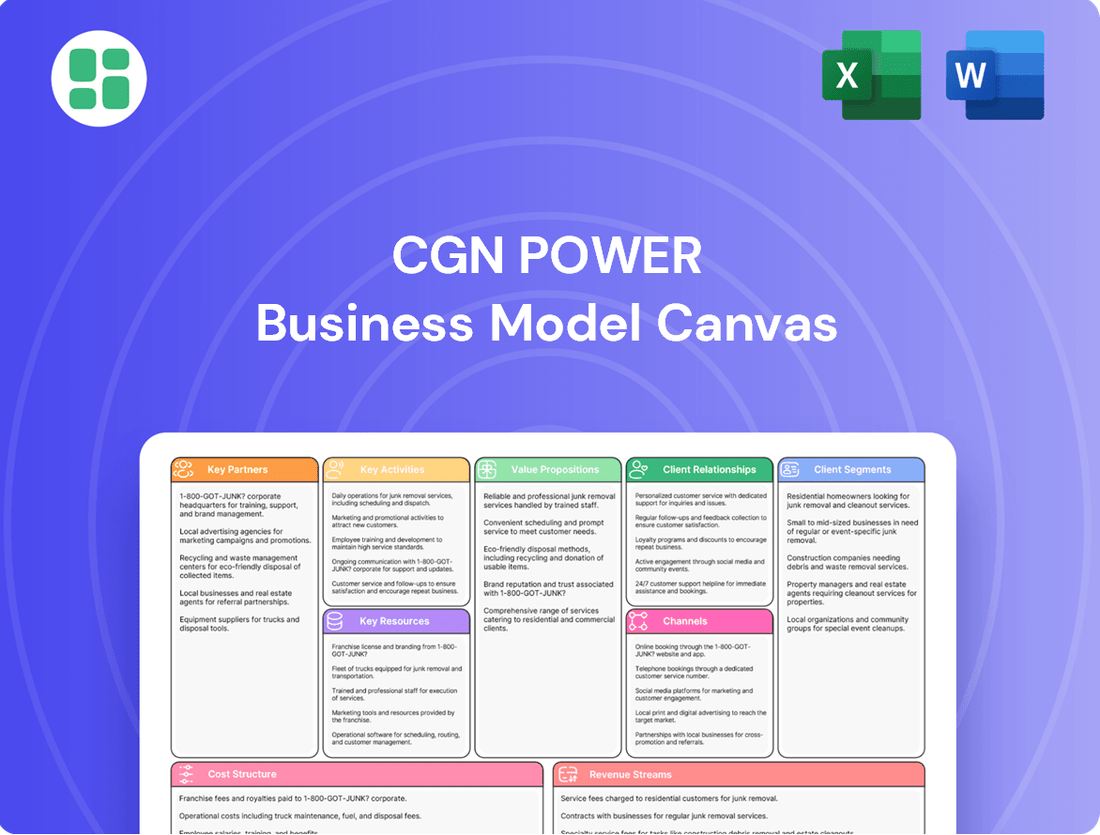

CGN Power Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CGN Power Bundle

Discover the core components of CGN Power's success with our comprehensive Business Model Canvas. This insightful overview reveals their key partners, value propositions, and revenue streams, offering a glimpse into their operational strategy. For a complete, actionable blueprint to fuel your own business endeavors, download the full version.

Partnerships

CGN Power's relationship with Chinese government agencies and regulators is foundational. These entities, including the National Nuclear Safety Administration (NNSA) and the Ministry of Natural Resources, are instrumental in granting the essential licenses and permits for CGN Power's operations, from plant construction to fuel management. In 2023, China continued its push for nuclear energy expansion, with new projects approved, underscoring the critical role of government policy in CGN Power's strategic direction and growth.

CGN Power actively collaborates with domestic and international technology providers to secure cutting-edge reactor designs, advanced safety systems, and sophisticated nuclear fuel cycle technologies. This strategic approach ensures the company remains a leader in nuclear innovation and upholds the highest safety benchmarks.

While China has successfully localized the production of critical nuclear plant equipment, international partnerships are indispensable for ongoing technological progress and the integration of global best practices. For instance, CGN Power's Hualong One reactor, a key domestic technology, has benefited from collaborations that enhance its global competitiveness and safety features.

CGN Power collaborates with major construction and engineering firms for its nuclear power plant projects. These partnerships are crucial for handling the immense complexity and specialized knowledge required for building nuclear facilities. For instance, in 2024, CGN Power continued its engagement with established players in civil engineering and equipment installation to ensure projects like the Taishan Nuclear Power Plant proceeded efficiently and safely.

Financial Institutions and Investors

CGN Power relies heavily on financial institutions and investors to fund its capital-intensive nuclear power projects. These partnerships are essential for securing the vast sums needed for construction, often through a mix of loans, bonds, and equity. For instance, in 2023, CGN Power successfully issued 3 billion yuan in green bonds to finance its renewable energy and nuclear power initiatives, demonstrating strong access to capital markets.

As a state-owned enterprise, CGN Power benefits from its SOE status, which typically grants it preferential access to lower-cost funding. This includes favorable loan terms from state-backed banks and a broader range of financing options. In 2024, the company continued to leverage these relationships, securing significant credit lines from major Chinese financial institutions to support its ongoing development pipeline.

- Financial Institutions: Banks (e.g., Bank of China, Industrial and Commercial Bank of China) and investment firms provide crucial debt and equity financing.

- Investor Base: A diverse range of investors, including institutional investors and sovereign wealth funds, contribute capital through various financial instruments.

- SOE Advantage: State backing facilitates access to lower borrowing costs and a wider array of funding sources.

- Bond Issuance: CGN Power actively uses bond markets, such as its 2023 green bond issuance, to raise capital for sustainable projects.

Research and Development Institutions

CGN Power actively partners with universities and national laboratories to foster innovation in nuclear technology. These collaborations are crucial for advancing safety protocols and developing cutting-edge reactor designs, including Small Modular Reactors (SMRs) and Generation IV concepts. This focus on R&D enhances technological independence and market competitiveness.

These strategic alliances are vital for CGN Power's long-term vision. For instance, in 2024, CGN Power continued its engagement with leading Chinese universities to explore advanced fuel cycle technologies and waste management solutions. Such partnerships are foundational for achieving technological self-reliance and maintaining a competitive edge in the global nuclear energy sector.

- University Collaborations: Joint research projects with academic institutions to explore novel materials and reactor physics.

- National Laboratory Engagement: Partnerships for advanced safety analysis and simulation capabilities.

- Specialized Research Institutes: Collaboration on developing next-generation nuclear technologies, including SMRs.

- Technological Advancement: Driving innovation to ensure CGN Power's leadership in the nuclear energy field.

CGN Power's key partnerships extend to a broad network of financial institutions and investors, crucial for funding its capital-intensive nuclear projects. These include major Chinese state-backed banks and a diverse investor base, facilitating access to significant debt and equity financing. In 2023, CGN Power successfully raised 3 billion yuan through green bond issuance, highlighting its ability to tap into capital markets for sustainable development.

Collaborations with domestic and international technology providers are vital for CGN Power's innovation and safety standards. These partnerships ensure access to advanced reactor designs and fuel cycle technologies, supporting the competitiveness of its flagship Hualong One reactor. Furthermore, working with leading construction and engineering firms is essential for the complex execution of nuclear plant projects, as seen in the ongoing development of facilities like the Taishan Nuclear Power Plant in 2024.

Strategic alliances with universities and national laboratories are fundamental for CGN Power's research and development efforts. These collaborations focus on advancing safety protocols, exploring new reactor concepts like Small Modular Reactors (SMRs), and improving waste management solutions. Such partnerships are key to achieving technological self-reliance and maintaining a competitive edge in the evolving nuclear energy landscape.

| Partner Type | Examples | Role/Contribution | 2023/2024 Data Point |

|---|---|---|---|

| Government Agencies | NNSA, Ministry of Natural Resources | Licensing, Regulation, Policy Support | Continued approval of new nuclear projects in China |

| Technology Providers | Domestic & International Firms | Reactor Designs, Safety Systems, Fuel Tech | Enhancement of Hualong One global competitiveness |

| Construction & Engineering | Major Civil Engineering Firms | Project Execution, Specialized Knowledge | Efficient and safe progress on Taishan Nuclear Power Plant |

| Financial Institutions | Bank of China, ICBC | Debt & Equity Financing, Loans, Bonds | 3 billion yuan green bond issuance in 2023 |

| Academic & Research | Universities, National Labs | R&D, Safety Advancements, New Reactor Concepts | Exploration of advanced fuel cycle technologies |

What is included in the product

A comprehensive, pre-written business model tailored to CGN Power's strategy, detailing customer segments, channels, and value propositions.

Organized into 9 classic BMC blocks with full narrative and insights, this model reflects CGN Power's real-world operations and plans.

CGN Power's Business Model Canvas offers a pain point reliever by providing a clear, one-page snapshot of their strategy, enabling rapid identification of core components and facilitating efficient team brainstorming and adaptation.

Activities

Nuclear Power Plant Design and Engineering is the bedrock of CGN Power's operations, encompassing the meticulous planning and technical blueprinting of nuclear facilities. This includes selecting appropriate reactor types, integrating robust safety systems, and defining optimal plant layouts to ensure efficient and secure energy generation.

CGN Power is deeply invested in refining its flagship Hualong One design, a testament to its commitment to technological advancement and global competitiveness. This continuous optimization aims to enhance safety, efficiency, and economic viability, ensuring the Hualong One remains a leading Gen-III+ nuclear technology.

Beyond current designs, CGN Power actively pursues the development of next-generation nuclear technologies. This forward-looking approach positions the company at the forefront of innovation, exploring advanced reactor concepts and modular designs to meet future energy demands and sustainability goals.

In 2023, CGN Power reported significant progress in its R&D for advanced nuclear technologies, contributing to China's broader goal of expanding its nuclear power capacity. The company's ongoing design and engineering efforts are crucial for supporting the deployment of new nuclear projects, both domestically and internationally.

CGN Power's core activity is the comprehensive construction and project management of nuclear power plants. This involves overseeing every stage, from site preparation and foundational work to the intricate installation of reactor components and final commissioning. They manage vast, multi-year projects, ensuring all phases are executed with precision and adherence to stringent regulatory requirements.

The company coordinates a complex network of specialized contractors and suppliers, managing budgets that can run into billions of dollars. For instance, the construction of a typical large-scale nuclear reactor can cost upwards of $6 billion, requiring sophisticated logistical planning and risk management to stay on schedule and within financial parameters. Their expertise lies in navigating these complexities to deliver safe and operational power facilities.

CGN Power's core operations revolve around the safe, reliable, and efficient running of its nuclear power stations. This involves scheduled maintenance, refueling shutdowns, and constant oversight to ensure maximum electricity output while adhering to strict safety standards. In 2023, CGN Power's nuclear power generation reached 229.4 billion kilowatt-hours, a testament to their operational prowess.

Nuclear Fuel Cycle Management

Nuclear Fuel Cycle Management is a critical activity for CGN Power, covering everything from sourcing uranium to managing spent fuel and waste. This ensures a stable and reliable fuel supply for their nuclear power plants, a cornerstone of their operations. In 2023, China's nuclear power generation reached 437.9 billion kilowatt-hours, highlighting the demand CGN Power helps meet.

CGN Power's involvement in the nuclear fuel cycle is multifaceted, aiming for efficiency and safety. This includes strategic procurement of uranium resources and managing the complex processes of fuel fabrication and enrichment. The company is committed to responsible stewardship throughout the entire fuel lifecycle, from front-end services to back-end waste management.

- Uranium Procurement: Securing long-term supply contracts for uranium concentrate.

- Fuel Fabrication: Manufacturing fuel assemblies for their fleet of reactors.

- Spent Fuel Management: Developing strategies for the safe storage and potential reprocessing of used nuclear fuel.

- Radioactive Waste Disposal: Implementing secure and environmentally sound disposal solutions for low and intermediate-level waste.

Renewable Energy Project Development and Operation

CGN Power is actively expanding its renewable energy segment, moving beyond its nuclear foundation. The company is developing and operating a range of wind and solar power projects, aligning with China's national drive for cleaner energy sources and bolstering its own market position. This diversification is crucial for long-term growth and sustainability.

By 2023, CGN Power had significantly increased its installed capacity in renewable energy. For instance, its wind power capacity reached approximately 32.9 GW, and its solar power capacity grew to around 10.6 GW by the end of 2023. These figures demonstrate a substantial commitment to expanding its clean energy footprint.

- Wind Power Expansion: CGN Power's wind energy portfolio is a key driver of its renewable strategy, with substantial installed capacity contributing to China's energy transition.

- Solar Energy Growth: The company is also making significant investments in solar power development, further diversifying its clean energy generation mix.

- Contribution to National Goals: These renewable energy activities directly support China's ambitious targets for carbon emission reduction and the increased use of non-fossil fuels in its energy consumption.

CGN Power's key activities center on designing, constructing, and operating nuclear power plants, with a strong focus on its Hualong One technology and developing next-generation reactors. They also manage the entire nuclear fuel cycle, from uranium procurement to waste disposal, ensuring a stable fuel supply. Furthermore, the company is actively expanding its renewable energy portfolio, particularly in wind and solar power, to diversify its energy generation and meet clean energy targets.

These activities are crucial for CGN Power's role in providing reliable and clean energy. In 2023, the company's nuclear power generation reached 229.4 billion kilowatt-hours. Their renewable energy expansion is also significant, with wind power capacity reaching approximately 32.9 GW and solar power capacity around 10.6 GW by the end of 2023.

| Key Activity | Description | 2023 Data/Notes |

| Nuclear Power Plant Operations | Safe and efficient running of nuclear facilities. | Generated 229.4 billion kWh of nuclear power. |

| Nuclear Fuel Cycle Management | Managing uranium sourcing, fuel fabrication, and waste. | Supports China's nuclear power generation of 437.9 billion kWh. |

| Renewable Energy Development | Expanding wind and solar power projects. | Wind capacity: ~32.9 GW; Solar capacity: ~10.6 GW. |

Delivered as Displayed

Business Model Canvas

The CGN Power Business Model Canvas preview you are viewing is the actual, complete document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered, ensuring no surprises and immediate usability for your strategic planning.

Resources

CGN Power's advanced nuclear technology, particularly its proprietary and licensed reactor designs like the Hualong One, represents a core intellectual property asset. This technology is the bedrock of their capacity to construct and operate state-of-the-art nuclear facilities, driving their competitive edge in the global energy market.

The associated digital instrumentation and control platforms, such as FirmSys, are equally vital intellectual property. These advanced systems ensure the safe, efficient, and reliable operation of their nuclear power plants, further solidifying CGN Power's technological leadership.

CGN Power's business model hinges on its highly skilled workforce and deep technical expertise, particularly in nuclear engineering and safety. This specialized talent pool is crucial for the safe and efficient operation of complex nuclear facilities, ensuring regulatory compliance and optimal energy generation.

In 2024, CGN Power continued to invest heavily in talent development, recognizing that continuous training is paramount. This commitment ensures their staff remains at the forefront of nuclear technology and safety protocols, fostering operational excellence and driving innovation within the industry.

CGN Power's operational nuclear power plants and the supporting grid infrastructure are its core physical assets. These facilities are the primary revenue generators, providing a consistent and reliable income stream. As of the end of 2024, CGN Power operated 28 nuclear reactors, demonstrating a substantial existing operational base.

This extensive fleet of 28 operational reactors as of December 31, 2024, is fundamental to CGN Power's business model. These assets not only generate significant electricity but also represent a stable foundation for future growth and investment in new nuclear technologies.

Government Licenses, Permits, and Policy Support

Access to essential regulatory approvals, construction permits, and ongoing operational licenses from national nuclear safety administrations forms the bedrock of CGN Power's operations. Without these governmental authorizations, the construction and continued functioning of nuclear power plants are impossible.

Strong government policy support and strategic planning for nuclear energy development are equally critical. This backing influences everything from financing to public acceptance and long-term energy mix integration. For instance, China's national energy strategy, updated periodically, often emphasizes nuclear power's role in achieving carbon reduction goals. By 2024, China had a significant pipeline of nuclear projects approved, underscoring this policy commitment.

CGN Power's business model relies heavily on these governmental frameworks:

- Regulatory Approvals: Obtaining and maintaining licenses from bodies like China's National Nuclear Safety Administration (NNSA) for plant design, construction, and operation.

- Permitting Processes: Securing various construction and environmental permits at national, provincial, and local levels.

- Policy Alignment: Benefiting from national energy policies that favor nuclear power for its low-carbon attributes and energy security contributions.

- Strategic Planning: Integrating CGN Power's development plans with China's broader national economic and environmental strategies, ensuring long-term viability and support.

Substantial Capital and Financial Backing

Nuclear power projects demand colossal capital, spanning initial construction, ongoing operations, and eventual decommissioning. CGN Power's position as a state-owned enterprise grants it access to substantial investment and diverse funding avenues, crucial for these capital-intensive ventures.

This financial backing is essential for CGN Power to undertake large-scale projects and maintain its competitive edge. For instance, in 2023, CGN Power's total assets reached approximately RMB 537.4 billion, underscoring its significant financial capacity.

- Capital Requirements: Nuclear power plants require billions of dollars for construction, fuel, maintenance, and waste management.

- State-Owned Advantage: CGN Power benefits from direct government support and easier access to loans from state banks.

- Funding Diversification: The company also leverages capital markets, issuing bonds and shares to secure necessary funds.

- 2023 Financials: CGN Power reported RMB 117.7 billion in revenue for 2023, demonstrating its operational scale and financial strength.

CGN Power's key financial resources include its substantial asset base, significant revenue generation capabilities, and access to diverse funding channels, particularly due to its state-owned status. These financial strengths are critical for funding the capital-intensive nature of nuclear power projects.

The company's financial health is evidenced by its asset scale and revenue performance. For example, CGN Power's total assets were approximately RMB 537.4 billion in 2023, with revenues reaching RMB 117.7 billion in the same year. This financial muscle enables sustained investment in operations and development.

| Financial Metric | 2023 Value (RMB) | Significance |

|---|---|---|

| Total Assets | 537.4 billion | Indicates substantial operational scale and investment capacity. |

| Revenue | 117.7 billion | Demonstrates strong operational performance and income generation. |

| Access to Capital | State-owned enterprise status facilitates access to government funding and state banks. | Crucial for financing large-scale, long-term nuclear projects. |

Value Propositions

CGN Power is a cornerstone of national energy security, providing a reliable and stable baseload electricity supply crucial for economic development. Unlike fluctuating renewable sources, their nuclear power plants ensure continuous, high-capacity operation, offering a dependable foundation for the grid.

In 2023, CGN Power's installed nuclear capacity reached 22.98 GW, contributing significantly to China's energy mix and demonstrating their commitment to consistent power generation. This stable output is vital for industries requiring uninterrupted power, such as manufacturing and data centers.

CGN Power's commitment to generating electricity without greenhouse gas emissions directly supports China's ambitious climate objectives, specifically the goal of peaking carbon emissions by 2030 and achieving carbon neutrality by 2060.

In 2023, CGN Power's nuclear power generation capacity reached 25,000 megawatts, contributing significantly to averting an estimated 200 million tons of carbon dioxide emissions annually, a crucial step in mitigating climate change.

This substantial reduction in CO2 emissions highlights CGN Power's integral role in transitioning China towards a cleaner energy future and meeting its international climate commitments.

CGN Power’s commitment to advanced nuclear safety and operational excellence is a cornerstone of its value proposition, ensuring adherence to stringent international standards. This dedication fosters public trust and underpins the company's long-term sustainability in the energy sector.

The company actively pursues continuous improvement in its operations, aiming for world-class performance metrics. This focus on efficiency and reliability is crucial for maintaining a competitive edge and delivering consistent energy output.

In 2024, CGN Power continued to emphasize its safety culture, with investments in advanced training and technology. This proactive approach aims to minimize risks and ensure the secure operation of its nuclear facilities, a critical factor for stakeholder confidence.

Technological Leadership and Innovation

CGN Power champions technological leadership by developing and deploying advanced nuclear reactor designs. Their portfolio includes the indigenous third-generation Hualong One reactors, which are a significant export product, and ongoing research into fourth-generation reactors and Small Modular Reactors (SMRs). This commitment to innovation solidifies China's position at the forefront of global nuclear energy advancements.

The company's dedication to R&D is evident in its significant investment in next-generation nuclear technologies. For instance, by the end of 2023, CGN Power had successfully connected several Hualong One units to the grid, demonstrating the commercial viability of their homegrown technology. Their work on SMRs, such as the ACP100 (Linglong One), aims to provide flexible and scalable nuclear power solutions for various applications.

CGN Power's technological prowess is a key value proposition, enabling them to offer competitive and safe nuclear energy solutions. This leadership not only drives domestic energy security but also positions them as a major player in the international nuclear market, exporting their advanced technologies and expertise.

- Hualong One Deployment: CGN Power has successfully commissioned multiple Hualong One reactors, showcasing the maturity and reliability of this third-generation technology.

- Fourth-Generation Reactor Development: Active research and development are underway for advanced fourth-generation reactor designs, promising enhanced safety and efficiency.

- SMR Innovation: The company is a pioneer in Small Modular Reactor (SMR) technology, with projects like the ACP100 (Linglong One) nearing operational status, offering new market opportunities.

- Global Export Potential: CGN Power's technological leadership makes their nuclear power solutions attractive for international markets seeking advanced and safe energy options.

Energy Security and Independence for China

CGN Power's commitment to expanding domestic nuclear capacity directly bolsters China's energy security. By increasing the share of nuclear power in the national energy mix, the country significantly reduces its dependence on imported fossil fuels, particularly coal and natural gas. This strategic shift enhances geopolitical stability by mitigating vulnerabilities associated with international energy supply chains.

This focus on nuclear energy aligns perfectly with China's overarching national strategy of achieving greater self-sufficiency. In 2024, China continued its aggressive nuclear build-out, with several new reactors expected to come online, further solidifying its domestic energy production capabilities. For instance, as of early 2024, China had over 50 nuclear reactors in operation and more under construction, positioning it as a global leader in nuclear power development.

- Energy Security: Reduces reliance on imported fossil fuels, enhancing national energy independence.

- Geopolitical Stability: Mitigates risks associated with international energy market volatility and supply disruptions.

- National Strategy Alignment: Directly supports China's long-term goals for energy self-sufficiency and sustainable development.

- Economic Benefits: Contributes to a more stable and predictable energy cost structure for domestic industries.

CGN Power's value proposition centers on providing reliable, low-carbon electricity through advanced nuclear technology. They ensure baseload power, crucial for economic stability, and contribute significantly to China's climate goals by reducing carbon emissions. Their commitment to safety and continuous operational improvement underpins public trust and competitiveness.

Technological leadership, particularly with the Hualong One reactor and advancements in SMRs, positions CGN Power as an innovator and global exporter of nuclear solutions. This focus on R&D, exemplified by their successful deployment of Hualong One units by the end of 2023, drives both domestic energy security and international market opportunities.

By expanding domestic nuclear capacity, CGN Power directly enhances China's energy security, lessening dependence on imported fossil fuels. This strategic alignment with national self-sufficiency goals is supported by China's continued nuclear build-out, with over 50 reactors operational and more under construction as of early 2024.

| Key Value Proposition | Description | Supporting Data/Facts |

|---|---|---|

| Reliable Baseload Power | Ensures continuous, high-capacity electricity supply, vital for industrial operations and grid stability. | 2023 installed nuclear capacity: 22.98 GW. |

| Low-Carbon Energy Contribution | Supports climate objectives by generating electricity without greenhouse gas emissions. | Averted an estimated 200 million tons of CO2 emissions annually in 2023. |

| Technological Innovation | Development and deployment of advanced reactors like Hualong One and SMRs. | Successful commissioning of multiple Hualong One units; ACP100 (Linglong One) nearing operational status. |

| Enhanced Energy Security | Reduces reliance on imported fossil fuels, bolstering national energy independence. | China's nuclear operational capacity growing, with over 50 reactors in operation as of early 2024. |

Customer Relationships

CGN Power cultivates enduring partnerships with government ministries and regulatory agencies, crucial for navigating the nuclear sector's inherent strategic importance and stringent oversight. This proactive engagement ensures alignment with national energy policies and facilitates ongoing compliance with evolving regulations.

In 2024, CGN Power's commitment to regulatory dialogue is underscored by its active participation in numerous industry forums and consultations. For instance, the company's investment in advanced safety protocols and waste management technologies, totaling billions of dollars annually, directly addresses key regulatory concerns and demonstrates a dedication to responsible operations.

CGN Power's customer relationships with grid operators are built on long-term power purchase agreements (PPAs). These contracts are fundamental to the business, particularly for nuclear power's consistent base-load generation. For instance, in 2023, CGN Power's operational capacity contributed significantly to China's electricity grid, with PPAs providing a predictable revenue stream.

CGN Power prioritizes building and maintaining public trust for its nuclear operations, recognizing it as essential for a social license to operate. In 2024, the company continued its commitment to transparent communication regarding safety protocols and operational performance.

Community engagement initiatives in 2024 focused on providing tangible benefits, such as local employment opportunities and support for community development projects. These efforts aim to foster acceptance and ensure long-term positive relationships with stakeholders living near their facilities.

Investor Relations and Transparency

CGN Power, as a publicly traded entity, prioritizes robust investor relations. This involves consistent communication with shareholders and prospective investors through detailed financial reports and informative investor briefings. The company aims to foster trust by openly sharing operational progress and strategic shifts, ensuring transparency in its dealings.

- Financial Reporting: CGN Power regularly publishes quarterly and annual financial statements, adhering to international accounting standards. For instance, in 2024, the company continued its practice of timely disclosures, providing investors with up-to-date performance metrics.

- Investor Briefings and Conferences: The company actively participates in investor conferences and hosts its own briefing sessions, often featuring management discussions on market outlook and strategic initiatives. These events offer direct engagement opportunities for stakeholders.

- Transparency in Disclosure: CGN Power is committed to providing clear and comprehensive information regarding its projects, regulatory compliance, and sustainability efforts. This includes detailed annual reports that outline key performance indicators and future plans.

Partnership-Based Supplier and Contractor Relationships

CGN Power cultivates deep, partnership-based relationships with its extensive network of suppliers and construction contractors. These collaborations are crucial for the successful execution of its power generation projects and ensuring smooth, ongoing operations. For instance, in 2024, CGN Power continued to emphasize long-term agreements with key equipment manufacturers and specialized construction firms, fostering reliability and quality.

These relationships are not merely transactional; they are strategic alliances built on mutual benefit, quality assurance, and dependable delivery. This approach ensures that CGN Power has access to the necessary components and expertise to maintain its operational excellence and undertake new developments effectively.

- Strategic Supplier Alliances: CGN Power prioritizes long-term partnerships with critical suppliers, ensuring consistent quality and timely delivery of components essential for power plant construction and maintenance.

- Contractor Collaboration for Project Execution: Effective collaboration with construction contractors is vital for the efficient and safe completion of new power projects, with a focus on shared objectives and performance standards.

- Focus on Reliability and Mutual Benefit: The company actively nurtures relationships that emphasize reliability, cost-effectiveness, and shared growth, fostering a stable and supportive supply chain.

CGN Power manages diverse customer relationships, from government bodies to grid operators and the public. These relationships are foundational for its operations, ensuring regulatory compliance, stable revenue streams via Power Purchase Agreements (PPAs), and public acceptance. In 2024, the company actively engaged in transparent communication and community initiatives to bolster trust and social license.

Channels

CGN Power's primary sales channel involves direct power sales to national and regional grids. These grids act as intermediaries, distributing electricity to a broad base of end-users. This channel is built upon direct contractual agreements with these essential grid operators.

In 2024, CGN Power's operational capacity, particularly in nuclear and renewable energy, directly feeds into China's national grid infrastructure. For instance, their nuclear power plants, a significant contributor to their portfolio, are integrated into the State Grid Corporation of China and China Southern Power Grid, ensuring consistent supply. The company's substantial wind and solar farms also contribute directly to regional grids, supporting the national energy mix.

Government directives, including national five-year plans and specific energy policies, are a primary channel shaping CGN Power's strategic direction. These top-down mandates influence everything from project approvals to market access, directly impacting the company's development and expansion strategies. For instance, China's 14th Five-Year Plan (2021-2025) emphasizes a significant increase in non-fossil fuel energy consumption, providing a clear roadmap for CGN Power's growth in nuclear and renewable sectors.

CGN Power actively engages with key industry bodies like the World Nuclear Association and the International Atomic Energy Agency. This participation is crucial for sharing technical expertise and shaping global nuclear energy standards. For instance, in 2023, the World Nuclear Association reported that nuclear power generated 2,567 TWh globally, highlighting the importance of collaborative efforts in this sector.

Attending international forums and conferences provides CGN Power with invaluable opportunities to network and explore potential collaborations. These events are vital for staying abreast of technological advancements and regulatory changes. In 2024, the Nuclear Energy Institute’s annual conference brought together over 1,000 industry leaders to discuss the future of nuclear power, underscoring the networking value.

Corporate Public Relations and Media Communications

CGN Power strategically engages in corporate public relations and media communications to highlight its commitment to nuclear safety and the environmental advantages of nuclear energy. This proactive approach aims to educate the public and foster trust, crucial for maintaining social license to operate. For instance, in 2023, CGN Power reported a safety performance with zero major incidents at its operating facilities, reinforcing its safety narrative.

The company's media outreach emphasizes its significant contributions to China's energy security, positioning nuclear power as a reliable and clean energy source. This communication strategy is vital for managing public perception and building a strong brand reputation in a sector that often faces scrutiny. CGN Power's investments in advanced nuclear technologies, such as the Hualong One reactor, are frequently featured in its public communications to showcase innovation and future-readiness.

Key aspects of CGN Power's public relations and media communications include:

- Nuclear Safety Advocacy: Communicating rigorous safety protocols and operational excellence to the public and stakeholders.

- Environmental Benefits Promotion: Highlighting the low-carbon emissions of nuclear power and its role in combating climate change.

- Energy Security Contributions: Demonstrating how nuclear power enhances national energy independence and stability.

- Brand Reputation Management: Building and maintaining a positive public image through transparent and consistent communication.

Financial Reports and Investor Platforms

CGN Power, like many publicly traded companies, leverages official stock exchange platforms and reputable financial news websites as primary channels to disseminate crucial information to its stakeholders. These platforms are vital for sharing financial results, comprehensive annual reports, and insightful investor presentations.

These published documents provide a transparent view of the company's performance and strategic direction. For instance, in their 2024 reporting, CGN Power would detail key financial metrics, offering investors a clear understanding of their operational and financial health. This transparency is fundamental for maintaining investor confidence and facilitating informed decision-making.

- Financial Results: CGN Power regularly publishes quarterly and annual financial results, including revenue, net income, and earnings per share, providing a snapshot of their economic performance.

- Annual Reports: These detailed documents offer a comprehensive overview of the company's operations, financial statements, risk factors, and management's discussion and analysis for the fiscal year.

- Investor Presentations: These presentations often accompany earnings releases, offering management's perspective on performance, strategic initiatives, and future outlook, frequently including forward-looking statements and market analysis.

- Stock Exchange and Financial News Websites: Platforms like the Hong Kong Stock Exchange, Bloomberg, and Reuters are critical for the timely and widespread distribution of CGN Power's financial disclosures.

CGN Power's channels extend beyond direct grid sales to encompass regulatory engagement and industry collaboration. Government policies, such as China's 14th Five-Year Plan, directly influence its strategic growth, particularly in nuclear and renewables, as evidenced by the plan's emphasis on increasing non-fossil fuel energy consumption. Furthermore, participation in industry bodies like the World Nuclear Association, which reported global nuclear generation at 2,567 TWh in 2023, facilitates knowledge exchange and standard-setting.

CGN Power also utilizes public relations and media communications as a key channel to build trust and highlight its commitment to nuclear safety and environmental benefits. In 2023, the company reported zero major incidents at its operating facilities, reinforcing its safety record. This communication aims to educate the public and manage brand reputation, showcasing innovations like the Hualong One reactor.

CGN Power's financial transparency is maintained through official stock exchange platforms and financial news websites. These channels disseminate crucial information like quarterly financial results and annual reports, providing investors with insights into operational and financial health. For instance, their 2024 reporting would detail key financial metrics, essential for investor confidence.

Customer Segments

National and provincial grid operators are CGN Power's core customers, absorbing the bulk of its nuclear-generated electricity. These entities depend on the consistent, high-volume baseload power that nuclear facilities provide to maintain grid stability and meet widespread demand.

In 2023, China's electricity consumption reached approximately 9.5 trillion kilowatt-hours, with nuclear power playing an increasingly significant role in ensuring supply security. Grid operators are thus critical partners, facilitating the distribution of this essential energy resource across vast networks.

CGN Power's operations are intrinsically linked to the Chinese government's strategic objectives. As a state-owned enterprise, its primary role is to ensure national energy security and contribute to carbon emission reduction targets. In 2023, China's total primary energy consumption reached approximately 5.9 billion tons of standard coal equivalent, with the government actively promoting cleaner energy sources to meet its climate commitments.

The government is CGN Power's most significant stakeholder, influencing its strategic direction and operational framework through policy and regulation. It also acts as the ultimate beneficiary, with CGN Power's performance directly impacting national economic stability and environmental goals. For instance, the government's push for nuclear power, a core area for CGN Power, aims to diversify the energy mix away from coal, which still accounted for over 55% of China's energy consumption in 2023.

Industrial and commercial large-scale consumers, while not directly purchasing electricity from CGN Power, are crucial indirect beneficiaries. Their operations, from manufacturing plants to large retail chains, depend heavily on the consistent and cost-effective electricity supplied through the national grid, a capacity CGN Power contributes to significantly.

In 2023, China's industrial sector, a primary consumer of electricity, accounted for approximately 70% of total electricity consumption. CGN Power's substantial installed capacity, which reached over 23.4 GW by the end of 2023, directly supports this demand, ensuring these businesses have the power they need to operate efficiently and competitively.

Investors and Financial Market Participants

Shareholders, bondholders, and other financial market participants form a vital customer segment for CGN Power, supplying the necessary capital that fuels its operations and expansion. These stakeholders are primarily driven by the expectation of financial returns, whether through dividends, capital appreciation, or interest payments, and they closely monitor the company's performance for signs of stable growth. For instance, as of the first half of 2024, CGN Power reported a net profit attributable to equity holders of RMB 5.45 billion, indicating a positive trend that would appeal to these investors.

The confidence of this segment is paramount, directly influencing CGN Power's ability to secure future funding and impacting its overall market valuation. A strong financial track record and transparent communication are key to maintaining this confidence. In 2023, CGN Power's total revenue reached RMB 126.3 billion, demonstrating its significant market presence and operational scale, which are critical factors for financial market participants assessing investment opportunities.

CGN Power's engagement with investors is crucial for its long-term financial health. This involves not only delivering consistent financial results but also articulating a clear strategic vision that aligns with market expectations for sustainable development and profitability. The company's commitment to renewable energy, with its installed capacity of clean energy reaching 114.7 GW by the end of 2023, is a significant draw for investors focused on ESG (Environmental, Social, and Governance) principles.

- Capital Provision: Shareholders and bondholders are the primary sources of equity and debt financing.

- Return Expectations: This segment seeks consistent financial returns, including dividends and interest payments.

- Market Valuation: Investor confidence directly impacts CGN Power's share price and overall market capitalization.

- Financial Performance: Key metrics like net profit and revenue are closely scrutinized by financial market participants.

International Partners and Export Markets

CGN Power actively cultivates relationships with international partners, leveraging its technological expertise to drive exports of nuclear power technology and related services. This expansion is a significant component of its global strategy, aiming to secure new markets and diversify revenue streams beyond its domestic operations.

The company's engagement in overseas project development, particularly in countries participating in the Belt and Road Initiative, highlights its commitment to international collaboration. These ventures not only facilitate the adoption of CGN Power's advanced energy solutions but also foster deeper economic ties and create new investment opportunities.

In 2023, CGN Power's international business segment demonstrated robust growth, contributing significantly to its overall financial performance. For instance, the company secured several key export contracts for its HPR1000 (Hualong One) reactor technology, underscoring its competitive edge in the global nuclear energy market.

- Global Reach: CGN Power's international partners span numerous countries, facilitating technology transfer and project execution.

- Belt and Road Initiative: Significant investments and project developments are concentrated in countries aligned with this strategic initiative.

- Export Growth: In 2023, the company reported a substantial increase in revenue from its international operations, driven by technology exports and overseas project contributions.

CGN Power's customer segments are diverse, encompassing national and provincial grid operators who are the primary purchasers of its nuclear-generated electricity, ensuring grid stability. The Chinese government stands as a crucial stakeholder, guiding strategic direction and benefiting from national energy security and emission reduction efforts. Financial market participants, including shareholders and bondholders, provide essential capital, seeking financial returns based on the company's performance. Additionally, industrial and commercial entities are indirect beneficiaries, relying on the consistent power supply CGN Power contributes to, while international partners engage for technology and project collaboration.

| Customer Segment | Primary Need/Relationship | Key Data Point (2023/H1 2024) |

|---|---|---|

| Grid Operators | Consistent, high-volume baseload power | China's electricity consumption ~9.5 trillion kWh |

| Chinese Government | National energy security, carbon reduction | Nuclear's role in diversifying energy mix from coal (55%+ in 2023) |

| Financial Market Participants | Capital provision, financial returns | H1 2024 Net Profit: RMB 5.45 billion; 2023 Revenue: RMB 126.3 billion |

| Industrial/Commercial Consumers | Reliable and cost-effective electricity (indirect) | Industrial sector ~70% of total electricity consumption |

| International Partners | Technology export, project collaboration | 2023 growth in international business, Hualong One exports |

Cost Structure

CGN Power's cost structure is heavily influenced by the immense upfront investment needed for building nuclear power facilities. The design, construction, and commissioning of these plants represent the most substantial expenditure, often running into billions of dollars per project. For instance, the Taishan Nuclear Power Plant, a key CGN asset, involved significant capital outlays during its development phases, reflecting the industry's capital-intensive nature.

CGN Power's cost structure heavily relies on nuclear fuel procurement and management, a significant ongoing operational expense. These costs encompass the purchasing of uranium, the complex process of enrichment, and the fabrication of fuel assemblies. For instance, in 2023, the global average cost for uranium concentrate (U3O8) fluctuated, with spot prices seeing increases, reflecting supply and demand dynamics.

Beyond initial fuel preparation, the long-term management of spent nuclear fuel and radioactive waste represents a substantial financial commitment. This includes secure storage and eventual disposal, adding to the overall cost of operating nuclear power plants. These expenditures are critical for ensuring safety and regulatory compliance throughout the fuel lifecycle.

CGN Power's operations and maintenance (O&M) expenses are a significant, ongoing cost. These cover essential activities like staffing, routine upkeep, and necessary equipment repairs to ensure safe and efficient plant operation. For instance, in 2023, CGN Power reported O&M expenses of approximately RMB 20.5 billion, reflecting the continuous investment required to maintain its diverse energy portfolio.

Scheduled outages, such as refueling for nuclear plants or seasonal maintenance for other generation types, also contribute substantially to O&M costs. These planned downtimes are critical for safety and long-term performance, representing a predictable yet considerable expenditure over the lifespan of their facilities. The company's commitment to stringent safety protocols further adds to these operational expenditures.

Research and Development (R&D) Investment

CGN Power's commitment to innovation is reflected in its substantial Research and Development (R&D) investments, crucial for staying ahead in the nuclear energy sector. These investments are channeled into developing next-generation reactor technologies, such as advanced Hualong One designs, and enhancing the safety protocols of existing plants. For instance, in 2023, CGN Power reported significant capital expenditure allocated towards R&D and technological upgrades, underscoring its strategic focus on future energy solutions and maintaining a competitive edge.

The company's R&D efforts are vital for improving operational efficiency and exploring new applications for nuclear technology. This continuous improvement cycle is essential for meeting evolving global energy demands and adhering to increasingly stringent environmental regulations. CGN Power's dedication to R&D ensures its ability to offer reliable and cost-effective nuclear power solutions.

- Technological Advancement: Focus on developing advanced reactor designs and improving safety features.

- Operational Efficiency: Investment in R&D to enhance the performance and cost-effectiveness of nuclear power generation.

- Future Energy Demands: R&D efforts are aligned with meeting the growing global need for clean and sustainable energy sources.

- Market Leadership: Maintaining technological leadership through continuous innovation and investment in new technologies.

Regulatory Compliance and Decommissioning Provisions

CGN Power faces significant expenses related to regulatory compliance and the eventual decommissioning of its nuclear facilities. Adhering to stringent safety and environmental regulations is paramount, leading to substantial costs associated with licensing fees, regular inspections, and ongoing monitoring. For instance, in 2024, the global nuclear industry continued to invest heavily in safety upgrades and regulatory adherence, reflecting the high stakes involved in nuclear power generation.

Furthermore, CGN Power must make long-term provisions for plant decommissioning and the safe disposal of nuclear waste. These provisions are crucial for ensuring responsible closure of facilities at the end of their operational life, which can span decades. By 2024, many older nuclear plants worldwide were entering or nearing their decommissioning phases, highlighting the growing financial and logistical challenges associated with this process. These future liabilities are factored into the company's cost structure to ensure financial preparedness.

- Licensing and Permitting: Ongoing fees and costs associated with obtaining and maintaining operating licenses for nuclear power plants.

- Safety and Environmental Monitoring: Expenses for continuous oversight, inspections, and compliance with evolving safety and environmental standards.

- Decommissioning Funds: Setting aside capital over the operational life of a plant to cover the eventual costs of safe shutdown, dismantling, and site restoration.

- Waste Management: Costs related to the interim storage and long-term disposal of radioactive waste, adhering to strict international and national guidelines.

CGN Power's cost structure is dominated by the massive capital expenditures for building nuclear power plants, with ongoing expenses for nuclear fuel, operations, maintenance, and regulatory compliance. The company also allocates significant funds to research and development for technological advancements and sets aside provisions for eventual plant decommissioning and waste management.

| Cost Category | Description | 2023/2024 Relevance |

| Capital Expenditure | Upfront investment in plant construction. | Billions of dollars per project; Taishan Nuclear Power Plant development exemplifies this. |

| Nuclear Fuel | Procurement, enrichment, and fabrication of fuel. | Global uranium prices fluctuated in 2023, impacting fuel costs. |

| Operations & Maintenance (O&M) | Staffing, upkeep, repairs, and scheduled outages. | CGN Power reported approx. RMB 20.5 billion in O&M in 2023. |

| R&D and Technology | Developing advanced reactor designs and safety. | Significant capital expenditure in 2023 for technological upgrades and Hualong One development. |

| Regulatory & Decommissioning | Licensing, safety compliance, waste management, and plant closure. | Global industry continued heavy investment in safety upgrades in 2024; long-term provisions for decommissioning are essential. |

Revenue Streams

CGN Power's main way of making money is by selling the electricity its nuclear power plants produce to the national and regional power grids. This is the biggest part of what they earn.

In 2023, CGN Power's revenue from electricity sales reached approximately 78.8 billion Chinese Yuan. This highlights the significant contribution of electricity sales to the company's overall financial performance.

CGN Power's revenue streams can also include services supporting the broader nuclear fuel cycle. This might involve providing fuel fabrication, enrichment, or even waste management solutions to other nuclear power operators or organizations. While often a smaller portion of overall revenue compared to electricity generation, these specialized services contribute to the company's integrated approach to nuclear energy.

CGN Power generates income from selling electricity produced by its wind and solar farms, a key element in diversifying its revenue. This income stream is crucial for the company's financial stability and growth.

The company's commitment to clean energy is evident in its substantial expansion of its renewable portfolio. As of the first half of 2024, CGN Power's installed capacity of wind power reached 34.98 GW, and solar power capacity stood at 24.53 GW, highlighting significant growth and a strong revenue base from these sources.

Engineering, Procurement, and Construction (EPC) Services

CGN Power leverages its extensive experience to offer Engineering, Procurement, and Construction (EPC) services, generating revenue from managing complex nuclear power plant projects. This segment allows the company to monetize its core competencies in design, engineering, and construction management.

CGN Power's EPC services can extend to both domestic and international markets, providing a diversified revenue stream beyond its own project development. This global reach allows them to capture opportunities in emerging nuclear markets.

- Revenue Generation: Income is derived from project management fees, engineering design contracts, and construction oversight for third-party clients.

- Market Expansion: In 2023, CGN Power continued to explore international partnerships, aiming to secure EPC contracts in regions with growing energy demands and nuclear ambitions.

- Expertise Monetization: The company's proven track record in constructing and operating nuclear facilities, such as the Taishan Nuclear Power Plant, underpins its ability to attract and secure lucrative EPC agreements.

Government Subsidies and Policy Support Mechanisms

CGN Power benefits from government policies that can indirectly boost revenue. For instance, priority dispatch for nuclear power plants over less efficient or more polluting sources like coal can ensure consistent operational hours and revenue generation. In 2024, China continued to emphasize energy security and the role of nuclear power in its decarbonization goals, which translates to a supportive policy environment.

Specific support for new nuclear technologies, such as Small Modular Reactors (SMRs), could also represent a future revenue stream or cost reduction avenue for CGN Power. While direct subsidies are less common for established nuclear operations, these policy mechanisms create a more favorable market for nuclear energy. The Chinese government's commitment to expanding its nuclear capacity, with plans to add significant gigawatts by 2030, underscores this policy support.

- Priority Dispatch: Ensures nuclear plants operate more consistently than some other energy sources.

- Policy Support for New Technologies: Favorable regulations for advanced nuclear reactors could create new revenue opportunities.

- Energy Security Goals: Government focus on reliable energy sources benefits nuclear power's market position.

- Decarbonization Targets: Nuclear's low-carbon profile aligns with national environmental policies, promoting its use.

CGN Power's revenue is primarily driven by electricity sales from its nuclear, wind, and solar power generation. In 2023, electricity sales alone accounted for approximately 78.8 billion Chinese Yuan. The company also diversifies income through Engineering, Procurement, and Construction (EPC) services for nuclear projects, both domestically and internationally, capitalizing on its extensive expertise.

The company's renewable energy segment is rapidly growing, with installed wind capacity reaching 34.98 GW and solar capacity at 24.53 GW by the first half of 2024. This expansion is crucial for financial stability and future growth, complementing its core nuclear operations.

Government policies, such as priority dispatch for nuclear power and support for new nuclear technologies, indirectly bolster CGN Power's revenue by ensuring consistent operations and creating future market opportunities. China's commitment to energy security and decarbonization further solidifies nuclear power's role and CGN Power's revenue potential.

| Revenue Stream | Primary Source | 2023 Contribution (Approx.) |

| Electricity Sales | Nuclear, Wind, Solar Power Generation | 78.8 Billion CNY |

| EPC Services | Nuclear Project Management & Construction | Significant, varies by project |

| Ancillary Nuclear Services | Fuel Cycle Support, Waste Management | Smaller, specialized revenue |

Business Model Canvas Data Sources

The CGN Power Business Model Canvas is built upon a foundation of extensive market research, detailed financial disclosures, and internal operational data. These sources ensure that each component of the canvas, from value propositions to cost structures, is grounded in verifiable information and strategic insights.